Professional Documents

Culture Documents

Bonus Method: Whose Liability Extends To His Separate Properties

Uploaded by

Robert ApolinarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonus Method: Whose Liability Extends To His Separate Properties

Uploaded by

Robert ApolinarCopyright:

Available Formats

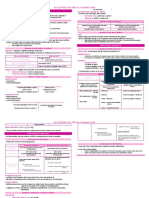

Bonus Method It is used to grant a new pa rtner an additional

capital in a partnership when the person is adding

goodwill or some other intangible asset to the

partnership- any positive difference between the

capital amount granted and the tangible asset

contribution of the new partner is recorded in the

existing partners’ capital accounts while if the

capital amount granted is less than the tangible

asset contribution, the difference is allocated to

the incoming or new partner.

Capitalist-Industrial partner Contributes money, property and industry in the

partnership.

Capitalist partner Contributes money, property to the partnership.

Dormant partner Who is secret and silent partner.

General partner One whose liability extends to his separate

properties.

Goodwill Represents the excess of the cost of the business

combination over the fair value of the identifiable

net assets obtained.

Industrial partner Contributes only his skills, knowledge, industry

or personal service to the partnership.

Limited partner One whose liability for partnership obligation is

limited to his contribution.

Liquidating partner One who takes charge of the winding up of the

partnership affairs after dissolution.

Managing partner One who is appointed by the partners to take

charge of the partnership.

Nominal or Ostensible partner One who is a partner in name only by permitting

the use of his name either for accommodation or

for consideration; subject to liability by the

doctrine of estoppel.

Partnership An association of two or more persons who

contributes money, property or industry to a

common fund with the intention of dividing the

profits among themselves.

Partnership Dissolution A change in the relationship of the partners within

the partnership; occurs generally when one of the

partners ceases to be a partner of the partnership

or another an another partner is admitted.

Partnership Formation, Operation, Dissolution and Liquidation

Partnership Liquidation Means the winding up of the business by selling

the assets, paying the liabilities, and distributing

the remaining cash to the partners.

Secret Partner One who is not known to third persons as a

partner

Silent Partner One who has no active part in the management of

the partnership.

Partnership Formation, Operation, Dissolution and Liquidation

Notes:

Admission of a New Partner

1. Purchase of interest – the new partner purchases a stake in the partnership from

an existing partner. The capital account of the new partner is recorded by merely

reclassifying the capital account of the old partner.

2. By investment of additional Assets – the new adds in investment by cash, property,

or expertise into the partnership.The capital accounts in the partnership are

adjusted and recorded based on two methods namely, the Bonus Method, and the

Goodwill method.

Methods in Accounting for Partner’s Contribution

1. Bonus Method – based on the historical cost principle which states that

admittance of a new partner involves debiting cash or other assets for the Fair

Market Value of the assets contributed and crediting the new partner’s capital for

the agreed percentage of total capital.

a. Bonus granted to the old partners – when the FMV of the assets contributed by

an incoming partner exceeds the amount of ownership interest to be credited

to his capital account, the old partners recognize a bonus equal to this excess

allocated based on income distribution rates of the old partners.

b. Bonus granted to new partner – an incoming partner may contribute assets

having a FMV smaller than the partnership interest granted to that new

partner. Similarly, the new partner is therefore presumed to contribute an

intangible asset, such as managerial expertise or personal business reputation.

In this case, a bonus is granted to the new partner, and the capital accounts of

the old partners are reduced on the basis of their profit and loss ratio.

2. Goodwill Method – According to PFRS 3, Goodwill represents the excess of the cost

of the business combination over the fair value of the identifiable net assets

obtained. Therefore, the standard provides that goodwill attaches only to a

business as a whole and is recognized only when a business is acquired. This

provision of PFRS 3 outlawed the use of the Goodwill method in partnership

accounting particularly admission and retirement of a partner because there is no

business involved.

a. Bonus granted to the old partners – when the FMV of the assets contributed by

an incoming partner exceeds the amount of ownership interest to be credited

to his capital account, the old partners recognize a bonus equal to this excess

allocated based on income distribution rates of the old partners.

b. Bonus granted to new partner – an incoming partner may contribute assets

having a FMV smaller than the partnership interest granted to that new

partner. Similarly, the new partner is therefore presumed to contribute an

intangible asset, such as managerial expertise or personal business reputation.

In this case, a bonus is granted to the new partner, and the capital accounts of

the old partners are reduced on the basis of their profit and loss ratio.

Partnership Formation, Operation, Dissolution and Liquidation

Partner’s

contribute

property

to

cash

value

agreement)

memorandum

Accounting

Contribution:

Valuation

Partners

Cash

Property

Industry

Methods

1.

2.

theitems

Bonus

Goodwill

or

(if

partnership.

=fair

no

or

at

Contribution

cash,

==

may

in

or

for

face

Method

industry

of

market

agreed

non

Method

entry

value

Valuation of Partner’s Contribution

Partners may contribute cash, property or industry to the partnership:

Cash – at face value of property

Non-Cash items – agreed value or fair market value (if no agreement)

Industry – memorandum entry

Method

Contribution

contribute

property

to

cash

value

agreement)

memorandum

Accounting

Contribution:

Partner’s

Valuation

Partners

Cash

Property

Industry

Methods

1.

2.

theitems

Bonus

Goodwill

or

(if

partnership.

=fair

no

or

atcash,

==

may

in

or

for

face

Method

industry

of

market

agreed

non

entry

Accounting for a Partnership differs from Other Forms of Business

Organizations with regard to Capital Accounts

Partner’s Capital

Debit Credit

Permanent withdrawal of Original investment by a partner,

Capital, share in partnership loss additional investment by

from operations debit balance of partner’s share in partnership

drawing account closed to profits from operations

capital

Partner’s Drawing

Debit Credit

Personal withdrawal of Capital The account originally credited

when a partner receives his/her

salary and/or share in the

partnership profits

Partnership Operations

Methods of Distributing Profits Based on Partners’ Agreement

1. Equally - simple to apply but does not give due recognition on the disparity of capital

contribution nor does it recognize the time and effort that a partner may devote in

running the firm’s business operations

2. Arbitrary Ratio - simple to apply but does not give recognition on the disparity of

capital contributions nor does it recognize the time and effort that a partner may

devote in running the firm’s business operations

3. Capital Ratio - (Original, Beginning, Ending, Average) – this method recognizes the

differences in the capital contributions but does not take into account the time and

effort that a partner may devote in running the firm’s business operations.

4. Interest on Capital and the Balance on Agreed Ratio - Interest is allowed to partners

for the use of invested capital. Interest as agreed by the partners shall be allowed in

proportion over the period such capital was actually used. Moreover, the interest

shall be provided whether the income is sufficient or insufficient or there is a net

loss unless otherwise agreed upon by the partners.

Partnership Formation, Operation, Dissolution and Liquidation

Partnership Operations

Methods of Distributing Profits Based on Partners’ Agreement

5. Salary Allowances to Partners and the balance on Agreed Rate - Salaries are allowed

to partners as compensation for their time devoted in the business. Salaries as agreed

by the partners shall be allowed in proportion to the time the partners actually

rendered services to the firm. Such salaries shall be provided whether the profit is

sufficient or not and when there is a loss unless otherwise agreed upon by the

partners

6. Bonus to Managing Partner and the balance on Agreed Ratio - this method allows a

bonus, as an incentive, to the managing partner. It is usually a percentage of the profit.

Bonus, therefore, is allowed only when there is a profit

Statement of Liquidation

Statement of liquidation is a statement prepared to summarize the liquidation process. It

is the basis of the journal entries made to record liquidation. This statement presents in

working paper form the effect of the liquidation on the Statement of Financial Position. It

shows the conversion of assets into cash, the allocation of gain or loss on realization, and

the distribution of cash to creditors and partners.

ILLUSTRATIVE: XYZ Partnership Balance Sheet

XYZ Partnership

Balance Sheet

Cash 8,000 Liabilities 44,800

Other Assets 130,000 Y, Loan 2,000

Loan to X 6,000 Z, Loan 3,200

X, Capital 38,000

Y, Capital 24,000

Z, Capital 32,000

The partners share profit or loss in 2:2:1 ratio respectively.

The partnership incurred 3,000 liquidation expenses.

Required: Prepare a statement of liquidation using the following

assumption:

Assets were sold for 140,000

Partnership Formation, Operation, Dissolution and Liquidation

Order of priority of payment:

1. Payment of liability

2. Right of offset

3. Payment to partners

Notice also that the first step in liquidation is the realization of non-cash assets. Any

gain or loss is allocated to the partners using their profit or loss ratio. In this case, the

Gain on Realization is equal to (140,000 – 130,000) 10,000.

Doctrine of Marshalling Assets

Involves the order of creditors’ rights against the partnership’s assets and the

personal assets of the individual partners. The order in which claims against the

partnership’s assets will be marshaled is as follows:

* Partnership creditors other than partners

* Partner’s claims other than capital and profits, such as loans payable and

accrued interest payable.

* Partner’s claim to capital or profits, to the extent of credit balances in

capital accounts.

The order of claims against the personal assets of the individual partners is as

follows:

* Personal creditors of individual partners

* Partnership creditors on unpaid partnership liabilities regardless of a

partner’s capital balance in the partnership.

Partnership Formation, Operation, Dissolution and Liquidation

You might also like

- Topic Wise Taxation Icap Past Papers (Pak) of C.ADocument30 pagesTopic Wise Taxation Icap Past Papers (Pak) of C.AIrfan33% (3)

- Partnership Formation NotesDocument3 pagesPartnership Formation NotesApril GumiranNo ratings yet

- Chapter 1&2Document34 pagesChapter 1&2iptrcrmlNo ratings yet

- ASE20091 June 2021 Mark SchemeDocument16 pagesASE20091 June 2021 Mark SchemeMusthari KhanNo ratings yet

- Reviewer in Partnership PDF FreeDocument120 pagesReviewer in Partnership PDF Free잔잔No ratings yet

- ACC 311 - Chapter 1 PartnershipDocument4 pagesACC 311 - Chapter 1 PartnershipAlyssa GuinoNo ratings yet

- Accspec 1Document2 pagesAccspec 1Aye ChavezNo ratings yet

- Chapter 1: PartnershipDocument121 pagesChapter 1: PartnershipGab IgnacioNo ratings yet

- Reviewer in PartnershipDocument121 pagesReviewer in PartnershipGlizette SamaniegoNo ratings yet

- Part II Partnerhsip Corporation FAR PDFDocument101 pagesPart II Partnerhsip Corporation FAR PDFMary Joy Albandia100% (1)

- AFAR 01 - Partnership AccountingDocument7 pagesAFAR 01 - Partnership AccountingcheoreciNo ratings yet

- Part II Partnerhsip CorporationDocument101 pagesPart II Partnerhsip CorporationKhrestine ElejidoNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- Partnership Dissolution: Liability of Incoming Partner For Existing Obligations of The PartnershipDocument28 pagesPartnership Dissolution: Liability of Incoming Partner For Existing Obligations of The PartnershipChristine SalvadorNo ratings yet

- PDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdfDocument57 pagesPDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdflinkin soyNo ratings yet

- Special TransactionsDocument3 pagesSpecial TransactionsTracy AguirreNo ratings yet

- Afar NotesDocument6 pagesAfar NotesGio BurburanNo ratings yet

- Accounting For PartnershipDocument11 pagesAccounting For PartnershipgabNo ratings yet

- Parcor ActgDocument7 pagesParcor Actgoneddd439No ratings yet

- HO 1.1 Partnership Formation & OperationsDocument3 pagesHO 1.1 Partnership Formation & OperationsDaenielle EspinozaNo ratings yet

- Part 1 - Partnership FormationDocument13 pagesPart 1 - Partnership FormationJoyme CorpusNo ratings yet

- Acc 9 TestbankDocument143 pagesAcc 9 TestbankPaula de Torres100% (2)

- 1 - PDFsam - 01 Partnership Formation & Admission of A Partnerxx PDFDocument43 pages1 - PDFsam - 01 Partnership Formation & Admission of A Partnerxx PDFnash67% (3)

- 01a Partnership Formation & Admission of A PartnerxxDocument73 pages01a Partnership Formation & Admission of A PartnerxxAnaliza OndoyNo ratings yet

- Partnership Study GuideDocument5 pagesPartnership Study GuidejtNo ratings yet

- PARTNERSHIPDocument7 pagesPARTNERSHIPoneddd439No ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument46 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionKeith Anthony AmorNo ratings yet

- Afar NotesDocument8 pagesAfar NotesToni Rose AbreraNo ratings yet

- Chapter 1 - Part 1Document2 pagesChapter 1 - Part 1clarizaNo ratings yet

- Subhash Dey's ACC XII Partnership Theory (1 Page)Document1 pageSubhash Dey's ACC XII Partnership Theory (1 Page)Darshpreet SinghNo ratings yet

- Advacc BookDocument4 pagesAdvacc Book20220633No ratings yet

- Accounting For Special TransactionDocument2 pagesAccounting For Special TransactionJoresol AlorroNo ratings yet

- Partnership Formation and OperationDocument2 pagesPartnership Formation and OperationRyan Malanum AbrioNo ratings yet

- AFAR 03 Partnership DissolutionDocument2 pagesAFAR 03 Partnership DissolutionArden LlantoNo ratings yet

- Partnership and Corporation CH1Document4 pagesPartnership and Corporation CH1Jesus Of SuburbiaNo ratings yet

- p2 ReviewerDocument14 pagesp2 Reviewerirish solimanNo ratings yet

- Xparcoac Midterms ReviewerDocument11 pagesXparcoac Midterms ReviewerKristine dela CruzNo ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument56 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionGwen Cabarse Pansoy100% (1)

- Chap 3Document25 pagesChap 3Aria LeenNo ratings yet

- Accounting For Partnership: Part 2Document15 pagesAccounting For Partnership: Part 2Lady Fe DielNo ratings yet

- PARTNERSHIPDocument8 pagesPARTNERSHIPShayne BenaweNo ratings yet

- 2 Partnership Dissolution 0 Liquidation 2022Document16 pages2 Partnership Dissolution 0 Liquidation 2022Kimberly IgnacioNo ratings yet

- SiwaloDocument18 pagesSiwaloLaina Recel NavarroNo ratings yet

- Partnership FormationDocument3 pagesPartnership Formationromerodriguez32No ratings yet

- Lecture 2 Partnership FormationDocument58 pagesLecture 2 Partnership FormationSherwin Benedict SebastianNo ratings yet

- Session 4 - Partnership AccountsDocument23 pagesSession 4 - Partnership AccountsFrederickNo ratings yet

- PArtDocument6 pagesPArtMay DabuNo ratings yet

- Module 4 - Introduction To Partnership and Partnership FormationDocument14 pagesModule 4 - Introduction To Partnership and Partnership Formation1BSA5-ABM Espiritu, CharlesNo ratings yet

- Reviwer MidtermDocument2 pagesReviwer MidtermMyrish Queen AnghagNo ratings yet

- M1 - Partnership FormationDocument11 pagesM1 - Partnership FormationJhay MenesesNo ratings yet

- Accounting For Special Transactions Chapter 1 SummarizedDocument3 pagesAccounting For Special Transactions Chapter 1 SummarizedbabyNo ratings yet

- Lesson 1. Introduction To PartnershipDocument4 pagesLesson 1. Introduction To Partnershipangelinelucastoquero548No ratings yet

- Chapter 1 - PartnershipDocument18 pagesChapter 1 - PartnershipFrancisco PradoNo ratings yet

- Ent CH 10Document9 pagesEnt CH 10fahad BataviaNo ratings yet

- 3 - Partnership DissolutionDocument6 pages3 - Partnership DissolutionAangela Del Rosario CorpuzNo ratings yet

- BAC 112 Midterm Examination With QuestionsDocument11 pagesBAC 112 Midterm Examination With Questionsjanus lopezNo ratings yet

- CHAPTER 12 Partnerships Basic Considerations and FormationsDocument9 pagesCHAPTER 12 Partnerships Basic Considerations and FormationsGabrielle Joshebed AbaricoNo ratings yet

- Parcoac Prelim Reviewer 2Document5 pagesParcoac Prelim Reviewer 2tokyoescotoNo ratings yet

- Accounting For Special Transactions PartneshipDocument43 pagesAccounting For Special Transactions Partneshipvee viajeroNo ratings yet

- PARTNESHIPDocument6 pagesPARTNESHIPJustine FloresNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Partnership Board ReviewerDocument13 pagesPartnership Board ReviewerRobert ApolinarNo ratings yet

- External Factor EvaluationDocument8 pagesExternal Factor EvaluationRobert ApolinarNo ratings yet

- External Factor EvaluationDocument8 pagesExternal Factor EvaluationRobert ApolinarNo ratings yet

- 2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaDocument33 pages2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaMia Jeruve Javier BautistaNo ratings yet

- 2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaDocument33 pages2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaMia Jeruve Javier BautistaNo ratings yet

- Solutions Chapter 8 - 3rd EditionDocument30 pagesSolutions Chapter 8 - 3rd Editionafsdasdf3qf4341f4asDNo ratings yet

- Goldman Shadow Bank Report May 2015Document69 pagesGoldman Shadow Bank Report May 2015CrowdfundInsiderNo ratings yet

- Star Health and Allied Insurance Co LTD DRHPDocument423 pagesStar Health and Allied Insurance Co LTD DRHPajitNo ratings yet

- Income Statement HumaidDocument1 pageIncome Statement HumaidMercians RXNo ratings yet

- Fusion Financials BrochureDocument16 pagesFusion Financials Brochureshan monsiNo ratings yet

- Rizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyDocument14 pagesRizal Technological University College of Business & Entrepreneurial Technology Department of AccountancyHatdogNo ratings yet

- OMAN - New Companies Commercial Law UpdatesDocument15 pagesOMAN - New Companies Commercial Law UpdatesSalman YaqubNo ratings yet

- RFBT Reviewer Final Pre-BoardDocument1 pageRFBT Reviewer Final Pre-Boardjerdelynvillegas7No ratings yet

- Excel File of Financial Projection and FundingDocument21 pagesExcel File of Financial Projection and FundingDave John LavariasNo ratings yet

- ChakulawordpdfDocument3 pagesChakulawordpdfMishhal Hamza P.KNo ratings yet

- Basic Concepts in Financial AccountingDocument19 pagesBasic Concepts in Financial AccountingAndrew Brown100% (1)

- Ipaper For Book NID#41987Document443 pagesIpaper For Book NID#41987bfelix100% (1)

- Variable Costing - Lecture NotesDocument22 pagesVariable Costing - Lecture NotesRaghavNo ratings yet

- Cpa Review School of The Philippines.2Document6 pagesCpa Review School of The Philippines.2Snow TurnerNo ratings yet

- PT GAJAH TUNGGAL TBK PDFDocument96 pagesPT GAJAH TUNGGAL TBK PDFKholila Mutia SafitriNo ratings yet

- Offshore BanksDocument22 pagesOffshore BanksMillenine Lupa-asNo ratings yet

- AccountingDocument7 pagesAccountingDaniela Pedrosa100% (1)

- Mayank Khemka Class AssignmentDocument2 pagesMayank Khemka Class AssignmentmayankNo ratings yet

- Accounting ElementsDocument21 pagesAccounting Elementsdemonking1273433No ratings yet

- Equity: Learning ObjectivesDocument32 pagesEquity: Learning ObjectivesAASNo ratings yet

- Business Networks: Anywhere RemodelingDocument32 pagesBusiness Networks: Anywhere RemodelingEvl SinNo ratings yet

- Understanding Financial Instruments and Mutual Funds (Jay Taparia)Document85 pagesUnderstanding Financial Instruments and Mutual Funds (Jay Taparia)National Press FoundationNo ratings yet

- 2021 Con Quarter04 CFDocument2 pages2021 Con Quarter04 CFMohammadNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- A Review of The Accounting CycleDocument44 pagesA Review of The Accounting CycleBelle PenneNo ratings yet

- ACC 105 SyllabusDocument2 pagesACC 105 Syllabusnaamsagar2019No ratings yet

- Accounts Ques (2 Files Merged)Document5 pagesAccounts Ques (2 Files Merged)Ishaan TandonNo ratings yet

- Notifying Us of Changes To A VAT Registered BusinessDocument2 pagesNotifying Us of Changes To A VAT Registered BusinessRavindra PallNo ratings yet