Professional Documents

Culture Documents

Process Flow of Loan Proposal 07.08.19-Process Flow of Diganta Proposal

Process Flow of Loan Proposal 07.08.19-Process Flow of Diganta Proposal

Uploaded by

Imran Hossain0 ratings0% found this document useful (0 votes)

16 views1 pageThe document outlines the complete credit proposal process for OCAS-Diganta. It involves several steps:

1) The ARO communicates with the customer, collects documents, verifies eligibility, and inputs data into the system.

2) The RM checks the proposal, verifies details, and forwards it to the BDM.

3) The BDM reviews major areas and forwards to the CRM officer.

If approved, the CRM authority executes the sanction advice and the branch disburses the loan. If declined, it can be appealed.

Original Description:

Original Title

process flow of loan proposal 07.08.19-process flow of Diganta proposal(1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the complete credit proposal process for OCAS-Diganta. It involves several steps:

1) The ARO communicates with the customer, collects documents, verifies eligibility, and inputs data into the system.

2) The RM checks the proposal, verifies details, and forwards it to the BDM.

3) The BDM reviews major areas and forwards to the CRM officer.

If approved, the CRM authority executes the sanction advice and the branch disburses the loan. If declined, it can be appealed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageProcess Flow of Loan Proposal 07.08.19-Process Flow of Diganta Proposal

Process Flow of Loan Proposal 07.08.19-Process Flow of Diganta Proposal

Uploaded by

Imran HossainThe document outlines the complete credit proposal process for OCAS-Diganta. It involves several steps:

1) The ARO communicates with the customer, collects documents, verifies eligibility, and inputs data into the system.

2) The RM checks the proposal, verifies details, and forwards it to the BDM.

3) The BDM reviews major areas and forwards to the CRM officer.

If approved, the CRM authority executes the sanction advice and the branch disburses the loan. If declined, it can be appealed.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

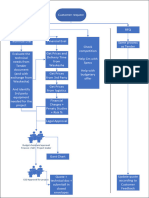

Complete Process flow for Credit Proposal on OCAS-Diganta

After completing all

ARO communicate with the ARO check eligibility of customer & RM will check the proposal and BDM will check the major areas of the

documentations & verification,

Customer customer & obtain all required check all documents, verify the complete the verification with his proposal and complete the verification & input

ARO will input his

needs fund for documents to start the process for authenticity then input data in the recommendation then forward the his final recommendation then forward the

recommendation and forward the

business loan proposal in the Diganta system with photographs of client's proposal to BDM through Diganta proposal to CRM Officer through Diganta

proposal to the RM through

System. business, home & guarantors etc. System System

Diganta System

CRM officer will now check

system generated Sanction

advice of the approved proposal

and forward to CRM Approval

In case of PPG exception Mr. Syed Atiqur Authority.

CRM Officer will send the Rahman, AVP will

proposal to Mr.Syed Approve/ Decline the

Atiqur Rahman, AVP for exception and forward to

exception approval CRM Approval Authority.

If all documents are in order,

If all documents are in Mr. Syed Atiqur Rahman,

CRM Officer will receive If all documents are in

order the CRM Officer will AVP finally approve/ decline

the Proposal. Scrutinize order the CRM Approval

forward to CRM Approval the Appeal request

the proposal and complete Authority finally approve/

Authority with his

credit assessment. decline the proposal

recommendation

If all documents are not in

order the CRM Officer will

send back to ARO for If all documents are not in

complete all documentation. order the CRM Approval

Authority will send back to CRM Approval Authority

ARO then again forward the

ARO for complete all receive the Appeal request

proposal to CRM Officer.

documentation. ARO then If the Branch and complete his further

again forward the proposal to Don't agree with credit assessment then

CRM Approval Authority this decision they forward to HOMSME & Agri

can apply for

Appeal request. CRM Approval Authority finally

execute the Sanction Advice

which will available on system

BDM recommend for for Branch & CAD.

Appeal with valid CRM Officer receive the

justifications Appeal request and

Branch will create a loan A/c complete his further credit

& complete the disbursement assessment then forward to

process. CRM Approval Authority

Branch download the

Sanction Advice from the

CAD checks all security & system and complete the

Note: other related documents security documentation for

BDM= Branch Development Manager, and load the loan limit disbursement and send to

RM= Relationship Manager, favoring the customer. CAD, CO (through MISDB)

ARO= Assistant Relationship Officer. for limit loading.

You might also like

- Commercial Law Complete Notes UOLDocument59 pagesCommercial Law Complete Notes UOLMohammad Ali Atta Malik50% (2)

- Rapido PaymentsDocument14 pagesRapido PaymentsHorrussNo ratings yet

- Granting-of-Business-Permit ILIGANDocument3 pagesGranting-of-Business-Permit ILIGANDavelBenB4 ApagNo ratings yet

- Maximo HSE Overview: Health, Safety and Environment SolutionDocument25 pagesMaximo HSE Overview: Health, Safety and Environment SolutionJaadi 786No ratings yet

- SRS (Service Receipt Sheet) Blank FormDocument1 pageSRS (Service Receipt Sheet) Blank FormAndika JuliandahriNo ratings yet

- Manpower Planning Grameen Bank (GB)Document52 pagesManpower Planning Grameen Bank (GB)SharifMahmud100% (2)

- Dark Roast JavaDocument59 pagesDark Roast Javajpauno201250% (2)

- The Principles of Legal InterpretationDocument8 pagesThe Principles of Legal InterpretationjellstinsNo ratings yet

- Online Permitting ProcedureDocument17 pagesOnline Permitting ProcedureEs SyNo ratings yet

- CAMex Training Doc RCIDocument4 pagesCAMex Training Doc RCIGuillermo SepulvedaNo ratings yet

- The Tube Map Status: An Example of A Process Flow and Its StepsDocument1 pageThe Tube Map Status: An Example of A Process Flow and Its StepsNomoNo ratings yet

- The Tube Map Status: An Example of A Process Flow and Its StepsDocument1 pageThe Tube Map Status: An Example of A Process Flow and Its StepsNomoNo ratings yet

- Rajesh Murugan.: ResumeDocument4 pagesRajesh Murugan.: ResumeShankker KumarNo ratings yet

- Claim Intimation Document Verification Approved Amount Credited To The WorkshopDocument2 pagesClaim Intimation Document Verification Approved Amount Credited To The WorkshopRohit JagotaNo ratings yet

- Compliance Risk Assessment (Sub Vendor)Document11 pagesCompliance Risk Assessment (Sub Vendor)Urjit KaviNo ratings yet

- Simplified New DMS ScopeDocument10 pagesSimplified New DMS ScopeMelody MerryNo ratings yet

- Mandor Payment ProcessDocument1 pageMandor Payment ProcessGoddi SuryaprayogaNo ratings yet

- Business Acquisition Practice & SPDocument8 pagesBusiness Acquisition Practice & SPShumaila HussainNo ratings yet

- Annexure G Government Printing WorksDocument3 pagesAnnexure G Government Printing WorksdchetNo ratings yet

- Wipro SLADocument2 pagesWipro SLAAvishek DuttaNo ratings yet

- PC Payer Claims ProcessingDocument2 pagesPC Payer Claims ProcessingsrinathNo ratings yet

- Xacta 360 For Fedramp: Reduce The Time and Cost Needed To Achieve and Maintain Fedramp Cloud ComplianceDocument2 pagesXacta 360 For Fedramp: Reduce The Time and Cost Needed To Achieve and Maintain Fedramp Cloud Complianceoguntoyinbo_kaNo ratings yet

- MRT Fit Out and Design GuidelineDocument62 pagesMRT Fit Out and Design GuidelineAnsinNo ratings yet

- WRAP Audit Procedure - (06.09.2022)Document1 pageWRAP Audit Procedure - (06.09.2022)Abdur Rahman SohagNo ratings yet

- Induction Programme: Gitanjali AWARDSDocument34 pagesInduction Programme: Gitanjali AWARDSDilip PanditNo ratings yet

- Perform AML Check (Corporate)Document1 pagePerform AML Check (Corporate)Ram Mohan MishraNo ratings yet

- User Manual Gold CertificationDocument34 pagesUser Manual Gold CertificationAmrutlal PatelNo ratings yet

- Ramco Erp For Services Staffing PDFDocument49 pagesRamco Erp For Services Staffing PDFinfo.glcom5161No ratings yet

- Tender247: Gem WebsiteDocument3 pagesTender247: Gem WebsiteTender 247No ratings yet

- My RCADocument3 pagesMy RCAAjeetKumarNo ratings yet

- Presentation of GeneratorDocument18 pagesPresentation of Generatorapi-3834081100% (1)

- Car M Training Final EditedDocument180 pagesCar M Training Final EditedTDHNo ratings yet

- K.Natarajan: Siemens LimitedDocument3 pagesK.Natarajan: Siemens LimitedNivetha VenkateswaranNo ratings yet

- 2023citizen's Charter (2nd Edition) For The SEC HeadquartersDocument1,176 pages2023citizen's Charter (2nd Edition) For The SEC HeadquartersLaura MangantulaoNo ratings yet

- SME BPR For Fulfillment - Central Admin - UpdatedDocument76 pagesSME BPR For Fulfillment - Central Admin - UpdatedJan Paolo CruzNo ratings yet

- HR Calender & ActivitiesDocument9 pagesHR Calender & ActivitiesAnandReddyNo ratings yet

- Building An API First CompanyDocument50 pagesBuilding An API First Companyroshan321@gmail.comNo ratings yet

- Kunstocom India Pvt. LTD.: Format No: Issue No./Date: Qav-Check Sheet Rev - No/Rev. Date: Control Item Check ItemsDocument2 pagesKunstocom India Pvt. LTD.: Format No: Issue No./Date: Qav-Check Sheet Rev - No/Rev. Date: Control Item Check ItemsSandeep VermaNo ratings yet

- Bureau of Investment Promotion, Rajasthan Statement of Work For Security AuditDocument2 pagesBureau of Investment Promotion, Rajasthan Statement of Work For Security AuditAmitNo ratings yet

- VDM ImplementationDocument4 pagesVDM ImplementationGinna CuadraNo ratings yet

- RCA - NOC-11538-Traffic Is Not Coming To Secure Payment and Users Were Unable To Make The PaymentDocument2 pagesRCA - NOC-11538-Traffic Is Not Coming To Secure Payment and Users Were Unable To Make The PaymentAjeetKumarNo ratings yet

- UBI - RFP Customization of Oracle Financial Services Analytical Applications (OFSAA) Modules - MFTP, ALM & PM and Implementation, Maintenance of Liquidity Risk Management System PDFDocument148 pagesUBI - RFP Customization of Oracle Financial Services Analytical Applications (OFSAA) Modules - MFTP, ALM & PM and Implementation, Maintenance of Liquidity Risk Management System PDFAndy_sumanNo ratings yet

- Work Flow - Recruitment DT: 2017Document3 pagesWork Flow - Recruitment DT: 2017Anonymous oZ18ajaaNo ratings yet

- Asset Lifecycle MGMT v6.2Document53 pagesAsset Lifecycle MGMT v6.2shanmugaNo ratings yet

- Saic LPT 2010Document4 pagesSaic LPT 2010Arjun RawatNo ratings yet

- Accnu Advanced Cloud Solution RattanDocument6 pagesAccnu Advanced Cloud Solution RattanEmphorasoft gmailNo ratings yet

- Crtotos FINALDocument24 pagesCrtotos FINALganeshNo ratings yet

- IP-Transformasi SCM - RecommDocument12 pagesIP-Transformasi SCM - RecommDadanNo ratings yet

- Tony C.W. Yeung and Eric-Thierry MartinDocument24 pagesTony C.W. Yeung and Eric-Thierry MartinzfbuibmzNo ratings yet

- CMMC Compliance and Managed ServicesDocument8 pagesCMMC Compliance and Managed ServicesjustdatagatewayNo ratings yet

- OLA Performance - SCMP APAC - v9Document12 pagesOLA Performance - SCMP APAC - v9carlota leyvaNo ratings yet

- Overview of Subcontracting Process: SCM Weekly Knowledge Sharing Initiative - 3 SessionDocument27 pagesOverview of Subcontracting Process: SCM Weekly Knowledge Sharing Initiative - 3 SessionmeskupNo ratings yet

- Waada Bank Partnership Presentation - 071023Document13 pagesWaada Bank Partnership Presentation - 071023Ali SaadNo ratings yet

- Operational Excellence Through Business Process Management (BPM)Document21 pagesOperational Excellence Through Business Process Management (BPM)Rahul ChaudharyNo ratings yet

- Procore Module 2 (Was & Wat)Document71 pagesProcore Module 2 (Was & Wat)Christelle Marie Aquino BeroñaNo ratings yet

- ULD 2024 Implementation ClarificationDocument2 pagesULD 2024 Implementation Clarification700kapeedNo ratings yet

- Waukesha Project ProcessDocument2 pagesWaukesha Project ProcessAhmed ElewaNo ratings yet

- 2023citizen's Charter (2nd Edition) For Extension OfficesDocument1,203 pages2023citizen's Charter (2nd Edition) For Extension OfficesJason YinNo ratings yet

- KCC205-FAS-OPE-2020 - Acid Plant Storm Water Ponds ConstructionDocument12 pagesKCC205-FAS-OPE-2020 - Acid Plant Storm Water Ponds Constructionelie kabondoNo ratings yet

- Unit 2: Effective Supplier Management and Collaboration: Week 2: From Today To TomorrowDocument5 pagesUnit 2: Effective Supplier Management and Collaboration: Week 2: From Today To TomorrowTUHIN GHOSALNo ratings yet

- Supplier EvaluationDocument14 pagesSupplier EvaluationajaykotianNo ratings yet

- Pioneering Views: Pushing the Limits of Your C/ETRM - Volume 2From EverandPioneering Views: Pushing the Limits of Your C/ETRM - Volume 2No ratings yet

- NEO ProfileDocument62 pagesNEO ProfileNassar IsmailNo ratings yet

- Andhra Bank PO Solved Paper 2009Document30 pagesAndhra Bank PO Solved Paper 2009Teresa CarterNo ratings yet

- EPA Region 7 Communities Information Digest - September 2, 2016Document8 pagesEPA Region 7 Communities Information Digest - September 2, 2016EPA Region 7 (Midwest)No ratings yet

- Metodos Design Service Doing PDFDocument180 pagesMetodos Design Service Doing PDFIara ZorzalNo ratings yet

- Ishwar CV IweDocument3 pagesIshwar CV IweIshwarNo ratings yet

- Sample Sap PP Business Blueprint Document For Textile CompanyDocument17 pagesSample Sap PP Business Blueprint Document For Textile CompanyKumar Ajit100% (1)

- Digests 3Document11 pagesDigests 3SuiNo ratings yet

- GS DDM Fair Value ModelDocument20 pagesGS DDM Fair Value ModelthiagopalaiaNo ratings yet

- Pidato Jokowi Apec Ceo Summit 2014Document3 pagesPidato Jokowi Apec Ceo Summit 2014Ibi Yulia SetyaniNo ratings yet

- The Concept of Service Quality Dimensions in LifeDocument21 pagesThe Concept of Service Quality Dimensions in LifePayal SahaNo ratings yet

- Ageing Debtors 2022 23Document10 pagesAgeing Debtors 2022 23Manojit GamingNo ratings yet

- Chapter Fourteen: Simulation: Problem Summary Problem SolutionsDocument20 pagesChapter Fourteen: Simulation: Problem Summary Problem SolutionsMisha LezhavaNo ratings yet

- Hewlett-Packard: Deskjet Printer Supply ChainDocument17 pagesHewlett-Packard: Deskjet Printer Supply Chainraghav_rohilaNo ratings yet

- REPUBLIC ACT No-WPS OfficeDocument3 pagesREPUBLIC ACT No-WPS OfficeKen KanekiNo ratings yet

- EN-DBSF Grant Application FormDocument8 pagesEN-DBSF Grant Application FormNugroho SaputroNo ratings yet

- Technology Product Marketing Manager in Atlanta GA Resume Jim ButoracDocument2 pagesTechnology Product Marketing Manager in Atlanta GA Resume Jim ButoracJimButoracNo ratings yet

- Bpmm3053 - International MarketingDocument29 pagesBpmm3053 - International Marketingtsrbina p12100% (1)

- Mba 518Document2 pagesMba 518api-3782519No ratings yet

- ACC Report FinalDocument41 pagesACC Report FinalSusmita NayakNo ratings yet

- Marketing Project: Presented by - Aashi, Bhavana, NandaDocument31 pagesMarketing Project: Presented by - Aashi, Bhavana, NandabhavanaNo ratings yet

- CN.2014-22 Pest ControlDocument28 pagesCN.2014-22 Pest ControlBhuds MoringNo ratings yet

- Copyright AssignmentDocument12 pagesCopyright AssignmentParul Nigam100% (1)

- SEC Rules and Regulations - Documentary Requirements For Registration of Corporations and Partnerships PDFDocument35 pagesSEC Rules and Regulations - Documentary Requirements For Registration of Corporations and Partnerships PDFArvinNo ratings yet

- Financial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsiDocument18 pagesFinancial Analysis, Planning & Control: Dr. H. Romli M. Kurdi, Se, MsifitriEmpiiNo ratings yet

- Mission Vision and ValuesDocument12 pagesMission Vision and ValuesGso ParañaqueNo ratings yet

- In-Tray Exercise 2: Answers and Candidate Guidance BookletDocument14 pagesIn-Tray Exercise 2: Answers and Candidate Guidance BookletThuyDuong100% (1)