Professional Documents

Culture Documents

FV PV (1+ K) : Fva PMT (1+k) - 1 1 - (1+ K)

Uploaded by

tanyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FV PV (1+ K) : Fva PMT (1+k) - 1 1 - (1+ K)

Uploaded by

tanyaCopyright:

Available Formats

Compounded (m) Times

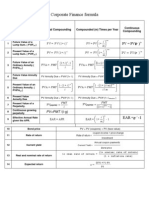

Formula For: Annual Compounding

per Year

Future Value of a n

1

Lump Sum. (FVIFk,n) FV= PV ( 1+ k )

Present Value of a -n

2

Lump Sum. (PVIFk,n) PV= FV ( 1+ k )

( 1+k )n - 1

3

Future Value of an

Annuity. (FVIFAk,n) FVA = PMT

k [ ]

1-( 1+ k )-n

4

Present Value of an

Annuity. (PVIFAk,n) PVA= PMT [ k ]

Present Value of PMT

5 PV perpetuity =

Perpetuity. (PVp) k

Effective Annual

m

6 Rate given the EAR = APR EAR =(1+k/m ) - 1

APR.

n

PMT 1+g

7

Present Value of a

Growing Annuity.

Present value of

PVGA=

( k−g )

1−

[ ( )]

1+k

8 PVGP=PMT/(k-g)

growing perpetuity

9 Yield to Maturity =(C+(M-P)/n)/(M+P)/2

Portfolio Variance

10 σ p2=w12 σ 12 +w 22 σ 22 +2 w1 w2 ρ12 σ 1 σ 2

(2 securities)

Legend

k = the nominal or Annual Percentage Rate n = the number of periods

m = the number of compounding periods per EAR = the Effective Annual Rate

year

PMT = the periodic payment or cash flow Perpetuity = an infinite annuity

C= Rs. Coupon payment on the par value of the M=Maturity value of bond (Face value if not

bond redeemed at premium or discount)

P=current market price of the bond

σ =Standard deviation , w=security weight ∈ portfolio , ρ=correlation coefficient

You might also like

- ) K + 1 PV ( FV: PVGP PMT/ (K-G) (C+ (M-P) /N) / (M+P) /2 + + 2Document1 page) K + 1 PV ( FV: PVGP PMT/ (K-G) (C+ (M-P) /N) / (M+P) /2 + + 2Shubham AggarwalNo ratings yet

- Time Value of Money Formula SheetDocument2 pagesTime Value of Money Formula SheetMD Abrar FaiyazNo ratings yet

- Final Exam Cover Formulas COMM 308 JMSBDocument4 pagesFinal Exam Cover Formulas COMM 308 JMSBmeilleurlNo ratings yet

- TVM formulae cheat sheetDocument4 pagesTVM formulae cheat sheetShawron weevNo ratings yet

- Time Value of Money FormulasDocument2 pagesTime Value of Money FormulasZubayer HussainNo ratings yet

- FV PV: LN LN (1)Document2 pagesFV PV: LN LN (1)Danneek BillingsNo ratings yet

- Corporate Finance FormulasDocument3 pagesCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Distance Test PDFDocument10 pagesDistance Test PDFSoneni HandaNo ratings yet

- Equation List - COMM 308 - Booth Et Al Text, 4 Edition: FV FV PV KDocument3 pagesEquation List - COMM 308 - Booth Et Al Text, 4 Edition: FV FV PV Kadcyechicon123No ratings yet

- Time value of money cheat sheetDocument3 pagesTime value of money cheat sheetTechbotix AppsNo ratings yet

- Cong ThucDocument12 pagesCong ThucGiang Thái HươngNo ratings yet

- Economics of solar PV power plant cost analysisDocument4 pagesEconomics of solar PV power plant cost analysisHisham BasherNo ratings yet

- Equation Formula: 1 1 FV PMT 1Document3 pagesEquation Formula: 1 1 FV PMT 1JMSB09No ratings yet

- Ba4827 FormulaSheet1Document2 pagesBa4827 FormulaSheet1kesgencNo ratings yet

- Formulas Bonds: Cpn Income+ price change APY(Approximate Yield to MaturityDocument1 pageFormulas Bonds: Cpn Income+ price change APY(Approximate Yield to MaturityGhitaNo ratings yet

- Finance 430 Executive SummaryDocument31 pagesFinance 430 Executive SummaryEin LuckyNo ratings yet

- Interest Rates That Vary With Time: I A I CWDocument3 pagesInterest Rates That Vary With Time: I A I CWTepe HolmNo ratings yet

- Profit Margin Total Assets Turnover Equity Multiplier: Formula AFDocument4 pagesProfit Margin Total Assets Turnover Equity Multiplier: Formula AFDiva Tertia AlmiraNo ratings yet

- Corporate Finance Equations NotesDocument4 pagesCorporate Finance Equations NotesSotiris HarisNo ratings yet

- Adms3530f18 Final Exam Formula Sheet PDFDocument6 pagesAdms3530f18 Final Exam Formula Sheet PDFSandy SandNo ratings yet

- FIN222 Equations NotesDocument49 pagesFIN222 Equations NotesSotiris HarisNo ratings yet

- Financial Management Formula Sheet N12403Document3 pagesFinancial Management Formula Sheet N12403Abdullah ShahNo ratings yet

- Valuation and Rates of Return ChapterDocument16 pagesValuation and Rates of Return ChapterLourdios EdullantesNo ratings yet

- Corporate Finance FormulasDocument2 pagesCorporate Finance FormulasFira SyawaliaNo ratings yet

- Nataliemoore Time Value of MoneyDocument4 pagesNataliemoore Time Value of MoneyMaurice AgbayaniNo ratings yet

- I. Financial Management: 1. Time Value of MoneyDocument21 pagesI. Financial Management: 1. Time Value of MoneyAritra ChatterjeeNo ratings yet

- List of Corporate Finance FormulasDocument9 pagesList of Corporate Finance FormulasYoungRedNo ratings yet

- Selection of Useful FormulasDocument3 pagesSelection of Useful FormulasМаша СкрипченкоNo ratings yet

- Formula Sheets-GDBA505 – must be returned after exam < 40Document3 pagesFormula Sheets-GDBA505 – must be returned after exam < 40FLOREAROMEONo ratings yet

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- BussFin. Formula SheetDocument2 pagesBussFin. Formula SheetkikennojinseiNo ratings yet

- Quiz 1 FormulasDocument2 pagesQuiz 1 FormulasCristina Beatrice MallariNo ratings yet

- The FRM Part I: Formula Guide: Value and Risk ModelsDocument10 pagesThe FRM Part I: Formula Guide: Value and Risk ModelsJavneet KaurNo ratings yet

- Formula Sheet - Study Version. - Portfolio Management PDFDocument2 pagesFormula Sheet - Study Version. - Portfolio Management PDFAnhthu DangNo ratings yet

- Financial Management - Paper 1: Chapter: - Indian Financial SystemDocument23 pagesFinancial Management - Paper 1: Chapter: - Indian Financial SystemToyaj JaiswalNo ratings yet

- Test 2 Formula SheetDocument1 pageTest 2 Formula Sheetgabriella portelliNo ratings yet

- MAF302 Formula Sheet: Key Financial ConceptsDocument2 pagesMAF302 Formula Sheet: Key Financial ConceptsWill LeeNo ratings yet

- Formula Sheet Corporate FinanceDocument19 pagesFormula Sheet Corporate FinancePatricia TekgültekinNo ratings yet

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- Measuring Productivity and Forecasting TechniquesDocument5 pagesMeasuring Productivity and Forecasting TechniquesShawron weevNo ratings yet

- FINA 1310 - Lecture 3 NotesDocument6 pagesFINA 1310 - Lecture 3 NotesAayushi ReddyNo ratings yet

- Hedging Interest Rate RiskDocument14 pagesHedging Interest Rate RiskVictor ManuelNo ratings yet

- Cost of DebtDocument1 pageCost of DebtAin YanieNo ratings yet

- BA 2802 - Principles of Finance Formula Sheet For The Second Interim ExamDocument1 pageBA 2802 - Principles of Finance Formula Sheet For The Second Interim ExamEda Nur EvginNo ratings yet

- Depreciation, Capital Recovery and Break Even AnalysisDocument6 pagesDepreciation, Capital Recovery and Break Even AnalysisMa. Angeline GlifoneaNo ratings yet

- Yield ObligasiDocument1 pageYield ObligasiGrace OliviaNo ratings yet

- Extra Questions On Time Value of Money (Div-I)Document5 pagesExtra Questions On Time Value of Money (Div-I)SHRADDHA BHOIRNo ratings yet

- Main Points of Lecture 1Document1 pageMain Points of Lecture 1katiemmo2016No ratings yet

- Time Value Money Formulas ExplainedDocument3 pagesTime Value Money Formulas ExplainedRahat IslamNo ratings yet

- Valor Del Dinero en El Tiempo y WACCDocument23 pagesValor Del Dinero en El Tiempo y WACCYesenia HernandezNo ratings yet

- PMBOK Formulas GuideDocument4 pagesPMBOK Formulas GuideWilliam Rojas MoralesNo ratings yet

- Appendix A: Formula Sheet: The Following Are Useful Formulae 1. Simple Interest FormulaDocument53 pagesAppendix A: Formula Sheet: The Following Are Useful Formulae 1. Simple Interest FormulasilentNo ratings yet

- Solution Manual for an Introduction to Equilibrium ThermodynamicsFrom EverandSolution Manual for an Introduction to Equilibrium ThermodynamicsNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Comparative Indian Literature Topics and QuestionsDocument18 pagesComparative Indian Literature Topics and QuestionstanyaNo ratings yet

- DUET LLM Entrance Ques. 2018Document27 pagesDUET LLM Entrance Ques. 2018udit singhNo ratings yet

- DU BA Honours Multimedia and Mass Communication PDFDocument17 pagesDU BA Honours Multimedia and Mass Communication PDFlisaNo ratings yet

- DU MA Hindustani MusicDocument31 pagesDU MA Hindustani MusictanyaNo ratings yet

- DU MA Environmental StudiesDocument9 pagesDU MA Environmental StudiesVarshaNo ratings yet

- DU MA GeographyDocument17 pagesDU MA Geographydebasish bhuniaNo ratings yet

- DU Master of Library N Information ScienceDocument15 pagesDU Master of Library N Information SciencetanyaNo ratings yet

- M.sc. StatisticsDocument15 pagesM.sc. Statisticsdasari balakrishnaNo ratings yet

- DU MA in Psychology PDFDocument22 pagesDU MA in Psychology PDFApoorvaNo ratings yet

- DU MPhil Phd in African Studies Comprehensive Practice QuestionsDocument9 pagesDU MPhil Phd in African Studies Comprehensive Practice QuestionstanyaNo ratings yet

- DU MPhil PHD in EconomicsDocument12 pagesDU MPhil PHD in EconomicstanyaNo ratings yet

- DU MPhil PHD in BotanyDocument10 pagesDU MPhil PHD in BotanytanyaNo ratings yet

- Du Mphil PHD in Commerce: Whether or Not There Is Really A Causal Relationship Between Two Variables (Option Id 23331)Document17 pagesDu Mphil PHD in Commerce: Whether or Not There Is Really A Causal Relationship Between Two Variables (Option Id 23331)Arshi BharadwajNo ratings yet

- The Multi-Objective Decision Making Methods Based On MULTIMOORA and MOOSRA For The Laptop Selection ProblemDocument9 pagesThe Multi-Objective Decision Making Methods Based On MULTIMOORA and MOOSRA For The Laptop Selection ProblemAnkushNo ratings yet

- 01 Lezione 1 Working LifeDocument18 pages01 Lezione 1 Working LifeVincenzo Di PintoNo ratings yet

- Caglar Araz CVDocument1 pageCaglar Araz CVAnonymous hSKPlVPNo ratings yet

- Ms. Irish Lyn T. Alolod Vi-AdviserDocument17 pagesMs. Irish Lyn T. Alolod Vi-AdviserIrish Lyn Alolod Cabilogan100% (1)

- Module 1 MC4 LOGIC CRITICAL THINKINGDocument6 pagesModule 1 MC4 LOGIC CRITICAL THINKINGAubrey Ante100% (1)

- Long Term Recommendation Bata India LTD.: The Growth SprintDocument38 pagesLong Term Recommendation Bata India LTD.: The Growth SprintPANo ratings yet

- 1-Verified-Assignment Brief P1 P2, M1 M2 & D1Document2 pages1-Verified-Assignment Brief P1 P2, M1 M2 & D1Altaf Khan100% (1)

- Algebra I Mid-Year Review (Grade 9)Document6 pagesAlgebra I Mid-Year Review (Grade 9)Ciern TanNo ratings yet

- PRODUCT DATA SHEET CCT15854Document1 pagePRODUCT DATA SHEET CCT15854Miloš AćimovacNo ratings yet

- Colourcon HRMDocument8 pagesColourcon HRMMohamed SaheelNo ratings yet

- Galatians Part 5Document3 pagesGalatians Part 5nullvoice84No ratings yet

- Case Study Brick School of ArchitectureDocument5 pagesCase Study Brick School of ArchitectureAFSHAN HAMIDNo ratings yet

- Macro PerspectiveDocument3 pagesMacro PerspectiveMARITONI MEDALLANo ratings yet

- GEC 107 - Art Appreciation Research Worksheet On Identifying ArtDocument4 pagesGEC 107 - Art Appreciation Research Worksheet On Identifying ArtJustine SicanNo ratings yet

- Sources of Strength For Mental Wellness by Sheryl Boswell, Youth Mental Health Canada (YMHC)Document11 pagesSources of Strength For Mental Wellness by Sheryl Boswell, Youth Mental Health Canada (YMHC)Youth Mental Health CanadaNo ratings yet

- Tao of Forgotten Food Diet - Taoist Herbology 2Document29 pagesTao of Forgotten Food Diet - Taoist Herbology 2ZioAngelNo ratings yet

- 03 Petroleum Basins of Southern South America - An OverviewDocument15 pages03 Petroleum Basins of Southern South America - An Overviewfiorela anait vera parqueNo ratings yet

- Essay Question On ARIMA ModelsDocument15 pagesEssay Question On ARIMA Modelsynhinguyen610No ratings yet

- Training Curriculum On Drug Addiction Counseling - Chapter 5Document139 pagesTraining Curriculum On Drug Addiction Counseling - Chapter 5Pinj Blue100% (1)

- More Notes of A Dirty Old Man (Converted FromDocument499 pagesMore Notes of A Dirty Old Man (Converted FromŽeljko ĐurićNo ratings yet

- 3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Document22 pages3 Pehlke. Observations On The Historical Reliability of OT. SJT 56.1 (2013)Cordova Llacsahuache Leif100% (1)

- Target Mature Men with Luxury Watch MarketingDocument13 pagesTarget Mature Men with Luxury Watch MarketingAndriDwisondiNo ratings yet

- United Kindom: Stefan Casian, 5BDocument14 pagesUnited Kindom: Stefan Casian, 5BClaudia Ramona StefanNo ratings yet

- Transformations Women Gender and Psychology 3rd Edition Crawford Test BankDocument17 pagesTransformations Women Gender and Psychology 3rd Edition Crawford Test BankFrankDiazagsyr100% (12)

- NEW GENERATION INTERNATIONAL SCHOOL SECOND UNIT TESTDocument4 pagesNEW GENERATION INTERNATIONAL SCHOOL SECOND UNIT TESTElmy ARNo ratings yet

- Circap Report 06Document28 pagesCircap Report 06Mónica SinisterraNo ratings yet

- Is There a Batak HistoryDocument14 pagesIs There a Batak HistoryMWahdiniPurbaNo ratings yet

- Module 7A Small Business Management: Adopted From: Noor Malinjasari Binti Ali PM Norsidah Ahmad PM Dr. Farok ZakariaDocument20 pagesModule 7A Small Business Management: Adopted From: Noor Malinjasari Binti Ali PM Norsidah Ahmad PM Dr. Farok ZakariafaizNo ratings yet

- Analisis Debussy PDFDocument2 pagesAnalisis Debussy PDFMiguel SeoaneNo ratings yet

- In Partial Fulfilment of The Requirements in Research Methods ClassDocument10 pagesIn Partial Fulfilment of The Requirements in Research Methods ClasstaniatotsNo ratings yet