Professional Documents

Culture Documents

CIF o Valor en Aduanas FOB + FLETE + SEGURO: A/V CIF XX %

CIF o Valor en Aduanas FOB + FLETE + SEGURO: A/V CIF XX %

Uploaded by

Priscila Edith Huacho Cruz0 ratings0% found this document useful (0 votes)

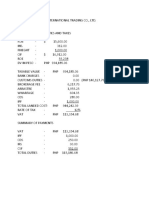

11 views3 pagesThis document calculates import taxes on a shipment with a CIF value of $5,731.95. It applies an IGV sales tax of 16% and an IPM tax of 2% to the CIF value, for a total of $1,032 in taxes owed. The taxes include a 917 IGV tax and 115 IPM tax. No other taxes (Ad Valorem, ISC, etc.) are applied in this case since the rates are 0%.

Original Description:

CALCULO DE IMPUESTOS

Original Title

NEGOCIOS INTERNACIONALES 17-20

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document calculates import taxes on a shipment with a CIF value of $5,731.95. It applies an IGV sales tax of 16% and an IPM tax of 2% to the CIF value, for a total of $1,032 in taxes owed. The taxes include a 917 IGV tax and 115 IPM tax. No other taxes (Ad Valorem, ISC, etc.) are applied in this case since the rates are 0%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views3 pagesCIF o Valor en Aduanas FOB + FLETE + SEGURO: A/V CIF XX %

CIF o Valor en Aduanas FOB + FLETE + SEGURO: A/V CIF XX %

Uploaded by

Priscila Edith Huacho CruzThis document calculates import taxes on a shipment with a CIF value of $5,731.95. It applies an IGV sales tax of 16% and an IPM tax of 2% to the CIF value, for a total of $1,032 in taxes owed. The taxes include a 917 IGV tax and 115 IPM tax. No other taxes (Ad Valorem, ISC, etc.) are applied in this case since the rates are 0%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

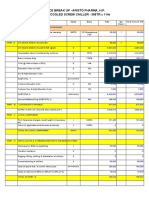

DERECHO ARANCEL BASE DE CALCULO

Ad/ Valorem 0%, 4%, 6% y 11% (CIF) * % A/V

IGV 16% (valor CIF + Ad Valorem + ISC + S/A + DE) * 16 %

IPM 2% (valor CIF + Ad Valorem + ISC + S/A + DE) * 2%

Régimen de (valor CIF+ Ad Valorem +ISC+ IGV + IPM + S/A + DE+ OT

3.5%, 5% ó 10%

Percepción TRIBUTO) * 3.5%

FOB FLETE SEGURO

4526.4 1205 0.55

CIF o Valor en Aduanas = FOB + FLETE + SEGURO

FOB 4526.4

flete 1205

seguro 0.55

CIF 5731.95

A/V = CIF * xx %

CIF 5,731.95

% A/V 0%

A/V 0

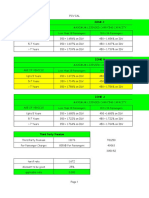

IGV = (CIF + Ad Valorem + ISC + S/A + DE) * 16 %

CIF 5731.95

A/V 0

ISC 0

S/A 0

DE 0

IGV 917

IPM = (CIF + Ad Valorem + ISC + S/A + DE) * 2 %

CIF 5731.95

A/V 0

ISC 0

S/A 0

DE 0

IPM 114.6390

RESUEMEN TOTAL DE TRIBUTOS A PAGAR

IGV 917

IPM 115

ISC 0

A/V 0

TOTAL 1032 USD

CULO

Valorem + ISC + S/A + DE) * 16 %

Valorem + ISC + S/A + DE) * 2%

Valorem +ISC+ IGV + IPM + S/A + DE+ OTRO

5%

CIF o Valor en

Aduanas

5,731.95

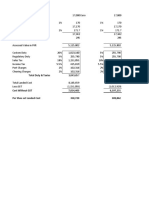

ISC = ( CIF+ Ad Valorem + S/A + E) * xx%

CIF 5731.95

A/V 0

%ISC 0%

ISC 0

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- UGG ValuationDocument7 pagesUGG ValuationPritam KarmakarNo ratings yet

- Parcial AduanasDocument8 pagesParcial AduanasSantiago Rafael Velarde CapuñayNo ratings yet

- Price Break Up in INR With Duties (04.12.08)Document2 pagesPrice Break Up in INR With Duties (04.12.08)calvin.bloodaxe4478No ratings yet

- UTS MK 15 Sep 18Document14 pagesUTS MK 15 Sep 18Anonymous KyYdMhfaKXNo ratings yet

- DT Last Day Revision Notes May 2024Document23 pagesDT Last Day Revision Notes May 2024nimisha vermaNo ratings yet

- Lesson 25Document15 pagesLesson 25TUẤN TRẦN MINHNo ratings yet

- FY24 Ryanair PresentationDocument22 pagesFY24 Ryanair Presentationarunvel007No ratings yet

- Income Tax Calulator With Computation of IncomeDocument18 pagesIncome Tax Calulator With Computation of IncomeSurendra DevadigaNo ratings yet

- GICE Govt Purchase IPIRATED IncomeDocument3 pagesGICE Govt Purchase IPIRATED IncomeChristy Boyd TurnerNo ratings yet

- Some Special Cases: ObjectivesDocument44 pagesSome Special Cases: Objectiveshuy anh leNo ratings yet

- Formulas For TariffDocument8 pagesFormulas For TariffforfloodphNo ratings yet

- Tariff Calculator Toyota AquaDocument3 pagesTariff Calculator Toyota AquaMohamed AfkarNo ratings yet

- Financial Benchmarks Cheat SheetDocument1 pageFinancial Benchmarks Cheat SheetMawuena GagakumaNo ratings yet

- Price Break Up in INR With Duties (04.06.08)Document2 pagesPrice Break Up in INR With Duties (04.06.08)calvin.bloodaxe4478No ratings yet

- Equity Valuation Assignment Chapter 7Document7 pagesEquity Valuation Assignment Chapter 7mehandiNo ratings yet

- Lecture Notes - Income Tax (PAS 12)Document25 pagesLecture Notes - Income Tax (PAS 12)Alliah ArrozaNo ratings yet

- CalculatorDocument59 pagesCalculatormitulNo ratings yet

- Subpartidas SunatDocument6 pagesSubpartidas SunatDamaris Fernandez SanchezNo ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- M&a ValluationDocument11 pagesM&a ValluationSumeet BhatereNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (30)

- Ultra Petroleum Corp. - Assumptions - NAV Model by Geography and Reserve TypeDocument321 pagesUltra Petroleum Corp. - Assumptions - NAV Model by Geography and Reserve TypeDiego VegaNo ratings yet

- N/a 66.48 234.57 16.95 16.32 0.47% N/a N/a 1.46% 2.59% - 7.72% 1.84% 1.62% 2.99% 3.24% PE Ratio Dividend Yield Operating MarginDocument7 pagesN/a 66.48 234.57 16.95 16.32 0.47% N/a N/a 1.46% 2.59% - 7.72% 1.84% 1.62% 2.99% 3.24% PE Ratio Dividend Yield Operating Marginsanam bansalNo ratings yet

- Analisa JalurDocument65 pagesAnalisa JalurRidwan YasinNo ratings yet

- Estimated Duties and Taxes PDFDocument1 pageEstimated Duties and Taxes PDFDianne Bernadeth Cos-agonNo ratings yet

- Explain (Simply and in Your Own Words) What The Company DoesDocument8 pagesExplain (Simply and in Your Own Words) What The Company DoesShreyas LakshminarayanNo ratings yet

- Joint Exercises May 2017 JointDocument31 pagesJoint Exercises May 2017 JointLorenaNo ratings yet

- Joint Exercises May 2017 JointDocument31 pagesJoint Exercises May 2017 JointLorenaNo ratings yet

- Tax Exercises May 2017 JointDocument31 pagesTax Exercises May 2017 JointLorenaNo ratings yet

- Tax Exercises May 2017 JointDocument31 pagesTax Exercises May 2017 JointLorenaNo ratings yet

- Kuis Manajemen Keuangan - Manajemen UIDocument16 pagesKuis Manajemen Keuangan - Manajemen UIjadwal SekjenNo ratings yet

- Quiz 2 SolutionDocument1 pageQuiz 2 SolutionFaiq MullaNo ratings yet

- Cálculo+SDocument1 pageCálculo+SmzcbrNo ratings yet

- Lecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingDocument38 pagesLecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingHồng KhánhNo ratings yet

- Chapter 5. Exhibits y AnexosDocument7 pagesChapter 5. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- 1.1cin Pricing: Step Ctyp From To Man. Reqt Subto Stat Altcty Altcbv Actky DescriptionDocument5 pages1.1cin Pricing: Step Ctyp From To Man. Reqt Subto Stat Altcty Altcbv Actky DescriptionSarosh100% (16)

- Top Academy Igv 2023-2Document91 pagesTop Academy Igv 2023-2guido martinez tacuchiNo ratings yet

- Nív Nu Tipc Denominação Nívds Nívat M O E I S Req Fórmc Fórmb CHC ProviDocument18 pagesNív Nu Tipc Denominação Nívds Nívat M O E I S Req Fórmc Fórmb CHC ProviSantanaSDNo ratings yet

- Part I. Free Cash Fow Before RepacementDocument1 pagePart I. Free Cash Fow Before RepacementLia NNo ratings yet

- Chicago Rates-1Document2 pagesChicago Rates-1mumbai TNL2No ratings yet

- Resolucion Ejercicio 3Document16 pagesResolucion Ejercicio 3Sebastián BosquezNo ratings yet

- Gulf Takeover ExcelDocument7 pagesGulf Takeover ExcelNarinderNo ratings yet

- Cash Flow Estimation and Risk AnalysisDocument42 pagesCash Flow Estimation and Risk AnalysisdaidainaNo ratings yet

- SP-1847 RS-6803 IVA Descrição Iva Pedido Item Liquido Exit Teste Pedido ItemDocument2 pagesSP-1847 RS-6803 IVA Descrição Iva Pedido Item Liquido Exit Teste Pedido Itemcarlosandrade777No ratings yet

- Brigham Chapter 21 Solution Manual PDFDocument12 pagesBrigham Chapter 21 Solution Manual PDFAhsan ZaidiNo ratings yet

- Com 600 DiningDocument1 pageCom 600 DiningLet J. CabreraNo ratings yet

- 4 After-Tax Economic AnalysisDocument31 pages4 After-Tax Economic AnalysisAngel NaldoNo ratings yet

- Solution Key To Problem Set 2Document6 pagesSolution Key To Problem Set 2Ayush RaiNo ratings yet

- Cinepolis & Exam 2018 - SolutionsDocument8 pagesCinepolis & Exam 2018 - Solutionsmathieu652540No ratings yet

- Basic Blank Discounted Cash Flow (DCF) TemplateDocument3 pagesBasic Blank Discounted Cash Flow (DCF) TemplateNamitNo ratings yet

- Chapter 10: Income TaxDocument32 pagesChapter 10: Income TaxNgô Thành DanhNo ratings yet

- Economic EvaDocument35 pagesEconomic EvaViona NaradelaNo ratings yet

- IFBL Oats Cost Model Comparison Statement Draft V1 24.4.24Document2 pagesIFBL Oats Cost Model Comparison Statement Draft V1 24.4.24Md. Habibullah ACCANo ratings yet

- Gravalty - Control Type Coding Rev.00Document1 pageGravalty - Control Type Coding Rev.00Vivi OktaviantiNo ratings yet

- Profit and Loss Account TemplatesDocument2 pagesProfit and Loss Account TemplatesSpam JunkNo ratings yet

- DCF Valuation TemplateDocument15 pagesDCF Valuation TemplateDEV DUTT VASHIST 22111116No ratings yet

- FM2 Cheat Sheet From CREsDocument4 pagesFM2 Cheat Sheet From CREstrijtkaNo ratings yet

- Data Sheets Property HCCBDocument42 pagesData Sheets Property HCCBRupesh SinghNo ratings yet