Professional Documents

Culture Documents

F9 Progress Test 1 Key Financial Ratios

Uploaded by

Coc GamingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F9 Progress Test 1 Key Financial Ratios

Uploaded by

Coc GamingCopyright:

Available Formats

F9: PROGRESS TEST 1

A company has the following statement of profit or loss and statement of financial position extracts:

$ $

PBIT 500,000 Non-current assets 5,000,000

Interest (50,000)

PBT 450,000 Current assets 2,500,000

Tax (50%) (225,000)

225,000 Less:

Current liabilities (1,500,000)

Preference dividend (25,000)

Ordinary dividend (100,000) Net assets 6,000,000

Dividend retained 100,000

1 The ROCE is:

A 10%

B 7.5%

C 8.3%

D 3.75% (2 marks)

2 Dividend cover is:

A 1.8

B 2

C 1.0

D 1.4 (2 marks)

3 Interest cover(age) is:

A 9.0

B 4.5

C 10.0

D 2.0 (2 marks)

F9: PROGRESS TEST 1

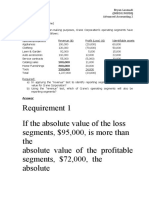

4 Extracts of financial details of a company are as follows:

$

Sales 500,000

Cost of sales 420,000

Purchases 280,000

Receivables 62,500

Payables 42,000

Inventory 185,000

The operating cycle to the nearest whole day is:

A 190 days

B 140 days

C 152 days

D Cannot be calculated (4 marks)

5 Using the data from Question 4, the sales to net working capital ratio is:

A 2.43

B 8.00

C 1.46

D Cannot be calculated (2 marks)

6 Using the data from Questions 4 and 5 the increase in cash required to support a sales

increase of 30%, to the nearest $'000 is:

A $6

B $215

C $62

D $65 (2 marks)

7 You are given the following details:

Share capital 500,000 5c shares

Statement of profit or

loss

$

Profit before tax 400,000

Tax (100,000)

Earnings 300,000

Dividends (100,000)

Retained 200,000

The EPS is:

A 80c

B 40c

C 60c

D 30c (2 marks)

F9: PROGRESS TEST 1

8 A company faces demand of 500 units per month for imported ipods that it purchases for

$50 per unit. The cost of an order is $100 and holding costs are 10% pa of inventory value.

The economic order quantity (to the nearest unit) is:

A 100

B 490

C 333

D 1,000 (2 marks)

9 A company with annual sales of $960,000 and average receivables of two months, is

considering offering a 2% prompt payment discount. They estimate that half of their

customers will take up this discount and that this will have the effect of reducing average

receivables to one month. This company currently has a bank overdraft which costs 15% pa.

The net benefit / (cost) of this change will be:

A ($7,200) cost

B $70,400 benefit

C ($22,400) cost

D $2,400 benefit (2 marks)

10 Bonds that are issued by a company at a large discount to their eventual redemption value,

but on which no interest is paid until redemption, are called:

A Loan notes

B Zero coupon bonds

C Equity bonds

D Floating rate bonds (2 marks)

1 Compare the objectives of a listed company with those of a not for profit organisation

(6 marks)

2 Identify the three key elements of a financial strategy (3 marks)

3 Discuss the impact of a devaluation of the pound on a UK firm exporting to the USA

(3 marks)

4 Describe the functions of a financial intermediary (3 marks)

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Advanced Analysis and Appraisal of PerformanceDocument7 pagesAdvanced Analysis and Appraisal of PerformanceAnn SalazarNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- B Exercises: E24-1B (Post-Balance-Sheet Events) (A) (B)Document4 pagesB Exercises: E24-1B (Post-Balance-Sheet Events) (A) (B)Saleh RaoufNo ratings yet

- Lecture 5-PostDocument52 pagesLecture 5-PostcoolirlbbNo ratings yet

- F3 Mock2 QuestDocument19 pagesF3 Mock2 QuestKiran Batool60% (5)

- Operating Income Assets Current LiabilitiesDocument4 pagesOperating Income Assets Current LiabilitiesFernando III PerezNo ratings yet

- F2 May 2012 Examiners AnswersDocument14 pagesF2 May 2012 Examiners AnswersFahadNo ratings yet

- Materi Accounting AdvancedDocument12 pagesMateri Accounting AdvancedRianty AstaniaNo ratings yet

- Model PAPER-Analysis of Financial Statement - MBA-BBADocument5 pagesModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Document14 pagesACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNo ratings yet

- Activity 01 PDFDocument5 pagesActivity 01 PDFJennifer AdvientoNo ratings yet

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- BCOE-142 December 2022Document12 pagesBCOE-142 December 2022SanjeetNo ratings yet

- BUS 349 Summer 2021 Assignment 1 Chapter QuestionsDocument5 pagesBUS 349 Summer 2021 Assignment 1 Chapter QuestionsAnhad SinghNo ratings yet

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- Question - BS and FADocument6 pagesQuestion - BS and FANguyễn Thùy LinhNo ratings yet

- ROCE, profit margin and financial analysis of Enn LtdDocument7 pagesROCE, profit margin and financial analysis of Enn LtdKccc siniNo ratings yet

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocument9 pagesSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (26)

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- Foundations in Financial ManagementDocument16 pagesFoundations in Financial ManagementQuỳnhNo ratings yet

- SHE (Part 2) - OvilloDocument13 pagesSHE (Part 2) - OvilloMaria AngelicaNo ratings yet

- Tutorial_11_Interco_transactions.docxDocument15 pagesTutorial_11_Interco_transactions.docxBình QuốcNo ratings yet

- Consolidated Financial Statements for Uni II – BDocument6 pagesConsolidated Financial Statements for Uni II – BDaisy TañoteNo ratings yet

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- Question - FS and FADocument6 pagesQuestion - FS and FANguyễn Thùy LinhNo ratings yet

- Advanced Accounting 2 Quiz AnswersDocument9 pagesAdvanced Accounting 2 Quiz AnswersBryan LesmadiNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumNo ratings yet

- FABVDocument10 pagesFABVdivyayella024No ratings yet

- 7 2010 Jun QDocument8 pages7 2010 Jun QWeezy360No ratings yet

- CN L8 Step AcquistionDocument5 pagesCN L8 Step AcquistionRyan RapisuraNo ratings yet

- ACCA ExerciseDocument23 pagesACCA ExerciseIndriyanti Krisdiana100% (1)

- FAR Material-2Document8 pagesFAR Material-2Blessy Zedlav LacbainNo ratings yet

- Retained Earnings AppropriationDocument4 pagesRetained Earnings AppropriationRey HandumonNo ratings yet

- ADVANCED ACCOUNTING 2CDocument5 pagesADVANCED ACCOUNTING 2CHarusiNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)admiral spongebobNo ratings yet

- Chapter 3 SolutionsDocument7 pagesChapter 3 Solutionshassan.murad63% (8)

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (60)

- AFE 5008 Model Answers for Final ExamsDocument10 pagesAFE 5008 Model Answers for Final ExamsDiana TuckerNo ratings yet

- AFA Tutorial 11: Analyzing Financial Statements and RatiosDocument9 pagesAFA Tutorial 11: Analyzing Financial Statements and RatiosJIA HUI LIMNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Sitti Ayesha HasimanNo ratings yet

- Shareholder's Equity 2 - PracAccDocument19 pagesShareholder's Equity 2 - PracAccClyn CFNo ratings yet

- ACC10007 Sample Exam 1Document9 pagesACC10007 Sample Exam 1dannielNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Dwnload Full Cfin 4 4th Edition Besley Solutions Manual PDFDocument35 pagesDwnload Full Cfin 4 4th Edition Besley Solutions Manual PDFbrandihansenjoqll2100% (13)

- Cfin 4 4th Edition Besley Solutions ManualDocument35 pagesCfin 4 4th Edition Besley Solutions Manualghebre.comatula.75ew100% (22)

- Analyze financial statements and calculate ratiosDocument11 pagesAnalyze financial statements and calculate ratiosFaria AlamNo ratings yet

- Profe03 - Chapter 5 Consolidated FS Intercompany TopicsDocument8 pagesProfe03 - Chapter 5 Consolidated FS Intercompany TopicsSteffany RoqueNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsTamar PkhakadzeNo ratings yet

- Cfin 5th Edition Besley Solutions ManualDocument35 pagesCfin 5th Edition Besley Solutions Manualghebre.comatula.75ew100% (28)

- Dwnload Full Cfin 5th Edition Besley Solutions Manual PDFDocument35 pagesDwnload Full Cfin 5th Edition Besley Solutions Manual PDFandrefloresxudd100% (11)

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- The Examiner's Answers F2 - Financial Management September 2012Document16 pagesThe Examiner's Answers F2 - Financial Management September 2012FahadNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- ACCA Pilot Paper Int PPQDocument19 pagesACCA Pilot Paper Int PPQqaisar1982No ratings yet

- ACCA F9 - Financial Management Multiple Choice QuestionsDocument40 pagesACCA F9 - Financial Management Multiple Choice QuestionsImranRazaBozdar67% (3)

- ACCA F9 Workbook SolutionsDocument251 pagesACCA F9 Workbook SolutionsSide Al Rifat100% (6)

- A Revision of Management Accounting (MA) Topics: OutcomeDocument24 pagesA Revision of Management Accounting (MA) Topics: OutcomeCoc GamingNo ratings yet

- 46554bosfinal p5 cp9 PDFDocument52 pages46554bosfinal p5 cp9 PDFAbhinandan SamnekarNo ratings yet

- UN Manual TransferPricingDocument67 pagesUN Manual TransferPricingAnshul SinghNo ratings yet

- Chapter 5 DCF With Inflation, Taxation and Working Capital: SyllabusDocument29 pagesChapter 5 DCF With Inflation, Taxation and Working Capital: SyllabusCoc GamingNo ratings yet

- F9 MCQ AnswersDocument1 pageF9 MCQ AnswersCoc GamingNo ratings yet

- Transfer Price Questuon Ca Final PDFDocument69 pagesTransfer Price Questuon Ca Final PDFCoc GamingNo ratings yet

- FM 2019 Sepdec Sample A PDFDocument10 pagesFM 2019 Sepdec Sample A PDFKristine Lirose BordeosNo ratings yet

- F9 Progress Test 2: Key Financial Calculations for Machine ProjectsDocument3 pagesF9 Progress Test 2: Key Financial Calculations for Machine ProjectsCoc GamingNo ratings yet

- Financial Management: Explanation of Formulae SheetDocument10 pagesFinancial Management: Explanation of Formulae SheetCoc GamingNo ratings yet

- F9 Progress Test 2: Key Financial Calculations for Machine ProjectsDocument3 pagesF9 Progress Test 2: Key Financial Calculations for Machine ProjectsCoc GamingNo ratings yet

- F9 MCQ AnswersDocument1 pageF9 MCQ AnswersCoc GamingNo ratings yet

- Unit 3 Issue of Debentures PDFDocument30 pagesUnit 3 Issue of Debentures PDFvivekNo ratings yet

- Silo - Tips - Effective Interest MethodDocument8 pagesSilo - Tips - Effective Interest MethodFuri Fatwa DiniNo ratings yet

- Imp QuestionDocument5 pagesImp QuestionKrish PaganiNo ratings yet

- Project 1: Develop and Use Personal Budget and Develop and Use Savings PlanDocument6 pagesProject 1: Develop and Use Personal Budget and Develop and Use Savings PlanBeka Asra100% (1)

- Assets Liabilities EquityDocument4 pagesAssets Liabilities EquityLiezel NunezaNo ratings yet

- En Pago (Transfer of Ownership of Property To The CreditorDocument9 pagesEn Pago (Transfer of Ownership of Property To The CreditorA cNo ratings yet

- Accounts g1 MTPDocument191 pagesAccounts g1 MTPJattu TatiNo ratings yet

- Acclaw QuizDocument4 pagesAcclaw QuizJasmine PeraltaNo ratings yet

- B If You Decide To Make A Lump Sum Deposit Today Instead of The Annual Deposits - Course Hero Document LandingDocument1 pageB If You Decide To Make A Lump Sum Deposit Today Instead of The Annual Deposits - Course Hero Document LandingBahiran DeguNo ratings yet

- Partnership Formation ActivityDocument8 pagesPartnership Formation ActivityShaira UntalanNo ratings yet

- Chapter 16-InvestmentDocument63 pagesChapter 16-InvestmentjadeNo ratings yet

- Loan Application Letter MK63626316ID46718930Document2 pagesLoan Application Letter MK63626316ID46718930Rohit KumarNo ratings yet

- Prelim - PART 2Document6 pagesPrelim - PART 2Dan RyanNo ratings yet

- A, B, C - Specialised Accounting - 2Document15 pagesA, B, C - Specialised Accounting - 2محمود احمدNo ratings yet

- Evening CompanyDocument2 pagesEvening Companyfaye fayeNo ratings yet

- Bank DepositDocument5 pagesBank Depositlit af100% (2)

- Financial Acctg Reporting 1 Chapter 10Document18 pagesFinancial Acctg Reporting 1 Chapter 10Charise Jane ZullaNo ratings yet

- (Dissol) Advanced Level Questions, Additional Questions-6Document5 pages(Dissol) Advanced Level Questions, Additional Questions-6Gyro SplashNo ratings yet

- Friend's Corporation Financial PositionDocument6 pagesFriend's Corporation Financial PositionKHAkadsbdhsgNo ratings yet

- CLASSIFICIATION OF ACCOUNTS - QuestionsDocument2 pagesCLASSIFICIATION OF ACCOUNTS - QuestionsRohit ChandraNo ratings yet

- Banking Practice Unit 3: Opening Accounts of Various Types of CustomersDocument5 pagesBanking Practice Unit 3: Opening Accounts of Various Types of CustomersNandhini VirgoNo ratings yet

- EM 531 - Lecture Notes 7Document45 pagesEM 531 - Lecture Notes 7Hasan ÖzdemNo ratings yet

- Partnership 2021 - Long ProblemsDocument5 pagesPartnership 2021 - Long ProblemsMichael MagdaogNo ratings yet

- Aud Ap MCQ FXDocument13 pagesAud Ap MCQ FXQueenie LazaroNo ratings yet

- MCQs For Accounting Principles and ProceduresDocument10 pagesMCQs For Accounting Principles and ProceduresAshfaq Afridi73% (11)

- Time Value of MoneyDocument21 pagesTime Value of MoneyKadita MageNo ratings yet

- Faqs of Islamic Naya Pakistan Certificates (Inpcs)Document3 pagesFaqs of Islamic Naya Pakistan Certificates (Inpcs)Ajmal AfzalNo ratings yet

- Ebit Eps Analysis: Sandeep KulshresthaDocument12 pagesEbit Eps Analysis: Sandeep KulshresthaMohmmedKhayyumNo ratings yet

- Dec-13 Leasing Vs Borrowing SolutionDocument1 pageDec-13 Leasing Vs Borrowing Solutiondon_mahinNo ratings yet

- I Practice of Horizontal & Verticle Analysis Activity IDocument3 pagesI Practice of Horizontal & Verticle Analysis Activity IZarish AzharNo ratings yet