Professional Documents

Culture Documents

Updates in Financial Reporting Standards: Northeastern College

Uploaded by

Jobelle Grace Soriano0 ratings0% found this document useful (0 votes)

18 views3 pagesModule

Original Title

a_Cash

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentModule

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views3 pagesUpdates in Financial Reporting Standards: Northeastern College

Uploaded by

Jobelle Grace SorianoModule

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

NORTHEASTERN COLLEGE

Santiago City, Philippines

UPDATES IN FINANCIAL REPORTING STANDARDS

Jimmy I. Peru, JD,MBM,MICB,CPA

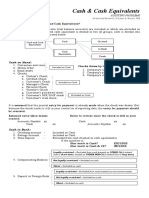

CASH AND CASH EQUIVALENTS

A. Cash. 7. Undelivered checks at the end of the reporting period

1. Cash is the standard medium of exchange in business should be included in cash.

transactions.

2. To include as cash, it must be unrestricted in use. 8. Information about compensating balance should be

included in the financial statement notes. (see section F)

3. Composition of cash

a. Coins – 10, 5, .25, .10, .05, .01 9. Foreign currency

b. Currency – 1000, 500, 200, 100, 50, 20 a. Cash in foreign currency should be translated to

c. Available funds on deposit at the bank Philippine Pesos using the current exchange rate.

(1) checking accounts b. Deposits in foreign currencies which are not subject

(2) savings accounts to any foreign exchange restriction are in included in

d. Negotiable instruments cash.

(1) bank drafts c. Deposits in foreign currencies which are subject to

(2) money orders foreign exchange restriction, if material should be

(3) checks classified separately among noncurrent assets and the

i. certified check restriction is clearly disclosed.

ii. cashier’s check

iii. manager’s check B. Financial statement presentation.

iv. traveler’s check a. A single “cash and cash equivalents” balance is

e. Cash Equivalents – (PAS 7) are short term and highly usually reported.

liquid investments that are readily convertible into b. Cash is reported at its face value.

cash and so near their maturity that they represent c. Cash is usually listed first in the current asset section.

insignificant risk of changes in value because of d. Restricted cash should be reported in the investments

changes in interest rates. section. (see section F)

i. Three-month BSP treasury bill

ii. Three-year BSP treasury bill purchased three C. Management of cash.

months before date of maturity 1. Effective cash management involves a balance between

iii. Three-month time deposit risk and profitability.

iv. Three-month market instrument or a. Too little cash on hand runs the risk of not meeting of

commercial paper obligations.

b. Too much cash on hand leads to missed earnings.

4. Money Market Instruments 2. Effective cash management requires careful planning and

a. Treasury bills (issued by the government) control.

b. Treasury bonds (issued by the government) a. The major tool of cash planning is the cash budget, an

c. Treasury notes (issued by the government) internal statement of projected cash flows.

d. Commercial paper (issued by corporation of good credit

rating) D. Petty Cash.

e. Time deposit (issued by a bank or cooperative) 1. As a general rule, all business payments should be

made by check, but this is impractical for some small

5. Presentation of Money Market Instruments payments.

a. Cash Equivalents – investments with original

maturities of 3 months or less. 2. Some small payments may be handled through a petty

b. Temporary Investments – investments with maturity cash fund.

of more than 3 months to 12 months a. Imprest fund-- A fund that is established for a

c. Long-term Investments – investments with maturity fixed amount.

of more than 12 months (1) A petty cashier is appointed.

(2) The fund is established by a debit to Petty Cash

6. Items which are NOT cash. Fund and a credit to Cash in Bank.

a. Postdated checks, NSF checks and IOUs should be (3) Money is disbursed from the fund in exchange

listed as receivables. for a receipt. No entry is made.

b. Travel advances and postage stamps should be (4) When the cash is low, the fund is replenished.

reported as prepaid expenses. The receipts are removed and cash is added to

c. A bank overdraft should be reported as a current achieved the total fund amount. An entry is made

liability, unless there are sufficient funds in another to record the expenses (debit) represented by the

account with the same bank to cover the overdraft,. If receipts and to credit Cash.

there are, overdraft maybe offset against cash. (5) The Cash Short and Over account is used when

d. Equity securities cannot qualify as cash equivalents the amount of the receipts do not match the

because shares do not have a maturity date. amount of cash disbursed from the fund.

(1) Preference shares with specified redemption date (a) Any difference usually results from errors in

and acquired 3 months before redemption date making change or failing to get a receipt for

can qualify as cash equivalent. very small amounts.

(b) At the end of the period, a small debit

balance in Cash Short and Over is classified

Jimmy I. Peru, Juris Doctor,MBM,MICB,CPA CASH AND CASH EQUIVALENTS page 1

as Miscellaneous Expense on the financial

statements. A credit balance is 2. Other types of Restrictions

Miscellaneous Revenue. A material a. Cash set aside for a particular purpose. These

shortage is classified as a receivable if fund balances are not material and therefore, are

recovery is expected and as a loss if no not segregated from cash when reported in the

recovery is expected. financial statement.

(6) If the fund is not replenished at the end of the (1) Petty Cash Fund

period, the receipts should be still be removed (2) Payroll Fund

and recorded as expenses, but the credit is to (3) Tax Fund

Petty Cash. (4) Dividend Fund

(7) A change in the basic petty cash amount should b. Cash classified as noncurrent asset:

be made if it runs out early or lasts too long. (1) plant expansion fund

(2) long-term debt retirement fund

E. Cash in Bank. (3) insurance fund

1. A business should keep most of its cash in the bank. (4) contingent fund

Cash on hand normally includes only petty cash, (5) sinking fund.

change funds and undeposited receipts.

2. Keeping the cash in the bank provides a double G. Malpractices related to handling of cash

record of cash transactions. 1. Window-dressing. It is the showing of a better picture

3. A bank reconciliation should be prepared each time a of the financial highlights and profit activities of the

bank statement is received, to verify the cash in the company through deliberate misstatement of the

bank and to determine any necessary journal entries. assets, liabilities, capital, income and expenses. It is

4. A bank reconciliation is a schedule that explains any usually accomplished as follows:

differences between the bank’s record of the cash in a. By recording as of the last day of the accounting

the account and the company’s record of the cash in period collections made subsequent to the close

the account. of the period.

a. Undeposited collections. b. By recording as of the last day of the accounting

b. Bank collections for the company. period payments of accounts made subsequent to

c. Bank charges, such as service charges. the close of the period.

d. Errors by the bank or the company.

5. The preferred format is to reconcile both the bank’s 2. Lapping

balance and the company’s balance to the corrected a. This is a practice used for concealing a cash

balance. shortage. It consists of misappropriating a

6. Journal entries will generally be necessary once the collection from one customer and concealing this

bank reconciliation is complete in order to update the defalcation by applying a subsequent collection

company’s records. These entries are based on the made from another customer.

information in the “balance per books” section.

7. A bank reconciliation should be prepared for each b. Lapping involves a series of postponements of

checking account. the entries for the collection of receivables. This

8. The amount listed as cash at the end of the reporting is possible when a company has poor internal

period will be the sum of all checking account control and especially when the bookkeeper and

balances plus any cash on hand. cashier are one and the same person.

9. Proof of cash. An expanded reconciliation in that it

includes proof of receipts and disbursements. 3. Kiting

a. Four-column bank reconciliation: a. It is another device used to conceal a cash

(1) Reconciliation of beginning balances. shortage. This practice is possible when a

(2) Reconciliation of checks for the current company maintains current accounts in different

month. banks. Kiting is usually employed at the end

(3) Reconciliation of receipts for the current of the month. It occurs when a check is drawn

month. against a first bank and depositing the same

(4) Reconciliation of ending balances. check in a second bank to cover the shortage in

b. The proof of cash is a stronger control because it the latter bank. No entry is made for both the

provides a reconciliation of transactions as well drawing and deposit of the check.

as cash balances. b. This fraudulent device is made possible because

c. This approach is particularly useful when there when the check is drawn against the first bank at

have been cash transferred between accounts. the end of the month, the bank statement for such

month does not yet show the check drawn

F. Restricted Cash because the said check is yet to be cleared or

1. Compensating Balances- a portion of any demand presented for payment to the first bank. As such,

deposit maintained by a corporation which constitutes the cash balance in the first bank at the end of the

support for existing borrowing arrangements of the month is not affected.

corporation with a lending institution. c. On the other hand, when the check is deposited

a. legally restricted deposits held as compensating in the second bank at the end of the month, the

balances against short term borrowing bank statement for such month will already show

arrangements be stated separately among the the deposit thereby increasing the cash in said

“cash and cash equivalent items” in Current bank and covering the cash shortage therein.

Assets as “cash held as compensating balance” d. This practice is uncovered by simultaneous

b. legally restricted deposits held as compensating preparation of bank reconciliation statements.

balances against long-term borrowing

arrangements be stated separately as noncurrent APPENDIX

investment.

c. Arrangement without legal restriction should be A certified check is a form of check for which the bank

classified as cash with disclosure. verifies that sufficient funds exist in the account to cover the

Jimmy I. Peru, Juris Doctor,MBM,MICB,CPA CASH AND CASH EQUIVALENTS page 2

check, and so certifies, at the time the check is written. Those

funds are then set aside in the bank's internal account until the A check sold by a post office for payment by a third party for a

check is cashed or returned by the payee. customer is referred to as a money order or postal order.

These are paid for in advance when the order is drawn and are

A cashier's check (managers check, bank draft, treasurer's guaranteed by the institution that issues them and can only be

check) is a check guaranteed by a bank, drawn on the bank's paid to the named third party. This was a common way to send

own funds and signed by a cashier. Cashier's checks are treated low value payments to third parties, avoiding the risks

as guaranteed funds because the bank, rather than the associated with sending cash via the mail, prior to the advent

purchaser, is responsible for paying the amount. They are of electronic payment methods.

commonly required for real estate and brokerage transactions.

Oversized checks are often used in public events such as

A traveler's check is a preprinted, fixed-amount check donating money to charity or giving out prizes. The checks are

designed to allow the person signing it to make an commonly 18 by 36 inches (46 cm × 91 cm) in

unconditional payment to someone else as a result of having size. Regardless of the size, such checks can still be redeemed

paid the issuer for that privilege. They were generally used by for their cash value as long as they have the same parts as a

people on vacation instead of cash as many businesses used to normal check, although usually the oversized check is kept as

accept traveler's check as currency. If a traveler's check were a souvenir and a normal check is provided. A bank may levy

lost or stolen, they could be replaced by the issuing financial additional charges for clearing an oversized check.

institution. Alternatives, such as credit cards, debit

cards and automated teller machines became more widely

available and were easier and more convenient for travelers.

Jimmy I. Peru, Juris Doctor,MBM,MICB,CPA CASH AND CASH EQUIVALENTS page 3

You might also like

- Conceptual Framework & Accounting Standards: Northeastern CollegeDocument5 pagesConceptual Framework & Accounting Standards: Northeastern CollegeMikaella SaduralNo ratings yet

- 1 CashDocument6 pages1 CashMikaella SaduralNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsRommel Cabel CapalaranNo ratings yet

- 2021 Chapter 3 Audit of Cash Student GuideDocument29 pages2021 Chapter 3 Audit of Cash Student GuideJan Luis RamiroNo ratings yet

- Pre2 Notesl Leo CcbrpocDocument15 pagesPre2 Notesl Leo CcbrpocCarla Jane Mirasol ApolinarioNo ratings yet

- 2020 Chapter 3 Audit of Cash Student GuideDocument29 pages2020 Chapter 3 Audit of Cash Student GuideBeert De la CruzNo ratings yet

- Cash and Cash Equivalent TheoryDocument1 pageCash and Cash Equivalent TheoryExcelsia Grace A. ParreñoNo ratings yet

- Cash and Cash Equivalents GuideDocument10 pagesCash and Cash Equivalents GuideMs VampireNo ratings yet

- Theory of Accounts Cash and Cash EquivalentsDocument15 pagesTheory of Accounts Cash and Cash EquivalentsAuroraNo ratings yet

- CCE BankRecon POCDocument3 pagesCCE BankRecon POCgamboamaeganNo ratings yet

- Cash EquivalentDocument8 pagesCash EquivalentEyra MercadejasNo ratings yet

- 1 B - Answer - Thories - Asset - Liability - Equity - Mas - MidtermsDocument23 pages1 B - Answer - Thories - Asset - Liability - Equity - Mas - MidtermsAlthea mary kate MorenoNo ratings yet

- 1 a - Thories - Asset - Liability - Equity - Mas - MidtermsDocument23 pages1 a - Thories - Asset - Liability - Equity - Mas - MidtermsAlthea mary kate MorenoNo ratings yet

- INTACC Reviewer Cash and EquivalentsDocument9 pagesINTACC Reviewer Cash and EquivalentsCzarhiena SantiagoNo ratings yet

- Cash and Cash Equi Theories and ProblemsDocument29 pagesCash and Cash Equi Theories and ProblemsIris Mnemosyne100% (5)

- Which of The Following Should Not Be Considered CashDocument5 pagesWhich of The Following Should Not Be Considered CashErica FlorentinoNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsNath BongalonNo ratings yet

- Topic 1 - Audit of Cash Transactions and BalancesDocument6 pagesTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganNo ratings yet

- A. B. Money Orders C.: D. IousDocument10 pagesA. B. Money Orders C.: D. IousRobert GarlandNo ratings yet

- Financial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyDocument8 pagesFinancial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyJamhel MarquezNo ratings yet

- Chap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaDocument4 pagesChap9 (Cash & Marketable Securities Management) VanHorne&Brigham, CabreaClaudine DuhapaNo ratings yet

- Cash & Cash Equivalents Accounting GuideDocument5 pagesCash & Cash Equivalents Accounting Guidejane dillanNo ratings yet

- Cash and Cash Equivalents Lecture NotesDocument2 pagesCash and Cash Equivalents Lecture Notesyna kyleneNo ratings yet

- Gov't Accounting-Semi Final ExamDocument5 pagesGov't Accounting-Semi Final ExamJubileen ReyesNo ratings yet

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonNo ratings yet

- Petty CashDocument1 pagePetty CashRose Marie Anne ReyesNo ratings yet

- C&CEDocument11 pagesC&CEAnne VinuyaNo ratings yet

- BSA REVIEW Cash TheoriesDocument4 pagesBSA REVIEW Cash TheorieschristineNo ratings yet

- Ia1 Mod 1Document9 pagesIa1 Mod 1omssheshNo ratings yet

- MSU Cash and Cash EquivalentsDocument2 pagesMSU Cash and Cash EquivalentsRosalinda DacayoNo ratings yet

- FARAP-4501 (Cash and Cash Equivalents)Document10 pagesFARAP-4501 (Cash and Cash Equivalents)Marya NvlzNo ratings yet

- Problem Solving (With Answers)Document12 pagesProblem Solving (With Answers)sunflower100% (1)

- 01 - Cash and Cash Equivalents - RM - Rev2023 24Document3 pages01 - Cash and Cash Equivalents - RM - Rev2023 24pilonia.donitarosebsa1993No ratings yet

- Cash & Cash Equivalents (Assessment Questions)Document4 pagesCash & Cash Equivalents (Assessment Questions)KN DumpNo ratings yet

- ZZZZDDocument2 pagesZZZZDDhierissa LeeNo ratings yet

- This Study Resource Was: Financial Accounting Review (Theory)Document7 pagesThis Study Resource Was: Financial Accounting Review (Theory)LianaNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- 1 Cash and Cash EquivalentsDocument4 pages1 Cash and Cash EquivalentsHamida Ismael MacabantogNo ratings yet

- Cce Part1 Cash and Cash Equivalents CompressDocument2 pagesCce Part1 Cash and Cash Equivalents CompressMARK JHEN SALANGNo ratings yet

- Acc05 Take Home Quiz Cash and ReceivablesDocument12 pagesAcc05 Take Home Quiz Cash and ReceivablesJullia BelgicaNo ratings yet

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- FAR1 CASH & CASH EQUIVALENTS - StudentsDocument4 pagesFAR1 CASH & CASH EQUIVALENTS - StudentsCHRISTIAN BETIANo ratings yet

- Cash and Cash Equivalents ReviewerDocument4 pagesCash and Cash Equivalents ReviewerWinnie ToribioNo ratings yet

- Santa-Ana Jerald Accounting For Cash Cash and Cash EquivalentsDocument11 pagesSanta-Ana Jerald Accounting For Cash Cash and Cash EquivalentsSanta-ana Jerald JuanoNo ratings yet

- AP.3404 Audit of Cash and Cash EquivalentsDocument5 pagesAP.3404 Audit of Cash and Cash EquivalentsMonica GarciaNo ratings yet

- Review 105 - Day 5 Theory of AccountsDocument12 pagesReview 105 - Day 5 Theory of AccountsAndre PulancoNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsErla PilapilNo ratings yet

- Review 105 - Day 5 Theory of AccountsDocument12 pagesReview 105 - Day 5 Theory of Accountsneo14No ratings yet

- Intermediate AccountingDocument4 pagesIntermediate AccountingjenNo ratings yet

- International Cash Management Alan C ShapiroDocument30 pagesInternational Cash Management Alan C ShapiroJoen ApriantoNo ratings yet

- Audit of Cash and Cash Equivalents Internal ControlsDocument7 pagesAudit of Cash and Cash Equivalents Internal ControlsmoNo ratings yet

- 2 - Cash and Cash EquivalentsDocument5 pages2 - Cash and Cash EquivalentsandreamrieNo ratings yet

- Audit of Cash and Cash Equivalents Internal ControlsDocument7 pagesAudit of Cash and Cash Equivalents Internal ControlsRNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash Equivalentsyes it's kaiNo ratings yet

- Quiz On Cash Ga TheoriesDocument5 pagesQuiz On Cash Ga TheoriesgarciarhodjeannemarthaNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Law Obligations Contracts EssentialsDocument30 pagesLaw Obligations Contracts EssentialsJobelle Grace SorianoNo ratings yet

- BASKETBALL HISTORY AND EQUIPMENT GUIDEDocument14 pagesBASKETBALL HISTORY AND EQUIPMENT GUIDEJobelle Grace SorianoNo ratings yet

- Law Obligations Contracts EssentialsDocument30 pagesLaw Obligations Contracts EssentialsJobelle Grace SorianoNo ratings yet

- Basketball Court BreakdownDocument12 pagesBasketball Court BreakdownJobelle Grace SorianoNo ratings yet

- General Provisions Part 2: Civil Code Art. 1156-1162Document28 pagesGeneral Provisions Part 2: Civil Code Art. 1156-1162Jobelle Grace SorianoNo ratings yet

- Job InterviewDocument5 pagesJob InterviewJobelle Grace SorianoNo ratings yet

- Updates in Financial Reporting Standards: Northeastern CollegeDocument3 pagesUpdates in Financial Reporting Standards: Northeastern CollegeJobelle Grace SorianoNo ratings yet

- Academic Track CoursesDocument4 pagesAcademic Track Coursesfelize padllaNo ratings yet

- Program OverviewDocument10 pagesProgram OverviewJobelle Grace SorianoNo ratings yet

- Literature ReportDocument2 pagesLiterature ReportJobelle Grace SorianoNo ratings yet

- Modern Tech's Impact in EducationDocument2 pagesModern Tech's Impact in EducationJobelle Grace SorianoNo ratings yet

- Child Labor and Slavery in The Chocolate IndustryDocument2 pagesChild Labor and Slavery in The Chocolate IndustryJobelle Grace SorianoNo ratings yet

- Adjusting and Closing Entries in AccountingDocument15 pagesAdjusting and Closing Entries in Accountingwalid ahmedNo ratings yet

- The Pre-WritingDocument1 pageThe Pre-WritingJobelle Grace SorianoNo ratings yet

- Literature ReportDocument2 pagesLiterature ReportJobelle Grace SorianoNo ratings yet

- Review of Stress and Coping Among Student TeachersDocument57 pagesReview of Stress and Coping Among Student TeachersJobelle Grace SorianoNo ratings yet

- Measures of Cost of Living and Real vs Nominal Interest Rates ExplainedDocument1 pageMeasures of Cost of Living and Real vs Nominal Interest Rates ExplainedJobelle Grace SorianoNo ratings yet

- Review of Stress and Coping Among Student TeachersDocument57 pagesReview of Stress and Coping Among Student TeachersJobelle Grace SorianoNo ratings yet

- AaaDocument2 pagesAaaJobelle Grace SorianoNo ratings yet

- APC Training Guide - QSDocument41 pagesAPC Training Guide - QSAinobushoborozi AntonyNo ratings yet

- Foreign Currency Translation RulesDocument1 pageForeign Currency Translation Rulesronnelson pascual100% (1)

- M 200Document3 pagesM 200Rafael Capunpon VallejosNo ratings yet

- Dissolution Deed TitleDocument2 pagesDissolution Deed TitleMuslim QureshiNo ratings yet

- Financial StatementsDocument2 pagesFinancial StatementsRjoshua PlaylistNo ratings yet

- Bcoc 136Document2 pagesBcoc 136Suraj JaiswalNo ratings yet

- Audit Data MapDocument553 pagesAudit Data MapDarma Bonar TampubolonNo ratings yet

- JhunjhunwalaDocument12 pagesJhunjhunwalapercysearchNo ratings yet

- Organization Functions and DutiesDocument21 pagesOrganization Functions and DutiesmhnNo ratings yet

- Customer Satisfaction towards RTGS & NEFTDocument70 pagesCustomer Satisfaction towards RTGS & NEFTRajibKumar100% (1)

- PEZA CITIZENS CHARTER (Rev 10, 31 Mar 2023, 1st Edition) - Compressed PDFDocument458 pagesPEZA CITIZENS CHARTER (Rev 10, 31 Mar 2023, 1st Edition) - Compressed PDFPatrickNo ratings yet

- Benjamin 2007 (Part)Document58 pagesBenjamin 2007 (Part)marcelluxNo ratings yet

- Cpar2017 Mas 8203 Cost Volume Profit Analysis PDFDocument22 pagesCpar2017 Mas 8203 Cost Volume Profit Analysis PDFtanginamotalagaNo ratings yet

- Lirag Textile Mills Vs Sss - FullDocument7 pagesLirag Textile Mills Vs Sss - FullLariza AidieNo ratings yet

- NSS Central Audit Report User Manual - 16.032020Document48 pagesNSS Central Audit Report User Manual - 16.032020Manoj TribhuwanNo ratings yet

- ExercisesDocument3 pagesExercisesrhumblineNo ratings yet

- Module 5: What You Will LearnDocument54 pagesModule 5: What You Will Learn刘宝英No ratings yet

- Corporate Finace 1 PDFDocument4 pagesCorporate Finace 1 PDFwafflesNo ratings yet

- RD 5 Tips To Startup SuccessDocument6 pagesRD 5 Tips To Startup SuccessRomar Angelo AvilaNo ratings yet

- Unbilled Transactions PDFDocument2 pagesUnbilled Transactions PDFArjun NkNo ratings yet

- EuroHedge Summit Brochure - April 2011Document12 pagesEuroHedge Summit Brochure - April 2011Absolute ReturnNo ratings yet

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 02Document36 pagesMultinational Business Finance 12th Edition Slides Chapter 02Alli TobbaNo ratings yet

- 1 MPB-501 - Application For Pension 2 MPC - 60Document10 pages1 MPB-501 - Application For Pension 2 MPC - 60Anitha Mary DambaleNo ratings yet

- Qingdao Thundsea Marine Technology Proforma InvoiceDocument1 pageQingdao Thundsea Marine Technology Proforma InvoiceLiu AllieNo ratings yet

- Corporate Restructuring Strategies ExplainedDocument26 pagesCorporate Restructuring Strategies ExplainedAmar Singh SaudNo ratings yet

- Bar Questions in Negotiable InstrumentDocument13 pagesBar Questions in Negotiable InstrumentAlyza Montilla BurdeosNo ratings yet

- Managing Working Capital and Cash FlowDocument8 pagesManaging Working Capital and Cash FlowEnelrejLeisykGarillos100% (1)

- File: Chapter 05 - Consolidated Financial Statements - Intra-Entity Asset Transactions Multiple ChoiceDocument53 pagesFile: Chapter 05 - Consolidated Financial Statements - Intra-Entity Asset Transactions Multiple Choicejana ayoubNo ratings yet

- Faculty of Commerace: I YearDocument23 pagesFaculty of Commerace: I YearKaran Veer SinghNo ratings yet