Professional Documents

Culture Documents

On December 31 2008 Before The Books Were Closed The

On December 31 2008 Before The Books Were Closed The

Uploaded by

M Bilal SaleemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On December 31 2008 Before The Books Were Closed The

On December 31 2008 Before The Books Were Closed The

Uploaded by

M Bilal SaleemCopyright:

Available Formats

On December 31 2008 before the books were closed the

On December 31, 2008, before the books were closed, the management and accountants of

Keltner Inc. made the following determinations about three depreciable assets.1. Depreciable

asset A was purchased January 2, 2005. It originally cost $495,000 and, for depreciation

purposes, the straight-line method was originally chosen. The asset was originally expected to

be useful for 10 years and have a zero salvage value. In 2008, the decision was made to

change the depreciation method from straight-line to sum-of-the-years’-digits, and the

estimates relating to useful life and salvage value remained unchanged.2. Depreciable asset B

was purchased January 3, 2004. It originally cost $120,000 and, for depreciation purposes, the

straight-line method was chosen. The asset was originally expected to be useful for 15 years

and have a zero salvage value. In 2008, the decision was made to shorten the total life of this

asset to 9 years and to estimate the salvage value at $3,000.3. Depreciable asset C was

purchased January 5, 2004. The asset’s original cost was $140,000, and this amount was

entirely expensed in 2004. This particular asset has a 10-year useful life and no salvage value.

The straight-line method was chosen for depreciation purposes.Additional data: 1. Income in

2008 before depreciation expense amounted to $400,000.2. Depreciation expense on assets

other than A, B, and C totaled $55,000 in 2008.3. Income in 2007 was reported at $370,000.4.

Ignore all income tax effects.5. 100,000 shares of common stock were outstanding in 2007 and

2008.Instructions(a) Prepare all necessary entries in 2008 to record these determinations.(b)

Prepare comparative retained earnings statements for Eloise Keltner Inc. for 2007 and 2008.

The company had retained earnings of $200,000 at December 31, 2006.View Solution:

On December 31 2008 before the books were closed the

SOLUTION-- http://expertanswer.online/downloads/on-december-31-2008-before-the-books-

were-closed-the/

See Answer here expertanswer.online

Powered by TCPDF (www.tcpdf.org)

You might also like

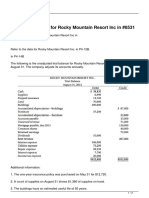

- The Following Is The Unadjusted Trial Balance For Rocky MountainDocument2 pagesThe Following Is The Unadjusted Trial Balance For Rocky MountainMiroslav GegoskiNo ratings yet

- ACCA F3 Financial Accounting INT Solcved Past Papers 0107Document40 pagesACCA F3 Financial Accounting INT Solcved Past Papers 0107QAMAR REHMAN100% (4)

- Week 1 Introduction To Strategy Lecture SlidesDocument45 pagesWeek 1 Introduction To Strategy Lecture SlidesHamada BakheetNo ratings yet

- Tax Invoice: ALWAR GAS SERVICE (000010176)Document1 pageTax Invoice: ALWAR GAS SERVICE (000010176)VijendraNo ratings yet

- Soal Kuis Asistensi AK1 Setelah UTSDocument6 pagesSoal Kuis Asistensi AK1 Setelah UTSManggala Patria WicaksonoNo ratings yet

- Solved Write in Algebraic Form A Calculation of U K Pounds PerDocument1 pageSolved Write in Algebraic Form A Calculation of U K Pounds PerM Bilal SaleemNo ratings yet

- Assignment Print View 3.11Document4 pagesAssignment Print View 3.11Zach JaapNo ratings yet

- Accounting Change and Error Analysis On December 31 2010 Befor PDFDocument1 pageAccounting Change and Error Analysis On December 31 2010 Befor PDFAnbu jaromiaNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- Asignación 3 PNIADocument4 pagesAsignación 3 PNIAElia SantanaNo ratings yet

- CH 06 - Intercompany Transfers of Services and Noncurrent Assets - Key AnswerDocument41 pagesCH 06 - Intercompany Transfers of Services and Noncurrent Assets - Key AnswerRonnie SalazarNo ratings yet

- CH 06 Intercompany Transfers of Services and Noncurrent AssetsDocument41 pagesCH 06 Intercompany Transfers of Services and Noncurrent Assetsjohn paulNo ratings yet

- Sample MCQDocument8 pagesSample MCQJacky LamNo ratings yet

- T6int 2009 Jun QDocument9 pagesT6int 2009 Jun QRana KAshif GulzarNo ratings yet

- Accounts Notes Grade 11Document47 pagesAccounts Notes Grade 11Jordan Mulenga100% (1)

- The University South Pacific: School of Accounting and FinanceDocument9 pagesThe University South Pacific: School of Accounting and FinanceTetzNo ratings yet

- Test Bank For Financial Statement Analysis and Valuation 2nd Edition EastonDocument29 pagesTest Bank For Financial Statement Analysis and Valuation 2nd Edition Eastonagnesgrainneo30No ratings yet

- MQ3 Spr08gDocument10 pagesMQ3 Spr08gjhouvanNo ratings yet

- F3 Mock1 QuestDocument18 pagesF3 Mock1 QuestKiran Batool86% (7)

- Accaf3junwk3qa PDFDocument13 pagesAccaf3junwk3qa PDFTiny StarsNo ratings yet

- Financial Accounting F3 25 August RetakeDocument12 pagesFinancial Accounting F3 25 August RetakeMohammed HamzaNo ratings yet

- Chapter 5 DepreciationDocument20 pagesChapter 5 DepreciationanuradhaNo ratings yet

- Principles of Accounts 11Document47 pagesPrinciples of Accounts 11Godfrey LwandoNo ratings yet

- Kathy Herman Opened Kwick Cleaners On March 1 2010 DuringDocument1 pageKathy Herman Opened Kwick Cleaners On March 1 2010 DuringM Bilal SaleemNo ratings yet

- Toaz - Info 15089702 Acca Cat Paper t6 Drafting Financial Statements Solved Past Papers PRDocument155 pagesToaz - Info 15089702 Acca Cat Paper t6 Drafting Financial Statements Solved Past Papers PRmiss ainaNo ratings yet

- Depreciation Syd Act SL and DDB The Following Data Relate To PDFDocument1 pageDepreciation Syd Act SL and DDB The Following Data Relate To PDFAnbu jaromiaNo ratings yet

- Tutorial Chpater 10-11 Part BDocument32 pagesTutorial Chpater 10-11 Part BKate BNo ratings yet

- Test Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy DoupnikDocument8 pagesTest Bank For Advanced Accounting 14th Edition Joe Ben Hoyle Thomas Schaefer Timothy Doupnikacetize.maleyl.hprj100% (48)

- Week 4 AssignmentDocument6 pagesWeek 4 AssignmentJames Bradley HuangNo ratings yet

- Chap006-Intercompany Transfers of Services and Non Current AssetsDocument41 pagesChap006-Intercompany Transfers of Services and Non Current Assets_casals100% (4)

- Edmund Halvor of The Controller S Office of East Aurora CorporatDocument1 pageEdmund Halvor of The Controller S Office of East Aurora CorporatM Bilal SaleemNo ratings yet

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Document14 pagesMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerribleNo ratings yet

- Advanced Accounting Baker Test Bank - Chap002Document36 pagesAdvanced Accounting Baker Test Bank - Chap002donkazotey60% (5)

- ch06 Beams10e TBDocument28 pagesch06 Beams10e TBKenneth Jay AcideraNo ratings yet

- Trắc nghiệmDocument8 pagesTrắc nghiệmHồ Đan Thục0% (1)

- Dfcamsw Intangibles Applied Auditing Woans 9-21-18Document2 pagesDfcamsw Intangibles Applied Auditing Woans 9-21-18rubert subangNo ratings yet

- Paper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Document8 pagesPaper T6 (Uk) Drafting Financial Statements: Sample Multiple Choice Questions - June 2009Jeremy LuNo ratings yet

- C2 Course Test 3Document16 pagesC2 Course Test 3Tinashe MashoyoyaNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Kathleen Cole Inc Acquired The Following Assets in January ofDocument1 pageKathleen Cole Inc Acquired The Following Assets in January ofM Bilal SaleemNo ratings yet

- Refer To The Data For Rocky Mountain Resort Inc inDocument2 pagesRefer To The Data For Rocky Mountain Resort Inc inMiroslav GegoskiNo ratings yet

- In y Ter CompanyDocument6 pagesIn y Ter CompanyEllenNo ratings yet

- Multiple Choice: - CPA AdaptedDocument4 pagesMultiple Choice: - CPA AdaptedQueen ValleNo ratings yet

- Instructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloDocument14 pagesInstructor Manual For Financial Managerial Accounting 16th Sixteenth Edition by Jan R Williams Sue F Haka Mark S Bettner Joseph V CarcelloMarkCallahanxgyfq100% (40)

- ACCT FINAL AnswersDocument8 pagesACCT FINAL AnswersBrian Tompkins (bct)No ratings yet

- Depreciation and Error Analysis A Depreciation Schedule For Semi PDFDocument1 pageDepreciation and Error Analysis A Depreciation Schedule For Semi PDFAnbu jaromiaNo ratings yet

- Linda Blye Opened Cardinal Window Washing Inc On July 1Document1 pageLinda Blye Opened Cardinal Window Washing Inc On July 1M Bilal SaleemNo ratings yet

- F.S.A Practicals Try MeDocument3 pagesF.S.A Practicals Try MeCherno B BahNo ratings yet

- Laura Eddy Opened Eddy S Carpet Cleaners On March 1 During PDFDocument1 pageLaura Eddy Opened Eddy S Carpet Cleaners On March 1 During PDFAnbu jaromiaNo ratings yet

- Grade 9 Accounting p2Document5 pagesGrade 9 Accounting p2AliNo ratings yet

- Advanced Accounting BU 455A Spring 2013 Test OneDocument14 pagesAdvanced Accounting BU 455A Spring 2013 Test OneMichael Tai Maimoni100% (2)

- C. Increase Assets and Increase EquityDocument3 pagesC. Increase Assets and Increase EquityEmiraslan MhrrovNo ratings yet

- Make Money with Affordable Apartment Buildings and Commercial PropertiesFrom EverandMake Money with Affordable Apartment Buildings and Commercial PropertiesNo ratings yet

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- The Real Estate Investor's Pocket Calculator: Simple Ways to Compute Cash Flow, Value, Return, and Other Key Financial MeasurementsFrom EverandThe Real Estate Investor's Pocket Calculator: Simple Ways to Compute Cash Flow, Value, Return, and Other Key Financial MeasurementsRating: 1 out of 5 stars1/5 (1)

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesNo ratings yet

- Solved You Should Never Buy Precooked Frozen Foods Because The PriceDocument1 pageSolved You Should Never Buy Precooked Frozen Foods Because The PriceM Bilal SaleemNo ratings yet

- Solved Your Local Fast Food Chain With Two Dozen Stores UsesDocument1 pageSolved Your Local Fast Food Chain With Two Dozen Stores UsesM Bilal SaleemNo ratings yet

- Solved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25Document1 pageSolved You Have Access To The Following Three Spot Exchange Rates 0 01 Yen 0 20 Krone 25M Bilal SaleemNo ratings yet

- Solved You Want To Price Posters at The Poster Showcase ProfitablyDocument1 pageSolved You Want To Price Posters at The Poster Showcase ProfitablyM Bilal SaleemNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Solved Your Company Is Bidding For A Service Contract in ADocument1 pageSolved Your Company Is Bidding For A Service Contract in AM Bilal SaleemNo ratings yet

- Solved Zack and Andon Compete in The Peanut Market Zack IsDocument1 pageSolved Zack and Andon Compete in The Peanut Market Zack IsM Bilal SaleemNo ratings yet

- Solved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesDocument1 pageSolved You Hedged Your Financial Firm S Exposure To Increasing Interest RatesM Bilal SaleemNo ratings yet

- Solved You Have Been Hired by The Government of Kenya WhichDocument1 pageSolved You Have Been Hired by The Government of Kenya WhichM Bilal SaleemNo ratings yet

- Solved You Won A Free Ticket To See A Bruce SpringsteenDocument1 pageSolved You Won A Free Ticket To See A Bruce SpringsteenM Bilal SaleemNo ratings yet

- Solved With A Purchase Price of 350 000 A Small Warehouse ProvidesDocument1 pageSolved With A Purchase Price of 350 000 A Small Warehouse ProvidesM Bilal SaleemNo ratings yet

- Solved You Are The Manager of A Monopoly A Typical Consumer SDocument1 pageSolved You Are The Manager of A Monopoly A Typical Consumer SM Bilal SaleemNo ratings yet

- Solved You Are An Advisor To The Egyptian Government Which HasDocument1 pageSolved You Are An Advisor To The Egyptian Government Which HasM Bilal SaleemNo ratings yet

- Solved You Are Driving On A Trip and Have Two ChoicesDocument1 pageSolved You Are Driving On A Trip and Have Two ChoicesM Bilal SaleemNo ratings yet

- Solved Why Should The Early Adopters of An Information Technology SystemDocument1 pageSolved Why Should The Early Adopters of An Information Technology SystemM Bilal SaleemNo ratings yet

- Solved Your Brother Calls You On The Phone Telling You ThatDocument1 pageSolved Your Brother Calls You On The Phone Telling You ThatM Bilal SaleemNo ratings yet

- Solved You Are A Usda Pork Analyst Charged With Keeping Up To DateDocument1 pageSolved You Are A Usda Pork Analyst Charged With Keeping Up To DateM Bilal SaleemNo ratings yet

- Solved You Are Considering Buying A New House and Have FoundDocument1 pageSolved You Are Considering Buying A New House and Have FoundM Bilal SaleemNo ratings yet

- Solved You Are Given The Production Function y Ak1 3n2 3 WhereDocument1 pageSolved You Are Given The Production Function y Ak1 3n2 3 WhereM Bilal SaleemNo ratings yet

- Solved You and Your Roommate Have A Stack of Dirty DishesDocument1 pageSolved You and Your Roommate Have A Stack of Dirty DishesM Bilal SaleemNo ratings yet

- Solved You Are Considering An Investment in 30 Year Bonds Issued byDocument1 pageSolved You Are Considering An Investment in 30 Year Bonds Issued byM Bilal SaleemNo ratings yet

- Solved You Plan To Purchase A House For 115 000 UsingDocument1 pageSolved You Plan To Purchase A House For 115 000 UsingM Bilal SaleemNo ratings yet

- Solved You Have Decided That You Are Going To Consume 600Document1 pageSolved You Have Decided That You Are Going To Consume 600M Bilal SaleemNo ratings yet

- Solved You Have 832 66 in A Savings Account That Offers ADocument1 pageSolved You Have 832 66 in A Savings Account That Offers AM Bilal SaleemNo ratings yet

- Solved You Can Either Take A Bus or Drive Your CarDocument1 pageSolved You Can Either Take A Bus or Drive Your CarM Bilal SaleemNo ratings yet

- Solved You Are Selling Two Goods 1 and 2 To ADocument1 pageSolved You Are Selling Two Goods 1 and 2 To AM Bilal SaleemNo ratings yet

- Solved With The Growth of The Internet There Are A LargeDocument1 pageSolved With The Growth of The Internet There Are A LargeM Bilal SaleemNo ratings yet

- Solved Wilson Walks Into His Class 10 Minutes Late Because HeDocument1 pageSolved Wilson Walks Into His Class 10 Minutes Late Because HeM Bilal SaleemNo ratings yet

- Solved With Reference To Figure 14 4 Explain A Why There Will BeDocument1 pageSolved With Reference To Figure 14 4 Explain A Why There Will BeM Bilal SaleemNo ratings yet

- OfferVault and CPA AFfiliate MarketingDocument37 pagesOfferVault and CPA AFfiliate Marketingajajkhan22659No ratings yet

- Formal Planning ProcessDocument10 pagesFormal Planning Processislam elnassagNo ratings yet

- Case Gowex SummaryDocument7 pagesCase Gowex SummaryyaniNo ratings yet

- San Diego Padres New Era Arch 59FIFTY Fitted Hat - BrownDocument1 pageSan Diego Padres New Era Arch 59FIFTY Fitted Hat - BrownRicardo GomezNo ratings yet

- Insurance Capsule For UIIC Assistant UIIC AO NICL AO GIC Assistant Manager 2024 Part 2Document9 pagesInsurance Capsule For UIIC Assistant UIIC AO NICL AO GIC Assistant Manager 2024 Part 2induNo ratings yet

- SAP Security GRC Consultant in United States Resume Rory GoreeDocument2 pagesSAP Security GRC Consultant in United States Resume Rory GoreeRoryGoreeNo ratings yet

- Charlse Handy - Virtual OrganizationDocument6 pagesCharlse Handy - Virtual OrganizationmabonaNo ratings yet

- U3 - L18 Nature Importance of Staffing PDFDocument1 pageU3 - L18 Nature Importance of Staffing PDFRandyl Medina FernandezNo ratings yet

- KatniDocument1 pageKatniRUPNIT PHOTOGRAPHYNo ratings yet

- Name: Nurul Salihah Binti Abdullah ID: 55213117016 The Facet ModelDocument5 pagesName: Nurul Salihah Binti Abdullah ID: 55213117016 The Facet ModelSalihah AbdullahNo ratings yet

- General Motors and CaterpillarDocument41 pagesGeneral Motors and CaterpillarAnirban BiswasNo ratings yet

- Detroit Contract With ShotSpotter Inc.Document307 pagesDetroit Contract With ShotSpotter Inc.Malachi BarrettNo ratings yet

- Spotify Versus Apple Music - CAPSTONE - Cemalettin ÖrkcüDocument6 pagesSpotify Versus Apple Music - CAPSTONE - Cemalettin ÖrkcücemalettinorkcuNo ratings yet

- Ecoman AssignmentDocument11 pagesEcoman AssignmentJohn Stephen EusebioNo ratings yet

- f3 NightDocument11 pagesf3 NightabasNo ratings yet

- Dwnload Full Mcgraw Hills Taxation of Individuals and Business Entities 2019 10th Edition Spilker Test Bank PDFDocument36 pagesDwnload Full Mcgraw Hills Taxation of Individuals and Business Entities 2019 10th Edition Spilker Test Bank PDFmagnusngah7aaz100% (9)

- Assignment McDonald'sDocument20 pagesAssignment McDonald'smaimunaNo ratings yet

- Journal of Asian Scientific Research, 2014, 4 (10) : 558-573Document16 pagesJournal of Asian Scientific Research, 2014, 4 (10) : 558-573Imtiaz AhmedNo ratings yet

- Tax Alert: The Transfer Pricing Guidelines, 2020Document5 pagesTax Alert: The Transfer Pricing Guidelines, 2020musaNo ratings yet

- Sales 2020Document100 pagesSales 2020Dhanica Panganiban100% (1)

- Management Accounting and Business Tutorial Activity SolutionDocument2 pagesManagement Accounting and Business Tutorial Activity SolutionTran NguyenNo ratings yet

- Overnight CPA Riches V1 PDFDocument62 pagesOvernight CPA Riches V1 PDFLucasNo ratings yet

- Planning and Deploying A Successful Intranet Interact SoftwareDocument41 pagesPlanning and Deploying A Successful Intranet Interact SoftwaregmaranzanaNo ratings yet

- MA25Document5 pagesMA25Enyell QtyNo ratings yet

- Chapter Two: The Global Business Environment and Its Implication in Foreign ProcurementDocument37 pagesChapter Two: The Global Business Environment and Its Implication in Foreign ProcurementTariku AsmamawNo ratings yet

- Deepak ProjectDocument62 pagesDeepak Projectdeepak singhNo ratings yet

- SITXCOM010 Conflict Resolution Policy and ProceduresDocument4 pagesSITXCOM010 Conflict Resolution Policy and ProceduresDilbar PathakNo ratings yet