Professional Documents

Culture Documents

Platts 04 Janv 2013 PDF

Uploaded by

Wallace YankotyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Platts 04 Janv 2013 PDF

Uploaded by

Wallace YankotyCopyright:

Available Formats

]

www.platts.com EUROPEAN MARKETSCAN

[OIL ]

Volume 45 / Issue 3 / January 4, 2013

n

tio

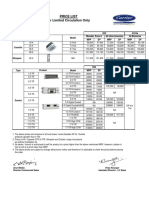

European products ($/mt) ICE futures

Code Mid Change Code Mid Change

Platts ICE 1630 London assessments* (PGA page 703)

Mediterranean cargoes (PGA page 1114)

Gasoil Low Sulfur Gasoil

FOB Med (Italy) CIF Med (Genova/Lavera)

a

Jan AARIN00 928.00 Jan AAGL001 951.50

Naphtha* PAAAI00 899.75–900.25 900.000 -12.250 PAAAH00 921.00–921.50 921.250 -12.750 Feb AARIO00 930.25 Feb AAGL002 951.50

Prem Unl 10ppm AAWZA00 990.00–990.50 990.250 -12.000 AAWZB00 1004.00–1004.50 1004.250 -12.250

Mar AARIP00 928.75 Mar AAGL003 952.25

lu

Jet AAIDL00 983.00–983.50 983.250 -5.500 AAZBN00 1008.25–1008.75 1008.500 -6.000

10ppm ULSD AAWYY00 938.75–939.25 939.000 -8.250 AAWYZ00 955.50–956.00 955.750 -8.500 Brent Brent NX

Gasoil 0.1% AAVJI00 921.00–921.50 921.250 -7.000 AAVJJ00 940.00–940.50 940.250 -7.000 Feb AAYES00 111.28 Feb AAXZL00 111.23

Fuel Oil 1.0% PUAAK00 629.25–629.75 629.500 +10.750 PUAAJ00 643.75–644.25 644.000 +10.250 Mar AAYET00 110.04 Mar AAXZM00 110.08

a

Fuel oil 3.5% PUAAZ00 592.50–593.00 592.750 -2.250 PUAAY00 607.00–607.50 607.250 -2.750

Apr AAXZY00 109.16 Apr AAXZN00 109.20

Jet FOB Med premium AAIDN00 10.50/11.00 10.750 +0.250

May AAYAM00 108.45 May AAYAP00 108.49

Ev

*Naphtha FOB Med is basis East Med

*Platts ICE assessments reflect the closing value of the ICE contracts at

Northwest Europe cargoes (PGA page 1110) precisely 16:30 London time.

FOB NWE CIF NWE/Basis ARA ICE gasoil settlements (PGA page 702)

Naphtha (Feb) PAAAJ00 918.25–918.75 918.500 -10.750

Gasoil Low Sulfur Gasoil

Naphtha PAAAL00 931.25–931.75 931.500 -12.750

Gasoline 10ppm AAXFQ00 999.25–999.75 999.500 +3.250 Jan AAQSG00 928.50 Jan AAGS001 951.50

F

Jet PJAAV00 994.00–994.50 994.250 -6.000 PJAAU00 1009.75–1010.25 1010.000 -6.000 Feb AAQSH00 930.75 Feb AAGS002 951.50

ULSD 10 ppm AAVBF00 929.50–930.00 929.750 -8.000 AAVBG00 950.00–950.50 950.250 -8.000 Mar AAQSI00 929.25 Mar AAGS003 951.00

Diesel 10ppm NWE AAWZD00 932.50–933.00 932.750 -8.250 AAWZC00 953.75–954.25 954.000 -8.000 Apr AAQSJ00 926.00 Apr AAGS004 947.25

PD

Diesel 10 ppm UK AAVBH00 956.00–956.50 956.250 -8.000 May AAQSK00 922.00 May AAGS005 943.75

Gasoil 0.1% AAYWR00 911.50–912.00 911.750 -7.000 AAYWS00 934.25–934.75 934.500 -7.000 Jun AAQSL00 918.00 Jun AAGS006 940.00

Fuel oil 1.0% PUAAM00 617.75–618.25 618.000 -3.750 PUAAL00 631.00–631.50 631.250 +3.500

Expiry AAQSM00 NA*

Fuel oil 3.5% PUABB00 580.50–581.00 580.750 -1.750 PUABA00 596.50–597.00 596.750 -1.750

Straight run 0.5-0.7% PKABA00 707.00–708.00 707.500 -7.000 *Value at 12:00 London time will only appear on day of expiry

VGO 0.5-0.6% AAHMX00 770.00–771.00 770.500 -7.000 AAHMZ00 773.00–774.00 773.500 -7.000 ICE gasoil GWAVE (Previous day’s values) (PGA page 702)

VGO 2% max AAHNB00 750.50–751.50 751.000 -7.000 AAHND00 753.50–754.50 754.000 -7.000

Jan PXAAJ00 935.00 Feb PXAAK00 936.50

rt

Northwest Europe barges (PGA page 1112)

FOB Rotterdam Eurobob swaps ($) NYMEX futures (16:30 London time)

Naphtha PAAAM00 927.25–927.75 927.500 -12.750

pe

Eurobob AAQZV00 970.00–970.50 970.250 -12.000 1200 NYMEX WTI (PGA page 703)

98 RON gasoline 10 ppm AAKOD00 1015.50–1016.00 1015.750 -12.000

Premium gasoline 10 ppm PGABM00 995.50–996.00 995.750 -12.000 $/barrel $/barrel

Jet PJABA00 1005.00–1005.50 1005.250 -8.000 Feb AASCR00 92.62 Mar AASCS00 93.05

Diesel 10 ppm AAJUS00 948.25–948.75 948.500 -9.000

NYMEX heating oil (PGA page 703)

Ex

Gasoil 50 ppm AAUQC00 944.25–944.75 944.500 -7.250 1000

Gasoil 0.1% AAYWT00 927.25–927.75 927.500 -7.000 ¢/gal ¢/gal

Fuel oil 1.0% PUAAP00 619.00–619.50 619.250 -0.500 Feb AASCT00 300.95 Mar AASCU00 299.42

Fuel oil 3.5% PUABC00 601.25–601.75 601.500 -1.750

Rotterdam bunker 380 CST PUAYW00 605.00–606.00 605.500 +3.000 NYMEX RBOB (unleaded gasoline) (PGA page 703)

VGO 0.5-0.6% AAHNF00 770.00–771.00 770.500 -7.000 800 ¢/gal ¢/gal

VGO 2% max AAHNI00 750.50–751.50 751.000 -7.000 Mar May Jul Sep Nov Jan

MTBE* PHALA00 1376.75–1377.25 1377.000 -13.000 Feb AASCV00 275.76 Mar AASCW00 276.01

*FOB Amsterdam-Rotterdam-Antwerp

The McGraw Hill Companies

EUROPEAN MARKETSCAN january 4, 2013

Market Update (PGA page 724) Euro-denominated assessments 16:30 London (€/mt)

Crude futures prices remained slightly bearish Med cargoes (PGA page 1120) Northwest Europe barges (PGA page 1118)

Friday, despite data from the US Energy Information FOB Med CIF Med FOB Rotterdam

(Italy) (Genova/Lavera) Naphtha ABWHF00 711.109

Administration that showed a heavy draw in crude Naphtha* ABWHE00 690.025 ABWHD00 706.318 Eurobob ABWGT00 743.886

stocks in the last week of the year. NYMEX February Prem Unl 10ppm ABWGV00 759.220 ABWGU00 769.953 98 RON gasoline 10 ppm ABWGX00 778.770

Jet ABWGZ00 753.853 AAZBO00 773.212 Premium gasoline 10 ppm AAQCH00 763.436

crude was down 60 cents on the day at a $92.32/ 10ppm ULSD ABWHM00 719.926 ABWHH00 732.769 Jet ABWHC00 770.720

n

barrel after an initial period of volatility immediately Gasoil 0.1% ABWGQ00 706.318 ABWGO00 720.885 Diesel 10 ppm AAQCI00 727.210

Fuel Oil 1.0% ABWGH00 482.634 ABWGF00 493.751 Gasoil 50 ppm AAUQF00 724.143

following the EIA’s release that saw the contract spike

tio

Fuel oil 3.5% ABWGM00 454.458 ABWGK00 465.575 Gasoil 0.1% AAYWY00 711.109

to $93.07/b and drop to a session low of $92.22/b Jet FOB Med premium ABWHA00 8.242 Fuel oil 1.0% ABWGI00 474.776

at 11:34 a.m. EST (1634 GMT), before sliding back *Naphtha FOB Med is basis East Med Fuel oil 3.5% AAQCK00 461.167

Rotterdam bunker 380 CST AAUHE00 464.234

within the 70 cent range that defined morning US Northwest Europe cargoes (PGA page 1116)

trade. Earlier Friday front-month NYMEX crude traded

a

FOB NWE CIF NWE/ New York Harbor cargoes 16:30 London (PGA pages 1350 & 1450)

between $91.52 and $93.07/b. US crude stocks fell Basis ARA FOB NY Harbor

Naphtha AAQCE00 714.176 (€ cent/gal)

11.12 million barrels last week to 359.939 million

lu

Gasoline 10ppm ABWGS00 766.311 Unleaded 87 AAPYV00 215.27

barrels, the EIA reported in its weekly domestic Jet ABWHB00 762.286 AAQCF00 774.362 Unleaded 89 AAPYW00 224.32

fuel stock survey, broadly in line with data released ULSD 10 ppm ABWHO00 715.135 ABWHI00 731.427 Unleaded 93 AAPYX00 237.88

Diesel 10ppm NWE ABWHP00 712.834 ABWHK00 728.552 No. 2 AAPYY00 232.08

a

Thursday by the US Energy Information Administration Diesel 10 ppm UK ABWHJ00 733.152

ICE February Brent was also lower, down $1.25/b at Gasoil 0.1% ABWGR00 699.034 ABWGP00 716.476

Ev

Fuel oil 1.0% AAQCG00 473.817 ABWGG00 483.976

$110.89/b after spiking to $111.50/b on the EIA Fuel oil 3.5% ABWGN00 445.258 ABWGL00 457.525

European clean product barge freight rates

data release. It is not uncommon for US crude stocks Straight run 0.5-0.7% ABWHG00 542.437

ARA ($/mt) (PGT page 1918)

to tumble sharply moving in to a new year, as refiners Euro/US$ forex rate: 1.3043. Platts Euro denominated European & US product

Rotterdam — Rotterdam TCAEI00 2.50

assessments are based on market values and a Euro/US$ forex rate at 4:30

move to reduce inventories for tax purposes. Over PM local London time. Rotterdam — Flushing TCAEJ00 3.50

Rotterdam — Ghent TCAEK00 4.00

the past five years, crude imports into the US have

F

Rotterdam — Antwerp TCAEL00 3.50

fallen in the first half of December before picking Foreign exchange rates (PGA page 1151) Germany ($/mt) (PGT page 1918)

back up in late December and early-January. Crude January 4, 2013 London 16:30 Rotterdam — Duisburg TCAEM00 8.50

PD

imports fell by 931,000 b/d to 7.094 million b/d Dollar/Swiss franc BCADC00 0.9267 Rotterdam — Cologne TCAEN00 11.75

GB pound/Dollar BCADB00 1.6038 Rotterdam — Karlsruhe TCAEO00 19.00

Analysts polled by Platts predicted a 1 million barrel Antwerp — Duisburg TCAEP00 9.00

Dollar/Yen BCACW00 88.2300

draw in crude stocks. Crude inputs also rose over Euro/Dollar BCADD00 1.3043 Switzerland ($/mt) (PGT page 1918)

the course of the week, the EIA showed, climbing Dollar/Ruble AAUJO00 30.3960 Rotterdam — Basel TCAEQ00 20.50

13,000 b/d to 15.341 million b/d, exacerbating

the effects of the decline in imports. Stocks at The API data showed a gain of 6.71 million barrels, Gasoline (PGA page 1399)

rt

Cushing, Oklahoma increased by 573,000 barrels to while analysts were anticipating an increase of 1.6

49.75 million barrels, with analysts pointing to the million barrels in distillate stocks. NYMEX February Northwest Europe EBOB gasoline crack swaps were

pe

temporary closure of the Seaway pipeline during its heating oil was down 2.27 cents to $3.0024/gal still hovering Friday around levels not seen since mid-

recent upgrade as a possible cause for the gain. The after recovering from a near-session low of $2.9989/ October, as Brent futures eased slightly, Platts data

capacity of the Seaway pipeline, which moves crude gal at 11:34 a.m. EST. RBOB, which had been falling showed. “I think it’s more due to crude moving than

oil from storage in Cushing to the US refining complex steadily throughout much of morning US trade, gasoline at the moment,” a gasoline trader said of the

Ex

along the US Gulf Coast, is currently being upgraded continued to slide as the EIA reported a 2.569 million- stable crack swap. The January FOB Rotterdam EBOB

from 150,000 b/d to 400,000 b/d and is expected barrel climb in gasoline stocks over the course of the gasoline crack swap was assessed at $6/barrel,

to reach full capacity some time next week. NYMEX week. NYMEX February RBOB was down 4.38 cents at down slightly from Thursday’s $6.20/b, while February

heating oil fell sharply as the EIA reported a 4.574 $2.7539/gal, recovering moderately from a session was assessed at $6.55/b, also down from Thursday’s

million barrel increase in domestic distillate stocks. low of $2.7447/gal at 11.34 a.m. $6.80/b. NWE EBOB gasoline barges were valued at

Copyright © 2013, The McGraw-Hill Companies 2

EUROPEAN MARKETSCAN january 4, 2013

a $3.50/mt premium to the February FOB Rotterdam Subscriber notes (PGA page 1500)

EBOB gasoline outright swap at $970.25/mt. In the

Mediterranean, the market was still experiencing ■■ As part of its commitment to maintaining open to calculate the netback formula for FOB NWE 10ppm

dialog with the industry, Platts is hosting an Oil diesel (Le Havre) is $8.89/mt. The Worldscale flat rate

additional demand for Red Sea cargoes due to a

Technical Workshop on January 23 in Rotterdam. This used to calculate the netback formula for the FOB ULSD

20-day shutdown at Saudi Arabia’s PetroRabigh

workshop will focus on barge and cargo logistics in the 10ppm diesel (ARA) is $8.66/mt. The Worldscale flat rate

refining and petrochemicals complex. “I still feel like Amsterdam-Rotterdam-Antwerp region, including the used to calculate the netback formula for the CIF 10ppm

n

there is cargo demand from the Mediterranean for the importance of performance in the Platts MOC process, diesel UK is $2.51/mt.

east. I think the additional demand is 2-3 cargoes Platts nomination procedures, rights and obligations in

tio

that we are seeing enquiry for,” a second trader said. ■■ Effective January 2, 2013 the Worldscale flat rate

chains, compensation, alternate delivery solutions and

used to calculate the netback formula for CIF Med pre-

At the same time, the market tightness could ease demurrage issues and is aimed at inviting feedback from

mium gasoline 10ppm is $8.02/mt. Comments please to

slightly, a third trader said. “Demand is still holding, traders and operators as well as other market partici-

europe_products with a CC to pricegroup@platts.com

but we are seeing more barrels from the central Med, pants. The Platts panel will comprise of Simon Thorne,

a

the Turkish Med and we expect some in the Spanish Tim Worledge, Benno Spencer and Chris Vowden. ■■ Effective January 1, 2013, Platts has removed a range

side as well.” Register now to reserve your free place: of biofuel assessments from European Marketscan. The

lu

http://marketing2012.platts.com/content/OLEM201301_ Platts MTBE assessment (code PHALA00) will continue

RotterdamOilTechnicalWorkshop to be published in European Marketscan. From 2013

Gasoline deals (PGA page 5) forward, the only Platts publication to carry biofuels is

a

■■ Effective January 4, 2013 and following a revised

Platts Biofuelscan. The codes affected are: Fuel grade eth-

Gasoline MOC deals: PREM UNL: ARGOSSU-Statoil at Rotterdam port tariff issued by Worldscale, the port fee cal-

anol codes AAWUQ00, AAYDT00, AAVLD00, AAYDS00;

Ev

$1000/mt MW; Trafigura-Spectron-Statoil at $998/mt culation within the cross NWE fuel oil freight rate is amend-

Biodiesel FAME -10 codes AAWGY00, AAWGH00; FAME

MW Gasoline cargo MOC deals: NWE CARGO: Statoil- ed to $0.93/mt. The Worldscale flat rate used to calculate the

0 codes AAXQL00, AAWGI00; Soy Methyl Ester (SME)

netback formula for FOB NWE 3.5% fuel oil will be $8.78/

Greenergy at $1007/mt for January 15-19 codes AAUCB00, AAWGJ00; Rapeseed Methyl Ester

mt. Comments please to europe_products@platts.com, CC

(RME) codes AAUCA00, AAWGK00.

to pricegroup@platts.com.

Naphtha (PGA page 1398) ■■ ICE has released a document covering Frequently

F

■■ Effective January 4, 2013 and following a revised

Asked Questions regarding the transition from swaps

The European naphtha market weakened Friday with Rotterdam port tariff issued by Worldscale, the port

to futures effective October 15, 2012. The document is

PD

fee calculation within the Jet NWE-Med freight rate is

Platts assessing CIF Northwest European cargoes at available at www.theice.com/publicdocs/Platts_Swaps_

amended to $1.15/mt. Comments please to

$931.50/mt, $12.75/mt lower on the day, while the to_Futures_FAQ.pdf. The move by ICE to convert swaps

europe_products@platts.com, CC to pricegroup@platts.com.

January/February spread for naphtha was assessed into futures has raised questions over whether the

at minus $11.00/mt--down $2/mt on the day. During ■■ Effective January 4, 2013 and following a revised change has also affected the nomenclature of Platts

the Platts Market on Close assessment process, four Rotterdam port tariff issued by Worldscale, the port fee assessments. The nomenclature of Platts assessments in

trades were concluded, all of them with Vitol as the calculation within the NWE-Med freight rate is amended to all its publications remains the same and there are no

rt

$0.95/mt. Comments please to europe_products@platts.com, changes envisioned as a result of the ICE move. Platts

seller and three of them with Trafigura as buyer. BP

CC to pricegroup@platts.com. methodologies are also unaffected by ICE changes. For

also bought a cargo from the Geneva-based trading

pe

more information about our methodology please access

company. Vitol’s selling follows huge buying through ■■ Effective January 2, 2013, the Worldscale flat rate

Platts.com or contact the various commodity sectors

December 2012, when the company bought a total used to calculate the netback formulas for FOB Med

including oil@platts.com and pricegroup@platts.com.

of 52 cargoes during the MOC process. Cracks for 0.1% gasoil is $10.69/mt. For FOB NWE 0.1% gasoil the

naphtha also came under pressure once again to Worldscale flat rate net back is $9.56/mt. Comments ■■ Effective January 2, 2014 and following industry

Ex

please to europe_products@platts.com with a CC to feedback to a previous subscriber note, Platts will cal-

minus $6.10/barrel for January and to minus $6.30/b

pricegroup@platts.com. culate the CIF Mediterranean naphtha assessment by

for February, while crude oil futures fell for a second

only applying the freight value between Alexandria

day in a row. According to market sources, the main ■■ Effective January 2, 2013, the Worldscale flat rate

and Lavera to the FOB Med naphtha assessment. This

element driving the naphtha complex lower is the used to calculate the netback formula for FOB Med

freight value will be calculated using the Platts cross

attractiveness of LPG, largely due to the unseasonable 10ppm diesel is $9.41/mt. The Worldscale flat rate used

Med clean tanker assessment for 27,500 mt naphtha

Copyright © 2013, The McGraw-Hill Companies 3

EUROPEAN MARKETSCAN january 4, 2013

mild temperatures in Europe. “Most of end-users Subscriber notes (cont.) (PGA page 1500)

that could switch to propane cracking did already,”

commented a petrochemical player. However, he thinks cargoes only. Currently the CIF Med naphtha assess- density, 420 CST viscosity, 80 ppm aluminium/silicon,

ment is calculated by applying the freight value between 6% asphaltenes and 120 ppm vanadium. All other spec-

that high operating rates in refineries will help support

Alexandria and Lavera plus an allowance of $3/mt for ifications remain unchanged from the current specifi-

the price of naphtha. “I would not read to much into it

port costs. Platts proposes to remove the port costs from cation reflected. Platts will continue to consider other

as it was a very quiet week and we will have a clearer the calculation of this assessment. Please send feedback merchantable LSFO specifications in its assessment

n

picture next week when everybody is back at work,” and questions to europe_products@platts.com with a cc process, and normalize to the updated specifications.

said a trader. A lot of market players were indeed to pricegroup@platts.com Please send comments to europe_products@platts.com

tio

just coming back from holidays after Christmas and with a cc to pricegroup@platts.com.

■■ Following feedback to its proposal published on June

the New Year, with the main financial news this week

27, 2012, Platts has discontinued its FOB NWE Premium ■■ In preparation for a change to the benchmark

being the deal to avoid a fiscal cliff in the US. Another

Gasoline Non-Oxy and Regular Unleaded Non-Oxy assess- Singapore FOB gasoil assessment, the Gasoil Reg 0.5%

point debated in the market was the arbitrage to

a

ments as planned. The assessments will be suspended assessment was renamed Gasoil on January 3, 2012.

send cargoes from Europe to Asia which could open, with effect from January 2, 2013. Platts proposed to dis- The renamed Gasoil assessment will continue to reflect

said traders. “If levels for naphtha drop in Europe,

lu

continue the assessment because the quality reflected in the same underlying methodology and quality speci-

more cargoes are going to be committed to Asia and the two assessments no longer reflects an actively traded fications, including a sulfur content of 0.5% sulfur,

the US,” said a trader at a petrochemical end-user. or supplied grade in northwest Europe. Please send ques- all through calendar year 2012. The specification will

a

However other sources were less sure there were tions and feedback to europe_products@platts.com with a change to 500 ppm sulfur on January 2, 2013. This

would be a huge glut of fresh material heading from CC to pricegroup@platts.com. name change has now also been made in the Platts

Ev

Europe to Asia in the immediate future. European Marketscan.

■■ Effective January 2, 2013, Platts is reflecting an

updated specification in all European cracked LSFO

cargoes in response to changes in supply and demand

Correction

Naphtha deals (PGA page 5)

patterns in the European low sulfur fuel oil market. ■■ Please note that Platts January 3 cargo assessments

No deals reported. Under its revised specifications, Platts assessments will for high sulfur fuel oil FOB Med (Italy) and CIF Med

F

reflect the following qualities: EU-qualified, 1.00% (Genova/Lavera) should read $594.75-595.25/mt

sulfur, 0.991 kg/l density, 380 CST viscosity, 60 ppm (PUAAZ00) and $609.75-610.25/mt (PUAAY00), respec-

Jet (PGA page 1497)

PD

aluminium/silicon, 7% asphaltenes, 30 degrees Celsius tively. These assessments appear in Platts European

pour point, 65 degrees Celsius flash point, 15% CCR, Marketscan, Platts Bunkerwire, Platts Global Alert page

Premiums ended the week Friday with a reversal of

0.1% ash, 0.5% water, 150 ppm vanadium, 9650 kcal/ 1420, and in the Platts price database under the code

the recent trend, as cargo premiums saw their first

kg NCV, 0.1% TSP. This represents a change from the PUAAZ00 and PUAAY00.

rise of 2013. Platts assessed the CIF Northwest previous Platts assessment specifications of 0.995 kg/l

Europe cargo market at an outright price of $1,010/

mt or a premium of $82/mt versus the front-month

rt

gasoil contract. Barge premiums did not share the said, referring to the way in which premiums have in kerosene demand. In the Platts Market on Close

same support though, as the impact of refining responded to the vagaries of supply over recent assessment process, BP withdrew its cargo offer on

pe

capacity and poor storage economics continued to months. Key to that was the increased reliance on the Venus R, basis Le Havre for 14-18 delivery, to sell

unleash oil into a market where demand remained imports secured from arbitrage flows--with the Persian to Morgan Stanley’s bid on the same dates and into

stubbornly elusive. The barge premium eased by 75 Gulf the most significant supply point, and loss of the same location at the average of Platts plus $2/

cents to be assessed at plus $77.25/mt, according European refining capacity the counterpoint to that mt pricing the average of January 7-31. On barges,

Ex

to Platts data. Market sources looked to familiar supply. “Sure, there are a few arrivals now, but Morgan Stanley was also a buyer, lifting an offer

trends keeping the complex in check Friday. “The there’s not much coming behind that,” the trader said from Statoil at January plus $76/mt for delivery on

market has rolled on from where it left off last year- of that incremental supply, with Europe likely to still 9-13 dates. That saw the spread between barges and

-one minute you think there’s enough jet around, have to price up to ensure flows continued to arrive- cargoes widen further, as barges sank to a $4.75/mt

the next minute there isn’t enough,” one trader -particularly with the full bite of winter still to be felt discount to cargoes.

Copyright © 2013, The McGraw-Hill Companies 4

EUROPEAN MARKETSCAN january 4, 2013

Jet deals (PGA page 5)

FOB Rotterdam 0.1% gasoil barge differential to the front n Gasoil 50ppm barge MOC deals: AST-STR at Jan plus

Jet MOC cargo deals: BP-Morgan Stanley 27kt at CCM month ICE 0.1% gasoil was assessed at minus $0.50, 16, 2 kt, FOB ARA, 12-16 Jan (MW).

PLUS 2 pxg 7 - 31 Jan 2013, Balance at Feb ICEGO a day-on-day rise of $0.25/mt, Platts data showed.

plus 78, for 30kt +/- 10% s/option, EU Qualified Jet A1 The unseasonably warm weather was also affecting Diesel (PGA page 1498)

Defstan 91-91 latest issue, JFSCLI latest issue (current the 50 ppm gasoil market, due to its use as a heating

at bill of lading) with possible exception of electrical oil in Germany. “The main point is the warmer weather The premium for diesel barges loading in Rotterdam over

n

conductivity (Stadis to be provided on board in drums), which is not supporting the 50 ppm demand...it’s 9 C the front-month ICE 0.1% gasoil futures contract was

standard Platt’s nomination details, with minimum BP, in Germany today, and it’s forecast to get even better in down from Thursday, being assessed as $1.75/mt lower

tio

Shell, Exxon approvals, ISPS compliant, f/p cargo s/ next 10 days,” a trader said. “The end-user is not keen at $20.50/mt Friday. “There are some offers, but on the

option, 14 - 29 Jan 2013 (laycan to be narrowed to 5 to buy given the current 50 ppm outright price, and the other side demand is not that great either,” one trader said

days at the time of the deal), CIF Basis CIM Le Havre inland supply is enough to suffice the demand.” Low of thin trading activity in the ULSD barge market. In the

+ full NWE C/P. Subject to acceptance of Venus R. Jet 50 ppm gasoil outright values can trigger buying activity Northwest European cargo market there continued to be

a

MOC barge deal summary: Statoil-Morgan Stanley at Jan in the German market, such as that seen in July 2012 available cargoes originating from the Baltic region. During

+$76/mt 2kt FARAG 09-13/1 when outright values fell to 18-month low of $829/mt the Platts Market on Close assessment process there were

lu

and triggered end users in Germany to come out and buy two cargo offers basis Le Havre. Both cargoes, one from

Jet Index (PGA page 115) around 2.8 million tonnes of 50 ppm over July according Vitol and one from Stasco were offered on prompt delivery

a

January 3, 2013 Index $/mt to German agency MVW. However a FOB Amsterdam- dates of January 14-18. Despite the absence of US and

Europe & CIS PJECI00 346.92 PJECI09 1014.63

Rotterdam-Antwerp 50 ppm barge value of $944.50/mt Asia arbitrage cargoes premiums premium remained

Ev

MidEast & Africa PJMEA00 372.74 PJMEA09 984.81

Global PJGLO00 350.78 PJGLO09 1011.31 was not low enough to stimulate buying demand. The 50 relative suppressed, sources said. The Mediterranean

ppm differential was assessed at $16.50/mt over the region continued to price above NWE, with demand into

front month ICE 0.1% gasoil futures contract, unchanged Italy and Turkey supporting premiums, sources said. The

Gasoil (PGA page 1499)

over the day Platts data showed. In the 50 ppm barge spread between the CIF NWE cargo premium and the CIF

MOC process Vitol bit to January plus $17/mt for Med cargo premium was $5.50/mt Friday, Platts data

F

The January futures contract was trading at a $2.50/ front window loading, while an offer by Argos Supply shows. During the MOC process Gunvor had two cargoes

mt discount to its February counterpart in the European Trading at January plus $16/mt for mid-window loading which demonstrated a lower premium on the day, while

PD

afternoon trading session before ending the day at was lifted by STR. AST re-offered at plus $17. The there were bids from OMV and Stasco showing demand

1630 London time at a $2.25/mt discount, compared Mediterranean 0.1% gasoil market retained is strength basis Turkey and from Trafigura demonstrating buying

with a $1.75/mt discount at the same time Thursday as North African demand supported differentials, and interest basis Italy. “Italy is becoming more of a regular

and from a flat structure December 27. Traders said traders noted a lack on on specification prompt cargoes. short. There has been a lot of refinery closures which

fundamentals were unchanged from Thursday, with low The combination of Algeria, Libya and Egypt buying has means now there is always interest in Fiumincino and

regional demand, stable export demand and healthy seed the CIF cargo differential reach its highest premium Falconara for example,” one trader said.

rt

flows from the Baltics. “It’s still same flows leaving the since October 24 when it was assessed at $12.50/

region South America, West Africa and North Africa,” a mt. The CIF Med 0.1% gasoil differential was assessed

pe

trader added. While any demand in the Benelux, French at $12.25/mt above the front-month ICE 0.1% gasoil

or Swiss region was put down to standard contractual futures contract. PLATTS OIL IS ON TWITTER

volumes rather than incremental demand to cover

increased consumption, as temperatures remained FOR UP-TO-THE-MINUTE OIL NEWS

Ex

Gasoil deals (PGA page 5)

warmer than typical for January. In the 0.1% gasoil barge AND INFORMATION FROM PLATTS

Platts Market on Close assessment process Vitol hit n Gasoil 0.1% barge MOC deals: VSA- Mercuria , 2kt Follow us on twitter.com/PlattsOil

a bid by Mercuria at January minus $1/mt for loading for 9-13 Jan 0.1 bgs FOB ARA at Jan minus 1; Gunvor-

January 9-13, a rebid by Mercuria at the same level was Mercuria bid 2kt for 9-13 Jan 0.1 bgs FOB ARA at Jan

then hit by Gunvor before the close of the window. The minus 1.

Copyright © 2013, The McGraw-Hill Companies 5

EUROPEAN MARKETSCAN january 4, 2013

Diesel deals (PGA page 5)

NWE LSFO cargoes fell a second day against equivalent n LSFO cargo MOC deals: 1) LSFO: CARGO: VITOL-BP

Diesel MOC barge trades: AST-Vitol Jan + 20 ARA, 9-13 front-month swaps to a discount of minus $5.25/ NWE Crg FOB bss Antwerp January 24-28, 1% FOB

Jan, 2kt; Statoil-Vitol Jan + 20 AR, 9-13 Jan, 2kt; AST-BP mt, from minus $4.00/mt the previous day. This NWE cargoes +$0.00 for 25000 mt. EU qualified.

Jan + 20 ARA, 9-13 Jan, 2kt. was based on a trade in the Platts Market on Close 25kt main volume pricing Jan 5-31. Optol pricing basis

assessment process in which Vitol’s aggressive offer of bl+3 days as per main volume differential.

Fuel oil (PGA page 1599)

a 25,000--30,000 mt FOB Antwerp LSFO cargo of Platts Spec - 1.00s / 0.991 / 280cst / 30pp / 65 min fp /

n

new specification, except for 280 CST viscosity and 6 9650 NCV / 60 alu+sili / 120 van / 0.5 water / 15 ccr

The high sulfur fuel oil market firmed for a third asphaltenes, was lifted by BP, pricing on the remainder / 6 asphaltenes / 0.1 TSP&TSE&TSA / 0.10 ash / 2

tio

straight session Friday following gains in Singapore, of FOB NWE 1% assessments flat. OW’s CIF NWE offer h2s / oil to contain no ULO / rest as per rmg

sources said. FOB Rotterdam 3.5% barges were was less aggressive Friday, allowing CIF NWE numbers

assessed at a $1/mt premium to the February to recover against FOB. LSFO barges were less active, n HSFO cargo MOC deal summary: none

swap, up $0.75/mt day-on-day. There were reports with no trades in the MOC process.

a

that Gunvor had fixed a VLCC, the D Whale, to VGO (PGA page 1597)

carry straight run fuel oil, and perhaps some high

lu

Fuel Oil deals (PGA page 5)

sulfur fuel oil, from Southwold to Singapore, for Vacuum gasoil differentials to ICE Brent futures held

loading January 15. Gunvor declined to comment. n HSFO barge MOC deals: 1) Gunvor-Vitol $602/mt, 2kt, steady Friday, as limited buying interest in Northwest

a

There were reports that other trading houses were FOB Rdam, FE; 2) Litasco-Vitol $602/mt, 2kt, FOB Rdam, Europe was seen. This might soon turn, sources

investigating arbitrage opportunities to Asia, though FE; 3) Litasco-Vitol $602/mt, 2kt, FOB Rdam, FE; 4) noted, as gasoline cracks had shown some strength

Ev

some traders did not feel it attractive enough for the Litasco-Vitol $602/mt, 2kt, FOB Rdam, FE; 5) Gunvor-Nioc in the region and beyond. Crude values in both high

time being. “It [the arb] appears to still be shut to $602.5/mt, 2kt, FOB Rdam, FE; 6) Litasco-Vitol $602/ and low sulfur grades in the region remained firm,

me. Arb spreads have narrowed,” a trader said. In mt, 2kt, FOB Rdam, FE; 7) Mercuria-Chemoil $602/mt, and product margins seeing the inevitable effect

Singapore, the FOB Singapore cash differential to the 2kt, FOB Rdam, BE; 8) Mercuria-Vitol $602/mt, 2kt, FOB of some knock-on weakness. “There isn’t a lot of

Mean of Platts Singapore assessment for 380 CST Rdam, FE; 9) BP-Vitol $602/mt, 2kt, FOB Rdam, FE; 10) demand out there for VGO at this moment,” said

F

high sulfur fuel oil firmed up to a two-month high. Gunvor-Vitol $602/mt, 2kt, FOB Rdam, FE; 11) BP-Vitol one regular seller of the low sulfur market, adding:

Nevertheless, Singapore traders seemed skeptical $602/mt, 2kt, FOB Rdam, FE; 12) Litasco-Vitol $602/ “Though I’d imagine demand will have to pick up

PD

that the momentum with which the market sentiment mt, 2kt, FOB Rdam, FE; 13) BP-Vitol $602/mt, 2kt, FOB if gasoline cracks remain where they are.” Indeed

has shifted would be sustained, amid good supply Rdam, FE; 14) Litasco-Chemoil $601.5/mt, 2kt, FOB gasoline cracks looked better than at the back end

levels. Trade sources estimate that western arbitrage Rdam, BE; 15) Chemoil-Vitol $602/mt, 2kt, FOB Rdam, of 2012, up at a two-and-a-half month high around

volumes amounting to around 5.5 million mt will arrive FE; 16) Litasco-Chemoil $601/mt, 2kt, FOB Rdam, MW; February Brent plus $6.50/barrel. “Since the fiscal

into the region this month, up from 4.5-5 million mt 17) Koch-Gunvor $601.75/mt, 2kt, FOB Rdam, BE; 18) cliff was averted we’ve seen an uptick and perhaps it

in December. “Yes, it seems like a big turnaround in BP-Vitol $602/mt, 2kt, FOB Rdam, FE. could rekindle interest in VGO,” a source said.

rt

market sentiment indeed, but I am not sure how much

of it really is rational,” said a Singapore-based trader.

pe

“Yes, the Chinese have been buying, but I don’t think

it’s any unusually incremental volume...they probably

imported slightly more in December than in November,

and for January it may be the same as in December. ] EUROPEAN MARKETSCAN Volume 45 / Issue 3 / January 4, 2013

Editorial: Gasoil: +44-20-7176-6166 Diesel: +44-20-7176-6684 Gasoline: +44-20-7176-6120 Jet: +44-20-7176-6206 Naphtha: +44-20-7176-3144

Ex

Crude: +44-20-7176-6114 Fuel Oil: +44-20-7176-6104 Feedstocks: +44-20-7176-6112

They have already covered their Chinese New year Client services information: North America: 800-PLATTS8 (800-752-8878); direct: +1 212-904-3070, Europe & Middle East: +44-20-7176-6111,

requirements. So I don’t think Chinese buying in Asian Pacific: +65-6530-6430 Latin America: +54-11-4121-4810, E-mail: support@platts.com

Copyright © 2013 The McGraw-Hill Companies. All rights reserved. No portion of this publication may be photocopied, reproduced, retransmitted, put into a compu-

itself is a big factor for the shift in sentiment,” said a ter system or otherwise redistributed without prior written authorization from Platts. Platts is a trademark of The McGraw-Hill Companies Inc.Information has been

trader with a Chinese trading house. In the Northwest obtained from sources believed reliable. However, because of the possibility of human or mechanical error by sources, McGraw-Hill or others, McGraw-Hill does not

guarantee the accuracy, adequacy or completeness of any such information and is not responsible for any errors or omissions or for results obtained from use of

European low sulfur fuel oil market Friday, physical FOB such information. See back of publication invoice for complete terms and conditions.

Copyright © 2013, The McGraw-Hill Companies 6

EUROPEAN MARKETSCAN january 4, 2013

VGO deals (PGA page 5)

Asia products

No deals reported. Code Mid Change Code Mid Change

Singapore (PGA page 2002)

FOB Singpore ($/barrel)

North Sea crude (PGA page 1299) Naphtha PAAAP00 104.31–104.35 104.330 -1.050

Gasoline 92 unleaded PGAEY00 119.15–119.19 119.170 -1.620

During the Platts Market on Close assessment Gasoline 95 unleaded PGAEZ00 121.47–121.51 121.490 -1.500

n

process Friday, Vitol bid for--and eventually bought- Gasoline 97 unleaded PGAMS00 123.97–124.01 123.990 -1.510

Kerosene PJABF00 126.34–126.38 126.360 -0.140

-a cargo of Forties crude at a premium of $1.50/ Gasoil 0.05% sulfur AAFEX00 125.84–125.88 125.860 -0.350

tio

barrel to Dated Brent. Crucially, this occurred while Gasoil 0.25% sulfur AACUE00 124.74–124.78 124.760 -0.380

Gasoil POABC00 125.84–125.88 125.860 -0.350

Trafigura offered a cargo of Brent-Ninian Blend to

Fuel oil 180 CST 2% ($/mt) PUAXS00 648.16–648.20 648.180 +9.800

Dated Brent plus $1.35/b, where Vitol ultimately HSFO 180 CST ($/mt) PUADV00 633.66–633.70 633.680 +10.880

bought it too. The trades that occurred Friday implied HSFO 380 CST ($/mt) PPXDK00 629.18–629.22 629.200 +10.940

a

that the value of Forties crude was $0.15/b higher Indonesia (PGA page 2516)

than BNB as both cargoes were for the same dates, FOB Indonesia ($/barrel)

lu

LSWR Mixed/Cracked PPAPU00 110.69–110.73 110.710 +1.480

loading January 21-23. Thursday, and for the first

Gasoline components (PBF page 2010)

time since January 27, 2011, Platts assessed BNB

FOB Singapore ($/mt)

a

at a discount of $0.07/b to Forties crude. Friday, a MTBE PHALF00 1168.00–1170.00 1169.000 -15.000

crude trader at Vitol confirmed the trading house had Singapore Swaps (PPA page 2654)

Ev

put the Hanjin Ras Tanura VLCC on subjects to carry February ($/barrel) March ($/barrel)

crude from the North Sea to South Korea, loading Naphtha Japan ($/mt) AAXFE00 930.75–931.25 931.000 -8.000 AAXFF00 917.75–918.25 918.000 -7.500

Naphtha PAAAQ00 101.48–101.52 101.500 -0.900 PAAAR00 100.13–100.17 100.150 -0.900

January 20. Another trader said they had heard that

Gasoline 92 unleaded AAXEL00 117.08–117.12 117.100 -1.050 AAXEM00 115.98–116.02 116.000 -0.950

the vessel was put on subjects for $5.75-5.8 million. Reforming Spread AAXEO00 15.58/15.62 15.600 -0.150 AAXEP00 15.83/15.87 15.850 -0.050

A crude trader at Vitol declined to comment on the Kerosene PJABS00 125.28–125.32 125.300 -0.410 PJABT00 124.74–124.78 124.760 -0.550

F

Gasoil POAFC00 125.37–125.41 125.390 -0.440 POAFG00 124.95–124.99 124.970 -0.530

price. Part of the reason for Forties crude--and by HSFO 180 CST ($/mt) PUAXZ00 637.48–637.52 637.500 +8.250 PUAYF00 638.23–638.27 638.250 +7.000

extension Dated Brent--being so strong recently was Middle East (PGA page 2004)

PD

demand for the grade, in particular from Vitol, which FOB Arab Gulf ($/barrel)

now owns two Forties cargoes loading January 19-23 Naphtha ($/mt) PAAAA00 904.66–913.16 908.910 -7.390

and one Brent cargo loading 21-23--nearly a full Naphtha LR2 ($/mt) AAIDA00 915.54–924.04 919.790 -8.110

Kerosene PJAAA00 123.45–123.49 123.470 -0.050

VLCC’s worth. A crude trader at Vitol said Thursday Gasoil 0.005% sulfur AASGJ00 123.37–123.41 123.390 -0.260

that it had demand to fill, hence the relatively strong Gasoil 0.05% sulfur AAFEZ00 122.77–122.81 122.790 -0.260

Gasoil 0.25% sulfur AACUA00 121.77–121.81 121.790 -0.260

premiums being bid. With other North Sea grades

rt

Gasoil POAAT00 122.77–122.81 122.790 -0.260

down slightly Friday, hindered from any rise on poor HSFO 180 CST ($/mt) PUABE00 618.63–618.67 618.650 +10.960

margins and weak demand, the current strength of Japan (PGA page 2006)

pe

the front-month ICE Brent crude futures spread was C+F Japan ($/mt) Premium/Discount

questioned by some traders--it traded as wide as Naphtha PAAAD00 945.25–953.75 949.500 -8.750

Naphtha MOPJ Strip AAXFH00 917.75–918.25 918.000 -7.500 AAXFI00 31.25/31.75 31.500 -1.250

$1.29/b Friday. “I don’t think fundamentals support Naphtha 2nd 1/2 Feb PAAAE00 961.75–962.25 962.000 -8.500

the spread where it is. I would expect things to Naphtha 1st 1/2 Mar PAAAF00 953.25–953.75 953.500 -8.500

Ex

Naphtha 2nd 1/2 Mar PAAAG00 945.25–945.75 945.500 -9.000

ease...Urals I am hearing might well ease...margins

Gasoline unleaded ($/barrel) PGACW00 122.03–122.07 122.050 -1.620

are not great--something is not quite adding up,” one Kerosene ($/barrel) PJAAN00 128.07–128.11 128.090 -0.190

trader said. Indeed, the February/March BFOE spread Gasoil ($/barrel) POABF00 127.98–128.02 128.000 -0.400

HSFO 180 CST PUACJ00 647.12–647.16 647.140 +10.880

was assessed in the narrower backwardation of

(continued on page 9)

Copyright © 2013, The McGraw-Hill Companies 7

EUROPEAN MARKETSCAN january 4, 2013

US Products: January 3, 2013

Code Mid Change Code Mid Change Code Mid Change

New York harbor (PGA page 152)

CIF cargoes (¢/gal) RVP

Unleaded 87 0.3% AAMHG00 284.27–284.37 284.320 -1.060 AAMHGRV 15.0

Unleaded-89 0.3% AAMIW00 296.07–296.17 296.120 -1.680 AAMIWRV 15.0

Unleaded-93 0.3% AAMIZ00 313.76–313.86 313.810 -2.610 AAMIZRV 15.0

n

Jet PJAAX00 309.80–309.90 309.850 -0.680

Low sulfur jet PJABK00 314.80–314.90 314.850 -1.930

ULS Kero AAVTH00 328.80–328.90 328.850 -1.930

tio

No. 2 POAEH00 302.80–302.90 302.850 -1.430

$/barrel 1% strip NYH cargo vs 1% strip

No. 6 0.3% HP PUAAE00 110.76–110.86 110.810 +2.170 AAUGA00 10.41/10.51 10.460 +0.410

No. 6 0.3% LP PUAAB00 116.76–116.86 116.810 +2.120 AAUGB00 16.41/16.51 16.460 +0.360

a

No. 6 0.7% PUAAH00 106.15–106.25 106.200 +2.180 AAUGC00 5.80/5.90 5.850 +0.420

No. 6 1.0%** PUAAO00 102.39–102.44 102.415 +2.175 AAUGG00 100.34–100.36 100.350 +1.760 AAUGD00 2.04/2.09 2.065 +0.415

No. 6 2.2% PUAAU00 98.13–98.23 98.180 +1.610 AAUGE00 -2.22/-2.12 -2.170 -0.150

lu

No. 6 3.0% PUAAX00 97.38–97.48 97.430 +1.510 AAUGF00 -2.97/-2.87 -2.920 -0.250

Residual swaps ($/barrel)

No. 6 1.0% paper Bal M AARZS00 100.44–100.46 100.450 +1.850

a

No. 6 1.0% paper 1st month PUAXD00 99.50–99.60 99.550 +1.050

No. 6 1.0% paper 2nd month PUAXF00 99.10–99.20 99.150 +0.700

No. 6 1.0% paper next quarter PUAXG00 98.65–98.75 98.700 +0.470

Ev

Boston cargoes (PGA pages 152)

¢/gal

Low sulfur jet PJABL00 316.80–316.90 316.850 -1.930

ULS Kero AAVTJ00 330.80–330.90 330.850 -1.930

No. 2 POAEA00 305.55–305.65 305.600 -1.430

No. 6 2.2% ($/barrel) PUAWN00 98.73–98.83 98.780 +1.660

F

NY/Boston numbers include duty. **This assessment reflects 150 max al+si

FOB Gulf Coast (PGA page 156 & 338)

PD

¢/gal RVP

Unleaded 87 PGACT00 270.00–270.10 270.050 +3.350 PGACTRV 13.5

Unleaded 89 PGAAY00 283.50–283.60 283.550 +3.670 PGAAYRV 13.5

Unleaded 93 PGAJB00 303.75–303.85 303.800 +4.150 PGAJBRV 13.5

MTBE PHAKX00 395.50–395.60 395.550 +8.400

Alkylate* AAFIE00 40.95/41.05 41.000 +6.500

Naphtha PAAAC00 285.25–285.35 285.300 +0.850

Jet 54 PJABM00 303.15–303.25 303.200 -1.080

rt

Jet 55 PJABN00 308.15–308.25 308.200 -1.080

ULS Kero AAVTK00 318.15–318.25 318.200 -1.080

No. 2 POAEE00 299.00–299.10 299.050 -0.380

pe

Low sulfur No. 2 POAES00 300.80–300.90 300.850 -0.980

*Premium to US Gulf Coast pipeline gasoline

$/barrel 3% strip vs 1% strip

Slurry Oil PPAPW00 98.04–98.06 98.050 +1.270 AAUGS00 1.49/1.51 1.500 -0.010

No. 6 1.0% 6 API PUAAI00 100.39–100.41 100.400 +0.070 AAUGT00 3.84/3.86 3.850 -1.210

Ex

No. 6 3.0% PUAFZ00 97.89–97.91 97.900 +1.270 AAUGW00 96.54–96.56 96.550 +1.280 AAUGU00 1.34/1.36 1.350 -0.010

RMG 380 PUBDM00 99.69–99.71 99.700 +1.470 AAUGV00 3.14/3.16 3.150 +0.190

Residual swaps ($/barrel)

No. 6 3.0% paper 1st month PUAXJ00 95.40–95.50 95.450 +0.950

No. 6 3.0% paper 2nd month PUAXL00 94.95–95.05 95.000 +0.800

No. 6 3.0% paper next quarter PUAXN00 94.40–94.50 94.450 +0.580

Copyright © 2013, The McGraw-Hill Companies 8

EUROPEAN MARKETSCAN january 4, 2013

LSSR (PGA page 1598)

$0.91/b Friday. With most February North Sea crude flirted with negative territory towards the end of the week,

loading programs expected Monday, January 7, the Low sulfur straight run values edged lower again Friday, could soon turn negative, a source agreed. “That could

end of the week saw the release of Statoil’s Oseberg beset by trader talk on the lack of European end-user help lift straight run [values] back towards some sense of

and Maersk’s Duc and Dumbarton. Oseberg was flat demand for material. There were signs of cargoes available, respectability after what’s been a tough run,” he said.

on January at six 600,000-barrel cargoes, Dumbarton according to sources, but few public offers gave much

also showed a stable program of one 425,000-barrel indication of value. “The straight run we are seeing is not in LSSR deals (PGA page 5)

n

cargo while Duc’s February program was at four massive quantities, but negative margins might impact that

600,000-barrel cargoes, down one cargo on January. even more,” said one trader. Refining margins, which have No deals reported.

a tio

a lu

Ev

F

PD

rt

pe

Ex

Copyright © 2013, The McGraw-Hill Companies 9

You might also like

- Platts Du 07 Août 2017 PDFDocument18 pagesPlatts Du 07 Août 2017 PDFWallace YankotyNo ratings yet

- Platts Du 07 Août 2017 PDFDocument18 pagesPlatts Du 07 Août 2017 PDFWallace YankotyNo ratings yet

- Us 20221109Document22 pagesUs 20221109javier roviraNo ratings yet

- HSFO ReportDocument17 pagesHSFO ReportAtif IqbalNo ratings yet

- Volume Flow IndicatorDocument12 pagesVolume Flow IndicatorNakata Lintong SiagianNo ratings yet

- ABM Applied Economics Module 4 Evaluating The Viability and Impacts of Business On The CommunityDocument24 pagesABM Applied Economics Module 4 Evaluating The Viability and Impacts of Business On The Communitymara ellyn lacsonNo ratings yet

- Boom and Crash 500Document18 pagesBoom and Crash 500Pauline Chaza100% (6)

- Chapter 10: Transaction C'eycle - The Expenditure Cycle True/FalseDocument13 pagesChapter 10: Transaction C'eycle - The Expenditure Cycle True/FalseHong NguyenNo ratings yet

- Appraisal Ce Exam 2 Review PDFDocument30 pagesAppraisal Ce Exam 2 Review PDFAmeerNo ratings yet

- Equity Research Analyst Interview Questions and Answers 1700748561Document15 pagesEquity Research Analyst Interview Questions and Answers 1700748561rascalidkNo ratings yet

- Apag 20230616Document28 pagesApag 20230616ECPoultry HouseNo ratings yet

- European Marketscan: Expert PDF EvaluationDocument10 pagesEuropean Marketscan: Expert PDF EvaluationWallace YankotyNo ratings yet

- Platts 02 Janv 2013 PDFDocument9 pagesPlatts 02 Janv 2013 PDFWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument9 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- Platts 03 Janv 2013 PDFDocument10 pagesPlatts 03 Janv 2013 PDFWallace YankotyNo ratings yet

- Doc2 PDFDocument10 pagesDoc2 PDFWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument9 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument9 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument9 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument10 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument10 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- Platts 28 Janv 2013Document9 pagesPlatts 28 Janv 2013Wallace YankotyNo ratings yet

- Platts 11 Janv 2013Document9 pagesPlatts 11 Janv 2013Wallace YankotyNo ratings yet

- Platt's 15dec14Document43 pagesPlatt's 15dec14Milkiss SweetNo ratings yet

- Eum 20221125 221126 102827Document32 pagesEum 20221125 221126 102827capttariqNo ratings yet

- Eum 20230918Document31 pagesEum 20230918Govend BarNo ratings yet

- Eum 20231110Document27 pagesEum 20231110Imperium InvestasNo ratings yet

- Eum 20230919Document32 pagesEum 20230919Hhp YmNo ratings yet

- LPG 20140106Document5 pagesLPG 20140106Milkiss SweetNo ratings yet

- Platts Du 04 Août 2017Document19 pagesPlatts Du 04 Août 2017Wallace Yankoty100% (1)

- Eum 20240319Document29 pagesEum 20240319Евгений КондратенкоNo ratings yet

- Eum 20240322Document29 pagesEum 20240322Евгений КондратенкоNo ratings yet

- Euromktscan PlattsDocument16 pagesEuromktscan PlattschrisofomaNo ratings yet

- Eum 20240313Document31 pagesEum 20240313Евгений КондратенкоNo ratings yet

- European Marketscan: Volume 50 / Issue 150 / August 3, 2018Document20 pagesEuropean Marketscan: Volume 50 / Issue 150 / August 3, 2018syaplinNo ratings yet

- Platts Du 02 Aout 2017Document20 pagesPlatts Du 02 Aout 2017Wallace YankotyNo ratings yet

- Eum 20180814Document22 pagesEum 20180814Victor FernandezNo ratings yet

- European Platts 12 April 2024 fullDocument26 pagesEuropean Platts 12 April 2024 fullliuheng1012No ratings yet

- PLATTS Crude 20190809Document24 pagesPLATTS Crude 20190809Huixin dong100% (1)

- EUROSCANDocument18 pagesEUROSCANWallace YankotyNo ratings yet

- Crude Oil Marketwire 030818Document31 pagesCrude Oil Marketwire 030818Sunil NagarNo ratings yet

- Eum 20180301Document20 pagesEum 20180301Marc OkambawaNo ratings yet

- Platts Du 01 Aout 2017Document21 pagesPlatts Du 01 Aout 2017Wallace YankotyNo ratings yet

- Platt 2018Document15 pagesPlatt 2018Haseen AslamNo ratings yet

- Asia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 71 / April 13, 2020Document23 pagesAsia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 71 / April 13, 2020Donnie HavierNo ratings yet

- CARL Price List 25th July 2013Document1 pageCARL Price List 25th July 2013calvin.bloodaxe4478No ratings yet

- Asia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 62 / March 30, 2020Document23 pagesAsia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 62 / March 30, 2020Donnie HavierNo ratings yet

- Apag 20190422Document21 pagesApag 20190422Ghasem BashiriNo ratings yet

- ApagscanDocument14 pagesApagscanSafri IchsanNo ratings yet

- Apag 20230918Document26 pagesApag 20230918Govend BarNo ratings yet

- Apag 20240325Document30 pagesApag 20240325elburkinyNo ratings yet

- Asia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Document21 pagesAsia-Pacific/Arab Gulf Marketscan: Volume 39 / Issue 65 / April 2, 2020Donnie HavierNo ratings yet

- Solventswire 310718Document10 pagesSolventswire 310718Mohammed BabatinNo ratings yet

- LPG 20140122Document6 pagesLPG 20140122Milkiss SweetNo ratings yet

- Apag 20240319Document33 pagesApag 20240319Евгений КондратенкоNo ratings yet

- Crude Oil Marketwire - 22102021Document29 pagesCrude Oil Marketwire - 22102021Đức Vũ NguyễnNo ratings yet

- Variance DMDLDocument28 pagesVariance DMDLRey Joyce AbuelNo ratings yet

- Apag 20240322Document31 pagesApag 20240322Евгений КондратенкоNo ratings yet

- AG & GULF PLATTS 11 April 2024 FULLDocument32 pagesAG & GULF PLATTS 11 April 2024 FULLliuheng1012No ratings yet

- Platts APAG Report 01 09 2015 PDFDocument14 pagesPlatts APAG Report 01 09 2015 PDFSafri IchsanNo ratings yet

- LONGSECTION MergedDocument24 pagesLONGSECTION Mergeddeprianto MNo ratings yet

- Apag 20171110Document16 pagesApag 20171110egif_thahirNo ratings yet

- Lpgas: Northwest Europe Daily Assessments $/MTDocument6 pagesLpgas: Northwest Europe Daily Assessments $/MTMilkiss SweetNo ratings yet

- Fertecon Ammonia Report: 4 September 2008Document8 pagesFertecon Ammonia Report: 4 September 2008Mike MureyaniNo ratings yet

- Zuendleitungen enDocument81 pagesZuendleitungen enManuel ChavesNo ratings yet

- BW 20231117Document10 pagesBW 20231117fysimveeNo ratings yet

- Petroleum Exploration and Exploitation in NorwayFrom EverandPetroleum Exploration and Exploitation in NorwayRating: 5 out of 5 stars5/5 (1)

- European Marketscan: Expert PDF EvaluationDocument9 pagesEuropean Marketscan: Expert PDF EvaluationWallace YankotyNo ratings yet

- EUROSCANDocument18 pagesEUROSCANWallace YankotyNo ratings yet

- Platts 04 Janv 2013 PDFDocument9 pagesPlatts 04 Janv 2013 PDFWallace YankotyNo ratings yet

- Platts 28 Janv 2013Document9 pagesPlatts 28 Janv 2013Wallace YankotyNo ratings yet

- Platts Du 01 Aout 2017Document21 pagesPlatts Du 01 Aout 2017Wallace YankotyNo ratings yet

- Platts Du 03 Août 2017 PDFDocument19 pagesPlatts Du 03 Août 2017 PDFWallace YankotyNo ratings yet

- Platts Du 02 Aout 2017Document20 pagesPlatts Du 02 Aout 2017Wallace YankotyNo ratings yet

- Platts Du 04 Août 2017Document19 pagesPlatts Du 04 Août 2017Wallace Yankoty100% (1)

- European Marketscan: European Products ($/MT) ICE FuturesDocument9 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument9 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument9 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument10 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- European Marketscan: European Products ($/MT) ICE FuturesDocument10 pagesEuropean Marketscan: European Products ($/MT) ICE FuturesWallace YankotyNo ratings yet

- Platts 11 Janv 2013Document9 pagesPlatts 11 Janv 2013Wallace YankotyNo ratings yet

- Platts Mail 13 Septembre 2016Document3 pagesPlatts Mail 13 Septembre 2016Wallace YankotyNo ratings yet

- Platts 30 Janv 2013Document9 pagesPlatts 30 Janv 2013Wallace YankotyNo ratings yet

- European Marketscan: Expert PDF EvaluationDocument9 pagesEuropean Marketscan: Expert PDF EvaluationWallace YankotyNo ratings yet

- International Economics 8th Edition Appleyard Test BankDocument7 pagesInternational Economics 8th Edition Appleyard Test BankNicholasSolisrimsa100% (15)

- Microeconomics 9th Edition Pindyck Test BankDocument38 pagesMicroeconomics 9th Edition Pindyck Test Banknbilojanoy100% (14)

- BB 12 Futures & Options Hull Chap 13Document25 pagesBB 12 Futures & Options Hull Chap 13Ibrahim KhatatbehNo ratings yet

- CH 06 - Macro Part 3Document18 pagesCH 06 - Macro Part 3Samar GrewalNo ratings yet

- Ratio Rate ProportionDocument1 pageRatio Rate Proportionfile.kurniawanNo ratings yet

- STOCK MARKET LINGO TERMSDocument2 pagesSTOCK MARKET LINGO TERMSErnest NievaNo ratings yet

- Sazgar Engineering Works Initiating CoverageDocument4 pagesSazgar Engineering Works Initiating CoverageMuhammad ZubairNo ratings yet

- CHAPTER 8 Classic Price PatternDocument29 pagesCHAPTER 8 Classic Price Patternnurul zulaikaNo ratings yet

- Reasoning Answer The Problem:: Can You Definitely Tell The Truthfulness To The Examples of Inductive Reasoning?Document4 pagesReasoning Answer The Problem:: Can You Definitely Tell The Truthfulness To The Examples of Inductive Reasoning?Haries Vi Traboc MicolobNo ratings yet

- Chapter 8 NotesDocument5 pagesChapter 8 NotesAshweta PrasadNo ratings yet

- Qatar Construction Market Outlook 2017 - 2030: June 2017Document20 pagesQatar Construction Market Outlook 2017 - 2030: June 2017nzm1100% (1)

- Evaluating Different Scenarios For Tradable Green Certificates by Game Theory ApproachesDocument15 pagesEvaluating Different Scenarios For Tradable Green Certificates by Game Theory Approachesprabin gautamNo ratings yet

- Question: A Company Has A Production Capacity of 500 Units Per MonthDocument2 pagesQuestion: A Company Has A Production Capacity of 500 Units Per MonthMICHAELDANE SALANGUITNo ratings yet

- Module 7. Mathematics of Buying and SellingDocument6 pagesModule 7. Mathematics of Buying and SellingMicsjadeCastilloNo ratings yet

- Gutierrez Corporation’s department A should sell component C to department B at P96 per unitDocument4 pagesGutierrez Corporation’s department A should sell component C to department B at P96 per unitRoseann KimNo ratings yet

- Principle of Microeconomics Note Lecture Notes Chapters 1-10-12 20Document65 pagesPrinciple of Microeconomics Note Lecture Notes Chapters 1-10-12 20Hymii SayedNo ratings yet

- Lyceum of The Philippines University - CaviteDocument15 pagesLyceum of The Philippines University - CaviteandreagassiNo ratings yet

- Principles of Contract NegotiationDocument4 pagesPrinciples of Contract NegotiationJade Arbee BarbosaNo ratings yet

- Be Commerce Unit 05Document8 pagesBe Commerce Unit 05swergeNo ratings yet

- Pricing Decision and Cost MGMNT QuizDocument2 pagesPricing Decision and Cost MGMNT QuizEwelina ChabowskaNo ratings yet

- Engineering Economics & Optimization: Lecture#1Document18 pagesEngineering Economics & Optimization: Lecture#1Sahab HafeezNo ratings yet

- IKN712 Jan23Document31 pagesIKN712 Jan23Marko MihajlovicNo ratings yet

- Eandis - Financing The Roll Out of Smart Meters in A Regulated EnvironmentDocument6 pagesEandis - Financing The Roll Out of Smart Meters in A Regulated EnvironmentRavi DhakarNo ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument3 pagesBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsSupraja DevarasettyNo ratings yet