Professional Documents

Culture Documents

Arbitrage Limit: Total Deductible Interest Expense

Uploaded by

Lyka RoguelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Arbitrage Limit: Total Deductible Interest Expense

Uploaded by

Lyka RoguelCopyright:

Available Formats

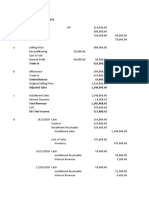

Prior year 300,000.

00

Current year 650,000.00

Next year 200,000.00

Gross Receipts 1,150,000.00

Less: Expenses

Salaries 82,800.00

Depreciation 20,700.00

Supplies 10,380.00

Ultilities 24,840.00

Transportation 16,560.00

Taxes and licenses 6,240.00 161,520.00

Gain on sale of equipment 65,000.00

Gross income from operations 1,053,480.00

Tax refund 32,500.00

Gross income 1,085,980.00

Less: Itemized deductions

Salaries 55,200.00

Depreciation 13,800.00

Supplies 6,920.00

Ultilities 16,560.00

Interest 3,000.00

Transportation 11,040.00

Taxes and licenses 4,160.00

Other 12,500.00 123,180.00

Taxable/Distributable income 962,800.00

Interest income in peso bank deposit 6,240.00

Interest income in FCDU 11,050.00

Total distributable income 980,090.00

Interest expense 5,574.00

Less: Interest income from peso bank deposit 7,800.00

Arbitrage limit 33% 2,574.00

Total deductible interest expense 3,000.00

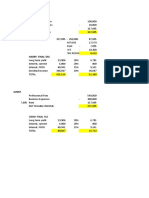

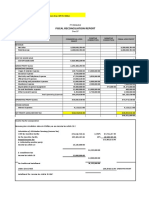

30% 70%

Corolla Toyota Total

Taxable income 288,840.00 673,960.00 962,800.00

Less: CWT, 10% 28,884.00 67,396.00 96,280.00

Income taxable to partners, net of CWT 259,956.00 606,564.00 866,520.00

Income subject to final tax: -

Interest income in peso bank deposit 1,872.00 4,368.00 6,240.00

Interest income in FCDU 3,315.00 7,735.00 11,050.00

Income not taxable to partners 5,187.00 12,103.00 17,290.00

Share of income in GPP, net of CWT 265,143.00 618,667.00 883,810.00

TOYOTA

Final Tax Rate FWT

Passive income:

Interest income in bank deposit 25,000.00 20% 5,000.00

Dividend income from domestic corporation 20,000.00 10% 2,000.00

Total 7,000.00

Capital Gains: Final Tax Rate FWT

Gain on sale of domestic stocks:

Directly through a buyer 60,000.00 15% 9,000.00

COROLLA

Final Tax Rate FWT

Passive income:

Royalty Income 20,000.00 10% 2,000.00

Prize 50,000.00 20% 10,000.00

Total 12,000.00

Capital Gains: -

You might also like

- PDFDocument1 pagePDFBrian SmithNo ratings yet

- Downloadfile 30 PDFDocument114 pagesDownloadfile 30 PDFYianniAnd Sophia0% (1)

- TAXATIONDocument2 pagesTAXATIONEnnavy Yongkol100% (1)

- Gross Income With Answer KeyDocument4 pagesGross Income With Answer KeyFallaria Paulo A.No ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- Irene LaguioDocument18 pagesIrene LaguioAlvinNoay100% (2)

- Payslip Lyka Labs-Ramjeet PalDocument1 pagePayslip Lyka Labs-Ramjeet PalPankaj PandeyNo ratings yet

- 4515512273482Document1 page4515512273482VermaNo ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- CIR Vs SONY PDFDocument2 pagesCIR Vs SONY PDFkaira marie carlosNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Bhaveshpriyam@ PDFDocument1 pageBhaveshpriyam@ PDFDonally PatelNo ratings yet

- CIR vs. CityTrustDocument2 pagesCIR vs. CityTrustRea Jane B. MalcampoNo ratings yet

- RR 1 - 1998Document3 pagesRR 1 - 1998Lady Ann CayananNo ratings yet

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- EstateDocument8 pagesEstateLyka RoguelNo ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Fabm SolutionDocument10 pagesFabm SolutionJasmine ActaNo ratings yet

- Franchising Consignment KeyDocument22 pagesFranchising Consignment KeyMichael Jay SantosNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- EXCEL INC TAX FinalDocument2 pagesEXCEL INC TAX FinalLysss EpssssNo ratings yet

- Via BIR Form 1706Document1 pageVia BIR Form 1706YnnaNo ratings yet

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- INCOME TAX Part 2Document1 pageINCOME TAX Part 2honeylove uNo ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- Case Study 1Document7 pagesCase Study 1Trisha Mae Mendoza MacalinoNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Tax Comp FLE02-1Document9 pagesTax Comp FLE02-1Lenielyn UbaldoNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- FS Group 2Document5 pagesFS Group 2Ge-Ann BonuanNo ratings yet

- Particulars Taka Taka TakaDocument2 pagesParticulars Taka Taka TakaTushar Mahmud SizanNo ratings yet

- 5,655.00 Additional Investment Needed/financingDocument23 pages5,655.00 Additional Investment Needed/financingMPCINo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Mini Project CAIA (Financial Statement)Document2 pagesMini Project CAIA (Financial Statement)norizzatisyamrilNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- Deductible Non-Deductible: PenaltiesDocument6 pagesDeductible Non-Deductible: PenaltiesFerl ElardoNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- Answer W8 - As5 CashflowDocument2 pagesAnswer W8 - As5 CashflowJere Mae MarananNo ratings yet

- Week 8 ExampleDocument3 pagesWeek 8 Examplejemybanez81No ratings yet

- Intax FINAL EXAMDocument20 pagesIntax FINAL EXAMSteph TubuNo ratings yet

- PatnershipDocument7 pagesPatnershipShevina MaghariNo ratings yet

- Shesnath ChowdharyDocument8 pagesShesnath ChowdharyCA Saurabh SrivastavaNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Nice Spring Icee Delight (Dumaguete) : For The Month Ended December 31, 2020Document2 pagesNice Spring Icee Delight (Dumaguete) : For The Month Ended December 31, 2020ARISNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- 2023 BudgetDocument1 page2023 Budgetmisyel deveraNo ratings yet

- Lembar Jawaban 4-LAPORAN FixDocument7 pagesLembar Jawaban 4-LAPORAN FixClara Shinta OceeNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Fin Accts 2 AdditionalDocument5 pagesFin Accts 2 AdditionalChevonne OatesNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- VatDocument23 pagesVatMichole chin MallariNo ratings yet

- JuneDocument2 pagesJuneMaddydon123No ratings yet

- TAX SolutionsDocument24 pagesTAX SolutionsJerome MadrigalNo ratings yet

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- Nice Spring Icee Delight (Bohol) : For The Month Ended December 31, 2020Document2 pagesNice Spring Icee Delight (Bohol) : For The Month Ended December 31, 2020ARISNo ratings yet

- Ch. 2 ConsolDocument58 pagesCh. 2 ConsolLyka RoguelNo ratings yet

- Stock AqDocument19 pagesStock AqLyka RoguelNo ratings yet

- No of Orders/month Value of Order Ave. Inventory Carrying Cost (4.24%) Ordering CostDocument7 pagesNo of Orders/month Value of Order Ave. Inventory Carrying Cost (4.24%) Ordering CostLyka RoguelNo ratings yet

- Naming Conventions of Tables in SAP Business OneDocument5 pagesNaming Conventions of Tables in SAP Business OneLyka RoguelNo ratings yet

- As You Think, So You AreDocument1 pageAs You Think, So You AreLyka RoguelNo ratings yet

- Summative Problems PDFDocument91 pagesSummative Problems PDFLyka RoguelNo ratings yet

- Question 1 of 50: Select The Correct ResponseDocument22 pagesQuestion 1 of 50: Select The Correct ResponseLyka RoguelNo ratings yet

- Asawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueDocument22 pagesAsawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueLyka RoguelNo ratings yet

- Research Summative AssessmentDocument7 pagesResearch Summative AssessmentLyka RoguelNo ratings yet

- 1 Comments On Research - IntroDocument7 pages1 Comments On Research - IntroLyka RoguelNo ratings yet

- BusinessDocument122 pagesBusinessLyka Roguel100% (1)

- Batch-Level Activities:: Total CostsDocument8 pagesBatch-Level Activities:: Total CostsLyka RoguelNo ratings yet

- Literature MatrixDocument27 pagesLiterature MatrixLyka RoguelNo ratings yet

- De La Salle University - Dasmariñas: ReferencesDocument3 pagesDe La Salle University - Dasmariñas: ReferencesLyka RoguelNo ratings yet

- HORNGREN 12-20 Target Operating Income, Value-Addedcosts, ServicecompanyDocument5 pagesHORNGREN 12-20 Target Operating Income, Value-Addedcosts, ServicecompanyLyka RoguelNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Lyka Jane R. Roguel: Effects of Inventory Management Practices On The Performance of Feeds Dealer in CaviteDocument6 pagesLyka Jane R. Roguel: Effects of Inventory Management Practices On The Performance of Feeds Dealer in CaviteLyka RoguelNo ratings yet

- De La Salle University - Dasmariñas: ReferencesDocument3 pagesDe La Salle University - Dasmariñas: ReferencesLyka RoguelNo ratings yet

- De La Salle University - DasmariñasDocument12 pagesDe La Salle University - DasmariñasLyka RoguelNo ratings yet

- What Is Research Proposal?Document3 pagesWhat Is Research Proposal?Lyka RoguelNo ratings yet

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocument7 pagesAescartin/Tlopez/Jpapa: Mobile Telephone GmailReynalyn BarbosaNo ratings yet

- Solved Elizabeth Owns Equipment That Cost 500 000 and Has An AdjustedDocument1 pageSolved Elizabeth Owns Equipment That Cost 500 000 and Has An AdjustedAnbu jaromiaNo ratings yet

- Application Guideline NepalDocument56 pagesApplication Guideline NepalkesharinareshNo ratings yet

- Income Tax 2nd PretestDocument3 pagesIncome Tax 2nd PretestEllaMay Delazerna0% (1)

- Go 141 Roads-BuildingsDocument1 pageGo 141 Roads-BuildingsRajaNo ratings yet

- Account Symphony TheatreDocument1,821 pagesAccount Symphony Theatresuryagc0% (1)

- Satyam Sudan: Offer LetterDocument2 pagesSatyam Sudan: Offer LetterssattyyaammNo ratings yet

- Qesco Online BillDocument2 pagesQesco Online BillGuru bhaiNo ratings yet

- E-Way Bill SRA 392Document1 pageE-Way Bill SRA 392GANUNo ratings yet

- Introduction To Taxation-UCTDocument41 pagesIntroduction To Taxation-UCTArvish RamseebaluckNo ratings yet

- Legal Framework of TaxationDocument34 pagesLegal Framework of TaxationCamille HofilenaNo ratings yet

- Intax-Activity 1Document1 pageIntax-Activity 1Venus PalmencoNo ratings yet

- Seminario Fénix de Brian TracyDocument1 pageSeminario Fénix de Brian TracyVíctor Antonio Rivera fermaintNo ratings yet

- Taxation Research PaperDocument40 pagesTaxation Research Papermonu panditNo ratings yet

- Agricultural IncomeDocument15 pagesAgricultural Incomerups05No ratings yet

- Taxiation AssignmentDocument9 pagesTaxiation AssignmentNoman AreebNo ratings yet

- Toaz - Info Chapter 10 Compensation Income True or False 1 PRDocument22 pagesToaz - Info Chapter 10 Compensation Income True or False 1 PRErna DavidNo ratings yet

- Itr Ay 23-24Document1 pageItr Ay 23-24Ashwani KumarNo ratings yet

- 21 (6) - 4A 12e SDocument5 pages21 (6) - 4A 12e SashibhallauNo ratings yet