Professional Documents

Culture Documents

Law On Business Organizations: Preliminary Test

Uploaded by

BJ SoilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law On Business Organizations: Preliminary Test

Uploaded by

BJ SoilCopyright:

Available Formats

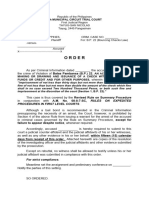

PRELIMINARY TEST

Law on Business Organizations

University of Luzon, College of Accountancy Judge Bryan Jasper Solis, Law Professor

Direction: Ready each question carefully. Choose the best answer by writing the letter of your choice on a separate answer sheet.

Each correct response is worth two (2) points. Good luck and enjoy the test!

1. On February 14, Elsie, Donald, and Vanix agreed to contribute in equal shares money for use as capital in the furniture

business. On February 16, they registered as partnership under the name EDV Elegant Furniture. On February 20,

each of them delivered the sum of Php150,000.00 to the partnership fund. For the operation of the business, they hired

Jovilan as store manager whose salary will paid from the profits of the business on a monthly basis. On February 28,

compelled by the need for specialty tools/equipments and delivery vehicle, they agreed to receive such contributions

from Renzel and Ariza, respectively, who shall each receive shares in the profits. When has EDV Elegant Furniture

acquired juridical personality?

a. February 14

b. February 16

c. February 20

d. February 28

2. Who among the partners in EDV Elegant Furniture is the industrial partner?

a. Vanix

b. Renzel

c. Jovilan

d. None

3. Without express agreement, how much will each partner share in the profits of the business of EDV Elegant Furniture?

a. Equal

b. In proportion to the amount of work performed for the partnership

c. In proportion to capital contribution

d. To be determined by the managing partner

4. Without express agreement, who is/are considered the managing partner/(s) of EDV Elegant Furniture?

a. Elsie, Donald, and Vanix because they the original partners

b. Renzel and Ariza, because they own the controlling interest in the partnership

c. Jovilan, because he is in charge of the operation of the business.

d. All of the partners.

5. What, if any, is the effect of registration of EDV Elegant Furniture before the SEC?

a. It makes the contract of partnership valid and legal.

b. It results into the acquisition of the partnership of a juridical personality.

c. It qualifies the partnership for issuance of business permit from the concerned local government unit as well as

BIR Registration Certificate.

d. All of the above.

6. EDV Elegant Furniture pays Jovilan the sum of Php15,000.00 out of the monthly profits of the business. Which

statement is legally correct about such share?

a. It is considered as wage or compensation as employee of EDV Elegant Furniture.

b. It represents his interest in the partnership as partner.

c. It is just and equitable a compensation under the circumstance.

d. It gives rise to a prima facie presumption that Jovilan is a partner.

e. All of the above.

7. The capability of EDV Elegant Furniture to acquire properties in its own name—

a. Is dependent on its partners’ will.

b. Is a necessary consequence of its status as a juridical person.

c. Is accorded to it only after registration before the SEC.

d. Is dependent on its existing capital

e. All of the above.

8. On the third year of EDV Elegant Furniture, the following events transpired:

i. Jovilan resigned as manager.

ii. Donald was convicted guilty of the crime of Rape.

iii. Ariza married a Chinese businessman and began living with him in Wuhan, China.

iv. Vanix was admitted as patient at the psychiatric ward of UL General Hospital.

v. Elsie put up a business outside of the partnership.

Which event above dissolved the partnership upon its occurrence?

a. (i)

b. (ii)

c. (iii)

d. (iv)

e. (v)

f. All of the above

g. None of the above

9. Who is entitled to the profits earned by Elsie from that business put up by her outside the partnership?

a. EDV Elegant Partnership only

b. Elsie only

c. Both (a) & (b)

d. Elsie, but she will indemnify the partnership for damages

10. If the partners in EDV Elegant Partnership have separate properties outside the partnership, the partnership formed is

—

a. General partnership

b. Particular partnership

c. Universal partnership

d. Limited Partnership

11. Without express agreement, who is liable for partnership debts in case of insolvency of EDV Elegant Partnership?

a. All the partners

b. All the partners, including Jovilan

c. The managing partner

d. The partner at fault or guilty of negligence

12. Assuming all the partners are liable for partnership debts in case of insolvency, EDV Elegant Partnership is a—

a. General partnership

b. Particular partnership

c. Universal partnership

d. Limited partnership

13. By agreement of the partners, those who contributed money to the partnership fund are exempt from liability to third

persons in case of insolvency of the partnership. Such is stipulation is—

a. Void insofar as third persons are concerned.

b. Valid as among the partners.

c. Valid if the contract with such stipulation is registered and acknowledged before the SEC.

d. All of the above.

14. By mere agreement that the partners who contributed money are exempt from liability mentioned in the preceding

number, the partnership is--

a. General partnership

b. Particular partnership

c. Universal partnership

d. Limited partnership

15. Vanix’ connection to EDV Elegant furniture is kept from the public. She is also not active in the management of the

business of the partnership. What kind of partner is Vanix?

a. Nominal

b. Secret

c. Silent

d. Dormant

16. Bryan and Freddie formed a universal partnership of profits. Which of the following properties belong to the

partnership?

a. Banana plantation inherited by Bryan before the formation of the partnership.

b. Salary received by Freddie as law professor of the College of Accountancy of UL.

c. Lotto prize won by Bryan during the first year of the partnership.

d. Vehicle donated to Freddie during the first year of the partnership.

17. Marisol owes Glenda Php10,000.00. She also owes Php12,000.00 to AGB Co., a partnership of which Glenda is the

partner authorized to collect the credits of the partnership. Both debts are due. Marisol gives Php10,000.00 informing

Glenda that the amount is in payment of her debt to the latter. However, Glenda issues a receipt of AGB Co. in partial

payment of its credit. To which credit will the payment be applied?

a. To the credit of Glenda

b. To the credit of AGB Co.

c. To the credit of Glenda and that of AGB Co. proportionately at Php4,000.00 and Php6,000.00 respectively.

d. To the credit of Glenda and that of AGB Co. equally at Php5,000.00 each.

18. CLAMPER Co., a partnership engaged in the trading of bathroom fixtures, is composed of the following partners with

their respective capital contributions: Christian, Php10,000.00; Laisa, Php20,000.00; April, Php30,000.00; Milyn,

Php50,000.00; Pamela, Php80,000.00; Elisha, Php200,000.00; and Rhealyn, Php300,000.00. Christian, Laisa, April,

Milyn and Pamela were appointed as managers without any specification of their respective duties. In March, 2020,

Christian proposed to buy stocks from LAVAVO Trading, but Pamela opposed. A voting took place and Laisa and

April sided with Christian, while Milyn sided with Pamela. How shall the conflict be resolved?

a. The group of Christian, Laisa and April will prevail because they constitute the majority of the managing

partners.

b. The group of Milyn and Pamela will prevail because they constitute the controlling interest among the

managing partners.

c. Neither of the two groups will prevail because the partners should act in unanimity.

d. The votes of Elisha and Rhealyn are necessary to resolve the conflict.

19. Supposing that when the voting took place, Laisa sided with Christian, Milyn sided with Pamela, while April abstained

thereby resulting in a tie among the managing partners. In this case:

a. The group of Pamela will prevail because she and Milyn own the controlling interest among the managing

partners.

b. The tie will have to be resolved by Rhealyn because she owns the controlling interest among all the partners.

c. Neither of the two groups will prevail because of the equal number of votes.

d. Another voting should be conducted to resolve the conflict.

20. For a decade, Jane and Jamille have been partners in J & J Boutique and Fashion House. At the end of February, Jane

assigned her interest to James, but Jamille objected on the ground that she did not want James to be her partner.

a. Jane, without Jamille’s consent, cannot convey her interest to James or any other person.

b. The partnership between Jane and Jamille was automatically dissolved when Jane assigned his interest to

James.

c. James automatically became Jamille’s partner when Jane assigned her interest to him.

d. Jane remains as a partner of Jamille with all the rights and obligations of a partner.

21. By assigning Jane’s interest in the partnership to James, he is entitled—

a. Co-equal right to use specific partnership property

b. Right to manage the affairs of the partnership

c. Share in the profits and surplus

d. All of the above.

22. BRAVO Enterprises is a partnership owned by Bernadette who invested Php20,000.00; Rowena, Php40,000.00; Aira,

Php10,000.00; Vanessa, Php30,000; and Oscar, who contributed her services. The partners have stipulated that

Bernadette shall be exempt from obligations to third persons. After three years of losses, the business had liabilities of

Php90,000.00, while its assets dwindled to Php50,000.00. In the payment of the liabilities, the assets of the partnership

will first be exhausted, and thereafter:

a. The unpaid liabilities of Php40,000.00 will be paid equally by all the partners from their separate assets at

Php8,000.00 each with no right to reimbursement.

b. The unpaid liabilities of Php40,000.00 will be paid equally by all the partners from their separate assets at

Php8,000.00 each with a right to reimbursement on the part of Bernadette, who was exempted from the

liability to third persons by agreement, and Oscar, who is an industrial partner who must not share in the

losses.

c. The unpaid liabilities of Php40,000.00 will be paid equally by Bernadette, Rowena, Aira, Vanessa, and Oscar

at Php10,000.00 each with no right of reimbursement on the part of Oscar.

d. The unpaid liabilities of Php40,000.00 will be paid equally by Bernadette, Rowena, Aira, Vanessa, and Oscar

at Php10,000.00 each with no right of reimbursement on the part of Bernadette.

23. Assume that there is concurrence of creditors of Bernadette, a partnership creditor and personal creditor with only her

personal assets remaining to satisfy any debt. Who shall have preference?

a. Partnership creditor

b. Personal creditor

c. Both partnership and personal creditor in proportion to the debts owed

d. Either on a “first come, first serve” basis

24. BRAVO Enterprises is engaged in the business of consumer electronics. Without due authority, Oscar purchased

sports watches from ICONX Corp. in the name of the partnership. Assuming ICONX Corp. is not aware of the lack of

authority, the resulting contract is—

a. Void, as it was entered without the consent of the partnership

b. Valid, as it was apparently carried on in the usual way the business of the partnership.

c. Unenforceable for being an ulta vires act.

d. Valid because any partner is deemed an agent of the partnership.

25. In payment of the price of Php350,000.00 for the sports watch, it is chargeable on—

a. Partnership assets only

b. Partnership assets, and if insufficient, personal assets of all partners.

c. Partnership assets, and if insufficient, personal assets of acting partner.

d. Personal assets of the acting partner only.

26. The following statements concerning notice and knowledge of a partner concerning partnership affairs are presented to

you:

i. Notice to any partner

ii. Knowledge of a partner acting on the particular matter obtained by him while already a partner.

iii. Knowledge of a partner not acting on the particular matter obtained by him before he became a

partner.

Which of the above notice/knowledge is also notice or knowledge of the partnership?

a. i and ii

b. i and iii

c. ii and iii

d. i, ii, and iii

27. The following sources of obligation are presented to you:

i. Liability arising from torts (quasi-delicts) and crimes for the individual acts of partners.

ii. Liability for contractual obligations of the partnership.

The liability of the partners and the partnership is:

a. i—solidary (partners and partnership); ii—joint (partners)

b. i-joint (partners); ii-solidary (partners and partnership)

c. solidary (partners and partnership) for both (i) and (ii)

d. joint (partners) for both (i) and (ii).

28. Which of the following losses will not cause the dissolution of the partnership?

a. Loss before its delivery to the partnership of property only the use of which was contributed by the partner

who owned it.

b. Loss after its delivery to the partnership of property only the use of which was contributed by the partner who

owned it.

c. Loss before its delivery to the partnership of property which a partner had promised to contribute to the

partnership.

d. Loess after its delivery to the partnership of property which a partner had promised to contribute to the

partnership.

29. A limited partner is liable as a general partner:

i. If he is also a general partner

ii. If he participates in the management of the partnership.

iii. If he allows his surname to be included in the partnership name.

The statement is true with respect to:

a. (i) and (ii)

b. (i) and (iii)

c. (ii) and (iii)

d. (i), (ii) and (iii)

30. Mariefel and Mariel entered into a universal partnership of all present property (M & M). At the time of the execution

of the partnership, Mariefel owned 5 delivery trucks, a warehouse building, and 5 cars, while Mariel owned a five-

hectare fruit and vegetable farm, a tractor, and a poultry farm. During the first year of the partnership, the following

transactions took place:

i. The delivery trucks earned trucking income.

ii. The warehouse earned storage income.

iii. The cars realized revenues from lease (Grab).

iv. Fruits and vegetables were harvested from the farm

v. Chickens and eggs were produced from the operations of the poultry farm

vi. Partner Mariefel purchased a commercial building from her own funds.

vii. Rent was realized from the commercial building.

viii. Partner Mariel inherited a rice field.

ix. Rice was harvested from the field.

The following properties belong to M & M partnership, except:

a. delivery trucks, warehouse and cars from Mariefel

b. Fruit and vegetable farm and poultry farm from Mariel

c. Trucking income, storage income, lease revenues, fruits and vegetable harvested, and chickens and eggs,

because they are the fruits of the present properties.

d. The commercial lot and building and the rentals therefrom.

e. None of the above.

31. Assume that the parties stipulated that after-acquired properties shall belong to the partnership, these properties belong

to M & M partnership, except:

a. Commercial lot and building

b. Rental of the commercial lot and building

c. Rice field inherited by Mariel

d. Rice harvested from the rice field inherited by Mariel

e. None of the above.

32. M & M partnership fixed a period of five (5) years to operate business. On the expiration of the term—

a. The partnership is deemed dissolved.

b. The partners cease to be partners outright.

c. The partnership is terminated.

d. The business becomes illegal.

33. Should Mariefel and Mariel continue the business after lapse of the specific period, the kind of partnership formed is—

a. Partnership by estoppel.

b. Limited partnership

c. Partnership at will.

d. Particular partnership.

34. BEST Company is a partnership composed of Bryce, Eric, Sean, and Tim. Bryce contributed Php50,000.00; Eric,

Php30,000.00; Sean, Php15,000.00; and Tim, Php5,000.00. During the year, BEST Company realized a net profit of

Php10,000.00. If the partners did not have a profit-sharing agreement, how much will each partner receive as share in

the profits?

a. Each partner will receive equal share of Php2,500.00 each.

b. Bryce, Php5,000.00; Eric, Php3,000.00; Sean, Php1,500.00; and Tim, Php500.00.

c. Bryce, Php5,000.00; Eric, Php2,000.00; Sean, Php2,000.00; and Tim, Php1,000.00.

d. Bryce, Php4,000.00; Eric, Php3,000.00; Sean, Php1,500.00; and Tim, Php1,500.00.

35. Partnership and Agency are peculiar from other contracts in that the parties have mutual trust and confidence. In this

sense, these contracts are characterized as:

a. Aleatory

b. Gratuitous

c. Fiduciary

d. Preparatory.

--nothing follows—

Work until your idols become your rivals!

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Business Law - PARTNERSHIPDocument24 pagesBusiness Law - PARTNERSHIPNina Vallerie Toledo100% (24)

- Business LawDocument3 pagesBusiness LawJave MontevirgenNo ratings yet

- Partnership - ANSWERS TO DIAGNOSTIC EXERCISESDocument20 pagesPartnership - ANSWERS TO DIAGNOSTIC EXERCISESBrent LigsayNo ratings yet

- Law On Partnership and Corporation ReviewerDocument8 pagesLaw On Partnership and Corporation ReviewerNoreen Delizo100% (1)

- PartnershipDocument4 pagesPartnershipAbigail Ann PasiliaoNo ratings yet

- Quiz 1Document3 pagesQuiz 1wivada75% (4)

- PAT Diagnostic ExerciseDocument125 pagesPAT Diagnostic ExerciseEd sorianoNo ratings yet

- File 7365772675460733734Document16 pagesFile 7365772675460733734Raisa Gelera100% (1)

- Partnership QuizzerDocument9 pagesPartnership QuizzerJessiCa AnTonio0% (1)

- Business Law and Regulations Quiz: Partnerships 2Document15 pagesBusiness Law and Regulations Quiz: Partnerships 2Gabriela Marie F. Palatulan100% (1)

- Second Periodical ExamDocument19 pagesSecond Periodical ExamGiner Mabale StevenNo ratings yet

- Answer Key On Sample Questions of Partnership LawDocument8 pagesAnswer Key On Sample Questions of Partnership LawHannah Jane Umbay100% (2)

- RFBT 4-Partnership Post-TestDocument5 pagesRFBT 4-Partnership Post-TestCharles D. FloresNo ratings yet

- Kier Jhoem - BLAW E-01 V2Document4 pagesKier Jhoem - BLAW E-01 V2Kier MahusayNo ratings yet

- The Law On Partnership: Business LawsDocument4 pagesThe Law On Partnership: Business LawsLFGS FinalsNo ratings yet

- PARTNERSHIP MCQ Without AnswersDocument24 pagesPARTNERSHIP MCQ Without AnswersShilla Mae BalanceNo ratings yet

- Partnership Diagnostic ExercisesDocument24 pagesPartnership Diagnostic ExercisesBrithney TurlaNo ratings yet

- Notes in LawDocument22 pagesNotes in LawBianca Mae UmaliNo ratings yet

- #Test Bank - Law 2-DiazDocument35 pages#Test Bank - Law 2-DiazKryscel Manansala81% (59)

- BSA BL2 Prelims 2022Document6 pagesBSA BL2 Prelims 2022Joy Consigene100% (1)

- Law Midterm QuestionsDocument14 pagesLaw Midterm QuestionsExequiel ZoletaNo ratings yet

- Q2 - PartnershipDocument6 pagesQ2 - PartnershipAngela Nichole Carandang100% (1)

- MCQDocument16 pagesMCQSelenä Heärt75% (4)

- Bam 241: Business Laws and Regulations Second Periodical ExaminationDocument19 pagesBam 241: Business Laws and Regulations Second Periodical ExaminationGiner Mabale StevenNo ratings yet

- Midterm Exam On Buslaw 102Document13 pagesMidterm Exam On Buslaw 102GeraldNo ratings yet

- PAT-Midterm 2020Document3 pagesPAT-Midterm 2020Ja VillaromanNo ratings yet

- RFBT AssessmentDocument9 pagesRFBT AssessmentJirah Bernal100% (1)

- PartnershipDocument18 pagesPartnershipVanessa DozonNo ratings yet

- RFBT 4-Partnership Pre-TestDocument4 pagesRFBT 4-Partnership Pre-TestCharles D. Flores0% (1)

- Quiz No. 1 - PrelimDocument6 pagesQuiz No. 1 - Prelimstar lightNo ratings yet

- Law Quiz PracticeDocument72 pagesLaw Quiz PracticeJyNo ratings yet

- Comlaw Reviewer QuestionnaireDocument36 pagesComlaw Reviewer QuestionnaireMIGUEL JOSHUA VILLANUEVANo ratings yet

- Quiz On PartnershipDocument28 pagesQuiz On PartnershipJhernel SuaverdezNo ratings yet

- BAM241 BusinesslawandregulationDocument3 pagesBAM241 BusinesslawandregulationKathleen J. GonzalesNo ratings yet

- AAO - SNITCH-ParCor Reviewer QuestionsDocument39 pagesAAO - SNITCH-ParCor Reviewer QuestionsKawaii SevennNo ratings yet

- PARCORDocument13 pagesPARCORAngelica PerosNo ratings yet

- PARTNERSHIPDocument10 pagesPARTNERSHIPArvin John MasuelaNo ratings yet

- PartnershipDocument8 pagesPartnershipAnonymous 03JIPKRkNo ratings yet

- TEST BANK FinalDocument9 pagesTEST BANK FinalAira Kaye MartosNo ratings yet

- Saint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Business Laws and Regulations Prelim ExamDocument22 pagesSaint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Business Laws and Regulations Prelim ExamJessaNo ratings yet

- RFBT Drill 2 (Partnership, Corpo, and Nego)Document13 pagesRFBT Drill 2 (Partnership, Corpo, and Nego)ROMAR A. PIGA100% (1)

- Partnership 1Document4 pagesPartnership 1Angel SagubanNo ratings yet

- Quiz 2Document3 pagesQuiz 2wivada100% (1)

- 2nd Quiz & 1st Graded Recitation.Document2 pages2nd Quiz & 1st Graded Recitation.Wally C. AranasNo ratings yet

- Law On Business OrganizationDocument36 pagesLaw On Business OrganizationChristine PalaganasNo ratings yet

- Test Bank Law 2 DiazDocument35 pagesTest Bank Law 2 DiazJessica ParingitNo ratings yet

- Page - 1Document18 pagesPage - 1Julian Adam Pagal75% (4)

- Problems On PartnershipDocument20 pagesProblems On PartnershipJanetGraceDalisayFabrero100% (3)

- This Study Resource Was: Law On PartnershipDocument5 pagesThis Study Resource Was: Law On PartnershipGraciela InacayNo ratings yet

- B Law Review P-Corp-coop 2022Document43 pagesB Law Review P-Corp-coop 2022Joyce Ann CortezNo ratings yet

- Saint Vincent College of CabuyaoDocument4 pagesSaint Vincent College of CabuyaoRovic OrdonioNo ratings yet

- Law On Partnership MCQ QuestionsDocument28 pagesLaw On Partnership MCQ QuestionsasdfghjklNo ratings yet

- Law On Business OrganizationDocument35 pagesLaw On Business OrganizationHafsah Amod DisomangcopNo ratings yet

- WWDocument7 pagesWWNico evansNo ratings yet

- An Ethiopian Family's Journey of Entrepreneurship in the US: A Story of Determination, Resourcefulness, and FaithFrom EverandAn Ethiopian Family's Journey of Entrepreneurship in the US: A Story of Determination, Resourcefulness, and FaithNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Template Order Declaring BP 22 as Summary Case covered Rules on Expedited ProcedureDocument2 pagesTemplate Order Declaring BP 22 as Summary Case covered Rules on Expedited ProcedureBJ SoilNo ratings yet

- Law 202 Exam on Parternship Laws 2021Document4 pagesLaw 202 Exam on Parternship Laws 2021BJ SoilNo ratings yet

- Law 202 Exam on Parternship Laws 2021Document4 pagesLaw 202 Exam on Parternship Laws 2021BJ SoilNo ratings yet

- Template Order Declaring BP 22 as Summary Case covered Rules on Expedited ProcedureDocument2 pagesTemplate Order Declaring BP 22 as Summary Case covered Rules on Expedited ProcedureBJ SoilNo ratings yet

- G.R. No. 178512Document7 pagesG.R. No. 178512ChristineNo ratings yet

- Mondragon V PeopleDocument3 pagesMondragon V PeoplequasideliksNo ratings yet

- Law On Business Organizations: Preliminary TestDocument5 pagesLaw On Business Organizations: Preliminary TestBJ SoilNo ratings yet

- Argumentative EssayDocument5 pagesArgumentative EssayBJ SoilNo ratings yet

- ARNEL COLINARES v PeopleDocument17 pagesARNEL COLINARES v PeopleBJ SoilNo ratings yet

- Argumentative Essay Sample 2Document7 pagesArgumentative Essay Sample 2BJ SoilNo ratings yet

- Bonus Activity Corporation LawDocument3 pagesBonus Activity Corporation LawBJ SoilNo ratings yet

- OCA Circular No. 89 2004 PDFDocument3 pagesOCA Circular No. 89 2004 PDFLinusMadamba100% (1)

- Law On Business Organizations 2021Document58 pagesLaw On Business Organizations 2021BJ SoilNo ratings yet

- STRAMADocument7 pagesSTRAMACherrylyn FajardoNo ratings yet

- Difference of General and Limited PartneDocument1 pageDifference of General and Limited PartneMary Joyce GarciaNo ratings yet

- SCM 1Document71 pagesSCM 1Abdul RasheedNo ratings yet

- Financial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFDocument67 pagesFinancial Acct2 2Nd Edition Godwin Test Bank Full Chapter PDFphongtuanfhep4u100% (10)

- Installment Sales Reviewer Problems PDFDocument43 pagesInstallment Sales Reviewer Problems PDFUnnamed homosapien100% (1)

- Causes of Business CycleDocument17 pagesCauses of Business CycletawandaNo ratings yet

- Question and Answer - 1Document31 pagesQuestion and Answer - 1acc-expertNo ratings yet

- CH 10 - Dividend & InterestDocument25 pagesCH 10 - Dividend & InterestPrashant ChandaneNo ratings yet

- Jakarta Port Concept ProposalDocument9 pagesJakarta Port Concept Proposaldeboline mitraNo ratings yet

- 11 Essential Procurement KPIs You CanDocument6 pages11 Essential Procurement KPIs You Canahmed morsi100% (1)

- Research Report For ReferenceDocument107 pagesResearch Report For ReferenceKaustubh ShindeNo ratings yet

- ExportDocument8 pagesExportValeria JiménezNo ratings yet

- Innovation: The Case of Samsung ElectronicsDocument13 pagesInnovation: The Case of Samsung ElectronicsYana AvramovaNo ratings yet

- IPoM Junio 2023Document44 pagesIPoM Junio 2023Cristian NeiraNo ratings yet

- Account Statement 10230002147823 3Document2 pagesAccount Statement 10230002147823 3Nabaratna BiswalNo ratings yet

- Loreal Key Success Factor LASTESTDocument11 pagesLoreal Key Success Factor LASTESTasish moharanaNo ratings yet

- Midterms Quiz Tax Part QuestionsDocument12 pagesMidterms Quiz Tax Part QuestionsChristoper BalangueNo ratings yet

- Initial Public Offering Investment: The General Investors' PerspectiveDocument12 pagesInitial Public Offering Investment: The General Investors' PerspectiveBickramNo ratings yet

- Chapter 1-Forms and InterpretationDocument14 pagesChapter 1-Forms and InterpretationSteffany RoqueNo ratings yet

- Velex Logistics Private Limited: Earnings Deductions Amount AmountDocument1 pageVelex Logistics Private Limited: Earnings Deductions Amount Amountaman tripathiNo ratings yet

- Best 300 MCQ Current Affairs June 2023 Ambitious BabaDocument375 pagesBest 300 MCQ Current Affairs June 2023 Ambitious BabaGautamNo ratings yet

- Scam 1992: The Story of Harshad Mehta: A Project Report ONDocument3 pagesScam 1992: The Story of Harshad Mehta: A Project Report ONPahulpreet SinghNo ratings yet

- PiyanshuDocument8 pagesPiyanshubabain219No ratings yet

- CrazyDocument6 pagesCrazyFlexjob careerNo ratings yet

- COOPERATIVEDocument8 pagesCOOPERATIVEChristian LugoNo ratings yet

- Profile On Dairy Processing EquipmentDocument20 pagesProfile On Dairy Processing Equipmentbiniam meazaneh100% (1)

- Module 9 - Earnings and Market Approach ValuationDocument46 pagesModule 9 - Earnings and Market Approach Valuationnatalie clyde matesNo ratings yet

- Double Entry Book Keeping Ts Grewal 2018 For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial StatementsDocument60 pagesDouble Entry Book Keeping Ts Grewal 2018 For Class 11 Commerce Accountancy Chapter 15 - Adjustments in Preparation of Financial Statementsrohit kumarNo ratings yet

- Business IdiomsDocument22 pagesBusiness IdiomsAileen PalaranNo ratings yet

- Airbnb Marketing ProcessDocument2 pagesAirbnb Marketing ProcessHuong DuongNo ratings yet