Professional Documents

Culture Documents

Financial Benchmarks Cheat Sheet

Uploaded by

Mawuena GagakumaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Benchmarks Cheat Sheet

Uploaded by

Mawuena GagakumaCopyright:

Available Formats

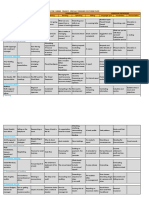

Farm Financial Ratios and Benchmarks Calculations & Implications

Liquidity Analysis Calculation Good Caution Danger

Current Ratio Total Current Assets ÷ Total Current Liabilities > 1.50 0.80 ‐ 1.50 < 0.80

Working Capital / Total

Expenses (Total Current Assets – Total Current Liabilities) ÷ Total Expenses > 50% 15 ‐ 50% < 15%

(expanding business)

Working Capital / Total

Expenses (Total Current Assets – Total Current Liabilities) ÷ Total Expenses > 25% 15 ‐ 25% < 15%

(stable business)

Solvency Analysis Calculation Good Caution Danger

Debt / Asset Ratio Total Liabilities ÷ Total Assets < 30% 30 ‐ 70% > 70%

Equity / Asset Ratio Total Equity ÷ Total Assets > 70% 30 ‐ 70% < 30%

Debt / Equity Ratio Total Liabilities ÷ Total Equity < 42% 42 ‐ 230% > 230%

Profitability Analysis Calculation Good Caution Danger

Rate of Return on Assets

(NFIFO* + Interest Expense – Operator Management Fee)

(ROA) > 8% 3 ‐ 8% < 3%

÷ Total Assets

(mostly owned)

Rate of Return on Assets

(NFIFO* + Interest Expense – Operator Management Fee)

(ROA) > 12% 3 ‐ 12% < 3%

÷ Total Assets

(mostly rented or leased)

(NFIFO* + Interest Expense – Operator Management Fee)

Operating Profit Margin > 25% 10 ‐ 25% < 10%

÷ Gross Revenue

Financial Efficiency Calculation Good Caution Danger

Asset Turnover Ratio Gross Revenue ÷ Total Assets > 40% 20 - 40% < 20%

Operating Expense / Revenue

Ratio (Operating Expenses ‐ Interest ‐ Depreciation) ÷ Gross Revenue < 65% 65 ‐ 80% > 80%

(mostly owned)

Operating Expense / Revenue

Ratio (Operating Expenses ‐ Interest ‐ Depreciation) ÷ Gross Revenue < 75% 75 ‐ 85% > 85%

(mostly rented or leased)

Net Farm Income From Look at trends; varies with cyclical

NFIFO* ÷ Gross Revenue

Operations Ratio nature of agricultural prices & income

Repayment Analysis Calculation Good Caution Danger

[(NFIFO* + Gross Non Farm Revenue + Depreciation Expense + Interest on

Term Debt and Lease Term Debts and Capital Leases) – Income Tax Expense

> 150% 110 ‐ 150% < 110%

Coverage Ratio – Family Living Withdrawals)] ÷ Scheduled Annual Principal and

Interest Payments on Term Debt and Capital Leases

(Total Non‐Current Liabilities + Current Portion of Term Debt) / (NFIFO +

Term Debt/EBITDA <3 3‐7 >7

Interest Expense + Depreciation Expense)

DAIRY INDUSTRY BENCHMARKS Good Caution Danger

Debt Per Cow Total Farm Liabilities / (Lactating + Dry Cows) ≤ $5,000 $5,001 ‐ 7,999 ≥ $8,000

Investment Per Cow Total Farm Assets / (Lactating + Dry Cows) ≤ $13,000 $13,001 ‐ 16,999 ≥ $17,000

Tillable Acres Per Cow Total Tillable Acres / (Lactating + Dry Cows) ≥4 2 ‐ 3.99 ≤ 1.99

Machinery Investment Per

Total Machinery & Equipment Value / (Lactating + Dry Cows) ≤ $2,500 $2,501 ‐ 3,499 ≥ $3,500

Cow

Lbs Milk Sold Per Cow Lbs Shipped / (Lactating + Dry Cows) ≥ 24,000 18,001 ‐ 23,999 ≤ 18,000

Lbs Milk Sold Per FTE Worker Lbs Shipped / FTE for all dairy‐related labor >1.5 million 1.0 ‐ 1.5 million <1.0 million

Gross Cash Income Per Cow (Milk + Culls + Calves & Heifers + Patronage) / (Lactating + Dry Cows) ≥ $4,500 $3,001 ‐ 4,499 ≤ $3,000

Interest Cost Per Cow Total Interest Expense / (Lactating + Dry Cows) ≤ $270 $269 ‐ 349 ≥ $350

Net Farm Cash Income Per

(NFIFO + Depreciation) / (Lactating + Dry Cows) ≥ $600 $201 ‐ 599 ≤ $200

Cow

Cost of Producing CWT of Milk (Total Dairy‐Related Expenses + Interest + Depreciation) / CWT Shipped ≤ $17.49 $17.50 ‐ 18.99 ≥ $19.00

*NFIFO = Net Farm Income From Operations: (Total Revenues - Total Expenses, excluding gains or losses from disposal of farm capital assets).

Financial benchmarks format developed by Dr. David Kohl, Virginia Tech. Industry benchmarks from Gary Sipiorski, Vita Plus Corporation.

Modified for Dairy Challenge, November 2019.

You might also like

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionDocument7 pagesCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARINo ratings yet

- 02 BIWS Projections Quick ReferenceDocument3 pages02 BIWS Projections Quick ReferencecarminatNo ratings yet

- Forex MarketDocument49 pagesForex MarketSanjay ReddyNo ratings yet

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- 11 The Cost of CapitalDocument43 pages11 The Cost of CapitalMo Mindalano MandanganNo ratings yet

- Market and Liquidity Risk Management by Jawwad Ahmed Farid PDFDocument88 pagesMarket and Liquidity Risk Management by Jawwad Ahmed Farid PDFJustin TalbotNo ratings yet

- TIFA CheatSheet MM X MLDocument10 pagesTIFA CheatSheet MM X MLCorina Ioana BurceaNo ratings yet

- Financial Ratio Cheat Sheet WAIICDocument2 pagesFinancial Ratio Cheat Sheet WAIICSierraNo ratings yet

- Financial RatiosDocument20 pagesFinancial RatiosThiên TiênNo ratings yet

- Final Cheat Sheet FA ML X MM UpdatedDocument8 pagesFinal Cheat Sheet FA ML X MM UpdatedIrina StrizhkovaNo ratings yet

- Ratio FormulaeDocument3 pagesRatio FormulaeNandhaNo ratings yet

- Fam - 1Document20 pagesFam - 1shahidNo ratings yet

- Arendain Tp4 FinanceDocument4 pagesArendain Tp4 FinanceMgrace arendaknNo ratings yet

- CHAP - 5 - Measuring and Evaluating The Performance of BanksDocument73 pagesCHAP - 5 - Measuring and Evaluating The Performance of BanksNgọc Minh VũNo ratings yet

- CHAP 5 Measuring and Evaluating The Performance of BanksDocument60 pagesCHAP 5 Measuring and Evaluating The Performance of BanksDương Thuỳ TrangNo ratings yet

- Bank Ratios To SubmitDocument6 pagesBank Ratios To SubmitKumar SnehitNo ratings yet

- Ratio Analysis: ROA (Profit Margin Asset Turnover)Document5 pagesRatio Analysis: ROA (Profit Margin Asset Turnover)Shahinul KabirNo ratings yet

- Cma Formula SheetDocument7 pagesCma Formula Sheetanushkamohanan0No ratings yet

- Financial Statement Analysis - RatioDocument7 pagesFinancial Statement Analysis - RatioJanelle De TorresNo ratings yet

- Financial Ratios Explanation: Icap Group S.ADocument15 pagesFinancial Ratios Explanation: Icap Group S.AReddy PreddyNo ratings yet

- 000 REC Working Formula Compiled by GMRCDocument12 pages000 REC Working Formula Compiled by GMRCbhobot riveraNo ratings yet

- OLD NEW: Purely Self-EmployedDocument13 pagesOLD NEW: Purely Self-EmployedkeyelNo ratings yet

- Worksheet On Accounting Ratios Board QPDocument10 pagesWorksheet On Accounting Ratios Board QPCfa Deepti BindalNo ratings yet

- Fa Cheat Sheet MM MLDocument8 pagesFa Cheat Sheet MM MLIrina StrizhkovaNo ratings yet

- Chapter 1 RatiosDocument81 pagesChapter 1 Ratiospaola sabbanNo ratings yet

- Sustainable Growth RateDocument6 pagesSustainable Growth RateadhishcaNo ratings yet

- Bholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Document9 pagesBholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Chirag MalhotraNo ratings yet

- Tax Reckoner For Investments in Mutual Fund Schemes FY 2014-2015 PDFDocument2 pagesTax Reckoner For Investments in Mutual Fund Schemes FY 2014-2015 PDFRupanjali Mitra BasuNo ratings yet

- Ratio Analysis I. Profitability RatiosDocument4 pagesRatio Analysis I. Profitability RatiosEnergy GasNo ratings yet

- Ratio AnalysisDocument35 pagesRatio AnalysisArya MahendruNo ratings yet

- Cheat Sheet of The GODS.v2.0 PDFDocument8 pagesCheat Sheet of The GODS.v2.0 PDFCorina Ioana BurceaNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- Analysis of Financial Statements: Made Gitanadya, Se., MSMDocument18 pagesAnalysis of Financial Statements: Made Gitanadya, Se., MSMLilia LiaNo ratings yet

- Chapter 6 For CUP Financial AccountingDocument15 pagesChapter 6 For CUP Financial Accountingratanak_kong1-9No ratings yet

- Ratio Analysis DuPont AnalysisDocument7 pagesRatio Analysis DuPont Analysisshiv0308No ratings yet

- Financial Statement Analysis and Performance MeasurementDocument6 pagesFinancial Statement Analysis and Performance MeasurementBijaya DhakalNo ratings yet

- Financial Analysis Cheat Sheet 1709070577Document2 pagesFinancial Analysis Cheat Sheet 1709070577herrerofrutosNo ratings yet

- 9 Mas Capital Budgeting Sessions 3 4Document14 pages9 Mas Capital Budgeting Sessions 3 4seya dummyNo ratings yet

- Ratio Indosat 2016Document21 pagesRatio Indosat 2016rebeliousageNo ratings yet

- ROE and ROA Ratios For Accounting SummaryDocument3 pagesROE and ROA Ratios For Accounting SummarymyzevelNo ratings yet

- Attock Cement Ratio Analysis 2019 by RizwanDocument8 pagesAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooNo ratings yet

- Accounting RatiosDocument7 pagesAccounting RatiosdanielNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisRaven PicorroNo ratings yet

- Farm Financial Ratiosand Benchmarks 3192009Document1 pageFarm Financial Ratiosand Benchmarks 3192009prabhunishaNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument27 pagesAnalysis and Interpretation of Financial StatementsRajesh PatilNo ratings yet

- Profitability RatioDocument17 pagesProfitability Ratioaayushiji789No ratings yet

- Topic 13 Financial Statement AnalysisDocument32 pagesTopic 13 Financial Statement AnalysisAbd AL Rahman Shah Bin Azlan ShahNo ratings yet

- Ratios Notes and ProblemDocument6 pagesRatios Notes and ProblemAniket WaneNo ratings yet

- FALLSEM2021-22 BAG2010 ELA VL2021220105026 Reference Material I 06-10-2021 Analysis of Farm Loan ProposalsDocument9 pagesFALLSEM2021-22 BAG2010 ELA VL2021220105026 Reference Material I 06-10-2021 Analysis of Farm Loan ProposalsLAKSHMI SUPRIYA J 20BAG0109No ratings yet

- Ratio Analysis - Converted - by - AbcdpdfDocument3 pagesRatio Analysis - Converted - by - AbcdpdfSerendipity 16No ratings yet

- Akshat Ratio AnanlysisDocument8 pagesAkshat Ratio AnanlysisAshutosh GuptaNo ratings yet

- Managerial Finance CH 3Document5 pagesManagerial Finance CH 3MPNo ratings yet

- BKM 10e Chap014Document8 pagesBKM 10e Chap014jl123123No ratings yet

- Unit 2Document17 pagesUnit 2hassan19951996hNo ratings yet

- Corp RatiosDocument1 pageCorp RatiosVishal PaulNo ratings yet

- MDSX M09 EP Slides v2Document34 pagesMDSX M09 EP Slides v2Little LoachNo ratings yet

- Level 1 Assessment Financial Analysis ProdegreeDocument4 pagesLevel 1 Assessment Financial Analysis ProdegreePrá ChîNo ratings yet

- Ratio Analysis: A Tool For Analysis and Interpretation of Financial StatementsDocument54 pagesRatio Analysis: A Tool For Analysis and Interpretation of Financial StatementsAjijur RahmanNo ratings yet

- Estee LauderDocument116 pagesEstee LauderHa DaoNo ratings yet

- Updated FSA Ratio SheetDocument4 pagesUpdated FSA Ratio Sheetmoussa toureNo ratings yet

- Analysis of Fianacial Statements-9Document25 pagesAnalysis of Fianacial Statements-9rohitsf22 olypm100% (1)

- Reflections and Research Paper On Backpack Simulation Solomon L 1Document5 pagesReflections and Research Paper On Backpack Simulation Solomon L 1Trisha ZarenoNo ratings yet

- Types of Money (Money and Banking Assignment)Document11 pagesTypes of Money (Money and Banking Assignment)Malik FatimaNo ratings yet

- DRM CompDocument4 pagesDRM CompHarsh JaiswalNo ratings yet

- 06 ISCLO 2018 Paper Template Prosiding v3Document3 pages06 ISCLO 2018 Paper Template Prosiding v3Rumah SepatuNo ratings yet

- Chap 008Document63 pagesChap 008Radu MirceaNo ratings yet

- FMGT211 Financial Management 1 Module 001 Introduction To Financial Management 1Document5 pagesFMGT211 Financial Management 1 Module 001 Introduction To Financial Management 1Marilou Arcillas PanisalesNo ratings yet

- ThebigshortDocument8 pagesThebigshortAnand P KumarNo ratings yet

- Business Plan On Hornenous Café and RestaurantDocument21 pagesBusiness Plan On Hornenous Café and RestaurantKGNo ratings yet

- Solved DR Quinn DR Rose and DR Tanner Are Dentists WhoDocument1 pageSolved DR Quinn DR Rose and DR Tanner Are Dentists WhoAnbu jaromiaNo ratings yet

- IFM Political RiskDocument11 pagesIFM Political Riskrakesh4488No ratings yet

- FIN 301 B Porter Rachna Exam III - Review I Soln.Document3 pagesFIN 301 B Porter Rachna Exam III - Review I Soln.Wilna Caryll V. DaulatNo ratings yet

- SEBI Categorization of Mutual Funds in IndiaDocument5 pagesSEBI Categorization of Mutual Funds in IndiaTrinath SharmaNo ratings yet

- Entrepreneur: Warren BuffetDocument12 pagesEntrepreneur: Warren BuffetAnadi GuptaNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementRaHul Rathod100% (1)

- Business Mathematics & Statistics (MTH 302)Document10 pagesBusiness Mathematics & Statistics (MTH 302)John WickNo ratings yet

- Governance Handout by MR Atish Mathur 2016 17Document32 pagesGovernance Handout by MR Atish Mathur 2016 17Prabhjot Singh Tinna100% (2)

- An Overview of Indian Financial SystemDocument17 pagesAn Overview of Indian Financial SystemArun DasNo ratings yet

- Investing in Rare Coins With MCDocument14 pagesInvesting in Rare Coins With MCMonetariusCapitalNo ratings yet

- ROLE of STOCKHOLDERS in Corporate GovernanceDocument34 pagesROLE of STOCKHOLDERS in Corporate GovernanceHOD CommerceNo ratings yet

- Bcoe 143 1Document1 pageBcoe 143 1ACS DersNo ratings yet

- Spitzer IndictmentDocument32 pagesSpitzer Indictmentjmaglich1No ratings yet

- History and CultureDocument7 pagesHistory and CultureVinay VatsaNo ratings yet

- Managerial Accounting 13th Edition Warren Solutions Manual DownloadDocument71 pagesManagerial Accounting 13th Edition Warren Solutions Manual DownloadRose Speers100% (22)

- Course Outline S1 2022Document5 pagesCourse Outline S1 2022Woon TNNo ratings yet

- English For Careers - Finance - Advance - PVNDocument2 pagesEnglish For Careers - Finance - Advance - PVNThúy Hà NguyễnNo ratings yet

- Nike Case Study VrindaDocument4 pagesNike Case Study VrindaAnchal ChokhaniNo ratings yet

- Time, Not Timing, Is The Best Way To Capitalize On Stock Market GainsDocument2 pagesTime, Not Timing, Is The Best Way To Capitalize On Stock Market GainsIsabella DuqueNo ratings yet