Professional Documents

Culture Documents

The Trial Balance Extracted From The Books of Mary A

Uploaded by

Bube KachevskaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Trial Balance Extracted From The Books of Mary A

Uploaded by

Bube KachevskaCopyright:

Available Formats

The trial balance extracted from the books of Mary a #8200

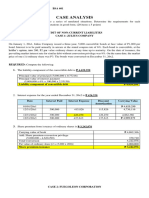

The trial balance extracted from the books of Mary, a sole trader, as at 31December 20X3 was

as follows:Additional information1. Inventory on hand on 31 December 20X3 is £94,280.2.

Rates paid in advance at 31 December 20X3 are £600.3.General expenses unpaid at 31

December 20X3 are £1,660.4. Provision for doubtful debts is to be adjusted to £2,410.5. A

motor van purchased on 1 January of this year at a cost of £8,000 was traded in for £3,500 on

31 December 20X3 and a new van purchased at a cost of £10,000 on the same day. The

amount due on the new van was payable on 1 January 20X4. No entries had been made in the

books in respect of this transaction when the trial balance at 31 December 20X3 was

extracted.6. Depreciation is to be charged on furniture and equipment at the rate of 5 per cent

per annum on cost and at the rate of 25 per cent per annum (reducing balance method) on

motor vehicles.RequiredPrepare Mary's statement of profit and loss for the year ended 31

December 20X3 and statement of financial position as at 31 December 20X3.View Solution:

The trial balance extracted from the books of Mary a

ANSWER

http://paperinstant.com/downloads/the-trial-balance-extracted-from-the-books-of-mary-a/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Abbie Merry VecinaBSA 6011Document7 pagesAbbie Merry VecinaBSA 6011elleeeewoodssssNo ratings yet

- Preparing Financial StatementsDocument18 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Intermediate Accounting 1 Quiz 1Document4 pagesIntermediate Accounting 1 Quiz 1Manuel MagadatuNo ratings yet

- Quiz - Chapter 32 - She Part 1 PrintingDocument3 pagesQuiz - Chapter 32 - She Part 1 PrintingAllen Kate50% (2)

- The Trial Balance of Norr LTD at 31 December 20x2Document1 pageThe Trial Balance of Norr LTD at 31 December 20x2Bube KachevskaNo ratings yet

- T Murray Has Prepared The Following Bank Ledger Account ForDocument1 pageT Murray Has Prepared The Following Bank Ledger Account ForMiroslav GegoskiNo ratings yet

- The Following Trial Balance Has Been Extracted From The LedgerDocument1 pageThe Following Trial Balance Has Been Extracted From The LedgerBube KachevskaNo ratings yet

- Consider The December Transactions For Crystal Clear Cleaning That WereDocument1 pageConsider The December Transactions For Crystal Clear Cleaning That Werehassan taimourNo ratings yet

- RMIT FR Week 3 Solutions PDFDocument115 pagesRMIT FR Week 3 Solutions PDFKiabu ParindaliNo ratings yet

- ENMG602 Week5 HW3Document3 pagesENMG602 Week5 HW3Issam TamerNo ratings yet

- Field Green and Lane Are in Partnership Making Up FinancialDocument1 pageField Green and Lane Are in Partnership Making Up FinancialBube KachevskaNo ratings yet

- The Company S Yearend Is 31 December 20x3 Prepare Ledger AccountsDocument1 pageThe Company S Yearend Is 31 December 20x3 Prepare Ledger AccountsMiroslav GegoskiNo ratings yet

- ' BUS10250 Financial Accounting Semester B 2019-2020 Written Assignment 3Document2 pages' BUS10250 Financial Accounting Semester B 2019-2020 Written Assignment 3Y KNo ratings yet

- Light and Dark Are in Partnership Sharing Profits and LossesDocument1 pageLight and Dark Are in Partnership Sharing Profits and LossesMiroslav GegoskiNo ratings yet

- The Following Account Balances Were Included in Bromley Company S BalanceDocument1 pageThe Following Account Balances Were Included in Bromley Company S BalanceTaimur TechnologistNo ratings yet

- Veronica Is The Owner of A Manufacturing Business The FollowingDocument1 pageVeronica Is The Owner of A Manufacturing Business The FollowingMiroslav GegoskiNo ratings yet

- Kathy Herman Opened Kwick Cleaners On March 1 2010 DuringDocument1 pageKathy Herman Opened Kwick Cleaners On March 1 2010 DuringM Bilal SaleemNo ratings yet

- Module A: Foundation ExaminationDocument5 pagesModule A: Foundation ExaminationHar San LeeNo ratings yet

- Gorlin Corporation Was Chartered in The Commonwealth of Massachusetts TheDocument1 pageGorlin Corporation Was Chartered in The Commonwealth of Massachusetts Thetrilocksp SinghNo ratings yet

- CAF-1 Over All Lecture Notes of Pre Batch (Without Basics)Document35 pagesCAF-1 Over All Lecture Notes of Pre Batch (Without Basics)Bushra AsgharNo ratings yet

- Cash Cash Equivalents Ia 1 2020 EditionDocument3 pagesCash Cash Equivalents Ia 1 2020 EditionmarielleNo ratings yet

- Foreign TransactionsDocument3 pagesForeign TransactionsMary Jescho Vidal AmpilNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- The Following Accounts Appeared in The December 31 Trial Balance PDFDocument1 pageThe Following Accounts Appeared in The December 31 Trial Balance PDFFreelance WorkerNo ratings yet

- Intermediate Accounting - MidtermsDocument9 pagesIntermediate Accounting - MidtermsKim Cristian MaañoNo ratings yet

- FOREX Part2Document9 pagesFOREX Part2misonim.eNo ratings yet

- Maraid Wendy and Diane Have Been in Partnership For ADocument1 pageMaraid Wendy and Diane Have Been in Partnership For AMiroslav GegoskiNo ratings yet

- BUSI 1001/1004 - Financial Accounting Sample Final ExaminationDocument19 pagesBUSI 1001/1004 - Financial Accounting Sample Final ExaminationThe oneNo ratings yet

- The Statement of Financial Position As at 31 December 20x2Document2 pagesThe Statement of Financial Position As at 31 December 20x2Amit PandeyNo ratings yet

- The Treasurer of Murray Golf Club Has Prepared The FollowingDocument1 pageThe Treasurer of Murray Golf Club Has Prepared The FollowingBube KachevskaNo ratings yet

- Reviewer AdvacDocument4 pagesReviewer AdvacMarjorie AmpongNo ratings yet

- Lecturing C Meeting 01 - Paper F3 PDFDocument34 pagesLecturing C Meeting 01 - Paper F3 PDFchrislinNo ratings yet

- Final ExamDocument5 pagesFinal ExamMishalm96No ratings yet

- PRELIM Quiz 1 Cash, CE, PCF, Bank ReconDocument8 pagesPRELIM Quiz 1 Cash, CE, PCF, Bank ReconApril Faye de la CruzNo ratings yet

- Copper Hospitals Trial Balance at November 30 20x2 Which Includes Data Accumulated Since 2Document3 pagesCopper Hospitals Trial Balance at November 30 20x2 Which Includes Data Accumulated Since 2CharlotteNo ratings yet

- FR ACCA Test FullDocument16 pagesFR ACCA Test Fullduducchi2308No ratings yet

- Year Sales Actual Warranty ExpendituresDocument5 pagesYear Sales Actual Warranty ExpendituresMinie KimNo ratings yet

- Preparing Financial StatementsDocument15 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Adjustments For Preparation of Financial Statements (ACCA)Document9 pagesAdjustments For Preparation of Financial Statements (ACCA)team aspirantsNo ratings yet

- Accn08bquiz1 pt2 PDF FreeDocument5 pagesAccn08bquiz1 pt2 PDF FreeChi ChiNo ratings yet

- Dayag 9Document2 pagesDayag 9dmangiginNo ratings yet

- Test 2 - Chap 8,10,11 & 12Document9 pagesTest 2 - Chap 8,10,11 & 12Bhushan SawantNo ratings yet

- This Problem Continues The Crystal Clear Cleaning Problem Crystal Clear PDFDocument1 pageThis Problem Continues The Crystal Clear Cleaning Problem Crystal Clear PDFAhsan KhanNo ratings yet

- Accounting PoliciesDocument8 pagesAccounting PoliciesJandyeeNo ratings yet

- S Bullock A Farmer Makes Up His Financial Statements ToDocument1 pageS Bullock A Farmer Makes Up His Financial Statements ToBube KachevskaNo ratings yet

- The Following Selected Transactions Were Completed by Gutters Co During PDFDocument1 pageThe Following Selected Transactions Were Completed by Gutters Co During PDFTaimur TechnologistNo ratings yet

- The Accounts Listed On The Next Page Appeared in TheDocument1 pageThe Accounts Listed On The Next Page Appeared in TheM Bilal SaleemNo ratings yet

- (Backup) (Backup) FA1 Revision 2019Document32 pages(Backup) (Backup) FA1 Revision 2019Hiền nguyễn thuNo ratings yet

- Franchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Document4 pagesFranchise: Jan. 1, 20x1 Feb. 1, 20x1 Apr. 1, 20x1Vine AlparitoNo ratings yet

- Selected Transactions Completed by Kornett Company During Its First FiscalDocument4 pagesSelected Transactions Completed by Kornett Company During Its First FiscalAmit PandeyNo ratings yet

- Assume Brilliant Spring Company Uses The Perpetual Inventory System TheDocument1 pageAssume Brilliant Spring Company Uses The Perpetual Inventory System Thehassan taimourNo ratings yet

- InvestmentsDocument2 pagesInvestmentsKRISHNA MAE PERANGNo ratings yet

- AAAAAAAAAAAAAADocument8 pagesAAAAAAAAAAAAAAEl - loolNo ratings yet

- Unseen 9.1b 9.2bDocument3 pagesUnseen 9.1b 9.2bayandaNo ratings yet

- The Statement of Financial Position of Beta LTD As atDocument1 pageThe Statement of Financial Position of Beta LTD As atBube KachevskaNo ratings yet

- 6 Disposal of Fixed AssetsDocument6 pages6 Disposal of Fixed Assetsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- Depreciation: Accountancy - II 1Document9 pagesDepreciation: Accountancy - II 1M JEEVARATHNAM NAIDUNo ratings yet

- The Transactions Completed by Ps Music During June 2016 WereDocument1 pageThe Transactions Completed by Ps Music During June 2016 WereBube KachevskaNo ratings yet

- The Unadjusted Trial Balance of Fashion Centre LTD Contained TheDocument2 pagesThe Unadjusted Trial Balance of Fashion Centre LTD Contained TheBube KachevskaNo ratings yet

- The Yard Shop Sells Plants Fertilizers and Other Garden ProductsDocument1 pageThe Yard Shop Sells Plants Fertilizers and Other Garden ProductsBube KachevskaNo ratings yet

- The Statement of Financial Position of Euston LTD As atDocument1 pageThe Statement of Financial Position of Euston LTD As atBube KachevskaNo ratings yet

- The Summarized Statements of Financial Position As at 31 MarchDocument1 pageThe Summarized Statements of Financial Position As at 31 MarchBube KachevskaNo ratings yet

- The Unadjusted Trial Balance of Mesa Inc at The Company SDocument2 pagesThe Unadjusted Trial Balance of Mesa Inc at The Company SBube KachevskaNo ratings yet

- The Transactions Completed by Revere Courier Company During December 2014Document1 pageThe Transactions Completed by Revere Courier Company During December 2014Bube KachevskaNo ratings yet

- The Treasurer of Murray Golf Club Has Prepared The FollowingDocument1 pageThe Treasurer of Murray Golf Club Has Prepared The FollowingBube KachevskaNo ratings yet

- The Treasurer of The Senior Social Club Has Prepared TheDocument1 pageThe Treasurer of The Senior Social Club Has Prepared TheBube KachevskaNo ratings yet

- The Trial Balance of Harmonica LTD at 31 December 20x1Document1 pageThe Trial Balance of Harmonica LTD at 31 December 20x1Bube KachevskaNo ratings yet

- The Walt Disney Company Has Four Major Sectors Described AsDocument1 pageThe Walt Disney Company Has Four Major Sectors Described AsBube KachevskaNo ratings yet

- The Statement of Financial Position and Statement of Profit andDocument1 pageThe Statement of Financial Position and Statement of Profit andBube KachevskaNo ratings yet

- The Village Hat Shop Limited Counted The Entire Inventory inDocument1 pageThe Village Hat Shop Limited Counted The Entire Inventory inBube KachevskaNo ratings yet

- The Records of Pelletier Inc Show The Following Data ForDocument2 pagesThe Records of Pelletier Inc Show The Following Data ForBube KachevskaNo ratings yet

- The Statement of Financial Position of Beta LTD As atDocument1 pageThe Statement of Financial Position of Beta LTD As atBube KachevskaNo ratings yet

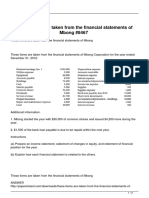

- These Items Are Taken From The Financial Statements of MbongDocument2 pagesThese Items Are Taken From The Financial Statements of MbongBube KachevskaNo ratings yet

- These Items Are Taken From Financial Statements of Beaulieu Limited PDFDocument2 pagesThese Items Are Taken From Financial Statements of Beaulieu Limited PDFBube KachevskaNo ratings yet

- The Records of Kmeta Inc Show The Following Data ForDocument2 pagesThe Records of Kmeta Inc Show The Following Data ForBube KachevskaNo ratings yet

- The Partnership of Nuan Zhang and Jen Phuah Needed AdditionalDocument1 pageThe Partnership of Nuan Zhang and Jen Phuah Needed AdditionalBube KachevskaNo ratings yet

- The Partnership of Malkin Neale Staal Has Experienced OperatingDocument1 pageThe Partnership of Malkin Neale Staal Has Experienced OperatingBube KachevskaNo ratings yet

- The Statement of Financial Position of C F LTD For TheDocument1 pageThe Statement of Financial Position of C F LTD For TheBube KachevskaNo ratings yet

- The Purchases Journal For Wallace Window Cleaners Inc Is ShownDocument1 pageThe Purchases Journal For Wallace Window Cleaners Inc Is ShownBube KachevskaNo ratings yet

- The Partnership of Telliher Bachra and Lang Has Experienced OperatingDocument2 pagesThe Partnership of Telliher Bachra and Lang Has Experienced OperatingBube KachevskaNo ratings yet

- The Piano Studio LTD Has Provided You With The FollowingDocument2 pagesThe Piano Studio LTD Has Provided You With The FollowingBube KachevskaNo ratings yet

- The Revenue Journal For Evergreen Consulting Inc Is Shown BelowDocument1 pageThe Revenue Journal For Evergreen Consulting Inc Is Shown BelowBube KachevskaNo ratings yet

- The Partnership of Du Chong and Quing Has Experienced OperatingDocument1 pageThe Partnership of Du Chong and Quing Has Experienced OperatingBube KachevskaNo ratings yet

- The Radical Edge LTD A Ski Tuning and Repair ShopDocument2 pagesThe Radical Edge LTD A Ski Tuning and Repair ShopBube KachevskaNo ratings yet

- The Partnership of Sewell Grange and Jones Has Just CompletedDocument1 pageThe Partnership of Sewell Grange and Jones Has Just CompletedBube KachevskaNo ratings yet

- The Production Supervisor of The Machining Department For Lei CompanyDocument1 pageThe Production Supervisor of The Machining Department For Lei CompanyBube KachevskaNo ratings yet