Professional Documents

Culture Documents

MODAUDP Sarbanes Oxley

Uploaded by

Red0 ratings0% found this document useful (0 votes)

7 views2 pagesa

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenta

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesMODAUDP Sarbanes Oxley

Uploaded by

Reda

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

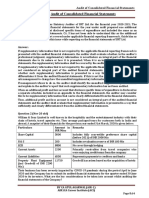

Sarbanes Oxley Act of 2002

- Meant to protect against corporate fraud as a response to financial scandals such as

that by Enron Corporation, Tyco International, and WorldCom.

- Led to stricter regulations for accountants, auditors, and corporate officers.

- Greater criminal penalties for violations

Five (5) Key Sections:

1. Section 302

a. Senior corporate officers have to personally certify in writing that the FS “comply

with SEC disclosure requirements & fairly present in all material aspects the

operations and financial condition of the issuer.” If these officers sign this

certification with the knowledge that said financial statements are inaccurate or

have been manipulated, they will be held liable and are subject to criminal

penalties which also include prison terms. Periodic statutory financial reports

must include certifications that:

i. Signing officers reviewed the report

ii. Report doesn’t have any material untrue statements/material

omissions/misleading statements

iii. FS fairly present the company’s financial condition

iv. Signing officers are responsible for internal controls which they must have

evaluated w/in the previous ninety (90) days

v. List of deficiencies in internal controls/information on fraud involving

employees

vi. Any significant changes in internal controls/other factors that could

negatively impact the internal controls

2. Section 401

a. Financial statements published by issuers

i. Required to be accurate

ii. Does not contain incorrect statements

b. Commission required to determine whether GAAP or other regulations result in

open and meaningful reporting by issuers

3. Section 404

a. Requires management & auditors to establish internal controls & reporting

methods (to ensure adequacy of controls)

4. Section 409

a. Issuers required to disclose to public information on material changes in their

financial condition/operations

b. ^ Must be easily understood & must present graphic presentations if appropriate

5. Section 802

a. 3 rules that affect recordkeeping

i. Destruction & falsification of records

ii. Defines retention period for storing records

iii. Outlines specific business records that companies need to store

b. Imposes penalties of fines and/or up to:

i. 20 years imprisonment for

altering/destroying/mutilating/concealing/falsifying records

ii. Penalties of fines and/or imprisonment of up to 10 years on any

accountant who knowingly and willfully violates the requirements of

maintenance of all audit or review papers for a period of five (5) years

You might also like

- These Protections Apply To ALL Public Companies, Including Emerging Growth CompaniesDocument7 pagesThese Protections Apply To ALL Public Companies, Including Emerging Growth CompaniesAmeya KulkarniNo ratings yet

- Ceo and Cfo CertificationDocument6 pagesCeo and Cfo CertificationNeha GeorgeNo ratings yet

- 1519744310723nature Objective and Scope of AuditDocument8 pages1519744310723nature Objective and Scope of AuditAnkur KunduNo ratings yet

- 55067bos44235p6 Iipc ADocument10 pages55067bos44235p6 Iipc AAshutosh KumarNo ratings yet

- SOX OverviewDocument7 pagesSOX Overview2010 mujtaba qureshiNo ratings yet

- Audit Engagement LetterDocument10 pagesAudit Engagement LetterJosart Tubay100% (1)

- Unit 3 (I)Document4 pagesUnit 3 (I)Saniya HashmiNo ratings yet

- NAME: Neha Mundra Class: Mba FT SEM 4 B' ROLL NO.: 68082 DATE: 13 MAY 2021 Internal 2Document3 pagesNAME: Neha Mundra Class: Mba FT SEM 4 B' ROLL NO.: 68082 DATE: 13 MAY 2021 Internal 2neha mundraNo ratings yet

- Ca Inter Audit CH 1 2 3 1693227643Document22 pagesCa Inter Audit CH 1 2 3 1693227643Zaara ShaikhNo ratings yet

- Inter Audit Module - 1-2-21Document20 pagesInter Audit Module - 1-2-21binu75% (4)

- Financial ReportingDocument39 pagesFinancial ReportingsamNo ratings yet

- PH Disclosure and Content Checklist Primary PDFDocument159 pagesPH Disclosure and Content Checklist Primary PDFShaira VillaflorNo ratings yet

- Checklist For Audit Report Under CARO: PreliminaryDocument15 pagesChecklist For Audit Report Under CARO: PreliminaryMudit KothariNo ratings yet

- Mia RPG 03 2000Document12 pagesMia RPG 03 2000aizatarief2015No ratings yet

- Audit Tutorial 2Document10 pagesAudit Tutorial 2Chong Soon Kai100% (1)

- Arens AAS17 sm 05筆記版Document20 pagesArens AAS17 sm 05筆記版林芷瑜No ratings yet

- Compilation of SA QuestionsDocument22 pagesCompilation of SA Questionsnirmal_faxNo ratings yet

- 18 Completing The AuditDocument7 pages18 Completing The Auditrandomlungs121223No ratings yet

- Auditing and Assurance Services A Systematic Approach 8th Edition Messier Solutions ManualDocument25 pagesAuditing and Assurance Services A Systematic Approach 8th Edition Messier Solutions ManualDebraPricemkw100% (45)

- Format of Quarterly Compliance Report On Corporate GovernanceDocument4 pagesFormat of Quarterly Compliance Report On Corporate GovernanceSushant Yashwant PawarNo ratings yet

- Audit Nov 20Document18 pagesAudit Nov 20ritz meshNo ratings yet

- A Summary of Accounting PoliciesDocument4 pagesA Summary of Accounting PoliciesCharles GalidoNo ratings yet

- EL Tax Audit Form 3CB IndividualDocument10 pagesEL Tax Audit Form 3CB IndividualNAYAN PATELNo ratings yet

- Audit1 QADocument8 pagesAudit1 QAAmjath JamalNo ratings yet

- Principles of Auditing Topic 1Document10 pagesPrinciples of Auditing Topic 1kitderoger_391648570No ratings yet

- All Subj - Board Exam-Picpa EeDocument9 pagesAll Subj - Board Exam-Picpa EeMJ YaconNo ratings yet

- Full N Final Audit PresentationDocument35 pagesFull N Final Audit Presentationfaraazxbox1No ratings yet

- AT NotesDocument8 pagesAT NotesMa. Noella PerezNo ratings yet

- 57060aasb46101 8Document20 pages57060aasb46101 8Wubneh AlemuNo ratings yet

- Review of Internal Control Over Financial ReportingDocument20 pagesReview of Internal Control Over Financial ReportingMark Angelo Bustos100% (1)

- MTP m21 A Ans 2Document8 pagesMTP m21 A Ans 2sakshiNo ratings yet

- 01 Natue Scope - ObjectDocument50 pages01 Natue Scope - ObjectReady 4 BooyahNo ratings yet

- IPCC - Auditing - RTP Nov 2009Document23 pagesIPCC - Auditing - RTP Nov 2009Omnia HassanNo ratings yet

- Audit Responsibilities and Objectives: Concept Checks P. 129Document20 pagesAudit Responsibilities and Objectives: Concept Checks P. 129hsingting yuNo ratings yet

- Basic ConceptsDocument14 pagesBasic ConceptsMacqwin FernandesNo ratings yet

- Solution Manual For Auditing and Assurance Services A Systematic Approach 7th Edition Messier, Glover, PrawittDocument11 pagesSolution Manual For Auditing and Assurance Services A Systematic Approach 7th Edition Messier, Glover, Prawitta420344589No ratings yet

- Corporate Law Assignment1234Document4 pagesCorporate Law Assignment1234Areej AJNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document16 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)RashmiNo ratings yet

- Responsibilities (Case Answer)Document6 pagesResponsibilities (Case Answer)MonikaChoudhouryNo ratings yet

- Paper 6 Ipcc Auditing and Assurance Solution Nov 2015Document13 pagesPaper 6 Ipcc Auditing and Assurance Solution Nov 2015ßãbÿ Ðøll ßəʌʋtɣ QʋɘɘŋNo ratings yet

- CA IPCC Auditing Suggested Answer Nov 2015Document12 pagesCA IPCC Auditing Suggested Answer Nov 2015Siva Narayana Phani MouliNo ratings yet

- Audit Assurance 2.3 August 2022 PDFDocument19 pagesAudit Assurance 2.3 August 2022 PDFProf. OBESENo ratings yet

- CBI Holding Company, Inc. / Case 2.6Document3 pagesCBI Holding Company, Inc. / Case 2.6octaevia50% (4)

- CARO ChecklistDocument26 pagesCARO ChecklistSantosh KumarNo ratings yet

- Management Representation Letter 2021Document11 pagesManagement Representation Letter 2021stillwinmsNo ratings yet

- Modern Auditing Assurance Services and The Integrity of Financial Reporting 8th Edition Test Bank BoDocument17 pagesModern Auditing Assurance Services and The Integrity of Financial Reporting 8th Edition Test Bank BoAngela Miles DizonNo ratings yet

- Final - Adv Auditing (O) - Suggested AnsDocument14 pagesFinal - Adv Auditing (O) - Suggested AnsPraveen Reddy DevanapalleNo ratings yet

- Presented by Syed Kashif Shah (Group Leader) Group Members Kashif Ali, M.Hamid Waqar Khan Bba 7Document22 pagesPresented by Syed Kashif Shah (Group Leader) Group Members Kashif Ali, M.Hamid Waqar Khan Bba 7Jemila SatchiNo ratings yet

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- Study Note 1Document2 pagesStudy Note 1Lurysa Ocate Dela CalzadaNo ratings yet

- Code of Ethics For Principal Executive Officer and Financial OfficersDocument5 pagesCode of Ethics For Principal Executive Officer and Financial OfficersNilesh ThoratNo ratings yet

- Duties of An AuditorDocument4 pagesDuties of An AuditorUday KhuleNo ratings yet

- Assignment On Sarbanes Oaxley Act 9Document3 pagesAssignment On Sarbanes Oaxley Act 9Haris MunirNo ratings yet

- SoxDocument13 pagesSoxcajitendergupta100% (2)

- Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions ManualDocument26 pagesAuditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions ManualDebraPricemkw100% (50)

- CFO Jan Hess - Sarbanes Oxley 2Document15 pagesCFO Jan Hess - Sarbanes Oxley 2FX ApostolNo ratings yet

- Dwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFDocument36 pagesDwnload Full Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions Manual PDFpetrorichelle501100% (15)

- © The Institute of Chartered Accountants of IndiaDocument10 pages© The Institute of Chartered Accountants of IndiaSanjay SahuNo ratings yet

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- DERVFOP - Lecture 3 (Hedging Strategies Using Futures)Document29 pagesDERVFOP - Lecture 3 (Hedging Strategies Using Futures)RedNo ratings yet

- How To Present A Case: Report, and Verbally To The Class. During Your Presentation You Have Two OverallDocument2 pagesHow To Present A Case: Report, and Verbally To The Class. During Your Presentation You Have Two OverallRedNo ratings yet

- ACFINA3 Formula Card PDFDocument4 pagesACFINA3 Formula Card PDFRedNo ratings yet

- 2.2 Report - Bond Markets PDFDocument99 pages2.2 Report - Bond Markets PDFRedNo ratings yet

- 2.1 Recap - Money Markets PDFDocument26 pages2.1 Recap - Money Markets PDFRedNo ratings yet

- Computing New Variables Using Generate and ReplaceDocument9 pagesComputing New Variables Using Generate and ReplaceRedNo ratings yet

- DERVFOP - Lecture 4 (Interest Rates)Document73 pagesDERVFOP - Lecture 4 (Interest Rates)RedNo ratings yet

- 2.3 Recap - Mortgage Market (Dec 7)Document45 pages2.3 Recap - Mortgage Market (Dec 7)RedNo ratings yet

- ACFINA3 Syllabus PDFDocument8 pagesACFINA3 Syllabus PDFRedNo ratings yet

- Lecture Cases On Consolidation With Intercompany Sale of InventoryDocument2 pagesLecture Cases On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- CLASSROOM EXERCISES ON CURRENT LIABILITIES 1st Term SY2018-2019 PDFDocument3 pagesCLASSROOM EXERCISES ON CURRENT LIABILITIES 1st Term SY2018-2019 PDFRedNo ratings yet

- Accounting Implications of Foreign Currency Transactions Translation and HedgingDocument15 pagesAccounting Implications of Foreign Currency Transactions Translation and HedgingRedNo ratings yet

- CLASSROOM EXERCISES ON CURRENT LIABILITIES 1st Term SY2018-2019 PDFDocument3 pagesCLASSROOM EXERCISES ON CURRENT LIABILITIES 1st Term SY2018-2019 PDFRedNo ratings yet

- MULTIPLE CHOICE Answers 2Document1 pageMULTIPLE CHOICE Answers 2RedNo ratings yet

- Operres Case 1 - American Sporting Equipment PDFDocument7 pagesOperres Case 1 - American Sporting Equipment PDFRed100% (1)

- Classroom Exercises On Consolidation With Intercompany Sale of InventoryDocument7 pagesClassroom Exercises On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- Multiple Choice Answers 3Document2 pagesMultiple Choice Answers 3RedNo ratings yet

- QUIZ 1 NotesDocument17 pagesQUIZ 1 NotesRedNo ratings yet

- Average Japanese Salaryman in Tokyo and in TokyoDocument3 pagesAverage Japanese Salaryman in Tokyo and in TokyoRedNo ratings yet

- MULTIPLE CHOICE Answers 1Document1 pageMULTIPLE CHOICE Answers 1RedNo ratings yet

- QUIZ 2 NotesDocument14 pagesQUIZ 2 NotesRedNo ratings yet

- IFRS 15 - Revenue From ContractsDocument5 pagesIFRS 15 - Revenue From ContractsRedNo ratings yet

- QUIZ 3 Notes PDFDocument12 pagesQUIZ 3 Notes PDFRedNo ratings yet

- In The Penal Colony Summary PDFDocument5 pagesIn The Penal Colony Summary PDFRedNo ratings yet

- Modaudp Units 6 - 8Document4 pagesModaudp Units 6 - 8RedNo ratings yet

- HW On Receivable Financing ADocument3 pagesHW On Receivable Financing ARedNo ratings yet

- Modmit1 Course Notes PDFDocument7 pagesModmit1 Course Notes PDFRedNo ratings yet

- Notes From Lecture (01/30/2020) : 10 Deductions 1. Ordinary and Necessary ExpensesDocument8 pagesNotes From Lecture (01/30/2020) : 10 Deductions 1. Ordinary and Necessary ExpensesRedNo ratings yet

- SALESBA ORAL EXAM REVIEWER - ConceptsDocument7 pagesSALESBA ORAL EXAM REVIEWER - ConceptsRedNo ratings yet

- Humanbe NotesDocument3 pagesHumanbe NotesRedNo ratings yet

- Professional EthicsDocument7 pagesProfessional EthicsKt KtNo ratings yet

- ADS 2014 Form 10-K With ExhibitsDocument347 pagesADS 2014 Form 10-K With Exhibits_erosalesNo ratings yet

- 2018.09.11 Owens v. Wendys - ComplaintDocument14 pages2018.09.11 Owens v. Wendys - ComplaintCatalin Cimpanu [ZDNet]No ratings yet

- AAP v. Golden Bear Realty Order Granting Motion For Preliminary InjunctionDocument9 pagesAAP v. Golden Bear Realty Order Granting Motion For Preliminary InjunctionSchneider Rothman IP Law GroupNo ratings yet

- Vermen Realty V CA - DigestDocument2 pagesVermen Realty V CA - DigestAbigail Tolabing100% (2)

- StockmanDocument3 pagesStockmanJoshua GrayNo ratings yet

- De Castro and Platon Vs CADocument3 pagesDe Castro and Platon Vs CACrissyNo ratings yet

- G.R. No. 1455 - in Re AllenDocument13 pagesG.R. No. 1455 - in Re AllenRichie SalubreNo ratings yet

- Welcome Resident Services Manual Revised June 2010Document43 pagesWelcome Resident Services Manual Revised June 2010Aparna GoliNo ratings yet

- Department of Home Affairs - Answers To Questions On NoticeDocument27 pagesDepartment of Home Affairs - Answers To Questions On Noticebobalice99No ratings yet

- Privacy Is No Longer A Social Norm EssayDocument3 pagesPrivacy Is No Longer A Social Norm EssayKaren TseNo ratings yet

- Applied Criminology 2008 PDFDocument225 pagesApplied Criminology 2008 PDFshafijanNo ratings yet

- Governmen Response To Slovacek Change of Venue MotionDocument6 pagesGovernmen Response To Slovacek Change of Venue MotionThe Dallas Morning News100% (1)

- Arbitration Rules CAS AHD FIFA WWC 2023 EN (Final)Document12 pagesArbitration Rules CAS AHD FIFA WWC 2023 EN (Final)mariusNo ratings yet

- Dow: "Step Outside Please"Document34 pagesDow: "Step Outside Please"New England Law ReviewNo ratings yet

- Gender Equality and Female Empowerment: USAID Policies and Strategies - Caren GrownDocument13 pagesGender Equality and Female Empowerment: USAID Policies and Strategies - Caren GrownADBGADNo ratings yet

- CONTRACT - Retainer AgreementDocument5 pagesCONTRACT - Retainer AgreementJeff SarabusingNo ratings yet

- 1 - Maceda V VasquezDocument6 pages1 - Maceda V VasquezRoyce HernandezNo ratings yet

- Litonjua Shipping V National Seamen BoardDocument1 pageLitonjua Shipping V National Seamen BoardVener Angelo MargalloNo ratings yet

- Surrogacy Laws in IndiaDocument20 pagesSurrogacy Laws in IndiaSUDHIR'S PHOTOGRAPHYNo ratings yet

- M2Ubiz MandateDocument1 pageM2Ubiz MandateVanessa LimNo ratings yet

- Panera BreadDocument2 pagesPanera BreadSharky Roxas100% (1)

- (171929) Structure of City Corporation and Its FunctionDocument10 pages(171929) Structure of City Corporation and Its FunctionMD Mahbub Ul Islam100% (1)

- Socsc 14 - Group 1 - Problem TreeDocument6 pagesSocsc 14 - Group 1 - Problem TreeRhoi FernandezNo ratings yet

- Criteria For Selecting Brand Elements: MemorableDocument2 pagesCriteria For Selecting Brand Elements: MemorableNiaz HussainNo ratings yet

- United States of America Ex Rel. Gerardo Catena v. Albert Elias, Superintendent of Youth Reception and Correction Center at Yardville, N. J, 449 F.2d 40, 3rd Cir. (1971)Document16 pagesUnited States of America Ex Rel. Gerardo Catena v. Albert Elias, Superintendent of Youth Reception and Correction Center at Yardville, N. J, 449 F.2d 40, 3rd Cir. (1971)Scribd Government DocsNo ratings yet

- Renato Diaz V Secretary of FinanceDocument2 pagesRenato Diaz V Secretary of FinanceDexter MantosNo ratings yet

- G.R. No. 93828 December 11, 1992 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, SANTIAGO EVARISTO and NOLI CARILLO, Accused-AppellantsDocument3 pagesG.R. No. 93828 December 11, 1992 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, SANTIAGO EVARISTO and NOLI CARILLO, Accused-AppellantsFranzMordenoNo ratings yet

- Criminal Law 1 Case DigestsDocument20 pagesCriminal Law 1 Case DigestsChe Catolico82% (11)

- Legal EthicsDocument10 pagesLegal EthicsMylaCambri100% (1)