Professional Documents

Culture Documents

ZZZZD

Uploaded by

Dhierissa Lee0 ratings0% found this document useful (0 votes)

94 views2 pagesOriginal Title

Zzzzd

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

94 views2 pagesZZZZD

Uploaded by

Dhierissa LeeCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

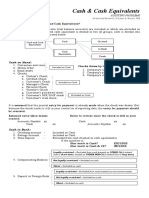

CASH

CASH AND CASH EQUIVALENTS date of maturity. THIS IS

WHEN YOU WILL CONSIDER

1. CASH includes MONEY and ANY OTHER BALANCE SHEET DATE.

NEGOTIABLE INSTRUMENT that is payable

in money and acceptable by the bank for 5. REMEMBER: If the problem asks for Cash,

deposit and immediate credit. do not include Cash Equivalents. Only add

them, if CASH and CASH EQUIVALENTS are

2. Cash must be: asked.

a. UNRESTRICTED; and

b. AVAILABLE for use in current 6. A Bank Draft (part of cash) is different from

operations a Bank Overdraft (liability pertaining to

i. Payment of operating bank accounts that have a negative

expenses balance).

ii. Settlement of current

liability (Note: check if a CASH MANAGEMENT (SIVIB)

liability is current or

noncurrent according to its 1. Segregation of duties (CAR)

due date) a. Custody

iii. Acquisition of current asset b. Approval/Authorization

(If for acquisition of c. Recording

noncurrent assets, fund is 2. Imprest system

NOT cash regardless of a. Receipts must be deposited daily;

timing of disbursement of b. Disbursement is through check

the fund. Example: “Land (exception is petty cash fund)

Acquisition Fund” that is 3. Voucher system

expected to be disbursed a 4. Irregular internal audit

few months from balance 5. Bank reconciliation

sheet date is STILL not cash)

PETTY CASH FUND

3. To be included in Cash, checks must be:

a. RECEIVED on or before balance 1. Imprest Fund System (PCF is set at an

sheet date; and imprest balance; replenishment is equal to

b. DATED on or before balance sheet disbursements) or Fluctuating Fund System

date (PCF balance fluctuates; replenishment

NOTE: Always check if you’re the payor does NOT necessarily need to be equal to

or the payee. disbursements)

4. CASH EQUIVALENTS are: 2. To compute for petty cash (assumption: no

a. Short term; replenishment yet), check first if there is

b. Highly liquid; and overage (Count > Accountability) or

c. Acquired 3 months or less before shortage (Count < Accountability).

maturity (Look for the acquisition a. Overage: deduct the overage from

date and maturity date ONLY. the cash items in the PCF to

Balance sheet date is irrelevant.) compute for your PCF

i. If an investment was b. Shortage: just count the cash items

acquired MORE than 3 for the balance of your PCF

months, it is not a cash

equivalent. For classification

of either current or

noncurrent, look between

the balance sheet date and

CASH

BANK RECONCILIATION Treasury bills acquired 4/15/19; due

1/1/20

Money market placements acquired

Adjusted Book = Unadjusted + CM – DM +/- Book

12/25/19; due 1/1/25

Errors

Negative balance in a bank account

Adjusted Bank = Unadjusted + DIT – OC +/- Bank

IOUs

Errors

Restricted compensating balance

Petty cash fund

Adjusted Balances must be equal. Cash in bank – sinking fund; Bonds

payable is due on 12/15/20

Bank to Book: Just consider bank reconciling items Cash in bank – sinking fund; Bonds

normally; book reconciling items are considered by payable is due on 12/15/21

changing their sign. Customer’s check; received 12/1/19,

Unadjusted Bank + DIT – OC +/- Bank Errors dated 12/1/19

– CM + DM +/- Book errors = Unadjusted Book Customer’s check; received 1/1/20,

dated 12/1/19

Book to Bank: Just consider book reconciling items Customer’s check; received 12/1/19,

normally; bank reconciling items are considered by dated 1/1/20

changing their sign. Company’s check; released 12/1/19,

Unadjusted + CM – DM +/- Book Errors dated 12/1/19

Company’s check; released 12/1/19,

– DIT + OC +/- Bank Errors = Unadjusted Bank

dated 1/1/20

Company’s check; released 1/1/20,

PROOF OF CASH dated 12/1/19

Vouchers paid

Basically an expanded bank reconciliation where Postage Stamps

you reconcile at least 2 dates.

Prepare Proof of Cash

DIT and CM affect RECEIPTS

OC and DM affect DISBURSEMENTS Cash in bank, 3/31 200,000

Book credits in April 720,000

Use the in-a-relationship technique. Couples who Book debits in April 800,000

are together are mad at each other (different Bank Statement, 3/31 330,000

signs); couples who are far from each other miss Bank debits 530,000

each other (same sign) Bank credits 700,000

Note collected by bank in March 60,000

Beginning + Receipts – Disbursements = End Note collected by bank in April 100,000

Service charge in March 8,000

Service charge in April 2,000

EXERCISES

NSF check in March 20,000

Which of the following is Cash? NSF check in April 30,000

Assume BSD is 12/31/19 DIT, 3/31 80,000

DIT, 4/30 220,000

Cash in bank – current account OC, 3/31 178,000

Cash in bank – payroll account OC, 4/30 372,000

Cash in bank – inventory fund

Cash on hand

Cash in bank – land acquisition fund; to

be disbursed 1/1/20

Cash in bank – plant acquisition fund; to

be disbursed 1/1/25

Time deposit acquired 12/15/19; due

3/1/20

You might also like

- Net Worth Summary: Enter Your Name HereDocument9 pagesNet Worth Summary: Enter Your Name HereKalaisejiane AthmalingameNo ratings yet

- TTS - LBO PrimerDocument5 pagesTTS - LBO PrimerKrystleNo ratings yet

- Auditing and Assurance PrinciplesDocument125 pagesAuditing and Assurance PrinciplesAaron Joy Dominguez Putian38% (34)

- Cash and Cash Equivalent AuditingDocument8 pagesCash and Cash Equivalent Auditing수지No ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2nd Edition Rosenbaum Test BankDocument12 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2nd Edition Rosenbaum Test Bankjeromescottxwtiaqgrem100% (22)

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Analysis of Investments in Debts InstrumentsDocument4 pagesAnalysis of Investments in Debts InstrumentsJan ryanNo ratings yet

- Accounting Questions and AnswerDocument9 pagesAccounting Questions and Answerangelica valenzuelaNo ratings yet

- 02 - Cash & Cash EquivalentDocument5 pages02 - Cash & Cash EquivalentEmmanuelNo ratings yet

- Financial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyDocument8 pagesFinancial Accounting and Reporting University of Luzon Cash and Cash Equivalents College of AccountancyJamhel MarquezNo ratings yet

- Cash and Cash Equi Theories and ProblemsDocument29 pagesCash and Cash Equi Theories and ProblemsIris Mnemosyne100% (5)

- A-Level Accounting PDFDocument11 pagesA-Level Accounting PDFTawanda B MatsokotereNo ratings yet

- Audit of Receivables and Adjusting EntriesDocument6 pagesAudit of Receivables and Adjusting EntriesEliyah Jhonson100% (1)

- Cash and Cash Equivalents GuideDocument10 pagesCash and Cash Equivalents GuideMs VampireNo ratings yet

- Sample Problem Case 2Document54 pagesSample Problem Case 2MAKI100% (1)

- CH 18 IFM10 CH 19 Test BankDocument12 pagesCH 18 IFM10 CH 19 Test Bankajones1219100% (1)

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- Topic 1 - Audit of Cash Transactions and BalancesDocument6 pagesTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganNo ratings yet

- Cash EquivalentDocument8 pagesCash EquivalentEyra MercadejasNo ratings yet

- Updates in Financial Reporting Standards: Northeastern CollegeDocument3 pagesUpdates in Financial Reporting Standards: Northeastern CollegeJobelle Grace SorianoNo ratings yet

- 00 Quick Notes - Cash and Cash Equivalents PDFDocument6 pages00 Quick Notes - Cash and Cash Equivalents PDFBecky GonzagaNo ratings yet

- Conceptual Framework & Accounting Standards: Northeastern CollegeDocument5 pagesConceptual Framework & Accounting Standards: Northeastern CollegeMikaella SaduralNo ratings yet

- Sta Clara - Summary Part 1Document49 pagesSta Clara - Summary Part 1Carms St ClaireNo ratings yet

- Ia1 ReviewerDocument10 pagesIa1 ReviewerVeronica SarmientoNo ratings yet

- 1.2 Bank Reconciliation and Proof of CashDocument6 pages1.2 Bank Reconciliation and Proof of CashShally Lao-unNo ratings yet

- CCEDocument4 pagesCCEせい じよNo ratings yet

- 1 CashDocument6 pages1 CashMikaella SaduralNo ratings yet

- CashDocument3 pagesCashAnne VinuyaNo ratings yet

- Intermediate Accounting 1Document49 pagesIntermediate Accounting 1Harry EvangelistaNo ratings yet

- CCE BankRecon POCDocument3 pagesCCE BankRecon POCgamboamaeganNo ratings yet

- ACCO 20053 Lecture 1 and 2 NotesDocument3 pagesACCO 20053 Lecture 1 and 2 NotesVincent Luigil AlceraNo ratings yet

- Cash and Cash Equivalents (Class Notes)Document5 pagesCash and Cash Equivalents (Class Notes)IAN PADAYOGDOGNo ratings yet

- C&CEDocument11 pagesC&CEAnne VinuyaNo ratings yet

- Cash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheDocument4 pagesCash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheannyeongNo ratings yet

- Gov't Accounting-Semi Final ExamDocument5 pagesGov't Accounting-Semi Final ExamJubileen ReyesNo ratings yet

- Intermediate Accounting 1Document46 pagesIntermediate Accounting 1Jashi SiñelNo ratings yet

- L2 Bank ReconciliationDocument3 pagesL2 Bank ReconciliationAshley BrevaNo ratings yet

- Intacc 1 Cash and Cash Equivalents-1Document10 pagesIntacc 1 Cash and Cash Equivalents-1randel10caneteNo ratings yet

- Cce Part1 Cash and Cash Equivalents CompressDocument2 pagesCce Part1 Cash and Cash Equivalents CompressMARK JHEN SALANGNo ratings yet

- Ia1 Mod 1Document9 pagesIa1 Mod 1omssheshNo ratings yet

- 3 Cash - Lecture Notes PDFDocument11 pages3 Cash - Lecture Notes PDFJohn Paul EslerNo ratings yet

- Banking and Accounting Ledger EssentialsDocument5 pagesBanking and Accounting Ledger EssentialsMikaella Adriana GoNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- Santa-Ana Jerald Accounting For Cash Cash and Cash EquivalentsDocument11 pagesSanta-Ana Jerald Accounting For Cash Cash and Cash EquivalentsSanta-ana Jerald JuanoNo ratings yet

- Acc Cash and Cash Equivalent Continuation NotesDocument3 pagesAcc Cash and Cash Equivalent Continuation NotesShane QuintoNo ratings yet

- Pre2 Notesl Leo CcbrpocDocument15 pagesPre2 Notesl Leo CcbrpocCarla Jane Mirasol ApolinarioNo ratings yet

- INTACC - Chapter 1 (1)Document4 pagesINTACC - Chapter 1 (1)MeriiiNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsRommel Cabel CapalaranNo ratings yet

- Financial Accounting and Reporting: Cash and Cash Equivalent CashDocument4 pagesFinancial Accounting and Reporting: Cash and Cash Equivalent CashJAPNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash Equivalentsyes it's kaiNo ratings yet

- Cash and Cash Equivalents Lecture NotesDocument2 pagesCash and Cash Equivalents Lecture Notesyna kyleneNo ratings yet

- Audit of Cash and Cash Equivalents Internal ControlsDocument7 pagesAudit of Cash and Cash Equivalents Internal ControlsmoNo ratings yet

- Audit of Cash and Cash Equivalents Internal ControlsDocument7 pagesAudit of Cash and Cash Equivalents Internal ControlsRNo ratings yet

- Reconciling Cash AccountsDocument2 pagesReconciling Cash AccountssyafaNo ratings yet

- Intermediate AccountingDocument4 pagesIntermediate AccountingjenNo ratings yet

- 02 Cash Cash EquivalentDocument5 pages02 Cash Cash EquivalentalteregoNo ratings yet

- Finals ReviewerDocument6 pagesFinals ReviewerMaliha KansiNo ratings yet

- 01 Xfinacr Cce-ReceivablesDocument6 pages01 Xfinacr Cce-ReceivablesNicah RoseNo ratings yet

- Cash Cash Equivalents: Practical Accounting 1 Theory of AccountsDocument4 pagesCash Cash Equivalents: Practical Accounting 1 Theory of AccountsMaria Fe ValenzuelaNo ratings yet

- FAR 03-13 Cash and Cash Equivalents, Proof of Cash, Bank Reconciliation - 1626523014Document46 pagesFAR 03-13 Cash and Cash Equivalents, Proof of Cash, Bank Reconciliation - 1626523014Angel Leah CuambotNo ratings yet

- 2Document99 pages2Erika Faith HalladorNo ratings yet

- ACC 102 - Cash and Cash EquivalentsDocument4 pagesACC 102 - Cash and Cash Equivalentswerter werterNo ratings yet

- Acct 312 Chapter 6Document32 pagesAcct 312 Chapter 6jantriciadNo ratings yet

- Key Terms and Chapter Summary-13Document2 pagesKey Terms and Chapter Summary-13onstudy015No ratings yet

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzNo ratings yet

- Understanding Cash and Cash EquivalentsDocument6 pagesUnderstanding Cash and Cash EquivalentsNicole Anne Santiago SibuloNo ratings yet

- Chapter XXI - Bank ReconciliationDocument7 pagesChapter XXI - Bank Reconciliationabbey89No ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsKent Raysil PamaongNo ratings yet

- Audit SamplingDocument4 pagesAudit SamplingDhierissa LeeNo ratings yet

- Audit Evidence and ProceduresDocument2 pagesAudit Evidence and ProceduresDhierissa LeeNo ratings yet

- AuuditDocument1 pageAuuditDhierissa LeeNo ratings yet

- Subtraction of integers performance taskDocument1 pageSubtraction of integers performance taskDhierissa LeeNo ratings yet

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDocument2 pagesInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASKristine Lirose BordeosNo ratings yet

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDocument2 pagesInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASKristine Lirose BordeosNo ratings yet

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDocument2 pagesInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASKristine Lirose BordeosNo ratings yet

- Partnership dissolution retirementDocument1 pagePartnership dissolution retirementDhierissa LeeNo ratings yet

- Power of The Bir and Cir-Income Taxation 101-02.23.20Document4 pagesPower of The Bir and Cir-Income Taxation 101-02.23.20Dhierissa LeeNo ratings yet

- Power of The Bir and Cir-Income Taxation 101-02.23.20Document4 pagesPower of The Bir and Cir-Income Taxation 101-02.23.20Dhierissa LeeNo ratings yet

- Modern Advanced Accounting by Donald E. Larsen (Chapter 2)Document50 pagesModern Advanced Accounting by Donald E. Larsen (Chapter 2)Imtiaz Rashid67% (3)

- MTP1 May2022 - Paper 8 FM EcoDocument19 pagesMTP1 May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Mock Prelim - Intermediate AcctDocument9 pagesMock Prelim - Intermediate AcctNikki LabialNo ratings yet

- Cash flow and financial planning exercisesDocument2 pagesCash flow and financial planning exercisesRaniel PamatmatNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Depreciation, Provisions and ReservesDocument51 pagesDepreciation, Provisions and ReservesRahulNo ratings yet

- 410 H21 ES Basic Accounting - Presentation (Part1)Document120 pages410 H21 ES Basic Accounting - Presentation (Part1)William Santiago Jaimes OrtizNo ratings yet

- Solution Chapter 7 Accounting For Non-Current AssetsDocument4 pagesSolution Chapter 7 Accounting For Non-Current AssetsIsmahNo ratings yet

- CH 6 & 7 - Capital Structure New SyllabusDocument50 pagesCH 6 & 7 - Capital Structure New SyllabusNurul Khaleeda binti KamalNo ratings yet

- ACCA F3-FFA Revision Mock - Answers D15Document12 pagesACCA F3-FFA Revision Mock - Answers D15Kiri chrisNo ratings yet

- Module 5Document14 pagesModule 5Sittie Nihaya MangondayaNo ratings yet

- Manage Overdue Customer AccountsDocument15 pagesManage Overdue Customer Accountsmulehabesha.mhNo ratings yet

- Disclosure Checklist-Companies ActDocument7 pagesDisclosure Checklist-Companies ActSarowar AlamNo ratings yet

- Lesson 1 SFPDocument14 pagesLesson 1 SFPLydia Rivera100% (3)

- Mudra App FormDocument6 pagesMudra App FormpraveenaNo ratings yet

- Home Office Branch and Agency Transaction Business Combination 1Document10 pagesHome Office Branch and Agency Transaction Business Combination 1PaupauNo ratings yet

- Solvency II For Beginners PDFDocument24 pagesSolvency II For Beginners PDFIoanna ZlatevaNo ratings yet

- Assignment: Fin 441 Bank ManagementDocument11 pagesAssignment: Fin 441 Bank ManagementNazir Ahmed ZihadNo ratings yet

- Finacc 3Document6 pagesFinacc 3Tong WilsonNo ratings yet

- T3 2004 - Dec - QDocument8 pagesT3 2004 - Dec - QVinh Ngo NhuNo ratings yet

- Comparative Study Supplier Buyer Credits Capital Goods ExportsDocument29 pagesComparative Study Supplier Buyer Credits Capital Goods Exportsjing qiangNo ratings yet