Professional Documents

Culture Documents

Taxation

Uploaded by

Pauline Jasmine Sta AnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation

Uploaded by

Pauline Jasmine Sta AnaCopyright:

Available Formats

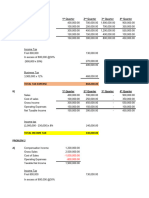

Problem 1

Salary 1,800,000.00

Profit Sharing 300,000.00 supplementary

Less: Mandatory Deductions (30,400.00)

Income subject to 90,000 limit Exempt Subject to limit

13th month pay 150,000.00

Clothing allowance 6,000.00 9,000.00

Laundry allowance 3,600.00 8,400.00

Christmas gift 5,000.00 20,000.00

Monetized unused VL credits 60,000.00 30,000.00

Monetized unused SL credits 60,000.00

277,400.00

Limit 90,000.00 187,400.00

mandatory deduction 30,400.00

Total exempt compensation 195,000.00

Total taxable compensation 2,257,000.00

Sales revenues 950,000.00 Review: Basis of OSD for individuals: 40% of total sales

COGS (400,000.00) Basis of OSD for corporations: 40% of gross income

Gross Income 550,000.00 For both individuals and corporations: Other operating income

Less: Expenses

Salaries Expense (195,000.00)

Rent Expense (50,000.00)

Utilities Expense (25,000.00)

Taxable income from business 280,000.00

Total income subject to regular tax / normal tax 2,537,000.00

Interest income from BPI (amount received) 9,600.00

Gross-up (divide by 80%) 80%

Total income subject to final tax 12,000.00

uals: 40% of total sales

0% of gross income

ions: Other operating income are included, non-operating income are not

Income Tax Due under graduated tax regime

Basic Tax 402,500.00

Excess over 2,000,000 537,000.00

30% of excess 161,100.00

Income Tax Due under graduated tax regime 563,600.00

Tax Credit (402,500.00)

Income Tax STILL due 161,100.00

Income Tax Due under 8% income tax

Basic Tax 402,500.00 Note: taxable compensation income will still be subjected to graduate rates

Excess over 2,000,000 257,000.00

30% of excess 77,100.00

Income Tax Due on taxable comp. income 479,600.00

Sales of pet shop business 950,000.00

Multiply by 8% rate 8%

Income Tax due of business 76,000.00

Income Tax Due under 8% income tax 555,600.00

duate rates

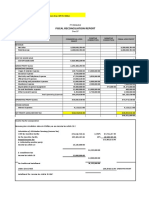

Itemized OSD

Sales 9,000,000.00

Sales Returns (100,000.00)

Net Sales 8,900,000.00

Cost of Sales (2,700,000.00)

Gross Income 6,200,000.00 6,200,000.00

Optional Standard Deduction 2,480,000.00

Depreciation expense 250,000.00

Rent expense 150,000.00

Utilities expense 100,000.00

Salaries expense 320,000.00

Taxes and Licenses 20,000.00

Mandatory contributions 55,000.00

Taxable Income 5,305,000.00 3,720,000.00

RCIT 1,326,250.00 930,000.00

MCIT 124,000.00 124,000.00

Tax due (Higher between RCIT and MCIT) 1,326,250.00 930,000.00

Tax Credits (790,000.00) (790,000.00)

Tax STILL due 536,250.00 140,000.00

2. tax benefit or tax cost of employing itemized deduction over OSD

--> compute both tax due under itemized and osd and compare

Tax due under itemized deduction 1,326,250.00

Tax due under OSD 930,000.00

Tax COST of employing itemized deduction 396,250.00

OSD is more beneficial, this, Marites incurred tax cost in employing itemized deduction.

You might also like

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDocument4 pages9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Via BIR Form 1706Document1 pageVia BIR Form 1706YnnaNo ratings yet

- EstateDocument8 pagesEstateLyka RoguelNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- 06 Quiz 1 Income TaxDocument1 page06 Quiz 1 Income TaxKarylle ComiaNo ratings yet

- Deductions TaxationDocument4 pagesDeductions Taxationramosinducil05No ratings yet

- Week 8 ExampleDocument3 pagesWeek 8 Examplejemybanez81No ratings yet

- Sales 3,000,000.00: Invoice Price 112,000.00Document11 pagesSales 3,000,000.00: Invoice Price 112,000.00Alicia FelicianoNo ratings yet

- INCOME TAX Part 1Document1 pageINCOME TAX Part 1honeylove uNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- Novelyn AIDocument3 pagesNovelyn AInovyNo ratings yet

- Installed Cost of Proposed Machine 400,000Document5 pagesInstalled Cost of Proposed Machine 400,000Mariame Abasola CagabhionNo ratings yet

- UntitledDocument13 pagesUntitledAnne GuamosNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Addisu Tadesse Adj FSDocument6 pagesAddisu Tadesse Adj FSGali AbamededNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- 5,655.00 Additional Investment Needed/financingDocument23 pages5,655.00 Additional Investment Needed/financingMPCINo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Intax FINAL EXAMDocument20 pagesIntax FINAL EXAMSteph TubuNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- Spring Day Company Statement of Financial Position For 20x1 and 20x2Document2 pagesSpring Day Company Statement of Financial Position For 20x1 and 20x2Printing PandaNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Responsiblity Accounting IllustrationDocument14 pagesResponsiblity Accounting IllustrationRianne NavidadNo ratings yet

- ACCTAX2 Business Case RecentDocument5 pagesACCTAX2 Business Case RecentHazel Joy DemaganteNo ratings yet

- Capital Budgeting Cash Flows ComputationDocument6 pagesCapital Budgeting Cash Flows Computationnelle de leonNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Deductible Non-Deductible: PenaltiesDocument6 pagesDeductible Non-Deductible: PenaltiesFerl ElardoNo ratings yet

- Answer W8 - As5 CashflowDocument2 pagesAnswer W8 - As5 CashflowJere Mae MarananNo ratings yet

- Preparation of Individual Income Tax Return For Mixed Income EarnerDocument3 pagesPreparation of Individual Income Tax Return For Mixed Income Earnercarl patNo ratings yet

- ExpensesDocument3 pagesExpensesJezerie Kaye T. FerrerNo ratings yet

- Sample Income Statement ManufacturingDocument1 pageSample Income Statement ManufacturingIrish Kit SarmientoNo ratings yet

- ExampleDocument8 pagesExampleAli Akand AsifNo ratings yet

- Case Study 1Document7 pagesCase Study 1Trisha Mae Mendoza MacalinoNo ratings yet

- Act 4 Masay Company (SCGS)Document4 pagesAct 4 Masay Company (SCGS)Reginald MundoNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Taller FinalDocument13 pagesTaller FinalJennifer Ramos PerezNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- EXCEL INC TAX FinalDocument2 pagesEXCEL INC TAX FinalLysss EpssssNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- HomeworkDocument17 pagesHomeworkMJNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Problem 3: Multiple Choice - COMPUTATIONAL 1. BDocument10 pagesProblem 3: Multiple Choice - COMPUTATIONAL 1. BCharizza Amor TejadaNo ratings yet

- Partnership - OperationDocument11 pagesPartnership - OperationAiziel OrenseNo ratings yet

- Output Tax 396,000Document2 pagesOutput Tax 396,000almira garciaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Esops 101 (What/Why/How) : Robert E. BrownDocument20 pagesEsops 101 (What/Why/How) : Robert E. Brownashwani7789No ratings yet

- CPC Rule 48 Order 21Document8 pagesCPC Rule 48 Order 21kaartheekvyyahruti4291No ratings yet

- Cash Flow - Turtorial 8Document33 pagesCash Flow - Turtorial 8Kevin ChandraNo ratings yet

- 3in1tax Calculator With Form 16 V 14.2 FY 2019-20Document18 pages3in1tax Calculator With Form 16 V 14.2 FY 2019-20Nihit SandNo ratings yet

- Income From Salary Problems Theory and Solutions New 200809 Assessment Year 1222393780092207 8 PDFDocument76 pagesIncome From Salary Problems Theory and Solutions New 200809 Assessment Year 1222393780092207 8 PDFvinayak ShedgeNo ratings yet

- Current Affair Questions On Lagos StateDocument43 pagesCurrent Affair Questions On Lagos Statealphatrade500No ratings yet

- 44 - Ma. Lourdes S. Florendo v. Philam Plans, Inc., Perla Abcede, Ma. Celeste AbcedeDocument2 pages44 - Ma. Lourdes S. Florendo v. Philam Plans, Inc., Perla Abcede, Ma. Celeste AbcedeKris GaoatNo ratings yet

- 127 - Compensation Management PDFDocument346 pages127 - Compensation Management PDFShikha Arora100% (1)

- Epjj Lesson Plan Fin533 Oct - Jan2021Document4 pagesEpjj Lesson Plan Fin533 Oct - Jan2021FatihaaroslanNo ratings yet

- Tax - Midterm NTC 2017Document12 pagesTax - Midterm NTC 2017Red YuNo ratings yet

- 2017 PWC-europe PDFDocument715 pages2017 PWC-europe PDFaammNo ratings yet

- Nivetha Mba Final Yr ProjectDocument22 pagesNivetha Mba Final Yr ProjectNivethaNo ratings yet

- Just Dial Joining Salary ChartDocument2 pagesJust Dial Joining Salary ChartPritam SamantaNo ratings yet

- Template For Family Trust in UgandaDocument19 pagesTemplate For Family Trust in UgandarngobyaNo ratings yet

- About The Student: This Se Ction A Sks For Importa NT Informa Tion A Bout The Stude NTDocument11 pagesAbout The Student: This Se Ction A Sks For Importa NT Informa Tion A Bout The Stude NTtop5 nepalNo ratings yet

- Deferred Compensation OutlineDocument45 pagesDeferred Compensation OutlineEli ColmeneroNo ratings yet

- Tax I R K FINAL AS AT 20 2 06Document315 pagesTax I R K FINAL AS AT 20 2 06Adarsh. UdayanNo ratings yet

- Acs102 Fundamentals of Actuarial Science IDocument6 pagesAcs102 Fundamentals of Actuarial Science IKimondo King100% (1)

- Macro Assignment 3Document5 pagesMacro Assignment 3Iqra TahirNo ratings yet

- Prashant Priyadarshi A-20 Banking TermpaperDocument23 pagesPrashant Priyadarshi A-20 Banking TermpaperPrashantNo ratings yet

- Whole of Life Insurance+: Policy SummaryDocument16 pagesWhole of Life Insurance+: Policy SummaryChristos YerolemouNo ratings yet

- Pay Slip TemplateDocument3 pagesPay Slip TemplateRachiel Kintos100% (1)

- PAS 19 (Revised) Employee BenefitsDocument35 pagesPAS 19 (Revised) Employee BenefitsReynaldNo ratings yet

- 5 SHRM CP-SCP People - 5 - Total RewardsDocument54 pages5 SHRM CP-SCP People - 5 - Total RewardsPhan Nguyễn Đăng KhoaNo ratings yet

- Taxation I Lesson 1 and 2 Introduction TDocument13 pagesTaxation I Lesson 1 and 2 Introduction TApex LionheartNo ratings yet

- Poniman, SE., M.S.A., Ak., CADocument10 pagesPoniman, SE., M.S.A., Ak., CAshelvira viraNo ratings yet

- The Role of Insurance in The Economy of The Republic of North MacedoniaDocument3 pagesThe Role of Insurance in The Economy of The Republic of North MacedoniaEditor IJTSRDNo ratings yet

- Feedback Report On Social Pension PayoutDocument1 pageFeedback Report On Social Pension PayoutAli HasanieNo ratings yet

- FL Reporting Instructions Manual For Unclaimed PropertyDocument23 pagesFL Reporting Instructions Manual For Unclaimed PropertyKayla PowellNo ratings yet

- Philam Life Offers Easy Payment Options For Policyholders: Media ReleaseDocument2 pagesPhilam Life Offers Easy Payment Options For Policyholders: Media ReleaseJ LaraNo ratings yet