Professional Documents

Culture Documents

Auditing Theory

Uploaded by

Allia AntalanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing Theory

Uploaded by

Allia AntalanCopyright:

Available Formats

1. Define Audit Risk.

Audit risk is the risk that, when reviewing a client's financial records, an auditor may not

find mistakes or fraud. It refers to the risk that financial records are materially

inaccurate, even though the audit judgment notes that the financial reports are free of

any factual misstatements. The aim of an audit is to reduce the audit risk to an

acceptable low level by proper testing and sufficient evidence.

2. What are the components of the risk of material misstatement? What are the components of

audit risk model?

The risk of material misstatements is defined as the risk that the financial statements

are significantly incorrect prior to the audit. It consists of two elements: the inherent

and control risks.

The inherent risk is 'the vulnerability of an assertion about a transaction class, account

balance or exposure to a mistake that may be material, either individually or when

combined with other mistakes, before any associated safeguards are taken into

account.’

The control risk is ‘the possibility that a mistake that could arise in a statement about a

transaction class, account balance or declaration and that may be material, either

separately or when combined with other errors, would not be avoided or identified and

corrected by the internal management of the company on a timely basis.'

The audit risk model is an instrument used by auditors to consider the relationship

between different risks resulting from an audit commitment that helps them to manage

the overall audit risk. The audit risk model shows that an engagement 's total audit risk

is the result of the following three component risks: Inherent Risk, Control Risk &

Detection Risk.

Inherent risk exists due to the essence of an item's vulnerability to misrepresentation.

For instance, since they require judgment, there is an implicit danger of

misrepresentation of estimates. Control risk is the risk that a company's internal

controls, which avoid or track and fix errors, malfunction and therefore the things in the

financial statement are mistaken. Detection risk occurs because all the misstatements

are not identified by the auditor's standards and strategies, to test balances and

transactions for factual errors.

3. How is the audit risk model used to plan the audit?

The aim of the auditor is to reduce the potential risk of an audit to an appropriate

amount. They would first determine the amounts of each variable vulnerability of the

model in order to do so. However, the risk values are not easily quantifiable and

auditors use expert discretion to determine the hazards. This suggests that, as most

mathematical calculations are normally used, the above equation is not usually used to

quantify threats. Nevertheless, the auditors will measure the risk values in some

manner, mostly through descriptive means. In order to create a relationship between

the risks, the auditors then use the model to take steps to reduce the total audit risk to

an appropriate level. This could be of great help for them to come up with an effective

audit result.

4. What is the primary difference between a material misstatement due to fraud or error?

If the underlying conduct that resulted in the misrepresentation of the financial report is

deliberate or accidental is the primary consideration that separates fraud from mistake.

Misstatements resulting from false financial reports are deliberate error or omission in

financial records of sums or disclosures intended to mislead consumers of financial

statements where the effect allows the financial statements not to be presented in all

relevant ways in compliance with GAAP. A vital aspect of an auditor's credential

engagement is the evaluation and reaction to threats of content misrepresentation due

to mistake or fraud. Auditors must provide an effective approach to their measured

threats of material misrepresentation due to control override management fraud,

including checking journal entries for evidence of potential material misrepresentation

due to fraud.

5. What is the auditor’s responsibility regarding fraud risk?

Paragraph 02 of AS 1001, Responsibilities and Functions of the Independent Auditor,

states, "The auditor has a responsibility to plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material

misstatement, whether caused by error or fraud. The audit committee is expected to

address the likelihood of a material error in the financial statements related to theft

before and after the evidence collecting process through a discussion or brainstorming

activity.

6. Identify the three different categories of fraud risk factors. Next, for each category what are

some of the conditions that can help contribute to a higher likelihood of financial statement

fraud?

Under the audit fraud risk lies the three categories namely: 1) incentive/pressure to

perpetrate fraud; 2) opportunity to carry out the fraud and 3) attitude/rationalization to

justify the fraudulent action.

o INCENTIVE/PRESSURE: The plan holds employer securities and the employer is

in an industry in which the value of the securities is subject to significant

volatility or is not readily determinable & Recurring negative cash flows

combined with an underfunded position or a threat of regulatory intervention

to the plan

OPPORTUNITY: Significant related-party transactions not in the ordinary course

of business or with related plans not audited or audited by another firm & Non-

readily marketable investments where valuation is based on significant

estimates that involve subjective judgments or uncertainties that are difficult to

corroborate, such as unregulated investments (hedge funds or "alternative

investments") or real estate

ATTITUDE/RATIONALIZATION: Ineffective communication, implementation,

support, or enforcement of the plan sponsor or plan's values or ethical

standards by management or the communication of inappropriate values or

ethical standards & Management failing to correct known operational

deficiencies, prohibited transactions, or reportable conditions on a timely basis

You might also like

- Summary Rules of Prizes and Winnings For Individual TaxpayersDocument2 pagesSummary Rules of Prizes and Winnings For Individual TaxpayersAllia AntalanNo ratings yet

- Strama AnswerDocument7 pagesStrama AnswerAllia AntalanNo ratings yet

- Other Exempt Income Under The Nirc and Special LawsDocument2 pagesOther Exempt Income Under The Nirc and Special LawsAllia AntalanNo ratings yet

- Effectiveness of The Operation.: AuditsDocument4 pagesEffectiveness of The Operation.: AuditsAllia AntalanNo ratings yet

- Real vs. Personal DefenseDocument3 pagesReal vs. Personal DefenseAllia AntalanNo ratings yet

- Pdic (Deposit Insurance)Document3 pagesPdic (Deposit Insurance)Allia AntalanNo ratings yet

- Financial MarketsDocument6 pagesFinancial MarketsAllia AntalanNo ratings yet

- China Bank Fixed Income FundDocument3 pagesChina Bank Fixed Income FundAllia AntalanNo ratings yet

- Projected Cash Income For The Year 2021-2025 RevenuesDocument9 pagesProjected Cash Income For The Year 2021-2025 RevenuesAllia AntalanNo ratings yet

- Sts Chapter 1 Part ADocument3 pagesSts Chapter 1 Part AAllia AntalanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Analytical Comparison Between Bot Boot and PPP Project Delivery SystemsDocument12 pagesAnalytical Comparison Between Bot Boot and PPP Project Delivery Systemsbudi hermawanNo ratings yet

- What We Know About Storytelling Strategies: Source: WARC Best Practice, September 2017Document5 pagesWhat We Know About Storytelling Strategies: Source: WARC Best Practice, September 2017Jimena ToledoNo ratings yet

- GCSE English LanguageDocument7 pagesGCSE English LanguagetrestNo ratings yet

- Activity: Pancakes, Pancakes' by Eric Carle: Directions Materials Needed Getting ReadyDocument2 pagesActivity: Pancakes, Pancakes' by Eric Carle: Directions Materials Needed Getting ReadyVijay VenkatNo ratings yet

- Arts and Creativity LiteracyDocument27 pagesArts and Creativity LiteracyAngielyn Montibon Jesus100% (11)

- Ellis Et Al. (2001)Document38 pagesEllis Et Al. (2001)xeodx13No ratings yet

- Chapter 15 Advertising and Public Relations 1 PDFDocument16 pagesChapter 15 Advertising and Public Relations 1 PDFSanaNo ratings yet

- Amazon SWOT 2021 - SWOT Analysis of Amazon - Business Strategy HubDocument18 pagesAmazon SWOT 2021 - SWOT Analysis of Amazon - Business Strategy HubFUNTV5No ratings yet

- Hayek and ScientismDocument17 pagesHayek and ScientismnieschopwitNo ratings yet

- Lesson Plan - Guided WritingDocument5 pagesLesson Plan - Guided Writingapi-451201960No ratings yet

- Project Scope StatementDocument4 pagesProject Scope StatementPrashant ParshivnikarNo ratings yet

- M A N I A: Causes of WWIDocument5 pagesM A N I A: Causes of WWIJamieJammyNo ratings yet

- Conventional Marketing Channels - Vertical Marketing SystemsDocument2 pagesConventional Marketing Channels - Vertical Marketing SystemsShruti Suman MiddhaNo ratings yet

- 133332.jpgDocument4 pages133332.jpgIssa AvenaNo ratings yet

- The Comparative Economic Impact of Travel Tourism PDFDocument44 pagesThe Comparative Economic Impact of Travel Tourism PDFkenanpa7590No ratings yet

- Keywords: Rumors, Marketplace Rumors, Consumer Behavior, Word ofDocument20 pagesKeywords: Rumors, Marketplace Rumors, Consumer Behavior, Word ofortega mukoNo ratings yet

- Impact of COVID 19 in College PDFDocument19 pagesImpact of COVID 19 in College PDFRikesh AcharyaNo ratings yet

- Using English Songs To Improve Young Learners' Listening ComprehensionDocument11 pagesUsing English Songs To Improve Young Learners' Listening ComprehensionIJELS Research JournalNo ratings yet

- As 8002-2003 Corporate Governance - Organizational Codes of ConductDocument7 pagesAs 8002-2003 Corporate Governance - Organizational Codes of ConductSAI Global - APACNo ratings yet

- Istvan Deak - Beyond Nationalism - A Social and Political History of The Habsburg Officer Corps, 1848-1918 (1990)Document300 pagesIstvan Deak - Beyond Nationalism - A Social and Political History of The Habsburg Officer Corps, 1848-1918 (1990)CydLosekannNo ratings yet

- Internalisasi Nilai Moderasi Melalui Pendidikan Agama Islam Di Perguruan Tinggi Umum PDFDocument15 pagesInternalisasi Nilai Moderasi Melalui Pendidikan Agama Islam Di Perguruan Tinggi Umum PDFMirzaNo ratings yet

- SEG-Newsletter-69-2007-April Metamorphic Gradient A Regional-Scale Area Selection Criterion For Gold in CanadianDocument48 pagesSEG-Newsletter-69-2007-April Metamorphic Gradient A Regional-Scale Area Selection Criterion For Gold in Canadianjunior.geologiaNo ratings yet

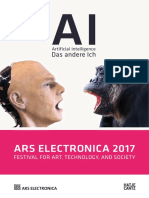

- Ars Electronica AI Artificial Intelligence The Other I 2017 PDFDocument202 pagesArs Electronica AI Artificial Intelligence The Other I 2017 PDFDenise Bandeira100% (1)

- HLURB RequirementsDocument2 pagesHLURB RequirementsIpe ClosaNo ratings yet

- M7-New Product Commercialization-Needs and StrategiesDocument18 pagesM7-New Product Commercialization-Needs and StrategiesLoi Foo CheongNo ratings yet

- G.R. No. 134298.PDF Tan Vs PeopleDocument5 pagesG.R. No. 134298.PDF Tan Vs PeopleAronJamesNo ratings yet

- Manufacturing StrategyDocument2 pagesManufacturing StrategyProcusto LNo ratings yet

- Tutorial Letter 102/3/2016: International LawDocument70 pagesTutorial Letter 102/3/2016: International Lawtech hutNo ratings yet

- Jackie Robinson BibliographyDocument5 pagesJackie Robinson Bibliographyapi-488066888No ratings yet

- Grade 9 Acetone and FormalinDocument2 pagesGrade 9 Acetone and Formalinking devesfrutoNo ratings yet