Professional Documents

Culture Documents

Poolvac Ansawers

Poolvac Ansawers

Uploaded by

wasif ahmed0 ratings0% found this document useful (0 votes)

5 views1 pageThe regression results show that the parameter estimates for both the variable cost and demand equations are statistically significant and have the required signs. The variable cost function is U-shaped, with average and marginal costs both being U-shaped as well. Minimum average variable cost occurs at a quantity of 1407.8, where AVC is $109.65. Demand is downward sloping, with pool cleaners being a normal good and the two companies selling substitute goods. At a price of $296.22, quantity demanded is 1725.8, total revenue is $511,221 and total cost is $238,049, resulting in a profit of $273,172.

Original Description:

Original Title

poolvac ansawers

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe regression results show that the parameter estimates for both the variable cost and demand equations are statistically significant and have the required signs. The variable cost function is U-shaped, with average and marginal costs both being U-shaped as well. Minimum average variable cost occurs at a quantity of 1407.8, where AVC is $109.65. Demand is downward sloping, with pool cleaners being a normal good and the two companies selling substitute goods. At a price of $296.22, quantity demanded is 1725.8, total revenue is $511,221 and total cost is $238,049, resulting in a profit of $273,172.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pagePoolvac Ansawers

Poolvac Ansawers

Uploaded by

wasif ahmedThe regression results show that the parameter estimates for both the variable cost and demand equations are statistically significant and have the required signs. The variable cost function is U-shaped, with average and marginal costs both being U-shaped as well. Minimum average variable cost occurs at a quantity of 1407.8, where AVC is $109.65. Demand is downward sloping, with pool cleaners being a normal good and the two companies selling substitute goods. At a price of $296.22, quantity demanded is 1725.8, total revenue is $511,221 and total cost is $238,049, resulting in a profit of $273,172.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

a.

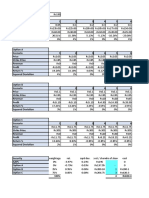

Regression results for variable cost (table)

The parameter estimates â , b̂ , and ĉ are all statistically significant at the 5 percent level or

better. The parameter estimates have the required signs for a U-shaped AVC function: aˆ 0 ,

bˆ 0 , and cˆ 0 .

b. TVC 152.881Q 0.06141Q 0.00002181Q

2 3

AVC 152.881 0.06141Q 0.00002181Q 2

MC 152.881 0.12282Q 0.00006543Q 2

Qmin 1407.8 AVC $109.65

c. and

a-Regression result for Demand (table)

ˆ

The parameter estimates ê , f , and ĝ are all statistically significant at the 5 percent level or

better.

eˆ 0 as required by the law of demand.

fˆ 0 indicates Sting Rays are normal (not inferior) goods.

gˆ 0 indicates PoolVac and Howard Industries are selling substitute (not complement) goods.

Qd 4912.60 10.7582 P

b. Demand:

P 456.6377 0.09295Qd

Inverse Demand:

MR 456.6377 0.18590Qd

Marginal Revenue:

3. P = $296.22; Q = 1725.8; TR = $511,221; TC = $238,049; Profit = $273,172.

4. E = –1.8465; increase, 9.2; rise; fall

5. EM = 0.8067

a. Yes, pool cleaners for swimming pools are likely to be normal goods not inferior goods.

b. Increase; 8.1

6. EXR = 0.4586

a. Yes, PoolVac and Howard Industries are selling substitute goods not complement goods.

b. Decrease; 1.4

7. P = $296.22; Q = 1725.8; TR = $511,221; TC = $248,049; Profit = $263,172.

8. $228.32; $187,588; lower than

You might also like

- Ch. 13 Leverage and Capital Structure AnswersDocument23 pagesCh. 13 Leverage and Capital Structure Answersbetl89% (28)

- Managerial Economics Baye Solutions (3-5)Document36 pagesManagerial Economics Baye Solutions (3-5)Rahim Rajani77% (22)

- Mgmt2032 Mid TermDocument10 pagesMgmt2032 Mid Termzhart1921No ratings yet

- Managerial Economics, Allen, Test Bank, CH 7Document10 pagesManagerial Economics, Allen, Test Bank, CH 7SBNo ratings yet

- Key Answer Isom 351Document14 pagesKey Answer Isom 351Yijia QianNo ratings yet

- 002 Topic 2b (Set A) Q - 98212a37f76c2aeb76f391122e9 - 202405051917 - 02377Document9 pages002 Topic 2b (Set A) Q - 98212a37f76c2aeb76f391122e9 - 202405051917 - 02377vooyinyin6No ratings yet

- Assignment 2-Feb2023Document18 pagesAssignment 2-Feb2023NURUL HANISNo ratings yet

- Solutions: To Odd-Numbered ProblemsDocument2 pagesSolutions: To Odd-Numbered ProblemsNajib ElNo ratings yet

- Test Bank For Om 5 5Th Edition Collier Evans 1285451376 9781285451374 Full Chapter PDFDocument36 pagesTest Bank For Om 5 5Th Edition Collier Evans 1285451376 9781285451374 Full Chapter PDFmichael.bermudes802100% (12)

- 02 MA2 LRP QuestionsDocument36 pages02 MA2 LRP QuestionsKopanang Leokana50% (2)

- PoolVac CaseDocument4 pagesPoolVac Caseshenjicodo0% (2)

- Cha10 EEDocument4 pagesCha10 EENguyen Huynh Duc LocNo ratings yet

- F2021 - MGT 2070 - Midterm MOCK ExamDocument8 pagesF2021 - MGT 2070 - Midterm MOCK ExamcsnzigptbvzwtvvddvNo ratings yet

- Answer Key - Econ 4351 - Midterm IIDocument5 pagesAnswer Key - Econ 4351 - Midterm IIAdam RenfroNo ratings yet

- Answers Chapter 7 & 8Document5 pagesAnswers Chapter 7 & 8Inanda ErvitaNo ratings yet

- CVP Exercises ReviewerDocument2 pagesCVP Exercises Reviewerdaniellejueco1228No ratings yet

- Principles of Managerial Finance Chapter 10Document13 pagesPrinciples of Managerial Finance Chapter 10vireu100% (3)

- Lycoming IO-360-A, - C, - D, - J, - K & AIO-360 Series Power ChartDocument13 pagesLycoming IO-360-A, - C, - D, - J, - K & AIO-360 Series Power ChartAbdullah SindhuNo ratings yet

- Micro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCDocument6 pagesMicro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCAhmadnur JulNo ratings yet

- Micro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCDocument6 pagesMicro Chapter 21 Practice Problems #2 Key: $ MC AVC ATCSoweirdNo ratings yet

- 06 Park ISM ch06 PDFDocument44 pages06 Park ISM ch06 PDFBenn DoucetNo ratings yet

- Quiz 2 Mang.Document5 pagesQuiz 2 Mang.Mahmoud KassemNo ratings yet

- Lecture 4Document15 pagesLecture 4Khurrum MughalNo ratings yet

- Cost ComboDocument188 pagesCost ComboShruti MohanrajNo ratings yet

- Elasticity and Demand ExerciseDocument7 pagesElasticity and Demand ExerciseKhairul Bashar Bhuiyan 1635167090No ratings yet

- 02 Micro ECO Assignment 02Document3 pages02 Micro ECO Assignment 02Syed TaqiNo ratings yet

- Homework Economic - Topic 2.3Document13 pagesHomework Economic - Topic 2.3Do Van Tu100% (1)

- Second Exam-Practice Test Questions-1Document11 pagesSecond Exam-Practice Test Questions-1srkdonNo ratings yet

- DPF ModelsDocument15 pagesDPF ModelsCURRENT AFFAIRS with KARANNo ratings yet

- Chapter 04 - Cost Theory and AnalysisDocument27 pagesChapter 04 - Cost Theory and Analysisphannarith100% (2)

- FA1 Chapter 8 EngDocument18 pagesFA1 Chapter 8 Enghahahaha wahahahhaNo ratings yet

- Test Bank Chapter 2Document13 pagesTest Bank Chapter 2mkranaNo ratings yet

- 897practice Final SolutionsDocument36 pages897practice Final SolutionsZeynep BaşkanNo ratings yet

- PS 2 Fall 2010Document3 pagesPS 2 Fall 2010Rizwan BashirNo ratings yet

- Assignment 3 SolDocument4 pagesAssignment 3 SolSyed Mohammad Ali Zaidi KarbalaiNo ratings yet

- PR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaDocument14 pagesPR Pertemuan 8 Chapter 13 Breakeven and Payback Analysis: Courses Jessica ChresstellaArsyil AkhirbanyNo ratings yet

- CIMA P2 AnswersDocument72 pagesCIMA P2 AnswersAssignmentsNo ratings yet

- NPV IrrDocument6 pagesNPV IrrKnt Nallasamy GounderNo ratings yet

- Microeconomic Theory Basic Principles and Extensions 10th Edition Nicholson Test BankDocument39 pagesMicroeconomic Theory Basic Principles and Extensions 10th Edition Nicholson Test Bankmasonpowellkp28100% (15)

- NPV IrrDocument6 pagesNPV IrrJuan AntonioNo ratings yet

- Econ Long Quiz 1Document2 pagesEcon Long Quiz 1mby2nrx59bNo ratings yet

- Solution Excel 2DDocument6 pagesSolution Excel 2DSooHan MoonNo ratings yet

- BLUE Exam 1 - Econ 419 - Fall 2012Document7 pagesBLUE Exam 1 - Econ 419 - Fall 2012tellmewhourNo ratings yet

- ReSA B44 MS Final PB Exam Questions Answers and SolutionsDocument12 pagesReSA B44 MS Final PB Exam Questions Answers and SolutionsWesNo ratings yet

- Principles of MIcroeconomics - Lecture - Markets/Supply/Demand - Part 2Document17 pagesPrinciples of MIcroeconomics - Lecture - Markets/Supply/Demand - Part 2Katherine Sauer100% (1)

- Sample Packet Exam IIDocument12 pagesSample Packet Exam IILaphat PiriyakiarNo ratings yet

- Session 5 - Cost of CapitalDocument49 pagesSession 5 - Cost of CapitalMuhammad HanafiNo ratings yet

- Answers To Multiple Choice Questions: Brief ExercisesDocument4 pagesAnswers To Multiple Choice Questions: Brief ExercisesBSA-2C John Dominic MiaNo ratings yet

- Eric Stevanus - 2201756600 - LA28: Assignment 2: Part ADocument2 pagesEric Stevanus - 2201756600 - LA28: Assignment 2: Part Aeric stevanusNo ratings yet

- Answer Keys (Problem Set-6)Document17 pagesAnswer Keys (Problem Set-6)Ameya SakpalNo ratings yet

- Bai Tap Toan Kinh TeDocument9 pagesBai Tap Toan Kinh TetranthevutNo ratings yet

- 74 C 85Document6 pages74 C 85Jorge M. FloresNo ratings yet

- Managerial Economics Applications Strategies and Tactics 13Th Edition Mcguigan Test Bank Full Chapter PDFDocument29 pagesManagerial Economics Applications Strategies and Tactics 13Th Edition Mcguigan Test Bank Full Chapter PDFJenniferPerrykisd100% (11)

- Managerial Accounting 6th Edition Jiambalvo Test Bank 1Document10 pagesManagerial Accounting 6th Edition Jiambalvo Test Bank 1crystalhensonfxjemnbkwg100% (27)

- Answers Are Displayed in Red.: Assumptions and Other Problem Notes Are Displayed at The Very BottomDocument11 pagesAnswers Are Displayed in Red.: Assumptions and Other Problem Notes Are Displayed at The Very Bottommandy YiuNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Science of Bubble Gum23fDocument2 pagesScience of Bubble Gum23fwasif ahmedNo ratings yet

- Course Outline MBA 2022Document5 pagesCourse Outline MBA 2022wasif ahmedNo ratings yet

- Case Study CDK Digital Marketing Addressing Channel Conflict With Data AnalyticsDocument11 pagesCase Study CDK Digital Marketing Addressing Channel Conflict With Data Analyticswasif ahmedNo ratings yet

- Depreciation Graph For Cockroach23dDocument3 pagesDepreciation Graph For Cockroach23dwasif ahmedNo ratings yet

- Case Study - Kectelogy P&L Analysisi Part 239823fDocument12 pagesCase Study - Kectelogy P&L Analysisi Part 239823fwasif ahmedNo ratings yet

- Depreciation Graph For CockroachDocument3 pagesDepreciation Graph For Cockroachwasif ahmedNo ratings yet

- Case Study - Kectelogy P&L Analysisi Part 087223fDocument12 pagesCase Study - Kectelogy P&L Analysisi Part 087223fwasif ahmedNo ratings yet

- Case Study - Kectelogy P&L Analysisi Part 34ex21e43erf23fsee2ww4weDocument3 pagesCase Study - Kectelogy P&L Analysisi Part 34ex21e43erf23fsee2ww4wewasif ahmedNo ratings yet

- 10922Document5 pages10922wasif ahmedNo ratings yet

- Unit 12Document37 pagesUnit 12wasif ahmedNo ratings yet

- Case Study of Tiger and Cat in The ForestDocument2 pagesCase Study of Tiger and Cat in The Forestwasif ahmedNo ratings yet

- Muhammad Saud Siddiqi - LRDocument32 pagesMuhammad Saud Siddiqi - LRwasif ahmedNo ratings yet

- Muhammad Saud Siddiqi - FRDocument104 pagesMuhammad Saud Siddiqi - FRwasif ahmedNo ratings yet

- Unit 14Document62 pagesUnit 14wasif ahmedNo ratings yet

- Banks - Loan - 1Document32 pagesBanks - Loan - 1wasif ahmedNo ratings yet

- Logistics Strategy and PlanningDocument9 pagesLogistics Strategy and Planningwasif ahmedNo ratings yet

- Unit 13Document42 pagesUnit 13wasif ahmedNo ratings yet

- Dynamics of Distribution & LogisticsDocument22 pagesDynamics of Distribution & Logisticswasif ahmedNo ratings yet

- Dynamics of Distribution & Logistics: Managing Distributors - Margins and ProfitabilityDocument6 pagesDynamics of Distribution & Logistics: Managing Distributors - Margins and Profitabilitywasif ahmedNo ratings yet

- Unit 08Document22 pagesUnit 08wasif ahmedNo ratings yet

- Dynamics of Distribution & LogisticsDocument6 pagesDynamics of Distribution & Logisticswasif ahmedNo ratings yet

- Fall Limit-Less: Day DQDocument2 pagesFall Limit-Less: Day DQwasif ahmedNo ratings yet