Professional Documents

Culture Documents

Rajesh Patel ITR 04 23

Uploaded by

The KingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rajesh Patel ITR 04 23

Uploaded by

The KingCopyright:

Available Formats

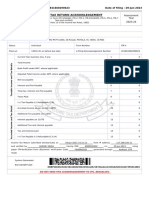

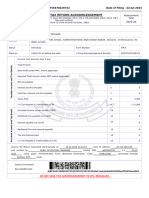

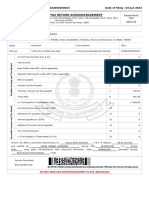

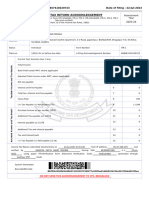

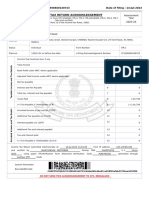

Acknowledgement Number:596366080210723 Date of filing : 21-Jul-2023

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment

[Where the data of the Return of Income in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 Year

filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962) 2023-24

PAN BKJPP2438M

Name RAJESHBHAI NATVARBHAI PATEL

Address 128, PATEL FALIYU, SIMADI, KAMREJ , SURAT , 11-Gujarat, 91- INDIA, 394326

Status Individual Form Number ITR-4

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 596366080210723

Current Year business loss, if any 1 0

Total Income 2 4,91,020

Taxable Income and Tax Details

Book Profit under MAT, where applicable 3 0

Adjusted Total Income under AMT, where applicable 4 0

Net tax payable 5 0

Interest and Fee Payable 6 0

Total tax, interest and Fee payable 7 0

Taxes Paid 8 0

(+) Tax Payable /(-) Refundable (7-8) 9 0

Accreted Income and Tax Detail

Accreted Income as per section 115TD 10 0

Additional Tax payable u/s 115TD 11 0

Interest payable u/s 115TE 12 0

Additional Tax and interest payable 13 0

Tax and interest paid 14 0

(+) Tax Payable /(-) Refundable (13-14) 15 0

Income Tax Return submitted electronically on 21-Jul-2023 20:17:24 from IP address 116.74.98.141 and

verified by RAJESHBHAI NATVARBHAI PATEL having PAN BKJPP2438M o n 21-Jul-

2023 using paper ITR-Verification Form /Electronic Verification Code 7UCEKHAMUI generated through

Aadhaar OTP mode

System Generated

Barcode/QR Code

BKJPP2438M04596366080210723d1ef301a6505a311fd89975598b35a99785bd496

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

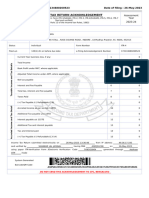

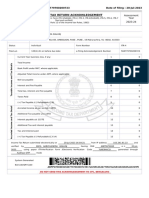

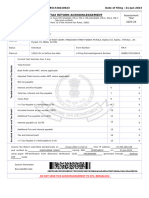

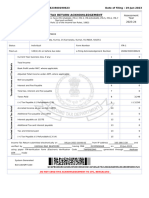

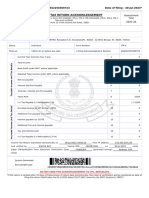

NAME OF ASSESSEE : RAJESHBHAI NATVARBHAI PATEL

PAN : BKJPP2438M

FATHER'S NAME : NATVARBHAI PATEL

RESIDENTIAL ADDRESS : 128, PATEL FALIYU, SIMADI, KAMREJ, SURAT, GUJARAT-394326

STATUS : INDIVIDUAL ASSESSMENT YEAR : 2023 - 2024

WARD NO : FINANCIAL YEAR : 2022 - 2023

GENDER : MALE DATE OF BIRTH : 01/11/1978

AADHAAR NO. : 460593961347

MOBILE NO. : 9909130722

EMAIL ADDRESS : rskachhwaha06@gmail.com

RESIDENTIAL STATUS : RESIDENT

NATURE OF BUSINESS : BUSINESS INCOME

STOCK VALUATION : COST OR MARKET VALUE WHICHEVER IS LESS

METHOD

METHOD OF : MERCANTILE

ACCOUNTING

NAME OF BANK : HDFC BANK

MICR CODE : 395240024

IFSC CODE : HDFC0003315

ADDRESS : KAMREJ

ACCOUNT NO. : 50100181422118

OPTED FOR TAXATION : NO

U/S 115BAC

RETURN : ORIGINAL (FILING DATE : 21/07/2023 & NO. : 596366080210723)

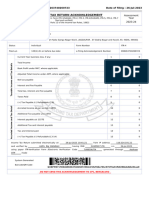

COMPUTATION OF TOTAL INCOME

PROFITS AND GAINS FROM BUSINESS AND 491018

PROFESSION

PROFIT U/S 44AD - MADHAV GRUH UDHYOG

PROFIT DEEMED U/S 44AD @ 8% OF RS. 865260 69221

PROFIT DECLARED U/S 44AD 491018

PROFIT (HIGHER OF THE ABOVE) 491018

INCOME FROM OTHER SOURCES 30

HDFC BANK LIMITED (AAACH2702H.AB772) 18

THE SURAT DISTRICT CO OP BANK LTD 12

(AAAAT2985Q.AC982)

TOTAL 30

GROSS TOTAL INCOME 491048

LESS DEDUCTIONS UNDER CHAPTER-VIA

80TTA INTEREST ON DEPOSITS IN SAVINGS ACCOUNT 30

TOTAL DEDUCTIONS 30

TOTAL INCOME 491018

TOTAL INCOME ROUNDED OFF U/S 288A 491020

COMPUTATION OF TAX ON TOTAL INCOME

TAX ON RS. 250000 NIL

TAX ON RS. 241020 (491020-250000) @ 5% 12051

TAX ON RS. 491020 12051

12051

LESS : REBATE U/S 87A 12051

TAX PAYABLE NIL

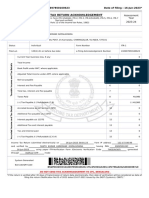

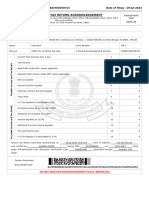

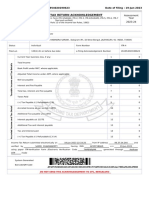

Previous Year Return Filing Details :

Return Income Rs. 488840

Financial Particulars of Business

Sundry creditors Nil

Total capital and liabilities Nil

Inventories Nil

Sundry debtors Nil

Cash-in-hand 399250

Total assets 399250

Details of Taxpayer Information Summary

S. Inform ation Cate gory Incom e Se ction Proce s s e d De rive d As pe r Diffe re nce As pe r Diffe re nce

N. He ad Value Value Com putatio 26AS

n/ITR

(1) (2) (3) (4) (5) (6) (7)=(5)-(6) (8) (9)=(8)-(6)

1 Inte re s t from s avings Other Source 194A 30 30 30.00 Nil

bank

RAJESHBHAI NATVARBHAI PATEL

(Self)

RAJESHBHAI NATVARBHAI PATEL

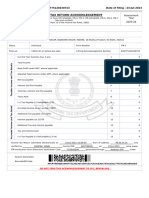

PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDING ON 31ST MARCH, 2023

PARTICULARS AM OUNT PARTICULARS AM OUNT

TO ADMINISTRATIVE EXPENSES BY INDIRECT INCOMES

ELECTRICITY EXPENSE 25,090.00 GRUH UDHYOG INCOME 8,65,260.00

JOBWORK EXPENSE 1,37,800.00

MATERIAL EXPENSE 1,65,019.00

PETROL EXPENSE 20,070.00

TO INDIRECT EXPENSES

BANK CHARGES 715.00

CANTEEN EXPENSE 2,350.00

MAINTENANCE EXPENSE 12,068.00

PROFESSIONAL CHARGES 1,500.00

STATIONERY AND PRINTING EXPENSE 9,630.00

TO NET PROFIT 4,91,018.00

8,65,260.00 8,65,260.00

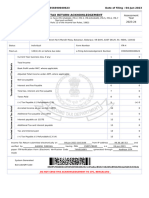

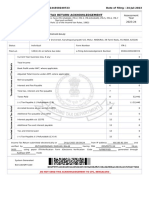

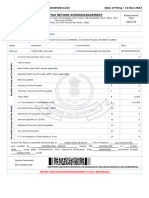

Schedule : 1

Capital Account

Particulars Amount Particulars Amount

To Drawings 1,30,750.00 By Opening Balance 22,12,224.37

To Closing Balance 25,72,522.37 By Net Profit 4,91,018.00

By Bank Interest 30.00

Total 27,03,272.37 Total 27,03,272.37

BALANCE SHEET

AS AT 31ST MARCH, 2023

LIABILITIES SCH AM OUNT ASSETS SCH AM OUNT

NO NO

CAPITAL 1 25,72,522.37 FIXED ASSETS

FOUR WHEELER 5,20,000.00

FURNITURE AND FIXTURE 5,50,970.00

HOME APPLIANCE 3,95,480.00

MOBILE 38,500.00

PLANT AND MACHINERY 4,25,000.00

REFRIGERATOR 39,350.00

SWEING MACHINE 19,500.00

TELEVISION 26,500.00

CURRENT ASSETS

CASH AND BANK

CASH AND BANK 3,99,250.37

OTHER CURRENT ASSETS

MATERIAL STOCK 1,57,972.00

TOTAL 25,72,522.37 TOTAL 25,72,522.37

You might also like

- Itrv 1Document1 pageItrv 1mickieNo ratings yet

- PDF 615803240220723Document1 pagePDF 615803240220723mohammadgausraza229No ratings yet

- PDF 293196870250623Document1 pagePDF 293196870250623nagesh valunjNo ratings yet

- Itr VDocument1 pageItr VohhNo ratings yet

- ACK660988680240723Document1 pageACK660988680240723Harsh JainNo ratings yet

- E-Return 22-23 GauravDocument1 pageE-Return 22-23 Gauravchaudharigaurav96No ratings yet

- Ack 172134680260523Document1 pageAck 172134680260523Niraj JaiswalNo ratings yet

- Kapil Raj Mandavi 23-24Document1 pageKapil Raj Mandavi 23-24khan khanNo ratings yet

- ITR 23-24Document1 pageITR 23-24Swapnil Sunil YadavNo ratings yet

- ack23-24eDocument1 pageack23-24emanishgoyani225No ratings yet

- Ack 435704550120723Document1 pageAck 435704550120723sawant.akshay64No ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- SUNIL ACHYUTRAO GAVHANE - 22-Jul-2023 - 620755370Document1 pageSUNIL ACHYUTRAO GAVHANE - 22-Jul-2023 - 620755370Somnath ThombareNo ratings yet

- ACK859248570300723Document1 pageACK859248570300723Manas Ranjan DalaiNo ratings yet

- Itr Fy 22-23Document6 pagesItr Fy 22-23Omkar kaleNo ratings yet

- itr 23-24 anubhavDocument1 pageitr 23-24 anubhavAnubhav MishraNo ratings yet

- PDF 144690140310723Document1 pagePDF 144690140310723AE Junnar UrbanNo ratings yet

- PDF 625143120230723Document1 pagePDF 625143120230723baluNo ratings yet

- Ack 657892140240723Document1 pageAck 657892140240723ravindraNo ratings yet

- PDF 596320240210723Document1 pagePDF 596320240210723Deepika SNo ratings yet

- PDF 242697850160623Document1 pagePDF 242697850160623Sujith GowdaNo ratings yet

- ACK280306620230623Document1 pageACK280306620230623cagopalofficebackupNo ratings yet

- ACK292417110240623Document1 pageACK292417110240623bpsrik123 reddyNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:312151100280623 Date of Filing: 28-Jun-2023Document2 pagesIndian Income Tax Return Acknowledgement: Acknowledgement Number:312151100280623 Date of Filing: 28-Jun-2023AMRIT23WALANo ratings yet

- Aakash 2023-24Document5 pagesAakash 2023-24suneetbansalNo ratings yet

- PDF 583561900281223Document1 pagePDF 583561900281223rohitkirtaniya5No ratings yet

- ACK195642050030623Document1 pageACK195642050030623Nihar RanjanNo ratings yet

- ACK576076730200723Document1 pageACK576076730200723Sourav MohapatraNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- Harcharan Singh 2023-2024Document1 pageHarcharan Singh 2023-2024thinkpadt480tNo ratings yet

- PDF 246625980160623-1Document1 pagePDF 246625980160623-1Nandkumar R KNo ratings yet

- PDF 608691750220723Document1 pagePDF 608691750220723S.SujathaNo ratings yet

- PDF 548483700190723Document1 pagePDF 548483700190723bghosh00112233No ratings yet

- Ack 702682430260723Document1 pageAck 702682430260723nimaygabaNo ratings yet

- ACK695440920260723Document1 pageACK695440920260723TarakRoyNo ratings yet

- ACK673640470250723Document1 pageACK673640470250723Deepak JangidNo ratings yet

- PDF 659144350240723Document1 pagePDF 659144350240723Madhan BalajiNo ratings yet

- PDF 608667410220723Document1 pagePDF 608667410220723Snehit RajNo ratings yet

- PDF 260623500190623Document1 pagePDF 260623500190623Harsha R BNo ratings yet

- Sachin It CPCDocument1 pageSachin It CPCADARSH PATTARNo ratings yet

- Ack 261954020190623Document1 pageAck 261954020190623TANUJ CHAKRABORTYNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentSatyam MaramNo ratings yet

- Hardeep Singh ITR 2023Document1 pageHardeep Singh ITR 2023parwindersingh9066No ratings yet

- ACK319389570290623Document1 pageACK319389570290623Jangle JeewanNo ratings yet

- PDF 400872730090723Document1 pagePDF 400872730090723Rstuv WNo ratings yet

- ACK663138420240723Document1 pageACK663138420240723Dr Sachin Chitnis M O UPHC AiroliNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- Itr 23-24Document1 pageItr 23-24Ashwani KumarNo ratings yet

- vineetDocument1 pagevineetRiaZ MoHamMaDNo ratings yet

- PDF 254872900180623Document1 pagePDF 254872900180623Sachin KumarNo ratings yet

- PDF 581584680210723Document1 pagePDF 581584680210723BhauNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- PDF 490744590160723Document1 pagePDF 490744590160723Gaurav BatraNo ratings yet

- ACK191196960010623Document1 pageACK191196960010623harsh sethiNo ratings yet

- Itr VDocument1 pageItr VArchana DeyNo ratings yet

- ACK377298960060723 HGDTDocument1 pageACK377298960060723 HGDTRagish RNo ratings yet

- ACK471398560140723Document1 pageACK471398560140723Dashing ParthiNo ratings yet

- PDF 732787000270723Document1 pagePDF 732787000270723ankit singhNo ratings yet

- ESHITA ROY ITR MERGEDDocument2 pagesESHITA ROY ITR MERGEDdeepghosh260897No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- I Will Say No With This Because I Think Catalogue Is One of The Best Marketing WayDocument2 pagesI Will Say No With This Because I Think Catalogue Is One of The Best Marketing WayYuMy Niê PrumNo ratings yet

- Ranez Marketing - Profile - 2020 - FinalDocument23 pagesRanez Marketing - Profile - 2020 - FinalAlazar Ahmed0% (1)

- CME-1 General Securities Part 1 - Securities Regulations 30-4-2015Document116 pagesCME-1 General Securities Part 1 - Securities Regulations 30-4-2015JeezNo ratings yet

- Answers To Chapter 5 Exercises: Review and Practice ExercisesDocument3 pagesAnswers To Chapter 5 Exercises: Review and Practice ExercisesHuyen NguyenNo ratings yet

- Meridian CaseDocument1 pageMeridian CasePriyanka ReddyNo ratings yet

- M.Com Accounting and Finance Revised SyllabusDocument29 pagesM.Com Accounting and Finance Revised SyllabusBeloved DhinaNo ratings yet

- Why Monopoly Can Be HarmDocument5 pagesWhy Monopoly Can Be Harmzakuan79No ratings yet

- Business Plan of Shubham Restaurant: Presented By: Bhavesh PipaliyaDocument14 pagesBusiness Plan of Shubham Restaurant: Presented By: Bhavesh PipaliyaAnkit SrivastavaNo ratings yet

- Compilation atDocument20 pagesCompilation atAshley Levy San PedroNo ratings yet

- Liben Farmers Cooperative Union Bankable Business Plan For Output FinancingDocument48 pagesLiben Farmers Cooperative Union Bankable Business Plan For Output FinancingIjaaraa SabaaNo ratings yet

- Microeconomics chapter on production theoryDocument24 pagesMicroeconomics chapter on production theoryabadi gebruNo ratings yet

- Chapter #7 Principles of MarketingDocument34 pagesChapter #7 Principles of Marketingkoibitoryu83% (6)

- MathematicsDocument316 pagesMathematicsParth Joshi100% (4)

- Summit Pointe AuditDocument54 pagesSummit Pointe AuditJennifer BowmanNo ratings yet

- Cost Control and Cost ReductionDocument16 pagesCost Control and Cost ReductionAnu AndrewsNo ratings yet

- Marketing InsightDocument13 pagesMarketing InsightVrishti LadhaniNo ratings yet

- Global Marketing Module Id: Th6De35O STUDENT ID: 21421232 Institute: Iihm, Delhi Word Count: 1562Document5 pagesGlobal Marketing Module Id: Th6De35O STUDENT ID: 21421232 Institute: Iihm, Delhi Word Count: 1562srishti capricornNo ratings yet

- Assignment Selecting An Organization Name of Student Name of ProfessorDocument4 pagesAssignment Selecting An Organization Name of Student Name of Professorrana ikramNo ratings yet

- The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDocument18 pagesThe Changing Role of Managerial Accounting in A Dynamic Business EnvironmentNijeshkumar PcNo ratings yet

- SAP SD Organizational StructuresDocument70 pagesSAP SD Organizational StructuresAnjan KumarNo ratings yet

- Financial Reporting in Hyperinflationary EconomiesDocument12 pagesFinancial Reporting in Hyperinflationary EconomiesRicardo PaduaNo ratings yet

- Flower Shop Customer Survey and QuestionnaireDocument6 pagesFlower Shop Customer Survey and QuestionnaireMariden Danna Barbosa100% (1)

- Haier in India: Building Presence in A Mass Market Beyond ChinaDocument12 pagesHaier in India: Building Presence in A Mass Market Beyond ChinaYusra AhmedNo ratings yet

- Sales Interview Territory Plan SalmanSalesAcademyDocument5 pagesSales Interview Territory Plan SalmanSalesAcademyrayan qureshey100% (1)

- Implementation of Supply Chain Management Strategy of A Study On Radiance Knitwears Ltd.Document9 pagesImplementation of Supply Chain Management Strategy of A Study On Radiance Knitwears Ltd.md.jewel ranaNo ratings yet

- Chapter 5 Solutions 6th EditionDocument6 pagesChapter 5 Solutions 6th EditionSarah Martin Edwards50% (2)

- Cost-to-Serve Model (CTS) : CIPS Procurement TopicDocument6 pagesCost-to-Serve Model (CTS) : CIPS Procurement TopicRoshanNo ratings yet

- Ch-3 - Supply & Demand Theory - NewDocument30 pagesCh-3 - Supply & Demand Theory - NewSAKIB MD SHAFIUDDINNo ratings yet

- Supply Chain Management (3rd Edition) : Network Design in An Uncertain EnvironmentDocument14 pagesSupply Chain Management (3rd Edition) : Network Design in An Uncertain EnvironmentCeceNo ratings yet

- Holding Notes 2Document16 pagesHolding Notes 2idealNo ratings yet