Professional Documents

Culture Documents

Equities Update: Morning

Uploaded by

sfarithaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equities Update: Morning

Uploaded by

sfarithaCopyright:

Available Formats

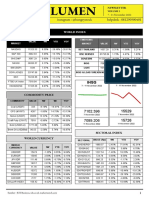

MORNING EQUITIES UPDATE

24 Nov.2020

INDEX PERFORMANCE Global Economy: The euro area private sector contracted sharply in November as member

countries reintroduced more restrictions to counter the spread of Covid-19 infection, flash

INDIAN INDICES LATEST % 1D % YTD survey data from IHS Markit showed Monday. The composite output index plunged to a

CNX NIFTY 12,926 0.0 % 56.6 % six-month low of 45.1 from the neutral 50.0 in October. The UK private sector contracted the

BSE SENSEX 44,077 0.4 % 55.9 % most in six months in November due to the fastest reduction in service sector output since

CNX BANK 29,024 0.0 % 59.4 % May. The IHS Markit/Chartered Institute of Procurement & Supply composite output index

CNX MIDCAP 19,211 0.0 % 67.5 %

dropped to 47.4 in November from 52.1 in October. The services PMI slid sharply to 45.8

from 51.4 in the previous month while manufacturing PMI rose to 55.2 in November from

CNX SMALLCAP 6,310 0.0 % 78.2 %

53.7 a month ago. Australia manufacturing sector continued to expand in November, with a

GLOBAL INDICES LATEST % 1D % YTD Manufacturing PMI score of 56.1, the latest survey from Markit Economics showed on

DOW JONES 29,591 1.1 % 3.7 % Monday. That was up from 54.2 in October and it moved further above the boom-or-bust line

S&P 500 3,578 0.6 % 10.7 %

of 50 that separates expansion from contraction. Production and sales both increased at faster

rates.

FTSE 100 6,334 (0.3) % (16.7) %

HANG SENG 26,486 0.1 % (7.2) % Global Equities: US stocks were supported. AstraZeneca has said that an interim analysis of

NIKKEI 25,527 (0.4) % 10.0 % clinical trials on its Covid-19 vaccine candidate, done in the United Kingdom and Brazil,

SHANGHAI showed that the vaccine was highly effective in preventing the infection.

3,414 1.1 % 10.7 %

COMPOSITE

Indian Economy: Finance Minister Nirmala Sitharaman on Monday assured the industry

that momentum of economic reforms will continue to make India a hotspot of global

FOREX RATES

investment. India has turned the crisis created by COVID-19 pandemic into an opportunity

LATEST % 1D % YTD to push the economic reforms, which remained pending for decades, she said while

USD/INR 73.96 (0.2) % 3.9 % addressing the National MNC's Conference 2020 organised by industry chamber CII.

EUR/USD 1.19 (0.1) % 5.7 % Equity Markets: Domestic benchmark indices ended with modest gains on Monday, tracking

GBP/USD 1.33 0.1 % 0.7 % positive global cues on hopes for imminent coronavirus vaccines. The Nifty managed to close

USD/JPY 103.90 (0.0) % (4.4) % above the 12,900 mark as pharma and IT shares rallied.

USD/AUD 1.37 0.0 % (4.0) %

USD/SGD 1.34 0.2 % (0.2) % Corporate News: IT spending in India is projected to rise 6 % to USD 81.9 billion in 2021

compared to this year on the back of growth across segments like enterprise software and IT

services, research firm Gartner said on Monday. Retailers Association of India (RAI) on

COMMODITIES Monday said Diwali shopping brought respite to some segments of retail, especially

garments, while items related to work-from-home (WFH) continued to show faster recovery,

LATEST % 1D % YTD particularly electronics and consumer durables. Exide Industries will further invested Rs

WTI Crude(USD/bbl) 43 2.2 % (29.6) % 33.17 crore in its subsidiary (joint venture company) Exide Leclanche Energy and increased

Gold(INR/10g) 50,180 (0.0) % 28.7 % its shareholding to 80.15%. Wockhardt will be in focus as promoter entity Themisto Trustee

Gold Comex(USD/oz) 1,843 (1.5) % 19.5 % Company Pvt Ltd released pledge on 14 lakh equity shares.

SILVER(INR/1Kg) 61,450 (0.9) % 33.4 %

Aluminium(USD/MT) 1,970 (0.7) % 11.1 %

Copper(USD/MT) 7,216 0.5 % 17.0 %

FIXED INCOME

INTERBANK

LATEST BPS 1D BPS YTD

RATES

10 Y GSec India 8.1 0.1 % (0.0) %

10 Y GSec US 10 0.9 0.1 % (1.1) %

Goodwill Wealth Management Pvt. Ltd. 1

FUND FLOWS NSE INDICES / SECTORAL PERFORMANCE

LATEST MTD YTD LATEST % 1D % YTD LATEST % 1D % YTD

FII(USD mm) 525.9 477.8 125.6 Banks 29,024 (0.7) % 59.4 % Energy 16,406 2.8 % 52.3 %

MF(INR cr) (88.4) (1,223.7) (340.1) IT 22,007 2.8 % 82.7 % Pharma 11,737 1.8 % 67.0 %

Metals 2,809 1.2 % 80.8 % Finance 14,059 (1.1) % 57.2 %

Auto 8,739 0.6 % 87.6 % PSU 1,467 (0.2) % 14.3 %

MARKET TURNOVER

FMCG 31,568 0.4 % 19.8 % Real Estate 254 1.0 % 47.4 %

LATEST AVG MTD AVG YTD

Cash(INR cr) 75,493 65,072 56,707

NSE MOVERS AND SHAKERS

F&O(INR cr) 2,190,026 2,632,823 1,916,367

TOP GAINERS LATEST % 1D % YTD TOP LOSERS LATEST % 1D % YTD

Bajaj Hold 3,247 7.9 % 85.1 % HDFC 2,251 (3.6) % 42.1 %

MARKET VOLATILITY

ONGC 77 6.8 % 16.3 % ICICI Bank 468 (2.5) % 50.5 %

LATEST AVG MTD AVG YTD L & T Info 3,264 5.6 % 134.5 % Petronet L 253 (2.5) % 26.3 %

CBOE VIX 22.7 26.6 29.9 Motherson 147 5.1 % 153.0 % Muthoot Fi 1,156 (2.3) % 91.2 %

NSE VIX 20.8 21.0 27.4 IndusInd B 850 4.8 % 148.3 % Axis Bank 596 (2.0) % 66.1 %

EVENTS CALENDAR

EVENT DATE TIME(GMT) REGION ACTUAL PREVIOUS VALUE

No Data Found

......... End of Report .........

Goodwill Wealth Management Pvt. Ltd. 2

You might also like

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Governing the Market: Economic Theory and the Role of Government in East Asian IndustrializationFrom EverandGoverning the Market: Economic Theory and the Role of Government in East Asian IndustrializationRating: 4.5 out of 5 stars4.5/5 (2)

- Equities Update: MorningDocument2 pagesEquities Update: MorningsfarithaNo ratings yet

- Equities Update: MorningDocument2 pagesEquities Update: MorningsfarithaNo ratings yet

- Strikes Back: .DJI 12,723.58 (-83.93) .SPX 1,347.32 (-9.30) .IXIC 2,828.23 (-13.39)Document6 pagesStrikes Back: .DJI 12,723.58 (-83.93) .SPX 1,347.32 (-9.30) .IXIC 2,828.23 (-13.39)Andre SetiawanNo ratings yet

- Analysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010Document5 pagesAnalysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010MansukhNo ratings yet

- 4june2014 India DailyDocument40 pages4june2014 India DailyhitpunNo ratings yet

- Market Radiance 30th October 2023Document8 pagesMarket Radiance 30th October 2023SUNDAR PNo ratings yet

- Market Outlook by Mansukh Investment & Trading Solutions 10/08/2010Document5 pagesMarket Outlook by Mansukh Investment & Trading Solutions 10/08/2010MansukhNo ratings yet

- Morning - India 20210825 Mosl Mi PG008Document8 pagesMorning - India 20210825 Mosl Mi PG008vikalp123123No ratings yet

- NSE India - Nov22 - EUDocument9 pagesNSE India - Nov22 - EUpremalgandhi10No ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- Amp - 231213Document39 pagesAmp - 231213Deepul WadhwaNo ratings yet

- 5 6154586374507856628 PDFDocument1 page5 6154586374507856628 PDFArka MitraNo ratings yet

- Inners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Document5 pagesInners & Osers: .DJI 12,319.73 (-30.88) .SPX 1,328.26 (-2.43) .IXIC 2,776.79 (+4.28)Andre SetiawanNo ratings yet

- Morning Insights - 13th February 2024Document14 pagesMorning Insights - 13th February 2024Varatharajan KNo ratings yet

- Msme in India PDFDocument66 pagesMsme in India PDFVenki GajaNo ratings yet

- Antique2 CUTDocument33 pagesAntique2 CUTrchawdhry123No ratings yet

- Nomura - Jun 8 - India Insurance May-22 VolumesDocument10 pagesNomura - Jun 8 - India Insurance May-22 VolumesSpam NestNo ratings yet

- Equity Research Report On Global Health Limited (Medanta)Document11 pagesEquity Research Report On Global Health Limited (Medanta)Jishan Enterprises Ltd.No ratings yet

- 03-Aug-2021 Morning India 20210803 Mosl Mi Pg042Document42 pages03-Aug-2021 Morning India 20210803 Mosl Mi Pg042vikalp123123No ratings yet

- Season Greetings!: (Earnings)Document6 pagesSeason Greetings!: (Earnings)Andre SetiawanNo ratings yet

- Portfolio Performance Analysis: Group 8Document8 pagesPortfolio Performance Analysis: Group 8AYUSHI NAGARNo ratings yet

- Orning India (12/march/21) : Westlife Development (COVID Boosts Convenience Channels Leads To Cost Optimization)Document14 pagesOrning India (12/march/21) : Westlife Development (COVID Boosts Convenience Channels Leads To Cost Optimization)vikalp123123No ratings yet

- Brokerage Report Jan 24Document6 pagesBrokerage Report Jan 24arnabdeb83No ratings yet

- BhartiAirtel-1QFY2013RU 10th AugDocument13 pagesBhartiAirtel-1QFY2013RU 10th AugAngel BrokingNo ratings yet

- Infosys Result UpdatedDocument14 pagesInfosys Result UpdatedAngel BrokingNo ratings yet

- Morning Notes 27 July 2010: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 27 July 2010: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Antique 1Document17 pagesAntique 1rchawdhry123No ratings yet

- BSE Limited National Stock Exchange of India Limited: Savithri ParekhDocument57 pagesBSE Limited National Stock Exchange of India Limited: Savithri ParekhAmit BahriNo ratings yet

- IDBI Diwali Stock Picks 2019Document12 pagesIDBI Diwali Stock Picks 2019Akt ChariNo ratings yet

- TTK Prestige Research ReportDocument22 pagesTTK Prestige Research Reportsujay85No ratings yet

- Repot On Stock Trading by Mansukh Investment & Trading Solutions 21/05/2010Document5 pagesRepot On Stock Trading by Mansukh Investment & Trading Solutions 21/05/2010MansukhNo ratings yet

- Morning Market Update with GEPL CapitalDocument8 pagesMorning Market Update with GEPL Capitaljeet2211No ratings yet

- January 29, 2010: Market OverviewDocument9 pagesJanuary 29, 2010: Market OverviewValuEngine.comNo ratings yet

- 23 UpdateDocument6 pages23 UpdateProject AtomNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAngel BrokingNo ratings yet

- Market Outlook 09-03-10 - DharamDocument4 pagesMarket Outlook 09-03-10 - DharamdpNo ratings yet

- Most Market Outlook Most Market Outlook Most Market Outlook: Morning UpdateDocument7 pagesMost Market Outlook Most Market Outlook Most Market Outlook: Morning Updatevikalp123123No ratings yet

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument4 pagesMarket Outlook: India Research Dealer's Diarylibran78No ratings yet

- 1 Antique 3QFY20Document23 pages1 Antique 3QFY20Girish Raj SankunnyNo ratings yet

- Annual Report of Info Edge by Icici SecurityDocument12 pagesAnnual Report of Info Edge by Icici SecurityGobind yNo ratings yet

- Narnolia Securities Limited Market Diary 13.1.2014Document6 pagesNarnolia Securities Limited Market Diary 13.1.2014Narnolia Securities LimitedNo ratings yet

- UniQuest Equity Intelligence 16th NovemberDocument7 pagesUniQuest Equity Intelligence 16th NovemberC A Luve HotchandaniNo ratings yet

- Securities and Exchange Board of IndiaDocument10 pagesSecurities and Exchange Board of IndiaRaman RanaNo ratings yet

- Property & REIT sector rebounds expected in 2H20Document3 pagesProperty & REIT sector rebounds expected in 2H20Brian StanleyNo ratings yet

- Weekly Wrap For The Week Ended 270919Document1 pageWeekly Wrap For The Week Ended 270919Dilkaran SinghNo ratings yet

- Hindustan Unilever's Longer Term Growth Engines RobustDocument26 pagesHindustan Unilever's Longer Term Growth Engines Robustvikalp123123No ratings yet

- Evaluation of The Performance and Challenges of Msme Since 1991 To 2010Document30 pagesEvaluation of The Performance and Challenges of Msme Since 1991 To 2010Anshuman SharveshNo ratings yet

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-12-18Document1 pageBetterInvesting Weekly Stock Screen 11-12-18BetterInvestingNo ratings yet

- Morning Notes 19 (1) .03.10Document5 pagesMorning Notes 19 (1) .03.10MansukhNo ratings yet

- Motilal Oswal 2022 Stock PicksDocument13 pagesMotilal Oswal 2022 Stock Pickskp_05No ratings yet

- SecA Group8 Report3Document7 pagesSecA Group8 Report3ADARSH GUPTANo ratings yet

- G20 Summit and Indonesia's GDP Growth Highlighted in HungryStock NewsletterDocument6 pagesG20 Summit and Indonesia's GDP Growth Highlighted in HungryStock NewsletterDaniel AldianNo ratings yet

- Accumulate: Growth Momentum Continues!Document7 pagesAccumulate: Growth Momentum Continues!sj singhNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Update On NSE - Q3FY23 - Feb14 PDFDocument11 pagesUpdate On NSE - Q3FY23 - Feb14 PDFAdityakondawar575No ratings yet

- Emerging Trends and Technologies: Business, People, and Technology TomorrowDocument30 pagesEmerging Trends and Technologies: Business, People, and Technology TomorrowsfarithaNo ratings yet

- Data Structure (DS) Solved Mcqs Set 4Document7 pagesData Structure (DS) Solved Mcqs Set 4sfarithaNo ratings yet

- BillingDocument3 pagesBillingsfarithaNo ratings yet

- Data Structure (DS) Solved Mcqs Set 2Document6 pagesData Structure (DS) Solved Mcqs Set 2sfarithaNo ratings yet

- Data Structure (DS) Solved Mcqs Set 1Document7 pagesData Structure (DS) Solved Mcqs Set 1sfarithaNo ratings yet

- Spanning TreeDocument3 pagesSpanning TreesfarithaNo ratings yet

- Poly TRB CS ItDocument19 pagesPoly TRB CS ItsfarithaNo ratings yet

- GE3171 Python Lab-SyllabusDocument2 pagesGE3171 Python Lab-SyllabussfarithaNo ratings yet

- ScheduleDocument1 pageSchedulesfarithaNo ratings yet

- ECE Regulation 2017 Full SyllabusDocument121 pagesECE Regulation 2017 Full SyllabusNandha KumarNo ratings yet

- Advt Asso Prof Deputy Librarian Dy Dir of PEDocument1 pageAdvt Asso Prof Deputy Librarian Dy Dir of PEsfarithaNo ratings yet

- Instructions For Updating The ApplicationDocument3 pagesInstructions For Updating The ApplicationsfarithaNo ratings yet

- Problem Description: ( ( ) Factorial ) ( ) ( ) ( ( ) )Document3 pagesProblem Description: ( ( ) Factorial ) ( ) ( ) ( ( ) )sfarithaNo ratings yet

- Python Program To Calculate Electricity Bill: If ConditionDocument6 pagesPython Program To Calculate Electricity Bill: If ConditionsfarithaNo ratings yet

- Schedule 2019Document7 pagesSchedule 2019sfarithaNo ratings yet

- GE3151 PYTHON SyllabusDocument2 pagesGE3151 PYTHON SyllabussfarithaNo ratings yet

- ScheduleDocument1 pageSchedulesfarithaNo ratings yet

- Annexure IDocument372 pagesAnnexure IsfarithaNo ratings yet

- Commodities Intraday TRDGDocument2 pagesCommodities Intraday TRDGsfarithaNo ratings yet

- Instructions For Updating The ApplicationDocument3 pagesInstructions For Updating The ApplicationsfarithaNo ratings yet

- Anna University Research Promotion Policy Encourages ExcellenceDocument1 pageAnna University Research Promotion Policy Encourages Excellenceommech2020No ratings yet

- Machine Learning and Cloud Computing: Survey of Distributed and Saas SolutionsDocument13 pagesMachine Learning and Cloud Computing: Survey of Distributed and Saas SolutionssfarithaNo ratings yet

- Machine Learning Applications for Cloud Resource ManagementDocument26 pagesMachine Learning Applications for Cloud Resource ManagementsfarithaNo ratings yet

- Multi-Objective Evolutionary Biclustering of Gene Expression DataDocument14 pagesMulti-Objective Evolutionary Biclustering of Gene Expression DatasfarithaNo ratings yet

- A Novel Machine Learning Algorithm For Spammer Identification in Industrial Mobile Cloud ComputingDocument5 pagesA Novel Machine Learning Algorithm For Spammer Identification in Industrial Mobile Cloud Computingsfaritha100% (1)

- Optimized Cluster Head Selection Using Krill Herd Algorithm For Wireless Sensor NetworkDocument10 pagesOptimized Cluster Head Selection Using Krill Herd Algorithm For Wireless Sensor NetworksfarithaNo ratings yet

- FDocument8 pagesFArya WibiNo ratings yet

- USD/INR Daily ChartDocument2 pagesUSD/INR Daily ChartsfarithaNo ratings yet

- Ans: AnsDocument7 pagesAns: AnsRomelie M. NopreNo ratings yet

- Ice Giants Desserts & Snack Inc.Document9 pagesIce Giants Desserts & Snack Inc.ronnel_amper12345678No ratings yet

- The Balance Sheet of Poodle Company at The End of PDFDocument1 pageThe Balance Sheet of Poodle Company at The End of PDFCharlotteNo ratings yet

- Factsheet ANTM 2023 01Document4 pagesFactsheet ANTM 2023 01arsyil1453No ratings yet

- Cash Pooling in Today's WorldDocument10 pagesCash Pooling in Today's Worldoramirezb2No ratings yet

- ITO notice for escaped incomeDocument2 pagesITO notice for escaped incomeSukalp WarhekarNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- Commercial Property Tax Appeal ServicesDocument7 pagesCommercial Property Tax Appeal ServicescutmytaxesNo ratings yet

- Chicken Business PlanDocument16 pagesChicken Business PlanmschotoNo ratings yet

- Accounting Equation & Major AccountsDocument19 pagesAccounting Equation & Major AccountsAldeguer Joy PenetranteNo ratings yet

- CH 11 Practice MCQ - S Financial Management by BrighamDocument49 pagesCH 11 Practice MCQ - S Financial Management by BrighamShahmir AliNo ratings yet

- Audit Data MapDocument553 pagesAudit Data MapDarma Bonar TampubolonNo ratings yet

- v1nChuHABHUWjH4tt5dcaP PDFDocument416 pagesv1nChuHABHUWjH4tt5dcaP PDFashaduzzamanNo ratings yet

- ICICI Pru Smart Life BrochureDocument23 pagesICICI Pru Smart Life Brochuresrinivas reddyNo ratings yet

- Eugene Fama ThesisDocument7 pagesEugene Fama Thesiskriscundiffevansville100% (1)

- Types of CompanyDocument3 pagesTypes of Companyshibashish PandaNo ratings yet

- Managing Working Capital and Cash FlowDocument8 pagesManaging Working Capital and Cash FlowEnelrejLeisykGarillos100% (1)

- Accounting Practice Problems 1Document4 pagesAccounting Practice Problems 1MarisseAnne CoquillaNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- MPC 2002 Financial ReportDocument25 pagesMPC 2002 Financial ReportMelbourne Press ClubNo ratings yet

- FinCEN Bitcoin Jan Clarification Release 1Document4 pagesFinCEN Bitcoin Jan Clarification Release 1Jason MickNo ratings yet

- Idx Monthly Oct 2023Document154 pagesIdx Monthly Oct 2023ikhsan AdiNo ratings yet

- Exercise - Dilutive Securities - AdillaikhsaniDocument4 pagesExercise - Dilutive Securities - Adillaikhsaniaidil fikri ikhsan100% (1)

- Exchange Rate Pass Through in India: Abhishek KumarDocument15 pagesExchange Rate Pass Through in India: Abhishek KumarinventionjournalsNo ratings yet

- SBI Life Insurance (Babloo Nayak)Document70 pagesSBI Life Insurance (Babloo Nayak)Prachi Nayak100% (1)

- Navi Loan Account StatementDocument1 pageNavi Loan Account StatementBorah SashankaNo ratings yet

- VC Investment Thesis Template-VCLABDocument1 pageVC Investment Thesis Template-VCLABRodolfo ValentinoNo ratings yet

- Fixed Income Repo Product NoteDocument2 pagesFixed Income Repo Product NoteJNo ratings yet

- Chapter One TDocument39 pagesChapter One TtemedebereNo ratings yet

- Busifin Final Period 2021 2022Document46 pagesBusifin Final Period 2021 2022Glenn Mark NochefrancaNo ratings yet