Professional Documents

Culture Documents

Mini Channel Breakout: Adichael J Parsons

Uploaded by

Nguyễn Phong0 ratings0% found this document useful (0 votes)

8 views1 pageMini channel breakouts occur when a market forms smaller channels within an overall unclear trend, like stair steps. Traders can look for these mini channels to break in the same direction repeatedly as an entry signal, setting stops just before the previous mini channel zone. This entry method has higher risk but can identify trading opportunities in scenarios where the trend is otherwise difficult to discern. The market must step consistently in one direction through breaking mini channels for the technique to be valid.

Original Description:

Original Title

47

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMini channel breakouts occur when a market forms smaller channels within an overall unclear trend, like stair steps. Traders can look for these mini channels to break in the same direction repeatedly as an entry signal, setting stops just before the previous mini channel zone. This entry method has higher risk but can identify trading opportunities in scenarios where the trend is otherwise difficult to discern. The market must step consistently in one direction through breaking mini channels for the technique to be valid.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageMini Channel Breakout: Adichael J Parsons

Uploaded by

Nguyễn PhongMini channel breakouts occur when a market forms smaller channels within an overall unclear trend, like stair steps. Traders can look for these mini channels to break in the same direction repeatedly as an entry signal, setting stops just before the previous mini channel zone. This entry method has higher risk but can identify trading opportunities in scenarios where the trend is otherwise difficult to discern. The market must step consistently in one direction through breaking mini channels for the technique to be valid.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Adichael J Parsons

Mini channel breakout

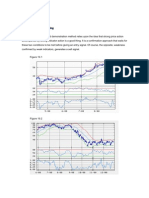

When a market is unclear about a channel parameter you will often have

instead smaller channels that develop somewhat li ke stair steps.

Obviously, there is a trend in there somewhere, but it is difficult to put your

finger on its limits. By using a similar approach as we did with the

rebound entry we still have the ability to trade such an obscure trend. The

difference here is that rather than based on the break of a larger channel you

are simply looking for smaller channels to repeat a break in the same

direction. So in a sense this entry is based on what could be referred to as

mini-channel breaks.

The basic concept fol lows these steps: A market breaks a channel,

whether large or small, and then forms a mini-channel. If the mini-

channel breaks in the same direction as before and continues the trend

direction you then enter at the break. A stop is set just before the mini-

channel zone that was used to signal the entry. Figure 2-4 demonstrates

the technique.

Later. a channel line will develop that Will replace the use of mini

British Pound

This method of entry has a higher risk associated with it as part of the

deal, but it does resolve a few scenarios where entering would normally

be a real problem. Just remember, you are looking for a secondary break

in the same direction, one right after the other. If you have a market that

breaks a mini channel in the opposite direction in-between the two then

this approach will not work. To be valid you must have a market stepping

either up or down, not both ways.

36

You might also like

- The Wyckoff Methodology in Depth: How to trade financial markets logicallyFrom EverandThe Wyckoff Methodology in Depth: How to trade financial markets logicallyRating: 4.5 out of 5 stars4.5/5 (65)

- Larry Williams - Trading Patterns For Stocks and CommoditiesDocument8 pagesLarry Williams - Trading Patterns For Stocks and CommoditiesAlex Grey83% (6)

- Fibonacci Retrace Ment Channel Trading StrategyDocument22 pagesFibonacci Retrace Ment Channel Trading Strategyrajen100% (4)

- Channel Trading Strategies Quick GuideDocument10 pagesChannel Trading Strategies Quick Guideonifade faesolNo ratings yet

- Trading Secrets They Dont Want You To Know FV 1 - MinDocument26 pagesTrading Secrets They Dont Want You To Know FV 1 - MinRakesh KumarNo ratings yet

- Channel Trading StrategyDocument51 pagesChannel Trading StrategyVijay86% (7)

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- Billy Kay and Pope BinaryDocument31 pagesBilly Kay and Pope BinaryzUMOH100% (1)

- Summary of John Bollinger's Bollinger on Bollinger BandsFrom EverandSummary of John Bollinger's Bollinger on Bollinger BandsRating: 3 out of 5 stars3/5 (1)

- How to Trade a Range: Trade the Most Interesting Market in the WorldFrom EverandHow to Trade a Range: Trade the Most Interesting Market in the WorldRating: 4 out of 5 stars4/5 (5)

- The Complete Guide To Trend Line Trading PDFDocument18 pagesThe Complete Guide To Trend Line Trading PDFVinesh Singh67% (3)

- Step Two of The Wyckoff Method: Stock Market Trading StrategiesDocument3 pagesStep Two of The Wyckoff Method: Stock Market Trading StrategiesDeepak Paul TirkeyNo ratings yet

- Inside BarDocument5 pagesInside Barcryslaw100% (2)

- Day Trading Forex with Price PatternsFrom EverandDay Trading Forex with Price PatternsRating: 4.5 out of 5 stars4.5/5 (40)

- How To Read Volume Profile StructuresDocument18 pagesHow To Read Volume Profile Structuresjnk987100% (10)

- Trend Lines and ChannelsDocument7 pagesTrend Lines and ChannelsSteve MckeanNo ratings yet

- Using Trailing Stops: in A Trading SystemDocument5 pagesUsing Trailing Stops: in A Trading SystemNitin Chanduka100% (1)

- Bollinger Bands Method - LLLDocument4 pagesBollinger Bands Method - LLLadoniscalNo ratings yet

- Harmonics Tradingpart OneDocument105 pagesHarmonics Tradingpart OneAndres Felipe HernandezNo ratings yet

- Volume Spread Analysis Karthik MararDocument34 pagesVolume Spread Analysis Karthik Mararku43to95% (19)

- Demark Indicator For Forex TraderDocument7 pagesDemark Indicator For Forex TraderesteekauderNo ratings yet

- Zahid NazDocument29 pagesZahid NazMSA100% (1)

- Anty SetupDocument3 pagesAnty SetupMarv Nine-o SmithNo ratings yet

- Snowflake2 @FOREXSyllabusDocument27 pagesSnowflake2 @FOREXSyllabusHamzah Ahmed100% (3)

- SMART MONEY ORDE BLOC EditedDocument9 pagesSMART MONEY ORDE BLOC Editedtawhid anam86% (7)

- CME Tmorge Currency GapDocument53 pagesCME Tmorge Currency GapAnonymous JrCVpu100% (1)

- Gourmet TraderDocument31 pagesGourmet TradersetioNo ratings yet

- Supply and Demand TradingDocument39 pagesSupply and Demand Tradingamirhosein tohidli100% (2)

- 14 Strategies of A Millionaire TraderDocument200 pages14 Strategies of A Millionaire Traderpiyush_rathod_13100% (2)

- PinocchioBars 03 2010 V2 PDFDocument4 pagesPinocchioBars 03 2010 V2 PDFanalyst_anil14No ratings yet

- Eight Questions To Help You With Price Action Bar AnalysisDocument12 pagesEight Questions To Help You With Price Action Bar Analysisaran singh100% (1)

- Volume Spread Analysis: KarthikmararDocument34 pagesVolume Spread Analysis: KarthikmararGuivaNo ratings yet

- How To Successfully Use Pitchforks and Median Lines To TradeDocument60 pagesHow To Successfully Use Pitchforks and Median Lines To TradekhangphongnguyengmaiNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- Support Methods Chart Structure Lists Screen Portfolio PatternsDocument10 pagesSupport Methods Chart Structure Lists Screen Portfolio PatternsmahmoudNo ratings yet

- Enter at The Break of The Secondary Channel That Rebounds Toward The Previous Inside Channel Line, As Long As It Does Not Exceed The Prior High or LowDocument1 pageEnter at The Break of The Secondary Channel That Rebounds Toward The Previous Inside Channel Line, As Long As It Does Not Exceed The Prior High or LowNguyễn PhongNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- ICT Charter Price Action Model 6Document27 pagesICT Charter Price Action Model 6yoatoyout550No ratings yet

- Already Begun To Form in The Direction of Your Trade, Even If It Is Only Partially Formed, You Can Use This To Limit The RiskDocument1 pageAlready Begun To Form in The Direction of Your Trade, Even If It Is Only Partially Formed, You Can Use This To Limit The RiskNguyễn PhongNo ratings yet

- Free SMC Guide 2022 SMTDocument1 pageFree SMC Guide 2022 SMTjasonjackmanNo ratings yet

- Vertex Indicator - A Successful Combination of IndicatorsDocument4 pagesVertex Indicator - A Successful Combination of IndicatorsMubashirNo ratings yet

- Learnforextrend ChannelsDocument8 pagesLearnforextrend Channelslewgraves33No ratings yet

- Kelvin KillerMarket SMC Ebooks 1.0Document33 pagesKelvin KillerMarket SMC Ebooks 1.0chigaemezuijeoma005No ratings yet

- Poliuu JkoDocument31 pagesPoliuu Jkoاندير انديرNo ratings yet

- Ghous 1-10Document30 pagesGhous 1-10Henry KunambiNo ratings yet

- InSilico Crayons Product Guide V3.4Document31 pagesInSilico Crayons Product Guide V3.4Illia LinovNo ratings yet

- Autochartist enDocument6 pagesAutochartist enAnonymous fE2l3DzlNo ratings yet

- Emperor PDF April 5Document23 pagesEmperor PDF April 5bastianbarrerarNo ratings yet

- Bollinger Bands Method - LLDocument4 pagesBollinger Bands Method - LLadoniscalNo ratings yet

- 11 The Auction Process Incorporating Multiple Examples All in One ExampleDocument3 pages11 The Auction Process Incorporating Multiple Examples All in One ExampleDeniss KoroblevNo ratings yet

- The ICT Bible - V1Document37 pagesThe ICT Bible - V1tailorNo ratings yet

- Poliuu JkoDocument30 pagesPoliuu Jkoاندير انديرNo ratings yet

- Price Action Trading in Crypto MarketsDocument29 pagesPrice Action Trading in Crypto MarketsCurtelomostv CurtelomosNo ratings yet

- ICT Mentorship 2022 Ep 3 NotesDocument26 pagesICT Mentorship 2022 Ep 3 Notesymnk6v2zx2No ratings yet

- The NFX Marketplace GlossaryDocument11 pagesThe NFX Marketplace GlossarySmallCap IndiaNo ratings yet

- The Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademyDocument6 pagesThe Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademyabhiNo ratings yet

- The Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademyDocument6 pagesThe Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademySiddikNo ratings yet

- The Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademyDocument6 pagesThe Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademyDHIRENDRANo ratings yet

- Ell R F-M: Th. PortDocument1 pageEll R F-M: Th. PortNguyễn PhongNo ratings yet

- 036Document1 page036Nguyễn PhongNo ratings yet

- TH Pric of Stori: To ToDocument1 pageTH Pric of Stori: To ToNguyễn PhongNo ratings yet

- 061Document1 page061Nguyễn PhongNo ratings yet

- 062Document1 page062Nguyễn PhongNo ratings yet

- The Internally Motivated 'I'l'3der Part 1Document1 pageThe Internally Motivated 'I'l'3der Part 1Nguyễn PhongNo ratings yet

- Uh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipDocument1 pageUh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipNguyễn PhongNo ratings yet

- HT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Document1 pageHT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Nguyễn PhongNo ratings yet

- The Price of Holding On To: StoriesDocument1 pageThe Price of Holding On To: StoriesNguyễn PhongNo ratings yet

- ""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Document1 page""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Nguyễn PhongNo ratings yet

- Mirl'OI', Mirl'or: If I""k This / While ManagpmentDocument1 pageMirl'OI', Mirl'or: If I""k This / While ManagpmentNguyễn PhongNo ratings yet

- About The Authol': Tarycr E, Wic/Ij"!1Document1 pageAbout The Authol': Tarycr E, Wic/Ij"!1Nguyễn PhongNo ratings yet

- Some Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirDocument1 pageSome Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirNguyễn PhongNo ratings yet

- Jlhi (: Ill) LJDocument1 pageJlhi (: Ill) LJNguyễn PhongNo ratings yet

- Foreword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Document1 pageForeword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Nguyễn PhongNo ratings yet

- Pauses Can Provide You With Advance Knowledge Regarding PossibleDocument1 pagePauses Can Provide You With Advance Knowledge Regarding PossibleNguyễn PhongNo ratings yet

- Are Rna,': - E I D Nki Dru Li - LL R I - . orDocument1 pageAre Rna,': - E I D Nki Dru Li - LL R I - . orNguyễn PhongNo ratings yet

- When The Trend Continues After Pausing: Michael 1. ParsonsDocument1 pageWhen The Trend Continues After Pausing: Michael 1. ParsonsNguyễn PhongNo ratings yet

- Michael J. ParsonsDocument1 pageMichael J. ParsonsNguyễn PhongNo ratings yet

- Between Your Entry and The Reversal's Extreme Price. Figure 3-1 Shows How Good of An Entry This Can BeDocument1 pageBetween Your Entry and The Reversal's Extreme Price. Figure 3-1 Shows How Good of An Entry This Can BeNguyễn PhongNo ratings yet

- An Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel LineDocument1 pageAn Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel LineNguyễn PhongNo ratings yet

- !" Lillt!: Michael J. ParsonsDocument1 page!" Lillt!: Michael J. ParsonsNguyễn PhongNo ratings yet

- Chapter Three: Kiss of The Channel LineDocument1 pageChapter Three: Kiss of The Channel LineNguyễn PhongNo ratings yet

- Michael 1. Parsons: Changing of The GuardDocument1 pageMichael 1. Parsons: Changing of The GuardNguyễn PhongNo ratings yet

- Michael 1. ParsonsDocument1 pageMichael 1. ParsonsNguyễn PhongNo ratings yet

- L. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsDocument1 pageL. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsNguyễn PhongNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- Afichael J ParsonsDocument1 pageAfichael J ParsonsNguyễn PhongNo ratings yet

- Trading False Breakouts: Michael 1. ParsonsDocument1 pageTrading False Breakouts: Michael 1. ParsonsNguyễn PhongNo ratings yet

- Channel Surfing: A Prior High Is Broken, But The Breakout Fails To HoldDocument1 pageChannel Surfing: A Prior High Is Broken, But The Breakout Fails To HoldNguyễn PhongNo ratings yet