Professional Documents

Culture Documents

Ia Problem 6

Uploaded by

Diana CamachoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ia Problem 6

Uploaded by

Diana CamachoCopyright:

Available Formats

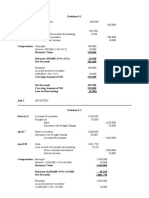

Problem 6

1 9 3/4% registered debentures, callable in 2002, due in 2007 700,000

9 1/2% collateral trust bonds, convertible into common stock

beginning in 2000, due in 2010 600,000

D 1,300,000

2 Serial Bonds

9.375% registered bonds (25,000 maturing annually

beginning in 20x4 275,000

10.0% commodity backed bonds (50,000 maturing annually

beginning in 20x5 200,000

A 475,000

Debenture Bonds

9.375% registered bonds (25,000 maturing annually

beginning in 20x4 275,000

11.5% convertible bonds, callable beginning in 20x9, due 2010 125,000

A 400,000

3 Promotion Costs 20,000

Engraving and Printing 25,000

Underwriters' Commission 200,000

D 245,000

4 Present value x Effective Interest Rate x Number of period

103,288 x 10% x 6/12 C 5,164

Date Interest Interest Amortization Present

5 Payments Expense Value

1/2/2001 469,500

6/30/2001 22, 500 23,475 975 470,475

Answer: B. 470,475

6 Face Amount 1,000,000

Less: Carrying Amount (Oct 31, 1999) 1,062,000

Unamortized bond premium A 62,000

7 Bond Proceeds 190,280

Less: Present value due in 12/31/x1 50,900

Carrying amount A 139,380

8 800,000 x 4% x 2/6 D 10,667

9 Face amount 200 x 1000 shares 200,000

Cash proceeds 200 x 101% 202,000

Cash proceeds including accrued interest 202,000

Less: Accrued interest sold

200,000 x 9% x 5/12 7,500

A 194,500

10 D. 700

You might also like

- Intermediate Accounting 2 Final ExamDocument35 pagesIntermediate Accounting 2 Final ExamJEFFERSON CUTE97% (32)

- Bonds Payable Quiz Part 2Document5 pagesBonds Payable Quiz Part 2justine reine cornico100% (1)

- Sia 1.bonds PayableDocument13 pagesSia 1.bonds PayableYasmin MamugayNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- Sol. Man. - Chapter 3 Bonds Payable Other ConceptsDocument21 pagesSol. Man. - Chapter 3 Bonds Payable Other ConceptsJasmine Nouvel Soriaga Cruz86% (7)

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Intermediate Accounting 2 Chapter 3 BondsDocument4 pagesIntermediate Accounting 2 Chapter 3 BondsMARRIETTE JOY ABADNo ratings yet

- 06 Notes Receivable Sec 2 MCPDocument3 pages06 Notes Receivable Sec 2 MCPkyle mandaresioNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- AssignmentDocument40 pagesAssignmentnoeljrpajaresNo ratings yet

- Bonds Payable ConceptsDocument20 pagesBonds Payable ConceptsThalia Rhine AberteNo ratings yet

- Current Liabilities ChapterDocument8 pagesCurrent Liabilities ChapterJonathan Villazon Rosales67% (3)

- MAE - P4 Chapter 5Document2 pagesMAE - P4 Chapter 5Leah Mae NolascoNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Prob.2 Classroom Discussion BP OCDocument4 pagesProb.2 Classroom Discussion BP OCWenjunNo ratings yet

- Property, Plant, & Equipment Problem SetDocument3 pagesProperty, Plant, & Equipment Problem SetSarah Nicole S. LagrimasNo ratings yet

- Intermediate Accounting 3 - Chap 10-12 Answer KeyDocument7 pagesIntermediate Accounting 3 - Chap 10-12 Answer KeyKrisselyn ReigneNo ratings yet

- Multiple Choice Practice QuestionsDocument3 pagesMultiple Choice Practice QuestionsKATHRYN CLAUDETTE RESENTENo ratings yet

- Answers - Chapter 1 - Current LiabilitiesDocument5 pagesAnswers - Chapter 1 - Current LiabilitiesLhica EsterasNo ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- Problem 6: For Classroom Discussion: Requirement (A)Document6 pagesProblem 6: For Classroom Discussion: Requirement (A)Nikky Bless LeonarNo ratings yet

- Sol. Man. - Chapter 3 Bonds Payable & Other ConceptsDocument23 pagesSol. Man. - Chapter 3 Bonds Payable & Other ConceptsMiguel Amihan100% (1)

- Answers - Chapter 2 Vol 2 RvsedDocument13 pagesAnswers - Chapter 2 Vol 2 Rvsedjamflox100% (3)

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Chapter 22 Current Liabilities ReviewDocument8 pagesChapter 22 Current Liabilities ReviewErwin Dave M. DahaoNo ratings yet

- Tutorial 4 Answer Mfrs123 Borrowing CostsDocument5 pagesTutorial 4 Answer Mfrs123 Borrowing CostsannabelleNo ratings yet

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- Bond valuation and stock issuance calculationsDocument13 pagesBond valuation and stock issuance calculationsHENDY YUDHA PRAMANANo ratings yet

- Tutorial 9: Statement of Cash FlowsDocument1 pageTutorial 9: Statement of Cash FlowsCheng Win-YarnNo ratings yet

- Group-1-Chap-4 & 5Document10 pagesGroup-1-Chap-4 & 5Cherie Soriano AnanayoNo ratings yet

- FR Mock Exam 4 - SolutionsDocument13 pagesFR Mock Exam 4 - Solutionsiram2005No ratings yet

- 4.EF232.FIM (IL-II) Solution CMA 2023 January ExamDocument6 pages4.EF232.FIM (IL-II) Solution CMA 2023 January ExamnobiNo ratings yet

- SW Chapter9 BDocument4 pagesSW Chapter9 BAnonnNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Compound Financial InstrumentDocument2 pagesCompound Financial Instrumenthae1234No ratings yet

- Bonds PayableDocument9 pagesBonds PayableKayla MirandaNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- INTACCDocument4 pagesINTACCApple RoncalNo ratings yet

- Group Activities in Receivable FinancingDocument2 pagesGroup Activities in Receivable FinancingTrisha VillegasNo ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Calculate interest expense, amortization, bond premium and discount problemsDocument2 pagesCalculate interest expense, amortization, bond premium and discount problemsLeah Mae NolascoNo ratings yet

- Omega Finance loan impairmentDocument9 pagesOmega Finance loan impairmentRengeline LucasNo ratings yet

- Answer Key Chapter 8 FranchiseDocument8 pagesAnswer Key Chapter 8 Franchisekaren perrerasNo ratings yet

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- Leases (Part 2) : Problem 1: True or FalseDocument23 pagesLeases (Part 2) : Problem 1: True or FalseKim Hanbin100% (1)

- Intacc Chap 9Document26 pagesIntacc Chap 9Shek Severino AlairNo ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Problem 9-1,9-2,9-3Document3 pagesProblem 9-1,9-2,9-3Annabeth ChaseNo ratings yet

- FM Model - Coffee ParlorDocument11 pagesFM Model - Coffee ParlorPRITESH PATILNo ratings yet

- Ia 2Document23 pagesIa 2Gelo OwssNo ratings yet

- Homework SolutionsDocument5 pagesHomework SolutionsAnonymous CuUAaRSNNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Case Study 6Document2 pagesCase Study 6Diana Camacho100% (1)

- A Thousand Splendid SunsDocument7 pagesA Thousand Splendid SunsDiana CamachoNo ratings yet

- Reaction Paper About Martial LawDocument1 pageReaction Paper About Martial LawDiana CamachoNo ratings yet

- Global Economy: Interconnectedness and Impact on NationsDocument1 pageGlobal Economy: Interconnectedness and Impact on NationsDiana CamachoNo ratings yet

- Om Reviewer Chapter 8Document2 pagesOm Reviewer Chapter 8Diana CamachoNo ratings yet

- Market Integration Definition and ExamplesDocument2 pagesMarket Integration Definition and ExamplesDiana CamachoNo ratings yet

- Global Interstate SystemDocument1 pageGlobal Interstate SystemDiana CamachoNo ratings yet

- Global Interstate SystemDocument1 pageGlobal Interstate SystemDiana CamachoNo ratings yet

- Global Interstate SystemDocument1 pageGlobal Interstate SystemDiana CamachoNo ratings yet

- Ice BreakerDocument21 pagesIce BreakerDiana CamachoNo ratings yet

- Global Interstate SystemDocument1 pageGlobal Interstate SystemDiana CamachoNo ratings yet

- Global Interstate SystemDocument1 pageGlobal Interstate SystemDiana CamachoNo ratings yet

- Ia Problem 6Document2 pagesIa Problem 6Diana CamachoNo ratings yet

- Ice BreakerDocument21 pagesIce BreakerDiana CamachoNo ratings yet

- Law Corporation TermsDocument3 pagesLaw Corporation TermsDiana CamachoNo ratings yet

- Teacher Resume Alison KnipferDocument2 pagesTeacher Resume Alison Knipferapi-317249919No ratings yet

- Medicard Phil Inc. vs. CIRDocument2 pagesMedicard Phil Inc. vs. CIRhigoremso giensdksNo ratings yet

- Tugas B.INGGRIS ALANDocument4 pagesTugas B.INGGRIS ALANAlan GunawanNo ratings yet

- Survey of Accounting 6th Edition Warren Solutions ManualDocument17 pagesSurvey of Accounting 6th Edition Warren Solutions Manualdevinsmithddsfzmioybeqr100% (19)

- Shlokas and BhajansDocument204 pagesShlokas and BhajansCecilie Ramazanova100% (1)

- Different Type of Dealers Detail: Mfms Id Agency Name District Mobile Dealer Type State Dealership NatureDocument1 pageDifferent Type of Dealers Detail: Mfms Id Agency Name District Mobile Dealer Type State Dealership NatureAvijitSinharoyNo ratings yet

- G3335-90158 MassHunter Offline Installation GCMSDocument19 pagesG3335-90158 MassHunter Offline Installation GCMSlesendreNo ratings yet

- Integrated BMSDocument14 pagesIntegrated BMSjim.walton100% (5)

- Report For Court, Sale of Dowling College Brookhaven CampusDocument26 pagesReport For Court, Sale of Dowling College Brookhaven CampusRiverheadLOCALNo ratings yet

- ĐỀ THI THỬ ĐH - Mã 129 (Smartie)Document6 pagesĐỀ THI THỬ ĐH - Mã 129 (Smartie)Hoang Huy NguyenNo ratings yet

- Zanussi ZBF 569 Oven ManualDocument24 pagesZanussi ZBF 569 Oven ManualJoohlsNo ratings yet

- U9L4 Activity+Guide+ +Exploring+Two+Columns+ +Unit+9+Lesson+4Document2 pagesU9L4 Activity+Guide+ +Exploring+Two+Columns+ +Unit+9+Lesson+4Rylan Russell0% (1)

- 2009 Bar Exam Criminal Law QuestionsDocument25 pages2009 Bar Exam Criminal Law QuestionsJonny Duppses100% (2)

- 2013 Typhoon YolandaDocument7 pages2013 Typhoon YolandaDieanne MaeNo ratings yet

- Self Unbound Ego Dissolution in PsychedelicDocument11 pagesSelf Unbound Ego Dissolution in Psychedelicszucsanna123456789No ratings yet

- Improving Oil Recovery with EOR/IOR MethodsDocument1 pageImproving Oil Recovery with EOR/IOR MethodsMuhammad Fawwad ObaidaNo ratings yet

- T e 2552731 Describe The Creature Writing Worksheet - Ver - 2Document3 pagesT e 2552731 Describe The Creature Writing Worksheet - Ver - 2Minah ZamanNo ratings yet

- Post Graduate Dip DermatologyDocument2 pagesPost Graduate Dip DermatologyNooh DinNo ratings yet

- BRI Divisions and Branches Level ReportDocument177 pagesBRI Divisions and Branches Level ReportCalvin Watulingas100% (1)

- Lecture 1 (Introductory Class)Document23 pagesLecture 1 (Introductory Class)Amara SoOmroNo ratings yet

- A Place in Lake County - The Property Owner's Resource GuideDocument16 pagesA Place in Lake County - The Property Owner's Resource GuideMinnesota's Lake Superior Coastal ProgramNo ratings yet

- Healthy Chicken Pasta Recipes From EatingWell MagazineDocument10 pagesHealthy Chicken Pasta Recipes From EatingWell MagazineAlice GiffordNo ratings yet

- Trust Law: Common Law Property Settlor Trustees Beneficiary FiduciaryDocument8 pagesTrust Law: Common Law Property Settlor Trustees Beneficiary FiduciaryDekweriz100% (1)

- Gept reading試題Document13 pagesGept reading試題Bateman Patrick100% (1)

- Ch01 Standard Methods and PractisesDocument44 pagesCh01 Standard Methods and PractisesUsman FarooqNo ratings yet

- Final Order in The Matter of M/s Alchemist Capital LTDDocument61 pagesFinal Order in The Matter of M/s Alchemist Capital LTDShyam SunderNo ratings yet

- Language Learning Enhanced by Music and SongDocument7 pagesLanguage Learning Enhanced by Music and SongNina Hudson100% (2)

- Human Rights EducationDocument149 pagesHuman Rights EducationLeonard MamergaNo ratings yet

- The University of Alabama PowerpointDocument18 pagesThe University of Alabama Powerpointapi-305346442No ratings yet

- Ode To The Spell Checker TCHDocument1 pageOde To The Spell Checker TCHCamila PaulucciNo ratings yet