Professional Documents

Culture Documents

Course Description For The Department of Finance and Banking

Uploaded by

Rayan0 ratings0% found this document useful (0 votes)

9 views4 pagesThis document provides course descriptions for the Department of Finance and Banking. It lists 30 courses covering topics like microeconomics, macroeconomics, financial management, investment management, banking, portfolio management, and more. Most courses are 3 credit hours and have prerequisites of other finance and economics courses. The courses introduce basic concepts and move to more advanced analytical skills and applications in finance.

Original Description:

Original Title

Finance_Course_description_EN

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides course descriptions for the Department of Finance and Banking. It lists 30 courses covering topics like microeconomics, macroeconomics, financial management, investment management, banking, portfolio management, and more. Most courses are 3 credit hours and have prerequisites of other finance and economics courses. The courses introduce basic concepts and move to more advanced analytical skills and applications in finance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views4 pagesCourse Description For The Department of Finance and Banking

Uploaded by

RayanThis document provides course descriptions for the Department of Finance and Banking. It lists 30 courses covering topics like microeconomics, macroeconomics, financial management, investment management, banking, portfolio management, and more. Most courses are 3 credit hours and have prerequisites of other finance and economics courses. The courses introduce basic concepts and move to more advanced analytical skills and applications in finance.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Course Description for the Department of Finance and Banking

55141 MICROECONOMICS {3} [3-3]

Basic economic concepts; demand and supply theory; elasticity; consumer

behavior; indifference curves analysis; production and costs; market structure:

perfect competition, pure monopoly, monopolistic competition and oligopoly;

input market.

Prerequisite: No Prerequisite:

55211 FINANCIAL MANAGEMENT (1) {3} [3-3]

Basic concepts in financial management; tools of financial decision-making;

overview of financial management; financial statements; analysis of financial

ratios; time value of money.

Prerequisite: 53101 Accounting (1)

55142 MACROECONOMICS {3} [3-3]

Production possibility curve; the national income and its components aggregate

income; aggregate expenditures; aggregate supply; consumption and savings;

theory of multiplier; fiscal and monetary policy and their effect on economic

stability; unemployment and inflation; money and banking; international trade;

the exchange rate and the balance of payment; economic development and

economics growth.

Prerequisite: 55141 Microeconomics

55151 FINANCIAL MATHEMATICS {3} [3-3]

Linear functions and economic application; quadratic functions and economic

application; exponential and logarithmic equations and economic application

and functions and economic application; mathematics in finance; differentiation

and economic application; partial differentiation and economic application;

matrices and economic application.

Prerequisite: No Prerequisite:

55152 BUSINESS STATISTICS {3} [3-3]

Elementary principles and applications of descriptive statistics; counting

principles; linear regression and correlation and ANOVA; elementary

probability principles; probability distributions; test of hypothesis and

confidence interval.

Prerequisite: No Prerequisite:

55212 FINANCIAL MANAGEMENT (2) {3} [3-3]

Working capital policy: short-term financial management, net working capital

and the related trade-off between profitability and risk; managing cash and

marketable securities: management of receipts and disbursements, including

float, speeding collections, slowing payments, cash concentration, and investing

in marketable securities; credit management: procedures for quantitatively

considering cash discount changes, other aspects of credit terms, and credit

monitoring; inventory management.

Prerequisite: 55211 Financial Management (1)

55213 FINANCIAL ANALYSIS {3} [3-3]

Comprehensive analyses to common financial statements; financial ratios

interpretation; profitability analysis; models related to determine the intrinsic

value of business institutions.

Prerequisite: 55211 Financial Management (1)

55221 INVESTMENT MANAGEMENT {3} [3-3]

Investment background: distinguish between real assets and financial assets,

objectives of investment, investment instruments; risk and return: risk, return,

security market line, systematic risk, unsystematic risk, the relationship between

risk and expected return, beta in a portfolio sense; bond and stock valuation;

diversification and asset allocation.

Prerequisite: 55211 Financial Management (1)

55222 INSURANCE MANAGEMENT {3} [3-3]

Basic concepts; nature of risk: types of risk that can be insured, how risk can be

insured, nature of risk characteristics of risk; insurance channels; insurance

procedures; types of insurance contracts; reinsurance procedures; the insurance

sector in Jordan.

Prerequisite: 55211 Financial Management (1)

55231 BANKS MANAGEMENT {3} [3-3]

Basic forms of banks; basic objectives of the banking system; relationship

between banks profitability and return; banks financial statement analysis;

managing deposits; managing capital; banks regulations and control.

Prerequisite: 55211 Financial Management

55232 ISLAMIC BANKS MANAGEMENT {3} [3-3]

Historical development of Islamic banks; components of the Islamic banking

systems; Islam perception of Usury; deposits and the cycles of investment and

financing; financial operation in Islamic banks; the calculation and distribution

of profits between shareholders and investors.

Prerequisite: 55231 Banks Management

55333 FINANCIAL MARKETS AND INSTITUTIONS {3} [3-3]

Overview of financial system: principles, functions, and mechanism of financial

markets and institutions; role of interest rates in the financial system; features of

securities traded in financial markets; efficient markets hypothesis; functions of

depository and non-depository financial institutions.

Prerequisite: 55221 Investment Management

55309 FINANCIAL CONTRACTS AND DERIVATIVES {3} [3-3]

Introduction to financial contracts and derivatives: financial derivatives and their

use in risk management, trading of financial contract; forwards and futures: the

difference between forwards and futures, valuing forwards and futures; options:

calls and puts, characteristics of options, option valuation techniques; swaps.

Prerequisite: 55221 Investment Management

55323 PORTFOLIO MANAGEMENT {3} [3-3]

Basic concepts to portfolio management; portfolio risk and diversification; the

Capital Asset Pricing Model (CAPM); the Arbitrage Pricing Theory (APT);

portfolios performance evaluation.

Prerequisite: 55221 Investment Management

55325 REAL ESTATE FINANCE {3} [3-3]

Introduction to real estate finance; legal considerations in real estate finance;

financing residential properties, commercial properties, and construction

projects; financing land development projects; real estate funds.

Prerequisite: 55221 Investment Management

55334 CREDIT MANAGEMENT {3} [3-3]

Credit policy overview; loans characteristics; basic evaluation of

commercial loans; evaluation used in consumer loans; credit risk.

Prerequisite: 55231 Banks Management

55414 CORPORATE FINANCE{3} [3-3]

Theories of cost of capital; capital structure and leverage; dividend policy;

mergers and acquisitions and leasing.

Prerequisite: 55323 Financial Analysis

55416 INTERNATIONAL FINANCE {3} [3-3]

International financial environment; methods used to analyze problems in

international finance; analyze securities in the international financial markets;

financial operations of multinational firms.

Prerequisite: 55323 Portfolio Management

55420 VALUATION OF INVESTMENT PROJECTS {3} [3-3]

Cost of capital evaluation; cash flow estimation: initial, operating, and terminal

cash flows; associated risk analysis; investment projects appraisal: capital

budgeting techniques NPV, IRR, and Payback period.

Prerequisite: 55323 Portfolio Management

55425 GRADUATION PROJECT

Data gathering; data presentation and analysis; report writing.

Prerequisite: 55414 Corporate Finance

55426 FINANCIAL RISK MANAGEMENT {3} [3-3]

Basic concepts in risk management: analyzing market risk, credit risk, liquidity

and operational risks; the risk management process; quantitative risk

management including the calculation of VAR and CAR.

Prerequisite: Portfolio Management 55323

55344 MONEY AND BANKING {3} [3-3]

History of money; types of money; monetary policy and regulation; the

role of money in economic stability; monetary systems and fiscal policy;

demand and supply; money, income and prices; interest rate, money and

real income; monetary policy instruments.

Prerequisite: 55142 Macroeconomics

55423 FINANCIAL PLANNING AND FORECASTING {3} [3-3]

Pro-forma financial statements; short-term financial planning; long-term

financial planning; strategic issues in finance.

Prerequisite: 55213 Financial Analysis

You might also like

- Csuf MbaDocument41 pagesCsuf Mbaee1993No ratings yet

- Stage-6 S-601 - Strategic Financial ManagementDocument4 pagesStage-6 S-601 - Strategic Financial ManagementMir Obaid Ullah ShahNo ratings yet

- LSE FN2191-Principles-of-Corporate-FinanceDocument2 pagesLSE FN2191-Principles-of-Corporate-Financesonia969696No ratings yet

- Department of Finance and Banking Faculty of Business Studies Begum Rokeya University, Rangpur. Master of Business Administration (MBA) SyllabusDocument18 pagesDepartment of Finance and Banking Faculty of Business Studies Begum Rokeya University, Rangpur. Master of Business Administration (MBA) SyllabusFuturesow support zone BangladeshNo ratings yet

- Mastering Financial Risk Management : Strategies for SuccessFrom EverandMastering Financial Risk Management : Strategies for SuccessNo ratings yet

- Synopsis On Credit Reist Analysis-1Document6 pagesSynopsis On Credit Reist Analysis-1Nehal DarvadeNo ratings yet

- Subject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamsDocument11 pagesSubject CA1 Actuarial Risk Management Syllabus: For The 2016 ExamszubboNo ratings yet

- Unit Iii: Credit Monitori NG and Risk Managem ENTDocument19 pagesUnit Iii: Credit Monitori NG and Risk Managem ENTHaritha HaribabuNo ratings yet

- MFS - Risk Management in Banks MuskanDocument54 pagesMFS - Risk Management in Banks Muskansangambhardwaj64No ratings yet

- Why Are (I) Information Memorandum and (Ii) Cash-Flow Analysis Relevant in Project Evaluation?Document27 pagesWhy Are (I) Information Memorandum and (Ii) Cash-Flow Analysis Relevant in Project Evaluation?flichuchaNo ratings yet

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- Oriental Bank of Commerce,: Head Office, DelhiDocument32 pagesOriental Bank of Commerce,: Head Office, DelhiAkshat SinghalNo ratings yet

- An Analysis of Determinants of Deposit Money Banks Lending in Nigeria, 1990-2014Document10 pagesAn Analysis of Determinants of Deposit Money Banks Lending in Nigeria, 1990-2014dagim ayenewNo ratings yet

- This Article Has Multiple IssuesDocument22 pagesThis Article Has Multiple IssuesMirza Ahmad EbrahimiNo ratings yet

- 001b - Why Regulate Banks ExcerptsDocument3 pages001b - Why Regulate Banks ExcerptsSohom BhowmickNo ratings yet

- Finance: Financial ManagementDocument13 pagesFinance: Financial ManagementRhiyam AhrajNo ratings yet

- A Study of Credit Risk Management IN Commercial Banks: (Regd. No. AAI-1261)Document47 pagesA Study of Credit Risk Management IN Commercial Banks: (Regd. No. AAI-1261)DivyaNo ratings yet

- Financial Management & Int Finance Study Text P-12Document744 pagesFinancial Management & Int Finance Study Text P-12Saleem Ahmed100% (4)

- Emerging Market Bank Lending and Credit Risk Control: Evolving Strategies to Mitigate Credit Risk, Optimize Lending Portfolios, and Check Delinquent LoansFrom EverandEmerging Market Bank Lending and Credit Risk Control: Evolving Strategies to Mitigate Credit Risk, Optimize Lending Portfolios, and Check Delinquent LoansRating: 3 out of 5 stars3/5 (3)

- 3rd Year SyllabusDocument9 pages3rd Year SyllabusFakhrul Islam RubelNo ratings yet

- Risk Management in Banks Under Basel NormsDocument53 pagesRisk Management in Banks Under Basel NormsSahni SahniNo ratings yet

- SyllabusDocument3 pagesSyllabusArsalan LobaniyaNo ratings yet

- CRM - ZuariDocument9 pagesCRM - ZuariKhaisarKhaisarNo ratings yet

- Banking SyllabusDocument7 pagesBanking SyllabusAnonymous BW3xfMZJ3No ratings yet

- Ug B.B.A English 104 62 Financial Management 9814Document324 pagesUg B.B.A English 104 62 Financial Management 9814Vyas ShraddhaNo ratings yet

- Insurance and Risk ManagementDocument10 pagesInsurance and Risk Managementlhanda261No ratings yet

- CA1 Actuarial Risk Management PDFDocument9 pagesCA1 Actuarial Risk Management PDFVignesh Srinivasan50% (2)

- A152 BWFF2033 Syllabus - StudentDocument9 pagesA152 BWFF2033 Syllabus - StudenthannahNo ratings yet

- Credit Card Lending: Comptroller's HandbookDocument99 pagesCredit Card Lending: Comptroller's HandbookGautam AgrawalNo ratings yet

- Unit II: Banking Products and Services (Credit Facility)Document38 pagesUnit II: Banking Products and Services (Credit Facility)darshan lamaNo ratings yet

- Introduction To Bank Credit ManagementDocument26 pagesIntroduction To Bank Credit ManagementNeeRaz KunwarNo ratings yet

- This Article Has Multiple IssuesDocument14 pagesThis Article Has Multiple Issuesarjun_rathoreNo ratings yet

- Alm in BankDocument34 pagesAlm in BankdeepakNo ratings yet

- Analysis OF Asset Liability Management Data OF BanksDocument32 pagesAnalysis OF Asset Liability Management Data OF BanksVinayakaMesthaNo ratings yet

- MBA (Finance)Document3 pagesMBA (Finance)Sunita BasakNo ratings yet

- 1Document23 pages1Abdul JabbarNo ratings yet

- Webinar ReportDocument10 pagesWebinar Reportmohd ChanNo ratings yet

- The Essentials of Risk Management, Second EditionFrom EverandThe Essentials of Risk Management, Second EditionRating: 2 out of 5 stars2/5 (7)

- Integretd ProjectDocument7 pagesIntegretd ProjectPatel AmitNo ratings yet

- SSRN Id3855367Document18 pagesSSRN Id3855367Chethana FrancisNo ratings yet

- Material For Pre-Prom-Officers-2018 - Final PDFDocument292 pagesMaterial For Pre-Prom-Officers-2018 - Final PDFRahulNo ratings yet

- Group Project Far 661Document19 pagesGroup Project Far 661azri2701No ratings yet

- Subject CA1 Actuarial Risk Management Syllabus: For The 2013 ExaminationsDocument11 pagesSubject CA1 Actuarial Risk Management Syllabus: For The 2013 ExaminationsMaina MuhoroNo ratings yet

- Riks Modeling of Banking IndustryDocument18 pagesRiks Modeling of Banking IndustrySumra KhanNo ratings yet

- Objectives of Credit Rating: Financial Statements CreditworthinessDocument6 pagesObjectives of Credit Rating: Financial Statements CreditworthinessvishNo ratings yet

- TranscriptDocument2 pagesTranscriptShakeeb AhmedNo ratings yet

- Finance: From Wikipedia, The Free EncyclopediaDocument13 pagesFinance: From Wikipedia, The Free Encyclopediatrineshmishra007No ratings yet

- SynopsisDocument17 pagesSynopsisHarini Bhandaru100% (1)

- A Synopsis Report ON Credit Risk Management AT Icici Bank LTDDocument19 pagesA Synopsis Report ON Credit Risk Management AT Icici Bank LTDMOHAMMED KHAYYUMNo ratings yet

- Financial Decision Making: Module Outline and AimsDocument7 pagesFinancial Decision Making: Module Outline and AimsAmrit PatnaikNo ratings yet

- Syllabus RiskManagement ICEF 2015 PDFDocument5 pagesSyllabus RiskManagement ICEF 2015 PDFJoseph SolivenNo ratings yet

- CHAPTER 2 Bank RegulationDocument55 pagesCHAPTER 2 Bank RegulationBaby Khor0% (1)

- FIN625Document27 pagesFIN625Mahmmood AlamNo ratings yet

- BBM 8th Sem Syllabus 2017 PDFDocument20 pagesBBM 8th Sem Syllabus 2017 PDFBhuwanNo ratings yet

- Credit ManagementDocument46 pagesCredit ManagementMohammed ShaffanNo ratings yet

- Financial Treasury and Forex ManagementDocument641 pagesFinancial Treasury and Forex Managementcharus289100% (1)

- Rubrik Quick Sell GuideDocument2 pagesRubrik Quick Sell GuideRayanNo ratings yet

- Rubrik CDM Sizzle Demo TrainingDocument2 pagesRubrik CDM Sizzle Demo TrainingRayanNo ratings yet

- Cloud-Scale Data Protection Runs On Hpe Proliant®: Recover in Seconds. AnywhereDocument2 pagesCloud-Scale Data Protection Runs On Hpe Proliant®: Recover in Seconds. AnywhereRayanNo ratings yet

- Official Rubrik First Meeting DeckDocument21 pagesOfficial Rubrik First Meeting DeckRayan100% (1)

- Al-Ahliyya Amman University Facult Engineering Study Plan 2019/2020 Computer Engineering (160 Credit Hours)Document1 pageAl-Ahliyya Amman University Facult Engineering Study Plan 2019/2020 Computer Engineering (160 Credit Hours)RayanNo ratings yet

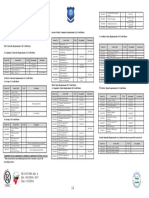

- CE Study PlanDocument1 pageCE Study PlanRayanNo ratings yet

- ةيلهلأا نامع ةعماج Al-Ahliyya Amman UniversityDocument1 pageةيلهلأا نامع ةعماج Al-Ahliyya Amman UniversityRayanNo ratings yet

- DATA SHEET Rubrik Cloud SolutionsDocument2 pagesDATA SHEET Rubrik Cloud SolutionsRayanNo ratings yet

- CE Course DescriptionDocument12 pagesCE Course DescriptionRayanNo ratings yet

- This Is Cloud Data ManagementDocument2 pagesThis Is Cloud Data ManagementRayanNo ratings yet

- ةيلهلأا نامع ةعماج Al-Ahliyya Amman University: 1 Year/ Second Semester 1 Year/ First SemesterDocument1 pageةيلهلأا نامع ةعماج Al-Ahliyya Amman University: 1 Year/ Second Semester 1 Year/ First SemesterRayanNo ratings yet

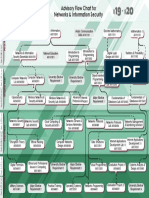

- NIS Study PlanDocument1 pageNIS Study PlanRayanNo ratings yet

- Four Year Advisory Plan (2019-2020) for NIS Students: ةيلهلأا نامع ةعماج Al-Ahliyya Amman UniversityDocument1 pageFour Year Advisory Plan (2019-2020) for NIS Students: ةيلهلأا نامع ةعماج Al-Ahliyya Amman UniversityRayanNo ratings yet

- ةيلهلاا نامع ةعماج Al-Ahliyya Amman University: A0111101 Mathematics (1) (3) (3-3)Document12 pagesةيلهلاا نامع ةعماج Al-Ahliyya Amman University: A0111101 Mathematics (1) (3) (3-3)RayanNo ratings yet

- SE Study PlanDocument1 pageSE Study PlanRayanNo ratings yet

- Study Plan - Networks & Information SecurityDocument1 pageStudy Plan - Networks & Information SecurityRayanNo ratings yet

- Faculty of Information Technology: Advanced Internet ProtocolsDocument1 pageFaculty of Information Technology: Advanced Internet ProtocolsRayanNo ratings yet

- CS Study PlanDocument1 pageCS Study PlanRayanNo ratings yet

- ةيلهلاا نامع ةعماج Al-Ahliyya Amman UniversityDocument13 pagesةيلهلاا نامع ةعماج Al-Ahliyya Amman UniversityRayanNo ratings yet

- Review Literature - 01 (12 Files Merged)Document12 pagesReview Literature - 01 (12 Files Merged)Obaid AhmedNo ratings yet

- HLA EverGreen Funds May 22Document7 pagesHLA EverGreen Funds May 22ivyNo ratings yet

- Director, Chief Investment Officer - New Jersey Department of The Treasury, Division of InvestmentDocument6 pagesDirector, Chief Investment Officer - New Jersey Department of The Treasury, Division of InvestmentMarshay HallNo ratings yet

- Itsm ch3 v6Document76 pagesItsm ch3 v6Br YaNo ratings yet

- CRD Portfolio AnalysisDocument12 pagesCRD Portfolio AnalysisDeep PatelNo ratings yet

- MBFS - PMSDocument12 pagesMBFS - PMSApparna BalajiNo ratings yet

- TN2 Bill Miller and Value TrustDocument7 pagesTN2 Bill Miller and Value Trustfrans leonardNo ratings yet

- Piramal Fund Management Domestic Real Estate Strategy IDocument31 pagesPiramal Fund Management Domestic Real Estate Strategy IkanikaNo ratings yet

- iFASTCorp AnnualReport 2020Document216 pagesiFASTCorp AnnualReport 2020Zheng Yuan TanNo ratings yet

- Intelligent Advisory Portfolios PDFDocument9 pagesIntelligent Advisory Portfolios PDFCASrinivasaRaoGuduruNo ratings yet

- Mutual Funds - IntroductionDocument9 pagesMutual Funds - IntroductionMd Zainuddin IbrahimNo ratings yet

- Nfo Presentation DSP Quant FundDocument26 pagesNfo Presentation DSP Quant FundPrajit NairNo ratings yet

- Real Estate Series 1, 2, 3 XIRRDocument4 pagesReal Estate Series 1, 2, 3 XIRRText81No ratings yet

- AssignmentDocument5 pagesAssignmentHabiba KausarNo ratings yet

- A Study On Finacial Advisor For Mutual Fund InvestorsDocument53 pagesA Study On Finacial Advisor For Mutual Fund InvestorsPrasanna Belligatti100% (1)

- NAV As at 29th January 2021Document33 pagesNAV As at 29th January 2021Avinash GanesanNo ratings yet

- Al Safi PlatformDocument15 pagesAl Safi PlatformbadrishNo ratings yet

- Anderton SICAV Launches New High Income Investment Fund. Gamma Capital Markets Acts As Investment Manager.Document5 pagesAnderton SICAV Launches New High Income Investment Fund. Gamma Capital Markets Acts As Investment Manager.PR.comNo ratings yet

- A Study On Customer Satisfaction Towards Reliance Mutual Fund Lucknow BranchDocument78 pagesA Study On Customer Satisfaction Towards Reliance Mutual Fund Lucknow BranchSTAR PRINTINGNo ratings yet

- WP - 09 - New Problems, New Solutions: Making Portfolio Management More EffectiveDocument8 pagesWP - 09 - New Problems, New Solutions: Making Portfolio Management More Effectivekuruvillaj2217100% (1)

- CV MaruthyDocument2 pagesCV MaruthyKanakz AgrawalNo ratings yet

- WNS BFS Capabilities Presentation - Jan - 2013Document30 pagesWNS BFS Capabilities Presentation - Jan - 2013VikasNo ratings yet

- JP Morgan Jargon BusterDocument24 pagesJP Morgan Jargon BusterzowpowNo ratings yet

- 01.is Alpha Just Beta Waiting To Be DiscoveredDocument16 pages01.is Alpha Just Beta Waiting To Be DiscoveredLiou Kevin100% (1)

- Investing in Banking Sector Mutual Funds - An OverviewDocument5 pagesInvesting in Banking Sector Mutual Funds - An OverviewarcherselevatorsNo ratings yet

- Kavya SrivastavaDocument100 pagesKavya Srivastavakavya srivastavaNo ratings yet

- Goldman Sachs PS ANALYSISDocument3 pagesGoldman Sachs PS ANALYSISGhali ReksaNo ratings yet

- Project Report On Reliance MoneyDocument32 pagesProject Report On Reliance MoneyNithin Ravindranath100% (1)

- HDFC Asset Allocator Fund of Funds - NFO LeafletDocument4 pagesHDFC Asset Allocator Fund of Funds - NFO LeafletJignesh PatelNo ratings yet

- Newzen Mba Finance 2022Document12 pagesNewzen Mba Finance 2022New Zen InfotechNo ratings yet