Professional Documents

Culture Documents

10922

Uploaded by

wasif ahmedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10922

Uploaded by

wasif ahmedCopyright:

Available Formats

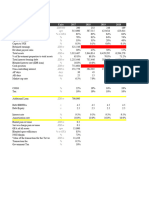

Total Investment Rs195

Scenario 1 2 3 4 5 6

Probability 0.05 0.1 0.2 0.3 0.2 0.1

AAPL Stock Price Rs235.00 Rs225.00 Rs205.00 Rs185.00 Rs175.00 Rs150.00

AAPL Stock Return Rs40.00 Rs30.00 Rs10.00 -Rs10.00 -Rs20.00 -Rs45.00

Return % 20.51% 15.38% 5.13% -5.13% -10.26% -23.08%

Squared Deviation 6% 4% 1% 0% 0% 4%

Option A

Scenario 1 2 3 4 5 6

Price Rs2.05 Rs2.05 Rs2.05 Rs2.05 Rs2.05 Rs2.05

Strike Price Rs185 Rs185 Rs185 Rs185 Rs185 Rs185

Revenue Rs0 Rs0 Rs0 Rs0 Rs10 Rs35

Profit -Rs2.05 -Rs2.05 -Rs2.05 -Rs2.05 Rs7.95 Rs32.95

Return % 19.26% 14.18% 4.03% -6.12% -6.12% -6.12%

Squared Deviation 4% 2% 0% 0% 0% 0%

Option B

Scenario 1 2 3 4 5 6

Price Rs5.1 Rs5.1 Rs5.1 Rs5.1 Rs5.1 Rs5.1

Strike Price Rs195 Rs195 Rs195 Rs195 Rs195 Rs195

Revenue Rs0 Rs0 Rs0 Rs10 Rs20 Rs45

Profit -Rs5.10 -Rs5.10 -Rs5.10 Rs4.90 Rs14.90 Rs39.90

Return % 17.44% 12.44% 2.45% -2.55% -2.55% -2.55%

Squared Deviation 3% 1% 0% 0% 0% 0%

Option C

Scenario 1 2 3 4 5 6

Price Rs11.75 Rs11.75 Rs11.75 Rs11.75 Rs11.75 Rs11.75

Strike Price Rs205 Rs205 Rs205 Rs205 Rs205 Rs205

Revenue Rs0 Rs0 Rs0 Rs20 Rs30 Rs55

Profit -Rs11.75 -Rs11.75 -Rs11.75 Rs8.25 Rs18.25 Rs43.25

Return % 13.66% 8.83% -0.85% -0.85% -0.85% -0.85%

Squared Deviation 2% 1% 0% 0% 0% 0%

Security weightage ret. sqrd dev. cost / share

ratio of shares cost

AAPL 0% -3.97% 0.23% Rs195 - 0

Option A 0% -0.79% 0.03% Rs197.05 - 0

Option B 25% 0.95% 0.00% Rs200.10 1 Rs200.1

Option C 75% 0.85% 0.00% Rs206.75 3 Rs620.3

100% 4 Rs820.4

2

Problem:

You have $10m

7 You can invest in the following 4 places:

0.05 Mean Return -3.97%

AAPL Stock worth 195

Rs130.00 Vairance 1.72% Put Option A Price: 2.05, Strike Price : 185

-Rs65.00 Risk (S.D) 13.11% Put Option B Price: 5.1 , Strike Price: 195

-33.33% Cost Rs195 Put Option C Price: 11.75, Strike Price: 205

9% Your goal is to minimize risk using the entire budget

optimal portfolio?

7

Rs2.05 Mean Return -0.79%

Rs185 Vairance 0.66%

Rs55 Risk (S.D) 8.10%

Rs52.95 Cost Rs197.05

-6.12%

0%

7

Rs5.1 Mean Return 0.95%

Rs195 Vairance 0.35%

Rs65 Risk (S.D) 5.93%

Rs59.90 Cost Rs200.10

-2.55%

0%

7

Rs11.75 Mean Return 0.85%

Rs205 Vairance 0.17%

Rs75 Risk (S.D) 4.13%

Rs63.25 Cost Rs206.75

-0.85%

0%

Total Investment Rs10,000,000

ratio of cost total cost

0 Rs - Weighted Return 0.87%

0 Rs - Weighted Vairance 0.00%

0.24392 Rs 2,500,000.00 Weighted Risk 0.04%

0.75608 Rs 7,500,000.00

1.00 Rs 10,000,000.00

Color Scheme ConstraintsObjective Changing Variable

ollowing 4 places:

05, Strike Price : 185

1 , Strike Price: 195

.75, Strike Price: 205

ze risk using the entire budget. What is the

You might also like

- Case Analysis - Mariott CorpDocument8 pagesCase Analysis - Mariott CorpratishmayankNo ratings yet

- Edgewonk's Math Cheat Sheet PDFDocument1 pageEdgewonk's Math Cheat Sheet PDFPrashant Tomar100% (1)

- An Introduction To Derivative Securities Financial Markets and Risk Management 1st Edition 2013 Jarrow ChatterjeaDocument881 pagesAn Introduction To Derivative Securities Financial Markets and Risk Management 1st Edition 2013 Jarrow Chatterjeahuhata100% (5)

- Cost of Capital NumericalsDocument9 pagesCost of Capital Numericalsckcnathan001No ratings yet

- STMT CASH 001 CACU014499 Oct2021-1Document5 pagesSTMT CASH 001 CACU014499 Oct2021-1Shaya NielsenNo ratings yet

- KjjuDocument237 pagesKjjuGuy Rider50% (2)

- Numbers and NarrativesDocument15 pagesNumbers and NarrativesPravin AwalkondeNo ratings yet

- 160 Tanuku Tanmai Prateek Q12Document6 pages160 Tanuku Tanmai Prateek Q12SATYA SHANKER KARINGULANo ratings yet

- Cost of CapitalDocument11 pagesCost of CapitalSakshi BaiwalNo ratings yet

- ACC LTD - Financial ModelDocument11 pagesACC LTD - Financial Modelmundadaharsh1No ratings yet

- The Stoploss and Re Entry MethodDocument3 pagesThe Stoploss and Re Entry MethodbooleanNo ratings yet

- Ways of Earnings ComputationsDocument37 pagesWays of Earnings Computationsedu manabatNo ratings yet

- Total Revenue: Product Profitability Analysis Template Sales Revenue DataDocument5 pagesTotal Revenue: Product Profitability Analysis Template Sales Revenue DataShubham DeshmukhNo ratings yet

- Sandeep Kothari Infinite Game FIL With The Masters June2023Document36 pagesSandeep Kothari Infinite Game FIL With The Masters June2023SiddharthNo ratings yet

- Assignment 1 SolutionDocument8 pagesAssignment 1 SolutionDanial HemaniNo ratings yet

- Varun BeveragesDocument16 pagesVarun BeveragesPuneet GirdharNo ratings yet

- Team Corleone - NMIMS Mumbai - FinancialsDocument6 pagesTeam Corleone - NMIMS Mumbai - FinancialsAkram MohiddinNo ratings yet

- Financial and DCF Model of Cipla LimitedDocument19 pagesFinancial and DCF Model of Cipla Limitedt2021basw010No ratings yet

- Adani Total GasDocument13 pagesAdani Total GasShiv LalwaniNo ratings yet

- Crops: Cost of ProductionDocument16 pagesCrops: Cost of ProductionFatma KatotoNo ratings yet

- KK Mankeu v2.4Document83 pagesKK Mankeu v2.4AkmalHafidzNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Pencapaian PI Bulanan: Proses No. Dok Indikator Kinerja Target Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecDocument16 pagesPencapaian PI Bulanan: Proses No. Dok Indikator Kinerja Target Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov DecafafiyyaNo ratings yet

- Corfin Study Case - Data Book and Working Paper - GalihAbimataDocument10 pagesCorfin Study Case - Data Book and Working Paper - GalihAbimataDImas AntonioNo ratings yet

- Tradeciety's Math Cheat Sheet: R-Multiple Required Winrate Drawdown Recovery RateDocument1 pageTradeciety's Math Cheat Sheet: R-Multiple Required Winrate Drawdown Recovery RateSchumacher JuniorNo ratings yet

- Ditta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Document36 pagesDitta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Ummaya MalikNo ratings yet

- Avenue SupermartDocument21 pagesAvenue SupermartAndy NainggolanNo ratings yet

- Finding A Minimum-Risk PortfolioDocument5 pagesFinding A Minimum-Risk PortfolioBhargaviNo ratings yet

- Day TradingDocument62 pagesDay TradingBahar Agus KurniawanNo ratings yet

- Fund Management - SIPDocument6 pagesFund Management - SIPZen TradzNo ratings yet

- Cop Crop ProductionDocument20 pagesCop Crop Productiongalaxy guoNo ratings yet

- Risk and Return: An Overview of Capital Market Theory: Problem 1Document6 pagesRisk and Return: An Overview of Capital Market Theory: Problem 1anubha srivastavaNo ratings yet

- Clarkson Lumber Co Calculations For StudentsDocument27 pagesClarkson Lumber Co Calculations For StudentsQuetzi AguirreNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- Temas FinancierosDocument82 pagesTemas FinancierosHenry Serrano PintoNo ratings yet

- AFM WorkingDocument7 pagesAFM Workingsairad1999No ratings yet

- Cipla Valuation ModelDocument17 pagesCipla Valuation ModelPuneet GirdharNo ratings yet

- Monthend Review July 2022 FinalDocument9 pagesMonthend Review July 2022 FinalRohit JaiswalNo ratings yet

- Balanced Scorecard Report: Corporate Owner Fresnillo OperationsDocument4 pagesBalanced Scorecard Report: Corporate Owner Fresnillo OperationsShun De VazNo ratings yet

- Planilha de Simulacao de ImpostosDocument29 pagesPlanilha de Simulacao de ImpostosFernando Brindes Da HoraNo ratings yet

- Toaz - Info Lmbo Binary Money Management System PRDocument2 pagesToaz - Info Lmbo Binary Money Management System PRRahul BohatNo ratings yet

- Item Uni/Año $/UNIDDocument11 pagesItem Uni/Año $/UNIDCatalina TiqueNo ratings yet

- Business Plan / Compensation Plan: E. Marco & A. Rodríguez, June 2013Document1 pageBusiness Plan / Compensation Plan: E. Marco & A. Rodríguez, June 2013EnriqueNo ratings yet

- UntitledDocument7 pagesUntitledShivangNo ratings yet

- Sensitivity Economic EvaluationDocument12 pagesSensitivity Economic EvaluationProject StudiNo ratings yet

- BondsDocument8 pagesBondsamirabbas mollaeiNo ratings yet

- Years To Maturity Spot/zero Rates Discount FunctionDocument6 pagesYears To Maturity Spot/zero Rates Discount FunctionAlly AbdullahNo ratings yet

- Turnover - 8 Turnover - 10 BenefitsDocument7 pagesTurnover - 8 Turnover - 10 BenefitsJoshua CabinasNo ratings yet

- AR ManagementDocument7 pagesAR ManagementJoshua CabinasNo ratings yet

- AR Management WorkbookDocument7 pagesAR Management WorkbookyukiNo ratings yet

- MARICO Ltd. - Financial ModelDocument12 pagesMARICO Ltd. - Financial Modelmundadaharsh1No ratings yet

- WorkbookDocument7 pagesWorkbookHarshit GoyalNo ratings yet

- Business Plan Format RJ ...Document9 pagesBusiness Plan Format RJ ...Deepak JhaNo ratings yet

- 8Document39 pages8Anirudh SubramanianNo ratings yet

- Capital Budgeting Class ExerciseDocument3 pagesCapital Budgeting Class ExerciseAryaman jaiswalNo ratings yet

- Basic Commercial Mathematics: Percentage, Profit & Loss, Simple Interest, Compound Interest, Growth & DepreciationDocument12 pagesBasic Commercial Mathematics: Percentage, Profit & Loss, Simple Interest, Compound Interest, Growth & Depreciationadposting wNo ratings yet

- Lucro Presumido Frete PorcentagemDocument9 pagesLucro Presumido Frete PorcentagemElivelton OliveiraNo ratings yet

- Asian Paint FMVRDocument20 pagesAsian Paint FMVRdeepaksg787No ratings yet

- ICDocument14 pagesICSridhar GandikotaNo ratings yet

- Trading Journal 08.11.21Document102 pagesTrading Journal 08.11.21krishna697No ratings yet

- Table 1: Performance of The Cooperatives Coop. 1 Coop. 2 Coop. 3Document10 pagesTable 1: Performance of The Cooperatives Coop. 1 Coop. 2 Coop. 3Abegail ArellanoNo ratings yet

- Final Assignment Business AnalyticsDocument10 pagesFinal Assignment Business AnalyticsSharoar Jahan SakibNo ratings yet

- Case Study CDK Digital Marketing Addressing Channel Conflict With Data AnalyticsDocument11 pagesCase Study CDK Digital Marketing Addressing Channel Conflict With Data Analyticswasif ahmedNo ratings yet

- Course Outline MBA 2022Document5 pagesCourse Outline MBA 2022wasif ahmedNo ratings yet

- Science of Bubble Gum23fDocument2 pagesScience of Bubble Gum23fwasif ahmedNo ratings yet

- Case Study - Kectelogy P&L Analysisi Part 34ex21e43erf23fsee2ww4weDocument3 pagesCase Study - Kectelogy P&L Analysisi Part 34ex21e43erf23fsee2ww4wewasif ahmedNo ratings yet

- Banks - Loan - 1Document32 pagesBanks - Loan - 1wasif ahmedNo ratings yet

- Depreciation Graph For CockroachDocument3 pagesDepreciation Graph For Cockroachwasif ahmedNo ratings yet

- Case Study of Tiger and Cat in The ForestDocument2 pagesCase Study of Tiger and Cat in The Forestwasif ahmedNo ratings yet

- Case Study - Kectelogy P&L Analysisi Part 239823fDocument12 pagesCase Study - Kectelogy P&L Analysisi Part 239823fwasif ahmedNo ratings yet

- Case Study - Kectelogy P&L Analysisi Part 087223fDocument12 pagesCase Study - Kectelogy P&L Analysisi Part 087223fwasif ahmedNo ratings yet

- Depreciation Graph For Cockroach23dDocument3 pagesDepreciation Graph For Cockroach23dwasif ahmedNo ratings yet

- Muhammad Saud Siddiqi - LRDocument32 pagesMuhammad Saud Siddiqi - LRwasif ahmedNo ratings yet

- Unit 13Document42 pagesUnit 13wasif ahmedNo ratings yet

- Unit 14Document62 pagesUnit 14wasif ahmedNo ratings yet

- Unit 12Document37 pagesUnit 12wasif ahmedNo ratings yet

- Dynamics of Distribution & Logistics: Managing Distributors - Margins and ProfitabilityDocument6 pagesDynamics of Distribution & Logistics: Managing Distributors - Margins and Profitabilitywasif ahmedNo ratings yet

- Logistics Strategy and PlanningDocument9 pagesLogistics Strategy and Planningwasif ahmedNo ratings yet

- Unit 08Document22 pagesUnit 08wasif ahmedNo ratings yet

- Fall Limit-Less: Day DQDocument2 pagesFall Limit-Less: Day DQwasif ahmedNo ratings yet

- Dynamics of Distribution & LogisticsDocument22 pagesDynamics of Distribution & Logisticswasif ahmedNo ratings yet

- Dynamics of Distribution & LogisticsDocument6 pagesDynamics of Distribution & Logisticswasif ahmedNo ratings yet

- Nomer 8 Ujian MKDocument5 pagesNomer 8 Ujian MKnoortiaNo ratings yet

- Bf2207 Final CheatsheetDocument2 pagesBf2207 Final CheatsheetBryan 林裕强No ratings yet

- Section A Group 1 Final SubmissionDocument31 pagesSection A Group 1 Final SubmissionAayush SaxenaNo ratings yet

- 9706 Accounts Nov 08 p4Document8 pages9706 Accounts Nov 08 p4hiraashrafNo ratings yet

- 13aasssd24c 58a58b1xxxxjsbf6c44dhyjb9669e8062c9xuunab338453Document3 pages13aasssd24c 58a58b1xxxxjsbf6c44dhyjb9669e8062c9xuunab338453Yuda GestriNo ratings yet

- Loan Valuation Using Present Value Analysis - FDICDocument25 pagesLoan Valuation Using Present Value Analysis - FDICAnonymous A0jSvP1100% (1)

- PEST Analysis of Securities Broking IndustryDocument33 pagesPEST Analysis of Securities Broking Industryhimanshushare100% (1)

- Basic Accounting: Concepts, Techniques, and ConventionsDocument22 pagesBasic Accounting: Concepts, Techniques, and Conventionsharikrishna_rsNo ratings yet

- BBMF2023Document7 pagesBBMF2023Yi Lin ChiamNo ratings yet

- Straight Line Method: Example 1Document8 pagesStraight Line Method: Example 1AkkamaNo ratings yet

- HB 311 CH 16 QuizDocument3 pagesHB 311 CH 16 QuizRyan Christian BalanquitNo ratings yet

- Cma-Vatsalya MineralsDocument13 pagesCma-Vatsalya MineralsAtul BhandariNo ratings yet

- Case Study 15112019a TOFLDocument5 pagesCase Study 15112019a TOFLSunny SouravNo ratings yet

- Pact Financial Proj B 3Document4 pagesPact Financial Proj B 3Benedict Arcino RodriguezNo ratings yet

- Dividend Policy at FPLDocument24 pagesDividend Policy at FPLKinnari PandyaNo ratings yet

- Relative Risk MeasuresDocument19 pagesRelative Risk MeasuresCarlos RojasNo ratings yet

- Chap5 Cost of CapitalDocument38 pagesChap5 Cost of CapitalIzzy BNo ratings yet

- Advanced Financial AccountingDocument6 pagesAdvanced Financial AccountingsathishNo ratings yet

- Financial Analysis Assignment No. 1Document9 pagesFinancial Analysis Assignment No. 1Shaista BanoNo ratings yet

- Creating Brand EquityDocument19 pagesCreating Brand EquitynahdiramuthiaNo ratings yet

- Intermediate+Financial+Accounting+I+-+Chapter+1+ SDocument38 pagesIntermediate+Financial+Accounting+I+-+Chapter+1+ SNeil StechschulteNo ratings yet

- Reporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No DifferentialDocument96 pagesReporting Intercorporate Investments and Consolidation of Wholly Owned Subsidiaries With No DifferentialShinta PakpahanNo ratings yet

- ch09-Inventories-Additional Valuation IssuesDocument50 pagesch09-Inventories-Additional Valuation IssuesrenandanfNo ratings yet

- Solutions To Problems AFAR2 Chapter 13Document18 pagesSolutions To Problems AFAR2 Chapter 13Jane DizonNo ratings yet

- Reverse DCFDocument9 pagesReverse DCFjenkisanNo ratings yet

- The Importance of Working Capital ManagementDocument2 pagesThe Importance of Working Capital ManagementparthNo ratings yet