Professional Documents

Culture Documents

Michael 1. Parsons

Michael 1. Parsons

Uploaded by

Nguyễn PhongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Michael 1. Parsons

Michael 1. Parsons

Uploaded by

Nguyễn PhongCopyright:

Available Formats

Michael 1.

Parsons

which direction the market is leaning toward before the move jumps into

high gear. Without some sort of early entry method you can easily find

that the profit opportunity is all over before you even have a chance to

enter.

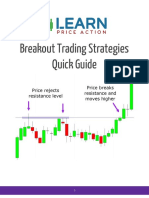

The way around this is through a few modified rules for Channel

Surfing that focuses on specific situations related to breakouts. A

breakout entry is designed to take advantage of a modified channel

signal. It takes a little more effort to construct, but is much easier and

effective to enter when the situation calls for it.

Breakout entries are not a new concept. In fact, many trading systems are

totally depended upon them. The theory is that once you exceed a certain

level then the market should continue in the direction of the break for

some time, allowing a person to make a profit. This method has proven

itself many times over. fol lows a very simple and basic law of physics;

It

once an object is set in motion it will continue in motion. Only in this case

we are talking about price.

To be a true breakout entry price has to breakout ofsomething. It isn't

enough to have prices rising or dropping in the normal course of a trend,

but rather price had in a sense run into a brick wall and then had to

develop enough force to break through. If something has enough force to

break through a brick wall it isn't li kely to be stopped anytime soon. So

the obvious first step to finding a breakout trade is to find the proverbial

brick wall.

Of course, there are no literal brick walls in the market, but support

and resistance levels behave similarly. Support and resistance levels are

simply price levels that the market reached but couldn't exceed. In

essence, they are horizontal fences that price is li kely to bounce off of

because it did so in the past. Find a place where price set a new high or

low and then fell away from it and you have one of these fences. The

more times that price bounces off support or resistance, the more solid

that support or resistance is. It's as if each bounce is another brick that

is added to the wall. So ideally you want to look for levels that price had

bounced off of several times in the past, because once price does break

through and holds it should continue for some while.

Trading range breakouts

An ideal example of this would be a trading range. A trading range locks

price within a high and low boundary. Sometimes they can run for

32

You might also like

- A Primer of Theosophy A Very Condensed Outline (1909)Document138 pagesA Primer of Theosophy A Very Condensed Outline (1909)Joma SipeNo ratings yet

- Trade Breakouts For Bigger Profit PotentialDocument7 pagesTrade Breakouts For Bigger Profit PotentialLoose100% (1)

- (SUNY Series in Transpersonal and Humanistic Psychology) Bricklin, Jonathan_ James, William - The Illusion of Will, Self, and Time_ William James's Reluctant Guide to Enlightenment-State University of.pdfDocument404 pages(SUNY Series in Transpersonal and Humanistic Psychology) Bricklin, Jonathan_ James, William - The Illusion of Will, Self, and Time_ William James's Reluctant Guide to Enlightenment-State University of.pdfBrian S. Danzyger100% (2)

- Simple Wedge FX Trading For ProfitsDocument12 pagesSimple Wedge FX Trading For Profitsanand_studyNo ratings yet

- Trade BreakoutsDocument7 pagesTrade Breakoutspetefader100% (1)

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideKiran KrishnaNo ratings yet

- Part 1 - Finding Important Price LevelsDocument7 pagesPart 1 - Finding Important Price LevelsMohanNo ratings yet

- The Awareness Principle 2nd Ed PDFDocument271 pagesThe Awareness Principle 2nd Ed PDFsushaantb400100% (1)

- 20 BreakoutDocument8 pages20 Breakoutalromani100% (2)

- 10 Price Action SecretsDocument6 pages10 Price Action SecretsElap Elap100% (2)

- Improve Your Market TimingDocument26 pagesImprove Your Market TimingAnonymous rOv67R100% (1)

- Getting An Edge Chris Capre 2 ND SkiesDocument5 pagesGetting An Edge Chris Capre 2 ND SkiesZakariya ThoubaNo ratings yet

- The Trading Triangle - AddendumDocument11 pagesThe Trading Triangle - AddendumoriolabranderoNo ratings yet

- The Strategy That Works - Caviru SDDocument13 pagesThe Strategy That Works - Caviru SDcaviru100% (3)

- Breakout Trading Strategies PDFDocument23 pagesBreakout Trading Strategies PDFJean Claude David100% (2)

- Trend LineDocument7 pagesTrend Lineranjeeiit1982100% (1)

- Pinbar StrategyDocument7 pagesPinbar Strategycryslaw100% (1)

- MTFX Nas100Document30 pagesMTFX Nas100aa mnjk100% (1)

- FXGOAT NAS100 Strategy PDFDocument29 pagesFXGOAT NAS100 Strategy PDFHaslucky Tinashe Makuwaza93% (526)

- Swing Failure PatternDocument10 pagesSwing Failure PatternsolomoneditasNo ratings yet

- Breakout Trading Pt1Document4 pagesBreakout Trading Pt1Surya NayakNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideAdam ChoNo ratings yet

- 05 - Market Structure - Trend, Range and VolatilityDocument9 pages05 - Market Structure - Trend, Range and VolatilityRamachandra Dhar100% (3)

- CryptoDocument57 pagesCryptoafs100% (1)

- Markt Profile GlossaryDocument7 pagesMarkt Profile GlossaryMadhu Reddy0% (1)

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformFrom EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideSMadhusuthanaPerumal100% (1)

- Market Structure and TrendDocument10 pagesMarket Structure and TrendbillNo ratings yet

- Supply and Demand - Inside The BreakoutDocument5 pagesSupply and Demand - Inside The BreakoutMichael Mario100% (3)

- Some Resources About Breakout Trading Strategies PDFDocument23 pagesSome Resources About Breakout Trading Strategies PDFKewal PatelNo ratings yet

- STF Pa Pin BarDocument7 pagesSTF Pa Pin BarCandra Yuda100% (2)

- CMC Markets Singapore Long Tail StrategyDocument6 pagesCMC Markets Singapore Long Tail StrategyCMC_Markets_SingaporeNo ratings yet

- Miller Analogies Practice Test Results 01Document1 pageMiller Analogies Practice Test Results 01Ferrer BenedickNo ratings yet

- The Trend Continuation Entry Strategy - The Crypto University - 1625053710893Document15 pagesThe Trend Continuation Entry Strategy - The Crypto University - 1625053710893SamsonNo ratings yet

- Supportand Resistance Trading StrategyDocument10 pagesSupportand Resistance Trading StrategyEng Abdikariim AbdillahiNo ratings yet

- Rules of Play Game Design Fundamentals PDFDocument3 pagesRules of Play Game Design Fundamentals PDFGrudobranNo ratings yet

- 04 Ethics in International BusinessDocument25 pages04 Ethics in International BusinessEarl Louie MasacayanNo ratings yet

- MahadFX Course 5Document11 pagesMahadFX Course 5Tuong Nguyen100% (1)

- Market Makers Method Order Blocks Englishpdf 3 PDF Free 77 165Document89 pagesMarket Makers Method Order Blocks Englishpdf 3 PDF Free 77 165Tùng Nguyễn100% (1)

- Paradigms by Joel Barker, Summaries of His Main IdeasDocument2 pagesParadigms by Joel Barker, Summaries of His Main IdeasKrajagopalNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideKiran KrishnaNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideYudha BimaNo ratings yet

- 9 Smart Money Concepts That Every Trader Must KnowDocument19 pages9 Smart Money Concepts That Every Trader Must Knowclrgwa100% (4)

- Price - Action DBPhoenix ContentDocument9 pagesPrice - Action DBPhoenix ContentnepretipNo ratings yet

- Support and Resisatnce Masterclass by @EmperorBTCDocument19 pagesSupport and Resisatnce Masterclass by @EmperorBTCManava SwiftNo ratings yet

- 14 Strategies of A Millionaire TraderDocument200 pages14 Strategies of A Millionaire Traderpiyush_rathod_13100% (2)

- Smart Money Concept Cryptocurrency Day Trading For A LivingDocument27 pagesSmart Money Concept Cryptocurrency Day Trading For A LivingZack Ming67% (3)

- Range Breakouts and Trading TacticsDocument12 pagesRange Breakouts and Trading TacticsNibbleTraderNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideRadical NtukNo ratings yet

- An Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel LineDocument1 pageAn Important Early Warning That A Reversal May Fail Can Be Seen in The Price Action Immediately Fol Lowing The Break of The Prior Channel LineNguyễn PhongNo ratings yet

- Michael 1. ParsonsDocument1 pageMichael 1. ParsonsNguyễn PhongNo ratings yet

- The Block Order Probability Is High That 61Document2 pagesThe Block Order Probability Is High That 61Kinglion Mabati DodomaNo ratings yet

- Michael 1. Parsons: SP 500 E Mini 10 MinuteDocument1 pageMichael 1. Parsons: SP 500 E Mini 10 MinuteNguyễn PhongNo ratings yet

- L. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsDocument1 pageL. When A Trend Reverses Direction 2. When The Trend Continues After Pausing 3. Changes in Momentum and Trend ShiftsNguyễn PhongNo ratings yet

- Options TrainingDocument39 pagesOptions TrainingSome OneNo ratings yet

- ICT Mentorship 2022 Ep 3 NotesDocument26 pagesICT Mentorship 2022 Ep 3 Notesymnk6v2zx2No ratings yet

- Bases Wyckoff BPGDocument11 pagesBases Wyckoff BPGRodrigo OcampoNo ratings yet

- A Complete Guide To Volume Price Analysis Read The Book Then Read The Market by Anna Coulling (Z-Lib - Org) (181-240)Document60 pagesA Complete Guide To Volume Price Analysis Read The Book Then Read The Market by Anna Coulling (Z-Lib - Org) (181-240)Getulio José Mattos Do Amaral FilhoNo ratings yet

- Failure Confirmation IntroductionDocument15 pagesFailure Confirmation IntroductionamanryzeNo ratings yet

- #3 - Ict PD ArraysDocument12 pages#3 - Ict PD ArraysbacreatheNo ratings yet

- 3 Top Price Action SignalsDocument12 pages3 Top Price Action Signalsluiska2008No ratings yet

- Investment Educators: Free Charting LessonDocument2 pagesInvestment Educators: Free Charting Lessonpderby1No ratings yet

- Tecniques For TradingDocument8 pagesTecniques For TradingDiego HerránNo ratings yet

- Stoic TradingDocument21 pagesStoic Tradingbruno.m.spyraNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideAdam ChoNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideTim KanikaNo ratings yet

- The Intemall Motivated Trader Part 2: T V T T Y M N R I U B " Ti B W Re T UDocument1 pageThe Intemall Motivated Trader Part 2: T V T T Y M N R I U B " Ti B W Re T UNguyễn PhongNo ratings yet

- 062Document1 page062Nguyễn PhongNo ratings yet

- ""Dping L'"Wcrlessn ) ('Ssimism. and Passh'Ly Thre ' Of: Attimd"" "Ss. AllDocument1 page""Dping L'"Wcrlessn ) ('Ssimism. and Passh'Ly Thre ' Of: Attimd"" "Ss. AllNguyễn PhongNo ratings yet

- Who Who in They ",arke (.S Inc"m What O"ef, ,, To Name:, e I InvuDocument1 pageWho Who in They ",arke (.S Inc"m What O"ef, ,, To Name:, e I InvuNguyễn PhongNo ratings yet

- Ell R F-M: Th. PortDocument1 pageEll R F-M: Th. PortNguyễn PhongNo ratings yet

- 061Document1 page061Nguyễn PhongNo ratings yet

- Ihe Ih Their: " Iilitl Thmu HDocument1 pageIhe Ih Their: " Iilitl Thmu HNguyễn PhongNo ratings yet

- The Internally Motivated 'I'l'3der Part 1Document1 pageThe Internally Motivated 'I'l'3der Part 1Nguyễn PhongNo ratings yet

- Yullr: /vital Irying "!ortlw Ur Write ForDocument1 pageYullr: /vital Irying "!ortlw Ur Write ForNguyễn PhongNo ratings yet

- 036Document1 page036Nguyễn PhongNo ratings yet

- TH Pric of Stori: To ToDocument1 pageTH Pric of Stori: To ToNguyễn PhongNo ratings yet

- The Price of Holding On To: StoriesDocument1 pageThe Price of Holding On To: StoriesNguyễn PhongNo ratings yet

- Freeze: (II, PRLLLLDocument1 pageFreeze: (II, PRLLLLNguyễn PhongNo ratings yet

- ""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Document1 page""'1Nm'Wm,: " NI OR L (.//' (" //, II-1"Nguyễn PhongNo ratings yet

- E ClaiDocument1 pageE ClaiNguyễn PhongNo ratings yet

- Some Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirDocument1 pageSome Lrarle ... Arrive at The Poil/!. Rlemanding Perf Etion in IheirNguyễn PhongNo ratings yet

- L'I Hi ..: L Iu,/:: Ba "Limi'S ) Tin His Whal WD!Document1 pageL'I Hi ..: L Iu,/:: Ba "Limi'S ) Tin His Whal WD!Nguyễn PhongNo ratings yet

- Uh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipDocument1 pageUh Yllu .-LL ND Tlwu Ih' LFH Oulln Oilll'R: Olulion 1 L I LL) /I LNP ' Gli DLLL'L Linn HipNguyễn PhongNo ratings yet

- Michael J. ParsonsDocument1 pageMichael J. ParsonsNguyễn PhongNo ratings yet

- HT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Document1 pageHT I1t'1"l //DL Li T T-Ti Hnilg: - LL - R - SS L'Nguyễn PhongNo ratings yet

- Mirl'OI', Mirl'or: If I""k This / While ManagpmentDocument1 pageMirl'OI', Mirl'or: If I""k This / While ManagpmentNguyễn PhongNo ratings yet

- Foreword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Document1 pageForeword: She Presen!s A Down H .. Ear/!" Easy Lv-Read Co",,,,,,n Sen""Nguyễn PhongNo ratings yet

- About The Authol': Tarycr E, Wic/Ij"!1Document1 pageAbout The Authol': Tarycr E, Wic/Ij"!1Nguyễn PhongNo ratings yet

- Motivators For: Down DayDocument1 pageMotivators For: Down DayNguyễn PhongNo ratings yet

- Are Rna,': - E I D Nki Dru Li - LL R I - . orDocument1 pageAre Rna,': - E I D Nki Dru Li - LL R I - . orNguyễn PhongNo ratings yet

- !" Lillt!: Michael J. ParsonsDocument1 page!" Lillt!: Michael J. ParsonsNguyễn PhongNo ratings yet

- 004Document1 page004Nguyễn PhongNo ratings yet

- Pauses Can Provide You With Advance Knowledge Regarding PossibleDocument1 pagePauses Can Provide You With Advance Knowledge Regarding PossibleNguyễn PhongNo ratings yet

- When The Trend Continues After Pausing: Michael 1. ParsonsDocument1 pageWhen The Trend Continues After Pausing: Michael 1. ParsonsNguyễn PhongNo ratings yet

- Jlhi (: Ill) LJDocument1 pageJlhi (: Ill) LJNguyễn PhongNo ratings yet

- What Is The Good Life ArticleDocument2 pagesWhat Is The Good Life ArticleEchuserang Froglet0% (1)

- Qualities of A Zambian CitizenDocument2 pagesQualities of A Zambian CitizenLevison NkhomaNo ratings yet

- Indian Traditional Knowledge Work BookDocument30 pagesIndian Traditional Knowledge Work BookTANISHA KAPOOR (RA2011027010056)No ratings yet

- Vandalizing The Subject. Carrière, Ulysse. Ill Will Editions, 2022Document20 pagesVandalizing The Subject. Carrière, Ulysse. Ill Will Editions, 2022GUADALUPE JIMENEZ SOTONo ratings yet

- Historical Criticism - 0Document10 pagesHistorical Criticism - 0Miraflor V. Macion0% (1)

- 5 Year Integrated BA LLB H 1Document194 pages5 Year Integrated BA LLB H 1Bhitalee PhukonNo ratings yet

- Lesson Plan in Arts First GradingDocument12 pagesLesson Plan in Arts First GradingMAY GALEDONo ratings yet

- Chapter 10: Become A Competent Speaker: Overcome The FearDocument2 pagesChapter 10: Become A Competent Speaker: Overcome The FearBETYNo ratings yet

- "The Tell-Tale Heart": Edgar Allan PoeDocument7 pages"The Tell-Tale Heart": Edgar Allan PoeJack MessarosNo ratings yet

- ARISTOTLEDocument4 pagesARISTOTLEWiljan Jay AbellonNo ratings yet

- Inferences - Lesson (Article) - Inferences - Khan AcademyDocument8 pagesInferences - Lesson (Article) - Inferences - Khan Academyisaacazad0033No ratings yet

- -Document1 page-Сашка ГагароваNo ratings yet

- 'S Journal: Daily - KaggaDocument29 pages'S Journal: Daily - Kaggagururaja28No ratings yet

- University Syllsbus - Universal Human Value and Professional EthicsDocument2 pagesUniversity Syllsbus - Universal Human Value and Professional EthicsSurbhi SharmaNo ratings yet

- Chapter 8 Presuppositions ImplicaturesDocument71 pagesChapter 8 Presuppositions ImplicaturesThu ThanhNo ratings yet

- Traduire Le Non-Sens Dans Le Théâtre IonescienDocument12 pagesTraduire Le Non-Sens Dans Le Théâtre IonescienOnur ÖzcanNo ratings yet

- Mass Dreams2Document385 pagesMass Dreams2Ricardo OliveiraNo ratings yet

- You Are Awesome Pasricha en 37841Document7 pagesYou Are Awesome Pasricha en 37841PopaMariaSofiaNo ratings yet

- Chapter 9 Memory Pt. 2Document61 pagesChapter 9 Memory Pt. 2Maricris GatdulaNo ratings yet

- Interpreting God and The Postmodern Self - On Meaning ManipulatioDocument4 pagesInterpreting God and The Postmodern Self - On Meaning ManipulatioCher DNo ratings yet

- Understanding The Self Module 2 Lesson 2Document4 pagesUnderstanding The Self Module 2 Lesson 2Marites MancerasNo ratings yet

- Philippine Normal University: The National Center of Teacher EducationDocument6 pagesPhilippine Normal University: The National Center of Teacher Educationnekiryn0% (1)

- Logic and FormalityDocument28 pagesLogic and FormalityVenus Abigail Gutierrez50% (2)