Professional Documents

Culture Documents

Notes To The Financial Statements27

Uploaded by

Loki0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

notes-to-the-financial-statements27

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

5 views1 pageNotes To The Financial Statements27

Uploaded by

LokiYou are on page 1of 1

NOTES TO THE FINANCIAL STATEMENTS 168

Note 27. Subsequent Events

Patient Protection and Affordable Care Act Excise Tax

The SOSI, SCSIA and SLTFP do not reflect legislation enacted subsequent to September 30, and the end of the fiscal

year. In December 2019, the Further Consolidated Appropriations Act, 2020 repealed the PPACA excise tax on certain

applicable employer-sponsored healthcare coverage. The effect of this legislation on the SOSI, SCSIA, and SLTFP is not

currently reasonably estimable, but may be material, and will be incorporated into the estimates for the fiscal year 2020

SOSI, SCSIA, and SLTFP.

PBGC Multi-Employer Program

In December 2019, the enactment of the Bipartisan American Miners Act of 2019 provided additional funding for future

annual Treasury transfers to the 1974 United Mine Workers of America Pension Plan (covered by PBGC’s multi-employer

program). PBGC is currently assessing the effect of the legislation on its liabilities and contingency disclosures (including the

estimated insolvency date for the multi-employer program), but the effect is not currently reasonably estimable.

Please refer to Note 15—Insurance and Guarantee Program Liabilities and Note 18—Contingencies for more

information.

You might also like

- Unemployment Insurance Trust FundDocument34 pagesUnemployment Insurance Trust FundLuke ParsnowNo ratings yet

- Social Security and Medicare Trustees ReportDocument28 pagesSocial Security and Medicare Trustees ReportAustin DeneanNo ratings yet

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018From EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018No ratings yet

- GCRO Top230 PG April2019Document223 pagesGCRO Top230 PG April2019Edmerl AbadNo ratings yet

- Food - The GuardianDocument7 pagesFood - The GuardianLoki100% (1)

- Ey The Impact of Covid 19 On Employer Unemployment Insurance CostsDocument23 pagesEy The Impact of Covid 19 On Employer Unemployment Insurance CostsIdowu AfolabiNo ratings yet

- Note 15. Insurance and Guarantee Program LiabilitiesDocument2 pagesNote 15. Insurance and Guarantee Program LiabilitiesLokiNo ratings yet

- Kombinasi Bisnis, Property, Sewa, Impairment IFRB 2020 07 Impairment Implications of COVID 19 (IAS 36)Document10 pagesKombinasi Bisnis, Property, Sewa, Impairment IFRB 2020 07 Impairment Implications of COVID 19 (IAS 36)Ryandana Alica SaputraNo ratings yet

- Kombinasi Bisnis, Property, Sewa, Impairment IFRB 2020 07 Impairment Implications of COVID 19 (IAS 36)Document10 pagesKombinasi Bisnis, Property, Sewa, Impairment IFRB 2020 07 Impairment Implications of COVID 19 (IAS 36)Ryandana Alica SaputraNo ratings yet

- CBO Report On The Effects of The Government ShutdownDocument12 pagesCBO Report On The Effects of The Government ShutdownPolitics Now - NewsNo ratings yet

- CBO Effects of ShutdownDocument12 pagesCBO Effects of ShutdownStephen LoiaconiNo ratings yet

- Mauritius Introduces Fiscal Incentives in Response To COVID-19Document4 pagesMauritius Introduces Fiscal Incentives in Response To COVID-19harryNo ratings yet

- House Bill 4001Document7 pagesHouse Bill 4001Elizabeth WashingtonNo ratings yet

- Muhammad Luthfi Mahendra - 2001036085 - EssayDocument2 pagesMuhammad Luthfi Mahendra - 2001036085 - Essayluthfi mahendraNo ratings yet

- 240-Article Text-1157-1-10-20211021Document25 pages240-Article Text-1157-1-10-20211021Rose SaparuNo ratings yet

- Icpau Tax Proposals For Fy 2023-24 BudgetDocument12 pagesIcpau Tax Proposals For Fy 2023-24 BudgetByamukama RobertNo ratings yet

- Published: Philippine Star, August 11, 2020 Business World, August 11, 2020Document1 pagePublished: Philippine Star, August 11, 2020 Business World, August 11, 2020mi4keeNo ratings yet

- Recap of Key Labour Law Developments of 2019 & Looking Forward To 2020 - Employment and HR - IndiaDocument3 pagesRecap of Key Labour Law Developments of 2019 & Looking Forward To 2020 - Employment and HR - Indiakamath.t.manjulaNo ratings yet

- The 2018 Long-Term Budget Outlook: JUNE 2018Document57 pagesThe 2018 Long-Term Budget Outlook: JUNE 2018HeisenbergNo ratings yet

- Compendium of Steps Taken by Government of India To Support Msme Sector in Fight Against Covid-19 PandemicDocument13 pagesCompendium of Steps Taken by Government of India To Support Msme Sector in Fight Against Covid-19 PandemicSantoshNo ratings yet

- CBO Cost Estimate For H.R. 1628 Obamacare Repeal Reconciliation Act of 2017Document19 pagesCBO Cost Estimate For H.R. 1628 Obamacare Repeal Reconciliation Act of 2017CNBC.comNo ratings yet

- Rationale of The StudyDocument35 pagesRationale of The StudyzxcNo ratings yet

- Final Report On EBA-GL-2020-02 Guidelines On Payment Moratoria - Consolidated VersionDocument23 pagesFinal Report On EBA-GL-2020-02 Guidelines On Payment Moratoria - Consolidated Versiongerardo testaNo ratings yet

- 2019 Part 2Document265 pages2019 Part 2Quant TradingNo ratings yet

- Briefing Notes On Key Political Questions For SA's Economic RecoveryDocument122 pagesBriefing Notes On Key Political Questions For SA's Economic RecoveryDocumentsZA100% (4)

- 2019 Riverside County Pension Advisory Review Committee ReportDocument20 pages2019 Riverside County Pension Advisory Review Committee ReportThe Press-Enterprise / pressenterprise.comNo ratings yet

- Tax Incentive During The Covid 19Document6 pagesTax Incentive During The Covid 19Ferial FerniawanNo ratings yet

- Department of Health & Human ServicesDocument31 pagesDepartment of Health & Human ServicesBrian AhierNo ratings yet

- Update - Government Announcements - Fight Against COVID 19Document53 pagesUpdate - Government Announcements - Fight Against COVID 19Vaibhav JainNo ratings yet

- General Solano Street, San Miguel, ManilaDocument3 pagesGeneral Solano Street, San Miguel, ManilaAldex DeganNo ratings yet

- United States Government Notes To The Financial Statements For The Fiscal Years Ended September 30, 2019, and 2018Document13 pagesUnited States Government Notes To The Financial Statements For The Fiscal Years Ended September 30, 2019, and 2018LokiNo ratings yet

- CONSTI 2 1C - Wilwayco, DDocument8 pagesCONSTI 2 1C - Wilwayco, DAr-Reb AquinoNo ratings yet

- Note 22. Social Insurance: 137 Notes To The Financial StatementsDocument18 pagesNote 22. Social Insurance: 137 Notes To The Financial StatementsLokiNo ratings yet

- Info Capsule: Securities Laws & Capital MarketDocument3 pagesInfo Capsule: Securities Laws & Capital MarketVinoth RajNo ratings yet

- Global Insurance Market Trends 2020Document36 pagesGlobal Insurance Market Trends 2020Daltonist OggyNo ratings yet

- IBC After COVIDDocument6 pagesIBC After COVIDRitwik PrakashNo ratings yet

- Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Document50 pagesDouglas W. Elmendorf, Director U.S. Congress Washington, DC 20515josephragoNo ratings yet

- Notes To Financial Statements 2019Document103 pagesNotes To Financial Statements 2019LokiNo ratings yet

- Midyear Budget ReportDocument402 pagesMidyear Budget Reportcbs6albanyNo ratings yet

- Overview of The Federal Tax System As in Effect For 2018: Prepared by The Staff of The Joint Committee On TaxationDocument38 pagesOverview of The Federal Tax System As in Effect For 2018: Prepared by The Staff of The Joint Committee On TaxationJulianaForbesNo ratings yet

- Insentif PMK 862020 Di Tengah Pandemi Covid 19 Apakah MempengaruhiDocument18 pagesInsentif PMK 862020 Di Tengah Pandemi Covid 19 Apakah MempengaruhiTaruna Putra Dirgantara100% (1)

- FOMB - Letter - Senate of Puerto Rico - Response Letter Section 204 (A) (6) SB 1304 - February 7, 2024Document3 pagesFOMB - Letter - Senate of Puerto Rico - Response Letter Section 204 (A) (6) SB 1304 - February 7, 2024Metro Puerto RicoNo ratings yet

- PFM Act IRR AnalysisDocument50 pagesPFM Act IRR AnalysisMarvin OlidNo ratings yet

- Bhumika 18132006Document4 pagesBhumika 18132006Jay MarwahaNo ratings yet

- Covid-19 Related Frequently Asked Questions (Faqs) On Corporate Social Responsibility (CSR)Document3 pagesCovid-19 Related Frequently Asked Questions (Faqs) On Corporate Social Responsibility (CSR)Pratim MajumderNo ratings yet

- Activity Report 2019Document32 pagesActivity Report 2019fabukaNo ratings yet

- Chanakya National Law University: Nyaya Nagar, Mithapur, Patna - 800001Document5 pagesChanakya National Law University: Nyaya Nagar, Mithapur, Patna - 800001Trinity PrevailsNo ratings yet

- COVID 19 Implications For BusinessDocument16 pagesCOVID 19 Implications For BusinessGilbert LomofioNo ratings yet

- IFRS PA 2020-02 Potential Effects of Coronavirus As at 31 December 2019Document5 pagesIFRS PA 2020-02 Potential Effects of Coronavirus As at 31 December 2019cghortaNo ratings yet

- Financial BILLDocument4 pagesFinancial BILLganeshNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Supplementary GN GICDocument20 pagesSupplementary GN GICABC 123No ratings yet

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankDocument2 pagesFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankFluenceMediaNo ratings yet

- Oakland Police Department: View Informational Memo - Kaplan 7202020Document41 pagesOakland Police Department: View Informational Memo - Kaplan 7202020Zennie AbrahamNo ratings yet

- Handouts SAICA Tax Bill UpdateDocument222 pagesHandouts SAICA Tax Bill UpdateMohola Tebello GriffithNo ratings yet

- Weakening Economic GrowthDocument3 pagesWeakening Economic GrowthAristegui NoticiasNo ratings yet

- MABIS, Vol. 12, No.1, Juni 2021 ISSN 2775-8516: Key WordsDocument9 pagesMABIS, Vol. 12, No.1, Juni 2021 ISSN 2775-8516: Key WordsLydiaa FebriatiNo ratings yet

- White House Budget For FY2018Document62 pagesWhite House Budget For FY2018OnPointRadioNo ratings yet

- BillsTexts LSBillTexts Asintroduced 227 of 2019 AsDocument4 pagesBillsTexts LSBillTexts Asintroduced 227 of 2019 Assudhir.kochhar3530No ratings yet

- Jurnal Administrasi Dan Kebijakan PublikDocument20 pagesJurnal Administrasi Dan Kebijakan PublikArju MahendraNo ratings yet

- COVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteNo ratings yet

- Unmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018Document1 pageUnmatched Transactions and Balances: Restated Fiscal Year Fiscal Year 2019 2018LokiNo ratings yet

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Document2 pagesUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiNo ratings yet

- Language Learning With Free PodcastsDocument3 pagesLanguage Learning With Free PodcastsLokiNo ratings yet

- Culture - The GuardianDocument8 pagesCulture - The GuardianLokiNo ratings yet

- 2019 Country Reports On Human Rights Practices - United States Department of StateDocument10 pages2019 Country Reports On Human Rights Practices - United States Department of StateLokiNo ratings yet

- Tax Gap: Corporate Income Tax Liability For Tax Year 2016Document1 pageTax Gap: Corporate Income Tax Liability For Tax Year 2016LokiNo ratings yet

- Tax Assessments: Required Supplementary Information (Unaudited) 208Document1 pageTax Assessments: Required Supplementary Information (Unaudited) 208LokiNo ratings yet

- Sustainability of Fiscal PolicyDocument11 pagesSustainability of Fiscal PolicyLokiNo ratings yet

- Largest Income Tax Expenditures As of September 30, 2019Document2 pagesLargest Income Tax Expenditures As of September 30, 2019LokiNo ratings yet

- Deferred Maintenance and RepairsDocument1 pageDeferred Maintenance and RepairsLokiNo ratings yet

- Note 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018Document3 pagesNote 19. Commitments: Long-Term Operating Leases As of September 30, 2019, and 2018LokiNo ratings yet

- Note 23. Long-Term Fiscal ProjectionsDocument6 pagesNote 23. Long-Term Fiscal ProjectionsLokiNo ratings yet

- Note 25. Disclosure Entities and Related PartiesDocument5 pagesNote 25. Disclosure Entities and Related PartiesLokiNo ratings yet

- Note 22. Social Insurance: 137 Notes To The Financial StatementsDocument18 pagesNote 22. Social Insurance: 137 Notes To The Financial StatementsLokiNo ratings yet

- Notes To The Financial Statements26 PDFDocument1 pageNotes To The Financial Statements26 PDFLokiNo ratings yet

- Social Insurance: Social Security and MedicareDocument26 pagesSocial Insurance: Social Security and MedicareLokiNo ratings yet

- Note 21. Fiduciary Activities: Thrift Savings PlanDocument2 pagesNote 21. Fiduciary Activities: Thrift Savings PlanLokiNo ratings yet

- Note 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsDocument1 pageNote 24. Stewardship Land and Heritage Assets: 161 Notes To The Financial StatementsLokiNo ratings yet

- Notes To The Financial Statements20Document6 pagesNotes To The Financial Statements20LokiNo ratings yet

- Notes To The Financial Statements18Document7 pagesNotes To The Financial Statements18LokiNo ratings yet

- Note 17. Collections and Refunds of Federal RevenueDocument3 pagesNote 17. Collections and Refunds of Federal RevenueLokiNo ratings yet

- Notes To The Financial Statements14Document1 pageNotes To The Financial Statements14LokiNo ratings yet

- Notes To The Financial Statements16Document2 pagesNotes To The Financial Statements16LokiNo ratings yet

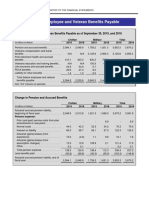

- Note 12. Federal Employee and Veteran Benefits PayableDocument10 pagesNote 12. Federal Employee and Veteran Benefits PayableLokiNo ratings yet

- Notes To The Financial Statements9Document1 pageNotes To The Financial Statements9LokiNo ratings yet

- Note 11. Federal Debt Securities Held by The Public and Accrued InterestDocument4 pagesNote 11. Federal Debt Securities Held by The Public and Accrued InterestLokiNo ratings yet

- Notes To The Financial Statements7Document3 pagesNotes To The Financial Statements7LokiNo ratings yet

- Note 13. Environmental and Disposal LiabilitiesDocument2 pagesNote 13. Environmental and Disposal LiabilitiesLokiNo ratings yet