Professional Documents

Culture Documents

Business Law and Regulations Quiz: Partnerships 2

Uploaded by

Gabriela Marie F. Palatulan100%(1)100% found this document useful (1 vote)

107 views15 pagesOriginal Title

Business Law and Regulations_Partnerships 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

107 views15 pagesBusiness Law and Regulations Quiz: Partnerships 2

Uploaded by

Gabriela Marie F. PalatulanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 15

Business Law and Regulations

Quiz: Partnerships 2

1. One of the following is not a characteristic of a contract of partnership

A. Real, in that the partners must deliver their contributions in order for the

partnership contract to be perfected.

B. Principal, because it can stand by itself.

C. Preparatory, because it is a means by which other contracts will be entered

into.

D. Onerous, because the parties contribute money, property or industry to the

common fund.

2. One of the following is not a requisite of partnership. Which is it?

A. There must be a valid contract.

B. There must be a mutual contribution of money, property or industry to a

common fund.

C. It is established for the common benefit of the partners which is to obtain

profits and divide the same among themselves.

D. The articles are kept secret among the members.

3. The minimum capital in money or property except when immovable property or

real rights thereto are contributed, that will require the contract of partnership to

be in public instrument and be registered with SEC.

A. P 5,000

B. P10,000

C. P 3,000

D. P30,000

4. X and Y entered into a universal partnership of all present property. At the time of

their agreement. X had a four-door apartment which he inherited from his father 3

years earlier. Y, on the other hand, had a fishpond which he acquired by dacion

en pago from Z. During the first year of the partnership, rentals collected on the

four-door apartment amounted to P480,000; while fish harvested from the

fishpond were sold for P300,000. During the same period. B received by way of

donation a vacant lot from an uncle. The partners had an stipulation that future

property shall belong to the partnership. Which of the following does not belong

to the common fund of the partnership?

A. Fish pond

B. Rental of P480,000

C. Apartment

D. Vacant lot

5. D and E entered into a universal partnership of profits. At the time of execution of

the articles of partnership, D had a two-door apartment which he inherited from

his father 3 years earlier. E on the other hand, had fleet of taxis which he

purchased two years before. In the first year of the partnership, D earned

P500,000 as radio talent while E won P1,000,000 in the lotto. During the same

period, rentals of P120,000 were collected from the apartment, while fare

revenues of P200,000 were realized from the operation of the fleet of taxis.

Which of the following belongs to the partnership?

A. Two-door apartment

B. Lotto winnings of P1,000,000

C. Salary of P500,000

D. Fleet of taxis

6. A partnership formed for the exercised of a profession which is duly registered is

an example of

A. Universal partnership of profits

B. Universal partnership of all present property

C. Particular partnership

D. Partnership by estoppel

7. A, B and C are partners in ABC Enterprises. Not having established yet their

credit standing, the three partners requested D, a well known businessman, to

help them negotiate a loan from E, a money lender. With the consent of A, B and

C, D represented himself as a partner of ABC Enterprises. Thereafter, E granted

a loan of P150,000 to ABC enterprises. What kind of partner is D?

A. Managing partner

B. Liquidating partner

C. Ostensible partner

D. Partner by estoppel

8. Using the preceding number, assuming ABC Enterprises was unable to pay the

loan on due date at which time the assets of the partnership amounted to

P120,000. From whom may E collect the payment?

A. D only for the whole amount of P120,000.

B. A, B and C who are liable jointly for P50,000 each.

C. ABC Enterprises for its assets of P120,000; hereafter, A, B and C from their

separate assets at P10,000 each.

D. ABC Enterprises for its assets of P120,000 thereafter, A, B, C and D from

their separate assets at P7,500 each.

9. A and B entered into a universal partnership of all present property. The common

property of the partnership shall be:

A. All the properties which belonged to each of the partners at the time of the

constitution of the partnership.

B. All the properties which belonged to each of the partners after the

constitution of the partnership.

C. All the properties which belonged to each of the partners at the time of the

constitution of the partnership as well as the profits which they may acquire

therewith.

D. All the properties which belonged to each of the partners at the time of the

constitution of the partnership as well as the profits which they may acquire

thereafter.

10. A partner can engage in business for himself without the consent of his co-

partners if he is

A. A capitalist partner whether or not the business he will engage in is of the

same kind as or different from the partnership business.

B. An industrial partner whether or not the business he will engage in is of the

same kind as or different from the partnership business.

C. A capitalist partner and the business he will engage in is of a kind different

from the partnership business.

D. An industrial partner and the business he will engage in is of a kind different

from the partnership business.

11. The partnership will bear the risk of loss of three of the following things, except

A. Things contributed to be sold.

B. Fungible things or those that cannot be kept without deteriorating.

C. Non-fungible things contributed so that only their use and fruits will be for the

common benefit.

D. Things brought and appraised in the inventory.

12. A partner's interest in the partnership is his share of the profits and surplus which

he may assign to a third person. Which of the following statements concerning

such right is correct?

A. The conveyance of a partner's interest will cause the dissolution of the

partnership.

B. The assignee becomes a partner.

C. The assignee has the right to interfere in the management of the partnership

business.

D. The assignee has the right to receive the profits which the assigning partner

would otherwise be entitled thereto.

13. X, Y and Z are equal partners of Xyz Partnership. A owes the XYZ Partnership

for p9,000. Z, a partner collected from A, P3,000 before X and Y received

anything. Z issued a receipt on the P3,000 as his share of what A owes. When X

and Y collected from A, A was insolvent.

A. Partner Z shall share partners X and Y with the P3,000

B. Z cannot be required to share X and Y with the P3,000

C. X and Y should first exhaust all remedies to collect from A.

D. X and Y can automatically deduct from the capital contributions of Z in the

partnership their respective share in the P3,000.

14. A and B are partners in a real estate partnership . The partnership owns a piece

of land which C desired to buy. C contacted A and inform him of his desire to buy

the land and A did not tell to B about it. A bought B out of the partnership and

afterwards sold the land to C with a big profit.

A. The partnership is dissolved when A became the sole owner

B. The sale of the land to C is void because it was without the knowledge of B.

C. A is not liable to B for the latter's share in the profits

D. A is liable to B for the latter's share in the profits

15. A, B and C are partners in ABC Partnership. D represented himself as a partner

in ABC Partnership to E, who, on the belief of such representation, extended

P50,000 credit to ABC Partnership. Assuming only B and C consented to such

representation, who will be held liable to E?

A. E extended the credit to ABC Partnership, so a partnership liability exists,

thus, all the partners, A, B and C are liable

B. B, C and D are partners by estoppels and thus, are liable prorate to E

C. Partners A, B and C who benefited from the credit extended by E are liable.

D. D who made the representation is liable to E

16. A and B are partners in a real estate business. A and B were approached by X

who offered to buy a parcel of land owned by the partnership. Thereafter, b sold

to A, B's share in the partnership. Then, A sold the land to X at a big profit.

A. A is liable to B for B's share in the profits

B. The partnership is dissolved when A became the sole owner

C. A is not liable to B for the latter's share in the profits

D. The sale of the land to X is void.

17.

18. A and B are equal partners in AB Partnership. Y presented himself as a partner

in AB Partnership to Z, who relying on such representation, extended P50,000

credit to AB Partnership. Of the two (2) partners only B knew and consented to

the representation of Y. Who should be held liable to Z?

A. Only Y, who presented himself as partner is liable.

B. Since the credit was extended to AB Partnership, a partnership liability was

created, so the two (2) partners and Y are liable.

C. Partners A and B who benefited from the credit extended to the partnership

AB Partnership shall be liable to Z.

D. B and Y are partners by estoppel and, thus, are liable to Z.

19. The following persons are disqualified to form a universal partnership. Who are

the exception?

A. Brother and sister

B. Husband and wife

C. Those guilty of adultery and concubinage

D. Those guilty of the same criminal offense, if the partnership is entered into a

consideration of the same.

20. A is the capitalist partner and B the industrial partner. A is engaged personally in

the same kind of business the partnership is engaged in.

A. If there are losses, the partnership will bear the losses

B. If there are profits, the profits will be shares by A and the partnership

C. If there are profits, A will give the profits to the partnership

D. A will be excluded from the partnership and pay damages.

21. A is the managing partner of ABC Partnership. X owes A personally and ABC

Partnership P20,000 each. A collected and receive from X, P10,000 and he

issued a receipt wherein it is stated that the amount is applied against his

personal credit.

A. The amount received will be applied in favor the partnership credit

B. The amount will be applied in proportion to both credits

C. The amount received will be applied in the credit of A

D. All the partners will decide as to whose favor it will apply

22. Three (3) of the following are similarities between a partnership and a

corporation. Which is not?

A. The individuals composing both have little voice in the conduct of the

business

B. Both have juridical personality separate and distinct from that of the

individuals composing them.

C. Like a partnership, a corporation can act only through agents

D. Both are organizations composed of an aggregate of individuals

23. A, B and C are general partners in ABC Partnership. A, the managing partner

engaged personally in a business that is the same as the business of the

partnership without the consent of B and C.

A. If there are profits, A will give the profits to the partnership

B. If there are losses, the partnership will bear the losses

C. If there are profits, they will be shared by partner A and the ABC Partnership

D. The profits or losses will be shared equally by A and the ABC Partnership

24.

25. The partnership is insolvent. These are preferred as regards to the partnership

property.

A. Partnership creditors

B. Partners separate creditors

C. Partners with respect to their capital

D. Partners with respect to their profits

26.

27. Bears the loss of property contributed to the partnership

A. Capitalist partner

B. Limited partner

C. None of the above

D. Partners contributing usufructory rights

28. When cash or property worth P3,000 or more is contributed as capital. The

Articles of Co-Partnership shall be in a public instrument and be registered with

the Securities and Exchange commission. If the said requirements are not

complied with:

A. It will render the partnership void.

B. It will not affect the liability of the partnership and the partners to third parties.

C. It will not give a legal personality to the partnership.

D. It will give the partnership a de-facto existence.

29. A, B and C are equal partners in Santos Brothers Partnership. The partnership is

indebted to PC for P150,000. Partner A is indebted to SC for P20,000 PC

attached and took all the assets of the partnership amounting to P90,000. B and

C are solvent while A is insolvent and all what he owns is a land valued at

P15,000.

A. SC has the priority to the land of A as a separate creditor.

B. PC has priority to the land of A to cover A's share of the P60,000 remaining

liability of the partnership

C. B and C have priority to the land of A if they paid PC the 60,000 remaining

liability of the partnership.

D. PC and AC shall have priority to the land o A in proportion to their claim of

P60,000 and P20,000 respectively

30. A newly admitted general partner is liable to creditors existing at the time of his

admission and his liability is

A. Up to his capital contribution only if there is stipulation.

B. Up to his separate property even there is no stipulation.

C. Up to his capital contribution even if there is stipulation.

D. Up to his separate property only if there is stipulation.

31. A and B are equal partners in AB Partnership C contacted XYZ and Co. and

represented himself as partner in AB Partnership. XYZ and Co. contacted A who

confirmed that C is in fact a partner of AB Partnership XYZ and Co. extended

credit to C for AB Partnership in the amount of P60,000. Who is liable to XYZ and

Co.?

A. A and C are partners by estoppels and are liable to XYZ and Co.

B. XYZ and Co. extended the credit to C for AB Partnership, so a partnership

liability exists, so both partners, A and B together with C are liable.

C. The AB Partnership benefited, so it is liable

D. Only C who made the representation is liable

32. A, B and C are partners in a trucking and freight business. B and C without the

knowledge of A approached X and offered to sell to X all the trucks of the

partnership at a price very much higher than their book value. Then B and C

bought-out A from the partnership and thereafter X bought all the trucks with a

big profit of B and C.

A. The sale of the trucks to X is void because it is without the knowledge and

consent of A.

B. B and C are not liable to A whatsoever

C. B and C are liable to A for his share in the profits in the sale.

D. When A was bought-out of the partnership, the partnership was dissolved so

A has no more share in the profits in the sale.

33. A and B are partners in a real estate business. A and B were approached by X

who offered to buy a parcel of land owned by the partnership. Thereafter B sold

to A, B's share in the partnership. Then A sold the land to X at a big profit. Which

is correct?

A. The sale of the land to X is void

B. A is liable to B for B's share in the profits.

C. B may rescind the contract between A and X

D. A is not liable to B for any share in the profits

34.

35. A, B and C are capitalist partners while D is an industrial partner. A, the

managing partner engaged personally in a business that is the same as the

business of the partnership without the consent of the other partners. As a result,

A. If there are losses, the partnership will bear the losses

B. If there are profits, the profits will be shared by A and the partnership.

C. If there are profits, A will give the profits to the partnership.

D. A will be excluded from the partnership and will pay damages.

36. A, a managing partner is B's creditor to the amount of P1,000 already

demandable. B also owes the partnership P1,000, also demandable. A collects

P1,000 from B. One is not correct.

A. If A gives a receipt for the partnership it is the partnership's credit that has

been collected.

B. If A gives a receipt for his own credit, it is A's credit that has been collected.

C. If A gives a receipt for his own credit, P500 will be given to him, P500 to the

partnership.

D. B may decide that he is paying only A's credit if the personal credit of A is

more onerous to B.

37. The following are similarities between partnership and a corporation. Which is the

exception?

A. Both have juridical personalities separate and distinct from that of the

individuals composing them.

B. Like a partnership, a corporation can act only through agents

C. Both are organization of an aggregate of individuals

D. The individuals composing both have little voice in the conduct of the

business.

38. In the partnership of A, B and C, A was appointed in the Articles of Co-

Partnership as managing partner. As such manager in good faith:

A. His power is revocable even without consent

B. His power can be revocable at any time even without just cause provided

C. He may execute all acts of administration despite the opposition of B and C

D. He can be removed for valid cause even without the vote of the partners

owning the controlling interest

39.

40. X and Y established a partnership by contributing, each at P50,000. Z, a third

party allowed his name to be included in the firm name of the partnership. The

partnership was insolvent and after exhausting all the remaining asset, there was

left a liability to third persons the amount of P30,000. The creditors can compel:

A. Z to pay P30,000 remaining liability

B. X, Y and Z to pay P10,000 each

C. X or Y to pay P30,000 remaining liability

D. X and Y to pay P15,000 each

41. W, X, Y and Z formed a partnership. W, X and Y are general partners and

contributed P50,000 each while Z, an industrial partner contributed his services

only. All the partners signed an agreement stipulating that the liability of W is

limited to its contribution After all the assets of the partnership were exhausted

there remains an unpaid liability of P40,000. The creditors of the partnership can

compel:

A. X and Y to pay the P40,000

B. X, Y and Z to pay the P40,000

C. W, X, Y and Z to pay P10,000 each and W and Z can demand

reimbursement from X and Y.

D. X and Y to pay P40,000

42. A, B and C are partners. D is admitted as a new partner. Will D be liable for

partnership obligations contracted prior to his admission to the partnership?

A. No, only for those contracted after his admission.

B. Yes, and his liability would extend to his own individual property.

C. Yes, but his liability will extend only to his share in the partnership property

and not to his own individual property.

D. Yes, as if he had been an original partner.

43. A and B are capitalist partners, with C as industrial partner. A and B contributed

P15,000 each to the capital of the partnership. A contractual liability of P40,000

was incurred by the partnership in favor of X. The capital assets of P30,000 shall

first be exhausted thereby leaving an unsatisfied liability of P10,000. X can

recover the amount from:

A. A and B only

B. A, B and C

C. A, B and C and C can recover for reimbursement from A and B

D. Answer not given

44. A, B and C are partners engaged in a retail business. Their contribution is

P20,000 each. D is admitted as a new partner with a contribution of P8,000. At

the time of his admission, the partnership has an outstanding obligation to E in

the amount of P80,000. In this case:

A. D is not liable to E for this obligation

B. D is liable to E for this obligation so that amounting to P68,000 will be

exhausted leaving a balance of P12,000. Only A, B and C shall be liable jointly or

pro-rata, out of their separate property.

C. D is liable to E for this obligation so that after the assets of the partnership

will be exhausted, leaving a balance of P12,000, all the partners shall be liable

jointly or pro-rata, out of their separate property.

D. Answer not given.

45. A, B and C, capitalist partners, each contributed P10,000. After exhausting the

assets of the firm, the firm's indebtedness amounts to P90,000. It was stipulated

that A would be exempted from liability. Which is correct?

A. A may recover his original capital of P10,000.

B. The creditors may collect P30,000 each from A, B and C.

C. A can recover P20,000 each from B and C should he be required to pay the

creditors.

D. The creditors can recover P45,000 each from B and C.

46. M and O are partners of M & O Partnership. M is the managing partner. N owes

M P10,000 and M & O partnership P30,000. The obligations of N are both due. M

collected from N the debt of N to M in the amount of P10,000 and issued a

receipt in the name of M. To which obligation will the P10,000 be applied?

A. The whole of the P10,000 be applied to debt of N to M

B. The P10,000 be applied to debt of N to M and to the partnership

C. P5,000 each of debt of N to M and to the partnership

D. P2,500 to debt of N to M and P7,500 debt of N to the partnership

47.

48.

49. R, S and T are partners. T is the industrial partner who in addition to his services,

he also contributed capital to the partnership. There is no stipulation as to

sharing of profits and losses. The partnership realized profits of P21,000. The

share of T in the profits:

A. R and will determine T's share I, in the profits

B. T's share is P7,000

C. Pro-rata to his contributed capital

D. Nothing, because he is an industrial partner

50. W, X, Y and Z are partners. They contributed capital as follows: W, P50,000; X,

P30,000; Y, P20,000 and Z, is an industrial partner, his services. The

partnership's obligation to outsiders exceed the total net assets by P18,000. Who

and by how much will the partners be liable for the payment of the P18,000?

W X Y Z

A. P9,000 P5,400 P3,600 0

B. P4,500 P4,500 P4,500 P4,500

C. P6,000 P6,000 P6,000 P6,000

D. P4,500 P2,700 P1,800 P9,000

51.

52. A, B and C are partners. Their contributions are as follows: A, P60,000; B,

P40,000 and C, services. The partners agreed to divide profits and losses in the

following proportions: A, 35%; B, 25% and C 40%. If there is a loss of P10,000,

how should the said loss be shared by the partners?

A. A P6,000; B P4,000; C nothing

B. A P3,000; B P2,000; C P5,000

C. A P3,500; B P3,500; C P3,000

D. A P3,500; B P2,500; C P4,000

53. Using the preceding number, but the partners did not agree on how to divide

profits and losses. If there is a loss of P10,000, how should the said loss be

shared by the partners?

A. A P6,000; B P4,000; C nothing

B. A P3,000; B P2,000; C P5,000

C. A P3,500; B P3,500; C P3,000

D. A P3,500; B P2,500; C P4,000

54.

55.

56.

57.

58. A is the managing partner of A and Company. X is indebted to A for P20,000 and

to the partnership for P60,000. When both debts mature, X pays A P20,000 and

the latter issues a receipt for his personal credit. The payment for P20,000 shall

be applied:

A. ¼ in favor of A and ¾ in favor of the partnership

B. To the whole debt owing to A

C. ½ in favor of A and ½ in favor of the partnership

D. To the debt owing to the partnership

59. A and B are partners, with A as the managing partner. D is indebted to A in the

amount of P10,000 and to the partnership in the amount of P5,000. Both debts

are due and demandable. D paid A P3,000. A issued to D a receipt in his own

name. How should the amount of P3,000 be applied?

A. The P3,000 should be applied to the indebtedness of D to A.

B. The P3,000 should be applied to the indebtedness of D to the partnership.

C. P2,000 should be applied to the indebtedness of D to the partnership and

P1,000 to the indebtedness of D to A.

D. P1,000 should be applied to the indebtedness of D to the partnership and

P2,000 to the indebtedness of D to A.

60. Using the preceding no. but A issued to D a receipt in the name of the

partnership. How should the payment of P3,000 be applied?

A. The P3,000 should be applied to the indebtedness of D to A.

B. The P3,000 should be applied to the indebtedness of D to the partnership.

C. P2,000 should be applied to the indebtedness of D to the partnership and

P1,000 to the indebtedness of D to A.

D. P1,000 should be applied to the indebtedness of D to the partnership and

P2,000 to the indebtedness of D to A.

61. A, B, C and D are partners. Their contributions are as follows: A, P50,000; B,

P30,000; C, P20,000; D, services. The partnership incurred obligations to third

persons which the firm was unable to pay. After exhausting the assets of the

partnership, there still is unpaid balance of P10,000 to E. Who are liable to E for

the payment of the unpaid balance of P10,000 and how much should each pay to

E?

A. A P5,000; B P3,000; C P2,000; D nothing

B. A P2,500; B P2,500; C P2,500; D P2,500

C. A P4,000; B P3,000; C P2,000; D P1,000

D. A P4,000; B P4,000; C P2,000; D nothing

62.

63. A, B and C are equal partners in ABC Partnership. The partnership is indebted to

D for P150,000. Partner A is indebted to E for P20,000. D attached and took all

the assets of the partnership amounting to P90,000. B and C are solvent while A

is insolvent and that he owns is a land valued at P15,000. Which is correct?

A. E has priority to the land of A as a separate creditor

B. D has priority to the land of A to cover A's share of the P60,000 remaining

liability of the partnership.

C. B and C have priority to the land of A if they paid D the P60,000 remaining

liability of the partnership.

D. D and E shall both have priority to the land of A in proportion to their claims

of P60,000 and P20,000, respectively.

64. A, B and C are partners. A is an industrial partner. During the first year of

operation, the firm realized a profit of P60,000. During the second year, the firm

sustained a loss of P30,000. So, the net profit for the two years of operation was

only P30,000. In the Articles of Partnership, it was agreed that A, the industrial

partner would get 1/3 of the profit but would not share in the losses. How much

will A, the industrial partner will get?

A. A will get only P20,000 which is 1/3 of the profit of the 1st year of operation.

B. A will get only P10,000 which is 1/3 of the net profit.

C. A will get only P20,000 in the first year and none in the second year.

D. A will share in the loss in the second year.

65. I. A partner cannot assign his interest in the partnership to a third person

without the consent of the other partners.

II. A partner's interest in the partnership is his personal property.

A. True; True

B. True; False

C. False; False

D. False; True

66. I. The creditor of each partner shall be preferred to those of the partnership as

regards the partner's separate property.

II. An industrial partner is exempted from losses but not from partnership

liabilities

A. True; True

B. True; False

C. False; False

D. False; True

67. I. Co-ownership or co-possession does not in itself establish a partnership,

except when such co-owners or co-possessors share in the profits made by the

use of the property.

II. The sharing of gross returns does not of itself establish a partnership,

except when the persons sharing them have a joint or common right or interest in

any property from which the returns are derived.

A. True; True

B. False; False

C. True; False

D. False; True

68. I. The receipt by a person of a share of the profits of a business is conclusive

evidence that he is a partner in the business.

II. A partnership of all present property is where the partners contribute all

property which actually belong to them to a common fund, with the intention of

dividing the same among themselves, as well as all the profits which they may

acquire therewith.

A. True; True

B. False; False

C. True; False

D. False; True

69. I. All the partners in a general partnership are considered managing partners

if thee is no stipulation as to who shall act as managing partner.

II. A partner is liable to the partnership for whatever property he agrees to

contribute without necessity of demand.

A. True; True

B. True; False

C. False; False

D. False; True

70. I. If the capital contribution of the partners amount to P3,000 or more the

contract of partnership must be in public a public document, otherwise the

contract is void.

II. A contract of partnership is void, whenever immovable property is

contributed thereto if an inventory of said property is not made, signed by the

parties and attached to the public document.

A. True; True

B. True; False

C. False; False

D. False; True

71. I. A partnership may be constituted in any form, except where immovable

property or real rights are contributed thereto, in which case a written instrument

shall be necessary.

II. Every contract of partnership having a capital of three thousand pesos or

more in money or property shall appear in a public instrument which must be

recorded in the office of the SEC, otherwise the partnership is void.

A. True; True

B. False; False

C. True; False

D. False; True

72. I. A contract of partnership is void, whenever immovable property is

contributed thereto, if an inventory of said property is not made, signed by the

parties and attached to the public instrument.

II. A universal partnership of profits is that in which the partners contribute all

the property which actually belongs to them to a common fund with the intention

of dividing the same among themselves, as well as the profits which they may

acquired therewith.

A. True; True

B. False; False

C. True; False

D. False; True

73. I. In a universal partnership of profits, the property which belong to each of the

partners at the time of the constitution of the partnership becomes the common

property of all the partners, as well as all the profits which they may acquire

therewith.

II. A universal partnership of all present property comprises only all that the

partners may acquire by their industry or work during the existence of the

partnership.

A. True; True

B. False; False

C. True; False

D. False; True

74. I. A universal partnership of profits comprises all movable or immovable

property which each of the partners may possess at the time of the celebration of

the contract and all that the partners may acquire by their industry or work during

the existence of the partnership.

II. Future property by inheritance, legacy or donation, including the fruits

thereof cannot be included in the stipulation regarding the universal partnership

of all present property.

A. True; True

B. False; False

C. True; False

D. False; True

75. I. A and B are partners in a universal partnership of profits. Subsequently, A

won first prize in the sweepstakes. The prize money will belong to the

partnership.

II. A and B are partners in a universal partnership of profits. Later A

purchased a parcel of land. The fruits of said land belong to the partnership.

A. True; True

B. False; False

C. True; False

D. False; True

76. I. Persons who are prohibited from giving each other any donation or

advantage cannot enter into universal or particular partnership.

II. A partnership begins from the moment of the execution of the contract,

unless it is otherwise stipulated.

A. True; True

B. False; False

C. True; False

D. False; True

77. I. If property has been promised by a partner as contribution to the

partnership, the fruits arising from the time the property should have been

delivered should also be given provided prior demand was made.

II. A partner who has undertaken to contribute a sum of money and fails to do

so becomes a debtor for the interest and damages from the time he should have

complied with his obligation, without the need of any demand.

A. True; True

B. False; False

C. True; False

D. False; True

78. I. The partners shall contribute equal shares to the capital of the partnership.

II. If there is no agreement to the contrary, in case of an imminent loss of the

business of the partnership, any partner who refuses to contribute additional

share to the capital, to save the venture, shall be obliged to sell his interest to the

other partners.

A. True; True

B. False; False

C. True; False

D. False; True

79. I. If a partner collects a demandable sum, which was owed to him in his own

name, from a person who owed the partnership another sum also demandable,

the sum thus collected shall be applied to the two credits in proportion to their

amounts, even though he may have given a receipt for his own credit only, but

should he have given it for the account of the partnership credit, the amount shall

be fully applied to the latter.

II. The risk of specific and determinate things contributed to the partnership so

that only their use and fruits may be for the common benefit, shall be borne by

the partner who owns them.

A. True; True

B. False; False

C. True; False

D. False; True

80. I. In the absence of stipulation, the share of each partner in the profits and

losses shall be equal to each other.

II. A stipulation which excludes one or more partners from any share in the

profits or losses is void, as a general rule.

A. True; True

B. False; False

C. True; False

D. False; True

81. I. The partner who has been appointed manager may execute all acts of

administration despite the opposition of his partners, unless he should act in bad

faith and his power is irrevocable without just or lawful cause.

II. When the manner of management has not been agreed upon, none of the

partners may, without the consent of the others, make any important alterations

in the property of the partnership, even if it may be useful to the partnership.

A. True; True

B. False; False

C. True; False

D. False; True

82. I. Every partner may associate another person with him in his share, provided

it is with the consent of all of the other partners.

II. The capitalist partners cannot engage for their own account in any

operation which is of the kind of business in which the partnership is engaged,

unless there is stipulation to the contrary.

A. True; True

B. False; False

C. True; False

D. False; True

83. I. Every partnership shall operate under a firm name, which shall include the

name of one or more of the partner.

II. All partners, excluding industrial ones, shall be liable pro-rata with all their

property and after all partnership assets have been exhausted, for the contracts

which may be entered into in the name of and for the account of the partnership,

under its signature, and by a person authorized to act for the partnership.

A. True; True

B. False; False

C. True; False

D. False; True

84. I. Persons who are not partners as to each other are not partners as to third

persons, except in cases of estoppel.

II. An admission or representation made by any partner concerning

partnership affairs is evidence against the partnership.

A. True; True

B. False; False

C. True; False

D. False; True

85. I. A person admitted as a partner into an existing partnership is liable for all

the obligations of the partnership arising before his admission as though he had

been a partner when incurred and that such liability will extend to his own

individual property.

II. B has worked for M and Co., as procurer of contracts for fertilizers to be

manufactured by the firm, and as supervisor of the mixing of the fertilizers.

However, he had no voice in the management of the business except in his task

of supervising the mixing of said fertilizers. For his service, he is entitled to 35%

of the profits in the fertilizer business. He is a partner in M and Co.

A. True; True

B. False; False

C. True; False

D. False; True

86. I. C was a bookkeeper in a partnership named "AB", with a yearly salary

amounting to 5% of the net profits or each year. C, however had no vote at all in

the management of the business. He is a partner in AB.

II. Unless there is a stipulation to the contrary, the partners shall contribute

equal shares to the capital of the partnership.

A. True; True

B. False; False

C. True; False

D. False; True

87. I. Every partner may associate another person with him in his share, but the

associate shall not be admitted in the partnership without the consent of all the

other partners, even if the partner having an associate should be a manager.

II. Articles of universal partnership, entered into without specification of its

nature, only constitute universal partnership of profits.

A. True; True

B. False; False

C. True; False

D. False; True

You might also like

- #Test Bank - Law 2-DiazDocument35 pages#Test Bank - Law 2-DiazKryscel Manansala81% (59)

- Logic and Critical Thinking - Quiz 2Document4 pagesLogic and Critical Thinking - Quiz 2Gabriela Marie F. Palatulan100% (3)

- Logic and Critical Thinking - Quiz 2Document4 pagesLogic and Critical Thinking - Quiz 2Gabriela Marie F. Palatulan100% (3)

- Logic and Critical Thinking - Quiz 2Document4 pagesLogic and Critical Thinking - Quiz 2Gabriela Marie F. Palatulan100% (3)

- Logic and Critical Thinking Quiz 3: Square of Oppositions Truth Test TableDocument3 pagesLogic and Critical Thinking Quiz 3: Square of Oppositions Truth Test TableGabriela Marie F. Palatulan100% (2)

- Logic and Critical Thinking Quiz 3: Square of Oppositions Truth Test TableDocument3 pagesLogic and Critical Thinking Quiz 3: Square of Oppositions Truth Test TableGabriela Marie F. Palatulan100% (2)

- Logic and Critical Thinking Quiz 3: Square of Oppositions Truth Test TableDocument3 pagesLogic and Critical Thinking Quiz 3: Square of Oppositions Truth Test TableGabriela Marie F. Palatulan100% (2)

- Garrison Industries Consolidated EPS SensitivityDocument4 pagesGarrison Industries Consolidated EPS SensitivitySTEIVERNo ratings yet

- Critical Thinking and Logic TestDocument6 pagesCritical Thinking and Logic TestGabriela Marie F. PalatulanNo ratings yet

- Religious Trust Formate TempleDocument10 pagesReligious Trust Formate TemplePawan Kumar100% (3)

- ReSA B46 AUD Final PB Exam Questions Answers Solutions 1Document16 pagesReSA B46 AUD Final PB Exam Questions Answers Solutions 1John Gabriel RafaelNo ratings yet

- Logic and Critical Thinking - Quiz 1Document2 pagesLogic and Critical Thinking - Quiz 1Gabriela Marie F. Palatulan80% (5)

- Logic and Critical Thinking - Quiz 1Document2 pagesLogic and Critical Thinking - Quiz 1Gabriela Marie F. Palatulan80% (5)

- Logic and Critical Thinking - Quiz 1Document2 pagesLogic and Critical Thinking - Quiz 1Gabriela Marie F. Palatulan80% (5)

- Practical Accounting OneDocument63 pagesPractical Accounting OneVtg86% (7)

- India CIO All Data SalesDocument177 pagesIndia CIO All Data Salesbharat50% (2)

- AralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Document14 pagesAralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Jaiz Cadang100% (1)

- AMPOONDocument28 pagesAMPOONMelanie AmpoonNo ratings yet

- RFBT 4-Partnership Post-TestDocument5 pagesRFBT 4-Partnership Post-TestCharles D. FloresNo ratings yet

- Partnership - ANSWERS TO DIAGNOSTIC EXERCISESDocument20 pagesPartnership - ANSWERS TO DIAGNOSTIC EXERCISESBrent LigsayNo ratings yet

- CTDI Final Pre-Board Special Laws Only PDFDocument4 pagesCTDI Final Pre-Board Special Laws Only PDFPatricia Marie MercaderNo ratings yet

- Regulatory Framework For Business Transactions: Page 1 of 9Document9 pagesRegulatory Framework For Business Transactions: Page 1 of 9DanicaNo ratings yet

- PAS 1 and PFRS 1 Multiple Choice QuestionsDocument4 pagesPAS 1 and PFRS 1 Multiple Choice Questionsjahnhannalei marticioNo ratings yet

- Cup - Regulatory Framework For Business TransactionDocument6 pagesCup - Regulatory Framework For Business TransactionJerauld BucolNo ratings yet

- III. Law On Pledge Mortgage Recto Law Maceda Law PD 957 and Assignment of Credit PDFDocument17 pagesIII. Law On Pledge Mortgage Recto Law Maceda Law PD 957 and Assignment of Credit PDFseya dummyNo ratings yet

- Second Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who IsDocument5 pagesSecond Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who IsLeilalyn NicolasNo ratings yet

- Bl2: The Law On Private Corporation Final Examination General InstructionsDocument4 pagesBl2: The Law On Private Corporation Final Examination General InstructionsShaika HaceenaNo ratings yet

- Negotiable Instruments Exam ReviewDocument14 pagesNegotiable Instruments Exam ReviewLester AguinaldoNo ratings yet

- Obligations and Rights of Mortgagor and MortgageeDocument1 pageObligations and Rights of Mortgagor and Mortgageesummer amberNo ratings yet

- Law 9Document2 pagesLaw 9Crissa Mae Falsis100% (1)

- Group 2 MiCparDocument21 pagesGroup 2 MiCparCarlito B. BancilNo ratings yet

- Regulatory Framework For Business TransactionsDocument13 pagesRegulatory Framework For Business TransactionsNash VelisanoNo ratings yet

- BL AnswerKeyDocument4 pagesBL AnswerKeyRosalie E. BalhagNo ratings yet

- At - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Document85 pagesAt - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Waleed MustafaNo ratings yet

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- Drill 2 CorporationDocument2 pagesDrill 2 CorporationweqweqwNo ratings yet

- Test Bank Law On Sales - CompressDocument7 pagesTest Bank Law On Sales - CompressViky Rose EballeNo ratings yet

- Unit 1-4: Property, Agency, and Patent Law ReviewDocument2 pagesUnit 1-4: Property, Agency, and Patent Law ReviewPrince Pierre100% (1)

- Exer LawDocument8 pagesExer LawRed MendozaNo ratings yet

- Theory On PPEDocument1 pageTheory On PPEExcelsia Grace A. ParreñoNo ratings yet

- Regulatory Framework For Business Transactions: ST NDDocument9 pagesRegulatory Framework For Business Transactions: ST NDMark Domingo MendozaNo ratings yet

- CPA Review School of The Philippin: First Pre-Board Examination Regulatory Framework For Business TransactionsDocument11 pagesCPA Review School of The Philippin: First Pre-Board Examination Regulatory Framework For Business TransactionsSophia PerezNo ratings yet

- Intacc 3Document102 pagesIntacc 3sofiaNo ratings yet

- Quiz4-Responsibilityacctg TP BalscoreDocument5 pagesQuiz4-Responsibilityacctg TP BalscoreRambell John RodriguezNo ratings yet

- AT-07 (FS Audit Process - Audit Planning)Document4 pagesAT-07 (FS Audit Process - Audit Planning)Bernadette PanicanNo ratings yet

- Local Government Taxation Short Cases ExplainedDocument1 pageLocal Government Taxation Short Cases ExplainedRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Law Exam Multiple Choice QuestionsDocument14 pagesLaw Exam Multiple Choice QuestionsJan ryanNo ratings yet

- Far Week 6 Investment Properties RevieweesDocument4 pagesFar Week 6 Investment Properties RevieweesAdan NadaNo ratings yet

- BLT 2012 First Pre-Board July 28Document14 pagesBLT 2012 First Pre-Board July 28Lester AguinaldoNo ratings yet

- Nfjpia Frontliners RFBT 2019Document19 pagesNfjpia Frontliners RFBT 2019Risalyn BiongNo ratings yet

- Law On Obligations and Contracts Quiz Bee Round 1 EasyDocument6 pagesLaw On Obligations and Contracts Quiz Bee Round 1 EasyadssdasdsadNo ratings yet

- Pre Board Examination RFBT Batch 2 PDFDocument18 pagesPre Board Examination RFBT Batch 2 PDFMikasa MikasaNo ratings yet

- Ch07 Compound Financial InstrumentDocument5 pagesCh07 Compound Financial InstrumentJessica AllyNo ratings yet

- ACC51114 (Sample Questions - Quiz 4)Document9 pagesACC51114 (Sample Questions - Quiz 4)The Brain Dump PHNo ratings yet

- CH07 Gross EstateDocument9 pagesCH07 Gross EstateRenelyn FiloteoNo ratings yet

- Business Law MidtermsDocument16 pagesBusiness Law MidtermsLory McmorryNo ratings yet

- Title 3Document6 pagesTitle 3Mark Hiro Nakagawa0% (1)

- BLT 2012 Final Pre-Board April 21Document17 pagesBLT 2012 Final Pre-Board April 21Lester AguinaldoNo ratings yet

- Corporation Law Quiz QuestionsDocument10 pagesCorporation Law Quiz QuestionsCJBNo ratings yet

- CPA review school Philippines tax questionsDocument9 pagesCPA review school Philippines tax questionsNah HamzaNo ratings yet

- CRC AceDocument3 pagesCRC AceNaSheengNo ratings yet

- 1ST Grading ExamDocument12 pages1ST Grading ExamJEFFERSON CUTENo ratings yet

- PRELEC1 Final ExamDocument4 pagesPRELEC1 Final ExamAramina Cabigting BocNo ratings yet

- RFBT CHALLENGE questionsDocument7 pagesRFBT CHALLENGE questionsRegine YbañezNo ratings yet

- Cash, Cash Equivalent and Bank ReconDocument7 pagesCash, Cash Equivalent and Bank ReconPrincess ReyesNo ratings yet

- Problem 1: The Statement of Affairs: Straight ProblemsDocument5 pagesProblem 1: The Statement of Affairs: Straight ProblemsJemNo ratings yet

- Module 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonDocument3 pagesModule 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonJoshua Daarol0% (1)

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- ReSA B45 TAX Final PB Exam Questions, Answers & SolutionsDocument13 pagesReSA B45 TAX Final PB Exam Questions, Answers & SolutionsjoyhhazelNo ratings yet

- 9201 - Partnership FormationDocument4 pages9201 - Partnership FormationBrian Dave OrtizNo ratings yet

- Business Law & TaxationDocument11 pagesBusiness Law & TaxationDarwin Competente LagranNo ratings yet

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Document4 pagesIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNo ratings yet

- Test Bank Law 2 DiazDocument35 pagesTest Bank Law 2 DiazJessica ParingitNo ratings yet

- Partnership & Corporation Test Bank QuestionsDocument35 pagesPartnership & Corporation Test Bank QuestionsHafsah Amod DisomangcopNo ratings yet

- Types of Partnerships ExplainedDocument13 pagesTypes of Partnerships ExplainedJannefah Irish SaglayanNo ratings yet

- Logic and Critical Thinking Summative Test 1Document6 pagesLogic and Critical Thinking Summative Test 1Gabriela Marie F. Palatulan100% (1)

- Logic and Critical Thinking Summative Test 1Document6 pagesLogic and Critical Thinking Summative Test 1Gabriela Marie F. Palatulan100% (1)

- Business Law and Regulations Quiz: Partnerships 1Document11 pagesBusiness Law and Regulations Quiz: Partnerships 1Gabriela Marie F. Palatulan100% (1)

- Business Law and Regulations Quiz: Partnerships 1Document11 pagesBusiness Law and Regulations Quiz: Partnerships 1Gabriela Marie F. Palatulan100% (1)

- Business Law and Regulations Quiz: Partnerships 2Document15 pagesBusiness Law and Regulations Quiz: Partnerships 2Gabriela Marie F. Palatulan100% (1)

- Business Law Partnerships QuizDocument10 pagesBusiness Law Partnerships QuizGabriela Marie F. PalatulanNo ratings yet

- Intermediate Accounting 1 - Quiz On Government Grants and Borrowing CostsDocument3 pagesIntermediate Accounting 1 - Quiz On Government Grants and Borrowing CostsGabriela Marie F. PalatulanNo ratings yet

- Intermediate Accounting 1 QuizDocument8 pagesIntermediate Accounting 1 QuizGabriela Marie F. PalatulanNo ratings yet

- Intermediate Accounting 1 - Quiz On Biological AssetsDocument2 pagesIntermediate Accounting 1 - Quiz On Biological AssetsGabriela Marie F. PalatulanNo ratings yet

- Anand Mahindra ProfileDocument14 pagesAnand Mahindra ProfileKhawar MehdiNo ratings yet

- Gazette Sectoral Targets 19 57Document39 pagesGazette Sectoral Targets 19 57Lincoln de kockNo ratings yet

- Introduction IFRS17Document9 pagesIntroduction IFRS17Ruben Perez Espinoza100% (1)

- Tour Costing and QuotationDocument2 pagesTour Costing and Quotation21Ni Made Dinda Puan Maharani100% (1)

- Chapter 3 - Sesi 1 2022 2023Document42 pagesChapter 3 - Sesi 1 2022 2023黄勇添No ratings yet

- Autority To Sell of Real PropertyDocument2 pagesAutority To Sell of Real PropertyBblabsLlamera100% (1)

- 1.) The 4 Aspects of TradingDocument1 page1.) The 4 Aspects of Tradingrichie2885100% (1)

- TXVNM 2019 Dec ADocument8 pagesTXVNM 2019 Dec AMinh AnhNo ratings yet

- Multistate Complaint PRC 1Document44 pagesMultistate Complaint PRC 1Michael JamesNo ratings yet

- India-Mauritius RelationsDocument4 pagesIndia-Mauritius RelationsBeing SydNo ratings yet

- Savings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationDocument2 pagesSavings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationVipin KumarNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountAmanNo ratings yet

- CIR Vs Pilipinas Shell MRDocument3 pagesCIR Vs Pilipinas Shell MRJan EchonNo ratings yet

- Alumni Fee Voucher UpdatedDocument1 pageAlumni Fee Voucher UpdatedHassan KhalidNo ratings yet

- Shipping DocumentsDocument5 pagesShipping DocumentsMahendran MaheNo ratings yet

- Pratik JadhavDocument64 pagesPratik JadhavSandip ChavanNo ratings yet

- File Uttarpradesh20191Document165 pagesFile Uttarpradesh20191ali khan SaifiNo ratings yet

- Lecture-7 Not For ProfitDocument10 pagesLecture-7 Not For ProfitAnkit Kumar SinghNo ratings yet

- Q1. Cadila Co. Has Three Production Departments A, B and C and Two ServiceDocument5 pagesQ1. Cadila Co. Has Three Production Departments A, B and C and Two Servicemedha surNo ratings yet

- Advantages of GlobalizationDocument8 pagesAdvantages of GlobalizationKen Star100% (1)

- ICICI BankDocument17 pagesICICI BankMehak SharmaNo ratings yet

- BUS310 TMA Spring 2020Document12 pagesBUS310 TMA Spring 2020Ola Doueh100% (1)

- Due Diligence For IPOsDocument14 pagesDue Diligence For IPOsNishant AnandNo ratings yet

- Pilgrim Bank FinalDocument23 pagesPilgrim Bank FinalAbhiGokhs100% (2)

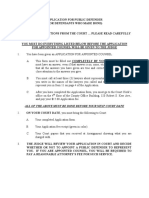

- Application For Public Defender PDFDocument6 pagesApplication For Public Defender PDFTaylor PopeNo ratings yet

- BUDGETING - Exercises: UnitsDocument2 pagesBUDGETING - Exercises: UnitsLeo Sandy Ambe CuisNo ratings yet