Professional Documents

Culture Documents

Paradigm - 2020 - Dr. Zain - 5 Authors

Uploaded by

032179253460 ratings0% found this document useful (0 votes)

19 views1 pageOriginal Title

Paradigm_2020_Dr. Zain_5 authors

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 pageParadigm - 2020 - Dr. Zain - 5 Authors

Uploaded by

03217925346Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Paradigms

Print ISSN 1996-2800, Online ISSN 2410-0854

2020, Vol. 14, No. 1 Page 157-165

DOI: 10.24312/193014024

Role of ESG Disclosure in Determining Asset Allocation Decision: An Individual Investor Perspective

Muhammad Naveed1, Muhammad Khalid Sohail2, Syed Zain ul Abdin3, Madiha Awais 4, Noshaba Batool 5

Bahria University, Islamabad12, Air University Islamabad35, Lecturer, The Univeristy of Lahore 4

Corresponding Author Email: qm.naveed@outlook.com

Cite this paper: Naveed, M., Sohail, M. K., Abdin, S. Z., Awais, M., & Batool, N. (2020). Role of ESG disclosure in determining

asset allocation decision: An individual investor perspective. Paradigms, 14(1), 157-165.

Besides financial disclosure, there is a rising surge of reporting environmental, social, and governance (ESG) information in

emerging countries. The ESG disclosure intended to fulfill the information needs of all the company’s stockholders, particularly

the investors. This study intends to determine how individual investors materialize ESG information into their investment

allocation decision. Moreover, to examine the information dimension having more prudent impact on their investment allocation

decision. The primary data was collected through a structured survey from 220 novices and experienced individual investor

actively involved in stock market trading Pakistan stock exchange (PSX). The predictive power of the deduced model is

determined through covariance-based structural equation modelling. Findings of the study suggest that, on average, the ESG

predicts the individual investor’s asset allocation decision in the context of the Pakistan stock exchange (PSX). Also, it ascertained

that the environment and governance had more magnitude than social information. Addationally, both novice and experienced

consider the decision usefulness of ESG disclosure while making investment allocation decision. The proposed model is novel and

offer insight for companies listed on Pakistan stock exchange to pay more attention to ESG disclosure practices. Moreover,

investor particularly individual investor by incorporating ESG information can make more informed and rational investment

allocation decision.

Keywords: ESG, individual investor, asset allocation decision, PSX

INTRODUCTION asset allocation decision and always remain utility centric by

The rising corporate stakeholder activism is an intriguing expecting minimum risk and maximum return. According to

pressure on firms to go beyond the mandatory level of classical decision-making theory, asset allocation decision is a

disclosure and sustain sustainability. The emergence of social temporal phenomenon and predicted by the quality of

responsibility provokes several notions like social performance, information (Beach & Lipshitz, 2017). Therefore, the corporate

environmental, social, and governance performance that remain disclosure practices of firms remain robust to predict the

most vibrant. In response to changing regulatory and stakeholder asset allocation decision. The corporate disclosure

mainstream investor demand for nonfinancial information, by firms is requisite to improve transparency and build a sound

there is a surge in integrating ESG information in investment corporate image. The corporate image or reputation remains

portfolio management (Esch, Schnellbächer, & Wald, 2019). central to signal an element of trust and robust to determine the

Moreover, the growing corporate scandal has trembled the stakeholder choices (Bechara, Damasio, & Damasio, 2000).

investor's trust in conventional financial disclosure practices. The stakeholder largely bases their asset allocation decision on

The economic contracts are earned based on trust, and the corporate image, which relies on corporate disclosure.

stakeholders consider the societal impact of their investment Therefore, enrich corporate disclosure remain exceptional to

while making asset allocation decisions. Asset allocation affect the stakeholder perception and mitigate the element of

decision remains daunting due to systematic and non- uncertainty involved in asset allocation decision (Becker-Olsen,

systematic risk involved in economic choices (Calabrese, Cudmore, & Hill, 2006). Studies expounded in past literature

Costa, Levialdi, & Menichini, 2019). The various level of risk established a link between financial disclosure and stakeholder

and their sources reshape the stakeholder’s asset allocation asset allocation decision. However, there is limited empirical

decision. The asset allocation decision primarily determined by evidence regarding the decision usefulness of social

the information provided by firms which reflect its financial information (Bushee, Goodman, & Sunder, 2018).

and nonfinancial prospect. Social information is also term as the nonfinancial

The financial disclosure practices mainly focus on material information reflects through environmental, social, and

information and ignore the viability of nonfinancial governance information. The ESG remains non-economic.

information. However, it is evidenced by past studies that However, they contain material information subject to

financial disclosure is subject to certain limitations and fail to influence the stakeholder asset allocation decision. The rising

predict the going concern of a business entity (Esch et al., 2019; socially responsible investment trend has increased investor

Khemir, Baccouche, & Ayadi, 2019). Therefore, the interest in ESG information. Categorically, ESG information

stakeholder remains reluctant only to base their asset allocation disclosure remains relevant; it provides an outlook on the social

decision on financial information. The economic utility theory performance of the business entity and also assists in making

holds the notion that individual remains rational while making informed asset allocation decisions. In the context of asset

157

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Real-Estate Investor's Psychology: Heuristics and Prospect FactorsDocument6 pagesReal-Estate Investor's Psychology: Heuristics and Prospect Factors03217925346No ratings yet

- Real-Estate Investor's Psychology: Heuristics and Prospect FactorsDocument6 pagesReal-Estate Investor's Psychology: Heuristics and Prospect Factors03217925346No ratings yet

- Corporate GovernanceDocument15 pagesCorporate Governance03217925346No ratings yet

- 149-Revised FINAL1 - AbstractDocument20 pages149-Revised FINAL1 - Abstract03217925346No ratings yet

- Corporate GovernanceDocument15 pagesCorporate Governance03217925346No ratings yet

- AJSS - 2020 - Dr. Zain - 4 AuthorsDocument1 pageAJSS - 2020 - Dr. Zain - 4 Authors03217925346No ratings yet

- Qualitative Research in Financial Markets: Article InformationDocument34 pagesQualitative Research in Financial Markets: Article Information03217925346No ratings yet

- HEC Approved National Social Sciences JournalsDocument4 pagesHEC Approved National Social Sciences Journals03217925346No ratings yet

- JIABR - 2019 - Dr. Zain - 2 AuthorsDocument1 pageJIABR - 2019 - Dr. Zain - 2 Authors03217925346No ratings yet

- Review of Behavioral Finance: Article InformationDocument20 pagesReview of Behavioral Finance: Article Information03217925346No ratings yet

- Focal Person: Assistant ProfessorDocument1 pageFocal Person: Assistant Professor03217925346No ratings yet

- "Impact of Demographics and Personality Traits On Confidence PDFDocument10 pages"Impact of Demographics and Personality Traits On Confidence PDF03217925346No ratings yet

- The Self-Serving Attributional Bias: Beyond Self-PresentationDocument12 pagesThe Self-Serving Attributional Bias: Beyond Self-Presentation03217925346No ratings yet

- HEC Approved Arts and Humanities JournalsDocument2 pagesHEC Approved Arts and Humanities Journals03217925346100% (1)

- Rasheed 2018 Is The Best KnowledgeDocument37 pagesRasheed 2018 Is The Best KnowledgeshaharyarkhanNo ratings yet

- Behaviour of Individual Investors in Stock Market Trading: Evidence From IndiaDocument16 pagesBehaviour of Individual Investors in Stock Market Trading: Evidence From IndiaPeterNo ratings yet

- International Journal of Housing Markets and Analysis: Article InformationDocument22 pagesInternational Journal of Housing Markets and Analysis: Article Information03217925346No ratings yet

- Qualitative Research in Financial Markets: Article InformationDocument34 pagesQualitative Research in Financial Markets: Article Information03217925346No ratings yet

- Review of Behavioral Finance: Article InformationDocument20 pagesReview of Behavioral Finance: Article Information03217925346No ratings yet

- Rasheed 2018 Is The Best KnowledgeDocument37 pagesRasheed 2018 Is The Best KnowledgeshaharyarkhanNo ratings yet

- Potential Underdog Bias, Overconfidence and Risk Propensity in Investor Decision-Making BehaviorDocument16 pagesPotential Underdog Bias, Overconfidence and Risk Propensity in Investor Decision-Making Behavior03217925346No ratings yet

- CH 19Document29 pagesCH 19CH Umair MerryNo ratings yet

- Thesis Questionnaires On BiasesDocument67 pagesThesis Questionnaires On Biases03217925346No ratings yet

- CHAPTER 7 Bonds and Their ValuationDocument43 pagesCHAPTER 7 Bonds and Their ValuationAhsan100% (2)

- Do Data Characteristics Change According To The Number of Scale Points Used?Document18 pagesDo Data Characteristics Change According To The Number of Scale Points Used?03217925346No ratings yet

- Behaviour of Individual Investors in Stock Market Trading: Evidence From IndiaDocument16 pagesBehaviour of Individual Investors in Stock Market Trading: Evidence From IndiaPeterNo ratings yet

- HJRS DataDocument4 pagesHJRS Data03217925346No ratings yet

- Syed Zain Ul Abdin MNGT Sci 2018 UoL PRRDocument144 pagesSyed Zain Ul Abdin MNGT Sci 2018 UoL PRR03217925346No ratings yet

- CHAPTER 7 Bonds and Their ValuationDocument43 pagesCHAPTER 7 Bonds and Their ValuationAhsan100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ID Risk Assessment TemplateDocument51 pagesID Risk Assessment TemplateCORAL ALONSONo ratings yet

- The First Thing We Install Is Confidence: We've Got Ammonia Refrigeration Labeling Down ColdDocument2 pagesThe First Thing We Install Is Confidence: We've Got Ammonia Refrigeration Labeling Down ColdUyên HàNo ratings yet

- Chapter 6Document5 pagesChapter 6Iris Jane SilvelaNo ratings yet

- Company ProfileDocument16 pagesCompany Profilelynn arciagaNo ratings yet

- According To Peter DruckerDocument6 pagesAccording To Peter DruckerTran TrangNo ratings yet

- City of Watertown Seasonal Collection of Brush and Green WasteDocument3 pagesCity of Watertown Seasonal Collection of Brush and Green WasteNewzjunkyNo ratings yet

- MAF661 Hogwarts IncDocument9 pagesMAF661 Hogwarts Inc2022470462No ratings yet

- 3218 Uyen Nguyen My 10210652 ULC A1.1 14923 1514468528Document33 pages3218 Uyen Nguyen My 10210652 ULC A1.1 14923 1514468528Uyên Nguyễn MỹNo ratings yet

- Social Responsibility Need For Social ResponsibilityDocument11 pagesSocial Responsibility Need For Social ResponsibilityRashi BatraNo ratings yet

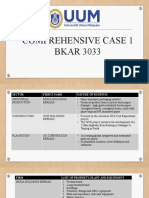

- Comprehensive Case 1 BKAR 3033Document7 pagesComprehensive Case 1 BKAR 3033nadiahNo ratings yet

- Review of Literature on Recycling Business BenefitsDocument2 pagesReview of Literature on Recycling Business Benefitsalyssa ramosNo ratings yet

- SDGs Assignment AKMDocument6 pagesSDGs Assignment AKMFrank Hobab MumbiNo ratings yet

- Curriculum Vitae Daniel Landaverde ENDocument1 pageCurriculum Vitae Daniel Landaverde ENDaniel Landaverde SandovalNo ratings yet

- Canadian Standards AssociationDocument11 pagesCanadian Standards AssociationJohn David NocheNo ratings yet

- Cruz Keanna Gentrep Mind Map PDFDocument1 pageCruz Keanna Gentrep Mind Map PDFMidas Troy VictorNo ratings yet

- Strategic Management: Concepts and Cases 9eDocument13 pagesStrategic Management: Concepts and Cases 9ePutriNo ratings yet

- Module 6 Community Relations and Strategic PhilanthropyDocument21 pagesModule 6 Community Relations and Strategic Philanthropychoose1No ratings yet

- (Textile Science and Clothing Technology) Subramanian Senthilkannan Muthu (Eds.) - Sustainability in The Textile Industry-Springer Singapore (2017)Document150 pages(Textile Science and Clothing Technology) Subramanian Senthilkannan Muthu (Eds.) - Sustainability in The Textile Industry-Springer Singapore (2017)Souâd Yasmina BouananiNo ratings yet

- Presentation, Analysis and Interpretation of DataDocument50 pagesPresentation, Analysis and Interpretation of DataGemver Baula BalbasNo ratings yet

- Business Ethics Unit - 5....Document18 pagesBusiness Ethics Unit - 5....collgamer18No ratings yet

- Business EnvironmentDocument23 pagesBusiness EnvironmentAlbert Gevero FalsarioNo ratings yet

- Riachuelo 4t22Document30 pagesRiachuelo 4t22Marcio JuliboniNo ratings yet

- Strategic Business Analysis 3Document2 pagesStrategic Business Analysis 3Alfred LopezNo ratings yet

- Revised layout plan of Central Warehouse at Katni (M.PDocument1 pageRevised layout plan of Central Warehouse at Katni (M.PRUPNIT PHOTOGRAPHYNo ratings yet

- AppendixDocument5 pagesAppendixasimNo ratings yet

- Consolidated Set of The GRI Standards PDFDocument870 pagesConsolidated Set of The GRI Standards PDFDineshNo ratings yet

- UK Gas TrucDocument1 pageUK Gas Truchuyenluong10398No ratings yet

- What Is Nike's Responsibility For Harms in Its Supply Chain?Document2 pagesWhat Is Nike's Responsibility For Harms in Its Supply Chain?mona fathyNo ratings yet

- Background Material On BRSR - Revised EditionDocument327 pagesBackground Material On BRSR - Revised EditionIshan BavejaNo ratings yet

- Mark and Spencer and H&M.editedDocument4 pagesMark and Spencer and H&M.editedsanuNo ratings yet