Professional Documents

Culture Documents

Int. Acc 1 Chap 1

Uploaded by

Nicole Anne Santiago SibuloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Int. Acc 1 Chap 1

Uploaded by

Nicole Anne Santiago SibuloCopyright:

Available Formats

TOPIC OUTLINE can be a date in the past since it is just the

starting date that matters for it to be in cash

I. Definition of Cash the check should not exceed 6 months. Within 6

months from the date written on the check is the

II. Definition of Cash Equivalents

only time for you to in cash it.

III. Valuation and statement presentation of cash 6 months expirations date or else it is called a

IV. Investment of excess cash stale check

V. Foreign currency, Cash fund for a certain

purpose, Bank overdraft, and Compensating

Antedated check

balance

preceding dates from the date today

VI. Undelivered check, Postdated check delivered,

and Stale check What will happen to stale checks?

VII. Imprest System

It will still remain in the account of the one who

VIII. Petty cash fund – imprest fund system and

gave you the check. As long as you don’t deposit

fluctuating fund system

the check, the cash will not be deducted from the

owner’s accounts

DEFINITION OF CASH UNRESTRICTED CASH

Layman’s term: Cash means money Hindi pwedeng galawin (will be considered as

non-current asset)

Money Current liabilities = current assets

Why restricted? pambayad utang and other

is the standard medium of exchange in business purpose

transactions.

currency and coin

PAS 1 PARAGRAPH 66

o Cash is not limited to bills and coins. An entity shall classify an asset as

current when the asset is cash or a cash

CASH equivalent unless it is restricted to settle a

liability for more than twelve months

money after the end of the reporting period.

other negotiable instrument (payable in money

and acceptable by the bank for deposit and

immediate credit)

checks CASH ITEMS INCLUDED IN CASH

bank drafts a. Cash on hand

money orders (acceptable by the bank for undeposited cash collections

deposit or immediate encashment) other cash items awaiting deposit

Is money in a bank an asset or liability? - customers’ checks

- cashier’s

Money in a bank is a liability since they

- manager’s checks

are responsible to it. Hence, it is a credit.

- traveler’s checks

Postdated checks - bank drafts

- money orders

Future date for future transactions

Not considered as cash (unacceptable for exemption: postdated check

immediate credit)

can be one year as long as it is a future date b. Cash in bank

can only be deposited when the date stated is demand deposit or checking account

reached saving deposit

NICOLE ANNE S. SIBULO | BSA-1 1.1

unrestricted as to withdrawal. Invested in: (1) time deposits money market

instruments (2) treasury bills

c. Cash fund (set aside for current purposes)

petty cash fund

payroll fund CLASSIFICATION OF INVESTMENT OF

dividend fund EXCESS CASH

CASH EQUIVALENTS Investments in time deposit, money market instruments

and treasury bills should be classified as follows:

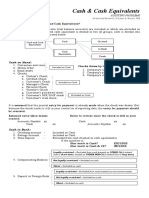

PAS 7 PARAGRAPH 6 PERIOD CLASSIFICATION

Defines cash equivalents as short-terms and

cash equivalents

highly liquid investments that are readily

3 months or less “cash and cash

convertible into cash and so near their

equivalents”

maturity that they present insignificant risk of

changes in value because of changes in

interest rates. short-term financial

more than three months assets or temporary

but within 1 year investments

“current assets”

*Interest rate can change depending in the

economic status of the country. long-term investments

more than one year

“noncurrent assets”

The standard further states that only highly

liquid investments that are acquired three months MEASUREMENT OF CASH

before maturity can qualify as cash equivalents

Cash is measured at face value (value seen on the

paper)

Examples of cash equivalents are: Cash in foreign currency is measured at the

current exchange rate (spot rate on the

a. Three-month BSP treasury bill

reporting date)

b. Three-year BSP treasury bill (purchased three

months before date of maturity) If the bank or financial institution holding the

c. Three-month time deposit funds of an entity is in bankruptcy or financial

d. Three-month money market instrument or difficulty, cash should be written down as

commercial paper estimated realizable value if the amount

recoverable is estimated to be lower than the face

value.

Treasury Bill – government issued bonds

ERV if the account recoverable is lower than the

*Equity securities (shares of stocks) – cannot qualify as face value.

cash equivalents; do not have a maturity date.

RA < FV = ERV

Redeemable preference share - specific date; acquired

three months before redemption to when it is to be FINANCIAL STATEMENT PRESENTATION

redeemable by the company.

The caption cash and cash equivalents should be

shown as the first line item under current assets.

!NOTE: it is important that the date of purchase which However, the details comprising the cash and

cash equivalents should be disclosed in the notes

should be three months or less before the maturity to financial statements.

INVESTMENT OF EXCESS CASH FOREIGN CURRENCY

The entity must maintain cash for use in current Cash in foreign currency should be translated to

operations. Philippine pesos using the current exchange rate.

Deposits in for foreign countries which are not

Any cash accumulated in excess should be

subject to any foreign exchange restriction

invested

for the purpose of earning interest income.

NICOLE ANNE S. SIBULO | BSA-1 1.2

should be classified separately among noncurrent EXCEPTION TO THE RULE OF OVERDRAFT

assets and the restriction clearly indicated.

1. Multiple accounts in one bank

- can be offset against the other bank

CASH FUND FOR A CERTAIN PURPOSE account with a debit balance in order to

show cash, net of bank overdraft or bank

set aside for use in current operations: current overdraft, net of other bank account.

asset

The cash fund is included as part of cash and 2. Offset against the other bank account

cash equivalents. - if the amount is not material.

Example: Under IFRS, bank overdraft can be offset

petty cash fund (fund for small against other bank account when payable on

disbursement ex: fair) demand and often fluctuates from positive to

payroll fund (ex. wage) negative as an integral part of cash management.

travel fund

interest fund (Interest payment) Positive net cash (offset against overdraft)

dividend fund (dividend to stock holders) = cash net of bank overdraft

tax fund (for tax)

Negative net cash (bank overdraft)

= net of other bank account

set aside for noncurrent purpose or payment of

noncurrent obligation: long-term investment.

Example: COMPENSATING BALANCE

sinking fund (pinagtatabi pambayad ng A compensating balance generally takes the form

utang) of minimum checking or demand deposit

preference share redemption fund account balance that must be maintained in

ontingent fund (lawsuit fee) connection with a borrowing arrangement with a

insurance fund bank.

fund for acquisition or construction of

property plant and equipment. results in the reduction of the amount borrowed

compensating balance provides a source of fund

to the bank as partial compensation for the loan

CLASSIFICATION OF CASH FUND extended.

The classification of a cash fund as a current or CLASSIFICATION OF COMPENSATING

noncurrent should be parallel the classification

BALANCE

of the related liability.

Non-current liability = non-current asset

Current liability = current asset CONDITION CLASSIFICATION

BANK OVERDRAFT cash

not legally restricted cash and cash

credited balance: overdraft equivalents”

- The credit balance in the cash in bank

account results from the issuance of checks short-term financial

in excess of the deposits. assets or temporary

legally restricted

investments

Business’ Perspective: “current assets”

Cash in bank account normal balance = Debit

long-term investments

A bank overdraft is classified as a current long-term

“noncurrent assets”

liability and should not be offset against other

bank accounts with debit balances.

UNDELIVERED OR UNRELEASED CHECK

!Note: It is not necessary to adjust and open a

bank overdraft account in the ledger. drawn and recorded but not given to the payee

before the end of reporting period

It is to be stated that generally overdrafts are not

permitted in the Philippines. Check is written. Do you have to make your

journal entry already?

NICOLE ANNE S. SIBULO | BSA-1 1.3

Yes, because the company has already The Negotiable Instruments Law provides that

written a check to the company, and if the where the instrument is payable on demand,

check is not delivered within the reporting presentment must be made within a reasonable

period, the entity has to adjust the journal time after issue.

entry to restore the amount. In determining what is a reasonable time,

(dr.) accounts payable; (cr.) cash in bank consideration should be made regarding the

Not within the reporting period: (dr.) nature of the instrument, the usage trade or

cash in bank; (cr.) accounts payable business, if any, with respect to such instrument

and the facts of the particular case.

Undelivered – not yet delivered Clearly, the law does not specify a definite

period within which checks must be presented

Unreleased – not yet received

for encashment. Reference is made to usage of

There is no payment when the check is pending trade or business practice.

delivery to the payee at the end of reporting In banking practice, a check becomes stale if not

period. encashed within six months from the time of

issuance. Of course, this is a matter of entity

The reason is that undelivered check is still policy.

subject to the entity's control and may thus be Thus, even after three months only, the entity

canceled any time before delivery at the may issue a stop payment order to bank for the

discretion of the entity. cancelation of a previously issued check.

Accordingly, an adjusting entry is required to If the amount of stale check is immaterial,

restore the cash balance and set up the liability. it is simply accounted for as

In practice, the foregoing adjustment is miscellaneous income.

sometimes ignored because the amount is not

substantial and there is no evidence of actual Cash xx

cancelation of the check in the subsequent

period. Miscellaneous income xx

POSTDATED CHECK DELIVERED

However, if the amount is material and

A postdated check delivered is a check drawn, liability is expected to continue, the cash is

recorded and already given to the payee but it restored and the liability is again set up.

bears a date subsequent to the end of reporting

period.

Cash xx

The original entry recording a delivered

postdated check shall also be reversed and Accounts payable or appropriate

therefore restored to the cash balance. xx

account

Cash xx ACCOUNTING FOR CASH SHORTAGE

Debit balance

Accounts payable or appropriate Where the cash count shows cash which is less

xx

account than the balance per book, a cash shortage is to

be recorded.

The reason is that there is no payment until the Cash short or over xx

check can be presented to the bank for Cash xx

encashment or deposit.

The cash short or over account is only a

temporary or suspense account. When

STALE CHECK OR CHECK LONG financial statements are prepared the same

OUTSTANDING should be adjusted.

A stale check is a check not encashed by the Hence, if the cashier or cash custodian

payee within relatively long period of time. is held responsible for cash shortage,

the adjustment should be:

The question is how long must the check remain

outstanding? Cash from cashier xx

NICOLE ANNE S. SIBULO | BSA-1 1.4

However, if reasonable efforts fail to Consequently, in such instances, it may

disclose the cause of the shortage, the be more economical and convenient to

adjustment is: pay in cash rather than issue checks.

Loss cash from shortage xx

PETTY CASH FUND

Cash short or over xx

The petty cash fund is money set aside to pay

small expenses which cannot be paid

ACCOUNTING FOR CASH OVERAGE conveniently by means of check.

Credit balance There are two methods of handling the petty

Where the cash count shows cash which is more cash, namely:

than the balance per book, a cash overage s to a. Imprest fund system

be recorded. b. Fluctuating fund system

Cash xx

Cash short or over xx

IMPREST FUND SYSTEM

Note: The imprest fund system is the one usually

followed in handling petty cash transactions.

Whether it is a cash shortage or cash overage, the

offsetting account is cash short over account.

Such amount should be adjusted when ACCOUNTING PROCEDURES

statements are made.

a. A check is drawn to establish the fund as:

The cash overage is treated as

miscellaneous income if there is no Petty cash fund xx

claim on the same. Cash in bank xx

Cash short or over xx

b. Payment of the expenses out of the fund.

Miscellaneous income xx No formal journal entries are made.

But where the cash overage is properly The petty cashier generally requires a signed

found to be the money of the cashier, the petty cash voucher for such payments are

journal entry is: simply prepares memorandum entries in the

petty cash

Cash short or over xx

c. Replacement of the petty cash payments.

Payable to cashier xx Whenever the petty cash fund runs low, a

check is drawn to replenish the fund.

The replenishment check is usually equal

IMPREST SYSTEM to the petty cash disbursements.

It is at this time that the petty cash

The imprest system is a system of control of cash disbursements are recorded.

which requires that all cash receipts should be

deposited intact and all cash disbursements Expense xx

should be made by means of check.

While internal control ideally requires that all Cash in bank xx

payments should be made by means of check,

this is sometimes impossible.

There are occasions when the issuance It is to be pointed out that the petty

of checks becomes impractical or cash disbursements should be

inconvenient such as when small replenished only by the means of

amounts are paid or things are hurriedly check and not from undeposited

bought or customers are entertained. collections.

NICOLE ANNE S. SIBULO | BSA-1 1.5

d. At the end of the accounting period, it is

necessary to adjust the unreplenished Dec 31 The fund was not replenished.

expenses in order to state the correct petty

cash balance. The fund is composed of the following:

currency and coin P7,000, supplies

P1,500, postage P500, miscellaneous

Expense xx expense P1,000.

Petty cash fund xx Supplies 1,500

The adjustment is to be reversed at the

Postage 500

beginning of the next accounting

period. Misc. expense 1,000

The reversal is made in order that the

normal replenishment procedures may PCF 3,000

be followed by simply debiting 2021

expenses and crediting cash in bank The adjustment made on December 31,

without distinguishing whether the Jan 1

2020 is reversed.

expenses pertain to the current period

or prior period. Petty cash fund 3,000

e. An increase in the fund is recorded as: Supplies 1,500

Postage 500

Petty cash fund xx Misc 1,000

Cash in bank xx

Feb 1 The fund is replenished and increased to

f. A decrease in the fund is recorded as: P15,000

Cash in bank xx

The composition of the fund:

Petty cash fund xx

Currency and coin 1,000

Supplies 4,500

ILLUSTRATIONS

Postage 3,000

2020 Miscellaneous

Nov 10 The entity established an imprest fund of expense 1,500

P10,000.

TOTAL 10,000

Petty cash fund 10,000

Cash in bank 10,000

JOURNAL ENTRY

29 Replenished the fund. The petty cash Petty cash fund 5,000

fund items include the following: Supplies 4,500

Postage 3,000

Currency and coin 2,000 Miscellaneous

expense 1,500

Supplies 5,000

Cash in bank 14,000

Telephone 1,800

Postage 1,200 The total amount of the check drawn is

P14,000 representing the petty cash

Nov 29 The journal entry to record the disbursements of P9,000 and the fund increase

replenishment is: of P5,000.

Supplies 5,000

Telephone 1,800

Postage 1,200

Cash in bank 8,000

NICOLE ANNE S. SIBULO | BSA-1 1.6

You might also like

- Cash and Cash Equivalents PDFDocument4 pagesCash and Cash Equivalents PDFJade Gomez100% (1)

- FAR Lecture NotesDocument80 pagesFAR Lecture NotesJuan Miguel Suerte Felipe100% (2)

- Cash and Cash Equivalent AuditingDocument8 pagesCash and Cash Equivalent Auditing수지No ratings yet

- Accounting NotesDocument20 pagesAccounting NotesAnonymous PersonNo ratings yet

- Cash and Cash Equivalents ReviewerDocument4 pagesCash and Cash Equivalents ReviewerEileithyia KijimaNo ratings yet

- Intermediate Accounting 1Document46 pagesIntermediate Accounting 1Jashi SiñelNo ratings yet

- Chapter 1Document22 pagesChapter 1Kalven Perry Agustin100% (4)

- Cash and Cash Equivalents: Layman's Term: Cash Means Money MoneyDocument9 pagesCash and Cash Equivalents: Layman's Term: Cash Means Money MoneyNicole Anne Santiago SibuloNo ratings yet

- Notes (Audit Prob)Document6 pagesNotes (Audit Prob)kodzuken.teyNo ratings yet

- Ia1 ReviewerDocument10 pagesIa1 ReviewerVeronica SarmientoNo ratings yet

- Intacc 1a Reviewer Conceptual Framework and Accounting StandardsDocument32 pagesIntacc 1a Reviewer Conceptual Framework and Accounting StandardsKrizahMarieCaballeroNo ratings yet

- Intacc ReviewerDocument20 pagesIntacc ReviewerAvos NnNo ratings yet

- INTACC - Chapter 1Document4 pagesINTACC - Chapter 1MeriiiNo ratings yet

- INTACCDocument4 pagesINTACCmrgrthflxsubNo ratings yet

- C7 Lecture NotesDocument3 pagesC7 Lecture NotesJonathan NavalloNo ratings yet

- Sta Clara - Summary Part 1Document49 pagesSta Clara - Summary Part 1Carms St ClaireNo ratings yet

- Topic 1 - Audit of Cash Transactions and BalancesDocument6 pagesTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash Equivalentsyes it's kaiNo ratings yet

- Chapter 1 Cash and Cash Equivalent - REVIEWERDocument32 pagesChapter 1 Cash and Cash Equivalent - REVIEWERAiyana AlaniNo ratings yet

- Ia1 QualiDocument44 pagesIa1 QualiAiyana AlaniNo ratings yet

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsAngel RosalesNo ratings yet

- If Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashDocument3 pagesIf Silent As To Date of Acquisition, Assume As Current: Cash and Cash Equivalents 1. CashKent Raysil PamaongNo ratings yet

- Acccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Document7 pagesAcccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Rey HandumonNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsCamille Joyce Corpuz Dela CruzNo ratings yet

- Intermediate Accounting 1: Cash and Cash EquivalentDocument17 pagesIntermediate Accounting 1: Cash and Cash EquivalentClar AgramonNo ratings yet

- Cash EquivalentDocument8 pagesCash EquivalentEyra MercadejasNo ratings yet

- Intacc Cash and Cash EquivalentsDocument2 pagesIntacc Cash and Cash EquivalentsKristalen ArmandoNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsKent Raysil PamaongNo ratings yet

- Intacc 1a Reviewer Conceptual Framework and Accounting StandardsDocument32 pagesIntacc 1a Reviewer Conceptual Framework and Accounting StandardsKatherine Cabading InocandoNo ratings yet

- Module 5 - Substantive Test of CashDocument6 pagesModule 5 - Substantive Test of CashJesievelle Villafuerte NapaoNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- Cce Part1 Cash and Cash Equivalents CompressDocument2 pagesCce Part1 Cash and Cash Equivalents CompressMARK JHEN SALANGNo ratings yet

- 3 Cash - Lecture Notes PDFDocument11 pages3 Cash - Lecture Notes PDFJohn Paul EslerNo ratings yet

- Chapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankDocument8 pagesChapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankJulie Mae Caling MalitNo ratings yet

- Auditing Problems Usl PDFDocument226 pagesAuditing Problems Usl PDFmusic niNo ratings yet

- Cash and Cash Equivalents (Class Notes)Document5 pagesCash and Cash Equivalents (Class Notes)IAN PADAYOGDOGNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- FAR 002 Summary Notes - Cash & Proof of CashDocument8 pagesFAR 002 Summary Notes - Cash & Proof of CashMarynelle Labrador SevillaNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsnikkitaaaNo ratings yet

- Ia1 Mod 1Document9 pagesIa1 Mod 1omssheshNo ratings yet

- Cash and Cash EquivsDocument7 pagesCash and Cash EquivsVic BalmadridNo ratings yet

- Accounting For Cash and Cash TransactionDocument63 pagesAccounting For Cash and Cash TransactionAura Angela SeradaNo ratings yet

- 01 Intermediate Accounting 1 PrelimDocument7 pages01 Intermediate Accounting 1 PrelimRoyu BreakerNo ratings yet

- Cash Part1Document7 pagesCash Part1cuaresmamonicaNo ratings yet

- Finals ReviewerDocument6 pagesFinals ReviewerMaliha KansiNo ratings yet

- Pre 2 Auditing Concepts and Applications Module 1 and 2Document3 pagesPre 2 Auditing Concepts and Applications Module 1 and 2Anjilla Amor RubiaNo ratings yet

- 2 Cash and Cash Equivalents Summary ReviewerDocument4 pages2 Cash and Cash Equivalents Summary ReviewerRey HandumonNo ratings yet

- Compiled Lessons - Far 1Document23 pagesCompiled Lessons - Far 1Gwyn OliverNo ratings yet

- Audit ProblemsDocument47 pagesAudit ProblemsShane TabunggaoNo ratings yet

- 01 Cash & CE CompositionDocument3 pages01 Cash & CE Compositionsharielles /No ratings yet

- NOTESmidtermDocument6 pagesNOTESmidtermAlexis Jhan MagoNo ratings yet

- Cash & Cash Equivalent Lecture NotesDocument6 pagesCash & Cash Equivalent Lecture NotesRena Lyn ManzanoNo ratings yet

- PPT2.1-1 Cash and Cash Equivalents (2020)Document42 pagesPPT2.1-1 Cash and Cash Equivalents (2020)Avery Paul MateoNo ratings yet

- Topic 1 - Cash and Cash Equivalents 2Document2 pagesTopic 1 - Cash and Cash Equivalents 2Harah LamanilaoNo ratings yet

- Cash and Cash EquivalentsDocument6 pagesCash and Cash EquivalentsPamela Mae PlatonNo ratings yet

- Summary of Cash and Cash EquivalentsDocument4 pagesSummary of Cash and Cash EquivalentsMhico Mateo100% (1)

- Iv.-Cash and Cash EquivalentsDocument4 pagesIv.-Cash and Cash EquivalentsKawaii SevennNo ratings yet

- AE 111 Midterm Formative Assessment 1Document4 pagesAE 111 Midterm Formative Assessment 1Djunah ArellanoNo ratings yet

- 02 - Cash & Cash EquivalentDocument5 pages02 - Cash & Cash EquivalentEmmanuelNo ratings yet

- SCIENCE 7 AssDocument1 pageSCIENCE 7 AssNicole Anne Santiago SibuloNo ratings yet

- Exercise 4.1Document2 pagesExercise 4.1Nicole Anne Santiago SibuloNo ratings yet

- Sibulo - Creative Folkdance Parent's Permit TemplateDocument1 pageSibulo - Creative Folkdance Parent's Permit TemplateNicole Anne Santiago SibuloNo ratings yet

- Comprehensive Problem 2Document4 pagesComprehensive Problem 2Nicole Anne Santiago SibuloNo ratings yet

- Comprehensive Problem 2Document4 pagesComprehensive Problem 2Nicole Anne Santiago SibuloNo ratings yet

- Glenn Jake C. Coronel 7-Cadores Research AssignmentDocument1 pageGlenn Jake C. Coronel 7-Cadores Research AssignmentNicole Anne Santiago SibuloNo ratings yet

- Shaine Andrea P. Sabiña Project 1st HalfDocument15 pagesShaine Andrea P. Sabiña Project 1st HalfNicole Anne Santiago SibuloNo ratings yet

- Illustrative Problem 4-2Document5 pagesIllustrative Problem 4-2Nicole Anne Santiago SibuloNo ratings yet

- Registration Form STARDocument2 pagesRegistration Form STARNicole Anne Santiago SibuloNo ratings yet

- Sibulo - Household CodesDocument1 pageSibulo - Household CodesNicole Anne Santiago SibuloNo ratings yet

- Methodology: ST ND RDDocument1 pageMethodology: ST ND RDNicole Anne Santiago SibuloNo ratings yet

- Acot103 - Final Exam Answer SheetDocument1 pageAcot103 - Final Exam Answer SheetNicole Anne Santiago SibuloNo ratings yet

- Research G10 2.0Document10 pagesResearch G10 2.0Nicole Anne Santiago Sibulo100% (1)

- Sibulo - Then - Meaning of Christian MarriageDocument1 pageSibulo - Then - Meaning of Christian MarriageNicole Anne Santiago SibuloNo ratings yet

- Sibulo - Accp Week Reflection PaperDocument1 pageSibulo - Accp Week Reflection PaperNicole Anne Santiago SibuloNo ratings yet

- UntitledDocument2 pagesUntitledNicole Anne Santiago SibuloNo ratings yet

- Acot103 Final ExamDocument8 pagesAcot103 Final ExamNicole Anne Santiago SibuloNo ratings yet

- SAMPLE PROBLEMS Chi Square TestDocument2 pagesSAMPLE PROBLEMS Chi Square TestNicole Anne Santiago SibuloNo ratings yet

- ACCT101 - MidtermsDocument15 pagesACCT101 - MidtermsNicole Anne Santiago SibuloNo ratings yet

- Sibulo - Acot103 - Final Exam Answer SheetDocument1 pageSibulo - Acot103 - Final Exam Answer SheetNicole Anne Santiago SibuloNo ratings yet

- 2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Document7 pages2020-02-ACCA112-OPTION CONTRACT-ILLUS 1 and 2Nicole Anne Santiago SibuloNo ratings yet

- SodapdfDocument61 pagesSodapdfNicole Anne Santiago SibuloNo ratings yet

- Sibulo - Acot103 - Final Exam Answer SheetDocument1 pageSibulo - Acot103 - Final Exam Answer SheetNicole Anne Santiago SibuloNo ratings yet

- Acot103 - Midterm Exam Answer SheetDocument2 pagesAcot103 - Midterm Exam Answer SheetNicole Anne Santiago SibuloNo ratings yet

- Intermediate Accounting - ReviewerDocument29 pagesIntermediate Accounting - ReviewerEthelyn Cailly R. ChenNo ratings yet

- ACCT101 NotesDocument12 pagesACCT101 NotesNicole Anne Santiago SibuloNo ratings yet

- Auditing Problem From Audit of InvestmentDocument61 pagesAuditing Problem From Audit of InvestmentNicole Anne Santiago SibuloNo ratings yet

- Statistical AnalysisDocument9 pagesStatistical AnalysisNicole Anne Santiago SibuloNo ratings yet

- ACCT101 NotesDocument20 pagesACCT101 NotesNicole Anne Santiago SibuloNo ratings yet

- Relevant CostingMake or Buy Special Order - S 1Document2 pagesRelevant CostingMake or Buy Special Order - S 1Nicole Anne Santiago SibuloNo ratings yet

- Sec 138 - NEGOTIABLE INSTRUMENT ACTDocument24 pagesSec 138 - NEGOTIABLE INSTRUMENT ACTamitNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- CFAF Std. T&C (EL) - Standard Terms and Conditions Governing Education LoanDocument5 pagesCFAF Std. T&C (EL) - Standard Terms and Conditions Governing Education LoanAvinab PandeyNo ratings yet

- Lesson: G.R. No. 167567 - SMC V PuzonDocument2 pagesLesson: G.R. No. 167567 - SMC V PuzonCristelle Elaine ColleraNo ratings yet

- People Vs WagasDocument2 pagesPeople Vs WagasZoe VelascoNo ratings yet

- The Need For A System of Credit: People Buy Things That They Cannot Afford To Pay For at The Moment, But Probably Can Pay For in The Long RunDocument63 pagesThe Need For A System of Credit: People Buy Things That They Cannot Afford To Pay For at The Moment, But Probably Can Pay For in The Long RunjaneNo ratings yet

- Megacosm - Order - FormDocument4 pagesMegacosm - Order - FormSwetha MaguluriNo ratings yet

- 3.sesbreno Vs CaDocument2 pages3.sesbreno Vs CaJesa FormaranNo ratings yet

- 01 Maralit vs. Imperial G.R. No. 130756, 21 January 1999, SCRA 605 FactsDocument12 pages01 Maralit vs. Imperial G.R. No. 130756, 21 January 1999, SCRA 605 FactsMadeleine DinoNo ratings yet

- Module1-Cash and Cash Equivalents: Learning ObjectivesDocument16 pagesModule1-Cash and Cash Equivalents: Learning ObjectivesSaclao John Mark GalangNo ratings yet

- Reservation Agreement 2023 08.23.23 1Document3 pagesReservation Agreement 2023 08.23.23 1Juvelyn LobingcoNo ratings yet

- Negotiable Instruments Act, 1881 - IPleadersDocument19 pagesNegotiable Instruments Act, 1881 - IPleadersIndraprakash RaiNo ratings yet

- CashDocument16 pagesCashJemson YandugNo ratings yet

- Espino Vs Presquito, A.C No. 4762 (Legal Ethics)Document3 pagesEspino Vs Presquito, A.C No. 4762 (Legal Ethics)Marlouis U. Planas100% (1)

- Plaintiff-Appellee Vs Vs Accused-Appellant The Solicitor General Francisco J. Farolan Oscar G. RaroDocument9 pagesPlaintiff-Appellee Vs Vs Accused-Appellant The Solicitor General Francisco J. Farolan Oscar G. RaroKathleen MartinNo ratings yet

- People of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Document3 pagesPeople of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Lexa L. DotyalNo ratings yet

- Promissory NoteDocument2 pagesPromissory NotealaricelyangNo ratings yet

- V3 Chit Funds 143A ApplicationDocument2 pagesV3 Chit Funds 143A ApplicationMegha SharmaNo ratings yet

- SMC Vs PuzonDocument2 pagesSMC Vs Puzonaldenamell100% (2)

- HW On Cash ADocument7 pagesHW On Cash ARedNo ratings yet

- Contract To Sell (Land)Document4 pagesContract To Sell (Land)Brian SabaloNo ratings yet

- Intermediate Accounting 1a Cash and Cash EquivalentsDocument8 pagesIntermediate Accounting 1a Cash and Cash EquivalentsGinalyn FormentosNo ratings yet

- Wong v. Court of Appeals, G.R. No. 117857, February 02, 2001Document10 pagesWong v. Court of Appeals, G.R. No. 117857, February 02, 2001Krister VallenteNo ratings yet

- CASH & CASH EQUIVALENTS Part 1 - StudentsDocument27 pagesCASH & CASH EQUIVALENTS Part 1 - StudentsAngel PulvinarNo ratings yet

- Reservation Agreement With Vat Revised2019 4Document2 pagesReservation Agreement With Vat Revised2019 4noemark burgosNo ratings yet

- Sihi V IacDocument2 pagesSihi V IacFrancis Kyle Cagalingan SubidoNo ratings yet

- Yusay Barcelona Complaint AffidavitDocument8 pagesYusay Barcelona Complaint AffidavitBelenReyesNo ratings yet

- Ia1 Posttest1 - Cash Composition (Key)Document9 pagesIa1 Posttest1 - Cash Composition (Key)Chris JacksonNo ratings yet