Professional Documents

Culture Documents

INCOME TAX Part 1

Uploaded by

honeylove u0 ratings0% found this document useful (0 votes)

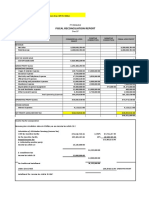

7 views1 pageThe document contains 9 sections that provide financial information for different businesses, including gross sales or receipts, costs of goods sold and other operating expenses, taxable income, and income tax payable calculations. Sections 4-7 show individual business financial statements, while sections 8-9 provide consolidated financial information by combining figures from multiple businesses.

Original Description:

Individual taxpayers

Original Title

INCOME TAX part 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains 9 sections that provide financial information for different businesses, including gross sales or receipts, costs of goods sold and other operating expenses, taxable income, and income tax payable calculations. Sections 4-7 show individual business financial statements, while sections 8-9 provide consolidated financial information by combining figures from multiple businesses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageINCOME TAX Part 1

Uploaded by

honeylove uThe document contains 9 sections that provide financial information for different businesses, including gross sales or receipts, costs of goods sold and other operating expenses, taxable income, and income tax payable calculations. Sections 4-7 show individual business financial statements, while sections 8-9 provide consolidated financial information by combining figures from multiple businesses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

(4) Gross sales 2,800,000.

00 (4)

COS (1,200,000.00)

OE (650,000.00)

Rent income 400,000.00

Taxable income 1,350,000.00

Tax due:

1st 800,000 102,500.00

Excess 137,500.00

Income tax payable 240,000.00

Not applicable - Gross

sales and other income

exceeded VAT threshold

(5) of 3,000,000. (5)

(6) Gross receipts 4,000,000.00 (6)

Cost of direct services (1,800,000.00)

Other operating

expenses (825,000.00)

Taxable income 1,375,000.00

Tax due:

1st 800,000 102,500.00

Excess 143,750.00

Income tax payable 246,250.00

Not applicable - Gross

receipts exceeded VAT

(7) threshold of 3,000 000. (7)

(8) Compensation income 1,400,000.00 (8)

Gross sales 2,800,000.00

COS (1,200,000.00)

OE (650,000.00)

Taxable income 2,350,000.00

Tax due:

1st 2,000,000 402,500.00

Excess 105,000.00

Less: Withholding tax on: 507,500.00

Compensation income (310,000.00)

Business income (80,000.00)

Income tax payable 117,500.00

(9) Gross sales 2,800,000.00 (9)

Multiply by 0.08

224,000.00

Add: Tax due on

compensation income

1st 800,000 102,500.00

Excess 150,000.00 252,500.00

Tax due 476,500.00

You might also like

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDocument4 pages9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Capital Budgeting Cash Flows ComputationDocument6 pagesCapital Budgeting Cash Flows Computationnelle de leonNo ratings yet

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Chapter 14 Solved Problems and ExercisesDocument17 pagesChapter 14 Solved Problems and ExercisesMelady Sison CequeñaNo ratings yet

- AEC-7 MIDTERM EXAMINATION SOLUTIONSDocument9 pagesAEC-7 MIDTERM EXAMINATION SOLUTIONSDaisy TañoteNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Income Tax Calculation for Multiple Individuals and EntitiesDocument8 pagesIncome Tax Calculation for Multiple Individuals and EntitiesLyka RoguelNo ratings yet

- Via BIR Form 1706Document1 pageVia BIR Form 1706YnnaNo ratings yet

- m2 Answer KeyDocument2 pagesm2 Answer KeyLara Camille CelestialNo ratings yet

- Deferred tax assets and liabilities reconciliationDocument8 pagesDeferred tax assets and liabilities reconciliationIan RelacionNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Income StatementDocument6 pagesIncome StatementMohamed Yusuf KarieNo ratings yet

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- Dinner Co. Profit Loss StatementDocument3 pagesDinner Co. Profit Loss StatementnovyNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- 06 Quiz 1 Income TaxDocument1 page06 Quiz 1 Income TaxKarylle ComiaNo ratings yet

- Act 4 Masay Company (SCGS)Document4 pagesAct 4 Masay Company (SCGS)Reginald MundoNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Sales 3,000,000.00: Invoice Price 112,000.00Document11 pagesSales 3,000,000.00: Invoice Price 112,000.00Alicia FelicianoNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Activity 2 Income TaxationDocument5 pagesActivity 2 Income TaxationEd HernandezNo ratings yet

- Income Taxation Mcqs&ProblemsDocument14 pagesIncome Taxation Mcqs&ProblemsJayrald LacabaNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- Exercises On Implementation of DCF ApproachDocument10 pagesExercises On Implementation of DCF ApproachVincenzoPizzulliNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- Asdos Jawaban 2Document3 pagesAsdos Jawaban 2mutiaoooNo ratings yet

- Quiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSDocument5 pagesQuiz 2.1 - Individual Taxpayers and Quiz 3.1 - INCOME TAX ON CORPORATIONSHunternotNo ratings yet

- Analyzing Financial Statements and Solving ProblemsDocument10 pagesAnalyzing Financial Statements and Solving ProblemsGeraldine Martinez DonaireNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- STAR LORD CORP. EMPLOYEE STOCK OPTIONSDocument20 pagesSTAR LORD CORP. EMPLOYEE STOCK OPTIONSadieNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Addisu Tadesse Adj FSDocument6 pagesAddisu Tadesse Adj FSGali AbamededNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- FinancialsDocument2 pagesFinancialsSailesh RankaNo ratings yet

- INCOME TAX Part 2Document1 pageINCOME TAX Part 2honeylove uNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Multiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)Document4 pagesMultiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)anitaNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- ACCTG 115 Lecture (01-27-2022)Document3 pagesACCTG 115 Lecture (01-27-2022)Janna Mari FriasNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- ACCTAX2 Business Case RecentDocument5 pagesACCTAX2 Business Case RecentHazel Joy DemaganteNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Synthesis ReportingDocument3 pagesSynthesis ReportingJason Dwight CamartinNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Accounting Assignments Financial StatementsDocument5 pagesAccounting Assignments Financial StatementsTendai MakosaNo ratings yet

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Taxation 1Document12 pagesTaxation 1Lady Zyanien DevarasNo ratings yet

- Single EntryDocument2 pagesSingle EntryAnswer KeyNo ratings yet

- Cash FlowsDocument7 pagesCash FlowsJasmine ActaNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Tutor 1Document6 pagesTutor 1Elaine LimNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Problem 1-1Document1 pageProblem 1-1honeylove uNo ratings yet

- Problem REDocument1 pageProblem REhoneylove uNo ratings yet

- INCOME TAX Part 3Document2 pagesINCOME TAX Part 3honeylove uNo ratings yet

- Prob 15-3Document1 pageProb 15-3honeylove uNo ratings yet

- INCOME TAX Part 2Document1 pageINCOME TAX Part 2honeylove uNo ratings yet

- Ci, Carried Forward 48,000.00 15,000.00 47,000.00: AssetDocument1 pageCi, Carried Forward 48,000.00 15,000.00 47,000.00: Assethoneylove uNo ratings yet

- Case 2Document1 pageCase 2honeylove uNo ratings yet

- Chap.14 Guerrero Process CostingQuestionsDocument22 pagesChap.14 Guerrero Process CostingQuestionshoneylove uNo ratings yet

- Case 1Document1 pageCase 1honeylove uNo ratings yet

- Problem 1-1Document1 pageProblem 1-1honeylove uNo ratings yet

- Part 1Document1 pagePart 1honeylove uNo ratings yet

- Aaca 2Document2 pagesAaca 2honeylove uNo ratings yet

- Problem 1Document1 pageProblem 1honeylove uNo ratings yet

- Ci, Carried Forward 48,000.00 15,000.00 47,000.00: AssetDocument1 pageCi, Carried Forward 48,000.00 15,000.00 47,000.00: Assethoneylove uNo ratings yet

- Amortizations:: Accounts Lif e Annual Amount 2014 2015 2016 2017Document1 pageAmortizations:: Accounts Lif e Annual Amount 2014 2015 2016 2017honeylove uNo ratings yet