Professional Documents

Culture Documents

Via BIR Form 1706

Uploaded by

YnnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Via BIR Form 1706

Uploaded by

YnnaCopyright:

Available Formats

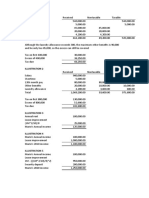

PAMANTASAN NG CABUYAO

INCOME TAX - SPECIAL PROBLEM

LUCARIO - Seller of Goods

BUSINESS

1Q 2Q 3Q 4Q Total Per ITR Disallowed/Subject to other type of taxes

Sales 1,250,000.00 1,500,000.00 2,000,000.00 1,000,000.00 5,750,000.00 5,750,000.00 -

Cost of Sales 625,000.00 750,000.00 1,000,000.00 500,000.00 2,875,000.00 2,875,000.00 -

Expenses (Income):

Other expenses 25,000.00 30,000.00 25,000.00 10,000.00 90,000.00 90,000.00 - Sales 5,750,000.00

Charitable Contributions 250,000.00 250,000.00 200,625.00 49,375.00 Other Income 100,000.00

Representation 70,000.00 70,000.00 28,750.00 41,250.00 Expenses before charity (3,843,750.00)

Gain from disposal of ordinary asset (100,000.00) (100,000.00) (100,000.00) Taxable income before charity 2,006,250.00

Gain from disposal of capital asset (150,000.00) (150,000.00) (150,000.00) Rate 10%

Salaries and wages 200,000.00 200,000.00 200,000.00 250,000.00 850,000.00 850,000.00 Limit 200,625.00

Net Income per Books 400,000.00 620,000.00 775,000.00 70,000.00 1,865,000.00 1,805,625.00 59,375.00

Capital Ordinary Other Data:

Acquisition Cost 200,000.00 1,000,000.00 Capital Gains Tax

Depreciation 850,000.00 Assessed Value:

Net Book Value 200,000.00 150,000.00 Capital Asset 200,000.00 350,000.00

Ordinary Asset 300,000.00 6% Cost of Sales 2,875,000.00

Selling Price 350,000.00 250,000.00 21,000.00 Other expenses 90,000.00

Gain on Sale 150,000.00 100,000.00 FMV: Allowed EAR 28,750.00

Capital Asset 300,000.00 Via BIR Form 1706 Salaries and wages 850,000.00

Ordinary Asset 385,000.00 Total 3,843,750.00

COMPENSATION

Per Actual Per ITR Disallowed/Exempted/Taxable other type of taxes

Basic Pay net of SSS, PHIC and HDMF 2,520,000.00 2,520,000.00 FBT:

13th Month Pay 210,000.00 210,000.00 100,000.00

Other benefits 80,000.00 80,000.00 153,846.15

90K Threshold (90,000.00)

Other benefits exclusive to Managers 100,000.00 100,000.00 35%

Receipts from accident - hospitalization 250,000.00 250,000.00 53,846.15

Receipts from accident - loss profit 50,000.00 50,000.00

Total 3,210,000.00 2,770,000.00 350,000.00 Via BIR Form 1603Q

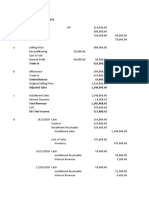

Income Tax Computation:

1Q 2Q 3Q ANNUAL

Sales 1,250,000.00 1,500,000.00 2,000,000.00 5,750,000.00

Other Income 100,000.00 100,000.00 Expenses before charity 3,843,750.00

Taxable compensation Income 2,770,000.00 Allowed charitable expense 200,625.00

Deductible expense 1,225,000.00 4,044,375.00 Total Deductible Expense 4,044,375.00

Total 1,250,000.00 1,600,000.00 775,000.00 4,575,625.00

Add: Taxable Income previous quarter 1,250,000.00 1,020,000.00

Taxable Income 1,250,000.00 2,850,000.00 1,795,000.00 4,575,625.00

100,000.00 Payment via 1701Q 1Q

128,000.00 Payment via 1701Q 2Q

Tax Due 100,000.00 228,000.00 428,500.00 1,314,200.00 200,500.00 Payment via 1701Q 3Q

Less: Tax paid previous quarter 100,000.00 228,000.00 508,500.00 80,000.00 Taxes deducted by Employer via BIR Form 2316

Tax due and payable 100,000.00 128,000.00 200,500.00 805,700.00 508,500.00

Via BIR Form 1701Q Via BIR Form 1701

You might also like

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- AE 120 Group Activity AnswersDocument5 pagesAE 120 Group Activity AnswersRichard Rhamil Carganillo Garcia Jr.No ratings yet

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDocument4 pages9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNo ratings yet

- LQ3 FinalDocument6 pagesLQ3 FinalRaz MahariNo ratings yet

- ACCTAX2 Business Case RecentDocument5 pagesACCTAX2 Business Case RecentHazel Joy DemaganteNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- EstateDocument8 pagesEstateLyka RoguelNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Pajak Rizki Rahmat Putra - 20AP2Document9 pagesPajak Rizki Rahmat Putra - 20AP2Alviana RenoNo ratings yet

- Reign Gagalac 2-7-22Document5 pagesReign Gagalac 2-7-22Rouise GagalacNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Fabm SolutionDocument10 pagesFabm SolutionJasmine ActaNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- Capital Budgeting Cash Flows ComputationDocument6 pagesCapital Budgeting Cash Flows Computationnelle de leonNo ratings yet

- Trial BalanceDocument1 pageTrial Balancebhoomika.shah0624No ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- AFAR 2 NotesDocument157 pagesAFAR 2 NotesAlexandria EvangelistaNo ratings yet

- Itax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Document13 pagesItax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Rose CastilloNo ratings yet

- Basic Accounting ExerciseDocument5 pagesBasic Accounting ExercisechubbybunbunNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- BA713 Financial Management Tutorial 2Document4 pagesBA713 Financial Management Tutorial 2Ten NineNo ratings yet

- Planed Cash Reciepts: Collection of Account RecievablesDocument11 pagesPlaned Cash Reciepts: Collection of Account RecievablesMani ManandharNo ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- WP - Forex Practice SetDocument8 pagesWP - Forex Practice SetJester LimNo ratings yet

- Example For Chapter 2 (FABM2)Document10 pagesExample For Chapter 2 (FABM2)Althea BañaciaNo ratings yet

- P and L and BSDocument8 pagesP and L and BSgautam48128No ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Uas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005Document1 pageUas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005raflyNo ratings yet

- ExpensesDocument3 pagesExpensesJezerie Kaye T. FerrerNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Assessment 1 - Assignment 1Document5 pagesAssessment 1 - Assignment 1Ten NineNo ratings yet

- Exchange Gain On DonationDocument11 pagesExchange Gain On DonationDinindu SahanNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- ABC MIDTERMS PROJECT Sene Di Pa TaposDocument11 pagesABC MIDTERMS PROJECT Sene Di Pa TaposJanesene SolNo ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- BA 118.3 Module 2 Post and Sage AnswersDocument18 pagesBA 118.3 Module 2 Post and Sage AnswersRed Ashley De LeonNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsAira Dane VillegasNo ratings yet

- InTax Unit 7Document1 pageInTax Unit 7ElleNo ratings yet

- IA Chapter-11-14Document7 pagesIA Chapter-11-14Christine Joyce EnriquezNo ratings yet

- 06 Quiz 1 Income TaxDocument1 page06 Quiz 1 Income TaxKarylle ComiaNo ratings yet

- Budget ControllingDocument1 pageBudget ControllingLester ErlanoNo ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- TrialBal (1) - 2Document1 pageTrialBal (1) - 2shreygautam12No ratings yet

- PatnershipDocument7 pagesPatnershipShevina MaghariNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisDocument3 pagesFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisBetcy RaetoraNo ratings yet

- Irene LaguioDocument18 pagesIrene LaguioAlvinNoay100% (2)

- Tugas AKL1Document4 pagesTugas AKL1Yandra Febriyanti0% (1)

- Evi4 104957Document2 pagesEvi4 104957Al QadriNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 3 Ethiopian Payroll SystemDocument10 pagesChapter 3 Ethiopian Payroll SystemWonde Biru89% (46)

- Bills Material PurchaseDocument2 pagesBills Material PurchaseChanchal PathakNo ratings yet

- Generator Registration Fees (El - Tax) Generator Registration Fees (El - Tax) Generator Registration Fees (El - Tax)Document1 pageGenerator Registration Fees (El - Tax) Generator Registration Fees (El - Tax) Generator Registration Fees (El - Tax)aaanathanNo ratings yet

- Superannuation WorksheetDocument2 pagesSuperannuation WorksheetAaron100% (1)

- Amit Singh-Payslip - Jun-2021-Unlocked PDFDocument3 pagesAmit Singh-Payslip - Jun-2021-Unlocked PDFamitNo ratings yet

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument4 pagesIncome Payee'S Sworn Declaration of Gross Receipts/SalesLeslie Darwin DumasNo ratings yet

- GST Session 38Document20 pagesGST Session 38manjulaNo ratings yet

- Re Care PackageDocument1 pageRe Care PackageYuvraj BanwaitNo ratings yet

- Your Payout: 19 September - 25 September 28 SeptemberDocument84 pagesYour Payout: 19 September - 25 September 28 SeptembersagarNo ratings yet

- CIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Document3 pagesCIR v. LEDNICKY, G.R. Nos. L-18169, L-18262 & L-21434, 11 SCRA 603, 31 July 1964Pamela Camille Barredo100% (1)

- Taxation Under The AmericanDocument10 pagesTaxation Under The AmericanMenard Nava88% (8)

- Pelaburan 1986Document4 pagesPelaburan 1986Ken ChiaNo ratings yet

- TAX Quiz 30Document2 pagesTAX Quiz 30LanceNo ratings yet

- Western Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Document2 pagesWestern Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Marc William SorianoNo ratings yet

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- AT1 Alberta Corporate Tax Return Guide Part 1Document39 pagesAT1 Alberta Corporate Tax Return Guide Part 1sharifNo ratings yet

- ISS 0744 CDocument1 pageISS 0744 CVinay RangariNo ratings yet

- 4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFDocument883 pages4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFElgun JafarovNo ratings yet

- Idt Test - 3 (CH - 8,14,15,16,24)Document12 pagesIdt Test - 3 (CH - 8,14,15,16,24)amaan sheikhNo ratings yet

- Assignment-Principles and Practices of TaxationDocument4 pagesAssignment-Principles and Practices of TaxationJayaNo ratings yet

- Reinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Document1 pageReinforced Earth India PVT LTD E-11, B1 EXTN, Mcie Mathura Road, New Delhi NEW DELHI - 110044 Delhi Payslip For April - 2019Kaushik BiswasNo ratings yet

- Pay Slip Format 1Document6 pagesPay Slip Format 1Rahmath RahmathNo ratings yet

- Form 15g NewDocument4 pagesForm 15g NewnazirsayyedNo ratings yet

- Principles of Economics/TaxationDocument2 pagesPrinciples of Economics/TaxationCarmi B. ChulipaNo ratings yet

- ACCA F6 Notes J15 PDFDocument264 pagesACCA F6 Notes J15 PDFopentuitionIDNo ratings yet

- Tax Reviewer - Train Law - Rates and ComputationsDocument5 pagesTax Reviewer - Train Law - Rates and ComputationsCelestiaNo ratings yet

- Form 16 Part BDocument4 pagesForm 16 Part BDharmendraNo ratings yet

- Purchase Transaction Reconciliation of Listing For EnforcementDocument7 pagesPurchase Transaction Reconciliation of Listing For EnforcementMArk BarenoNo ratings yet

- Normal Tax Rates For Individual & HUFDocument14 pagesNormal Tax Rates For Individual & HUFAdarsh PandeyNo ratings yet

- BRIEF HISTORICAL VIEW OF MODERN TAX ADMINISTRATION IN ALBANIA, 1994-2011 - AL-TaxDocument3 pagesBRIEF HISTORICAL VIEW OF MODERN TAX ADMINISTRATION IN ALBANIA, 1994-2011 - AL-TaxEduart GjokutajNo ratings yet