Professional Documents

Culture Documents

Consumer Sector Update PDF

Consumer Sector Update PDF

Uploaded by

vishi.segalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consumer Sector Update PDF

Consumer Sector Update PDF

Uploaded by

vishi.segalCopyright:

Available Formats

Emkay ©

Sector Update

Consumer Sector

Your success is our success

Hair Pin-Bend, Drive Cautiously

May 28, 2010

Asian Paints HOLD We believe that consumer sector is facing multiple risks like (1) marginal reduction in

CMP: Rs2,109 Target: Rs1,651 volume growth momentum – signs especially visible in January-March 2010 (2) temporary

Price Performance

fall in pricing power, owing to inflation and fragile consumer sentiments (3) absence of

left-over price benefits, which contributed to earnings growth in recent past (4) cost index

(%) 1M 3M 6M 12M

being marginally higher (average of January-April 2010 is higher than FY10 average) (5)

Absolute 2 20 25 94

competition in select segments and (6) higher A&P spends. Despite this, market participants

Rel. to Sensex 9 17 27 64

are factoring earnings growth of 14% in FY11E similar to FY10 earnings growth. Further,

Essel Propack BUY adjusting for HUL, the earnings growth forecasts are 16% yoy for FY11E against 45% yoy in

CMP: Rs41 Target: Rs76 FY10E –closer to the long-term average earnings growth for the sector. We believe that

Price Performance consensus forecasts reflect high optimism.

(%) 1M 3M 6M 12M

Absolute (17) (1) (3) 38

We have marginally factored the risks - consequently our earnings growth at 2% for FY11E

Rel. to Sensex (12) (4) (2) 17

and 11% for FY12E are lower than the consensus estimates of 11% for FY11E and 16% for

FY12E. We believe that there is a temporary disconnect in the valuations of consumer

Godrej Consumer ACCUM companies and future course of earnings growth (sector valuations are 13% premium to

CMP: Rs322 Target: Rs371 the average 5-year (long term) PER and 3% premium to average 1-year PER, when earnings

Price Performance growth is closer to long-term average growth).

(%) 1M 3M 6M 12M

Absolute 9 26 12 95

We believe that, consumer sector at large will roll to FY12E earnings once clarity on near-

Rel. to Sensex 16 23 13 65

term earnings emerges. Until then, we believe that sector offers miniscule upside in best

case and downside of 13% in worst case i.e. realigning the valuation to long-term average

Hindustan Unilever HOLD and adjusting the premium. We prefer Hindustan Unilever and Godrej Consumer over

CMP: Rs233 Target: Rs257 Asian Paints and Marico in our coverage universe - considering former's underperformance

Price Performance and over-pessimism alongside attractive valuation and latter's surprise element on account

(%) 1M 3M 6M 12M of pending corporate action. Alternatively, we recommend few direct plays - Jubliant

Absolute (3) (4) (19) 1 Foods (upside 32%), Titan (upside 10%) that are riding the consumerism wave of India and

Rel. to Sensex 2 (6) (18) (14) derived plays - Essel Propack (upside 80%), Piramal Glass (upside 11%) which are riding

on growth of consumer companies.

Jubilant FoodWorks ACCUM

CMP: Rs280 Target: Rs350

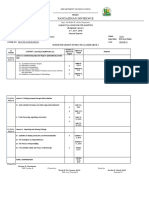

Risks Benefits Medium Near Earning

Price Performance of Base Term Term CAGR

(%) 1M 3M 6M 12M Effect Earning Earning FY10-12E v/s

Absolute (19) 27 - - Volume Margin Valuation CAGR in CAGR Average

Rel. to Sensex (14) 24 - - Risk Risk Risk FY10-12E v/s FY11E v/s CAGR

FY07-10 FY10

Marico HOLD

Asian Paints ü ü ü x Lower Lower Lower

CMP: Rs106 Target: Rs100

Colgate* ü ü ü x Lower Lower Lower

Price Performance

(%) 1M 3M 6M 12M Dabur* ü ü ü x Equal Lower Equal

Absolute (6) 6 5 60 Godrej Consumer ü ü x x Higher Lower Lower

Rel. to Sensex 0 3 6 36

GSK Consumer* x ü ü x Equal Lower Equal

Piramal Glass Buy Hindustan Unilever ü ü x ü Lower Lower Equal

CMP: Rs98 Target: Rs117

Marico ü x ü x Lower Lower Higher

Price Performance

(%) 1M 3M 6M 12M

Nestle* x ü ü x Lower Higher Higher

Absolute 5 32 27 247 * Non coverage companies - relied on consensus earnings

Rel. to Sensex 12 28 29 194

Titan Industries ACCUM

CMP: Rs2,180 Target: Rs2,483 Pritesh Chheda, CFA Sachin Bobade

pritesh.chheda@emkayglobal.com sachin.bobade@emkayglobal.com

Price Performance

+91 22 6612 1273 +91 22 6624 2492

(%) 1M 3M 6M 12M

Absolute 5 25 70 117

Rel. to Sensex 12 22 72 83 Emkay Global Financial Services Ltd.

Consumer Sector Update

Staying ahead of the curve

Analysed the various risk factors We have been correct in pre-empting the trends and factors likely to have a bearing on the

surrounding the consumer sector and consumer sector. Our past sector notes and updates, “Drawing Parallels” dated Dec’08

their impact on sector profitability and “Conundrum” dated Aug’09 have played out with a quarter’s lag. Further, we have

been well-ahead of competition in pin-pointing and directing the future course of action for

the consumer sector. In this note, we have analysed the various risk factors surrounding

the consumer sector and their impact on sector profitability.

Excerpts from sector updates dated December 2008 and August 2009

In 'Drawing Parallel' we said that 'All companies are welcoming FY10E/CY09E with

promise of robust earnings growth and likely breach of linear trend in earnings growth.

Our base case earnings forecasts for FY10E/CY09 were 15%-18% growth and blue-

sky earnings forecasts are 26%-44%' for companies under coverage. (Excerpts from

report)

In 'Conundrum' we said that 'The likely failure of monsoon-2009 has replaced the

'enablers to earnings' with 'risk to earnings' resulting in higher risks to FY10E and

FY11E earnings. In the worst case scenario- FY11E earnings growth could slow down

from erstwhile expectation of 12.8% to 7.0%'.

Advancing into FY11E, what has changed?

Volumes are bracing for change

Earlier volume enablers have now Earlier volume enablers such as rural-led demand, low inflation and higher spending

become key concerns power (due to higher MSP and stimulus package) have now become key concerns-

thanks to the high food inflation coupled with monsoon failure. Moreover, the improved

performance in FY10 (significantly attributed to a favourable base) is likely to create an

unfavourable base for FY11E. The impact of this is slowly but surely visible in the volume

growth momentum of Q4FY10. The following instances strengthen our belief .

(1) Domestic business of Godrej Consumer comprising of hair colour and soaps

failed to register volume growth in Q4FY10

(2) Though Marico has maintained volume growth in Q3FY10 and Q4FY10- there was

contribution by non-core brands like Sweekar and benefits from promotional activity

(3) We believe that Hindustan Unilever could be an exception to our theory, owing to

favorable base effects in FY10E.

Volume performance of consumer companies

Q1FY09 Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10E

**Asian Paints 20.6% 19.2% 0.2% 16.0% 9.2% 14.7% 29.3% 8.0%

**Colgate* 10.9% 11.2% 14.0% 15.2% 14.0% 18.0% 15.0% 14.0%

Dabur 10.0% 13.0% 9.0% 10.0% 14.0% 13.0% 13.0% 14.0%

Godrej Consumer 10.0% 9.4% 14.3% 26.0% 14.8% 22.0% 11.5% 0.0%

GSK Consumer 13.0% 16.0% 13.0% 13.5% 12.0% 6.0% 16.0% 13.0%

Hindustan Unilever 8.3% 6.8% 2.3% -4.2% 2.0% 1.0% 5.0% 11.4%

Marico 15.0% 11.0% 7.0% 15.4% 14.0% 15.0% 14.0% 14.0%

* Toothpaste segment only

**Estimate numbers, balance are actuals

Source: Emkay Research, Company

Emkay Research 28 May, 2010 2

Consumer Sector Update

Bracing for volume-led growth, instead of price-led growth

Contribution of price-led growth has The consumer industry reported strong value growth in Q1FY09-Q4FY09 period, led by

come down from 50% in Q1FY09 to price increases. However, there has been a gradual decline of these pricing benefits

zilch in Q4FY10E beginning Q1FY10 and largely vanishing in Q4FY10. Thanks to the unfavourable base

effect beginning Q4FY10, the price-led growth has disappeared. A look at the chart indicates

– revenue growth of 21% yoy in Q1FY09 has trickled down to 14% yoy in Q3FY10 and is

expected to go down to 10.6% yoy in Q4FY10E. The contribution of price-led growth has

come down from 50% in Q1FY09 to zilch in Q4FY10E. Future scenario is challenging –

considering price-adjustments by industry players. Thus, industry is now bracing for

volume-led growth against price-led growth earlier. This is a reversal of Q1FY09-Q4FY10

period and can pose risks to earnings during transition.

Industry is seeing a transition from price-led growth to volume-led growth

25% 50% 75% 100%

24%

16%

8%

0%

0%

Q1FY09 Q3FY09 Q1FY10 Q3FY10 Q4FY10

Q1FY09 Q3FY09 Q1FY10 Q3FY10 Q4FY10

Volume grow th Price grow th Volume grow th Price grow th

Source: Emkay Research, Company

Excerpts from Q4FY10 result press releases

Mr. Antonio Hello Waszyk, Chairman and Managing Director NESTLE had said - "We all

know that commodity prices have spiked to record high levels such as milk increased

by 30%, sugar by 70% and wheat by 25%. These have significantly impacted our

costs. We will continue with our strategy to drive volumes with limited and staggered

price increases".

Management comments of MARICO in the press release - "As the company has begun

observing slowdown in the 'recruiter packs', it took pricing action to pass on part of the

value to consumers of rigid pack".

Competition has raised its head again

Twin forces of price adjustments and In the last 3 months, the consumer industry has witnessed twin forces at work (1) Marginal

high A&P spends could be detrimental price correction and (2) aggressive A&P spends -both either induced by competition or a

to the sector’s near-term earnings strategy to maintain volume growth momentum. However, twin forces at work at the same

time are quite unheard of and could be detrimental to the sector’s near-term earnings.

The last serious price-correction was 4 years ago. We are witnessing a similar correction

unfold - initiated by consumer majors like HUL and P&G. Since January 2010, P&G has

slashed prices of its key brands Tide by almost 20-50%. Hindustan Unilever has retaliated

with a 20-30% price reduction – encompassing key brands - Rin and Wheel. Some spill-

over of this correction has been witnessed in product categories like hair oils (Marico

reduced ‘Parachute’ prices by 5-15%), soaps (Hindustan Unilever reduced ‘Lux’ prices by

7-10%) and shampoos. However, it is difficult to judge, whether price adjustments are

strategy-driven or competition-driven.

Emkay Research 28 May, 2010 3

Consumer Sector Update

In addition to price adjustments, brand building and promotional activities have taken

centre-stage. There has been a significant increase in A&P spends, with an unprecedented

intensity. At the industry level, A&P spends have increased by 450 bps in Q3FY09-Q4FY10

period i.e. from 9.3% in Q3FY09 to 13.8% in 4QFY10. Hindustan Unilever continues to

remain the largest spender in the industry. Further, Hindustan Unilever has reported

highest increase in A&P spends – approximately 560 bps increase from 8.7% in Q3FY09

to 14.3% in Q4FY10. Going ahead, A&P spends are expected to remain at high-levels- as

guided by industry players in Q4FY10 earnings call.

Price adjustments effected in last 3-4 months

Jan-10 Mar-10

Hindustan Unilever Price Gram Price/Kg Price Gram Price/Kg Change (%)

Wheel Bar 5 190 26.3 5 190 26.3 0.0%

Rin Bar 7 96 72.9 5 96 52.1 -28.6%

W heel Powder 20 650 30.8 20 650 30.8 0.0%

Rin Powder 70 1000 70.0 50 1000 50.0 -28.6%

Jan-10 Mar-10

P&G Price Gram Price/Kg Price Gram Price/Kg Change (%)

Tide Bar 7 105 66.7 4 105 38.1 -42.9%

Tide Powder 70 1000 70.0 70 1250 56.0 -20.0%

Tide Naturals 10 200 50.0 10 250 40.0 -20.0%

Tide Naturals - MP, Chattisgarh 10 250 40.0 10 300 33.3 -16.7%

Nov-09 Jan-10

Marico Price ml Price/Litre Price ml Price/Litre Change (%)

Parachute 12 50 240.0 10 50 200.0 -16.7%

Parachute 21 100 210.0 20 100 200.0 -4.8%

Parachute 39 200 195.0 40 200 200.0 2.6%

Source: Emkay Research, Company

Advertising spends are inching higher – rose by 450 bps yoy in Q1FY09-Q4FY10 period

14%

7%

0%

Q1FY09 Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10

Advertising spends

Source: Emkay Research, Company

Emkay Research 28 May, 2010 4

Consumer Sector Update

Cost indexes have started inching up

Consumer sector’s average cost index The benign cost environment is coming to a close as key commodity prices inch higher.

has jumped 4% from 89.5 in Q4FY09 The consumer sector's average cost index has jumped 4% from 89.5 in Q4FY09 to 92.6

to 92.6 in April 2010 in April 2010, though it is lower than the 109.1 recorded in Q2FY09. We scanned the raw

material basket and noticed a sharp uptick in agri-commodities like tea, edible oil (except

copra and kardi), sugar, wheat, rice, etc. Crude and crude-linked materials and packaging

materials like paper and plastics have also registered similar uptick. Further analysis

indicates that cost inflation is more pronounced and visible in Asian Paints, Godrej

Consumer, GSK Consumer and Nestle India and less pronounced in Marico and HUL.

Costs are inching upwards

Q1FY09 Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10 Apr-10

Hindustan Unilever 100.0 111.6 97.7 93.5 95.9 96.5 96.4 91.7 91.0

Asian Paints 100.0 105.0 83.3 83.7 89.5 89.7 92.1 93.4 97.7

Godrej Consumer 100.0 109.2 88.0 81.5 85.3 86.4 88.9 88.7 90.1

Marico 100.0 104.2 92.2 83.1 83.5 86.4 88.7 91.9 93.1

Industry Level 100.0 109.1 93.4 89.5 92.7 93.1 94.2 91.9 92.6

Source: Emkay Research, Capital Line

Industry players are trading at premium to historical valuations, barring HUL

Sighting temporary disconnect in the We are sighting temporary disconnect in the valuations of consumer companies and

valuations of consumer companies future course of earnings growth. Consumer sector is likely to witness a slowdown in

and future course of earnings growth earnings growth on account of pressure on revenues and margins.

We expect a downtrend in revenue growth on account of (1) unfavourable base effect (2)

volume growth bracing for change (3) lack of pricing benefits and (4) selective price

adjustments.

Consumer sector reported healthy operating margins until Q4FY10. But, citing above

factors coupled with higher material prices and A&P spends, operating margins are also

likely to witness a downtrend in ensuing quarters.

Valuations continue to command a The current consensus estimates have marginally factored the above risks- with their

13% premium to the average 5-year earnings growth slowing down from 45% in FY10E to 16% in FY11E (ex HUL) and

(long term) PER and 3% premium to maintained at 14% in FY10E and FY11E (including HUL). Despite this, the valuations

average 1-year PER continue to command a 13% premium to the average 5-year (long term) PER and 3%

premium to average 1-year PER (assuming valuations of last year are sustainable).

Though, valuations are not at historic highs, they are still discomforting considering that

they are at a significant premium to their historic average despite earnings growth expected

to be closer to long-term average.

At company level, Asian Paints and Nestle are trading at significant premiums of 27% and

29% respectively, to the long-term average PER. All other companies like Colgate, Dabur,

Godrej Consumer and Marico are trading at 5-13% premium to long-term average PER.

HUL is the only exception, trading at 7% discount to the long-term average PER.

Emkay Research 28 May, 2010 5

Consumer Sector Update

Current valuations are at premium to historic average

PER – Valuations Average Average Premium Premium

Company Name FY10 FY11E FY12E 5-yr PER * 1-yr PER * to 5-yr PER to 1-yr PER

Asian Paints 26.0 28.8 25.4 22.5 28.7 28% 0%

Colgate 25.8 23.6 20.6 22.5 23.0 5% 2%

Dabur 31.1 25.7 21.5 22.7 24.1 13% 7%

Godrej Consumer 26.4 23.7 19.5 21.2 25.5 12% -7%

Glaxo Consumer 29.6 23.9 20.2 18.9 18.6 27% 29%

Hindustan Unilever 22.8 22.0 20.3 24.2 22.3 -9% -2%

Marico 27.0 23.4 19.1 20.6 21.9 13% 7%

Nestle 40.7 31.7 26.6 24.6 28.9 29% 10%

Industry Valuations 13% 3%

Source: Emkay Research

Consensus earnings growth at 14% for FY11E- marginally factoring

external risks

Earnings forecasts are not showing a We analysed the earnings forecasts released by consensus (market participants) and their

downtrend in growth momentum in underlying expectations and assumptions. Our prime observation is that – earnings forecasts

FY11E versus FY10E are not showing a downtrend in growth momentum in FY11E versus FY10E. Market

participants are factoring earnings growth of 14% in FY11E against earnings growth of 14%

in FY10E. Further, adjusting for HUL, the earnings growth is forecasted at 16% yoy for FY11E

against 45% yoy in FY10E –closer to the long-term average earnings for the sector.

At this stage, the current forecasts This is despite multiple risks surrounding FY11E earnings like (1) cost index being

reflect high optimism marginally higher (average of January-April 2010 is higher than FY10 average) (2) marginal

reduction in volume growth momentum – signs especially visible in January-March 2010

(3) temporary fall in pricing power, owing to inflation and fragile consumer sentiments (4)

absence of left-over price benefits, which contributed to earnings growth in recent past (5)

competition in select segments and (6) higher A&P spends. We believe that above risks

are partially factored in consensus earnings forecasts and could undergo modifications

in next 2-3 quarters. At this stage, the current forecasts reflect high optimism.

Consensus earnings forecasts, reflecting high optimism

In Rs Mn FY07 FY08 FY09 FY10 FY11E FY12E CAGR CAGR

FY10-12E FY07-09

Asian Paints 2810 4092 3978 7672 8111 9601 12% 19%

yoy gr 46% -3% 93% 6% 18%

Colgate 1826 2359 2878 3956 4327 4947 12% 26%

yoy gr 29% 22% 37% 9% 14%

Dabur 2747 3263 3912 5035 6079 7239 20% 19%

yoy gr 19% 20% 29% 21% 19%

Godrej Consumer 1392 1591 1728 3396 3905 4548 16% 11%

yoy gr 14% 9% 97% 15% 16%

GSK Consumer 1272 1626 1870 2327 2845 3367 20% 21%

yoy gr 28% 15% 24% 22% 18%

Hindustan Unilever 15223 17379 25076 22023 24581 28130 13% 28%

yoy gr 14% 44% -12% 12% 14%

Marico 1005 1585 1969 2433 2921 3521 20% 40%

yoy gr 58% 24% 24% 20% 21%

Nestle 3276 4273 5360 6572 8326 9982 23% 28%

yoy gr 30% 25% 23% 27% 20%

Industry Total 29551 36166 46771 53414 61095 71336 16% 26%

yoy gr 22% 29% 14% 14% 17%

Industry Total (Ex HUL) 14328 18787 21694 31391 36514 43206 17% 23%

yoy gr 31% 15% 45% 16% 18%

Source: Bloomberg

Emkay Research 28 May, 2010 6

Consumer Sector Update

Considering the external risks – there is high likelihood of downgrade

in FY11E earnings

Market participants have partially factored the external risks in their FY11E earnings

forecasts. Consequently, earnings growth is forecasted at 14% for FY11E –closer to the

long-term earnings growth. Given market participants being largely reactive to changes in

business environment, we do not rule out downgrade to FY11E earnings.

Consumer sector reported upgrade of We would like to draw attention to earnings forecasts of FY10E - best anecdotal example

9.8% (including HUL) and 24.2% to highlight reactive behaviour of market participants. Consumer sector reported upgrade

(excluding HUL) in FY10 earnings of 9.8% (including HUL) and 24.2% (excluding HUL) in FY10 earnings estimates in 12-

estimates in 12-month period i.e. April month period i.e. April 2009 – March 2010. Since, the sector was evincing change in

2009 – March 2010 external environment (extreme volatility in material prices and mixed signals in domestic

and foreign markets) - the market participants were very sceptical and reactive and

gradually became optimistic. The highest upgrade was witnessed in Asian Paints (57.5%),

Godrej Consumer (29.3%) and GSK Consumer (24.6%). Whereas, Hindustan Unilever

was the only exception - witnessing 10.5% downgrade in FY10E earnings.

FY11E is marked by external risks and fragile consumer sentiment. While, these risks are

partially factored in the earnings, competition risk has not been factored. Hence, there is

probability of downgrade in FY11E earnings – picture would be clear in ensuing quarters.

Changes in FY10E consensus earnings – sector witnessed upgrade of 9.8% in one-year

115

FY10E EPS (In Rs/Share) 01-04-2009 31-03-2010 Upgrades

Asian Paints 48.9 77.0 57.5%

110

Colgate 24.8 28.8 16.1%

Dabur 6.1 6.8 11.5%

105

Godrej Consumer 9.8 12.7 29.3%

100

GSK Consumer 65.1 81.0 24.6%

Hindustan Unilever 11.4 10.2 -10.5%

95

Marico 4.4 4.8 7.7%

90

Nestle 79.9 82.5 3.2%

Apr-09 Jul-09 Oct-09 Jan-10 Apr-10

Industry Earning 100 110 9.8%

FY10 Earnings Index

Industry Total (Excl HUL) 100 124 24.2%

Source: Emkay Research, Bloomberg

Reiterate our earlier view that earnings growth could be below long-

term average - against estimated growth of 14% in FY11E

In our earlier communications, we had highlighted that FY10E earnings growth momentum

of the consumer sector could derail. Infact led by external risks, the earnings growth could

temporarily be lower than the long-term earnings growth. Considering the current situation,

we maintain status-quo and reiterate our view.

Given only marginal consideration to external risks in the FY11E earnings forecasts, there

is likelihood of FY11E earnings growth trailing long-term growth. Also, any incremental

material cost pressure and rise in competitive activities could temporarily derail the

earnings growth momentum. Upfront, companies likely to trail long term growth are Asian

Paints, Colgate, Dabur, Marico, Nestle and Hindustan Unilever.

Emkay Research 28 May, 2010 7

Consumer Sector Update

Company Name FY08 FY09 FY10 FY11E FY12E FY10-12E FY07-09 CAGR FY10-12E FY11E Growth

Versus CAGR Versus

FY07-09 FY10E

Asian Paints 45.6% -2.8% 92.8% 5.7% 18.4% 11.9% 19.0% Lower Lower

Colgate 29.2% 22.0% 37.5% 9.4% 14.3% 11.8% 25.5% Lower Lower

Dabur 18.8% 19.9% 28.7% 20.7% 19.1% 19.9% 19.3% Equal Lower

Godrej Consumer 14.3% 8.6% 96.5% 15.0% 16.5% 15.7% 11.4% Higher Lower

GSK Consumer 27.8% 15.0% 24.4% 22.3% 18.3% 20.3% 21.3% Equal Lower

Hindustan Unilever 14.2% 44.3% -12.2% 11.6% 14.4% 13.0% 28.3% Lower Lower

Marico 57.7% 24.2% 23.6% 20.0% 20.5% 20.3% 40.0% Lower Lower

Nestle 30.4% 25.5% 22.6% 26.7% 19.9% 23.2% 27.9% Lower Higher

Industry Total 22.4% 29.3% 14.2% 14.4% 16.8% 15.6% 25.8% Lower Lower

Industry Total (Ex HUL) 31.1% 15.5% 44.7% 16.3% 18.3% 17.3% 23.1% Lower Lower

Source: Emkay Research, Company

EMKAY universe to grow at 2% in FY11E and 7% CAGR in FY10-12E

period

Earnings of EMKAY universe is EMKAY universe earnings growth is based on the following assumptions (1) marginal

expected to grow at 2% in FY11E and increase in cost index with reduction in gross margins (2) fiercely competitive environment

earnings CAGR of 7% in FY10-12E – with high A&P spends (3) marginal change in volume growth momentum and (4) no left-

over price benefits. Further, recent price actions undertaken by industry players are

selectively factored in our estimates – (1) HUL and P&G’s price correction in detergents

(2) Marico undertaking corrective action in ‘Parachute’ and (3) No price actions initiated by

Asian Paints- despite increase in excise duty. We have adjusted our FY11E and FY12E

estimates, wherever necessary. Consequently, earnings of EMKAY universe is expected

to grow at 2% in FY11E. Whereas, led by base effect in FY10E – earnings CAGR for FY10-

12E is expected at 7%. The earnings CAGR for FY10-12E at 7% is lower than the 21%

CAGR reported in FY07-09 period.

EMKAY earnings forecast

In Rs Mn FY07 FY08 FY09 FY10 FY11E FY12E FY10-12E FY07-09

Asian Paints 2810 4092 3978 7672 6927 7840 1% 19%

yoy Gr 46% -3% 93% -10% 13%

Godrej Consumer 1392 1591 1728 3396 3779 4405 14% 11%

yoy Gr 14% 9% 97% 11% 17%

Hindustan Unilever 15223 17379 25076 22023 22776 24701 6% 28%

yoy Gr 14% 44% -12% 3% 8%

Marico 1005 1585 1969 2433 2791 3210 15% 40%

yoy Gr 58% 24% 24% 15% 15%

Industry Total 20430 24647 32751 35525 36273 40156 6% 27%

yoy Gr 21% 33% 8% 2% 11%

Industry Total (Ex HUL) 5207 7268 7675 13502 13497 15455 7% 21%

yoy Gr 40% 6% 76% 0% 15%

Source: Emkay Research, Company

Emkay Research 28 May, 2010 8

Consumer Sector Update

EMKAY earnings estimates are lower than consensus estimates,

though not at the lowest end of expectation band

EMKAY estimates are 9% and 5% We are conservative in our earnings forecasts for FY11E and FY12E, way below consensus

higher than the lowest estimate for but certainly not the last of the lot. Our EMKAY universe is resting on earnings growth of 2%

FY11E and FY12E in FY11E and 11% in FY12E against consensus earnings growth of 11% in FY11E and

16% in FY12E. We are 9% and 5% lower than consensus estimates for FY11E and

FY12E. But, our estimates are 10% and 5% higher than the lowest estimate for FY11E and

FY12E.

At the company level, EMKAY is 5-17% and 2-11% higher than lowest estimates for FY11E

and FY12E. Large deviation is seen in Asian Paints, where we feature last in the consensus.

We don’t share the optimism of most market participants.

Deviation from consensus estimates

FY10 FY11E FY12E

Emkay Growth Cons’s Growth Emkay Growth Cons’s Growth Emkay Growth Cons’s Growth

Asian Paints 80.0 92.8% 77.0 85.6% 72.2 -9.7% 84.7 10.0% 81.7 13.2% 100.7 18.9%

Godrej Consumer 11.0 63.8% 10.6 58.1% 12.3 11.3% 12.8 19.9% 14.9 21.5% 14.9 16.6%

Hindustan Unilever 10.1 -12.2% 10.2 -11.1% 10.4 3.4% 11.2 9.9% 11.3 8.5% 12.8 13.9%

Marico 4.0 23.6% 4.0 23.9% 4.6 14.7% 4.8 19.6% 5.3 15.0% 5.8 20.7%

Deviation from the highest and lowest consensus estimates

FY10 FY11E FY12E

Cons’s Cons’s Dev. Dev. Cons’s Cons’s Dev. Dev. Cons’s Cons’s Dev. Dev.

High Low from from High Low from from High Low from from

High Low High Low High Low

Asian Paints 83.0 70.0 3.8% -12.5% 96.4 68.8 33.5% -4.7% 108.0 88.7 32.1% 8.5%

Godrej Consumer 11.7 9.2 6.2% -16.5% 14.4 10.2 17.4% -16.8% 17.2 13.3 15.4% -10.7%

Hindustan Unilever 11.1 9.7 9.9% -4.0% 12.8 9.7 22.4% -7.5% 14.8 11.1 30.7% -2.0%

Marico 4.6 3.1 14.4% -23.2% 5.6 4.2 22.2% -8.4% 6.9 4.9 30.9% -7.0%

Source: Emkay Research, Bloomberg

Initial signs visible in Q4FY10 performance, case to strengthen in

Q1FY11E - yet again there is lag of one-two quarters

There is lag of two quarters between We recall earlier experiences in consumer sector w.r.t to change in business environment

change in business environment and and resultant impact on earnings performance and valuations. There are couple of

its impact on earnings performance anecdotal evidences, which clearly point at a lag of two quarters between change in

business environment and its impact on earnings performance.

Anecdotal Evidence 1 - January 2008-March 2008 was characterized by extreme volatility

in material prices followed by unstable business environment. The impact of high material

prices was evident in April-June 2008 quarter, a lag of 3 months.

Anecdotal Evidence 2 - August 2008-December 2008 was characterized by decline in

material prices followed by selective pricing action. The impact of fall in material prices

was evident in April - June 2009 quarter, a lag of 6 months.

Emkay Research 28 May, 2010 9

Consumer Sector Update

Trend in Gross margins – initial rise in Q209 and trend strengthened in Q309

In % Terms Q1FY09 Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10

Asian Paints 39.5 38.9 36.1 38.7 43.9 43.2 43.7 45.7

Colgate 59.5 58.0 57.5 57.5 57.8 58.7 58.9 71.2

Dabur 50.3 51.2 49.4 53.5 52.8 55.3 54.8 55.2

Godrej Consumer 45.7 43.3 40.9 49.1 54.0 52.9 52.6 55.5

GSK Consumer 62.8 61.1 79.3 69.2 64.5 63.4 78.1 68.0

Hindustan Unilever 47.7 46.6 47.0 48.7 48.8 49.7 51.8 49.4

Marico 45.9 45.7 44.9 49.6 49.7 52.9 52.7 56.1

Nestle 50.6 49.9 52.9 52.9 52.6 52.4 52.0 50.3

Industry Average 48.1 47.2 47.7 49.7 50.3 50.9 52.4 52.1

(Weighted Gross Margins)

Rise in Gross Margins was visible from Q209, full benefits was visible in Q309

Cost Index – Decline accentuated from Q209

Index Values Q1FY09 Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10 Apr-10

Asian Paints 100.0 105.0 83.3 83.7 89.5 89.7 92.1 93.4 97.7

Godrej Consumer 100.0 109.2 88.0 81.5 85.3 86.4 88.9 88.7 90.1

Hindustan Unilever 100.0 111.6 97.7 93.5 95.9 96.5 96.4 91.7 91.0

Marico 100.0 104.2 92.2 83.1 83.5 86.4 88.7 91.9 93.1

Emkay Universe Average 100.0 109.1 93.4 89.5 92.7 93.1 94.2 91.9 92.6

(Weighted Index)

Fall in cost index accentuated from Q209 – full benefits visible in Q309

On the volume growth front, sector has experienced buoyancy over the last 16 quarters-

reporting robust growth in volumes. The sector is bracing for change on the back of

change in business environment beginning October 2009 (on failure of monsoon and

high inflation). The impact is partially visible in January-March 2010 period and is likely to

be pronounced in April-June 2010 period – with a lag of 2 quarters.

Quarterly trend in volume growth – initial signs visible in Q3FY10-Q4FY10

In % Terms Q1FY09 Q2FY09 Q3FY09 Q4FY09 Q1FY10 Q2FY10 Q3FY10 Q4FY10

Asian Paints 20.6% 19.2% 0.2% 16.0% 9.2% 14.7% 29.3% NA

Colgate* 10.9% 11.2% 14.0% 15.2% 14.0% 18.0% 15.0% 11.0%

Dabur 10.0% 13.0% 9.0% 10.0% 14.0% 13.0% 13.0% 14.0%

Godrej Consumer 10.0% 9.4% 14.3% 26.0% 14.8% 22.0% 11.5% 0.0%

GSK Consumer 13.0% 16.0% 13.0% 13.5% 12.0% 6.0% 16.0% 13.0%

Hindustan Unilever 8.3% 6.8% 2.3% -4.2% 2.0% 1.0% 5.0% 11.4%

Marico 15.0% 11.0% 7.0% 15.4% 14.0% 15.0% 14.0% 14.0%

Two companies have already started showing downtrend in volume growth momentum in Q310-Q410

* Only toothpaste segment

Emkay Research 28 May, 2010 10

Consumer Sector Update

Uncomfortable over rolling valuations to FY12E earnings- Prefer to

let the turbulent quarters pass by

Presence of multiple risks and Currently, we have based our valuations on FY11E earnings. We are not aligning with

ambiguity surrounding the near-term market participants and rolling our valuations to FY12E earnings. Presence of multiple

earnings performance restricts roll- risks and ambiguity surrounding the near-term earnings performance restricts roll-over

over of valuation to FY12E earnings of valuation to FY12E earnings.

Market participants are highly optimistic with earnings growth of 14% - similar to FY10E.

However, we believe that external risks can have serious bearing on sector earnings and

our estimates of 2% earnings growth in FY11E presents a more realistic view.

Roll-over of long-term valuations to Further, if the valuations are rolled to FY12E earnings- we do not see meaningful upsides.

FY12E consensus earnings estimates Even if we consider the consensus estimates (which are optimistic) - roll-over of long-

yields a marginal upside of 7% term valuations to FY12E consensus earnings estimates yields a marginal upside of 7%

(best case) in the industry. At company level, relatively higher upside can surface in HUL

(+20%) and Marico (7%) – whereas downside can surface in Nestle (8%). Thus, we shall

roll-over the valuations to FY12E earnings, once ambiguity surrounding earnings growth

resolves. However, we are positive on the long-term growth prospects – considering the

strong consumerism wave in India.

EMKAY coverage universe – marginal upsides on roll-over to FY12E earnings

FY11E FY12E CMP Average Average Discounting Upside On

5-yr PER 1-yr PER FY12E FY12E Earnings

EMKAY Cons’s EMKAY Cons’s EMKAY Cons’s EMKAY Cons’s

(Target) (Target)

Asian Paints 72.2 84.7 81.7 100.7 2144 22.5 29.0 1842.1 2269.4 -14% 6%

Godrej Consumer 12.3 12.8 14.9 14.9 344 21.4 26.3 318.6 317.9 -7% -8%

Hindustan Unilever 10.4 11.2 11.3 12.8 240 24.2 22.4 274.4 310.0 14% 29%

Marico 4.6 4.8 5.3 5.8 111 20.6 21.9 108.7 119.2 -2% 7%

Other consumer stocks - marginal upsides on roll-over to FY12E earnings

FY11E FY12E CMP Average Average Discounting Upside On

5-yr PER 1-yr PER FY12E FY12E Earnings

EMKAY Cons’s EMKAY Cons’s EMKAY Cons’s EMKAY Cons’s

(Target) (Target)

Colgate NA 31.4 NA 35.9 733 22.6 23.2 NA 810.7 NA 11%

Dabur NA 7.0 NA 8.4 181 22.7 24.3 NA 190.1 NA 5%

GSK Consumer NA 68.5 NA 81.0 1650 18.9 18.6 NA 1529.2 NA -7%

Nestle NA 87.3 NA 104.4 2800 24.5 28.8 NA 2562.1 NA -8%

Source: Emkay Research, Bloomberg

We did risk profiling of consumer companies

Companies exposed to twin risks In view of multiple risks, we have classified the risks into 3 sub-components (1) volume

would be laggards in roll-over of growth risks (2) Ebidta margin risk and (3) valuation risks. We have given relatively higher

valuations to FY12E earnings importance to volume growth risk against Ebidta margin risk. We have done risk profiling

for consumer companies and believe that, companies exposed to twin risks i.e. both

volume growth and Ebidta margin would be laggards in roll-over of valuations to FY12E

earnings. Whereas, companies exposed to purely Ebidta margin risk will roll-over

valuations to FY12E earnings. In our view, companies having favorable valuations are

best plays for ensuing quarters.

Emkay Research 28 May, 2010 11

Consumer Sector Update

However, companies facing special situations like (1) impending corporate actions (2)

acquisitions (3) consolidation of acquired business and (4) fund raising activity could defy

the above philosophy - purely on account of surprise element surrounding these corporate

action. Godrej Consumer could fit the bill, which is yet to announce full details of Megasari

and Tura acquisition. Further, Godrej Consumer is trading at fair valuations of 19.5X

FY12E earnings.

Godrej Consumer and Hindustan Companies facing twin risks are Asian Paints, Godrej Consumer, Hindustan Unilever,

Unilever are exception, one having Colgate and Dabur. Nestle and GSK Consumer face single risk of higher material prices,

pending corporate action and other whereas Marico faces volume risk and is relatively safer on material price risks. There are

trading at attractive valuations other exceptions like Godrej Consumer which has impending corporate action i.e.

consolidation of Megasari and Tura and Hindustan Unilever is trading at attractive

valuations.

Considering above, we like Hindustan Unilever (Large cap) and Godrej Consumer (Mid

Cap) in the EMKAY universe. Beyond EMKAY universe, we prefer GSK Consumer and

Nestle over Colgate and Dabur. We maintain our ‘HOLD’ rating on Hindustan Unilever

with price target of Rs257/Share and ‘ACCUMULATE’ rating on Godrej Consumer with

price target of Rs371/Share (after factoring all the acquisitions). We revise our rating on

Marico from ‘REDUCE’ to ‘HOLD’ with price target of Rs100/Share.

Risk profiling – prefer Hindustan Unilever and Godrej Consumer

Risks Benefits Medium Near Earning Remarks

of Base Term Term CAGR

Effect FY10-12E v/s

Volume Margin Valuation Earning CAGR Earning Average

Risk Risk Risk in FY10-12E v/s CAGR FY11E CAGR

FY07-10 v/s FY10

Asian Paints ü ü ü x Lower Lower Lower No Special Remarks

Colgate ü ü ü x Lower Lower Lower No Special Remarks

Dabur ü ü ü x Equal Lower Equal Upsides from Fem Care could

yield positive surprise

Godrej Consumer ü ü x x Higher Lower Lower Consolidation is a surprise

element

GSK Consumer x ü ü x Equal Lower Equal Attractive New Product

Launches Funnel

Hindustan Unilever ü ü x ü Lower Lower Equal Attractive Valuation – No

Downside Risk Due To Valuation

Marico ü x ü x Lower Lower Higher Eyeing Acquisition In Asia

and Africa

Nestle x ü ü x Lower Higher Higher None

Course of action - until ambiguity resolves and valuations are rolled

to FY12E earnings

Sector in best case will be a defensive We prefer Hindustan Unilever and Godrej Consumer over Asian Paints and Marico in our

bet and worst case could yield coverage universe - considering former's underperformance and over-pessimism

downside of 13% alongside attractive valuation and latter's surprise element on account of pending corporate

action. Further, sector at large will roll to FY12E earnings once clarity on near-term earnings

emerges. Until then, we believe that sector in best case will be a defensive bet and worst

case could yield downside of 13% i.e. realigning the valuation to long-term average and

adjusting the premium.

Emkay Research 28 May, 2010 12

Consumer Sector Update

Roll-over of long-term valuations to Best Case - Assuming, valuations in the sector are rolled to FY12E earnings - we do not

FY12E consensus earnings estimates see meaningful upsides. Even if we consider the consensus estimates (which are

yields upside of approximately 7% optimistic) - roll-over of long-term valuations to FY12E consensus earnings estimates

yields a marginal upside of approximately 7% and case specific 5-7% upsides. Hindustan

Unilever is the only exception yielding a strong upside of +20%.

Worst Case - We are sighting temporary disconnect in the valuations of consumer

companies and future course of earnings growth. Despite this, the valuations continue to

remain at higher end - almost 13% premium to the average 5-year (long term) PER and

3% premium to average 1-year PER (assuming valuations of last year are sustainable).

Though, valuations are not at historic highs, they are discomforting as they are at a

significant premium to historic average despite earnings growth expected to be closer to

long-term average. In worst case, sector could retrace to long-term average PER, yielding

downside of 13% and case specific 5%-25% downsides.

Since, consumer sector is largely going to be a defensive bet in best case, we recommend

widening horizons beyond pure consumer plays. We are recommending few direct plays

- Jubliant Foods (upside 32%), Titan (upside 10%) that are riding the consumerism wave

of India and derived plays - Essel Propack (upside 80%), Piramal Glass (upside 11%)

which are riding on growth of consumer companies.

Jubliant Foods - Upside of 32% - Jubilant FoodWorks Ltd (JFL), the master franchisee for

Domino's' brand in India, Nepal, Bangladesh and Sri Lanka is likely to dish out a VFM

recipe for investors in the years to come. Given the strong growth prospects of the QSR

segment in India and Domino's well entrenched business model, we are confident that

JFL will sustain its earnings growth momentum for the next 5-7 years. JFL discounts its

FY11E and FY12E earnings at 34X and 25X. We have 'ACCUMULATE' rating with price

target of Rs350/Share.

Titan Industries - Upside of 10% - Titan has entered a favourable base effect in jewellery

business, yielding benefits for the next 3-4 quarters. Furthermore, down trading in watch

business is expected to come to a halt - with expectation of all-round growth in watches

portfolio. Titan's restructuring and right sizing exercise in the eyewear business is likely to

augur well for the business in the long run. We have estimated EPS of Rs65.2/Share and

Rs79.6/Share for FY11E and FY12E respectively. We have 'ACCUMULATE rating' with

price target of Rs2483/Share, which discounts FY12E earnings at 29X.

Essel Propack - Upside of 80% - We are enthused by Essel Propack's (EPL) region

specific strategy in tubes business - taking measures to address the issues and capitalize

the opportunities specific to each regional segment. Consequently, we expect tubes

revenue to grow at 10.2% CAGR in CY09-11E period and return to black with net profit of

Rs1,049 mn in CY11E (surpassing CY06 peak profitability). Alongside, strong earnings

performance - we expect the valuations to retrace to CY06 levels- fill up the gap created

during the turmoil of CY06-08 period. We have BUY rating with a price target of Rs76/Share.

Piramal Glass - Upside of 11% - Piramal Glass (PGL) is geared to reap the benefits of its

new business strategies involving (1) increased focus on high margin Cosmetics &

Perfumery (C&P) and Specialty Food & Beverage segments and (2) restructuring activity

of shifting US C&P operations to India and conversion of pharmaceutical furnace into

C&P furnace. The positive impact of these initiatives is already visible in the turnaround of

the company in FY10 (net profit of Rs44 mn against loss of Rs1.0 bn in FY09). We believe

that impressive performance in FY10 is just the beginning of a strong earnings growth

trajectory, with PGL likely to report profit of Rs1.5 bn in FY12E. We have valued PGL at 4.6X

EV/EBIDTA - in-line with the global and local peers. We have BUY rating with target price of

Rs117/Share.

Emkay Research 28 May, 2010 13

Consumer Sector Update

Key financials (Rs Mn)

Asian Paints HOLD Price Target: Rs 1,651

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

FY2009 54,632 7,001 12.8 4165 41.2 27.5 16.2 0.9 38.1 49.1

FY2010E 62,066 11,598 18.7 7410 72.8 16.1 12.1 2.1 52.7 27.8

FY2011E 70,409 11,384 16.2 7311 72.2 16.4 9.9 1.8 40.9 28.0

FY2012E 80,066 12,983 16.2 8281 81.7 14.4 8.2 2.0 38.3 46.0

Essel Propack BUY Price Target: Rs 76

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

CY2008 12,911 1,801 13.9 -903 -5.8 9.5 1.1 3.0 -11.1 -8.5

FY2010 16,594 2,840 0.3 295 1.2 7.1 1.1 3.0 3.6 39.5

FY2011E 13,866 2,614 18.8 617 3.9 5.8 1.1 3.0 9.4 12.4

FY2012E 15,464 3,253 21.0 992 6.3 4.4 1.0 3.0 13.5 7.7

Godrej Consumer Products ACCUMULATE Price Target: Rs 371

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

FY2009 13,966 2,112 15.1 1,733 6.7 39.9 15.0 1.3 30.5 49.4

FY2010 20,437 4,098 20.1 3,396 10.9 26.7 12.9 2.2 42.4 30.6

FY2011E 40,409 7,294 18.1 4,734 14.5 16.4 6.8 2.3 39.8 22.9

FY2012E 45,946 8,307 18.1 6,067 18.6 13.7 8.9 2.6 39.8 17.9

Hindustan Unilever HOLD Price Target: Rs 257

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

FY2009 202,393 29,779 14.7 24941 11.5 15.1 24.4 3.2 143.3 20.1

FY2010E 172,826 27,856 16.1 21555 10.3 16.6 21.3 3.7 101.2 22.5

FY2011E 185,132 28,910 15.6 23231 10.7 15.9 18.5 3.9 91.3 21.7

FY2012E 200,987 31,579 15.7 25381 11.6 14.4 16.1 4.2 86.7 19.8

Jubilant FoodWorks ACCUMULATE Price Target: Rs 350

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

FY2009 2,806 352 12.5 73 1.4 54.7 81.8 0.0 34.7 235.3

FY2010 4,242 664 15.7 330 5.0 31.6 17.9 0.0 46.7 63.8

FY2011E 5,662 933 16.5 492 7.7 21.6 13.0 0.3 36.3 41.4

FY2012E 7,484 1,269 17.0 634 10.0 15.6 9.8 0.6 34.6 32.2

Emkay Research 28 May, 2010 14

Consumer Sector Update

Marico HOLD Price Target: Rs 100

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

FY2009 23884 3048 12.8% 1969 3.1 22.5 14.5 0.6 29.4 34.9

FY2010 26608 3751 14.1% 2433 4.0 16.4 10.2 0.8 29.5 27.0

FY2011E 30191 4252 14.1% 2791 4.6 15.2 7.6 1.0 28.3 23.6

FY2012E 34306 4831 14.1% 3210 5.3 13.0 6.0 1.2 27.5 20.5

Piramal Glass BUY Price Target: Rs 117

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

FY2009 10,088 1,289 12.8 -1038 -57.7 16.1 3.7 0.0 -108.9 -1.5

FY2010 11,260 2,381 21.1 44 0.6 8.2 2.9 0.0 2.2 160.7

FY2011E 12,034 2,646 22.0 672 8.4 6.0 2.2 0.0 25.9 10.6

FY2012E 13,116 3,559 27.1 1451 18.0 3.9 1.5 0.0 38.3 4.9

Titan Industries ACCUMULATE Price Target: Rs 2,483

Net EBITDA AEPS EV/ Div Yld RoE

YE-Mar Sales (Core) (%) APAT (Rs) EBITDA P/BV (%) (%) P/E

FY2009 38,034 3,371 8.9 2,100 47.3 28.4 17.1 0.5 41.6 45.0

FY2010 46,750 3,821 8.2 2,398 54.0 26.0 12.4 0.5 39.9 40.8

FY2011E 53,747 4,524 8.4 2,894 65.2 20.8 9.5 0.5 39.3 32.7

FY2012E 63,639 5,438 8.5 3,532 79.6 17.0 7.3 0.5 38.8 26.8

Emkay Rating Distribution

BUY Expected total return (%) (stock price appreciation and dividend yield) of over 25% within the next 12-18 months.

ACCUMULATE Expected total return (%) (stock price appreciation and dividend yield) of over 10% within the next 12-18 months.

HOLD Expected total return (%) (stock price appreciation and dividend yield) of upto 10% within the next 12-18 months.

REDUCE Expected total return (%) (stock price depreciation) of upto (-)10% within the next 12-18 months.

SELL The stock is believed to under perform the broad market indices or its related universe within the next 12-18 months.

Emkay Global Financial Services Ltd.

Paragon Center, H -13 -16, 1st Floor, Pandurang Budhkar Marg, Worli, Mumbai – 400 013. Tel No. 6612 1212. Fax: 6624 2410

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to

any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States.

Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal

information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of

an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with Emkay Global Financial Services Ltd.

is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon

information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither Emkay Global Financial Services

Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations

and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on

a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective

investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates,

officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short

positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn

brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or may perform or seek to perform

investment banking services for such company(ies)or act as advisor or lender / borrower to such company(ies) or have other potential conflict of interest with respect

to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may

be duplicated in any form and/or redistributed without Emkay Global Financial Services Ltd.’sprior written consent. No part of this document may be distributed in

Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although

its accuracy and completeness cannot be guaranteed.

Emkay Research 28 May, 2010 www.emkayglobal.com 15

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Indian Alcoholic Beverages IndustryDocument35 pagesIndian Alcoholic Beverages Industryvishi.segalNo ratings yet

- Afcons Infrastructure Limited: Procedure Qualification Record (PQR)Document21 pagesAfcons Infrastructure Limited: Procedure Qualification Record (PQR)GaapchuNo ratings yet

- Shivani STPRDocument78 pagesShivani STPRAbsolute ManagementNo ratings yet

- Chapter 06 RISK ManagementDocument35 pagesChapter 06 RISK ManagementMelkamu LimenihNo ratings yet

- Facebook and Privacy A Cautionary TaleDocument1 pageFacebook and Privacy A Cautionary Talevishi.segalNo ratings yet

- Power Equipment IndustryDocument18 pagesPower Equipment Industryvishi.segalNo ratings yet

- Gas Pricing: Out of APM, FinallyDocument5 pagesGas Pricing: Out of APM, Finallyvishi.segalNo ratings yet

- Gas Price Hike Impact Analysis 200510Document5 pagesGas Price Hike Impact Analysis 200510vishi.segalNo ratings yet

- Petrosilicon Petroleum ReportDocument14 pagesPetrosilicon Petroleum Reportvishi.segalNo ratings yet

- Petrosil Titanium Dioxide ReportDocument7 pagesPetrosil Titanium Dioxide Reportvishi.segalNo ratings yet

- Telecom Sector: BWA Auctions - Week 1Document3 pagesTelecom Sector: BWA Auctions - Week 1vishi.segalNo ratings yet

- Amazon Translating Into More BusinessDocument1 pageAmazon Translating Into More Businessvishi.segalNo ratings yet

- Petrosil Fertilizer ReportDocument11 pagesPetrosil Fertilizer Reportvishi.segalNo ratings yet

- Pet Food Market in India 2010 - Trends, Competition and Key DevelopmentsDocument17 pagesPet Food Market in India 2010 - Trends, Competition and Key Developmentsvishi.segalNo ratings yet

- KSL - Telecom Sector Update May 24 10Document11 pagesKSL - Telecom Sector Update May 24 10vishi.segalNo ratings yet

- Pet Food Market in India 2010 - Market Size, Drivers and ChallengesDocument13 pagesPet Food Market in India 2010 - Market Size, Drivers and Challengesvishi.segalNo ratings yet

- Life InsuranceDocument8 pagesLife Insurancevishi.segalNo ratings yet

- How Long Before PPP Bridges The Education Demand Supply GapDocument1 pageHow Long Before PPP Bridges The Education Demand Supply Gapvishi.segalNo ratings yet

- Gems and Jewellery Market in 2010 - Introduction, Value Chain and Market Size PDFDocument14 pagesGems and Jewellery Market in 2010 - Introduction, Value Chain and Market Size PDFvishi.segalNo ratings yet

- GRMs and Petroleum Product Spreads - WeeklyDocument1 pageGRMs and Petroleum Product Spreads - Weeklyvishi.segalNo ratings yet

- Cement Monthly May 2010 PDFDocument7 pagesCement Monthly May 2010 PDFvishi.segalNo ratings yet

- Banking Review - Q4FY10Document26 pagesBanking Review - Q4FY10vishi.segalNo ratings yet

- TECHOP (O-01 - Rev1 - Jan21) DP OPERATIONS MANUALDocument26 pagesTECHOP (O-01 - Rev1 - Jan21) DP OPERATIONS MANUALStoyan StoyanovNo ratings yet

- Research Paper Servo MotorDocument6 pagesResearch Paper Servo Motorc9rz4vrm100% (1)

- 1.1. TS 2Document4 pages1.1. TS 2design mepNo ratings yet

- Lundebye Et Al 2010syntantioksifiskDocument7 pagesLundebye Et Al 2010syntantioksifiskMarcio HahnNo ratings yet

- Historical Timeline of Yves Saint LaurentDocument5 pagesHistorical Timeline of Yves Saint Laurentmisbah khanNo ratings yet

- Exam MidDocument9 pagesExam Midzay_cobain100% (1)

- Case Studies in Construction Materials: Paola Di Mascio, Laura MorettiDocument11 pagesCase Studies in Construction Materials: Paola Di Mascio, Laura MorettiRam TulasiNo ratings yet

- STLED316S: Serial-Interfaced 6-Digit LED Controller With KeyscanDocument33 pagesSTLED316S: Serial-Interfaced 6-Digit LED Controller With KeyscanDhivya NNo ratings yet

- Current Sensing Power MOSFET MOTOROLA PDFDocument6 pagesCurrent Sensing Power MOSFET MOTOROLA PDFRecep IvedikNo ratings yet

- 3 Cigüeñal y Arbol de LevasDocument32 pages3 Cigüeñal y Arbol de LevasGuillermo Gerardo Sanchez PonceNo ratings yet

- Z-34/22 Bi-Energy: Serial Number RangeDocument120 pagesZ-34/22 Bi-Energy: Serial Number RangeСвятослав ВороновNo ratings yet

- 2ND Quarter Budgeted Lesson in Practical Research 2Document3 pages2ND Quarter Budgeted Lesson in Practical Research 2Mike GuerzonNo ratings yet

- Free Keyboard Shortcuts (WIN) : Number PadDocument1 pageFree Keyboard Shortcuts (WIN) : Number PadLeonardo AguileraNo ratings yet

- ARC FLASH - Definition 2 - Days: Sparrow Risk Management ServicesDocument33 pagesARC FLASH - Definition 2 - Days: Sparrow Risk Management ServicesDevasyrucNo ratings yet

- NGR Guide PDFDocument4 pagesNGR Guide PDFajaymannNo ratings yet

- NHRS' Day of ReckoningDocument3 pagesNHRS' Day of ReckoningNHGOPSenateNo ratings yet

- 22 - Effective Pages: Beechcraft CorporationDocument24 pages22 - Effective Pages: Beechcraft CorporationMartín LaraNo ratings yet

- Numerical Simulation of 1D Heat Conduction in Spherical and Cylindrical Coordinates by Fourth-Order Finite Difference MethodDocument5 pagesNumerical Simulation of 1D Heat Conduction in Spherical and Cylindrical Coordinates by Fourth-Order Finite Difference MethodGokma Sahat Tua SinagaNo ratings yet

- User'S Manual: Powerpanel Business Edition Installation GuideDocument25 pagesUser'S Manual: Powerpanel Business Edition Installation Guided.patai2718No ratings yet

- Weekly Current Affairs May 2023 Week 01 - CompressedDocument31 pagesWeekly Current Affairs May 2023 Week 01 - Compressedsailesh singhNo ratings yet

- 2nd EBT Webinar - Lufthansa Grading System 28.09.2021Document11 pages2nd EBT Webinar - Lufthansa Grading System 28.09.2021Alireza Ghasemi moghadamNo ratings yet

- Tips For Writing Better Answers in Upsc Main ExamiDocument30 pagesTips For Writing Better Answers in Upsc Main ExamivikramadhityaNo ratings yet

- Chapter 2 Strategy and Tactics of Distributive Bargaining 2020-09-28 09 - 52 - 18Document31 pagesChapter 2 Strategy and Tactics of Distributive Bargaining 2020-09-28 09 - 52 - 18fbm2000No ratings yet

- DHAWAL BHANDARI - Vakalatnama, Power of AttorneyDocument3 pagesDHAWAL BHANDARI - Vakalatnama, Power of Attorneydhawal4uNo ratings yet

- Creating FairphonesDocument1 pageCreating FairphonesDat Tran Thanh0% (1)

- DCN Project ReportDocument6 pagesDCN Project ReportNur Fatin Firzanah Mohd Fauzi100% (1)

- NetView For ZOS Programming PipesDocument394 pagesNetView For ZOS Programming Pipesrobhal01No ratings yet