Professional Documents

Culture Documents

An Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel Line

Uploaded by

Nguyễn PhongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel Line

Uploaded by

Nguyễn PhongCopyright:

Available Formats

Channel Surfing

as one, they make the whole stronger. In like manner, price will naturally

attempt to connect to itself in some form or fashion.

Entering as price draws near to a prior channel line is often an ideal

entry because the risk is small and the profit potential high. But this still

doesn't guarantee a profitable trade. Unfortunately, it is also not

uncommon for a market to excessively drift, paralleling a prior channel

line for quite some time before actually breaking in the direction of the

new trend. This is one of the quandaries of trading that despite breaking

a channel, price can still exceed a prior high or low and continue in its

prior trend's direction, resulting in a loss. Only after a new trend is

clearly established do you know for sure whether an entry was good or

bad. Obviously, you want to get in at the very best possible price, which

requires an early entry. But you also don't want to take a heavy loss or

do the opposite, get too nervous and jump out too soon, missing the

trade entirely. So how do you know when a drift is just a minor delay

in a new trend or a failed break that threatens a major loss?

While it is possible for a market to develop a double top or bottom or

even slightly exceed prior highs or lows and still reverse, the odds change

dramatically when it does. It is better to take a small loss than to risk a

large one. Once a market breaks a prior high or low, the move can be

extremely fast. The slippage can be very large if you hesitate too long.

is a sickening feeling to have the points rack up against you whi le

H

you desperately try to get out, but are unable to find someone to take the

other side of your trade. If there is no indication of a channel that will

provide support or resistance in close proximity of the previous high or

low, then the high or low has to act as your limit. Multiple attempts at

this level or actually exceeding it will require an immediate exit.

This possibility emphasizes that the best approach for a beginner is usually

to wait until the small channel is actually broken before entering. But

entering is often a matter of taking stabs at a market, getting out of the

ones that become questionable and sticking with the trades that show signs

of paying off. A prior channel line acts as an indicator of what will unfold.

Even at the expense of exceeding a prior high or low, this channel line will

normally be the limit of price's progression and once it is reached price

should show clear signs ofreversing direction. Ifprice reaches this point

and fails to reverse quickly, the trade's success quickly fades with it.

An important early warning that a reversal may fail can be seen in the price

action immediately fol lowing49the break of the prior channel line.

You might also like

- 7 Rejection Price PatternDocument7 pages7 Rejection Price PatternMuhammad Irwan Chong100% (1)

- 14 Lessons From A Millionaire TraderDocument200 pages14 Lessons From A Millionaire TraderMichel Duran100% (1)

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- Forex Range Trading with Price ActionFrom EverandForex Range Trading with Price ActionRating: 4.5 out of 5 stars4.5/5 (39)

- Pivot NotesDocument56 pagesPivot Notessuresh100% (4)

- 10 Price Action SecretsDocument6 pages10 Price Action SecretsElap Elap100% (2)

- Price Action Trading - 6 Things To Look For Before You Place A TradeDocument20 pagesPrice Action Trading - 6 Things To Look For Before You Place A TradeSalman Munir100% (9)

- Al Brooks - Trading Price Action Ranges-8Document2 pagesAl Brooks - Trading Price Action Ranges-8André Vitor Favaro Medes de OliveiraNo ratings yet

- Absorptioncourse Module3Document23 pagesAbsorptioncourse Module3Vishal Nikam100% (1)

- High Probability Swing Trading Strategies: Day Trading Strategies, #4From EverandHigh Probability Swing Trading Strategies: Day Trading Strategies, #4Rating: 4.5 out of 5 stars4.5/5 (4)

- VSA - Cheat SheetDocument18 pagesVSA - Cheat SheetAriel Devulsky90% (20)

- Trading-Rules PDFDocument14 pagesTrading-Rules PDFNDameanNo ratings yet

- Specials Use of Gaps On ChartsDocument2 pagesSpecials Use of Gaps On ChartsaddqdaddqdNo ratings yet

- Session1 PDFDocument104 pagesSession1 PDFpravin020282100% (1)

- 4 Steps To Making A Living Rading Forex by LUCIANO KELLY PDFDocument50 pages4 Steps To Making A Living Rading Forex by LUCIANO KELLY PDFOgechinwankwo100% (1)

- Pattern Cycles - Mastering Short-Term TradingDocument16 pagesPattern Cycles - Mastering Short-Term TradingAnton Downes100% (1)

- Reading Gaps in Charts PDFDocument11 pagesReading Gaps in Charts PDFkalelenikhlNo ratings yet

- Absorptioncourse Module5Document29 pagesAbsorptioncourse Module5H N100% (1)

- How To Day Trade With The 5 Simple GAP Trading Strategy PDFDocument14 pagesHow To Day Trade With The 5 Simple GAP Trading Strategy PDFShiju SeeNo ratings yet

- 12.finding Trades at Specific Areas Inside The TrendDocument11 pages12.finding Trades at Specific Areas Inside The Trendanalyst_anil140% (1)

- Catching The Pullback TradeDocument8 pagesCatching The Pullback Tradeanand_studyNo ratings yet

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformFrom EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformNo ratings yet

- Rectangle, Bearish and Triangle Chart PatternsDocument9 pagesRectangle, Bearish and Triangle Chart PatternsJustine Chinenyeze100% (1)

- Swing Trading - The Definitive Guide 1 PDFDocument21 pagesSwing Trading - The Definitive Guide 1 PDFEmiliano Morata Pilones50% (2)

- High Probability Trading StrategiesDocument3 pagesHigh Probability Trading Strategiesnfappa50% (2)

- Principles of Price BehaviorDocument4 pagesPrinciples of Price BehaviorDavid DharmawanNo ratings yet

- The Triple Tap Strategy GuideDocument11 pagesThe Triple Tap Strategy Guidebenjy woodNo ratings yet

- Gaps, Pro Versus NoviceDocument2 pagesGaps, Pro Versus Novicertkiyous2947No ratings yet

- Market Profile NotesDocument5 pagesMarket Profile Notesbinujames100% (1)

- The Laws of Charts and MenDocument49 pagesThe Laws of Charts and MenAlister Mackinnon100% (4)

- DAY TRADING Sand RDocument6 pagesDAY TRADING Sand RAnshuman Gupta100% (1)

- Forex Engulfing Trading Strategy: A Complete Forex Trading Strategy That Really Makes MoneyFrom EverandForex Engulfing Trading Strategy: A Complete Forex Trading Strategy That Really Makes MoneyRating: 4 out of 5 stars4/5 (13)

- Al Brooks - Trading Price Action Ranges-7Document2 pagesAl Brooks - Trading Price Action Ranges-7André Vitor Favaro Medes de Oliveira0% (2)

- Financial Analysis of EbayDocument27 pagesFinancial Analysis of EbaySullivan Military0% (2)

- 04 - Support & Resistance and Market StructureDocument8 pages04 - Support & Resistance and Market StructureRyme El OtmaniNo ratings yet

- Capturing Trend DaysDocument12 pagesCapturing Trend DaysBill Gaugler100% (1)

- 14 Strategies of A Millionaire TraderDocument200 pages14 Strategies of A Millionaire Traderpiyush_rathod_13100% (2)

- The Power of The Pull Back Forex Trading StrategyDocument17 pagesThe Power of The Pull Back Forex Trading StrategyMoha FxNo ratings yet

- High Probability TradesDocument5 pagesHigh Probability Tradesnettide100% (2)

- 05 - Market Structure - Trend, Range and VolatilityDocument9 pages05 - Market Structure - Trend, Range and VolatilityRamachandra Dhar100% (3)

- CMC Markets Singapore Long Tail StrategyDocument6 pagesCMC Markets Singapore Long Tail StrategyCMC_Markets_SingaporeNo ratings yet

- Fakeouts, Support and Resistance and Trend LinesDocument8 pagesFakeouts, Support and Resistance and Trend Linesamedkillpic100% (1)

- The Selling Climax Has A Widening Spread and Increasing Volume. If It Does Not HaveDocument5 pagesThe Selling Climax Has A Widening Spread and Increasing Volume. If It Does Not HaveUDAYAN SHAHNo ratings yet

- Regulations of Advertising in The UKDocument27 pagesRegulations of Advertising in The UKCallum FinnNo ratings yet

- Nial Fuller - Support & Resistance TradingDocument11 pagesNial Fuller - Support & Resistance TradingRameshKumarMurali100% (1)

- Applications - Gabriel Staicu - MICROECONOMICS PDFDocument127 pagesApplications - Gabriel Staicu - MICROECONOMICS PDFLuca CristinaNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- Enter at The Break of The Secondary Channel That Rebounds Toward The Previous Inside Channel Line, As Long As It Does Not Exceed The Prior High or LowDocument1 pageEnter at The Break of The Secondary Channel That Rebounds Toward The Previous Inside Channel Line, As Long As It Does Not Exceed The Prior High or LowNguyễn PhongNo ratings yet

- L. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsDocument1 pageL. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsNguyễn PhongNo ratings yet

- Inside Entry: The Rule For An Inside Entry Is As Fol LowsDocument1 pageInside Entry: The Rule For An Inside Entry Is As Fol LowsNguyễn PhongNo ratings yet

- Broadening Formations: A .The Orthodox Broadening TopDocument6 pagesBroadening Formations: A .The Orthodox Broadening TopKalfy WarspNo ratings yet

- Michael 1. ParsonsDocument1 pageMichael 1. ParsonsNguyễn PhongNo ratings yet

- Already Begun To Form in The Direction of Your Trade, Even If It Is Only Partially Formed, You Can Use This To Limit The RiskDocument1 pageAlready Begun To Form in The Direction of Your Trade, Even If It Is Only Partially Formed, You Can Use This To Limit The RiskNguyễn PhongNo ratings yet

- Michael 1. Parsons: Enter On TheDocument1 pageMichael 1. Parsons: Enter On TheNguyễn PhongNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- Chapter TWQ: Breaking WavesDocument1 pageChapter TWQ: Breaking WavesNguyễn PhongNo ratings yet

- Michael 1. Parsons: SP 500 E Mini 10 MinuteDocument1 pageMichael 1. Parsons: SP 500 E Mini 10 MinuteNguyễn PhongNo ratings yet

- Finding and Trading Rejection ZonesDocument3 pagesFinding and Trading Rejection ZonesalpepezNo ratings yet

- Trades About To Happen - David Weiss - Notes FromDocument3 pagesTrades About To Happen - David Weiss - Notes FromUma Maheshwaran100% (1)

- Michael 1. ParsonsDocument1 pageMichael 1. ParsonsNguyễn PhongNo ratings yet

- Selling Tail: Single Prints (Single Tpos) On The Top of A Profile A Gauge of Sellers' Reactions To ADocument2 pagesSelling Tail: Single Prints (Single Tpos) On The Top of A Profile A Gauge of Sellers' Reactions To Ajadie aliNo ratings yet

- HalfbackDocument3 pagesHalfbackjadie aliNo ratings yet

- Ell R F-M: Th. PortDocument1 pageEll R F-M: Th. PortNguyễn PhongNo ratings yet

- 036Document1 page036Nguyễn PhongNo ratings yet

- TH Pric of Stori: To ToDocument1 pageTH Pric of Stori: To ToNguyễn PhongNo ratings yet

- 061Document1 page061Nguyễn PhongNo ratings yet

- 062Document1 page062Nguyễn PhongNo ratings yet

- The Internally Motivated 'I'l'3der Part 1Document1 pageThe Internally Motivated 'I'l'3der Part 1Nguyễn PhongNo ratings yet

- Uh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipDocument1 pageUh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipNguyễn PhongNo ratings yet

- HT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Document1 pageHT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Nguyễn PhongNo ratings yet

- The Price of Holding On To: StoriesDocument1 pageThe Price of Holding On To: StoriesNguyễn PhongNo ratings yet

- ""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Document1 page""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Nguyễn PhongNo ratings yet

- Mirl'OI', Mirl'or: If I""k This / While ManagpmentDocument1 pageMirl'OI', Mirl'or: If I""k This / While ManagpmentNguyễn PhongNo ratings yet

- About The Authol': Tarycr E, Wic/Ij"!1Document1 pageAbout The Authol': Tarycr E, Wic/Ij"!1Nguyễn PhongNo ratings yet

- Some Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirDocument1 pageSome Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirNguyễn PhongNo ratings yet

- Jlhi (: Ill) LJDocument1 pageJlhi (: Ill) LJNguyễn PhongNo ratings yet

- Foreword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Document1 pageForeword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Nguyễn PhongNo ratings yet

- Pauses Can Provide You With Advance Knowledge Regarding PossibleDocument1 pagePauses Can Provide You With Advance Knowledge Regarding PossibleNguyễn PhongNo ratings yet

- Are Rna,': - E I D Nki Dru Li - LL R I - . orDocument1 pageAre Rna,': - E I D Nki Dru Li - LL R I - . orNguyễn PhongNo ratings yet

- When The Trend Continues After Pausing: Michael 1. ParsonsDocument1 pageWhen The Trend Continues After Pausing: Michael 1. ParsonsNguyễn PhongNo ratings yet

- Michael J. ParsonsDocument1 pageMichael J. ParsonsNguyễn PhongNo ratings yet

- Between Your Entry and The Reversal's Extreme Price. Figure 3-1 Shows How Good of An Entry This Can BeDocument1 pageBetween Your Entry and The Reversal's Extreme Price. Figure 3-1 Shows How Good of An Entry This Can BeNguyễn PhongNo ratings yet

- !" Lillt!: Michael J. ParsonsDocument1 page!" Lillt!: Michael J. ParsonsNguyễn PhongNo ratings yet

- Afichael J ParsonsDocument1 pageAfichael J ParsonsNguyễn PhongNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- Chapter Three: Kiss of The Channel LineDocument1 pageChapter Three: Kiss of The Channel LineNguyễn PhongNo ratings yet

- Michael 1. Parsons: Changing of The GuardDocument1 pageMichael 1. Parsons: Changing of The GuardNguyễn PhongNo ratings yet

- Michael 1. ParsonsDocument1 pageMichael 1. ParsonsNguyễn PhongNo ratings yet

- Channel Surfing: A Prior High Is Broken, But The Breakout Fails To HoldDocument1 pageChannel Surfing: A Prior High Is Broken, But The Breakout Fails To HoldNguyễn PhongNo ratings yet

- Channel SurfingDocument1 pageChannel SurfingNguyễn PhongNo ratings yet

- Trading False Breakouts: Michael 1. ParsonsDocument1 pageTrading False Breakouts: Michael 1. ParsonsNguyễn PhongNo ratings yet

- Final Britania Marie BiscuitDocument7 pagesFinal Britania Marie Biscuitrabi_kungleNo ratings yet

- S4 (01) Basic Concepts.Document7 pagesS4 (01) Basic Concepts.Cheuk Wai LauNo ratings yet

- Walmart Ret LatestDocument16 pagesWalmart Ret LatestHitaishi Gupta VaidNo ratings yet

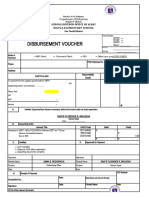

- Disbursement Voucher: Department of EducationDocument15 pagesDisbursement Voucher: Department of EducationMargel Airon TheoNo ratings yet

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument13 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNo ratings yet

- Cost I Final ExtDocument6 pagesCost I Final ExtGetu WeyessaNo ratings yet

- Financial Management June 2011 Exam Paper ICAEWDocument6 pagesFinancial Management June 2011 Exam Paper ICAEWMuhammad Ziaul HaqueNo ratings yet

- LaxmiDocument11 pagesLaxmikattyperrysherryNo ratings yet

- QUIZ1Document4 pagesQUIZ1alellieNo ratings yet

- Kentucky Bannister Trufanov Aff Kentucky Round2Document67 pagesKentucky Bannister Trufanov Aff Kentucky Round2aesopwNo ratings yet

- GEAS1Document46 pagesGEAS1Jonabelle Mendoza100% (1)

- Strength WeaknessDocument11 pagesStrength WeaknessshekycooolNo ratings yet

- Indah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014Document3 pagesIndah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014btishidbNo ratings yet

- Segmentation, Targeting, and PositioningDocument50 pagesSegmentation, Targeting, and PositioningPrathibani PoornikaNo ratings yet

- Microeconomics Assignment 8Document17 pagesMicroeconomics Assignment 8abreaNo ratings yet

- Ratios TaskDocument3 pagesRatios Taskiceman2167No ratings yet

- L2D 008097-Urban Sprawl, Lan Values and The Density of DevelopmentDocument12 pagesL2D 008097-Urban Sprawl, Lan Values and The Density of DevelopmentGustika Farheni WulanasriNo ratings yet

- MITI - National E-Commerce Strategic Roadmap OverviewDocument26 pagesMITI - National E-Commerce Strategic Roadmap Overviewலிவண்யா பிரியா மணிமாறன்100% (2)

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument2 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnKumar SonalNo ratings yet

- HSEB SyllabusDocument5 pagesHSEB Syllabusanon_5216366No ratings yet

- Final Exam ECON 262 FALL 2020-21Document5 pagesFinal Exam ECON 262 FALL 2020-21Syed Irtiza HussainNo ratings yet

- 7.6 Mateo Vs LaguaDocument20 pages7.6 Mateo Vs LaguaEvan NervezaNo ratings yet

- Date: 28/05/2021 Current Price: 101,000 VND The Highest: 103,000 VND The Shortest: 100,800 VND Transaction Volume: 8,505,700Document6 pagesDate: 28/05/2021 Current Price: 101,000 VND The Highest: 103,000 VND The Shortest: 100,800 VND Transaction Volume: 8,505,700Vi TrươngNo ratings yet

- Chapter 7 - Teacher's Manual - Ifa Part 1aDocument7 pagesChapter 7 - Teacher's Manual - Ifa Part 1aCharmae Agan CaroroNo ratings yet

- 7 - Starbuck's Transfer Pricing PDFDocument5 pages7 - Starbuck's Transfer Pricing PDFIan TehNo ratings yet

- Namma Kalvi 11th Economics Study Material em 216598Document44 pagesNamma Kalvi 11th Economics Study Material em 216598durairaju2403No ratings yet