Professional Documents

Culture Documents

Inter Final Dec2020 PDF

Inter Final Dec2020 PDF

Uploaded by

elizasunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inter Final Dec2020 PDF

Inter Final Dec2020 PDF

Uploaded by

elizasunderCopyright:

Available Formats

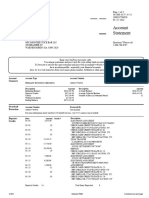

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

(STATUTORY BODY UNDER AN ACT OF PARLIAMENT)

INTERMEDIATE AND FINAL EXAMINATION TIME TABLE & PROGRAMME – JUNE 2020 (Merging) AND DECEMBER 2020

PROGRAMME FOR SYLLABUS 2016

ATTENTION: INTERMEDIATE & FINAL EXAMINATION WILL BE HELD ON ALTERNATE DATES FOR EACH GROUP.

INTERMEDIATE FINAL

Day & Date (Time: 10.00 A.M. to 1.00 P.M.) (Time: 2.00 P.M. to 5.00 P.M.)

(Group – I) (Group – II) (Group – III) (Group – IV)

Thursday,

Financial Accounting (P-05) ------------------- Corporate Laws & Compliance (P-13) -------------------

10th December, 2020

Friday, Operations Management & Strategic

------------------- ------------------- Corporate Financial Reporting (P-17)

11th December, 2020 Management (P-09)

Saturday,

Laws & Ethics (P-06) ------------------- Strategic Financial Management (P-14) -------------------

12th December, 2020

Sunday, Cost & Management Accounting and

------------------- ------------------- Indirect Tax Laws & Practice (P-18)

13th December, 2020 Financial Management (P-10)

Monday,

Direct Taxation (P-07) ------------------- Strategic Cost Management – Decision Making (P-15) -------------------

14th December, 2020

Tuesday,

------------------- Indirect Taxation (P-11) ------------------- Cost & Management Audit (P-19)

15th December, 2020

Wednesday,

Cost Accounting (P-08) ------------------- Direct Tax Laws and International Taxation (P-16) -------------------

16th December, 2020

Thursday, Strategic Performance Management and Business

------------------- Company Accounts & Audit (P-12) -------------------

17th December, 2020 Valuation (P-20)

EXAMINATION FEES

Group (s) Final Examination Intermediate Examination

One Group (Inland Centres) `1400/- `1200/-

(Overseas Centres) US $ 100 US $ 90

Two Groups (Inland Centres) `2800/- `2400/-

(Overseas Centres) US $ 100 US $ 90

1. Application Forms for Intermediate and Final Examination has to be filled up through online only and fees will be accepted through online mode only (including Payfee Module of IDBI Bank). No Offline form and DD

payment will be accepted for domestic candidate.

2. STUDENTS OPTING FOR OVERSEAS CENTRES HAVE TO APPLY OFFLINE AND SEND DD ALONGWITH THE FORM.

3. (a) Students can login to the website www.icmai.in and apply online through payment gateway by using Credit/Debit card or Net banking.

(b) Students can also pay their requisite fee through pay-fee module of IDBI Bank.

4. Examination form already submitted by the students for the Intermediate and Final Examinations, June, 2020 session will remain same for the Intermediate and Final Examinations to be held in December, 2020. Students

need not apply again.

5. Students who have submitted examination form for the Intermediate and Final Examinations, June, 2020 session are allowed to add their Group with payment of differential examination fee for appearing in the

Intermediate and Final Examinations to be held in December, 2020.

6. The students who have not enrolled for the Intermediate and Final Examinations, June, 2020 session may enroll afresh by submitting online examination form for December, 2020 term of examination.

7. Last date for receipt of Examination Application Forms is 10 th October, 2020.

8. The provisions of Direct Tax Laws and Indirect Tax Laws, as amended by the Finance Act, 2019, including notifications and circulars issued up to 31 st May, 2020, are applicable for December, 2020 term of examination for

the Subjects Direct Taxation, Indirect Taxation (Intermediate), Direct Tax laws and International Taxation and Indirect Tax Laws & Practice (Final) under Syllabus 2016. The relevant assessment year is 2020-21. For

statutory updates and amendments please refer to: https://icmai.in/studentswebsite/Syl-2016.php

9. Companies (Cost Records and Audit) Rules, 2014 as amended till 31st May, 2020 is applicable for December, 2020 examination for Paper 12- Company Accounts and Audit (Intermediate) and Paper 19 - Cost and

Management Audit (Final) under Syllabus 2016. For updates and amendments please refer to the link: https://icmai.in/studentswebsite/Syl-2016.php

10. The provisions of the Companies Act 2013 are applicable for Paper 6 - Laws and Ethics (Intermediate) and Paper 13 - Corporate Laws and Compliance (Final) under Syllabus 2016 to the extent notified by the Government

up to 31st May, 2020 are applicable for December, 2020 term of examination. Additionally, for applicability of ICDR, 2018 for Paper-13 - Corporate Laws & Compliance (Final) under Syllabus 2016 refer to relevant circular

in website for December, 2020 term examination by following link: https://icmai.in/studentswebsite/Syl-2016.php

11. For Applicability of IND AS and AS for Paper 5 - Financial Accounting, Paper 12 - Company Accounts and Audit (Intermediate) and Paper 17 - Corporate Financial Reporting (Final) refer to relevant circulars and

notifications in website for December, 2020 term examination in the given link: https://icmai.in/studentswebsite/Syl-2016.php

12. Pension Fund Regulatory and Development Authority Act, 2013 is being included in Paper 6-Laws and Ethics (Intermediate) and Insolvency and Bankruptcy Code 2016 is being included in Paper 13 - Corporate Laws and

Compliance (Final) under Syllabus 2016 for December, 2020 term of examination. Please refer to the link: https://icmai.in/studentswebsite/Syl-2016.php

13. Examination Centres: Adipur-Kachchh (Gujarat), Agartala, Agra, Ahmedabad, Akurdi, Allahabad, Asansol, Aurangabad, Bangalore, Baroda, Berhampur (Ganjam), Bhilai, Bhilwara, Bhopal, Bewar City(Rajasthan),

Bhubaneswar, Bilaspur, Bikaner (Rajasthan), Bokaro, Calicut, Chandigarh, Chennai, Coimbatore, Cuttack, Dehradun, Delhi, Dhanbad, Duliajan (Assam), Durgapur, Ernakulam, Erode, Faridabad, Ghaziabad, Guntur,

Gurgaon, Guwahati, Haridwar, Hazaribagh, Howrah, Hyderabad, Indore, Jaipur, Jabalpur, Jalandhar, Jammu, Jamshedpur, Jodhpur, Kalyan, Kannur, Kanpur, Kolhapur, Kolkata, Kollam, Kota, Kottakkal

(Malappuram), Kottayam, Lucknow, Ludhiana, Madurai, Mangalore, Mumbai, Mysore, Nagpur, Naihati, Nasik, Nellore, Neyveli, Noida, Palakkad, Panaji (Goa), Patiala, Patna, Pondicherry, Port Blair, Pune, Raipur,

Rajahmundry, Ranchi, Rourkela, Salem, Sambalpur, Shillong, Shimla, Siliguri, Solapur, Srinagar, Surat, Thrissur, Tiruchirapalli, Tirunelveli, Tirupati, Trivandrum, Udaipur, Vapi, Vashi, Vellore, Vijayawada,

Vindhyanagar, Waltair and Overseas Centres at Bahrain, Dubai and Muscat.

14. A candidate who is fulfilling all conditions specified for appearing in examination will only be allowed to appear for examination.

15. Probable date of publication of result: To be announced in due course.

* For any examination related query, please contact exam.helpdesk@icmai.in

CMA Kaushik Banerjee

Secretary

You might also like

- Monzo Bank Statement 2023 06 01 2023 08 31 40Document10 pagesMonzo Bank Statement 2023 06 01 2023 08 31 40Aniella94No ratings yet

- Your Adv Plus Banking: Account SummaryDocument6 pagesYour Adv Plus Banking: Account Summaryhanh nguyen hoang ngoc100% (2)

- CM1 Assignment Y1 Solutions 2019 (FINAL)Document8 pagesCM1 Assignment Y1 Solutions 2019 (FINAL)Swapnil SinghNo ratings yet

- J20 If Reschedule PDFDocument1 pageJ20 If Reschedule PDFJack kumarNo ratings yet

- Exam Notification RecheduleDocument1 pageExam Notification Rechedulepuda worksNo ratings yet

- InterDocument1 pageInterParameswaran T.N.No ratings yet

- J21 InterFinalDocument1 pageJ21 InterFinalAnkitKumarNo ratings yet

- J20 If Reschedule 2106Document1 pageJ20 If Reschedule 2106girish.nara4967No ratings yet

- Programme For Syllabus 2016Document1 pageProgramme For Syllabus 2016Good Win RockNo ratings yet

- Inter Final J19Document1 pageInter Final J19Apoorv GawadeNo ratings yet

- Exam Notification RecheduleDocument1 pageExam Notification RecheduletejaminnikantiNo ratings yet

- (Statutory Body Under An Act of Parliament) CMA Bhawan, 12, Sudder Street, Kolkata - 700 016, IndiaDocument2 pages(Statutory Body Under An Act of Parliament) CMA Bhawan, 12, Sudder Street, Kolkata - 700 016, IndiaRifa Naz Fathy ParavathNo ratings yet

- Dec2023 Inter Final Exam NotificationDocument1 pageDec2023 Inter Final Exam NotificationMadhuriNo ratings yet

- Inter Final Exam Notification Dec 22Document1 pageInter Final Exam Notification Dec 22Julakanti AjayNo ratings yet

- Programme For Syllabus 2016 Programme For Syllabus 2022 Programme For Syllabus 2016 Programme For Syllabus 2022Document1 pageProgramme For Syllabus 2016 Programme For Syllabus 2022 Programme For Syllabus 2016 Programme For Syllabus 2022pendurthi ravi kumarNo ratings yet

- Jun 2024 Inter Final Exam NotificationDocument1 pageJun 2024 Inter Final Exam Notificationfscdeep6No ratings yet

- Week 1: Week Subject Topic/S Materials To Be Used Concept PracticeDocument6 pagesWeek 1: Week Subject Topic/S Materials To Be Used Concept PracticeAngelica Nicole TamayoNo ratings yet

- Punjab Public Service CommissionDocument33 pagesPunjab Public Service CommissionRanaFaizanNo ratings yet

- PBC List 22.11.2022 - Huawei Intérim 2022Document35 pagesPBC List 22.11.2022 - Huawei Intérim 2022Selmane DjeddaNo ratings yet

- 2020 FSAEJ Localrules02 eDocument18 pages2020 FSAEJ Localrules02 ezahidtaduNo ratings yet

- International Courses TIMETABLE 2018 19 May22th Upd II BMDocument4 pagesInternational Courses TIMETABLE 2018 19 May22th Upd II BMludoscoutNo ratings yet

- October 20, 2016Document74 pagesOctober 20, 2016SriKadimiNo ratings yet

- Government of Andhra Pradesh: Finance (Fmu-He-Skills-Dev-Trng) DepartmentDocument2 pagesGovernment of Andhra Pradesh: Finance (Fmu-He-Skills-Dev-Trng) Departmentrbharat87100% (1)

- Phase 2 Presentation: On Kotak Mahindra Bank Limited 2015-2016Document10 pagesPhase 2 Presentation: On Kotak Mahindra Bank Limited 2015-2016Shafiulhaq Kaoon QuraishiNo ratings yet

- Information Brochure of CSAB-2020 Special RoundsDocument32 pagesInformation Brochure of CSAB-2020 Special RoundsHarsh67% (3)

- Programme For Syllabus 2008 Intermediate Final FoundationDocument3 pagesProgramme For Syllabus 2008 Intermediate Final Foundationguest1No ratings yet

- United Paragon Mining Corporation SEC 17 Q June302020Document51 pagesUnited Paragon Mining Corporation SEC 17 Q June302020Jon DonNo ratings yet

- Subject/Paper: Thursday (Rural DevelopmentDocument1 pageSubject/Paper: Thursday (Rural DevelopmentQuotes & JokesNo ratings yet

- Dashboards DeckDocument20 pagesDashboards DeckJuan José Donayre VasquezNo ratings yet

- List of Semi Expendable ItemsDocument47 pagesList of Semi Expendable ItemsLeandro BambeNo ratings yet

- SAP IntroductionDocument51 pagesSAP IntroductionankitavengNo ratings yet

- Accomplishment Report: Page 1 of 2Document2 pagesAccomplishment Report: Page 1 of 2Jael CanedoNo ratings yet

- Ben MurrayCapital Expenditure Forecast TemplateDocument27 pagesBen MurrayCapital Expenditure Forecast TemplateMuhammad Reza AlkhawarismiNo ratings yet

- Aafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiDocument35 pagesAafr & Aars TSB Mock QP With Solution by Sir Hasnain BadamiMuhammad Sohaib AzharNo ratings yet

- Test Series: May, 2020 Mock Test Paper 1 Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument10 pagesTest Series: May, 2020 Mock Test Paper 1 Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- COSTINGDocument6 pagesCOSTINGriyaNo ratings yet

- Advertisement For The Post of AM (Materials), HR, R and D and Legal.Document12 pagesAdvertisement For The Post of AM (Materials), HR, R and D and Legal.AbhishekNo ratings yet

- Test 4Document1 pageTest 4ANo ratings yet

- Sanchit Grover Income Tax Amendments May2021 6Document71 pagesSanchit Grover Income Tax Amendments May2021 6Ismail RizwanNo ratings yet

- ICAO Coronavirus Econ Impact PDFDocument108 pagesICAO Coronavirus Econ Impact PDFDarwis IdrusNo ratings yet

- AFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Document7 pagesAFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)MABI ESPENIDONo ratings yet

- April 2020 Examinations UG PG FinalTime TableDocument19 pagesApril 2020 Examinations UG PG FinalTime TablePanthalaraja JagaaNo ratings yet

- Discontinued Operations (Disclosure Practice)Document5 pagesDiscontinued Operations (Disclosure Practice)Shaheryar ShahidNo ratings yet

- Priyanka FurnitureDocument96 pagesPriyanka Furniturehimalaya sharmaNo ratings yet

- Coats GRI Index 2020Document7 pagesCoats GRI Index 2020Risty Amalia NurfauziahNo ratings yet

- ICAO Coronavirus Econ ImpactDocument112 pagesICAO Coronavirus Econ ImpactForrestNo ratings yet

- Appendix 4D and Condensed Consolidated Interim Financial Statements 9 Spokes International Limited 30 September 2020Document33 pagesAppendix 4D and Condensed Consolidated Interim Financial Statements 9 Spokes International Limited 30 September 2020jenny smithNo ratings yet

- ICCA Market Intelligence On COVID-19 Affected MeetingsDocument15 pagesICCA Market Intelligence On COVID-19 Affected MeetingsElif Nas UnalNo ratings yet

- 2020 21 H1 30.09.2020Document12 pages2020 21 H1 30.09.2020wekepix890No ratings yet

- Cash To Accrual Basis of AccountingDocument6 pagesCash To Accrual Basis of AccountingChocobetternotNo ratings yet

- Annual Report FY2020Document424 pagesAnnual Report FY2020SAGAR KASERANo ratings yet

- Sec14 SACS SoftwareDocument40 pagesSec14 SACS SoftwareS Bharat SelvamNo ratings yet

- Fiscal Year 2017 Operating Budget Supplement (01-00-00) LEGISLATIVEDocument70 pagesFiscal Year 2017 Operating Budget Supplement (01-00-00) LEGISLATIVEKevinOhlandtNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- CPI Press Statement 12nov20 PDFDocument6 pagesCPI Press Statement 12nov20 PDFVishnu KanthNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )johanes ongoNo ratings yet

- Rush of Expenditure in The Last Quarter of Financial Year 2019-20 - Central Government Employees NewsDocument2 pagesRush of Expenditure in The Last Quarter of Financial Year 2019-20 - Central Government Employees NewsbimlapalNo ratings yet

- PWD Budget 2016 - bp18Document216 pagesPWD Budget 2016 - bp18amitNo ratings yet

- Case Study 2 - Tasks - SADocument2 pagesCase Study 2 - Tasks - SADimakatsoNo ratings yet

- Answer:: Mohammed Bilal Choudhary (Ju2021Mba14574) QuestionsDocument3 pagesAnswer:: Mohammed Bilal Choudhary (Ju2021Mba14574) QuestionsMd BilalNo ratings yet

- வாக்கியம் அமைத்தல்Document40 pagesவாக்கியம் அமைத்தல்Anandha Raj MunnusamyNo ratings yet

- AAFR Topic-Wise Test Regards Awais ALIDocument34 pagesAAFR Topic-Wise Test Regards Awais ALIUmmar FarooqNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Veejay Lee Is The Owner of VJ's Internet Cafe. ...Document5 pagesVeejay Lee Is The Owner of VJ's Internet Cafe. ...MingNo ratings yet

- Introduction To Corporate Finance - PPTDocument25 pagesIntroduction To Corporate Finance - PPT洪昀霙No ratings yet

- Dissertation On Banking Law in IndiaDocument6 pagesDissertation On Banking Law in IndiaWriteMyApaPaperSingapore100% (1)

- VUL Mock Exam 1Document10 pagesVUL Mock Exam 1NatoNo ratings yet

- Accounting For ManagersDocument61 pagesAccounting For ManagersSwapnil DeshpandeNo ratings yet

- ADC (Alternate Delivery Channel) : Bank AL Habib LimitedDocument9 pagesADC (Alternate Delivery Channel) : Bank AL Habib LimitedZainab RiazNo ratings yet

- ACCT 352 Fall 2022 Midterm BlankDocument12 pagesACCT 352 Fall 2022 Midterm Blankannika.schmunkNo ratings yet

- Bank Deposit Slip NBP-8000Document1 pageBank Deposit Slip NBP-8000RK DanishNo ratings yet

- Tutorial Questions - Topic4Document2 pagesTutorial Questions - Topic4Thirusha balamuraliNo ratings yet

- Quick Guide: Amway Distribution CentersDocument1 pageQuick Guide: Amway Distribution CentersJamz LopezNo ratings yet

- CB Consent CibcgeneratedDocument2 pagesCB Consent CibcgeneratedJonathan CristanchoNo ratings yet

- Thesis On Regional Rural Banks in IndiaDocument8 pagesThesis On Regional Rural Banks in Indiafj9dbfw4100% (2)

- Advert Assistant Branch Manager Mto Wa Mbu 2Document5 pagesAdvert Assistant Branch Manager Mto Wa Mbu 2Rashid BumarwaNo ratings yet

- ICICI Group: Strategy & PerformanceDocument51 pagesICICI Group: Strategy & PerformanceJason SanchezNo ratings yet

- Main Exam 2014-Sol-1Document7 pagesMain Exam 2014-Sol-1Diego AguirreNo ratings yet

- EVA Approach: Calculation of Economic Value Added (EVA)Document4 pagesEVA Approach: Calculation of Economic Value Added (EVA)Lakshmi BaiNo ratings yet

- Trial - Intro To Accounting Ch. 2 (12th Ed)Document5 pagesTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasNo ratings yet

- Book-FABM P1 052217Document357 pagesBook-FABM P1 052217MarielJoY100% (4)

- Activity 5 Non Current Assets Held For Sale and Discontinued OperationsDocument3 pagesActivity 5 Non Current Assets Held For Sale and Discontinued Operationsnglc srzNo ratings yet

- Topic 7 Sources of Financing New and Growing Business VenturesDocument5 pagesTopic 7 Sources of Financing New and Growing Business Ventures2024783507No ratings yet

- Csec Poa June 2005 p2Document11 pagesCsec Poa June 2005 p2zarzsultan12No ratings yet

- Forensic Loan Audit Report - Sample Report 4-2009Document47 pagesForensic Loan Audit Report - Sample Report 4-2009boufninaNo ratings yet

- Mills MarchDocument3 pagesMills MarchAli HassanNo ratings yet

- 9021 - Foreign Currency Transactions and DerivativesDocument6 pages9021 - Foreign Currency Transactions and DerivativesAljur SalamedaNo ratings yet

- Key Fact StatementDocument2 pagesKey Fact StatementBNREDDY PSNo ratings yet

- Bank Financial Distress Prediction Model With Logit RegressionDocument18 pagesBank Financial Distress Prediction Model With Logit RegressionAnjar FadhliaNo ratings yet

- P03 - Absorption, Variable & Throughput CostingDocument88 pagesP03 - Absorption, Variable & Throughput CostingNoro100% (1)