Professional Documents

Culture Documents

Project Report at A Glance

Uploaded by

Raj StudioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Report at A Glance

Uploaded by

Raj StudioCopyright:

Available Formats

Project Report at a glance

1. Name of the Entrepreneur : Pintu Kumar

2. Constitution (Legal Status) : Individual

3. Father’s Name / spouse’s Name :

4. Unit Address :

5. Product and By Product : Fly Ash Bricks

6. Cost of Project : 5,95,000/-

7. Means of Finance

Term Loan : Rs. 4,75,000.00

Own Capital : Rs. 1,20,000.00

8. Pay Back Period : 5 Years

9. Project Implement period : 12 Months

10. Employment : 6

11. Power requirement : 5 HP

12. Major Raw Material : Fly Ash, Stone Dust, Cements, Lime, Sand

13. Estimated annual sale turnover : Rs. 54,00,000.00

DETAILED PROJECT REPORT

INTRODUCTION :

Concrete bricks produced with or without frog, bricks are uniform in shape and size,

there for bricks is less mortar in brick work. Plaster thickness required will be less

compared to clay Bricks thus saving of cement mortar. Concrete bricks are

environment friendly as: (i) it uses stone dust which is by products of stone curser (ii)

Saves agriculture land which is used in manufacturing of clay bricks (iii) Lessen energy

intensive compared to clay brick sand helps in keeping environment clean. Concrete

bricks are a well-proven building material and used as a brunt clay bricks. NIC CODE

26958 ( Based on ASICC 2004)for Concrete Bricks. Large number of houses is being

constructed with these bricks by privet parties and government agencies across the

India. Particularly in Rural area if this kind of Concrete bricks plant is installed and

manufactured bricks this will bring employment for such area.

2. ABOUT THE PROMOTER:

Mr. Pintu Kumar, aged 40 years is the proprietor of this business is hardworking self employed

with leadership quality to monitor day to day affairs of the business.

3. COST OF PROJECT

A Fixed Capital Investment

a. Land Rent Own

b. Work shed Area Sq. Ft Rate in Rs Amt. in Rs

Manufacturing Area 4000 0.00 0.00

Office Area 100 0.00 00.00

0 0 0.00 0.00

0 0 0.00 0.00

0 0 0.00 0.00

0 0 0.00 0.00

0 0 0.00 0.00

Total 0.00

c. Machinery Qty Rate Amounts

Bricks Making Machine 1 0.00 0.00

Electric and Water 1 10.00 0.00

System

0 0 0.00 0.00

0 0 0.00 0.00

0 0 0.00 0.00

0 0 0.00 0.00

0 0 0.00 0.00

0 0 0.00 0.00

Total 00.00

d. Preliminary & Pre-operative Cost Rs. 0.00

e. Furniture and Fixtures Rs. 0.00

f. Contingency/Other Miscellaneous Rs.0.00

Total capital Expenditure Rs,4,95,000.00

Working capital Rs. 1,00,000.00

Total Cost Project Rs. 5,95,000.00

3.1 Means of Financing

Own contribution Rs. 1,20,000.00

Bank Finance Rs. 4,00,000.00

Term Loan Rs 75,000.00

Working Capital Rs. 4,75,000.00

Total Rs. 5,95,000.00

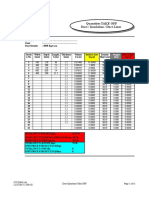

3.2 STATEMENT SHOWING THE PRPAYMENT OF TERM LOAN & WORKING CAPITAL

TERM LOAN

Year Opening Balance Installment Closing Balance Interest @12%

1st 807500 1615000 1518100 96900

2nd 1518100 1615000 1432828 182172

3rd 1432828 1615000 144306 171939

4th 144306 1615000 144183 173167

5th 144183 1615000 1441980 173020

6th 0 0 0 0

7th 0 0 0 0

8th 0 0 0 0

WORKING CAPITAL

Year Opening Balance Installment Closing Balance Interest @12%

Year 475000 95000 475000 57000

1st 380000 95000 380000 45600

2nd 285000 95000 285000 34200

3rd 190000 95000 190000 22800

4th 95000 95000 95000 11400

5th 0 0 0 0

6th 0 0 0 0

7th 0 0 0 0

8th 0

3.3 STATEMENT SHOWING THE DEPRECIATION ON FIXED ASSETS

Workshed @ 10%

Particular 1st year 2nd Year 3rd year 4th Year 5th Year

Opening Balance 100000 90000 81000 72900 65610

Depreciation 10000 9000 8100 7290 6561

Closing Balance 90000 81000 72900 65610 59049

MACHINERY @ 15%

Opening Balance 5950000 505750 429888 365404 310594

Depreciation 89250 75863 64483 54811 46589

Closing Balance 505750 429888 365404 310594 264005

TOTAL DEPRECIATION

Workshed 10000 9000 8100 7290 6561

Machinery 89250 75863 64483 54811 46589

Total 99250 84863 72583 62101 53150

4. Schedule of Sales Realization

4.1 Details of Sales

Particular of Product Rate / Unit No. of Unit Amount in Rs

0

Concrete Bricks 4.50 1200000 5400000.00

0 0.0 0 0

Total 5400000.00

4.2 Capacity Utilization of Sales

Particular 1st Year 2nd Year 3rd Year 4th Year 5th Year

Capital Utilization 70% 80% 90% 90% 90%

Sales/Receipt 37800000 43200000 4860000 4860000 4860000

5. Raw materials

Particular Unit Rate/Unit Reqd Unit Amount in Rs

Cement 0 1.35 1200000 1620000.00

Lime 0 0.10 1200000 120000.00

Sand 0 0.15 1200000 180000.00

Stone Dust 0 0.07 1200000 84000.00

Other Consumables 0 0.05 1200000 60000.00

0 0 0 0 0

Total 2064000.00

5.1 Wages

Particular No.of Worker Wages Per Month Amt in Rs (Per Annum)

Operator 1 5000.00 60000.00

Labour 5 4000.00 2400000.00

Total 6 300000.00

5.3 Power and Fuel : Rs.54000.00

5.4 Other Overhead Expenses : Rs. 27000.00

6. Administrative Expenses

6.1 Telephone Expenses 2700.00

6.2 Stationary & Postage 1080.00

6.3 Advertisement & Publicity 3240.00

6.4 Work Shed Rent 48000.00

6.5 Other Miscellaneous Expenses 67500.00

Total 122520.00

7. Capacity Utilization of Manufacturing & Administrative Expenses

Particular 1st Year 2nd Year 3rd Year 4th Year 5th Year

Capacity Utilization 70% 80% 90% 90% 90%

Manufacturing Expenses

Raw Material 1444800 1651200 1857600 1857600 1857600

Wages 210000 240000 270000 270000 270000

Repairs & Maintenance 5670 7290 7290 7290 7290

Power & Fuel 37800 48600 48600 48600 48600

Other Overhead Expenses 18900 24300 24300 24300 24300

Administrative Expenses

Salary 0 0 0 0 0

Postage Telephone Expenses 1890 2160 2430 2430 2430

Stationery & Postage 756 864 972 972 972

Advertisement & Publicity 2268 2592 2916 2916 2916

Workshed Rent 48000 48000 48000 48000 48000

Other Miscellaneous Exps 47250 54000 60750 60750 60750

Total 1817334 2070096 2322858 2322858 2322858

8. ASSESSMENT OF WORKING CAPITAL

Particular Amounts in Rs

Sale 5400000.00

Manufacturing Expenses

Raw Material 2064000.00

Wages 300000.00

Repair & Maintenance 8100.00

Power & Fuel 54000.00

Other Over Expenses 27000.00

Production Cost 2453100.00

Administrative Cost 122520.00

Manufacturing Cost 2575620.00

Working Capital Estimate

No. Of Days Basis Amount in Rs

Element of Working Capital

40 Material Cost 275200.00

Raw Material

15 Production Cost 122655.00

Stock in Process

Finished goods 5 Manufacturing Cost 42927.00

7 Manufacturing 59218.00

Receivable by Cost

Per Cycle 500000.00

Total Working Capital Requirement

9. Financial Analysis

9.1 Projected Profit & Loss Account

Particular 0 Year 1st Year 2nd Year 3rd Year 4th Year

Sales/ Receipts 3780000 4320000 4860000 4860000

3780000 4320000 4860000 4860000

Manufacturing Expenses

Raw Material 1444800 1651200 1857600 1857600

Wages 210000 240000 270000 270000

Repairs & Maintenance 5670 6480 7290 7290

Power & Fuel 378000 43200 48600 48600

Other Overhead Expenses 18900 21600 24300 24300

Depreciation 99250 84863 72583 62101

Production Cost 1816420 2047343 2280373 2269891

Administrative Expenses

Salary 0 0 0 0

Postage Telephone Expenses 1890 2160 2430 2430

Stationery & Postage 756 864 972 972

Advertisement & Publicity 2268 2592 2916 2916

Workshed Rent 48000 48000 48000 48000

Other Miscellaneous Exps 47250 54000 60750 60750

Administrative Cost 100164 107616 115068 115068

Interest Bank Credit @12%

Term Loan 96900 182172 171939 173167

Working Capital Loan 5700 45600 34200 22800

Cost of Sale 2052814 2263943 2477179 2439451

Net Profit Before Tax 1727186 2056058 2382821 2420549

Less Tax 0.00 0.00 0.00 0.00

Net Profit 1727186 2056058 2382821 2420549

9.2. Clculation of Debt service credit Ratio (D.S.C.R)

Particular 0 Year 1st Year 2nd Year 3rd Year 4th Year

Net Profit 1727186 2056058 2382821 2420549

Add:

Depreciation 99250 84863 72583 62101

TOTAL – A 1826436 2140920 2455404 2482650

Payments:

On Term Loan

Interest 96900 182172 171939 173167

Installment 1615000 1615000 1615000 1615000

On Working Capital

Interest 57000 45600 34200 22800

TOTAL – B 268280 241034 213788 186542

D.S.C.R = A/B

Average D.S.C.R 6.81 8.88 11.49 13.31

9.3 PROJECTED BALANCE SHEET

Particular 0 Year 1st Year 2nd Year 3rd Year 4th Year

LIABILITIES 59750 59750 59750 59750

Promoters Capital 1727186 2056058 2382821 2420549

Profit 660250 528200 396150 264100

Term Loan 475000 380000 285000 190000

Working Capital Loan 0 0 0 0

Current Liabilities 0 0 0 0

Sundry Creditors 2922186 3024008 3123721 2934399

ASSETS:

Gross Fixed Assets 695000 595750 510888 438304

Less: Depreciation 99250 84863 72583 62101

Net Fixed Assets 595750 510888 438304 376204

Preliminary &Pre-Op- Expenses 0 0 0 0

Current Assets 475000 380000 285000 190000

Cash in Bank/Hand 1851436 2133120 2400417 2368196

Total 2922186 3024008 3123721 2934399

9.4 CASH FLOW STATEMENT:

Particular 0 Year 1st Year 2nd Year 3rd Year 4th Year

Net Profit 1727186 2056058 2382821 2420549

Add: Dpreciation 99250 84863 72583 62101

Term Loan 96900 182172 171939 173167

Working Capital Loan 475000 380000 285000 190000

Promoters Capital 59750 0 0 0

Total 3021436 3049120 3136554 2936750

Total fixed Capital Invested 695000

Repayment of Term Loan 132050 132050 132050 132050

Repayment of WC Loan 95000 95000 95000 95000

Current assets 475000 380000 285000 190000

Total 702050 607050 512050 417050

Opening Balance 0 2319386 4761456 7385960

Surplus 2319386 2442070 2624504 2519700

Closing Balance 2319386 4761456 7385960 9905660

9.5 BREAK EVEN PONT AND RATION ANALYSIS

Particular 0 Year 1st Year 2nd Year 3rd Year 4th Year

Fixed Cost 278644 255863 235189 208861

Variable Cost 1873420 2092943 2314573 2292691

Total Cost 2152064 2348805 2549762 2501551

Sale 3780000 4320000 4860000 4860000

Contribution ( Sales – VC) 1906580 2227058 2545427 2567309

B.E.P in % 14.61% 11.49% 9.24% 8.14%

Break Even Sales in Rs. 552442 496317 449048 395380

Break Even Units 122765 110293 99788 87562

Current Ration 1.31 1.13 0.92 0.67

Net Profit Ration 45.69% 47.59% 49.03 49.81

________________________________________________________________________

This Project Report has been prepared based on the data furnished by the entrepreneur whose

details are given in the application.

Full Name :

State : Date:

Signature of the

Beneficiary

You might also like

- Pintu KumarDocument9 pagesPintu KumarRaj StudioNo ratings yet

- Pintu KumarDocument9 pagesPintu KumarRaj StudioNo ratings yet

- Dpr-Clay Brick UnitDocument8 pagesDpr-Clay Brick UnitGateway ComputersNo ratings yet

- Govind Narayan HarvesterDocument6 pagesGovind Narayan Harvesterrashidsilwani01No ratings yet

- Jayaram HarvesterDocument13 pagesJayaram Harvesterrashidsilwani01No ratings yet

- PMEGP Project Estimate....Document9 pagesPMEGP Project Estimate....Sangzuala HlondoNo ratings yet

- PMEGP Project For Engineering WorkshopDocument8 pagesPMEGP Project For Engineering WorkshopShreyans Tejpal Shah100% (5)

- 1 Individual: Project at A Glance - Top SheetDocument10 pages1 Individual: Project at A Glance - Top SheetDigital InfotechNo ratings yet

- DPR Alluminium FoilDocument8 pagesDPR Alluminium FoilFrankenstein100% (1)

- App 32889883Document8 pagesApp 32889883SANTANU KUMAR PRADHANNo ratings yet

- Project ReportDocument17 pagesProject ReportPawan KumarNo ratings yet

- Poultry Project ReportDocument8 pagesPoultry Project ReportVINITA DWIVEDINo ratings yet

- PPPPDocument8 pagesPPPPBhagyavanti BNo ratings yet

- Project ReportDocument16 pagesProject ReportAshok PatelNo ratings yet

- DPRPACKAGEDocument16 pagesDPRPACKAGEAlok G ShindeNo ratings yet

- Project ReportDocument8 pagesProject ReportPritam685No ratings yet

- PROJECTBDocument16 pagesPROJECTBNukamreddy Venkateswara ReddyNo ratings yet

- Project 1Document8 pagesProject 1Rachna KumariNo ratings yet

- CBS 1000007234Document1 pageCBS 1000007234tarekNo ratings yet

- Project Report JCB Service CenterDocument10 pagesProject Report JCB Service CenterGateway ComputersNo ratings yet

- Home Budget ExcelDocument13 pagesHome Budget ExcelHilal RomeNo ratings yet

- SunittaaaaDocument8 pagesSunittaaaaBhagyavanti BNo ratings yet

- Sattva Paints F-Plan FinalDocument44 pagesSattva Paints F-Plan FinalShrushti MehtaNo ratings yet

- Calcolo Effetti Secondo OrdineDocument7 pagesCalcolo Effetti Secondo OrdineTommaso PasconNo ratings yet

- Ambey Trading CorporationDocument9 pagesAmbey Trading Corporationgbv bbbNo ratings yet

- Deepakrishnan 21217406 Weaving UnitDocument13 pagesDeepakrishnan 21217406 Weaving UnitVenkyNo ratings yet

- Economic AnalysisDocument1 pageEconomic AnalysisAntonio Mendoza BallartaNo ratings yet

- Project ReportDocument8 pagesProject ReportGAJJA SURENDRANo ratings yet

- Total Wall Area (SQ.M) : Total Area of Doors (SQ.M)Document8 pagesTotal Wall Area (SQ.M) : Total Area of Doors (SQ.M)frederickNo ratings yet

- Sample Company Project Assumptions LOC AssumptionDocument4 pagesSample Company Project Assumptions LOC AssumptionRasserNo ratings yet

- Direct Costing Excel TemplateDocument8 pagesDirect Costing Excel TemplateAri Tri PrasetyoNo ratings yet

- Project at A Glance: Taluk/Block: District: Pin: State: E-Mail: MobileDocument8 pagesProject at A Glance: Taluk/Block: District: Pin: State: E-Mail: MobilesandeepNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- Financial Plan General Description Amount JustificationDocument5 pagesFinancial Plan General Description Amount JustificationClaudio LaCervaNo ratings yet

- Prati BhaDocument4 pagesPrati BhaABHIJEET RATHODNo ratings yet

- Butle 1Document17 pagesButle 1Gursharan KohliNo ratings yet

- P.P. On Tailoring - 2 LAC LOAN FOR BANK OF MAHARASHTRADocument13 pagesP.P. On Tailoring - 2 LAC LOAN FOR BANK OF MAHARASHTRAShyamal Dutta100% (3)

- Annex 1 Grain CleaningDocument11 pagesAnnex 1 Grain CleaningShegaw BalambarasNo ratings yet

- Sanwariya Stone Trading Co.Document12 pagesSanwariya Stone Trading Co.PUNEET JAINNo ratings yet

- HVAC System Duct Quantity Take Off Example ExplainedDocument1 pageHVAC System Duct Quantity Take Off Example ExplainedTaurian TaurianNo ratings yet

- Ramadan Food Packet Report 2023-04-16Document6 pagesRamadan Food Packet Report 2023-04-16nazmulamuNo ratings yet

- Lunxh BoxDocument24 pagesLunxh BoxShibli Sadik RezaNo ratings yet

- Model Cash Flow KophamDocument13 pagesModel Cash Flow KophamDenny MuhammadNo ratings yet

- Final DPRDocument10 pagesFinal DPRGateway ComputersNo ratings yet

- Supply and Application of Intumescent Paint - EvaluatedDocument3 pagesSupply and Application of Intumescent Paint - EvaluatedMary Joy ZamoraNo ratings yet

- Project Report On General StoreDocument12 pagesProject Report On General Storeimtaj320haqueNo ratings yet

- HVAC System - Duct Quantity Take Off (Example Explained)Document1 pageHVAC System - Duct Quantity Take Off (Example Explained)Rudy Jesus Capa IlizarbeNo ratings yet

- Duct Take Off-ModelDocument11 pagesDuct Take Off-ModelAbdul RaheemNo ratings yet

- Chapter 4 Financial AnilsisDocument5 pagesChapter 4 Financial AnilsisIzo Izo GreenNo ratings yet

- M/s.Ganesh Enterprise - Kolhapur Establishment:-2007 Propriter: - MR - Satej Patil Year P.M Over All Picture Firm Parle PravinDocument4 pagesM/s.Ganesh Enterprise - Kolhapur Establishment:-2007 Propriter: - MR - Satej Patil Year P.M Over All Picture Firm Parle PravinAbhishek GuptaNo ratings yet

- Diaper Case StudyDocument5 pagesDiaper Case StudyAbhijeet SarodeNo ratings yet

- Flujo de Caja Del ProyectoooDocument27 pagesFlujo de Caja Del Proyectooolink megaNo ratings yet

- M/s XYZ Industries: Unsecured LoanDocument33 pagesM/s XYZ Industries: Unsecured LoanDaya SharmaNo ratings yet

- P.P. On Paper PlatesDocument16 pagesP.P. On Paper PlatesShyamal DuttaNo ratings yet

- Ots 24 24009366 Annexure SialileaDocument17 pagesOts 24 24009366 Annexure Sialileaapi-3774915No ratings yet

- Project Report ON Sharma Pickles: Vishal Sharma Mba (Finance) Section B 19MBAJ0200Document9 pagesProject Report ON Sharma Pickles: Vishal Sharma Mba (Finance) Section B 19MBAJ0200Sushil PrajapatNo ratings yet

- SHG BhagyawantiDocument8 pagesSHG BhagyawantiBhagyavanti BNo ratings yet

- South Africa’s Renewable Energy IPP Procurement ProgramFrom EverandSouth Africa’s Renewable Energy IPP Procurement ProgramNo ratings yet

- Building with Virtual LEGO: Getting Started with LEGO Digital Designer, LDraw, and MecabricksFrom EverandBuilding with Virtual LEGO: Getting Started with LEGO Digital Designer, LDraw, and MecabricksNo ratings yet

- Enabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesFrom EverandEnabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesNo ratings yet

- Project ProposalDocument4 pagesProject ProposalJayde GalopeNo ratings yet

- Pengaruh Orientasi Pasar Terhadap Inovasi Produk Padaukm SmescoDocument18 pagesPengaruh Orientasi Pasar Terhadap Inovasi Produk Padaukm SmescoYohanes SiagianNo ratings yet

- LuxuryGoods 01-2019-09 SectorDocument77 pagesLuxuryGoods 01-2019-09 SectorJavi ToNo ratings yet

- CH 02 Managerial Planning and Goal SettingDocument45 pagesCH 02 Managerial Planning and Goal Settingrock starNo ratings yet

- Lloyd's Register Group: Cristopher Rico A Delgado BSTM M502 Task PerformanceDocument5 pagesLloyd's Register Group: Cristopher Rico A Delgado BSTM M502 Task PerformanceCristopher Rico Delgado100% (1)

- Sap CostcenterDocument47 pagesSap CostcenterTarakeshsapNo ratings yet

- Letter To Supplier For Price Negotiation - Creative WritersDocument4 pagesLetter To Supplier For Price Negotiation - Creative Writersammian7980% (5)

- Section 88 To Sec 122Document38 pagesSection 88 To Sec 122YashSukhwalNo ratings yet

- 8615-1 (Spring)Document17 pages8615-1 (Spring)Danial AwanNo ratings yet

- HTPL Icd Tariff Wef 11-05-2021Document3 pagesHTPL Icd Tariff Wef 11-05-2021Fasteners GargNo ratings yet

- RateGain AnnualReport FY2021-22Document135 pagesRateGain AnnualReport FY2021-22ATRIUM NEET EXPONo ratings yet

- 15 MW SolarDocument2 pages15 MW SolarAkd DeshmukhNo ratings yet

- Mumin Odeh Resume 1Document1 pageMumin Odeh Resume 1api-634831395No ratings yet

- Project Organization: Chapter FourDocument32 pagesProject Organization: Chapter Fourgeachew mihiretuNo ratings yet

- 05 Quiz 1-HRMDocument2 pages05 Quiz 1-HRMJhanry CataliñoNo ratings yet

- MGT 504 Group Assignment Sec BDocument9 pagesMGT 504 Group Assignment Sec BKhusbu JaiswalNo ratings yet

- CMR 00062-17Document78 pagesCMR 00062-17pokhara144No ratings yet

- Telecom Expense ManagementDocument1 pageTelecom Expense Managementkravs85No ratings yet

- B2B Marketing PPT 21Document14 pagesB2B Marketing PPT 21Prashant patilNo ratings yet

- Sarboox ScooterDocument6 pagesSarboox ScooterNisa SuriantoNo ratings yet

- Solved Gloria Detoya and Esterlina Gevera Have Operated A Successful... - Course HeroDocument4 pagesSolved Gloria Detoya and Esterlina Gevera Have Operated A Successful... - Course HeroeannetiyabNo ratings yet

- 7 Mistakes People Make Hiring Financial AdvisorsDocument2 pages7 Mistakes People Make Hiring Financial AdvisorsJimKNo ratings yet

- Cost Sheet Format: Profit or Loss Statement For The Year Ended On 31 December 2020Document6 pagesCost Sheet Format: Profit or Loss Statement For The Year Ended On 31 December 2020sanathNo ratings yet

- WK 8-Lean SynchronizationDocument51 pagesWK 8-Lean SynchronizationSri NarendiranNo ratings yet

- Initiating The Inactive Employees Credit Card Process - SPDDocument5 pagesInitiating The Inactive Employees Credit Card Process - SPDFerasHamdanNo ratings yet

- Norsok Standard R-003 Safe Use of Lifting EquipmentDocument58 pagesNorsok Standard R-003 Safe Use of Lifting EquipmentDing Liu100% (1)

- Alumni Zoom Info ListDocument9 pagesAlumni Zoom Info ListFayez AliNo ratings yet

- Maximo Asset ManagementDocument53 pagesMaximo Asset ManagementriadNo ratings yet

- Karthikeyan G: Metallurgical EngineerDocument3 pagesKarthikeyan G: Metallurgical EngineerASHRITHA DURUSOJUNo ratings yet

- 11 - NYC 2019 COA Report Part2 - Observations and RecommDocument37 pages11 - NYC 2019 COA Report Part2 - Observations and RecommVERA FilesNo ratings yet