Professional Documents

Culture Documents

As A Loan Officer For First Bank You Re Evaluating Newton: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As A Loan Officer For First Bank You Re Evaluating Newton: Unlock Answers Here Solutiondone - Online

Uploaded by

trilocksp SinghCopyright:

Available Formats

As a loan officer for First Bank you re evaluating Newton

As a loan officer for First Bank you re evaluating Newton

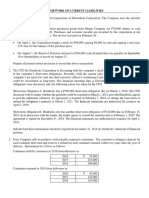

As a loan officer for First Bank, you're evaluating Newton Co.'s financial statements. Your

evaluation reveals that Newton has no capital leases recorded on its financial statements. To

effectively evaluate Newton's financial position, you've decided to constructively capitalize

Newton's operating leases in accordance with ASC 842. The following information is available

from Newton's financial statements for the year ended December 31, 2017:

Minimum Operating

Year ______________________________Lease Payments

2018..........................................................$ 500

2019............................................................450

2020............................................................410

2021............................................................410

2022.............................................................320

After 2022...................................................2,880

Total........................................................$ 4,970

Required:

1. Assuming that Newton's long-term debt rate is 8%, estimate its constructively capitalized

operating lease liability under ASU 2016-02 (ASC 842).

2. What would be the right-of-use asset under ASU 2016-02 (ASC 842)?

3. How will constructive capitalization affect Newton Co.'s debt-to-equity ratio?

As a loan officer for First Bank you re evaluating Newton

SOLUTION-- http://solutiondone.online/downloads/as-a-loan-officer-for-first-bank-you-re-

evaluating-newton/

Unlock answers here solutiondone.online

You might also like

- The Complete Money Workbook PDFDocument59 pagesThe Complete Money Workbook PDFJoseNo ratings yet

- Sample Exercises and Problems (Accounting Cycle)Document17 pagesSample Exercises and Problems (Accounting Cycle)Fely MaataNo ratings yet

- Ak - Keu (Problem)Document51 pagesAk - Keu (Problem)RAMA100% (9)

- Week5 Fundamentals of ABM 2Document12 pagesWeek5 Fundamentals of ABM 2Janna Gunio100% (1)

- Exercise 18Document9 pagesExercise 18raihan aqilNo ratings yet

- The Following Selected Accounts Were Taken From The Financial RecordsDocument1 pageThe Following Selected Accounts Were Taken From The Financial Recordstrilocksp SinghNo ratings yet

- Accounting Adjusting EntriesDocument42 pagesAccounting Adjusting EntriesDonnelly Keith MumarNo ratings yet

- Homework On Current Liabilities 1st Term Sy2018-2019Document4 pagesHomework On Current Liabilities 1st Term Sy2018-2019RedNo ratings yet

- Toth Company Had The Following Assets and Liabilities On TheDocument1 pageToth Company Had The Following Assets and Liabilities On Thetrilocksp SinghNo ratings yet

- ACC13 Activity 7.1Document2 pagesACC13 Activity 7.1Jeva, Marrian Jane NoolNo ratings yet

- The Following Data Were Taken From The Financial Statements ofDocument1 pageThe Following Data Were Taken From The Financial Statements ofMiroslav GegoskiNo ratings yet

- Solutiondone 144Document1 pageSolutiondone 144trilocksp SinghNo ratings yet

- Anzelika Cintana - Tugas Minggu Ke-9 - AM-S1 ManajemenDocument9 pagesAnzelika Cintana - Tugas Minggu Ke-9 - AM-S1 ManajemenApes Together Strongs ATSNo ratings yet

- Solved Manning Company Reported The Following Information For 2019 Cash ProvidedDocument1 pageSolved Manning Company Reported The Following Information For 2019 Cash ProvidedAnbu jaromiaNo ratings yet

- You Have Been Asked by A Client To Review The PDFDocument3 pagesYou Have Been Asked by A Client To Review The PDFHassan JanNo ratings yet

- This Information Is For Paulo Company For The Year Ended: Unlock Answers Here Solutiondone - OnlineDocument1 pageThis Information Is For Paulo Company For The Year Ended: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Completing The Operating CycleDocument29 pagesCompleting The Operating CycleGaluh Boga KuswaraNo ratings yet

- Foa CH V P.ship 2021Document18 pagesFoa CH V P.ship 2021Ermi ManNo ratings yet

- Solution Ch04Document146 pagesSolution Ch04Harmanjot 03No ratings yet

- You Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - OnlineDocument1 pageYou Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- FSA M.com IVDocument5 pagesFSA M.com IVAli HaiderNo ratings yet

- The Preliminary Draft of The Balance Sheet at The End: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Preliminary Draft of The Balance Sheet at The End: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- QP Half Yearly Accounts XiiDocument8 pagesQP Half Yearly Accounts XiiVazahat HusainNo ratings yet

- BU127 Quiz Q&aDocument14 pagesBU127 Quiz Q&aFarah Luay AlberNo ratings yet

- Camp and Fevurly Financial Planners Have Forecasted Revenues For TheDocument1 pageCamp and Fevurly Financial Planners Have Forecasted Revenues For TheTaimour HassanNo ratings yet

- The Smythe Davidson Corporation Just Issued Its Annual Report The CurrentDocument1 pageThe Smythe Davidson Corporation Just Issued Its Annual Report The CurrentMuhammad ShahidNo ratings yet

- The Partnership Agreement of Jones King and Lane Provides ForDocument1 pageThe Partnership Agreement of Jones King and Lane Provides Fortrilocksp SinghNo ratings yet

- 1 AssignmentDocument4 pages1 AssignmentHammad Hassan AsnariNo ratings yet

- Solutiondone 203Document1 pageSolutiondone 203trilocksp SinghNo ratings yet

- Programs Plus Is A Retail Firm That Sells Computer Programs: Unlock Answers Here Solutiondone - OnlineDocument1 pagePrograms Plus Is A Retail Firm That Sells Computer Programs: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Berkshire Hathaway IncDocument2 pagesBerkshire Hathaway IncZerohedgeNo ratings yet

- The Artisan Wines Is A Retail Store Selling Vintage Wines: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Artisan Wines Is A Retail Store Selling Vintage Wines: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- MSK Construction Company Contracted To Construct A Factory Building ForDocument1 pageMSK Construction Company Contracted To Construct A Factory Building Fortrilocksp SinghNo ratings yet

- QUIZ1 - Finacc3Document4 pagesQUIZ1 - Finacc3Jonnie RegalaNo ratings yet

- Mojakoe Ak2 Uts 2018 PDFDocument17 pagesMojakoe Ak2 Uts 2018 PDFRayhandi AlmerifkiNo ratings yet

- Review Questions For Final Exam ACC210Document13 pagesReview Questions For Final Exam ACC210AaaNo ratings yet

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- Reparing Consolidated Statements: Data For The IllustrationDocument16 pagesReparing Consolidated Statements: Data For The IllustrationIndra PramanaNo ratings yet

- The Post Closing Trial Balance of Storey Corporation at December 31Document1 pageThe Post Closing Trial Balance of Storey Corporation at December 31trilocksp SinghNo ratings yet

- REVISION AccountingDocument13 pagesREVISION Accountingiquidbae1No ratings yet

- 2019 June 23 ACT 701 Chapter 3 Problems and SolutionDocument21 pages2019 June 23 ACT 701 Chapter 3 Problems and SolutionZisanNo ratings yet

- Question Bank For NPODocument17 pagesQuestion Bank For NPOSanyam BohraNo ratings yet

- DeVry University Walmart ProjectDocument12 pagesDeVry University Walmart ProjectKristin ParkerNo ratings yet

- Quiz 5 ProblemsDocument5 pagesQuiz 5 ProblemsElizabeth100% (1)

- Tugas Pert.1Document3 pagesTugas Pert.1Hari YantoNo ratings yet

- Accounting LM3Document6 pagesAccounting LM3Nathan Kurt LeeNo ratings yet

- Chapter 15 JawabanDocument24 pagesChapter 15 JawabanDamelinaNo ratings yet

- ACCT215 Principles of Accounting I - First Exam Part II QuestionsDocument4 pagesACCT215 Principles of Accounting I - First Exam Part II QuestionsshigekaNo ratings yet

- Practice C6-2Document6 pagesPractice C6-2Huyền TrangNo ratings yet

- The Following Information Is For Kon Inc For The YearDocument1 pageThe Following Information Is For Kon Inc For The YearMiroslav GegoskiNo ratings yet

- Minutemen Law Services Maintains Its Books Using Cash Basis Accounting HoweverDocument1 pageMinutemen Law Services Maintains Its Books Using Cash Basis Accounting Howevertrilocksp SinghNo ratings yet

- TradesDocument3 pagesTradesAlber Howell MagadiaNo ratings yet

- On January 1 2017 Allan Company Bought A 15 PercentDocument2 pagesOn January 1 2017 Allan Company Bought A 15 PercentAmit PandeyNo ratings yet

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- Selected Financial Information Follows For Maison Corporation For The YearDocument1 pageSelected Financial Information Follows For Maison Corporation For The YearBube KachevskaNo ratings yet

- Solutiondone 140Document1 pageSolutiondone 140trilocksp SinghNo ratings yet

- Solutiondone 429Document1 pageSolutiondone 429trilocksp SinghNo ratings yet

- FDNACCT Quiz-3 Set-B Answer-KeyDocument4 pagesFDNACCT Quiz-3 Set-B Answer-KeyPia DigaNo ratings yet

- Pamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2Document4 pagesPamantasan NG Lungsod NG Marikina Auditing and Assurance Concepts & Applications On-Line Learning Mr. Nilo N. Iglesias, CPA, MBA, REA Activities For Week 1 and Week 2suruth242No ratings yet

- Government Competition Leviathan and Benevolence Suppose Governments Can Spend TaxpayerDocument2 pagesGovernment Competition Leviathan and Benevolence Suppose Governments Can Spend Taxpayertrilocksp SinghNo ratings yet

- Goal Incongruence and Roi Bleefi Corporation Manufactures FurniDocument1 pageGoal Incongruence and Roi Bleefi Corporation Manufactures Furnitrilocksp SinghNo ratings yet

- Gazarra Company Is A Very Profitable Small Business It HasDocument1 pageGazarra Company Is A Very Profitable Small Business It Hastrilocksp Singh0% (1)

- Global Company Ethical Challenges in June 2009 The GovernmentDocument2 pagesGlobal Company Ethical Challenges in June 2009 The Governmenttrilocksp SinghNo ratings yet

- General Guideline Transfer Pricing The Slate Company ManufacturDocument1 pageGeneral Guideline Transfer Pricing The Slate Company Manufacturtrilocksp SinghNo ratings yet

- Game Guys Is A Retail Store Selling Video GamesDocument1 pageGame Guys Is A Retail Store Selling Video Gamestrilocksp SinghNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Follete Inc Operates at Capacity and Makes Plastic Combs andDocument2 pagesFollete Inc Operates at Capacity and Makes Plastic Combs andtrilocksp SinghNo ratings yet

- General Ledger Relationships Under and Over AllocationDocument1 pageGeneral Ledger Relationships Under and Over Allocationtrilocksp SinghNo ratings yet

- Goal Congruence Problems With Cost Plus Transfer Pricing MethodsDocument1 pageGoal Congruence Problems With Cost Plus Transfer Pricing Methodstrilocksp SinghNo ratings yet

- Fishing in The Commons in The Text We Introduced TheDocument2 pagesFishing in The Commons in The Text We Introduced Thetrilocksp SinghNo ratings yet

- Fifteen Workers Are Assigned To A Group Project The ProductionDocument1 pageFifteen Workers Are Assigned To A Group Project The Productiontrilocksp SinghNo ratings yet

- For Each of The Following Transactions Determine The Contribution ToDocument1 pageFor Each of The Following Transactions Determine The Contribution Totrilocksp SinghNo ratings yet

- Financial and Nonfinancial Performance Measures Goal CongruenceDocument1 pageFinancial and Nonfinancial Performance Measures Goal Congruencetrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Marron Inc ProduceDocument1 pageFlexible Budget and Sales Volume Variances Marron Inc Producetrilocksp SinghNo ratings yet

- Figures 1 2 and 1 6 Rely On Data From 2010 andDocument1 pageFigures 1 2 and 1 6 Rely On Data From 2010 andtrilocksp SinghNo ratings yet

- Flexible Budget Variances Review of Chapters David James Is ADocument1 pageFlexible Budget Variances Review of Chapters David James Is Atrilocksp SinghNo ratings yet

- Five Weeks Ago Robin Corporation Borrowed From The Commercial FinanceDocument1 pageFive Weeks Ago Robin Corporation Borrowed From The Commercial Financetrilocksp SinghNo ratings yet

- Figures A B and C Are Taken From A PaperDocument1 pageFigures A B and C Are Taken From A Papertrilocksp SinghNo ratings yet

- Flexible Budget and Sales Volume Variances Market Share andDocument1 pageFlexible Budget and Sales Volume Variances Market Share andtrilocksp SinghNo ratings yet

- First Security National Bank Has Been Approached by A Long StandingDocument1 pageFirst Security National Bank Has Been Approached by A Long Standingtrilocksp SinghNo ratings yet

- Financial Budgets Cash Outflows Country Club Road NurseriesDocument1 pageFinancial Budgets Cash Outflows Country Club Road Nurseriestrilocksp SinghNo ratings yet

- Executive Compensation Balanced Scorecard Community BankDocument1 pageExecutive Compensation Balanced Scorecard Community Banktrilocksp SinghNo ratings yet

- Exploring The Difference Between Willingness To Pay and Willingness ToDocument2 pagesExploring The Difference Between Willingness To Pay and Willingness Totrilocksp SinghNo ratings yet

- Exogenous Price Uncertainty and The Option To Abandon Management Has GoneDocument2 pagesExogenous Price Uncertainty and The Option To Abandon Management Has Gonetrilocksp SinghNo ratings yet