Professional Documents

Culture Documents

The Following Selected Transactions Were Completed by Gutters Co During PDF

The Following Selected Transactions Were Completed by Gutters Co During PDF

Uploaded by

Taimur Technologist0 ratings0% found this document useful (0 votes)

15 views1 pageGutters Co sold irrigation supplies to wholesalers and retailers in May and June. Transactions included sales to Tamarack Co and Fir Inc. on account, and retail cash sales. Supplies were also purchased from Boyd Company. Goods were returned by Tamarack Co. and payments were received from Tamarack Co. and Fir Inc. Provincial sales tax was paid at a rate of 6%.

Original Description:

Original Title

the-following-selected-transactions-were-completed-by-gutters-co-during.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGutters Co sold irrigation supplies to wholesalers and retailers in May and June. Transactions included sales to Tamarack Co and Fir Inc. on account, and retail cash sales. Supplies were also purchased from Boyd Company. Goods were returned by Tamarack Co. and payments were received from Tamarack Co. and Fir Inc. Provincial sales tax was paid at a rate of 6%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views1 pageThe Following Selected Transactions Were Completed by Gutters Co During PDF

The Following Selected Transactions Were Completed by Gutters Co During PDF

Uploaded by

Taimur TechnologistGutters Co sold irrigation supplies to wholesalers and retailers in May and June. Transactions included sales to Tamarack Co and Fir Inc. on account, and retail cash sales. Supplies were also purchased from Boyd Company. Goods were returned by Tamarack Co. and payments were received from Tamarack Co. and Fir Inc. Provincial sales tax was paid at a rate of 6%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

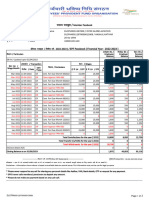

The following selected transactions were completed by

Gutters Co during #1718

The following selected transactions were completed by Gutters Co. during May and June of the

current year. The company sells irrigation supplies to both wholesalers and retail customers.

The PST rate is 6%.May 2. Sold merchandise on account to Tamarack Co. (a wholesaler),

$13,000, terms FOB shipping point, n/eom. The cost of the goods sold was $7,000.6. Sold

merchandise for $15,000 to retail cash customers. The cost of goods sold was $6,500.7. Sold

merchandise on account to Fir Inc. (a retail company), $20,000, terms FOB destination, 2/10,

n/30. The cost of goods sold was $11,000.12. Purchased supplies and inventory on account

from Boyd Company, for $2,000 and $2,500, respectively.17. Received cheque for amount due

from Fir Inc. for sale on May 7.17. Issued credit memo for $1,600 to Tamarack Co. for

merchandise returned from sale on May 2. The cost of the goods returned was $900.29.

Received cheque for amount due from Tamarack Co. for May 2 sale, less returned

merchandise.Jun. 30. Paid appropriate taxes.InstructionsJournalize the entries in one of the

scenarios below to record the selected transactions for the month of May and the July payment,

assuming the use of the perpetual inventory system.a. The PST rate is 4 %. On December 31,

paid provincial sales taxes payable of $6,000.b. The PST is 4% and the GST is 5%. On

December 31, paid provincial sales tax payable of $3,000. Also on December 31, filed goods

and services tax - GST Paid on Purchases was $6,000 and GST Charged on Sales was

$8,000.c. The HST is 11%. Filed harmonized sales tax - HST Paid on Purchases was $6,000

and HST Charged on Sales was $8,000.View Solution:

The following selected transactions were completed by Gutters Co during

ANSWER

http://paperinstant.com/downloads/the-following-selected-transactions-were-completed-by-

gutters-co-during/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Chapter 3Document10 pagesChapter 3Kristina Kitty100% (1)

- Chapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Document7 pagesChapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Dyan NoviaNo ratings yet

- Intermacc Inventories and Bio Assets Postlec WaDocument2 pagesIntermacc Inventories and Bio Assets Postlec WaClarice Awa-aoNo ratings yet

- Problem 3-1 Problem 3-1Document26 pagesProblem 3-1 Problem 3-1MichelleNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Ia Reviewer QuizzesandexamsDocument22 pagesIa Reviewer QuizzesandexamsReady PlayerNo ratings yet

- PWW Currency Guide enDocument112 pagesPWW Currency Guide enrrajesheeeNo ratings yet

- SCO IC 45 - 300kDocument3 pagesSCO IC 45 - 300kFarhan Ashraf100% (1)

- The Following Selected Transactions Were Completed by Green Lawn SuppliesDocument1 pageThe Following Selected Transactions Were Completed by Green Lawn SuppliesAmit PandeyNo ratings yet

- The Following Selected Transactions Were Complete by Lawn Suppli PDFDocument1 pageThe Following Selected Transactions Were Complete by Lawn Suppli PDFAnbu jaromiaNo ratings yet

- The Following Selected Transactions Were Completed PDFDocument1 pageThe Following Selected Transactions Were Completed PDFAnbu jaromia0% (1)

- The Following Selected Transactions Were Completed by Artic SuppDocument1 pageThe Following Selected Transactions Were Completed by Artic SuppM Bilal SaleemNo ratings yet

- Journalize The Following Transactions That Occurred in June 2016 For PDFDocument1 pageJournalize The Following Transactions That Occurred in June 2016 For PDFhassan taimourNo ratings yet

- The Following Selected Transactions Were Completed by InterstateDocument1 pageThe Following Selected Transactions Were Completed by InterstateM Bilal SaleemNo ratings yet

- Auditing Problems - 2Document8 pagesAuditing Problems - 2KiM BrlyNo ratings yet

- The Following Selected Transactions Were Completed by Amsterdam Supply CoDocument1 pageThe Following Selected Transactions Were Completed by Amsterdam Supply CoAmit PandeyNo ratings yet

- Sukulo Stores Inc Completed The Following Transactions During The CurrentDocument1 pageSukulo Stores Inc Completed The Following Transactions During The CurrentTaimur TechnologistNo ratings yet

- The Following Merchandise Transactions Occurred in December Both Companies UseDocument1 pageThe Following Merchandise Transactions Occurred in December Both Companies UseBube KachevskaNo ratings yet

- Group Assignment 2014Document3 pagesGroup Assignment 2014Samuel AberaNo ratings yet

- Clapton Guitar Company Entered Into The Following Transactions During 2016Document1 pageClapton Guitar Company Entered Into The Following Transactions During 2016Taimur TechnologistNo ratings yet

- A Company Had The Following Transactions During Its Most RecentDocument1 pageA Company Had The Following Transactions During Its Most RecentLet's Talk With HassanNo ratings yet

- Bill Building Supplies LTD Completed The Following Transactions During JuneDocument1 pageBill Building Supplies LTD Completed The Following Transactions During Junehassan taimourNo ratings yet

- Selected Transactions Completed by Kornett Company During Its First FiscalDocument4 pagesSelected Transactions Completed by Kornett Company During Its First FiscalAmit PandeyNo ratings yet

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Illustrative Problems On IAS 2 InventoriesDocument2 pagesIllustrative Problems On IAS 2 InventoriesAnne Marieline BuenaventuraNo ratings yet

- Daniels Company Engaged in The Following Transactions During 201Document1 pageDaniels Company Engaged in The Following Transactions During 201M Bilal SaleemNo ratings yet

- CH 5Document3 pagesCH 5Raeha Tul Jannat BuzdarNo ratings yet

- The Following Were Selected From Among The Transactions Completed by 120198Document1 pageThe Following Were Selected From Among The Transactions Completed by 120198M Bilal SaleemNo ratings yet

- The Following Transactions Were Completed by Hammond Auto Supply During PDFDocument2 pagesThe Following Transactions Were Completed by Hammond Auto Supply During PDFDoreenNo ratings yet

- Beta Watches Completed The Following Selected Transactions During 2016 andDocument1 pageBeta Watches Completed The Following Selected Transactions During 2016 andhassan taimourNo ratings yet

- Audit of Inventories and Cost of Goods SoldDocument9 pagesAudit of Inventories and Cost of Goods SoldDita Indah0% (1)

- Journalize The Following Transactions That Occurred in March 2016 For PDFDocument1 pageJournalize The Following Transactions That Occurred in March 2016 For PDFhassan taimourNo ratings yet

- Beta Supply Completed The Following Selected Transactions During The Year JanDocument1 pageBeta Supply Completed The Following Selected Transactions During The Year Janhassan taimourNo ratings yet

- The Following Account Balances Were Included in Bromley Company S BalanceDocument1 pageThe Following Account Balances Were Included in Bromley Company S BalanceTaimur TechnologistNo ratings yet

- Presented Here Are Selected Transactions For Shaoshi Inc During OctoberDocument2 pagesPresented Here Are Selected Transactions For Shaoshi Inc During OctoberMiroslav GegoskiNo ratings yet

- q2 SolutionsDocument19 pagesq2 SolutionsjangjangNo ratings yet

- Accounting Textbook Solutions - 25Document19 pagesAccounting Textbook Solutions - 25acc-expert0% (1)

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- Asset Acquisition Logan Industries Purchased The Following Asset PDFDocument1 pageAsset Acquisition Logan Industries Purchased The Following Asset PDFAnbu jaromiaNo ratings yet

- Aec 22 - Take Home Long Quiz: Trading SecuritiesDocument4 pagesAec 22 - Take Home Long Quiz: Trading SecuritiesOriel Ricky GallardoNo ratings yet

- AFE3781 06 Nor 20190001Document7 pagesAFE3781 06 Nor 20190001Selma IilongaNo ratings yet

- Acctg - Day37.2017 2Document4 pagesAcctg - Day37.2017 2Mason PalmateerNo ratings yet

- Final Exam Revision - Set 2Document2 pagesFinal Exam Revision - Set 2Tran Pham Quoc ThuyNo ratings yet

- Prepare General Journal Entries To Record The Following Perpetual SystemDocument1 pagePrepare General Journal Entries To Record The Following Perpetual SystemLet's Talk With HassanNo ratings yet

- Based On The Following Transactions Calculate The Revenues Expenses andDocument1 pageBased On The Following Transactions Calculate The Revenues Expenses andhassan taimourNo ratings yet

- Q2FT InventoriesDocument2 pagesQ2FT Inventoriesfrancis dungcaNo ratings yet

- Lecture 6 Accounting For Inventory (I)Document33 pagesLecture 6 Accounting For Inventory (I)chestervale1No ratings yet

- Mock Quiz 3 FAR InvestmentSecutities X InventoriesDocument11 pagesMock Quiz 3 FAR InvestmentSecutities X InventoriesMARISA SYLVIA CAALIMNo ratings yet

- The Following Data Were Selected From The Records of Tunga PDFDocument1 pageThe Following Data Were Selected From The Records of Tunga PDFLet's Talk With HassanNo ratings yet

- On December 1 2015 Prosen Distributing Company Had The FollowingDocument1 pageOn December 1 2015 Prosen Distributing Company Had The Followingtrilocksp SinghNo ratings yet

- Binco Inc Completed The Following Transactions During Month of DecemberDocument1 pageBinco Inc Completed The Following Transactions During Month of Decemberhassan taimourNo ratings yet

- 1st Finale 11252018FARAPDocument3 pages1st Finale 11252018FARAPGletzmar IgcasamaNo ratings yet

- Chapter 6 Extra ActivitiesDocument4 pagesChapter 6 Extra Activitieslinh thongNo ratings yet

- T o R e C o R D C o S: Cases Revenue Recognition Case 1Document3 pagesT o R e C o R D C o S: Cases Revenue Recognition Case 1Tio SuyantoNo ratings yet

- Comfy Recliner Chairs Completed The Following Selected Transactions 2016 Jul 1 SoldDocument1 pageComfy Recliner Chairs Completed The Following Selected Transactions 2016 Jul 1 Soldhassan taimourNo ratings yet

- AFAR 3 AnswersDocument5 pagesAFAR 3 AnswersTyrelle Dela CruzNo ratings yet

- Accounting Assignment 06A 207Document12 pagesAccounting Assignment 06A 207Aniyah's RanticsNo ratings yet

- Solved Tarkington Freight Service Provides Delivery of Merchandise To RDocument1 pageSolved Tarkington Freight Service Provides Delivery of Merchandise To RDoreenNo ratings yet

- Journalize The Following Transactions That Occurred in September 2016 For PDFDocument1 pageJournalize The Following Transactions That Occurred in September 2016 For PDFhassan taimourNo ratings yet

- Intermacc Inventories and Bio Assets Postlec WaDocument2 pagesIntermacc Inventories and Bio Assets Postlec WaClarice Awa-ao100% (1)

- Accountancy TestDocument9 pagesAccountancy TestGaurav PitaliyaNo ratings yet

- AUDITPR1Document3 pagesAUDITPR1Baby ValixNo ratings yet

- The Closing Balance Sheet Items Are Given Below For JasonDocument1 pageThe Closing Balance Sheet Items Are Given Below For JasonTaimur TechnologistNo ratings yet

- The Company Lalo Company Headquartered in Vaduz Is A CompanyDocument4 pagesThe Company Lalo Company Headquartered in Vaduz Is A CompanyTaimur TechnologistNo ratings yet

- The Columbus Electronics Company Is Considering Replacing A 1 000 Pound Capacity ForkliftDocument1 pageThe Columbus Electronics Company Is Considering Replacing A 1 000 Pound Capacity ForkliftTaimur TechnologistNo ratings yet

- The Chart of Accounts of Clara S Design Service of MontrealDocument1 pageThe Chart of Accounts of Clara S Design Service of MontrealTaimur TechnologistNo ratings yet

- The Directors of Panel A Public Limited Company Are ReviewingDocument2 pagesThe Directors of Panel A Public Limited Company Are ReviewingTaimur TechnologistNo ratings yet

- The Chart of Accounts of Angel S Delivery Service of FlinDocument1 pageThe Chart of Accounts of Angel S Delivery Service of FlinTaimur TechnologistNo ratings yet

- The Consolidated Statement of Financial Position For Mic As atDocument1 pageThe Consolidated Statement of Financial Position For Mic As atTaimur TechnologistNo ratings yet

- The December 31 2014 Unadjusted Trial Balance For Tucker PhotographersDocument1 pageThe December 31 2014 Unadjusted Trial Balance For Tucker PhotographersTaimur TechnologistNo ratings yet

- The Bragg Stratton Company Manufactures A Specialized Motor ForDocument1 pageThe Bragg Stratton Company Manufactures A Specialized Motor ForTaimur TechnologistNo ratings yet

- The Cash General Ledger Account Balance of Gladstone LTD WasDocument1 pageThe Cash General Ledger Account Balance of Gladstone LTD WasTaimur TechnologistNo ratings yet

- The Candy Co of Lethbridge Pays Its Workers Twice EachDocument1 pageThe Candy Co of Lethbridge Pays Its Workers Twice EachTaimur TechnologistNo ratings yet

- The Chart of Accounts For Angel S Delivery Service of FlinDocument1 pageThe Chart of Accounts For Angel S Delivery Service of FlinTaimur TechnologistNo ratings yet

- The Bookkeeper of Floore Company Records Credit Sales in ADocument1 pageThe Bookkeeper of Floore Company Records Credit Sales in ATaimur TechnologistNo ratings yet

- The Cash Flows Below Were Extracted From The Accounts ofDocument1 pageThe Cash Flows Below Were Extracted From The Accounts ofTaimur TechnologistNo ratings yet

- The Accounting Records of I Eclaire Delivery Services Show The FollowingDocument1 pageThe Accounting Records of I Eclaire Delivery Services Show The FollowingTaimur TechnologistNo ratings yet

- The Accompanying Chart Figure p8 6 Shows The Expected Monthly ProfitDocument1 pageThe Accompanying Chart Figure p8 6 Shows The Expected Monthly ProfitTaimur TechnologistNo ratings yet

- The Accountants at French Perfumery Decided To Increase The PriceDocument1 pageThe Accountants at French Perfumery Decided To Increase The PriceTaimur TechnologistNo ratings yet

- The A M I Company Is Considering Installing A New Process MachineDocument1 pageThe A M I Company Is Considering Installing A New Process MachineTaimur TechnologistNo ratings yet

- The Accountant For Karma Counselling Services Found Several Errors inDocument1 pageThe Accountant For Karma Counselling Services Found Several Errors inTaimur TechnologistNo ratings yet

- The American Aluminum Company Is Considering Making A Major InvestmentDocument1 pageThe American Aluminum Company Is Considering Making A Major InvestmentTaimur TechnologistNo ratings yet

- The Annual Revenues in Billion Dollars in Financial Year 2001Document1 pageThe Annual Revenues in Billion Dollars in Financial Year 2001Taimur TechnologistNo ratings yet

- CopyrightDocument249 pagesCopyrightdarshanNo ratings yet

- Kotak Securities Limited FY18Document81 pagesKotak Securities Limited FY18Arpita Sen BhattacharyaNo ratings yet

- ABSLI Nishchit AayusDocument23 pagesABSLI Nishchit Aayusm00162372No ratings yet

- Area Pricing Report RENTDocument4 pagesArea Pricing Report RENTAshish NayyarNo ratings yet

- Environment & GovernanceDocument8 pagesEnvironment & Governancejojie dadorNo ratings yet

- Econ 406 Assignment 1 International FinanceDocument5 pagesEcon 406 Assignment 1 International FinanceCharlotteNo ratings yet

- Principles of Marketing - Chapter 9Document42 pagesPrinciples of Marketing - Chapter 9Ashek AHmedNo ratings yet

- PDF Week1 MeasuringNationIncomeDocument24 pagesPDF Week1 MeasuringNationIncomeTâm TrươngNo ratings yet

- Present Worth Method of ComparisonDocument56 pagesPresent Worth Method of Comparisonvignesh sivakumarNo ratings yet

- Asm Chap 4 Bus 3382Document9 pagesAsm Chap 4 Bus 3382Đào ĐăngNo ratings yet

- DanoneDocument4 pagesDanoneRithanya SelvakumarNo ratings yet

- Regulasi Anti Dumping Sebagai UpayaDocument13 pagesRegulasi Anti Dumping Sebagai UpayaNurmadiaNo ratings yet

- ACC421 Chapter 18 Questions and AnswersDocument11 pagesACC421 Chapter 18 Questions and AnswersNhel AlvaroNo ratings yet

- CHAPTER ONE and TWODocument8 pagesCHAPTER ONE and TWOLozi MaranataNo ratings yet

- Cooperative BankingDocument13 pagesCooperative BankingwubeNo ratings yet

- ECN 9125 QUIZ 1 - SolutionsDocument5 pagesECN 9125 QUIZ 1 - SolutionsIvecy ChilalaNo ratings yet

- DLCPM00312970000013908 2022Document2 pagesDLCPM00312970000013908 2022Anshul KatiyarNo ratings yet

- Econ Chapter 7 Section 1ADocument3 pagesEcon Chapter 7 Section 1AAbi CalderaleNo ratings yet

- ASEAN - Economic: ASEAN Connectivity: Challenge For An Integrated ASEAN CommunityDocument6 pagesASEAN - Economic: ASEAN Connectivity: Challenge For An Integrated ASEAN CommunitysreypichNo ratings yet

- Pak 14Document3 pagesPak 14Sesylia Angreni GintingNo ratings yet

- Lease TheoryDocument10 pagesLease TheorySyeda AtikNo ratings yet

- ChangeofnameDocument7 pagesChangeofnameJean GllgsNo ratings yet

- Forms of Businesss Ownership and FranchisingDocument24 pagesForms of Businesss Ownership and FranchisingGöktürk DaylanNo ratings yet

- BL Data 01Document8 pagesBL Data 01transhomes2005No ratings yet

- The Dotcom BubbleDocument12 pagesThe Dotcom BubbleAsteway MesfinNo ratings yet

- Ryanair Case SubmissionDocument5 pagesRyanair Case SubmissionGaurav ManiyarNo ratings yet

- Cases That Are Considered COADocument2 pagesCases That Are Considered COANorman CorreaNo ratings yet

- Articles and AnalysesDocument6 pagesArticles and AnalysesDAZZLING CROWNNo ratings yet