Professional Documents

Culture Documents

Cash & Cash Equivalent Lecture Notes

Uploaded by

Rena Lyn ManzanoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash & Cash Equivalent Lecture Notes

Uploaded by

Rena Lyn ManzanoCopyright:

Available Formats

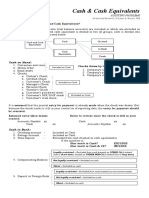

CHAPTER 1: “Cash & Cash Equivalents” Q: How do we account company’s drawn check but not withdrawable?

A: These should be reverted (added back) to cash in bank.

Topic 1: “Composition” 1. Company’s stale check

2. Company’s postdated check

• There are many compositions of cash and cash equivalents, to easily understand 3. Company’s undelivered check

the composition we break it down first to (1) cash and (2) cash equivalents Q: What are the items to be included as part “cash in bank”?

Q: What is the composition of “cash”? A:

A: To qualify as cash, it should be immediately available for unrestricted 1. Checking account / demand deposit / current account

use. Cash is composed of three (3) groups: 2. Savings deposit

§ Cash on hand

Q: What are the items to be excluded as part “cash in bank”?

§ Cash in bank

A:

§ Cash fund

1. Time deposit

2. Deposit in closed bank

Q: What is the composition of “cash on hand”?

3. Deposit in foreign bank – restricted

A: 1. Currencies (bills) and coins.

4. Compensating balance – legally restricted

2. Money order

5. Bank overdraft – different bank

3. Bank drafts

4. Checks Q: What is the treatment to compensating balance?

A:

Q: What are the checks to be included as part of cash on hand? If not legally restricted, it should be included as part of cash.

A: If legally restricted, it should be excluded as part of cash.

1. Certified checks 4. Cashier’s check § If relates to short term borrowing, it is presented as part of current asset.

2. Manager’s check 5. Customer’s check § If relates to long term borrowing, it is presented as part of non-current asset.

3. Personal check 6. Traveler’s check If the problem is silent, assume it is not legally restricted.

Q: What is the treatment to bank overdraft?

Q: What are the checks that is not included as part of cash on hand? A:

A: Different bank = current liability, (ignore in computing cash composition)

Checks that are not withdrawable as of balance sheet date. Same bank = offset to cash in bank (include as deduction in computing cash)

These checks should be included as part of receivables. If the problem is silent, it is assumed to be in different bank.

1. Customer’s checks NSF/DAIF/DAUD check Q: What are the cash funds that should be included as part of your cash?

2. Customer’s postdated check A:

3. Customer’s stale check Cash funds are classified into two (2):

§ Cash fund for current operation – included as part of cash

§ Cash fund not available for current operation – excluded as part of cash

H1: “Cash and Cash Equivalents” Page 1 of 6

Q: What are the other items to be excluded from cash and cash equivalents?

Q: What are the items classified as cash fund for current operation (included)? A:

A: These are cash set aside for payment of (1) current liability or (2) operating expenses 1. IOUs from employees – presented as receivable

2. Postage stamps – presented as supplies

1. Petty cash fund 5. Tax fund

3. Credit memo from suppliers – presented as deduction from liability

2. Revolving fund 6. Interest fund

4. Cash surrender value (CSV) – presented as non-current asset

3. Payroll fund 7. Dividend fund

4. Travel fund 8. Change fund Summary of inclusion and exclusion as general rule

Q: What are the items classified as cash fund for not for operation (excluded)?

Included as part of C & CE Excluded as part of C & CE

A: These are cash set aside for payment of (1) non-current liability or (2) non-current asset

1. Currencies and coins 1. Customer’s NSF checks

1. Sinking fund 4. PPE acquisition fund 2. Money order 2. Customer’s postdated checks

2. Pension fund 5. Depreciation fund 3. Bank draft 3. Customer’s stale checks

3. Preference share redemption fund 6. Insurance fund 4. Certified checks 4. Deposit in closed bank

7. Contingency fund 5. Manager’s checks 5. Deposit in foreign bank – restricted

6. Personal checks 6. Compensating balance restricted

Notes: 7. Cashier’s check 7. Overdraft

• Cash fund for settlement of liability (1-3) expected to disburse within 12 months, 8. Customer’s check 8. Sinking fund

included as part of cash. 9. Traveler’s check 9. Pension fund

• Cash fund set aside for acquisition of asset (1-4), always excluded as part of cash. 10. Company’s stale checks 10. Preference share redemption fund

• Cash fund for settlement of NCL (1-3), if silent, should be excluded as part of cash. 11. Company’s postdated checks 11. PPE acquisition fund

12. Company’s undelivered checks 12. Depreciation fund

Q: What are the cash equivalents to be included as part of cash? 13. Checking account 13. Insurance fund

A: 14. Savings account 14. Contingency fund

15. Compensating bal. not restricted 15. IOUs

Cash equivalents are investment that are highly liquid and readily convertible into cash.

16. Petty cash fund 16. Postage stamps

Subject to insignificant risk of change in value.

17. Revolving fund 17. Credit memo from supplier

To be qualified as highly liquid, the duration should be three (3) months from the date

18. Payroll fund 18. Cash surrender value

of purchase up to maturity date. 19. Travel fund

In the event it exceeds 3 months, it should be presented as 20. Tax fund

§ Current asset, if the maturity is within 12 months from reporting date. 21. Interest fund

§ Noncurrent asset, if the maturity is beyond 12 months from reporting date. 22. Dividend fund

• If the problem is silent as to the duration or date of acquisition and maturity, it is 23. Change fund

24. Time deposit/certificate of deposit

assumed to be highly liquid (within 3 months) therefore, included as part of C & CE. 25. Commercial paper

1. Time deposit / certificate of deposit 26. Money market

2. Commercial paper / money market 27. Treasury bills

3. Treasury bills / treasury warrants / treasury bonds 28. Investment in redeemable

preference shares

4. Investment in preference share with specific redemption date

H1: “Cash and Cash Equivalents” Page 2 of 6

Topic 2: “Petty Cash Fund”

Q: What is the journal entry involving petty cash fund (PCF)?

Establishment: Disbursement coming from the petty

Dr. Petty cash fund XX = imprest balance cash No journal entry.

Cr. Cash in bank XX = imprest balance

Increase of imprest balance: Decrease of imprest balance:

Dr. Petty cash fund XX = increase of imprest balance Dr. Cash in bank XX = decrease of imprest balance

Cr. Cash in bank XX = increase of imprest balance Cr. Petty cash fund XX = decrease of imprest balance

Replenishment of petty cash fund: Year-end adjustment of petty cash fund:

Dr. Various expenses XX = amount of vouchers Dr. Various expenses XX = amount of vouchers

Cr. Cash in bank XX = note A Cr. Petty cash fund XX = note B

Note A: the amount credited to cash in bank upon replenishment is computed below: Note B: the amount credited to petty cash at year-end adjustment is equal to:

Imprest balance of petty cash fund XX Imprest balance of petty cash fund XX

Remaining petty cash fund (XX) Remaining petty cash fund (XX)

Amount credited to cash in bank XX Amount credited to petty cash fund XX

Q: How to compute petty cash “shortage” or “overage”?

• Petty cash shortage arises when the cashier’s accountability > accounted.

• Petty cash overage arises when the cashier’s accountability < accounted.

Accountability Accounted

(1) Imprest balance (1) Remaining currency

(2) Undeposited customer currency collection (a) (2) Undeposited customer currency collection

(3) Undeposited customer check collection (3) Undeposited customer check collection

(4) Unclaimed employee salary (4) Paid vouchers

(5) Excess of travel advances (5) Replenishment checks (b)

(6) Employee contribution (7) Envelop containing Employee contribution (c)

(8) IOUs

Accommodation check (d)

Total Total

(a) – undeposited customer’s check only includes those check that are withdrawable, meaning it excludes: (1) NSF; (2) postdated; and (3) stale checks.

(b) – replenishment checks are checks that are payable to the custodian.

(c) – employee contribution will be included in the accounted only if it the envelop actually contains the employee contribution. (sealed, closed)

(d) – accommodation checks are checks made by the employee payable to the company.

(e) – checks issued by the company are ignored in computing the cash shortage.

H1: “Cash and Cash Equivalents” Page 3 of 6

Q: How to compute the adjusted petty cash fund balance at year-end? (for auditing)

Currencies and coins at the date of cash count XX Topic 3: “Bank Reconciliation & Proof of Cash”

+ petty cash disbursement from January 1 to count date XX

– currency collections from January 1 to count date (XX) Q: How to compute the adjusted cash in bank balance and the unadjusted balance?

Currency and coins at year-end XX

Currencies and coins not belonging in the petty cash fund Per book Per bank

1. Undeposited customer currency collection XX Unadjusted balance per ledger + + Unadjusted balance per bank statement

2. Unclaimed salary XX Credit memos + Deposit in transit

3. Excess of advance travel expense XX 1. loan proceeds

4. Employee contribution (in the there were no currency in the envelop) XX (XX) 2. note collection in behalf of Co.

Currencies and coins belonging to petty cash fund XX 3. interest earned from bank

+ petty cash fund not in the form of currencies Debit memo – – Outstanding checks

1. Replenishment checks XX 1. NSF check

2. Accommodation check that are withdrawable at year-end XX 2. Bank service charge

Adjusted petty cash fund at year-end XX 3. Automatic debit

Book errors Bank errors

1. Understatement of receipt + + 1. Erroneous bank disbursement

2. Overstatement of disbursement + + 2. Unrecorded bank receipt

Simplified (for FAR)

3. Overstatement of receipt – – 3. Erroneous bank receipt

Currencies and coins XX 4. Understatement of disbursemnt – – 4. Unrecorded disbursement

+ vouchers dated January 1 onwards (or after year-end) XX Adjusted cash in bank balance Adjusted cash in bank balance

+ replenishment check XX

+ accommodation check (withdrawable as of year-end) XX Q: How to proof of cash?

– employee contribution (in case the envelop is opened) (XX)

First, compute for the unadjusted balances if not given.

Adjusted petty cash balance at year-end XX

Q: How to compute the unadjusted book and bank receipt and disbursement?

Per bank

Checks withdrawn (per record) XX XX Deposits received (per record)

Debit memo, current month XX XX Credit memo, current month

Correction of over receipt XX XX Correction of over disburse

Correction of under disburse XX XX Correction of under receipt

Unadjusted debit / disbursement XX XX Unadjusted credit / receipt

Per book

Collection from customer (per record) XX XX Checks issued to supplier (per record)

Credit memo, prior period XX XX Debit memo, prior month

Correction of over receipt XX XX Correction of over disbursement

Correction of under disbursement XX XX Correction of under receipt

Unadjusted debit / disbursement XX XX Unadjusted credit / receipt

H1: “Cash and Cash Equivalents” Page 4 of 6

Q: How to compute the adjusted balances?

Per bank

Beginning Receipt Disbursement Ending

Unadjusted xx xx xx xx

Deposit in transit, beg + –

Deposit in transit, end + +

Outstanding check, beg – –

Outstanding check, end + –

Erroneous debit last month corrected current month + –

Erroneous credit last month corrected current month – –

Erroneous debit last month not yet corrected + +

Erroneous credit last month not yet corrected – –

Erroneous debit this month corrected current month – –

Erroneous credit this month corrected current month – –

Erroneous debit this month not yet corrected – +

Erroneous credit this month not yet corrected – –

Unrecorded debit last month, recorded current month – –

Unrecorded credit last month, recorded current month + –

Unrecorded debit last month, not yet recorded – –

Unrecorded credit last month, not yet recorded + +

Per book

Beginning Receipt Disbursement Ending

Unadjusted xx xx xx xx

Credit memo, last month recorded this month + –

Credit memo, last month not yet recorded + +

Credit memo, this month + +

Debit memo, last month recorded this month – –

Debit memo, last month not yet recorded – –

Debit memo, this month + –

Overstatement of receipt last month corrected current month – –

Overstatement of receipt last month not yet corrected – –

Overstatement of receipt this month not yet corrected – –

Overstatement of disbursement last month corrected this month + –

Overstatement of disbursement last month not yet corrected + +

Overstatement of disbursement this month not yet corrected – +

Overstatement of disbursement or receipt this month correct current month – –

Understatement of receipt last month corrected this month + –

Understatement of receipt last month not yet corrected + +

Understatement of receipt this month not yet corrected + +

Understatement of disbursement last month corrected this month – –

– –

Understatement of disbursement. last month not yet corrected

Understatement of disbursement. this month not yet corrected + –

Understatement of disbursement or receipt dis mo. correct dis mo. none none none none

H1: “Cash and Cash Equivalents” Page 5 of 6

Special Adjustments

(1) NSF check redeposited in the same month without entry made on the return and Topic 4: “Shortage”

redeposit. Q: How to compute cash shortage from in a “accrual to cash problem”?

Alternative 1 Beginning cash balance XX

Per book Cash receipts during the year XX

Beginning Receipt Disbursement Ending Cash disbursements during the year (XX)

NSF check redeposited in the + + Ending cash balance – should be (accountability) XX

same month Unadjusted cash balance per bank XX

Alternative 2 Deposit in transit XX

Per bank Outstanding checks (XX)

Beginning Receipt Disbursement Ending Ending cash balance – actual (accounted) XX

NSF check redeposited in the – – Ending cash balance – should be (accountability) XX

same month Ending cash balance – actual (accounted) (XX)

Cash shortage XX

(2) Cash receipt paid out in cash. Q: How to compute cash shortage from in a “bank reconciliation problem”?

Alternative 1 Per book Per bank

Per book Unadjusted balance per ledger + + Unadjusted balance per bank statement

Beginning Receipt Disbursement Ending Credit memos + + Deposit in transit

Cash receipt paid out in cash – – 1. loan proceeds

2. note collection in behalf of Co.

Alternative 2 3. interest earned from bank

Per bank Debit memo – – Outstanding checks

Beginning Receipt Disbursement Ending 1. NSF check

Cash receipt paid out in cash + + 2. Bank service charge

3. Automatic debit

Book errors Bank errors

(3) NSF check recorded as deduction of receipt 1. Understatement of receipt + + 1. Erroneous bank disbursement

Adjustment 2. Overstatement of disbursement + + 2. Unrecorded bank receipt

3. Overstatement of receipt – – 3. Erroneous bank receipt

Per book

4. Understatement of disbursement – – 4. Unrecorded disbursement

Beginning Receipt Disbursement Ending

NSF check recorded as + + Unrecorded disbursement (shortage)

deduction of receipt Adjusted cash in bank balance XX XX Adjusted cash in bank balance

Squeeze

END

H1: “Cash and Cash Equivalents” Page 6 of 6

You might also like

- FAR Lecture NotesDocument80 pagesFAR Lecture NotesJuan Miguel Suerte Felipe100% (2)

- Cash and Cash Equivalent AuditingDocument8 pagesCash and Cash Equivalent Auditing수지No ratings yet

- Summarized Notes: Let'S Go!Document7 pagesSummarized Notes: Let'S Go!Andrei Nicole Mendoza RiveraNo ratings yet

- Audit - Cash and Cash Equivalents PDFDocument15 pagesAudit - Cash and Cash Equivalents PDFSiena Farne100% (1)

- LECTURE NOTES - Aud ProbDocument15 pagesLECTURE NOTES - Aud ProbJean Ysrael Marquez100% (1)

- NU - Audit of Cash and Cash EquivalentsDocument14 pagesNU - Audit of Cash and Cash EquivalentsDawn QuimatNo ratings yet

- Module 3 Cash and Cash EquivalentsDocument32 pagesModule 3 Cash and Cash Equivalentschuchu tv100% (1)

- Cash and Cash EquivalentsDocument10 pagesCash and Cash EquivalentsMs VampireNo ratings yet

- 2021 Chapter 3 Audit of Cash Student GuideDocument29 pages2021 Chapter 3 Audit of Cash Student GuideJan Luis RamiroNo ratings yet

- Banking FinalsDocument15 pagesBanking FinalsApril CastilloNo ratings yet

- Cash & Cash EquivalentsDocument20 pagesCash & Cash Equivalentsalexis prada100% (2)

- Cash & Cash Equivalents, Lecture &exercisesDocument16 pagesCash & Cash Equivalents, Lecture &exercisesNMCartNo ratings yet

- Marketing Management - II PDFDocument149 pagesMarketing Management - II PDFjio teamNo ratings yet

- Feu Notes 231Document7 pagesFeu Notes 231Naiv Yer NagaliNo ratings yet

- Audit ProblemsDocument47 pagesAudit ProblemsShane TabunggaoNo ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Acccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Document7 pagesAcccob 2 Lecture 2 Cash and Cash Equivalents T2ay2021Rey HandumonNo ratings yet

- Secret-Notes BY Cayetano: Accountancy (University of Northern Philippines)Document99 pagesSecret-Notes BY Cayetano: Accountancy (University of Northern Philippines)Erika Faith HalladorNo ratings yet

- Chapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankDocument8 pagesChapter 1: Cash and Cash Equivalents Expected Question(s) :: Cash On Hand Cash Fund Cash in BankJulie Mae Caling MalitNo ratings yet

- Topic 1 - Cash and Cash EquivalentsDocument2 pagesTopic 1 - Cash and Cash EquivalentsJust AlexNo ratings yet

- Topic 1 - Audit of Cash Transactions and BalancesDocument6 pagesTopic 1 - Audit of Cash Transactions and BalancesChelsea PagcaliwaganNo ratings yet

- Cce Part1 Cash and Cash Equivalents CompressDocument2 pagesCce Part1 Cash and Cash Equivalents CompressMARK JHEN SALANGNo ratings yet

- INTACC - Chapter 1Document4 pagesINTACC - Chapter 1MeriiiNo ratings yet

- Module 1.2Document19 pagesModule 1.2Althea mary kate MorenoNo ratings yet

- Intermediate Accounting 1.2Document7 pagesIntermediate Accounting 1.2Pia SolNo ratings yet

- Sta Clara - Summary Part 1Document49 pagesSta Clara - Summary Part 1Carms St ClaireNo ratings yet

- ACCO 20053 Lecture Notes 1 - Cash and Cash EquivalentsDocument3 pagesACCO 20053 Lecture Notes 1 - Cash and Cash EquivalentsVincent Luigil AlceraNo ratings yet

- Accounting For Cash and Cash TransactionDocument63 pagesAccounting For Cash and Cash TransactionAura Angela SeradaNo ratings yet

- Module 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Document6 pagesModule 2A - ACCCOB2 Lecture 2 - Cash and Cash Equivalents - FHV T1AY2021Cale Robert RascoNo ratings yet

- Cash and Cash Equivalents Lecture NotesDocument2 pagesCash and Cash Equivalents Lecture Notesyna kyleneNo ratings yet

- Cash Part1Document7 pagesCash Part1cuaresmamonicaNo ratings yet

- Int. Acc 1 Chap 1Document6 pagesInt. Acc 1 Chap 1Nicole Anne Santiago SibuloNo ratings yet

- Cash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheDocument4 pagesCash Cash - Money and Other Negotiable Instrument That Is Payable in Money and Acceptable by TheannyeongNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsCamille Joyce Corpuz Dela CruzNo ratings yet

- PPT2.1-1 Cash and Cash Equivalents (2020)Document42 pagesPPT2.1-1 Cash and Cash Equivalents (2020)Avery Paul MateoNo ratings yet

- CashDocument3 pagesCashKimNo ratings yet

- Ia1 Mod 1Document9 pagesIa1 Mod 1omssheshNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- Far ReviewerDocument5 pagesFar ReviewerKairo ZeviusNo ratings yet

- 3 Cash - Lecture Notes PDFDocument11 pages3 Cash - Lecture Notes PDFJohn Paul EslerNo ratings yet

- Cash and Cash Equivalents (Class Notes)Document5 pagesCash and Cash Equivalents (Class Notes)IAN PADAYOGDOGNo ratings yet

- Module 5 - Substantive Test of CashDocument6 pagesModule 5 - Substantive Test of CashJesievelle Villafuerte NapaoNo ratings yet

- Intacc 1 Cash and Cash Equivalents-1Document10 pagesIntacc 1 Cash and Cash Equivalents-1randel10caneteNo ratings yet

- Cash & Cash Equivalents, LECTURE &EXERCISESDocument16 pagesCash & Cash Equivalents, LECTURE &EXERCISESNMCartNo ratings yet

- 2020 Chapter 3 Audit of Cash Student GuideDocument29 pages2020 Chapter 3 Audit of Cash Student GuideBeert De la CruzNo ratings yet

- Assignment Mo BoboDocument5 pagesAssignment Mo BoboRommel Cabel CapalaranNo ratings yet

- Cash and Cash Equivalents ReviewerDocument4 pagesCash and Cash Equivalents ReviewerWinnie ToribioNo ratings yet

- Audit ProblemsDocument32 pagesAudit ProblemsShane TabunggaoNo ratings yet

- 01 Cash & CE CompositionDocument3 pages01 Cash & CE Compositionsharielles /No ratings yet

- Acct 312 Chapter 6Document32 pagesAcct 312 Chapter 6jantriciadNo ratings yet

- Topic 1 - Cash and Cash Equivalents 2Document2 pagesTopic 1 - Cash and Cash Equivalents 2Harah LamanilaoNo ratings yet

- Iv.-Cash and Cash EquivalentsDocument4 pagesIv.-Cash and Cash Equivalentsby ScribdNo ratings yet

- Santa-Ana Jerald Accounting For Cash Cash and Cash EquivalentsDocument11 pagesSanta-Ana Jerald Accounting For Cash Cash and Cash EquivalentsSanta-ana Jerald JuanoNo ratings yet

- 01 CashandCashEquivalentsNotesDocument7 pages01 CashandCashEquivalentsNotesVeroNo ratings yet

- 01 Intermediate Accounting 1 PrelimDocument7 pages01 Intermediate Accounting 1 PrelimRoyu BreakerNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- Mo 10 Balancing Cash HoldingsDocument30 pagesMo 10 Balancing Cash HoldingsGeleta BikilaNo ratings yet

- 1 CashDocument6 pages1 CashMikaella SaduralNo ratings yet

- Intermediate Accounting 1: Cash and Cash EquivalentDocument17 pagesIntermediate Accounting 1: Cash and Cash EquivalentClar AgramonNo ratings yet

- Conceptual Framework & Accounting Standards: Northeastern CollegeDocument5 pagesConceptual Framework & Accounting Standards: Northeastern CollegeMikaella SaduralNo ratings yet

- What Is AccountingDocument76 pagesWhat Is AccountingMa Jemaris Solis0% (1)

- Mickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Document37 pagesMickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Sandeep ManipatruniNo ratings yet

- Sugar Carr 872eDocument24 pagesSugar Carr 872eSainaath RNo ratings yet

- Indumoti Pandaveswar 0956Document2 pagesIndumoti Pandaveswar 0956souravsrkNo ratings yet

- Accounting StandardsDocument105 pagesAccounting Standardskrishnakantpachouri026No ratings yet

- MOW Marketing PlanDocument29 pagesMOW Marketing Plandanlor1991100% (1)

- Unit-Linked Fund: Virtue II (Open Fund)Document1 pageUnit-Linked Fund: Virtue II (Open Fund)sandeepNo ratings yet

- Process Costing-WIPDocument3 pagesProcess Costing-WIPSigei LeonardNo ratings yet

- Marketing 1Document4 pagesMarketing 1Crisielyn BuyanNo ratings yet

- Black Book Project Sem 4 (Sangeeta) SampleDocument72 pagesBlack Book Project Sem 4 (Sangeeta) SamplebottomgeezNo ratings yet

- Hotel Accountancy Unit Test March 2022Document2 pagesHotel Accountancy Unit Test March 2022sumitha ganesanNo ratings yet

- Template SuppliesDocument4 pagesTemplate SuppliesAceco JanitorialNo ratings yet

- Kindly Find The Complete Steps For Indian Payroll ConfigurationDocument10 pagesKindly Find The Complete Steps For Indian Payroll ConfigurationAmruta HanagandiNo ratings yet

- Ra 7641 & 7549 ProvisionsDocument3 pagesRa 7641 & 7549 ProvisionsRebecca ChanNo ratings yet

- ManuelitaDocument92 pagesManuelitaMarco Augusto Robles AncajimaNo ratings yet

- Advanced Business Calculations/Series-3-2011 (Code3003)Document15 pagesAdvanced Business Calculations/Series-3-2011 (Code3003)Hein Linn Kyaw86% (21)

- Edward J. Nell Company vs. Pacific Farms, Inc.Document2 pagesEdward J. Nell Company vs. Pacific Farms, Inc.Christian Joe QuimioNo ratings yet

- Business Summit 2015Document10 pagesBusiness Summit 2015UrtaBaasanjargalNo ratings yet

- Slide bài giảng môn Lý Thuyết kế toánDocument49 pagesSlide bài giảng môn Lý Thuyết kế toándacminNo ratings yet

- Chapter - 2: FinancialDocument21 pagesChapter - 2: FinancialYasir Saeed AfridiNo ratings yet

- Warehouse Receipt System: Between Expectation and Reality: Sistem Resi Gudang Di Indonesia: Antara Harapan Dan KenyataanDocument18 pagesWarehouse Receipt System: Between Expectation and Reality: Sistem Resi Gudang Di Indonesia: Antara Harapan Dan KenyataanFiryal BarakudaNo ratings yet

- Veloso Case Digests For ObliconDocument10 pagesVeloso Case Digests For ObliconRalph VelosoNo ratings yet

- Brgy. 34 Monthly Reports 2014Document30 pagesBrgy. 34 Monthly Reports 2014Katrina Marie A. BelloNo ratings yet

- Unit - 19 - Accounting and Financial Statement SlidesDocument41 pagesUnit - 19 - Accounting and Financial Statement SlidesPychNo ratings yet

- A Contemporary Example of Riba AlDocument4 pagesA Contemporary Example of Riba AlAnnum RafiqueNo ratings yet

- SME Development Challenges and Opportunities in Bangladesh: A Case Study On Poultry Hatcheries by Triple Triangle Framework (TTF)Document20 pagesSME Development Challenges and Opportunities in Bangladesh: A Case Study On Poultry Hatcheries by Triple Triangle Framework (TTF)meftahul arnobNo ratings yet

- RFQ Epc Final - 01112016Document68 pagesRFQ Epc Final - 01112016TAMILNo ratings yet