Professional Documents

Culture Documents

Binco Inc Completed The Following Transactions During Month of December

Uploaded by

hassan taimour0 ratings0% found this document useful (0 votes)

9 views1 pageBinco Inc. completed several financial transactions in December. They borrowed $50,000 from a bank, purchased inventory on credit twice, sold merchandise on credit, leased a photocopier, received payments from customers, recorded salary and benefits expenses, and received a deposit for back-ordered goods. The company's fiscal year ends on December 31.

Original Description:

Accounts

Original Title

Binco Inc Completed the Following Transactions During Month of December

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBinco Inc. completed several financial transactions in December. They borrowed $50,000 from a bank, purchased inventory on credit twice, sold merchandise on credit, leased a photocopier, received payments from customers, recorded salary and benefits expenses, and received a deposit for back-ordered goods. The company's fiscal year ends on December 31.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageBinco Inc Completed The Following Transactions During Month of December

Uploaded by

hassan taimourBinco Inc. completed several financial transactions in December. They borrowed $50,000 from a bank, purchased inventory on credit twice, sold merchandise on credit, leased a photocopier, received payments from customers, recorded salary and benefits expenses, and received a deposit for back-ordered goods. The company's fiscal year ends on December 31.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Binco Inc completed the following transactions during

month of December #618

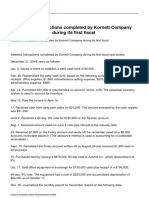

Binco Inc. completed the following transactions during month of December. The company’s

fiscal year ends on December 31. The HST of 13% is included on all purchases and sales. Cost

of goods sold is 60% of the sales.December 1 Borrowed $50,000 from the PC Bank by signing

a five-year note at 6% interest rate. The interest is paid monthly on the 1st of the month.3

Purchased merchandise inventory on credit for $50,850, terms 2/10, n/30. Binco uses a

perpetual inventory system.8 Sold merchandise on credit for $14,125, including HST, terms

2/10, n/30.15 Leased a photocopier with a fair value of $50,000. The present value of the

monthly payments, $500 for 5 years, represents a major portion of the fair value of the

photocopier.17 Received a cheque from a customer who purchased merchandise on December

8.20 Purchased merchandise inventory on credit for $40,680, (including HST) terms 2/10,

n/30.24 Received a $300 deposit for back-ordered merchandise to be shipped at the beginning

of the New Year.31 Salary Expense for the month was $10,000, of which employees deductions

included CPP, $450; El, $160; and income tax, $2,400. Binco also recorded the employee

benefits expense.Requirements1. Record all journal entries, including adjusting entries, for the

month of December.2. Show the liability section of the balance sheet on December 31.3.

Identify the impact on the debt ratio—(1) no change, (2) increase, or (3) decrease, after each

transaction is complete. Identify each transaction as an independent case, rather than a

cumulative effect. Assume that the debt ratio is at 50% and current ratio is 1.5 before

considering each transaction.View Solution:

Binco Inc completed the following transactions during month of December

ANSWER

http://paperinstant.com/downloads/binco-inc-completed-the-following-transactions-during-month-

of-december/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Profit and Loss Statement - StatementDocument1 pageProfit and Loss Statement - StatementTirta syah putra AlamNo ratings yet

- ch13 PDFDocument5 pagesch13 PDFNoSepasi FebriyaniNo ratings yet

- (INCOME TAX-BUSINESS TAX) AnswersDocument37 pages(INCOME TAX-BUSINESS TAX) AnswersAeyjay Manangaran100% (1)

- Non Current Liabilities San Carlos CollegeDocument12 pagesNon Current Liabilities San Carlos CollegeRowbby Gwyn50% (2)

- Accounting & Financial Management for Residential Construction, Sixth EditionFrom EverandAccounting & Financial Management for Residential Construction, Sixth EditionNo ratings yet

- Quiz - Chapter 1 - Current Liabilities - 2021Document3 pagesQuiz - Chapter 1 - Current Liabilities - 2021Jennifer RelosoNo ratings yet

- PDF Chapter 9 Audit of Liabilities Roque CompressDocument77 pagesPDF Chapter 9 Audit of Liabilities Roque CompressLovely Dela Cruz GanoanNo ratings yet

- Ia Reviewer QuizzesandexamsDocument22 pagesIa Reviewer QuizzesandexamsReady PlayerNo ratings yet

- Assignment Adjusting EntriesDocument2 pagesAssignment Adjusting EntriesKim Patrick VictoriaNo ratings yet

- IGCSE Economics WB Answers Screen Optimised PDFsDocument40 pagesIGCSE Economics WB Answers Screen Optimised PDFscthiruvazhmarbanNo ratings yet

- PAS 23 Borrowing Costs: Learning ObjectivesDocument5 pagesPAS 23 Borrowing Costs: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Zumra Company S Annual Accounting Year Ends On December 31 It PDFDocument1 pageZumra Company S Annual Accounting Year Ends On December 31 It PDFhassan taimourNo ratings yet

- Auditing Problems, CRC-ACEDocument9 pagesAuditing Problems, CRC-ACESannyboy Paculio Datumanong100% (1)

- Case DDocument4 pagesCase DMarkus TNo ratings yet

- Liabilities QuizDocument5 pagesLiabilities QuizVanshee 11No ratings yet

- Budai Inc Completed The Following Transactions During The Month ofDocument1 pageBudai Inc Completed The Following Transactions During The Month ofhassan taimourNo ratings yet

- Moncton Manufacturing LTD Had The Following Information Available On BondsDocument2 pagesMoncton Manufacturing LTD Had The Following Information Available On BondsMiroslav GegoskiNo ratings yet

- Current Liabilities: Redemption of Certificates Lapse of CertificatesDocument3 pagesCurrent Liabilities: Redemption of Certificates Lapse of CertificatesGrezel NiceNo ratings yet

- LiabilitiesDocument5 pagesLiabilitiesViky Rose EballeNo ratings yet

- CH 10Document3 pagesCH 10pablozhang1226No ratings yet

- Selected Transactions Completed by Kornett Company During Its First FiscalDocument4 pagesSelected Transactions Completed by Kornett Company During Its First FiscalAmit PandeyNo ratings yet

- The Following Transactions Were Completed by Navarez Inc Whose FiscalDocument1 pageThe Following Transactions Were Completed by Navarez Inc Whose FiscalAmit PandeyNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument7 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualKellyMorenootdnj100% (81)

- One Product Corp Opc Incorporated at The Beginning of LastDocument2 pagesOne Product Corp Opc Incorporated at The Beginning of LastLet's Talk With HassanNo ratings yet

- AP 10-2 TemplateDocument9 pagesAP 10-2 TemplateKirusiga KrishnakumarNo ratings yet

- Daniels Company Engaged in The Following Transactions During 201Document1 pageDaniels Company Engaged in The Following Transactions During 201M Bilal SaleemNo ratings yet

- Tb15 ExercisesDocument35 pagesTb15 ExercisesReal Ximo PiertoNo ratings yet

- Curb Company Completed The Following Transactions During 2010 TDocument1 pageCurb Company Completed The Following Transactions During 2010 TM Bilal SaleemNo ratings yet

- Balance Sheet Presentation of Liabilities: Problem 10.2ADocument4 pagesBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Current Liabilities StudentsDocument7 pagesCurrent Liabilities StudentsEmmanuelNo ratings yet

- HW On Sinking Fund CDocument2 pagesHW On Sinking Fund CCha PampolinaNo ratings yet

- Near The End of Its First Year of Operations DecemberDocument2 pagesNear The End of Its First Year of Operations DecemberMiroslav GegoskiNo ratings yet

- On January 1 2015 Burlington Inc S General Ledger Contained TheseDocument1 pageOn January 1 2015 Burlington Inc S General Ledger Contained TheseMiroslav GegoskiNo ratings yet

- Minute Corp A Canadian Public Corporation Reported The Following OnDocument3 pagesMinute Corp A Canadian Public Corporation Reported The Following OnHassan JanNo ratings yet

- D. Discounted - YES Pledged - NODocument9 pagesD. Discounted - YES Pledged - NOJasper LuagueNo ratings yet

- Bonds Payable Straight Problems: Problem No. 1 Problem No. 3Document3 pagesBonds Payable Straight Problems: Problem No. 1 Problem No. 3gringo dreamersNo ratings yet

- Indicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsDocument5 pagesIndicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsBONNo ratings yet

- Ae 211 Solutions-PrelimDocument10 pagesAe 211 Solutions-PrelimNhel AlvaroNo ratings yet

- Fifteen Transactions or Events Affecting Computer Specialists Inc Are AsDocument1 pageFifteen Transactions or Events Affecting Computer Specialists Inc Are Astrilocksp SinghNo ratings yet

- Financial Instruments CASE STUDIES FRDocument5 pagesFinancial Instruments CASE STUDIES FRDaniel AdegboyeNo ratings yet

- Financial Assets ReviewDocument3 pagesFinancial Assets ReviewJobelle Candace Flores AbreraNo ratings yet

- KorpratsiDocument4 pagesKorpratsidelgermurun deegiiNo ratings yet

- Johnson Corporation S Bank Statement For October Reports An Ending BalanceDocument1 pageJohnson Corporation S Bank Statement For October Reports An Ending BalanceLet's Talk With HassanNo ratings yet

- The Following Items Represent Liabilities On A Firm S Balance SheetDocument1 pageThe Following Items Represent Liabilities On A Firm S Balance SheetBube KachevskaNo ratings yet

- Liabilities Part 2Document2 pagesLiabilities Part 2Corazon MartinNo ratings yet

- The Following Data Were Taken From The Financial Statements ofDocument1 pageThe Following Data Were Taken From The Financial Statements ofMiroslav GegoskiNo ratings yet

- Far 3rd YearDocument8 pagesFar 3rd YearJanine LerumNo ratings yet

- Ias 10 Events After Reporting PeriodDocument13 pagesIas 10 Events After Reporting Periodesulawyer2001No ratings yet

- M4 Accele 4Document42 pagesM4 Accele 4Julie Marie Anne LUBINo ratings yet

- ACC 211 Quiz-LIABILITIESDocument1 pageACC 211 Quiz-LIABILITIESAeyjay ManangaranNo ratings yet

- UCDocument2 pagesUCJohn Alden NatividadNo ratings yet

- Ias 23Document19 pagesIas 23Reever RiverNo ratings yet

- Acctg 105 Answer Key 1 PDFDocument3 pagesAcctg 105 Answer Key 1 PDFNathan J AhmadNo ratings yet

- Ogonquit Enterprises Prepares Annual Financial Statements and Adjusts Its AccountsDocument1 pageOgonquit Enterprises Prepares Annual Financial Statements and Adjusts Its AccountsMiroslav GegoskiNo ratings yet

- The Following Transactions Were Completed by Montague Inc Whose FiscalDocument1 pageThe Following Transactions Were Completed by Montague Inc Whose Fiscaltrilocksp SinghNo ratings yet

- Solved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFDocument1 pageSolved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFAnbu jaromiaNo ratings yet

- Glencoe Inc Operates With A June 30 Year End During 2017Document1 pageGlencoe Inc Operates With A June 30 Year End During 2017Bube KachevskaNo ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- This Study Resource Was: Use The Following Information For The Next Two QuestionsDocument2 pagesThis Study Resource Was: Use The Following Information For The Next Two QuestionsClaudette Clemente100% (1)

- Notes and Loans Payable ExerciseDocument4 pagesNotes and Loans Payable ExerciseLovenia M. FerrerNo ratings yet

- Intermediate Accounting 2: Chapter 3: The Accounting Equation (FAR By: Millan)Document34 pagesIntermediate Accounting 2: Chapter 3: The Accounting Equation (FAR By: Millan)Patricia GalvezNo ratings yet

- AP Final Mockboard 1Document7 pagesAP Final Mockboard 1Ciatto SpotifyNo ratings yet

- Q1Document6 pagesQ1Ray Pop0% (2)

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- Zippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFDocument1 pageZippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFhassan taimourNo ratings yet

- Your Best Friend From Home Writes You A Letter About PDFDocument1 pageYour Best Friend From Home Writes You A Letter About PDFhassan taimourNo ratings yet

- You Ca Have Been Working For Plener and Partners Chartered PDFDocument4 pagesYou Ca Have Been Working For Plener and Partners Chartered PDFhassan taimourNo ratings yet

- You Manage A 13 5 Million Portfolio Currently All Invested PDFDocument1 pageYou Manage A 13 5 Million Portfolio Currently All Invested PDFhassan taimourNo ratings yet

- Your Supervisor Has Asked You To Research The Following Situation PDFDocument1 pageYour Supervisor Has Asked You To Research The Following Situation PDFhassan taimourNo ratings yet

- Yangzi International Inc Uses The Aging of Accounts Receivable Method PDFDocument1 pageYangzi International Inc Uses The Aging of Accounts Receivable Method PDFhassan taimourNo ratings yet

- You Own 10 000 Shares 1 of The Outstanding Shares of PDFDocument1 pageYou Own 10 000 Shares 1 of The Outstanding Shares of PDFhassan taimourNo ratings yet

- Windmere Corporation S Statement of Financial Position at December 31 2016 PDFDocument1 pageWindmere Corporation S Statement of Financial Position at December 31 2016 PDFhassan taimourNo ratings yet

- You Ca Have Recently Been Assigned As Audit Senior For PDFDocument2 pagesYou Ca Have Recently Been Assigned As Audit Senior For PDFhassan taimourNo ratings yet

- Xanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFDocument1 pageXanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFhassan taimourNo ratings yet

- You Are A Senior Manager at Poeing Aircraft and Have PDFDocument1 pageYou Are A Senior Manager at Poeing Aircraft and Have PDFhassan taimourNo ratings yet

- Wright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFDocument1 pageWright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFhassan taimourNo ratings yet

- Whistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFDocument1 pageWhistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFhassan taimourNo ratings yet

- Wood Work LTD Sells Home Furnishings Including A Wide Range PDFDocument1 pageWood Work LTD Sells Home Furnishings Including A Wide Range PDFhassan taimourNo ratings yet

- Wright Fishing Charters Has Collected The Following Data For The PDFDocument1 pageWright Fishing Charters Has Collected The Following Data For The PDFhassan taimourNo ratings yet

- Your Friend Is Celebrating Her 30th Birthday Today and Wants PDFDocument1 pageYour Friend Is Celebrating Her 30th Birthday Today and Wants PDFhassan taimourNo ratings yet

- Whitley Company Is Considering Two Capital Investments Both Investments Have PDFDocument1 pageWhitley Company Is Considering Two Capital Investments Both Investments Have PDFhassan taimourNo ratings yet

- While Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFDocument1 pageWhile Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFhassan taimourNo ratings yet

- Whiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFDocument1 pageWhiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFhassan taimourNo ratings yet

- Wollo University: College of Business & Economics Department Accounting and FinanceDocument39 pagesWollo University: College of Business & Economics Department Accounting and Financetesfay100% (9)

- Learning Activity 3 - Inc TaxDocument3 pagesLearning Activity 3 - Inc TaxErica FlorentinoNo ratings yet

- Pay For Performance and Financial Incentives: T TwelveDocument14 pagesPay For Performance and Financial Incentives: T TwelveNouman AhmadNo ratings yet

- Notes For IGCSE AccountingsDocument33 pagesNotes For IGCSE AccountingsLai YeeNo ratings yet

- Interpretation of Financial StatementDocument5 pagesInterpretation of Financial StatementHuế ThùyNo ratings yet

- Audit Planning: SGB & CDocument17 pagesAudit Planning: SGB & CMelanie SamsonaNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- Five Accounting ElementsDocument2 pagesFive Accounting ElementsD AngelaNo ratings yet

- Bata IndiaDocument16 pagesBata Indiavaibhav chaurasiaNo ratings yet

- 2 Bond MKTDocument67 pages2 Bond MKTanandhuNo ratings yet

- SAP FI Enterprise Structure & GLDocument8 pagesSAP FI Enterprise Structure & GLRahul ShelarNo ratings yet

- Case Study #3: Wake Up and Smell The Coffee!Document4 pagesCase Study #3: Wake Up and Smell The Coffee!USD 654No ratings yet

- TM 4 - Earning ManagementDocument27 pagesTM 4 - Earning ManagementRifqa aulia nabylaNo ratings yet

- Supplementary Learning Resource Material SUMMARY-due Nov.10Document5 pagesSupplementary Learning Resource Material SUMMARY-due Nov.10LIGAWAD, MELODY P.No ratings yet

- Ratio Analysis of Kohinoo R Sugar Mill: Financial ManagemantDocument10 pagesRatio Analysis of Kohinoo R Sugar Mill: Financial ManagemantPrince RajputNo ratings yet

- Colgate DCF ModelDocument19 pagesColgate DCF Modelshubham9308No ratings yet

- Rajesh Patel ITR 04 23Document4 pagesRajesh Patel ITR 04 23The KingNo ratings yet

- 3 Spreadsheet PR 3.5ADocument2 pages3 Spreadsheet PR 3.5ARizkyDirectioners'ZaynsterNo ratings yet

- Different Types of Property IncomeDocument21 pagesDifferent Types of Property IncomeYoven VeerasamyNo ratings yet

- Reporting and Analyzing Long-Lived AssetsDocument75 pagesReporting and Analyzing Long-Lived AssetsDang ThanhNo ratings yet

- DepreciationDocument6 pagesDepreciationKylie Luigi Leynes Bagon100% (2)

- Accounting For Managers Acf1200 Extensive Notes HDDocument70 pagesAccounting For Managers Acf1200 Extensive Notes HDIshan MalakarNo ratings yet

- FAR2 AnswersDocument10 pagesFAR2 Answersjulietpamintuan100% (1)

- Equity Research: Karuturi Global LimitedDocument9 pagesEquity Research: Karuturi Global LimitedAjit DhawaleNo ratings yet

- PFN1223 - Financial Management - Set C 2020Document14 pagesPFN1223 - Financial Management - Set C 2020alya farhanaNo ratings yet

- Financial Management Note WK 1 2 PDFDocument58 pagesFinancial Management Note WK 1 2 PDFJiaXinLimNo ratings yet