Professional Documents

Culture Documents

Advanced Accounting Solutions Chapter 7 MC Problems and Theories

Uploaded by

john carlos doringoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting Solutions Chapter 7 MC Problems and Theories

Uploaded by

john carlos doringoCopyright:

Available Formats

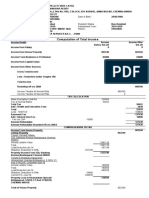

Multiple Choice Problems

1. b –

20x4: P500,000 x 30% = P 150,000

20x5: P600,000 x 40% = 240,000 P390,000

2. d

Realized Gross Profit on Installment Sales in 20x6:

20x4 sales: P10,000 x 22%P 2,200

20x5 sales: P50,000 x 25% 12,500

20x6 sales: P45,000 x P28,200 / (P28,200+P91,800) 10,575

P 25,275

Realized Gross Profit on Sales in 20x5 P 10,500

Less: Realized Gross Profit in 20x5 for 20x5 sales: (P20,000 x 25%) 5,000

Realized Gross Profit in 20x5 for 20x4 sales P 5,500

Divided by: Collections in 20x5 for 20x4 sales P 25,000

Gross Profit % for 20x4 sales 22%

3. a

Installment Sales Method:

20x3 Sales: P240,000 x 25/125P 48,000

20x4 Sales: P180,000 x 28/128 39,375

Realized Gross Profit on Installment SalesP 87,375

Cost Recovery Method:

20x3 Cost: P480,000 / 1.25 P384,000

Less: Collections in 20x3 140,000

Collections in 20x4 240,000

Unrecovered Cost, 12/31/20x4 P 4,000

Under the cost recovery method, no income is recognized on a sale until the cost of the item sold is recovered through cash

receipts. All cash receipts, both interest and principal portions, are applied first to the cost of the items sold. Then, all

subsequent receipts are reported as revenue. Because all costs have been recovered, the recognized revenue after the cost

recovery represents income (interest and realized gross profit). This method is used only when the circumstances

surrounding a sale are so uncertain that earlier recognition is impossible.

4. a P0.

5. c

You might also like

- Multiple Choice Problems Solved Step-by-StepDocument1 pageMultiple Choice Problems Solved Step-by-Stepjohn carlos doringoNo ratings yet

- Installment Sales DayagDocument11 pagesInstallment Sales DayagJAP100% (1)

- Answers - Installment Sales - DayagDocument11 pagesAnswers - Installment Sales - DayagAye Buenaventura75% (16)

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- Chapter 07Document30 pagesChapter 07Britt John BallentesNo ratings yet

- Template - Acctg. Major 3 Module 5 PDFDocument16 pagesTemplate - Acctg. Major 3 Module 5 PDFRia Mendez100% (2)

- Sol. Man. - Chapter 10 - Installment Sales Method - 2021 Edition 1Document12 pagesSol. Man. - Chapter 10 - Installment Sales Method - 2021 Edition 1amad.hannah0913No ratings yet

- Chapter 10 Installment Sales AccountingDocument13 pagesChapter 10 Installment Sales AccountingFaithful FighterNo ratings yet

- Unrealized Gain On Sale of Equipment: Cost ModelDocument25 pagesUnrealized Gain On Sale of Equipment: Cost ModelLove FreddyNo ratings yet

- Multiple choice problem computation installment salesDocument4 pagesMultiple choice problem computation installment salesPaupauNo ratings yet

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- Multiple Choice Problems and Unrecovered Cost CalculationsDocument1 pageMultiple Choice Problems and Unrecovered Cost Calculationsjohn carlos doringoNo ratings yet

- Advanced Accounting Chapter 7Document26 pagesAdvanced Accounting Chapter 7Shealalyn1No ratings yet

- Solution Chapter 7Document26 pagesSolution Chapter 7Roselle Manlapaz LorenzoNo ratings yet

- Solution Chapter 18Document78 pagesSolution Chapter 18Sy Him100% (6)

- Chapter 5 - Dayag - MCSDocument2 pagesChapter 5 - Dayag - MCSMazikeen DeckerNo ratings yet

- Solution Chapter 7Document31 pagesSolution Chapter 7P.FabieNo ratings yet

- Chapter 6Document18 pagesChapter 6marieieiemNo ratings yet

- 08 02 12 2022 Q 6 7Document9 pages08 02 12 2022 Q 6 7Pragathi SundarNo ratings yet

- Quiz 7 Solutions Installment and Cost Recovery MethodsDocument9 pagesQuiz 7 Solutions Installment and Cost Recovery MethodsTricia Mae Fernandez100% (2)

- Quiz Installment Sales 2Document1 pageQuiz Installment Sales 2MARJORIE BAMBALANNo ratings yet

- Multiple Choice ProblemsDocument24 pagesMultiple Choice ProblemsRodeth CeaNo ratings yet

- Activity 2Document5 pagesActivity 2Lala FordNo ratings yet

- Cost Accounting and ControlDocument5 pagesCost Accounting and ControlJell DemocerNo ratings yet

- Eliminating EntriesDocument81 pagesEliminating EntriesRose CastilloNo ratings yet

- Cost Volume Profit Analysis Cost Accounting 2022 P1Document6 pagesCost Volume Profit Analysis Cost Accounting 2022 P1jay-an DahunogNo ratings yet

- GainersDocument17 pagesGainersborn2grow100% (1)

- Installment T SalesDocument31 pagesInstallment T SalesNiki DimaanoNo ratings yet

- Chapter 18 Consolidated Financial Statements ProblemsDocument61 pagesChapter 18 Consolidated Financial Statements Problemsxxxxxxxxx100% (3)

- This Proc Edur e Woul D Be Not Be Appli Cable Wher e TheDocument38 pagesThis Proc Edur e Woul D Be Not Be Appli Cable Wher e TheLove FreddyNo ratings yet

- Installment Sales Method 1Document7 pagesInstallment Sales Method 1Roy Mitz Bautista29% (7)

- MA Assignment 3Document3 pagesMA Assignment 3SumreeenNo ratings yet

- Chapter 5 - Multiple Choice ProblemsDocument22 pagesChapter 5 - Multiple Choice Problemssol lunaNo ratings yet

- CVP Analysis GuideDocument6 pagesCVP Analysis GuideGamuchirai Michael DereraNo ratings yet

- MAS Answer Key SolutionDocument6 pagesMAS Answer Key SolutionJonalyn JavierNo ratings yet

- Management Accounting Case SolutionDocument4 pagesManagement Accounting Case SolutionhadiNo ratings yet

- 6 CVP AnalysisDocument37 pages6 CVP AnalysisRodolfo ManalacNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-18Document76 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-18allysa ampingNo ratings yet

- Franchise Comprehensive Prob PDF FreeDocument6 pagesFranchise Comprehensive Prob PDF FreetrishaNo ratings yet

- Recording Sales and Costs for Installment and Regular SalesDocument2 pagesRecording Sales and Costs for Installment and Regular Salesjohn carlos doringoNo ratings yet

- CH 10 Long Term ContractsDocument6 pagesCH 10 Long Term ContractsMerr Fe PainaganNo ratings yet

- Equity Method: Amortization of Allocated ExcessDocument4 pagesEquity Method: Amortization of Allocated ExcesseiaNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoNo ratings yet

- Module 2 ARS PCC - CVP, Absorption and Variable (Answers)Document6 pagesModule 2 ARS PCC - CVP, Absorption and Variable (Answers)Via Jean Lacsie100% (1)

- Omega Corporation transactions and entries 20x4-20x5Document5 pagesOmega Corporation transactions and entries 20x4-20x5AlexandriteNo ratings yet

- Solution Chapter 18 PDFDocument78 pagesSolution Chapter 18 PDFMesbrookNo ratings yet

- Solutions CH 04 Managerial Accounting 11th Edition GarrisonDocument24 pagesSolutions CH 04 Managerial Accounting 11th Edition GarrisonArina Kartika RizqiNo ratings yet

- Quiz Btaxxx 1Document3 pagesQuiz Btaxxx 1John LucaNo ratings yet

- Cost-Volume-Profit Analysis Lecture Notes 02Document7 pagesCost-Volume-Profit Analysis Lecture Notes 02Annamarisse parungaoNo ratings yet

- Illustration Problem & SolutionDocument4 pagesIllustration Problem & SolutionClauie BarsNo ratings yet

- Chap 3 Take Home Activity 2Document1 pageChap 3 Take Home Activity 2Jhaister Ashley LayugNo ratings yet

- Ma Mod4 W08Document221 pagesMa Mod4 W08Randy KuswantoNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial MeasuresRating: 4.5 out of 5 stars4.5/5 (9)

- The Passive Income BluePrint - How To Make Money While You SleepFrom EverandThe Passive Income BluePrint - How To Make Money While You SleepRating: 2.5 out of 5 stars2.5/5 (3)

- The McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/EFrom EverandThe McGraw-Hill 36-Hour Course: Finance for Non-Financial Managers 3/ERating: 4.5 out of 5 stars4.5/5 (6)

- Broker to Broker: Management Lessons From America's Most Successful Real Estate CompaniesFrom EverandBroker to Broker: Management Lessons From America's Most Successful Real Estate CompaniesNo ratings yet

- Actuarial Finance: Derivatives, Quantitative Models and Risk ManagementFrom EverandActuarial Finance: Derivatives, Quantitative Models and Risk ManagementNo ratings yet

- Digital Wealth: An Automatic Way to Invest SuccessfullyFrom EverandDigital Wealth: An Automatic Way to Invest SuccessfullyRating: 4.5 out of 5 stars4.5/5 (3)

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set D (Multiple Choice), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Multiple Choice), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Chapter 15 Statement of Cash Flows True or False QuestionsDocument1 pageChapter 15 Statement of Cash Flows True or False Questionsjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument2 pagesAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set E (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set E (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Statement of Cash Flows True or False QuestionsDocument1 pageStatement of Cash Flows True or False Questionsjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter-6Document2 pagesAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- Recording Sales and Costs for Installment and Regular SalesDocument2 pagesRecording Sales and Costs for Installment and Regular Salesjohn carlos doringoNo ratings yet

- Execution of RizalDocument11 pagesExecution of Rizaljohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument1 pageAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter-6Document1 pageAdvanced Accounting Solutions Chapter-6john carlos doringo0% (1)

- Advanced Accounting Solutions Chapter-6Document1 pageAdvanced Accounting Solutions Chapter-6john carlos doringoNo ratings yet

- Multiple Choice Problems and Unrecovered Cost CalculationsDocument1 pageMultiple Choice Problems and Unrecovered Cost Calculationsjohn carlos doringoNo ratings yet

- Execution of RizalDocument11 pagesExecution of Rizaljohn carlos doringoNo ratings yet

- (M1 - PPT) Economic Development IntroductionDocument14 pages(M1 - PPT) Economic Development Introductionjohn carlos doringoNo ratings yet

- (M1 - Lecture Notes) Economic Development IntroductionDocument8 pages(M1 - Lecture Notes) Economic Development Introductionjohn carlos doringoNo ratings yet

- The Indolence of The FilipinosDocument7 pagesThe Indolence of The Filipinosjohn carlos doringoNo ratings yet

- Economic Development Goals and MeasuresDocument26 pagesEconomic Development Goals and Measuresjohn carlos doringoNo ratings yet

- (M3 - PPT) National Income Accounting - GDPDocument22 pages(M3 - PPT) National Income Accounting - GDPjohn carlos doringoNo ratings yet

- Economic Development Goals and MeasuresDocument26 pagesEconomic Development Goals and Measuresjohn carlos doringoNo ratings yet

- Active Gear Historical Income Statement Operating Results Revenue Gross ProfitDocument20 pagesActive Gear Historical Income Statement Operating Results Revenue Gross ProfitJoan Alejandro MéndezNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- National Income ConceptsDocument23 pagesNational Income ConceptsVinita BhagatNo ratings yet

- Income From BusinessDocument14 pagesIncome From BusinessPreeti ShresthaNo ratings yet

- Bookkeeping Basics: Name - Block - DateDocument12 pagesBookkeeping Basics: Name - Block - DateMaria AparicioNo ratings yet

- 01 First Preboard Examination MASDocument12 pages01 First Preboard Examination MASReynaldo corpuzNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Intermediate Accounting 2 SyllabusDocument15 pagesIntermediate Accounting 2 SyllabusNikka Mae Socito DusabanNo ratings yet

- Responsibility Accounting and Transfer PricingDocument7 pagesResponsibility Accounting and Transfer PricingRod Lester de Guzman100% (6)

- Income-Tax-Assignment No. 3 SolutionDocument18 pagesIncome-Tax-Assignment No. 3 SolutionAuralin UbaldoNo ratings yet

- 5-3 Resolution Approving Subchapter S ElectionDocument2 pages5-3 Resolution Approving Subchapter S ElectionDaniel100% (5)

- Carol Majestica-01012190047-PR Pertemuan 02Document6 pagesCarol Majestica-01012190047-PR Pertemuan 02nadila ika sefiraNo ratings yet

- Cash in A Flash by Mark Victor Hansen - ExcerptDocument42 pagesCash in A Flash by Mark Victor Hansen - ExcerptCrown Publishing Group100% (7)

- Gender EquityDocument2 pagesGender EquitySrirama LakshmiNo ratings yet

- Profitability Ratio 2Document18 pagesProfitability Ratio 2Wynphap podiotanNo ratings yet

- Financial Management Cash Flow AnalysisDocument6 pagesFinancial Management Cash Flow Analysismax zeneNo ratings yet

- FundamentalsOfFinancialManagement Chapter8Document17 pagesFundamentalsOfFinancialManagement Chapter8Adoree RamosNo ratings yet

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaNo ratings yet

- Sheila Sasso Karen Schwimmer and Jim Perry Have Formed ADocument1 pageSheila Sasso Karen Schwimmer and Jim Perry Have Formed ABube KachevskaNo ratings yet

- Income Tax: Ca - Cma - Cs Inter / EPDocument55 pagesIncome Tax: Ca - Cma - Cs Inter / EPINDIRA GHOSHNo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- Pascual vs. DragonDocument2 pagesPascual vs. DragonRussell John HipolitoNo ratings yet

- Federal Income Tax OutlineDocument14 pagesFederal Income Tax OutlineAllison HannaNo ratings yet

- 0455 w15 Ms 22 PDFDocument12 pages0455 w15 Ms 22 PDFMost. Amina KhatunNo ratings yet

- Accounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFDocument67 pagesAccounting Principles Canadian Volume II 7th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (17)

- Macro EconDocument128 pagesMacro EconDawne BrownNo ratings yet

- r2010d11421071 Danish Kanojia Assessment2 Uel HR 7003 27850Document16 pagesr2010d11421071 Danish Kanojia Assessment2 Uel HR 7003 27850D bfcpt pNo ratings yet

- Assignment FSADocument5 pagesAssignment FSAgeo023No ratings yet

- Trend AnalysisDocument14 pagesTrend Analysisjhim1990100% (5)

- Excel Proyeksi KeuanganDocument26 pagesExcel Proyeksi KeuanganMeliana WandaNo ratings yet