Professional Documents

Culture Documents

Advanced Accounting Solutions Chapter-6

Uploaded by

john carlos doringoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting Solutions Chapter-6

Uploaded by

john carlos doringoCopyright:

Available Formats

Multiple Choice Problems

31. P56,900 – refer to No. 30 for computation

32. P72,625 – refer to No. for computation

33. Dividend - P56,900/P72,625 = P.78 – refer to No. 30 for further computation

34. P80,975 – refer to No. 30 for computation

35. P45,160 = P28,000 + (P22,000 x 78%)

36. P3,775

37. P39,487.50 = 78% x (P40,625 + P10,000)

38. P169,397.50

No. 34……………..P 80.975

No. 35…………….. 45,160

No. 36…………….. 3,775

No. 37…………….. 39,487.50

P169,397.50 (discrepancy around P250 plus due to rounding-off)

39. P15,725 – refer to No. 30 or P56,700, estimated net loss – P40,975, owners’ equity

40. P56,700 – refer to No. 30 or P169,650 – P226,350

41. P56,700 (same with No. 40 since there are no unrecorded expenses liabilities)

42. P22,475

Liabilities

Unsecured

Assets Fully Partial With Without Owners'

Cash Noncash Secured Secured Priority Priority Equity

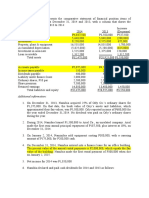

6/1/x5 Balances:

1,850 224,500 80,975 50,000 3,775 50,625 40,975

Cash Receipts:

Securities Sale 16,000 (5,800) 10,200

N/R Collected 15,000 (15,000) 0

Equipment Sale 7,000 (43,000) (36,000)

Inventory Sale 22,000 (41,000) (19,000)

Cash Disbursements:

Bank Loan (10,375) (10,375)

Part Pyt-A/P (29,000) ---------- --------- (50,000) ------- 21,000 ----------

6/30 Balance 22,475 119,700 70,600 0 3,775 71,625 (3,825)

43. P119,700 – refer to No. 42

44. P70,600 – refer to No. 42

45. None – refer to No. 42

46. P3,775 – refer to No. 42

47. P71,625 – refer to No. 42

48. (P3,825) deficit – refer to No. 42

You might also like

- Fischer10j Ch21 TBDocument2 pagesFischer10j Ch21 TBLouiza Kyla AridaNo ratings yet

- ParcorDocument12 pagesParcoreys shop100% (1)

- Advanced Accounting Solutions Chapter-6Document1 pageAdvanced Accounting Solutions Chapter-6john carlos doringo0% (1)

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Business Combination - Date of Acquisition - SolManDocument9 pagesBusiness Combination - Date of Acquisition - SolManTrace ReyesNo ratings yet

- Fsa Questions and SolutionsDocument11 pagesFsa Questions and SolutionsAnjali Betala KothariNo ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- Acc133 PQ4Document8 pagesAcc133 PQ4Karina Barretto AgnesNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Multiple Choice Answers and SolutionsDocument12 pagesMultiple Choice Answers and SolutionsLaraNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- An0090 Xls EngDocument27 pagesAn0090 Xls Engdiana sofia galvisNo ratings yet

- Oct 4 - LectureDocument4 pagesOct 4 - LectureCarl Dhaniel Garcia SalenNo ratings yet

- Advanced Accounting Chapter 4Document19 pagesAdvanced Accounting Chapter 4Ya Lun100% (1)

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- AFAR Preboards SolutionsDocument27 pagesAFAR Preboards SolutionsIrra May GanotNo ratings yet

- Test Bank Chapter 3 Cost Volume Profit ADocument4 pagesTest Bank Chapter 3 Cost Volume Profit AKarlo D. ReclaNo ratings yet

- Chapter 7Document18 pagesChapter 7Louie De La Torre100% (1)

- Diagnostic Level 3 AccountingDocument17 pagesDiagnostic Level 3 AccountingRobert CastilloNo ratings yet

- PreweekSol (Advacc)Document91 pagesPreweekSol (Advacc)Rommel Cruz100% (2)

- Chapter 7Document18 pagesChapter 7143incomeNo ratings yet

- Intl Business Machines Corp Com in Dollar US in ThousandsDocument6 pagesIntl Business Machines Corp Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Chapter 7 Guerrero PDFDocument17 pagesChapter 7 Guerrero PDFIrene Eloisa100% (2)

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- Partnership Formation ExerciseDocument2 pagesPartnership Formation ExerciseArlene Diane OrozcoNo ratings yet

- Partnership Formation ExerciseDocument2 pagesPartnership Formation ExerciseArlene Diane OrozcoNo ratings yet

- Partnership Formation ExerciseDocument2 pagesPartnership Formation ExerciseArlene Diane OrozcoNo ratings yet

- NPV Lesson 2Document5 pagesNPV Lesson 2Barack MikeNo ratings yet

- To Be Withdrawn by Gangnam: Problem 1 1. Capital Balances Case 1Document12 pagesTo Be Withdrawn by Gangnam: Problem 1 1. Capital Balances Case 1Alizah BucotNo ratings yet

- Attachment AccountingDocument6 pagesAttachment Accountingtaylor swiftyyyNo ratings yet

- Answer Key All QuizDocument22 pagesAnswer Key All QuizJaynalyn MonasterialNo ratings yet

- Anticipated Pro Forma For Cash Flow of Dimka Mart Account Titles Year 1 Year 2 Year 3 Year 4 Year 5 Cash Flow From Operating ActivitiesDocument6 pagesAnticipated Pro Forma For Cash Flow of Dimka Mart Account Titles Year 1 Year 2 Year 3 Year 4 Year 5 Cash Flow From Operating ActivitiesM VNo ratings yet

- 8-9 Mecca Copy Budget Balance SheetDocument5 pages8-9 Mecca Copy Budget Balance SheetAli Hassan SukheraNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- Coneptual Frameworks and Accounting Standards Probs and TheoriesDocument17 pagesConeptual Frameworks and Accounting Standards Probs and TheoriesIris MnemosyneNo ratings yet

- Copia de Economatica Apple 2Document12 pagesCopia de Economatica Apple 2Juan o Ortiz aNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- CH 4 and 5 Sanjay Ind Sol Finacman 6th EdDocument8 pagesCH 4 and 5 Sanjay Ind Sol Finacman 6th EdAnshika100% (2)

- Aucap2 Unit 5Document6 pagesAucap2 Unit 5Sel BarrantesNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- Quiz Corporate Bankruptcy Solution Mar 10 2023 2AACDocument4 pagesQuiz Corporate Bankruptcy Solution Mar 10 2023 2AACLorifel Antonette Laoreno TejeroNo ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- DCF Case Sample 1Document4 pagesDCF Case Sample 1Gaurav SethiNo ratings yet

- Solution Chapter 6Document10 pagesSolution Chapter 6Clarize R. MabiogNo ratings yet

- Unit 9 Audit of Shareholders EquityDocument18 pagesUnit 9 Audit of Shareholders EquityKenneth PabloNo ratings yet

- Partnership LiquidationDocument8 pagesPartnership LiquidationJhane XiNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Kasus PT Sowhat GitolhooDocument22 pagesKasus PT Sowhat GitolhooAnas ThaciaNo ratings yet

- FINAN204-21A Tutorial 10 Week 13Document24 pagesFINAN204-21A Tutorial 10 Week 13Danae YangNo ratings yet

- Accounts Receivable and AFBDDocument18 pagesAccounts Receivable and AFBDeia aieNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- I. Adjustments Ii. WorksheetDocument11 pagesI. Adjustments Ii. WorksheetDarwyn MendozaNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Advanced Accounting Solutions Chapter-6Document2 pagesAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- Corporate Finance QuizDocument6 pagesCorporate Finance Quizarslan mumtazNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set C (True or False), Chapter 15 - Statement of Cash FlowDocument1 pageExamination Question and Answers, Set C (True or False), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set D (Multiple Choice), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Multiple Choice), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set E (True or False), Chapter 15 - Statement of Cash FlowDocument1 pageExamination Question and Answers, Set E (True or False), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument2 pagesAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set E (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set E (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument1 pageAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Execution of RizalDocument11 pagesExecution of Rizaljohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument2 pagesAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter-6Document2 pagesAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- (M1 - Lecture Notes) Economic Development IntroductionDocument8 pages(M1 - Lecture Notes) Economic Development Introductionjohn carlos doringoNo ratings yet

- Execution of RizalDocument11 pagesExecution of Rizaljohn carlos doringoNo ratings yet

- (M2 - PPT) Principles and Concepts of Economic DevelopmentDocument26 pages(M2 - PPT) Principles and Concepts of Economic Developmentjohn carlos doringoNo ratings yet

- (M3 - PPT) National Income Accounting - GDPDocument22 pages(M3 - PPT) National Income Accounting - GDPjohn carlos doringoNo ratings yet

- The Indolence of The FilipinosDocument7 pagesThe Indolence of The Filipinosjohn carlos doringoNo ratings yet

- (M1 - PPT) Economic Development IntroductionDocument14 pages(M1 - PPT) Economic Development Introductionjohn carlos doringoNo ratings yet