Professional Documents

Culture Documents

Deferred Maintenance and Repairs

Uploaded by

Loki0 ratings0% found this document useful (0 votes)

18 views1 pageOriginal Title

deferred-maintenance-repairs

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

18 views1 pageDeferred Maintenance and Repairs

Uploaded by

LokiYou are on page 1of 1

207 REQUIRED SUPPLEMENTARY INFORMATION (UNAUDITED)

Deferred Maintenance and Repairs

DM&R result from maintenance not being performed on a timely basis and is the estimated cost to bring government-

owned PP&E to an acceptable condition. DM&R exclude the cost of expanding the capacity of assets or upgrading them to

serve needs different from those originally intended. The consequences of not performing regular maintenance and repairs

could include increased safety hazards, poor service to the public, higher costs in the future, and inefficient operations.

Estimated DM&R costs are not accrued in the Statements of Net Cost or recognized as a liability on the Balance Sheets.

The amounts disclosed for DM&R are allowed to be measured using one of the following three methods:

Condition assessment surveys which are periodic inspections of government-owned property to determine the

current condition and estimated cost to bring the property to an acceptable condition.

Life-cycle cost forecast that is an acquisition or procurement technique that considers operation, maintenance, and

other costs in addition to the acquisition cost of assets.

Any other method of choice that is similar to the condition assessment survey or life-cycle costing methods.

The table below of DM&R is presented as a single estimate in accordance with SFFAS No. 42, Deferred Maintenance

and Repairs: Amending Statements of Federal Financial Accounting Standards 6, 14, 29, and 32. These amounts were all

measured using the condition assessment survey method. Please refer to the individual financial statements of DOD, DOI,

VA, DOE, USDA, NASA, HHS, GSA, DHS, and DOT for detailed significant information on DM&R.

Deferred Maintenance and Repairs as of September 30, 2019, and 2018

(In billions of dollars) 2019 2018

Asset category:

General property, plant, and equipment ...................................................................... 161.4 147.3

Heritage assets ......................................................................................................... 20.9 18.9

Stewardship land....................................................................................................... 0.5 0.4

Total deferred maintenance and repairs ................................................................... 182.8 166.6

Other Claims for Refunds

Other claims for refunds are claims filed for which specific administrative actions such as review by the courts are

required before payments can be made and unasserted claims for refund by taxpayers or importers that may or may not

become payable depending upon the resolution of subsequent events. As stated in SFFAS No. 7, Accounting for Revenue and

Other Financing Sources and Concepts for Reconciling Budgetary and Financial Accounting, unasserted claims for refund

such as unfiled claims for refunds or drawbacks for which no claim has been filed, are not known, therefore estimates are not

able to be determined, and are not recognized on the balance sheet. Claims filed for refunds where required administrative

actions are not yet complete as of the close of the reporting period may not be known however, the refunds, may be

reasonably estimable.

Management has estimated amounts that may be paid out as other claims for tax refunds. This estimate represents an

amount (principal and interest) that may be paid for claims pending judicial review by the federal courts or, internally, by

appeals. The total estimated payout (including principal and interest) for claims pending judicial review by the federal courts

is $7.8 billion and $11.1 billion for fiscal years 2019 and 2018, respectively. For those under appeal, the estimated payout is

$2.3 billion and $1.8 billion for fiscal years 2019 and 2018, respectively. To the extent judgments against the government for

these claims prompt other similarly situated taxpayers to file similar refund claims, these amounts could become significantly

greater.

You might also like

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Notes To The Financial Statements9Document1 pageNotes To The Financial Statements9LokiNo ratings yet

- Modadv3 Comprehensive Examination 12072021Document10 pagesModadv3 Comprehensive Examination 12072021Maha Bianca Charisma CastroNo ratings yet

- Textbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesFrom EverandTextbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesNo ratings yet

- Midterm - Exam PDFDocument16 pagesMidterm - Exam PDFLouisse Marie Catipay100% (1)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- PSA Chapter 3 TeacherDocument9 pagesPSA Chapter 3 TeacherEbsa AbdiNo ratings yet

- Statement No. 6 of The Governmental Accounting Standards BoardDocument31 pagesStatement No. 6 of The Governmental Accounting Standards BoardSteffi DorothyNo ratings yet

- Chapter 31 - AnswerDocument15 pagesChapter 31 - AnswerEunice LigutanNo ratings yet

- Hyundai Motor Company Fy 2019 Consolidated FinalDocument95 pagesHyundai Motor Company Fy 2019 Consolidated FinalmNo ratings yet

- Procedure - Provision or Impairment of Financial Assets and Accounting For Fraud and Financial LossDocument13 pagesProcedure - Provision or Impairment of Financial Assets and Accounting For Fraud and Financial LossMarc HenriNo ratings yet

- Chapter 14 - Pas 16 Property, Plant and Equipment: Measurement After RecognitionDocument5 pagesChapter 14 - Pas 16 Property, Plant and Equipment: Measurement After RecognitionVince PeredaNo ratings yet

- EIA (Assignment 02)Document7 pagesEIA (Assignment 02)Eshfaque Alam DastagirNo ratings yet

- NOTESDocument20 pagesNOTESGraziella CathleenNo ratings yet

- Text Doc - NFJPIA Exam MOCKDocument15 pagesText Doc - NFJPIA Exam MOCKEugeneDumalagNo ratings yet

- Revised AccountingDocument46 pagesRevised AccountingAli NasarNo ratings yet

- FINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsDocument11 pagesFINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsAmie Jane MirandaNo ratings yet

- TestbankDocument15 pagesTestbankKatreen SamaniegoNo ratings yet

- Assignment On Syllabus Summary: Course: Financial Statement Analysis and Valuation (F-401)Document8 pagesAssignment On Syllabus Summary: Course: Financial Statement Analysis and Valuation (F-401)Md Ohidur RahmanNo ratings yet

- Week 2 TUTE Chapter 1 SolutionsDocument6 pagesWeek 2 TUTE Chapter 1 SolutionsDylan AdrianNo ratings yet

- Notes To FS EncodingDocument11 pagesNotes To FS EncodingPappi JANo ratings yet

- IFRS Buletin CovidDocument13 pagesIFRS Buletin CovidMuhammad RezaNo ratings yet

- GNP CHP 6Document21 pagesGNP CHP 6fentaw melkieNo ratings yet

- AAA TOA Review QuizbowlDocument50 pagesAAA TOA Review QuizbowlVINCENT GAYRAMONNo ratings yet

- XXXXXXXXXXXXXXX, Inc.: Notes To Financial Statements DECEMBER 31, 2018 1.) Corporate InformationDocument7 pagesXXXXXXXXXXXXXXX, Inc.: Notes To Financial Statements DECEMBER 31, 2018 1.) Corporate InformationJmei AfflieriNo ratings yet

- Sample Notes To Financial Statements For Single ProprietorDocument6 pagesSample Notes To Financial Statements For Single ProprietorLost Student100% (3)

- Unit 6Document16 pagesUnit 6YonasNo ratings yet

- Mary Joy L. Amigos Rice Store Notes To The Financial StatementsDocument5 pagesMary Joy L. Amigos Rice Store Notes To The Financial StatementsLizanne GauranaNo ratings yet

- Hyundai Motor Company Annual 2022 Consolidated FinalDocument92 pagesHyundai Motor Company Annual 2022 Consolidated Finalsreejithbhasi128No ratings yet

- Significant Accounting Policies TVS MotorsDocument12 pagesSignificant Accounting Policies TVS MotorsArjun Singh Omkar100% (1)

- United States Government Notes To The Financial Statements For The Years Ended September 30, 2006, and September 30, 2005Document62 pagesUnited States Government Notes To The Financial Statements For The Years Ended September 30, 2006, and September 30, 2005losangelesNo ratings yet

- Us 2018 20 Long Duration Contracts Asu 2018 12 PDFDocument110 pagesUs 2018 20 Long Duration Contracts Asu 2018 12 PDFfsdNo ratings yet

- Us 2018 20 Long Duration Contracts Asu 2018 12Document110 pagesUs 2018 20 Long Duration Contracts Asu 2018 12fsdNo ratings yet

- Govt Acctg ReviewerDocument18 pagesGovt Acctg Reviewerdewlate abinaNo ratings yet

- Hyundai Motor Company Annual 2021 Consolidated FinalDocument91 pagesHyundai Motor Company Annual 2021 Consolidated Finalgarysingh187westNo ratings yet

- Advanced Financial AccountingDocument2 pagesAdvanced Financial AccountingBS Accoutancy St. SimonNo ratings yet

- Consolidated Financial Statements of Samsung Electronics Co., Ltd. and Its Subsidiaries Index To Financial StatementsDocument103 pagesConsolidated Financial Statements of Samsung Electronics Co., Ltd. and Its Subsidiaries Index To Financial StatementsAlen Vincent JosephNo ratings yet

- Account Assign 2Document4 pagesAccount Assign 2shan khanNo ratings yet

- Tata Technologies Inc.Document16 pagesTata Technologies Inc.sanjit kadneNo ratings yet

- ... Helping People Live Better: 2018 Annual ReportDocument104 pages... Helping People Live Better: 2018 Annual ReportAdv Sandeep SinghNo ratings yet

- Shezan Food AnalysisDocument10 pagesShezan Food AnalysisUmme Laila JatoiNo ratings yet

- Continous Assignment 2: Mittal School of BusinessDocument8 pagesContinous Assignment 2: Mittal School of BusinessMd UjaleNo ratings yet

- Railway Hand Book On Internal ChecksDocument308 pagesRailway Hand Book On Internal ChecksHiraBallabh82% (34)

- Lecture Notes Background: Page 1 of 15Document15 pagesLecture Notes Background: Page 1 of 15Marielle Mae BurbosNo ratings yet

- Ar-18 9Document5 pagesAr-18 9jawad anwarNo ratings yet

- Ipsas 1 NoteDocument12 pagesIpsas 1 NoteNwogboji EmmanuelNo ratings yet

- Impact of CovidDocument5 pagesImpact of CovidObisike EmeziNo ratings yet

- Kieso15e ContinuingCase Sols Vol1Document41 pagesKieso15e ContinuingCase Sols Vol1HảiAnhInviNo ratings yet

- NFJPIA - Mockboard 2011 - TOA PDFDocument7 pagesNFJPIA - Mockboard 2011 - TOA PDFSteven Mark MananguNo ratings yet

- Q4 2022 Earnings PresentationDocument21 pagesQ4 2022 Earnings PresentationCesar AugustoNo ratings yet

- Note 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018Document3 pagesNote 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018LokiNo ratings yet

- Assignment: On Financial Statement Analysis and ValuationDocument4 pagesAssignment: On Financial Statement Analysis and ValuationMd Ohidur RahmanNo ratings yet

- Airlines Financial Reporting Implications of Covid 19Document15 pagesAirlines Financial Reporting Implications of Covid 19Rama KediaNo ratings yet

- Midterm Exams ReviewDocument5 pagesMidterm Exams ReviewJeanette LampitocNo ratings yet

- TADocument12 pagesTAArwind ReyesNo ratings yet

- Chapter 08Document26 pagesChapter 08sdnm dnkNo ratings yet

- YTD 20 - PTTEP EngDocument174 pagesYTD 20 - PTTEP EngEugene TanNo ratings yet

- Accounting Policies - Study Group 4IDocument24 pagesAccounting Policies - Study Group 4ISatish Ranjan PradhanNo ratings yet

- Accounting For Govt GrantsDocument20 pagesAccounting For Govt GrantsSaisanthosh Kumar SharmaNo ratings yet

- Culture - The GuardianDocument8 pagesCulture - The GuardianLokiNo ratings yet

- 2019 Country Reports On Human Rights Practices - United States Department of StateDocument10 pages2019 Country Reports On Human Rights Practices - United States Department of StateLokiNo ratings yet

- Tax Gap: Corporate Income Tax Liability For Tax Year 2016Document1 pageTax Gap: Corporate Income Tax Liability For Tax Year 2016LokiNo ratings yet

- Unmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018Document1 pageUnmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018LokiNo ratings yet

- Language Learning With Free PodcastsDocument3 pagesLanguage Learning With Free PodcastsLokiNo ratings yet

- Food - The GuardianDocument7 pagesFood - The GuardianLoki100% (1)

- Largest Income Tax Expenditures As of September 30, 2019Document2 pagesLargest Income Tax Expenditures As of September 30, 2019LokiNo ratings yet

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Document2 pagesUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiNo ratings yet

- Notes To The Financial Statements27Document1 pageNotes To The Financial Statements27LokiNo ratings yet

- Social Insurance: Social Security and MedicareDocument26 pagesSocial Insurance: Social Security and MedicareLokiNo ratings yet

- Tax Assessments: Required Supplementary Information (Unaudited) 208Document1 pageTax Assessments: Required Supplementary Information (Unaudited) 208LokiNo ratings yet

- Sustainability of Fiscal PolicyDocument11 pagesSustainability of Fiscal PolicyLokiNo ratings yet

- Notes To The Financial Statements26 PDFDocument1 pageNotes To The Financial Statements26 PDFLokiNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Note 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018Document3 pagesNote 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018LokiNo ratings yet

- Notes To The Financial Statements26 PDFDocument1 pageNotes To The Financial Statements26 PDFLokiNo ratings yet

- Note 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsDocument1 pageNote 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsLokiNo ratings yet

- Note 22. Social Insurance: 137 Notes To The Financial StatementsDocument18 pagesNote 22. Social Insurance: 137 Notes To The Financial StatementsLokiNo ratings yet

- Notes To The Financial Statements16Document2 pagesNotes To The Financial Statements16LokiNo ratings yet

- Note 25. Disclosure Entities and Related PartiesDocument5 pagesNote 25. Disclosure Entities and Related PartiesLokiNo ratings yet

- Note 21. Fiduciary Activities: Thrift Savings PlanDocument2 pagesNote 21. Fiduciary Activities: Thrift Savings PlanLokiNo ratings yet

- Notes To The Financial Statements18Document7 pagesNotes To The Financial Statements18LokiNo ratings yet

- Note 17. Collections and Refunds of Federal RevenueDocument3 pagesNote 17. Collections and Refunds of Federal RevenueLokiNo ratings yet

- Notes To The Financial Statements20Document6 pagesNotes To The Financial Statements20LokiNo ratings yet

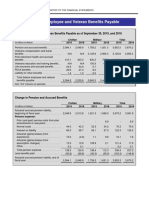

- Note 12. Federal Employee and Veteran Benefits PayableDocument10 pagesNote 12. Federal Employee and Veteran Benefits PayableLokiNo ratings yet

- Note 13. Environmental and Disposal LiabilitiesDocument2 pagesNote 13. Environmental and Disposal LiabilitiesLokiNo ratings yet

- Note 15. Insurance and Guarantee Program LiabilitiesDocument2 pagesNote 15. Insurance and Guarantee Program LiabilitiesLokiNo ratings yet

- Notes To The Financial Statements14Document1 pageNotes To The Financial Statements14LokiNo ratings yet

- Note 11. Federal Debt Securities Held by The Public and Accrued InterestDocument4 pagesNote 11. Federal Debt Securities Held by The Public and Accrued InterestLokiNo ratings yet

- Tutorial 6Document3 pagesTutorial 6Lai Qing YaoNo ratings yet

- Products ListDocument11 pagesProducts ListPorag AhmedNo ratings yet

- Transformational LeadershipDocument75 pagesTransformational LeadershipvincentpalaniNo ratings yet

- 1 s2.0 S2238785423001345 MainDocument10 pages1 s2.0 S2238785423001345 MainHamada Shoukry MohammedNo ratings yet

- Small Business and Entrepreneurship ProjectDocument38 pagesSmall Business and Entrepreneurship ProjectMădălina Elena FotacheNo ratings yet

- MSDS Formic AcidDocument3 pagesMSDS Formic AcidChirag DobariyaNo ratings yet

- One and Half SindromeDocument4 pagesOne and Half SindromeYulia DamayantiNo ratings yet

- MPPSC ACF Test Paper 8 (26 - 06 - 2022)Document6 pagesMPPSC ACF Test Paper 8 (26 - 06 - 2022)Hari Harul VullangiNo ratings yet

- Name of The Business-Rainbow Blooms LLC. Executive SummaryDocument17 pagesName of The Business-Rainbow Blooms LLC. Executive SummaryAhamed AliNo ratings yet

- Distance SortDocument6 pagesDistance SortAI Coordinator - CSC JournalsNo ratings yet

- 2021-01-01 - Project (Construction) - One TemplateDocument1,699 pages2021-01-01 - Project (Construction) - One TemplatemayalogamNo ratings yet

- Chapter 3 Depreciation - Sum of The Years Digit MethodPart 4Document8 pagesChapter 3 Depreciation - Sum of The Years Digit MethodPart 4Tor GineNo ratings yet

- Leibniz, Gottfried Wilhelm - Strickland, Lloyd - Leibniz's Monadology - A New Translation and Guide-Edinburgh University Press (2014)Document327 pagesLeibniz, Gottfried Wilhelm - Strickland, Lloyd - Leibniz's Monadology - A New Translation and Guide-Edinburgh University Press (2014)Gigla Gonashvili100% (1)

- University of Southern Philippines Foundation. College of Engineering and ArchitectureDocument7 pagesUniversity of Southern Philippines Foundation. College of Engineering and ArchitectureJason OwiaNo ratings yet

- School Clinic Action PlanDocument2 pagesSchool Clinic Action PlanAlera Kim100% (7)

- 0409 Book About Minoru Yamasaki, ReviewDocument4 pages0409 Book About Minoru Yamasaki, RevieweviannNo ratings yet

- USTH Algorithm RecursionDocument73 pagesUSTH Algorithm Recursionnhng2421No ratings yet

- History of Drilling PDFDocument9 pagesHistory of Drilling PDFNguyen Van TinhNo ratings yet

- Retailing PPT (Shailwi Nitish)Document14 pagesRetailing PPT (Shailwi Nitish)vinit PatidarNo ratings yet

- IELTS Material Writing 1Document112 pagesIELTS Material Writing 1Lê hoàng anhNo ratings yet

- Model 900 Automated Viscometer: Drilling Fluids EquipmentDocument2 pagesModel 900 Automated Viscometer: Drilling Fluids EquipmentJazminNo ratings yet

- FM Testbank-Ch18Document9 pagesFM Testbank-Ch18David LarryNo ratings yet

- Investing in Granada's Property Market - Gaspar LinoDocument1 pageInvesting in Granada's Property Market - Gaspar LinoGaspar LinoNo ratings yet

- Honeywell Rondostat Hr20 SpesificationDocument2 pagesHoneywell Rondostat Hr20 Spesificationfrox123No ratings yet

- Steve JobsDocument18 pagesSteve JobsVibhor AggarwalNo ratings yet

- Manual TV Hyundai HYLED3239iNTMDocument40 pagesManual TV Hyundai HYLED3239iNTMReinaldo TorresNo ratings yet

- Oral Com Reviewer 1ST QuarterDocument10 pagesOral Com Reviewer 1ST QuarterRaian PaderesuNo ratings yet

- Coefficient of Restitution - Center of MassDocument3 pagesCoefficient of Restitution - Center of MassMannyCesNo ratings yet

- State Farm Claims: PO Box 52250 Phoenix AZ 85072-2250Document2 pagesState Farm Claims: PO Box 52250 Phoenix AZ 85072-2250georgia ann polley-yatesNo ratings yet

- IEEE 802 StandardsDocument14 pagesIEEE 802 StandardsHoney RamosNo ratings yet

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (88)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessFrom EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessRating: 4.5 out of 5 stars4.5/5 (407)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyFrom EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyRating: 5 out of 5 stars5/5 (22)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (1026)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- 7 Secrets to Investing Like Warren BuffettFrom Everand7 Secrets to Investing Like Warren BuffettRating: 4.5 out of 5 stars4.5/5 (121)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziFrom Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNo ratings yet

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyFrom EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyRating: 4.5 out of 5 stars4.5/5 (300)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 5 out of 5 stars5/5 (24)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesFrom EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesRating: 4.5 out of 5 stars4.5/5 (99)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (800)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchFrom EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchRating: 4 out of 5 stars4/5 (114)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Zero to Sold: How to Start, Run, and Sell a Bootstrapped BusinessFrom EverandZero to Sold: How to Start, Run, and Sell a Bootstrapped BusinessRating: 4.5 out of 5 stars4.5/5 (19)