Professional Documents

Culture Documents

Assignment Intermediate Financial Accounting I - Rifky Mahendra - 1900012264

Assignment Intermediate Financial Accounting I - Rifky Mahendra - 1900012264

Uploaded by

Rahmat Alamsyah0 ratings0% found this document useful (0 votes)

10 views4 pagesOriginal Title

Assignment Intermediate Financial Accounting I_Rifky Mahendra_1900012264..docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesAssignment Intermediate Financial Accounting I - Rifky Mahendra - 1900012264

Assignment Intermediate Financial Accounting I - Rifky Mahendra - 1900012264

Uploaded by

Rahmat AlamsyahCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Name : Rifky Mahendra

Nim : 1900012264

First Assignment Intermediate Financial Accounting I

rifky1900012264@webmail.uad.ac.id

1. Differences of IFRS and GAAP

GAAP is rule-based, whereas IFRS is based on principles only. In measuring asset

value, GAAP assesses using historical value, while IFRS assesses using fair value.

The focus of financial statements on GAAP is the Profit and Loss Statement, while

IFRS focuses on the Statement of Financial Position (balance sheet) and the Income

Statement.

2. BE2-2, BE2-5, BE2-8, BE2-9, BE2-14

BE2-2 (LO2) Match the qualitative characteristics below with the following

statements.

a. Timelinessp =

b. Completeness : d. Includes all the information that is necessary for a

faithful representation of the economic phenomena that it purports to

represent.

c. Free from error =

d. Understandability = e. Quality of information that allows users to

comprehend its meaning.

e. Faithful representation = a. Quality of information that assures users that

information represents the economic phenomena that it purports to

represent.

f. Relevance = b. Information about an economic phenomenon that changes

past or present expectations based on previous evaluations.

g. Neutrality =

h. Confirmatory value = c. The extent to which information is accurate in

representing the economic substance of a transaction.

BE2.5 (LO2) Explain how you would decide whether to record each of the

following expenditures as an asset or an expense. Assume all items are material.

a. Legal fees paid in connection with the purchase of land are €1,500.

b. Eduardo SA paves the driveway leading to the office building at a cost of

€21,000.

c. A meat market purchases a meat-grinding machine at a cost of €3,500.

d. On June 30, Monroe and Meno, medical doctors, pay 6 months' office rent to

cover the month of July and the next 5 months

e. Smith's Hardware pays €9,000 in wages to laborers for construction on a

building to be used in the business.

f. Alvarez's Florists pays wages of €2,100 for November to an employee who

serves as driver of their delivery truck.

Answer :

a. recorded as a load account due to the cost of € 1,500 for the

purchase of land

b. recorded as a load as it cost € 21,000 to pave the road to the office

c. recorded as a cost account because it aims to make work easier

d. recorded as a cost account because it has a useful life of 5 months

e. recorded as a load account to pay construction workers' salaries of

€ 9,000

f. is recorded as a cost account because it pays the flower delivery

driver's employee salary of € 2,100

BE2.8 (LO3) Identify which basic assumption of accounting is best described in

each of the following items.

a. The economic activities of FedEx Corporation (USA) are divided into 12-

month periods for the purpose of issuing annual reports.

b. Total S.A. (FRA) does not adjust amounts in its financial statements for

the effects of inflation.

c. Barclays (GBR) reports current and non-current classifications in its

statement of financial position.

d. The economic activities of Tokai Rubber Industries (JPN) and its

subsidiaries are merged for accounting and reporting purposes.

Answer :

a. Periodicity - firms can divide economic activities

be a period of time.

b. Monetary unit - money is a common denominator.

c. Sustainability - company that lasts moderately

long to fulfill goals and commitments.

d. Economic entity - The company continues to maintain its activities

separate from their owners and other business units.

BE2.9 (LO4) Identify which basic principle of accounting is best described in

each of the following items.

a. Parmalat (ITA) reports revenue in its income statement when it delivers

goods instead of when the cash is collected.

b. Google (USA) recognizes depreciation expense for a machine over the 2-

year period during which that machine helps the company earn revenue.

c. Oracle Corporation (USA) reports information about pending lawsuits in

the notes to its financial statements.

d. Fuji Film (JPN) reports land on its statement of financial position at the

amount paid to acquire it, even though the estimated fair value is greater.

Answer :

a. Revenue recognition - revenue is to be recognized when it is

probable that future economic benefits will flow to the company

and reliable measurement of the amount of revenue is possible.

b. Expense Recognition - outflows or “using up” of assets or

incurring of liabilities (or a combination of both) during a period as

a result of delivering or producing goods and/or rendering services.

c. Full disclosure - providing information that is of sufficient

importance to influence the judgment and decisions of an informed

user.

d. Measurement - as a medium for measuring economic resources and

liabilities.

BE2.14 (LO1,2,4) Fill in the blanks related to the following statements.

1. Financial reporting imposes cost; the benefits of financial reporting

should justify those cost

2. The information provided by financial report for general purpose

focuses on the needs of all capital providers, not just the needs of a

particular group.

3. A depiction of economic phenomena is economic chart descriptions if

it includes all the information that is necessary for faithful

representation of the economic phenomena that it purports to represent.

4. Compness the quality of information that allows users to comprehend

its meaning.

5. Can be compared is the quality of information that permits users to

identify similarities in and differences between two sets of economic

phenomena.

6. Information about economic phenomena has confirmation value if it

confirms or changes past or present expectations based on previous

evaluations.

You might also like

- Sample Strategic IA PlanDocument34 pagesSample Strategic IA PlanSheyam Selvaraj100% (1)

- Brand Audit ElementsDocument11 pagesBrand Audit ElementsMartin Jelsema93% (15)

- Balanced Score CardDocument29 pagesBalanced Score CardCarl ChiangNo ratings yet

- CH 07Document81 pagesCH 07Tio Budi Santoso100% (1)

- Vistex Day 1 and DayDocument24 pagesVistex Day 1 and Daypraveen.ktg1No ratings yet

- Qa QC CoordinatorDocument2 pagesQa QC CoordinatorMurugananthamParamasivamNo ratings yet

- Mahalaxmi Bikash Bank ReportDocument45 pagesMahalaxmi Bikash Bank ReportDeep MeditationNo ratings yet

- IFRS Edition-2nd: Conceptual Framework For Financial ReportingDocument30 pagesIFRS Edition-2nd: Conceptual Framework For Financial ReportingAhmed SroorNo ratings yet

- 6.PR Spoilage Good Proses CostingDocument2 pages6.PR Spoilage Good Proses CostingSembilan 19No ratings yet

- Questions Part2 Srikant and Datar TextbookDocument5 pagesQuestions Part2 Srikant and Datar TextbookUmar SyakirinNo ratings yet

- ACCT3001 Ch.10 WP SolutionsDocument14 pagesACCT3001 Ch.10 WP SolutionsJoshua Solite0% (1)

- New Marketing Services Plan - Toni & GuyDocument34 pagesNew Marketing Services Plan - Toni & Guyjosiechee100% (3)

- Accounting Problem 5 5ADocument8 pagesAccounting Problem 5 5AParbon Acharjee100% (1)

- OneCIS - ASME CA Connect BrochureDocument20 pagesOneCIS - ASME CA Connect BrochureBayu Jatmiko0% (1)

- 2.1 (Usefulness, Objective of Financial Reporting) Indicate Whether TheDocument8 pages2.1 (Usefulness, Objective of Financial Reporting) Indicate Whether TheKinanti PutriNo ratings yet

- Accounting 1Document11 pagesAccounting 1Audie yanthiNo ratings yet

- AKUNTANSI BIAYA Week 4 - Cornelius CakraDocument3 pagesAKUNTANSI BIAYA Week 4 - Cornelius CakraCornelius cakraNo ratings yet

- Revenue Recognition: Assignment Classification Table (By Topic)Document32 pagesRevenue Recognition: Assignment Classification Table (By Topic)BryanaNo ratings yet

- Lecture 10 - LiabilitiesDocument50 pagesLecture 10 - LiabilitiesIsyraf Hatim Mohd TamizamNo ratings yet

- Problems Chapter 7Document9 pagesProblems Chapter 7Trang Le0% (1)

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Name: Exercise: Exercise E7-5, Record Sales Gross and Net Course: DateDocument3 pagesName: Exercise: Exercise E7-5, Record Sales Gross and Net Course: DaterahmawNo ratings yet

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiNo ratings yet

- Page 204 Post ClosingDocument7 pagesPage 204 Post ClosingPaulina MayganiaNo ratings yet

- Chapter 4 CourseDocument15 pagesChapter 4 CourseMagdy KamelNo ratings yet

- Soal Latihan Minggu 4Document9 pagesSoal Latihan Minggu 4Alifia AprizilaNo ratings yet

- Exercise 6Document4 pagesExercise 6Tania MaharaniNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- Pertemuan 8 Chapter 17Document29 pagesPertemuan 8 Chapter 17Jordan Siahaan100% (1)

- Chapter 3 Homework Chapter 3 HomeworkDocument8 pagesChapter 3 Homework Chapter 3 HomeworkPhương NguyễnNo ratings yet

- Akdas Brief Dan SelfDocument18 pagesAkdas Brief Dan SelfAwun Sukma100% (1)

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123Document3 pagesFinancial Accounting - Tugas 5 - 18 Sep - REVISI 123AlfiyanNo ratings yet

- Chapter 10Document26 pagesChapter 10IstikharohNo ratings yet

- Bab 9 AkmDocument44 pagesBab 9 Akmcaesara geniza ghildaNo ratings yet

- Fitzgeraldhyne Rappan - A031221038Document2 pagesFitzgeraldhyne Rappan - A031221038Fitzgeraldhyne RappanNo ratings yet

- Lucky Carrot : Show Transcribed Image TextDocument2 pagesLucky Carrot : Show Transcribed Image TextAchmad RizalNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sultan LimitNo ratings yet

- The Statement of Financial Position of Stancia Sa at DecemberDocument1 pageThe Statement of Financial Position of Stancia Sa at DecemberCharlotte100% (1)

- Jawaban P5-5aDocument2 pagesJawaban P5-5arezky100% (1)

- Jawaban TugasDocument7 pagesJawaban TugasRani AdhirasariNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklMelati SepsaNo ratings yet

- Tugas MK Dasar Akuntansi Pertemuan Ke-15Document2 pagesTugas MK Dasar Akuntansi Pertemuan Ke-15Mochamad Ardan FauziNo ratings yet

- ForumDocument5 pagesForumMariana Hb0% (1)

- Jawaban Sia 3.6 Bab 3Document2 pagesJawaban Sia 3.6 Bab 3WandaNo ratings yet

- 645873Document3 pages645873mohitgaba19No ratings yet

- Exercise 21Document3 pagesExercise 21Ruth UtamiNo ratings yet

- Chapter 6 - Accounting and The Time Value of MoneyDocument96 pagesChapter 6 - Accounting and The Time Value of MoneyTyas Widyanti100% (2)

- Prepare Adjusting Entries For DeferralsDocument15 pagesPrepare Adjusting Entries For DeferralsKirammin Bararrah100% (1)

- P5 4Document3 pagesP5 4Monica HutagaolNo ratings yet

- Jawaban Soal Latihan Ch.11Document2 pagesJawaban Soal Latihan Ch.11Wira DinataNo ratings yet

- Mock Test 201 KeyDocument12 pagesMock Test 201 Keydengdeng2211No ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- Working 4Document8 pagesWorking 4Hà Lê DuyNo ratings yet

- AccountingDocument8 pagesAccountingDarshan SomashankaraNo ratings yet

- Bahasa Inggris UTSDocument52 pagesBahasa Inggris UTSFania LutuNo ratings yet

- P7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDocument3 pagesP7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDella Putri Reba UtamyNo ratings yet

- CrockerDocument6 pagesCrockersg31No ratings yet

- 3 Cash - Assignment PDFDocument6 pages3 Cash - Assignment PDFCatherine RiveraNo ratings yet

- Tutorial 6Document4 pagesTutorial 6Muntasir AhmmedNo ratings yet

- Chapter4 Cost AllocationDocument14 pagesChapter4 Cost AllocationNetsanet BelayNo ratings yet

- Acc303 Homework 2Document1 pageAcc303 Homework 2Dian AnjaniNo ratings yet

- Contoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Document9 pagesContoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Mega LengkongNo ratings yet

- Bab 2 Cost Concept and The Cost Accounting Information SystemDocument5 pagesBab 2 Cost Concept and The Cost Accounting Information SystemFransiskusSinagaNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Pertemuan 14 - Investasi Saham (20% - 50%) PDFDocument17 pagesPertemuan 14 - Investasi Saham (20% - 50%) PDFayu utamiNo ratings yet

- Workbook International Acc1 - C.02Document7 pagesWorkbook International Acc1 - C.02trinhbk19No ratings yet

- Intermediate Accounting HWDocument6 pagesIntermediate Accounting HWbossman890% (1)

- ACCTBA1 - Sample Quiz 1Document3 pagesACCTBA1 - Sample Quiz 1Marie Beth BondestoNo ratings yet

- BreadTalk - Annual Report 2014Document86 pagesBreadTalk - Annual Report 2014Vicky NeoNo ratings yet

- Airplane NotesDocument1 pageAirplane NotesEmma Mariz GarciaNo ratings yet

- PakopyaDocument9 pagesPakopyaKate NuevaNo ratings yet

- Rehmat InternationalDocument13 pagesRehmat InternationalAnoop MittalNo ratings yet

- Auditing Assurance A Business Risk Approach 3Rd Edition Jubb Solutions Manual Full Chapter PDFDocument67 pagesAuditing Assurance A Business Risk Approach 3Rd Edition Jubb Solutions Manual Full Chapter PDFindicterpointingzbqg2100% (11)

- Ascend QC Weekly Digest - April 29, 2015 IssueDocument21 pagesAscend QC Weekly Digest - April 29, 2015 IssueAscend QueensCollegeNo ratings yet

- Financial Management of CourtsDocument23 pagesFinancial Management of CourtsmamimomashesheNo ratings yet

- Suggested Answers - Dec 2023 - CAP III - Group 1Document72 pagesSuggested Answers - Dec 2023 - CAP III - Group 1xalay93488No ratings yet

- Bea 326 Auditing LectureDocument26 pagesBea 326 Auditing LectureSam RockerNo ratings yet

- Resume-Rashi AswaniDocument3 pagesResume-Rashi AswaniMitesh dharamwaniNo ratings yet

- Overall Descriptive StatisticsDocument127 pagesOverall Descriptive StatisticsMind CoolerNo ratings yet

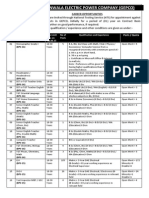

- Gujranwala Electric Power Company (Gepco)Document5 pagesGujranwala Electric Power Company (Gepco)JawadAmjadNo ratings yet

- 1 SPL 19-20Document86 pages1 SPL 19-20westway NOIDANo ratings yet

- How To Calculate Your GPA & Major GPA: Course Credits Grade Merit PointsDocument1 pageHow To Calculate Your GPA & Major GPA: Course Credits Grade Merit PointsDon Rayburn PilanNo ratings yet

- Activity 6Document4 pagesActivity 6Isabell CastroNo ratings yet

- Strat Quality Cost Concepts ExercisesDocument16 pagesStrat Quality Cost Concepts ExercisesDalia DelrosarioNo ratings yet

- Taaleem Prospectous enDocument364 pagesTaaleem Prospectous enajit23nayakNo ratings yet

- 8 Marketing ControlDocument9 pages8 Marketing ControlMadhuri SheteNo ratings yet

- Basics of Book Keeping and AccountingDocument4 pagesBasics of Book Keeping and AccountingNiya Maria NixonNo ratings yet

- Facilities Operations ManagementDocument13 pagesFacilities Operations Managementhabib poragNo ratings yet

- Chief Financial Officer in Seattle WA Resume Troy WilliamsDocument1 pageChief Financial Officer in Seattle WA Resume Troy WilliamsTroyWilliamsNo ratings yet

- AAA Student Book (2021)Document122 pagesAAA Student Book (2021)Nam Nguyễn AnhNo ratings yet