Professional Documents

Culture Documents

Hawthorn and Privet Have Carried On Business in Partnership For

Uploaded by

Bube Kachevska0%(1)0% found this document useful (1 vote)

76 views1 pageHawthorn and Privet Have Carried on Business in Partnership For

Original Title

Hawthorn and Privet Have Carried on Business in Partnership For

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHawthorn and Privet Have Carried on Business in Partnership For

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

76 views1 pageHawthorn and Privet Have Carried On Business in Partnership For

Uploaded by

Bube KachevskaHawthorn and Privet Have Carried on Business in Partnership For

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

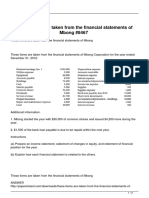

Hawthorn and Privet have carried on business in

partnership for #8264

Hawthorn and Privet have carried on business in partnership for a number of years, sharing

profits in the ratio of 4 : 3 after charging interest on capital at 4 per cent per annum. Holly was

admitted into the partnership on 1 October 20X2, and the terms of the partnership from then

were agreed as follows: 1. Partners' annual salaries to be: Hawthorn £1,800, Privet £1,200,

Holly £1,100.2. Interest on capital to be charged at 4 per cent per annum.3. Profits to be shared:

Hawthorn four-ninths, Privet three-ninths, Holly two ninths. On 1 October 20X2 Holly paid

£7,000 into the partnership bank and of this amount £2,100 was in respect of the share of

goodwill acquired by her. Since the partnership has never created, and does not intend to

create, a goodwill account, the full amount of £7,000 was credited for the time being to Holly's

capital account at 1 October 20X2.The trial balance of the partnership at 30 June 20X3 was as

follows:After taking into account the following information and the adjustment required for

goodwill, prepare a statement of profit and loss for the year ended 30 June 20X3 and a

statement of financial position as on that date. On 30 June 20X3:1. Inventory was £15,000.2.

Rates (£110) and wages and salaries (£300) were outstanding.3. Telephone rental paid in

advance was £9.4. Provision for bad debts is to be adjusted to 2.5 per cent of trade

receivables.5. Depreciation is to be provided on furniture, fixtures and fittings at 10 per

cent.Apportionments required are to be made on a time basis.View Solution:

Hawthorn and Privet have carried on business in partnership for

ANSWER

http://paperinstant.com/downloads/hawthorn-and-privet-have-carried-on-business-in-partnership-

for/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesFrom EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesNo ratings yet

- December 2002 ACCA Paper 2.5 QuestionsDocument11 pagesDecember 2002 ACCA Paper 2.5 QuestionsUlanda2No ratings yet

- Thông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Document367 pagesThông tư 200/2014 (Tiếng Anh) Circular 200/2014 (English-Free)Kent PhamNo ratings yet

- Strategic Business Management Exam Nov 2019Document22 pagesStrategic Business Management Exam Nov 2019Wong AndrewNo ratings yet

- Ias 40 Ias 40investment PropertyDocument16 pagesIas 40 Ias 40investment PropertyPhebieon MukwenhaNo ratings yet

- BFD Notes Part 1 Investment AppraisalDocument24 pagesBFD Notes Part 1 Investment Appraisalzaheer shahzadNo ratings yet

- December 2006 P4 QuestionDocument11 pagesDecember 2006 P4 QuestionKrishantha WeerasiriNo ratings yet

- P6ATX Revision Question Bank SelectedQuestions PDFDocument46 pagesP6ATX Revision Question Bank SelectedQuestions PDFMubashar HussainNo ratings yet

- MACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionDocument8 pagesMACC 709 GROUP 3 ASSIGNMENT GROSS INCOME 2020 (2) Final SolutionFadzai MhepoNo ratings yet

- Case Study Ep November 2012Document19 pagesCase Study Ep November 2012Sajjad Cheema100% (1)

- William WongDocument3 pagesWilliam WongKashif Mehmood0% (1)

- PPE Intangibles ImpairmentDocument96 pagesPPE Intangibles ImpairmentNomthetho ZincumeNo ratings yet

- Final Chapter 2 Revised 2015Document92 pagesFinal Chapter 2 Revised 2015Nearchos A. IoannouNo ratings yet

- The Fall of Enron: Group 1Document20 pagesThe Fall of Enron: Group 1Thiện NhânNo ratings yet

- Chapter 1 - Updated-1 PDFDocument29 pagesChapter 1 - Updated-1 PDFj000diNo ratings yet

- FR Tutorials 2022 - Some Theory Question SolutionDocument26 pagesFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDocument11 pagesACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainNo ratings yet

- CIMA P3 First IntuitionDocument212 pagesCIMA P3 First IntuitionMyo NaingNo ratings yet

- I Cap If Rs QuestionsDocument34 pagesI Cap If Rs QuestionsUsmän MïrżäNo ratings yet

- F7 Sir Zubair NotesDocument119 pagesF7 Sir Zubair NotesAli OpNo ratings yet

- Financial Accounting March 2009 Marks PlanDocument14 pagesFinancial Accounting March 2009 Marks Plankarlr9No ratings yet

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid AliNo ratings yet

- Accounting: The Institute of Chartered Accountants in England and WalesDocument26 pagesAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhNo ratings yet

- F9 Past PapersDocument32 pagesF9 Past PapersBurhan MaqsoodNo ratings yet

- F8 - BPP Passcard (2017)Document161 pagesF8 - BPP Passcard (2017)Dime PierrowNo ratings yet

- Recognition of CIM QualificationsDocument6 pagesRecognition of CIM QualificationsrazanymNo ratings yet

- F20-AAUD Questions Dec08Document3 pagesF20-AAUD Questions Dec08irfanki0% (1)

- Gagnon Company Reported The Following Sales and Quality Costs ForDocument1 pageGagnon Company Reported The Following Sales and Quality Costs ForAmit PandeyNo ratings yet

- Financial Management: Page 1 of 7Document7 pagesFinancial Management: Page 1 of 7cima2k15No ratings yet

- BPP AccaDocument1 pageBPP AccaNawazish Gillani0% (1)

- Dec 2007 - AnsDocument10 pagesDec 2007 - AnsHubbak KhanNo ratings yet

- Chapter 1 Accruals and prepayments (應計與預付項目) : 1.2 Cash accounting vs. accrual accounting (現金制會計與應計制會計)Document20 pagesChapter 1 Accruals and prepayments (應計與預付項目) : 1.2 Cash accounting vs. accrual accounting (現金制會計與應計制會計)Haroon AhmadNo ratings yet

- KPMG - CB Assistance Final Report - Oct 2012Document22 pagesKPMG - CB Assistance Final Report - Oct 2012Deepak Bahl & Co.No ratings yet

- F5 - Revision Answers Dec 2010Document32 pagesF5 - Revision Answers Dec 2010Vagabond Princess Rj67% (3)

- F9FM RQB Conts - j09klDocument8 pagesF9FM RQB Conts - j09klErclanNo ratings yet

- Accountant TestDocument3 pagesAccountant TestMax SuperNo ratings yet

- Financial Accounting September 2012 Marks Plan ICAEWDocument14 pagesFinancial Accounting September 2012 Marks Plan ICAEWMuhammad Ziaul HaqueNo ratings yet

- 17-BSA 700 and 705Document16 pages17-BSA 700 and 705Sohel Rana100% (1)

- September 2022 Audit and Assurance Paper ICAEWDocument10 pagesSeptember 2022 Audit and Assurance Paper ICAEWTaminderNo ratings yet

- Consolidated Financial StatementsDocument33 pagesConsolidated Financial StatementsTamirat Eshetu Wolde100% (1)

- Nust Tax Module Jan 2018Document180 pagesNust Tax Module Jan 2018Phebieon MukwenhaNo ratings yet

- SBR Study Notes - 2018 - FinalDocument293 pagesSBR Study Notes - 2018 - Finalprerana pawar100% (2)

- SA 701 MCQsDocument2 pagesSA 701 MCQspreethesh kumarNo ratings yet

- Practice Questions - Ratio AnalysisDocument2 pagesPractice Questions - Ratio Analysissaltee100% (5)

- Tareq Ahmed (Faisal) M.J.Abedin & CoDocument49 pagesTareq Ahmed (Faisal) M.J.Abedin & Cotusher pepolNo ratings yet

- Cv-Sithara FernandoDocument4 pagesCv-Sithara Fernandoapi-539974905No ratings yet

- BPP Publishing ACCA 2017 Studying Materials: Study Text Practice & Revision KitDocument4 pagesBPP Publishing ACCA 2017 Studying Materials: Study Text Practice & Revision KitYasir AliNo ratings yet

- Mia by Law SlideDocument8 pagesMia by Law Slidehaziqhussin33No ratings yet

- Acca SBR 204 210 PDFDocument7 pagesAcca SBR 204 210 PDFYudheesh P 1822082No ratings yet

- Chapter-1 of Advanced AccountingDocument4 pagesChapter-1 of Advanced AccountingAsif AliNo ratings yet

- Summary of IFRSDocument32 pagesSummary of IFRSFarwa Samreen67% (3)

- P4 ACCA Summary + Revision Notes 2021Document139 pagesP4 ACCA Summary + Revision Notes 2021Farman ShaikhNo ratings yet

- F7 June 2013 BPP Answers - LowresDocument16 pagesF7 June 2013 BPP Answers - Lowreskumassa kenya100% (1)

- Part C F5 RevisionDocument20 pagesPart C F5 RevisionMazni HanisahNo ratings yet

- Fac 3703Document99 pagesFac 3703Nozipho MpofuNo ratings yet

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKDocument206 pagesICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderNo ratings yet

- All ISADocument30 pagesAll ISANTurin1435No ratings yet

- Jun 2005 - AnsDocument13 pagesJun 2005 - AnsHubbak Khan100% (1)

- The Transactions Completed by Ps Music During June 2016 WereDocument1 pageThe Transactions Completed by Ps Music During June 2016 WereBube KachevskaNo ratings yet

- The Yard Shop Sells Plants Fertilizers and Other Garden ProductsDocument1 pageThe Yard Shop Sells Plants Fertilizers and Other Garden ProductsBube KachevskaNo ratings yet

- The Unadjusted Trial Balance of Mesa Inc at The Company SDocument2 pagesThe Unadjusted Trial Balance of Mesa Inc at The Company SBube KachevskaNo ratings yet

- The Trial Balance Extracted From The Books of Mary ADocument1 pageThe Trial Balance Extracted From The Books of Mary ABube KachevskaNo ratings yet

- The Statement of Financial Position of Euston LTD As atDocument1 pageThe Statement of Financial Position of Euston LTD As atBube KachevskaNo ratings yet

- The Unadjusted Trial Balance of Fashion Centre LTD Contained TheDocument2 pagesThe Unadjusted Trial Balance of Fashion Centre LTD Contained TheBube KachevskaNo ratings yet

- The Treasurer of The Senior Social Club Has Prepared TheDocument1 pageThe Treasurer of The Senior Social Club Has Prepared TheBube KachevskaNo ratings yet

- The Walt Disney Company Has Four Major Sectors Described AsDocument1 pageThe Walt Disney Company Has Four Major Sectors Described AsBube KachevskaNo ratings yet

- The Trial Balance of Harmonica LTD at 31 December 20x1Document1 pageThe Trial Balance of Harmonica LTD at 31 December 20x1Bube KachevskaNo ratings yet

- The Summarized Statements of Financial Position As at 31 MarchDocument1 pageThe Summarized Statements of Financial Position As at 31 MarchBube KachevskaNo ratings yet

- The Village Hat Shop Limited Counted The Entire Inventory inDocument1 pageThe Village Hat Shop Limited Counted The Entire Inventory inBube KachevskaNo ratings yet

- The Transactions Completed by Revere Courier Company During December 2014Document1 pageThe Transactions Completed by Revere Courier Company During December 2014Bube KachevskaNo ratings yet

- The Stockholders Equity Section of Velcro World Is Presented Here VelcroDocument1 pageThe Stockholders Equity Section of Velcro World Is Presented Here VelcroBube KachevskaNo ratings yet

- The Treasurer of Murray Golf Club Has Prepared The FollowingDocument1 pageThe Treasurer of Murray Golf Club Has Prepared The FollowingBube KachevskaNo ratings yet

- The Statement of Financial Position and Statement of Profit andDocument1 pageThe Statement of Financial Position and Statement of Profit andBube KachevskaNo ratings yet

- These Items Are Taken From Financial Statements of Beaulieu Limited PDFDocument2 pagesThese Items Are Taken From Financial Statements of Beaulieu Limited PDFBube KachevskaNo ratings yet

- The Trial Balance of Norr LTD at 31 December 20x2Document1 pageThe Trial Balance of Norr LTD at 31 December 20x2Bube KachevskaNo ratings yet

- The Records of Kmeta Inc Show The Following Data ForDocument2 pagesThe Records of Kmeta Inc Show The Following Data ForBube KachevskaNo ratings yet

- The Statement of Financial Position of Beta LTD As atDocument1 pageThe Statement of Financial Position of Beta LTD As atBube KachevskaNo ratings yet

- These Items Are Taken From The Financial Statements of MbongDocument2 pagesThese Items Are Taken From The Financial Statements of MbongBube KachevskaNo ratings yet

- The Statement of Financial Position of C F LTD For TheDocument1 pageThe Statement of Financial Position of C F LTD For TheBube KachevskaNo ratings yet

- The Records of Pelletier Inc Show The Following Data ForDocument2 pagesThe Records of Pelletier Inc Show The Following Data ForBube KachevskaNo ratings yet

- The Partnership of Nuan Zhang and Jen Phuah Needed AdditionalDocument1 pageThe Partnership of Nuan Zhang and Jen Phuah Needed AdditionalBube KachevskaNo ratings yet

- The Partnership of Malkin Neale Staal Has Experienced OperatingDocument1 pageThe Partnership of Malkin Neale Staal Has Experienced OperatingBube KachevskaNo ratings yet

- The Partnership of Pavelski Ovechin and Oh Has Experienced OperatingDocument1 pageThe Partnership of Pavelski Ovechin and Oh Has Experienced OperatingBube KachevskaNo ratings yet

- The Revenue Journal For Evergreen Consulting Inc Is Shown BelowDocument1 pageThe Revenue Journal For Evergreen Consulting Inc Is Shown BelowBube KachevskaNo ratings yet

- The Piano Studio LTD Has Provided You With The FollowingDocument2 pagesThe Piano Studio LTD Has Provided You With The FollowingBube KachevskaNo ratings yet

- The Partnership of Telliher Bachra and Lang Has Experienced OperatingDocument2 pagesThe Partnership of Telliher Bachra and Lang Has Experienced OperatingBube KachevskaNo ratings yet

- The Partnership of Du Chong and Quing Has Experienced OperatingDocument1 pageThe Partnership of Du Chong and Quing Has Experienced OperatingBube KachevskaNo ratings yet

- The Purchases Journal For Wallace Window Cleaners Inc Is ShownDocument1 pageThe Purchases Journal For Wallace Window Cleaners Inc Is ShownBube KachevskaNo ratings yet

- Application Icx Sales ManagerDocument5 pagesApplication Icx Sales ManagerPersy LópezNo ratings yet

- C1036 16Document10 pagesC1036 16masoudNo ratings yet

- h110m Pro VD Plus User GuideDocument19 pagesh110m Pro VD Plus User GuideIgobi LohnNo ratings yet

- Inter 10 - Third ClassDocument96 pagesInter 10 - Third ClassRicardo Jackichan Barzola LopezNo ratings yet

- GSKDocument22 pagesGSKChaudhary Hassan ArainNo ratings yet

- Honkon Laser PDFDocument18 pagesHonkon Laser PDFEvolution MedNo ratings yet

- Shunt Reactor ConstructionDocument9 pagesShunt Reactor ConstructionIrfan AhmedNo ratings yet

- Stats 2B03 Test #1 (Version 4) October 26th, 2009Document7 pagesStats 2B03 Test #1 (Version 4) October 26th, 2009examkillerNo ratings yet

- Leadership's Ramdom MCQsDocument48 pagesLeadership's Ramdom MCQsAhmed NoumanNo ratings yet

- EtamolDocument5 pagesEtamolthonyyanmuNo ratings yet

- Rexroth 4we10 Data Sheet PDFDocument10 pagesRexroth 4we10 Data Sheet PDFSIVARAMANJAGANATHANNo ratings yet

- Sample From Cambridge AssessmentDocument2 pagesSample From Cambridge AssessmentVinicius GomesNo ratings yet

- Vat Reg. CertificateDocument1 pageVat Reg. CertificateMaaz AzadNo ratings yet

- Ms. Louise Lim Mr. Ivan Cyrus DaldeDocument27 pagesMs. Louise Lim Mr. Ivan Cyrus DaldeJazlyn Andria JarafaNo ratings yet

- Eligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseDocument5 pagesEligibility Conditions: Advertisement For Regular Commission in Pakistan Army Through 136 Pma Long CourseHusnain IshtiaqNo ratings yet

- Dallas Symphony Orchestra 2009 Annual ReportDocument14 pagesDallas Symphony Orchestra 2009 Annual ReportCharlie StephensonNo ratings yet

- BOLBOK (1st)Document10 pagesBOLBOK (1st)Mj EndozoNo ratings yet

- What Is System and Subsystem? What Is Its Relationship?Document6 pagesWhat Is System and Subsystem? What Is Its Relationship?Mulugeta kinde100% (1)

- Air Pollution Modelling With Deep Learning A ReviewDocument6 pagesAir Pollution Modelling With Deep Learning A ReviewliluNo ratings yet

- 66 Essential Phrasal Verbs EnglishDocument6 pages66 Essential Phrasal Verbs EnglishNarcisVega100% (15)

- Open World First B2 Students BookDocument257 pagesOpen World First B2 Students BookTuan Anh Bui88% (8)

- Training SCLDocument60 pagesTraining SCLAlu menzikenNo ratings yet

- PRACTICES AND CHALLENGES IN THE IMPLEMENTATION OF BASIC EDUCATION LEARNING CONTINUITY PLAN-Authored By: Reynaldo C. CruzDocument71 pagesPRACTICES AND CHALLENGES IN THE IMPLEMENTATION OF BASIC EDUCATION LEARNING CONTINUITY PLAN-Authored By: Reynaldo C. CruzInternational Intellectual Online PublicationsNo ratings yet

- Fraction Selection BrochureDocument2 pagesFraction Selection Brochureapi-186663124No ratings yet

- Barotac Nuevo POP PDFDocument10 pagesBarotac Nuevo POP PDFJason Barrios PortadaNo ratings yet

- UCLA-Career Preparation ToolkitDocument61 pagesUCLA-Career Preparation ToolkitCaelulalaNo ratings yet

- Quintin Kynaston School Wikipedia.Document3 pagesQuintin Kynaston School Wikipedia.John_Adam_St_Gang_QKNo ratings yet

- Lethal Dose TableDocument1 pageLethal Dose TableRochie DiezNo ratings yet

- Models For Location SelectionDocument13 pagesModels For Location SelectionSajal ChakarvartyNo ratings yet

- Name and Logo Design Contest For Public Wi-Fi Network Services Terms & ConditionsDocument2 pagesName and Logo Design Contest For Public Wi-Fi Network Services Terms & ConditionsAc RaviNo ratings yet