Professional Documents

Culture Documents

The Partnership of Sewell Grange and Jones Has Just Completed

The Partnership of Sewell Grange and Jones Has Just Completed

Uploaded by

Bube KachevskaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Partnership of Sewell Grange and Jones Has Just Completed

The Partnership of Sewell Grange and Jones Has Just Completed

Uploaded by

Bube KachevskaCopyright:

Available Formats

The partnership of Sewell Grange and Jones has just

completed #8254

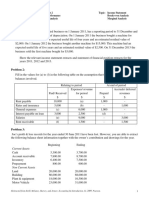

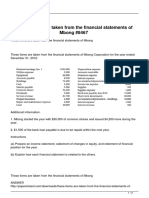

The partnership of Sewell, Grange and Jones has just completed its first year in business. The

partnership agreement stipulates that profits should be apportioned in the ratio of Sewell 3,

Grange 2 and Jones 1 after allowing interest on capital at 12 per cent per annum and crediting

Sewell with a salary of £15,000.The following information relates to their first financial year that

ended on 31 October 20X3:1. The partners introduced the following amounts as capital on 1

November

20X2:_________________£Sewel..............50000Gronge............40000Jones...............200002.

Cash drawings during the year

were:_________________£Sewel..............3900Gronge............4500Jones...............24003. The

draft statement of profit and loss for the year showed a profit for the year of £61,720.4. Included

in the motor expenses account for the year was a bill for £300 that related to Grange's private

motoring expenses.5. No entries had been made in the financial statements to record the

following:a. As a result of a cash flow problem during April, Grange invested a further £10,000

as capital with effect from 1 May 20X3, and on the same date Jones brought into the business

additional items of equipment at an agreed valuation of £6,000. In addition, in order to settle a

debt, Jones had privately undertaken some work for Foster, a creditor of the partnership. Foster

accepted the work as full settlement of the £12,000 the partnership owed her for materials.b.

Sewell had accepted a holiday provided by Miller, a credit customer of the partnership. The

holiday, which was valued at £1,000, was accepted in full settlement of a debt of £2,500 that

Miller owed to the partnership and that he was unable to pay.c. Each partner had taken goods

for his own use during the year at cost as

follows:_________________£Sewel..............1400Gronge............2100Jones...............2100It is

the policy of the firm to depreciate equipment at the rate of 10 per cent per annum based on the

cost of equipment held at the end of each financial year.Requireda. The appropriation account

for the year ended 31 October 20X3 showing clearly the corrected profit from the first year's

trading.b. The capital and current accounts of Sewell, Grange and Jones for the year ended 31

October 20X3.View Solution:

The partnership of Sewell Grange and Jones has just completed

ANSWER

http://paperinstant.com/downloads/the-partnership-of-sewell-grange-and-jones-has-just-

completed/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Fabozzi Solution ManualDocument21 pagesFabozzi Solution ManualNhlanhla ZuluNo ratings yet

- NISM-Series-VIII Equity Derivatives Solved Exam QuestionsDocument21 pagesNISM-Series-VIII Equity Derivatives Solved Exam QuestionsHitisha agrawalNo ratings yet

- Auditing ProblemsDocument67 pagesAuditing ProblemsAngelica Ann Salen100% (1)

- Week 2Document6 pagesWeek 2Maryane AngelaNo ratings yet

- FAR Summary Lecture (14 May 2021)Document10 pagesFAR Summary Lecture (14 May 2021)rav danoNo ratings yet

- Module 1.1 - Partnership Formation PDFDocument4 pagesModule 1.1 - Partnership Formation PDFMila MercadoNo ratings yet

- ACCT 3001 Exams 1 and 2 All QuestionsDocument7 pagesACCT 3001 Exams 1 and 2 All QuestionsRegine VegaNo ratings yet

- Uts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFDocument4 pagesUts - Akm3 - Suci Purnama Devi - F0318108 - E17.9 & P21.13 PDFSuci Purnama Devi100% (1)

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- Joint Arrangement QS Problems No AnswerDocument7 pagesJoint Arrangement QS Problems No AnswerChristine Jane Abang100% (1)

- QUIZ 3 CompileDocument12 pagesQUIZ 3 CompileChanel AnnNo ratings yet

- Quiz Chapter 7 Leases Part 1 2021Document2 pagesQuiz Chapter 7 Leases Part 1 2021Jennifer Reloso100% (1)

- 2 Ceilli Set A (Eng)Document24 pages2 Ceilli Set A (Eng)chiewteck0% (1)

- Capital Structure Analysis of Lafarge SuDocument21 pagesCapital Structure Analysis of Lafarge SuRakibul IslamNo ratings yet

- ACC 308 - Week2 - 2-2 Homework - Chapter 10Document8 pagesACC 308 - Week2 - 2-2 Homework - Chapter 10Lilian LNo ratings yet

- Brick Stone and Breeze Carry On A Manufacturing Business inDocument1 pageBrick Stone and Breeze Carry On A Manufacturing Business inMiroslav GegoskiNo ratings yet

- Field Green and Lane Are in Partnership Making Up FinancialDocument1 pageField Green and Lane Are in Partnership Making Up FinancialBube KachevskaNo ratings yet

- trắc nghiệm part 2Document39 pagestrắc nghiệm part 2HankhnilNo ratings yet

- IFRS 15 Maths PDFDocument4 pagesIFRS 15 Maths PDFFeruz Sha RakinNo ratings yet

- CFAB Accounting Chapter 9. Accruals and PrepaymentsDocument33 pagesCFAB Accounting Chapter 9. Accruals and PrepaymentsVânAnh NguyễnNo ratings yet

- Leases - Brief ExercisesDocument5 pagesLeases - Brief ExercisesPeachyNo ratings yet

- Final ExamDocument11 pagesFinal Examdar •No ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasAdrian RoxasNo ratings yet

- The Trial Balance of Norr LTD at 31 December 20x2Document1 pageThe Trial Balance of Norr LTD at 31 December 20x2Bube KachevskaNo ratings yet

- AFAR 2nd Monthly AssessmentDocument7 pagesAFAR 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- Long Quiz Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document4 pagesLong Quiz Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- MCQ - Current Liabilities واجبDocument5 pagesMCQ - Current Liabilities واجبmode.xp.jamelNo ratings yet

- CFAB - Accounting - QB - Chapter 9Document13 pagesCFAB - Accounting - QB - Chapter 9Nga Đào Thị Hằng100% (1)

- Tutorial 2-Income Statement - Break-Even Modified PDFDocument5 pagesTutorial 2-Income Statement - Break-Even Modified PDFKhiren MenonNo ratings yet

- Leases - ASSIGNMENT 1Document2 pagesLeases - ASSIGNMENT 1PeachyNo ratings yet

- Hawthorn and Privet Have Carried On Business in Partnership ForDocument1 pageHawthorn and Privet Have Carried On Business in Partnership ForBube Kachevska0% (1)

- Chapter E21Document2 pagesChapter E21Matus HanunNo ratings yet

- St. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)Document7 pagesSt. Mary'S University Department of Accounting Advanced Accounting MID EXAM (30%)temedebereNo ratings yet

- Review of FA3Document9 pagesReview of FA3ngquynhanh3110No ratings yet

- Ac5007 QuestionsDocument8 pagesAc5007 QuestionsyinlengNo ratings yet

- Activity Debt Restructuring LeaseDocument2 pagesActivity Debt Restructuring LeaseLory Dela PeñaNo ratings yet

- Contoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Document9 pagesContoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Mega LengkongNo ratings yet

- Financial Quali - ADocument9 pagesFinancial Quali - ACarl AngeloNo ratings yet

- As CH # 6 Partnership Final AccountsDocument15 pagesAs CH # 6 Partnership Final AccountsHamza AsadNo ratings yet

- 2.2. PPE IAS16 - Practice - EnglishDocument12 pages2.2. PPE IAS16 - Practice - EnglishBích TrâmNo ratings yet

- Module A: Foundation ExaminationDocument5 pagesModule A: Foundation ExaminationHar San LeeNo ratings yet

- Partnership CE QuestionsDocument19 pagesPartnership CE QuestionsChan Chin ChunNo ratings yet

- Day 1 - Capital Gain TaxDocument20 pagesDay 1 - Capital Gain TaxAbdullah EjazNo ratings yet

- Recitation #9Document5 pagesRecitation #9wtfNo ratings yet

- The Company S Yearend Is 31 December 20x3 Prepare Ledger AccountsDocument1 pageThe Company S Yearend Is 31 December 20x3 Prepare Ledger AccountsMiroslav GegoskiNo ratings yet

- AssignmentsWk8 2Document3 pagesAssignmentsWk8 2simamo4203No ratings yet

- Kuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerDocument4 pagesKuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerBastian Nugraha SiraitNo ratings yet

- Set ADocument6 pagesSet AJeremiah Navarro PilotonNo ratings yet

- Street Rhode and Close Carried On Business in Partnership SharingDocument1 pageStreet Rhode and Close Carried On Business in Partnership SharingBube KachevskaNo ratings yet

- On December 31 2010 Clean and White Linen Supplies LTDDocument1 pageOn December 31 2010 Clean and White Linen Supplies LTDFreelance WorkerNo ratings yet

- Solutions To Multiple Choice Questions, Exercises and ProblemsDocument30 pagesSolutions To Multiple Choice Questions, Exercises and ProblemsJan SpantonNo ratings yet

- Acttg Process QstnsDocument4 pagesActtg Process QstnsMicheleNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Mock Test 1Document7 pagesMock Test 1Toàn ĐứcNo ratings yet

- CFR Paper 2020 PDFDocument10 pagesCFR Paper 2020 PDFharoon nasirNo ratings yet

- Partnership AccountsDocument15 pagesPartnership AccountsAbdul Sameeu MohamedNo ratings yet

- Partnership AccountsDocument15 pagesPartnership AccountsAbdul Sameeu MohamedNo ratings yet

- The Following Information Relates To Redwood City During Its FiscalDocument1 pageThe Following Information Relates To Redwood City During Its FiscalMuhammad ShahidNo ratings yet

- August 20 DiscussionDocument26 pagesAugust 20 DiscussionJOSCEL SYJONGTIANNo ratings yet

- Exercise Chap 7Document16 pagesExercise Chap 7JF FNo ratings yet

- Sheet (6) Tegara English First Year Financial Accounting: GroubDocument11 pagesSheet (6) Tegara English First Year Financial Accounting: Groubmagdy kamelNo ratings yet

- Adjusting Entries: Problem 1Document9 pagesAdjusting Entries: Problem 1Wholehearted LayoutsNo ratings yet

- Poem PoemDocument5 pagesPoem PoemElizabeth Espinosa ManilagNo ratings yet

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- Report on the Cost of Living in Ireland, June 1922From EverandReport on the Cost of Living in Ireland, June 1922No ratings yet

- The Statement of Financial Position of Euston LTD As atDocument1 pageThe Statement of Financial Position of Euston LTD As atBube KachevskaNo ratings yet

- The Treasurer of The Senior Social Club Has Prepared TheDocument1 pageThe Treasurer of The Senior Social Club Has Prepared TheBube KachevskaNo ratings yet

- The Trial Balance Extracted From The Books of Mary ADocument1 pageThe Trial Balance Extracted From The Books of Mary ABube KachevskaNo ratings yet

- The Transactions Completed by Ps Music During June 2016 WereDocument1 pageThe Transactions Completed by Ps Music During June 2016 WereBube KachevskaNo ratings yet

- The Unadjusted Trial Balance of Fashion Centre LTD Contained TheDocument2 pagesThe Unadjusted Trial Balance of Fashion Centre LTD Contained TheBube KachevskaNo ratings yet

- The Treasurer of Murray Golf Club Has Prepared The FollowingDocument1 pageThe Treasurer of Murray Golf Club Has Prepared The FollowingBube KachevskaNo ratings yet

- The Unadjusted Trial Balance of Mesa Inc at The Company SDocument2 pagesThe Unadjusted Trial Balance of Mesa Inc at The Company SBube KachevskaNo ratings yet

- The Summarized Statements of Financial Position As at 31 MarchDocument1 pageThe Summarized Statements of Financial Position As at 31 MarchBube KachevskaNo ratings yet

- The Yard Shop Sells Plants Fertilizers and Other Garden ProductsDocument1 pageThe Yard Shop Sells Plants Fertilizers and Other Garden ProductsBube KachevskaNo ratings yet

- The Trial Balance of Harmonica LTD at 31 December 20x1Document1 pageThe Trial Balance of Harmonica LTD at 31 December 20x1Bube KachevskaNo ratings yet

- The Statement of Financial Position and Statement of Profit andDocument1 pageThe Statement of Financial Position and Statement of Profit andBube KachevskaNo ratings yet

- The Village Hat Shop Limited Counted The Entire Inventory inDocument1 pageThe Village Hat Shop Limited Counted The Entire Inventory inBube KachevskaNo ratings yet

- The Transactions Completed by Revere Courier Company During December 2014Document1 pageThe Transactions Completed by Revere Courier Company During December 2014Bube KachevskaNo ratings yet

- The Walt Disney Company Has Four Major Sectors Described AsDocument1 pageThe Walt Disney Company Has Four Major Sectors Described AsBube KachevskaNo ratings yet

- These Items Are Taken From The Financial Statements of MbongDocument2 pagesThese Items Are Taken From The Financial Statements of MbongBube KachevskaNo ratings yet

- The Statement of Financial Position of C F LTD For TheDocument1 pageThe Statement of Financial Position of C F LTD For TheBube KachevskaNo ratings yet

- The Statement of Financial Position of Beta LTD As atDocument1 pageThe Statement of Financial Position of Beta LTD As atBube KachevskaNo ratings yet

- The Trial Balance of Norr LTD at 31 December 20x2Document1 pageThe Trial Balance of Norr LTD at 31 December 20x2Bube KachevskaNo ratings yet

- The Revenue Journal For Evergreen Consulting Inc Is Shown BelowDocument1 pageThe Revenue Journal For Evergreen Consulting Inc Is Shown BelowBube KachevskaNo ratings yet

- The Records of Kmeta Inc Show The Following Data ForDocument2 pagesThe Records of Kmeta Inc Show The Following Data ForBube KachevskaNo ratings yet

- The Records of Pelletier Inc Show The Following Data ForDocument2 pagesThe Records of Pelletier Inc Show The Following Data ForBube KachevskaNo ratings yet

- The Partnership of Nuan Zhang and Jen Phuah Needed AdditionalDocument1 pageThe Partnership of Nuan Zhang and Jen Phuah Needed AdditionalBube KachevskaNo ratings yet

- These Items Are Taken From Financial Statements of Beaulieu Limited PDFDocument2 pagesThese Items Are Taken From Financial Statements of Beaulieu Limited PDFBube KachevskaNo ratings yet

- The Partnership of Telliher Bachra and Lang Has Experienced OperatingDocument2 pagesThe Partnership of Telliher Bachra and Lang Has Experienced OperatingBube KachevskaNo ratings yet

- The Piano Studio LTD Has Provided You With The FollowingDocument2 pagesThe Piano Studio LTD Has Provided You With The FollowingBube KachevskaNo ratings yet

- The Partnership of Malkin Neale Staal Has Experienced OperatingDocument1 pageThe Partnership of Malkin Neale Staal Has Experienced OperatingBube KachevskaNo ratings yet

- The Radical Edge LTD A Ski Tuning and Repair ShopDocument2 pagesThe Radical Edge LTD A Ski Tuning and Repair ShopBube KachevskaNo ratings yet

- The Partnership of Du Chong and Quing Has Experienced OperatingDocument1 pageThe Partnership of Du Chong and Quing Has Experienced OperatingBube KachevskaNo ratings yet

- The Purchases Journal For Wallace Window Cleaners Inc Is ShownDocument1 pageThe Purchases Journal For Wallace Window Cleaners Inc Is ShownBube KachevskaNo ratings yet

- The Production Supervisor of The Machining Department For Lei CompanyDocument1 pageThe Production Supervisor of The Machining Department For Lei CompanyBube KachevskaNo ratings yet

- Reading 59 Performance Calculation and Appraisal of Alternative InvestmentsDocument4 pagesReading 59 Performance Calculation and Appraisal of Alternative InvestmentsNeerajNo ratings yet

- Problem 4-5 - Chapter 4 - Investments in Equity SecuritiesDocument2 pagesProblem 4-5 - Chapter 4 - Investments in Equity SecuritiesDennise Marie Buranday BoniaoNo ratings yet

- Resume 8.7.2012Document1 pageResume 8.7.2012Cole FunNo ratings yet

- CH1Document55 pagesCH1星喬No ratings yet

- Maskeliya Plantations PLC and Kahawatta Plantations PLC (1199)Document22 pagesMaskeliya Plantations PLC and Kahawatta Plantations PLC (1199)Bajalock VirusNo ratings yet

- Quizzer 1 - OverallDocument25 pagesQuizzer 1 - OverallJan Elaine CalderonNo ratings yet

- Intro Financial Management PresentationDocument17 pagesIntro Financial Management PresentationSoothing BlendNo ratings yet

- Calvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Document12 pagesCalvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Jhoanne CalvoNo ratings yet

- Ratio AnalysisDocument5 pagesRatio Analysisvini2710No ratings yet

- DPDCDocument49 pagesDPDCsamuelNo ratings yet

- Available Index in KenyaDocument4 pagesAvailable Index in KenyaFarjana AnwarNo ratings yet

- Maple Leaf Foods MLF Is A Canadian Manufacturer of MeatDocument1 pageMaple Leaf Foods MLF Is A Canadian Manufacturer of MeatLet's Talk With HassanNo ratings yet

- Value-Based Metrics: Foundations and Practice: June 2000Document3 pagesValue-Based Metrics: Foundations and Practice: June 2000abdelmutalabNo ratings yet

- Modern Portfolio Theory and Investment Analysis, 7th EditionDocument6 pagesModern Portfolio Theory and Investment Analysis, 7th EditionAniket GaikwadNo ratings yet

- Financial Accounting Standards BoardDocument12 pagesFinancial Accounting Standards BoardNoor HossainNo ratings yet

- Chapter 10: Risk-Return and Asset Pricing ModelsDocument22 pagesChapter 10: Risk-Return and Asset Pricing Modelstjarnob13No ratings yet

- Debt A-BDocument270 pagesDebt A-BkasyapNo ratings yet

- Applications of SukukDocument14 pagesApplications of SukukUsama AnsariiNo ratings yet

- China Industrials: Rail Juggernaut: CSR-CNR Merger AnnouncedDocument8 pagesChina Industrials: Rail Juggernaut: CSR-CNR Merger AnnouncedethandanfordNo ratings yet

- Argus Coal Daily International: ContentsDocument11 pagesArgus Coal Daily International: ContentsFatah. RNo ratings yet

- Gide To Indiv Work-2Document13 pagesGide To Indiv Work-2Daiva ValienėNo ratings yet

- Case Study - Indian StartupsDocument5 pagesCase Study - Indian StartupsYash LakhwaniNo ratings yet

- The Valuation Coundrum in The United Tech - Pytheon Merger)Document4 pagesThe Valuation Coundrum in The United Tech - Pytheon Merger)Tayba AwanNo ratings yet

- Evca Yearbook PDFDocument2 pagesEvca Yearbook PDFJonNo ratings yet