Professional Documents

Culture Documents

Examination Question and Answers, Set E (Problem Solving), Chapter 15 - Statement of Cash Flow

Uploaded by

john carlos doringoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Examination Question and Answers, Set E (Problem Solving), Chapter 15 - Statement of Cash Flow

Uploaded by

john carlos doringoCopyright:

Available Formats

Chapter 15—Statement of Cash Flows [Problem Solving]

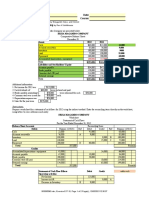

11. The comparative balance sheet of Nance Company, for the current year and the preceding year

ended December 31, 20--, appears below in condensed form:

Current Preceding

Year Year

Cash $ 68,000 $ 42,500

Accounts receivable (net) 61,000 70,200

Inventories 121,000 105,000

Investments ..... 100,000

Equipment 515,000 425,000

Accumulated depreciation-equipment (153,000) (175,000)

$612,000 $567,700

======== ========

Accounts payable $ 59,750 $ 47,250

Bonds payable, due 2000 ..... 75,000

Common stock, $20 par 375,000 325,000

Premium on common stock 50,000 25,000

Retained earnings 127,250 95,450

$612,000 $567,700

======== ========

Additional data for the current year are as follows:

(a) Net income, $71,800.

(b) Depreciation reported on income statement, $38,000.

(c) Fully depreciated equipment costing $60,000 was scrapped, no salvage, and

equipment was purchased for $150,000.

(d) Bonds payable for $75,000 were retired by payment at their face amount.

(e) 2,500 shares of common stock were issued at 30 for cash.

(f) Cash dividends declared and paid, $40,000.

(g) Investments of $100,000 were sold for $125,000.

Prepare a statement of cash flows using the indirect method.

ANS:

Nance Company

Statement of Cash Flows

For Year Ended December 31, 20--

Cash flows from operating

activities:

Net income, per income statement $ 71,800

Add: Depreciation $38,000

Decrease in accts. rec. 9,200

Increase in accts. pay. 12,500 59,700

$131,500

Deduct: Increase in inventories $16,000

Gain on sale of 25,000 41,000

investments

Net cash flow from operating

activities $ 90,500

Cash flows from investing

activities:

Cash from sale of investments $125,000

Less: Cash paid for purchase of

equipment 150,000

Net cash flow used for investing

activities (25,000)

Cash flows from financing

activities:

Cash from sale of common stock $ 75,000

Less: Cash paid to retire bonds

payable $ 75,000

Cash paid for dividends 40,000 115,000

Net cash flow used for financing

activities (40,000)

Increase in cash $ 25,500

Cash at the beginning of the year 42,500

Cash at the end of the year $ 68,000

========

DIF: 5 OBJ: 03

You might also like

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- Chapter-2 Solution For 27 and 28Document6 pagesChapter-2 Solution For 27 and 28Tarif IslamNo ratings yet

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- WS QHSE Std23 3313701 07Document24 pagesWS QHSE Std23 3313701 07ralph100% (1)

- Latihan Soal Cash FlowDocument2 pagesLatihan Soal Cash FlowRuth AngeliaNo ratings yet

- Solution Aassignments CH 13Document2 pagesSolution Aassignments CH 13RuturajPatilNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- Protecto Company Purchaesed 75 Percent of StrandDocument4 pagesProtecto Company Purchaesed 75 Percent of Strandlaale dijaanNo ratings yet

- Revision Questions - CH 17 - QuestionsDocument3 pagesRevision Questions - CH 17 - QuestionsMinh ThưNo ratings yet

- Advanced Accounting Solutions Chapter-6Document1 pageAdvanced Accounting Solutions Chapter-6john carlos doringo0% (1)

- Glosario JurídicaDocument56 pagesGlosario JurídicaMaría Cristina MartínezNo ratings yet

- Diamond Service SoftwareDocument42 pagesDiamond Service Softwareqweqwe50% (2)

- Extending Criminal LiabilityDocument14 pagesExtending Criminal LiabilitymaustroNo ratings yet

- California Child and Spousal Support Bench GuideDocument96 pagesCalifornia Child and Spousal Support Bench GuideAnonymous oY5Dk8c5u100% (2)

- Manual Survey Pro For RangerDocument337 pagesManual Survey Pro For RangerIni ChitozNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Garing, Aireen - Sa No.13 Statement of CashflowsDocument3 pagesGaring, Aireen - Sa No.13 Statement of CashflowsAireen GaringNo ratings yet

- Name: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingDocument2 pagesName: Date: Instructor: Course: Accounting Principles Primer On Using Excel in AccountingHernando MaulanaNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- Net Cash Flow in Operating ActivitiesDocument1 pageNet Cash Flow in Operating ActivitiesMary Ann AmparoNo ratings yet

- CH 07 PPTsDocument30 pagesCH 07 PPTsAfifan Ahmad FaisalNo ratings yet

- Chapter 16 Problem SolutionsDocument6 pagesChapter 16 Problem SolutionsAnila ANo ratings yet

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- Examination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Cashflow Exercise - RocastleDocument1 pageCashflow Exercise - RocastleAbrashiNo ratings yet

- Complex GroupDocument5 pagesComplex Grouptαtmαn dє grєαtNo ratings yet

- Assignment EMB660Document11 pagesAssignment EMB660Ashekin MahadiNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsAira Dane VillegasNo ratings yet

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Document3 pagesQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923No ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- 6 - Cash Flow Statement PDFDocument30 pages6 - Cash Flow Statement PDFJohn Paul CristobalNo ratings yet

- Practice CF Scooter KeyDocument4 pagesPractice CF Scooter KeyAllie LinNo ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Chemalite AnswersDocument2 pagesChemalite AnswersMine SayracNo ratings yet

- Solutions Chapter 23Document11 pagesSolutions Chapter 23Avi SeligNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Assignment - CASH FLOWDocument6 pagesAssignment - CASH FLOWFariha tamannaNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Jawaban Chapter 23 - Soal DikerjakanDocument2 pagesJawaban Chapter 23 - Soal Dikerjakanabd storeNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- CH 12 Exhibit 22Document4 pagesCH 12 Exhibit 22ЭниЭ.No ratings yet

- AKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085Document4 pagesAKL1C - Soal7 Dan E6-11 - Marhaendra Ihza Pahlevi - 18013010085mahendra ihzaNo ratings yet

- UntitledDocument13 pagesUntitledTejasree SaiNo ratings yet

- Revision Questions - CH 17 - SolutionsDocument4 pagesRevision Questions - CH 17 - SolutionsMinh ThưNo ratings yet

- Buscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodDocument46 pagesBuscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodJohn Stephen PendonNo ratings yet

- BE Chap 17Document3 pagesBE Chap 17TIÊN NGUYỄN LÊ MỸNo ratings yet

- Cash Flow ExampleDocument10 pagesCash Flow ExampleewaidaebaaNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Examination Question and Answers, Set C (True or False), Chapter 15 - Statement of Cash FlowDocument1 pageExamination Question and Answers, Set C (True or False), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set D (Multiple Choice), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Multiple Choice), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set G (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument1 pageAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set E (Multiple Choice), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Examination Question and Answers, Set E (True or False), Chapter 15 - Statement of Cash FlowDocument1 pageExamination Question and Answers, Set E (True or False), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument2 pagesAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Execution of RizalDocument11 pagesExecution of Rizaljohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 ProblemsDocument2 pagesAdvanced Accounting Solutions Chapter 7 Problemsjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- Execution of RizalDocument11 pagesExecution of Rizaljohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter-6Document2 pagesAdvanced Accounting Solutions Chapter-6john carlos doringo100% (1)

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter-6Document1 pageAdvanced Accounting Solutions Chapter-6john carlos doringoNo ratings yet

- Advanced Accounting Solutions Chapter 7 MC Problems and TheoriesDocument1 pageAdvanced Accounting Solutions Chapter 7 MC Problems and Theoriesjohn carlos doringoNo ratings yet

- (M1 - Lecture Notes) Economic Development IntroductionDocument8 pages(M1 - Lecture Notes) Economic Development Introductionjohn carlos doringoNo ratings yet

- (M2 - PPT) Principles and Concepts of Economic DevelopmentDocument26 pages(M2 - PPT) Principles and Concepts of Economic Developmentjohn carlos doringoNo ratings yet

- (M2 - PPT) Principles and Concepts of Economic DevelopmentDocument26 pages(M2 - PPT) Principles and Concepts of Economic Developmentjohn carlos doringoNo ratings yet

- (M3 - PPT) National Income Accounting - GDPDocument22 pages(M3 - PPT) National Income Accounting - GDPjohn carlos doringoNo ratings yet

- (M1 - PPT) Economic Development IntroductionDocument14 pages(M1 - PPT) Economic Development Introductionjohn carlos doringoNo ratings yet

- The Indolence of The FilipinosDocument7 pagesThe Indolence of The Filipinosjohn carlos doringoNo ratings yet

- Excutive Oeder 2023Document1 pageExcutive Oeder 2023Catherine Parinas0% (1)

- Office of The Municipal Economic Enterprise and Development OfficerDocument11 pagesOffice of The Municipal Economic Enterprise and Development Officerrichard ferolinoNo ratings yet

- Political Science, History Of: Erkki Berndtson, University of Helsinki, Helsinki, FinlandDocument6 pagesPolitical Science, History Of: Erkki Berndtson, University of Helsinki, Helsinki, FinlandRanjan Kumar SinghNo ratings yet

- Feb Month - 12 Feb To 11 MarchDocument2 pagesFeb Month - 12 Feb To 11 MarchatulNo ratings yet

- Data Loss Prevention (Vontu) Customer Community (Ask Amy) : Archiving IncidentsDocument3 pagesData Loss Prevention (Vontu) Customer Community (Ask Amy) : Archiving IncidentsatiffitaNo ratings yet

- Was The WWII A Race War?Document5 pagesWas The WWII A Race War?MiNo ratings yet

- Family Law 1 Final Project TopicsDocument2 pagesFamily Law 1 Final Project TopicsSiddharth100% (4)

- ROXAS Vs DE LA ROSADocument1 pageROXAS Vs DE LA ROSALiaa AquinoNo ratings yet

- J.B. Cooper by Dr. S.N. SureshDocument16 pagesJ.B. Cooper by Dr. S.N. SureshdrsnsureshNo ratings yet

- Ansys Autodyn Users Manual PDFDocument501 pagesAnsys Autodyn Users Manual PDFRama BaruvaNo ratings yet

- Volkswagen Emission ScandalDocument4 pagesVolkswagen Emission ScandalProfVicNo ratings yet

- EX Broker Carrier - PacketDocument17 pagesEX Broker Carrier - PacketJor JisNo ratings yet

- Islamic Finance On BNPL - The Opportunity AheadDocument14 pagesIslamic Finance On BNPL - The Opportunity AheadFaiz ArchitectsNo ratings yet

- Moz PROCUREMENT COORDINATOR JOB DESCRIPTIONDocument2 pagesMoz PROCUREMENT COORDINATOR JOB DESCRIPTIONTsholofeloNo ratings yet

- Atty. VLSalido - Banking Laws Phil JudDocument75 pagesAtty. VLSalido - Banking Laws Phil Judjz.montero19No ratings yet

- Grade 11 Entreprenuership Module 1Document24 pagesGrade 11 Entreprenuership Module 1raymart fajiculayNo ratings yet

- Addition Worksheet2Document2 pagesAddition Worksheet2JoyceNo ratings yet

- Introduction To Finance: Course Code: FIN201 Instructor: Tahmina Ahmed Section: 7 Chapter: 1 and 2Document27 pagesIntroduction To Finance: Course Code: FIN201 Instructor: Tahmina Ahmed Section: 7 Chapter: 1 and 2Tarif IslamNo ratings yet

- British Collectors Banknotes 1 PDFDocument104 pagesBritish Collectors Banknotes 1 PDFRafael VegaNo ratings yet

- Introduction and Summary: ListedDocument118 pagesIntroduction and Summary: Listedkcc2012No ratings yet

- Exploring The World's First Successful Truth Commission Argentina's CONADEP and The Role of Victims in Truth-SeekingDocument19 pagesExploring The World's First Successful Truth Commission Argentina's CONADEP and The Role of Victims in Truth-SeekingEugenia CabralNo ratings yet

- 6 Master Plans - ReviewerDocument2 pages6 Master Plans - ReviewerJue Lei0% (1)

- INTRODUCTION TO ENVIRONMENTAL and NATURA PDFDocument31 pagesINTRODUCTION TO ENVIRONMENTAL and NATURA PDFsuruchi agrawalNo ratings yet

- Operations TXT PLUS CLAIREDocument513 pagesOperations TXT PLUS CLAIRElimetta09No ratings yet