Professional Documents

Culture Documents

Declining Method (RV Rs. 16,000) 2. Prepare Entries If The Asset Is Sold at Teh End of Year 2018 at A. Rs.20,000 and B. Rs. 40,000

Uploaded by

Syeda Tooba0 ratings0% found this document useful (0 votes)

43 views2 pagesOriginal Title

Depreciation Question

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views2 pagesDeclining Method (RV Rs. 16,000) 2. Prepare Entries If The Asset Is Sold at Teh End of Year 2018 at A. Rs.20,000 and B. Rs. 40,000

Uploaded by

Syeda ToobaCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

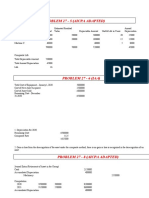

An asset was purchased on 1st January 2016 from sialkott at cost of Rs. 95,000. Rs.

10,000 was paid for

transportation to bring that asset to factory at Lahore. It need to get a fitness certificate so need additional

repairs at cost of Rs. 12,000 and was made. After wards Rs. 10,000 was paid to an engineer to get fitness

certificate. It is estimated that the useful life of machinery will be 5 years and it may be sold for Rs. 17,000

at the end of usefull life. Requirments 1. Prepare depreciation schedule a. streght Line Method b. double

Declining Method (RV Rs. 16,000) 2. Prepare entries if the asset is sold at teh end of year 2018 at a.

Rs.20,000 and b. Rs. 40,000

Streight Line Cost-Residual Value /life Date Account title Debit

Year Depreciation acc Depreciation Book value 1 31-Dec-18 Cash 20000

2016 22000 22000 105000 Acc Dep 66000

2017 22000 44000 83000 Loss on sale 41000

2018 22000 66000 61000 Machinery

2019 22000 88000 39000

2020 22000 110000 17000 2 31-Dec-18 Cash 40000

Accc Dep 66000

Loss on sale 21000

Machinery

Double declining rate = 1/life x 200 40 Date Account title Debit

Year Depreciation acc Depreciation Book value 1 31-Dec-18 Cash 20000

2016 50800 50800 76200 Acc Dep 99568

2017 30480 81280 45720 Loss on sale 7432

2018 18288 99568 27432 Machinery

2019 10973 110541 16459

2020 459 111000 16000 2 31-Dec-18 Cash 40000

Acc Dep 99568

Gain on sale

Machinery

Credit

127000

127000

Credit

127000

12568

127000

You might also like

- Modul 8 PembahasanDocument12 pagesModul 8 PembahasanAi TanahashiNo ratings yet

- FA Practice ExcelDocument7 pagesFA Practice ExcelSwati PorwalNo ratings yet

- Assignment Cover Sheet: Northrise UniversityDocument11 pagesAssignment Cover Sheet: Northrise UniversitySapcon ThePhoenixNo ratings yet

- SYbcom Ac Sem3Document56 pagesSYbcom Ac Sem3Anandkumar Gupta56% (9)

- ACCT 1107 - Assignment #4Document3 pagesACCT 1107 - Assignment #4hkarim8641No ratings yet

- Boildiy Mostas Legube: BuildaDocument6 pagesBoildiy Mostas Legube: BuildaInvestearn repeatNo ratings yet

- Truck 12000 Equipment 6000 Rototiller 400 Cash Register 3600 Cash 80000Document8 pagesTruck 12000 Equipment 6000 Rototiller 400 Cash Register 3600 Cash 80000RishabhJainNo ratings yet

- (MCOF19M018) CF ProjectDocument8 pages(MCOF19M018) CF ProjectFaaiz YousafNo ratings yet

- Accounting 1 2013Document3 pagesAccounting 1 2013Qasim IbrarNo ratings yet

- Module 2 Capital Budgeting Handout For LMS 2020Document11 pagesModule 2 Capital Budgeting Handout For LMS 2020sandeshNo ratings yet

- Luqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsDocument5 pagesLuqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsQasim KhokharNo ratings yet

- VIII. Financial Plan: A. Current Funding RequirementsDocument15 pagesVIII. Financial Plan: A. Current Funding RequirementsSaad AkramNo ratings yet

- Sensitivity_Scenario_Analysis_1711549320367Document18 pagesSensitivity_Scenario_Analysis_1711549320367pre.meh21No ratings yet

- 1-Handloom ExhibitionDocument5 pages1-Handloom Exhibitionsivakasi2022 KumarNo ratings yet

- A) Allocate and Apportion Production Overheads: Oarofa OarofbDocument3 pagesA) Allocate and Apportion Production Overheads: Oarofa Oarofbusman faisalNo ratings yet

- Business Plan: Team C-7Document20 pagesBusiness Plan: Team C-7lijyonasNo ratings yet

- Financial Feasibility: 4.1 Total Start Up Cash NeededDocument5 pagesFinancial Feasibility: 4.1 Total Start Up Cash NeededAmna Arif100% (1)

- Muhammad Usman 2077 Cert 4 AccountingDocument10 pagesMuhammad Usman 2077 Cert 4 AccountinggazanNo ratings yet

- McReath Original SolutionDocument2 pagesMcReath Original SolutionSuchi0% (1)

- Production Requirements For Combine Warehouse (Variable Cost) Production Requirements For Combine Warehouse (Fixed Cost) SR - NoDocument4 pagesProduction Requirements For Combine Warehouse (Variable Cost) Production Requirements For Combine Warehouse (Fixed Cost) SR - NoJoginder ChhikaraNo ratings yet

- Financial Plan: Sales ForecastDocument8 pagesFinancial Plan: Sales ForecastAyush BishtNo ratings yet

- 0 20211022172312preparing PL Account Balance Sheet Cash Flow 3Document6 pages0 20211022172312preparing PL Account Balance Sheet Cash Flow 3VISHAL PATILNo ratings yet

- Higher National Diploma in Accountancy Hnda 2 Year, Second Semester Examination - 2018 2202-Computer Applications For AccountingDocument14 pagesHigher National Diploma in Accountancy Hnda 2 Year, Second Semester Examination - 2018 2202-Computer Applications For AccountingName of RoshanNo ratings yet

- CASH FLOW ModelDocument2 pagesCASH FLOW ModeloanaNo ratings yet

- Pre-Final Exam in Audit 2-3Document5 pagesPre-Final Exam in Audit 2-3Shr BnNo ratings yet

- Calculating Depreciation Using the Composite MethodDocument2 pagesCalculating Depreciation Using the Composite MethodAriean Joy DequiñaNo ratings yet

- F.A Assignment Shahryar Zehri (1811188Document9 pagesF.A Assignment Shahryar Zehri (1811188Ahmed ZaiNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetShaheena SanaNo ratings yet

- Financial Reporting and Analysis Final OSADocument9 pagesFinancial Reporting and Analysis Final OSATracy-lee JacobsNo ratings yet

- ACF - Preksha GulatiDocument4 pagesACF - Preksha GulatiPreksha GulatiNo ratings yet

- Financial Management - Assigment No.6Document5 pagesFinancial Management - Assigment No.6besho_3No ratings yet

- Q1 GMS LimitedDocument2 pagesQ1 GMS Limitedamosmalusi5No ratings yet

- Assignment 2Document9 pagesAssignment 2PoommalarNo ratings yet

- KuisparakDocument8 pagesKuisparakLepupurNo ratings yet

- Partnership Final Account and Balance SheetDocument42 pagesPartnership Final Account and Balance SheetAnandkumar Gupta0% (1)

- Natural Foods Income StatementDocument9 pagesNatural Foods Income StatementabraamNo ratings yet

- Xii Ca Model KeyDocument3 pagesXii Ca Model Keyapmmontage112No ratings yet

- FAC2601 Assignment 02Document4 pagesFAC2601 Assignment 02SibongileNo ratings yet

- Tess Pascual Shoes Worksheet For The Month Ended Feb. 29, 2020Document10 pagesTess Pascual Shoes Worksheet For The Month Ended Feb. 29, 2020Sofia Gwen VenturaNo ratings yet

- Srinath SirDocument19 pagesSrinath Sirmy Vinay100% (1)

- Trading Profit Loss 2020Document8 pagesTrading Profit Loss 2020Nikhil RajNo ratings yet

- Asset Liability Expenses Income Owner's CapitalDocument4 pagesAsset Liability Expenses Income Owner's Capitalamitmehta29No ratings yet

- AnswersDocument4 pagesAnswersamitmehta29No ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Walking Stick For Blind With Sensors: Presented byDocument12 pagesWalking Stick For Blind With Sensors: Presented byAbbas MookhyNo ratings yet

- Capital computations and financial statementsDocument2 pagesCapital computations and financial statementsKashan AzizNo ratings yet

- Madaraka Ltd. income statement and financialsDocument17 pagesMadaraka Ltd. income statement and financialsMaryjoy KilonzoNo ratings yet

- Solution Practice 9 Business Combinations and ImpairmentDocument8 pagesSolution Practice 9 Business Combinations and ImpairmentGuinevereNo ratings yet

- Balance Sheet 12345Document32 pagesBalance Sheet 12345Anurag KshatriNo ratings yet

- Net Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentDocument6 pagesNet Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentMadina MamasalievaNo ratings yet

- Jaycee Ltd impairment testDocument2 pagesJaycee Ltd impairment testMi ThaiNo ratings yet

- FF - Karil Koiriyah - 180421621551 - Tugas 4Document92 pagesFF - Karil Koiriyah - 180421621551 - Tugas 4karinaNo ratings yet

- Worksheet AccountingDocument5 pagesWorksheet AccountingDorinNo ratings yet

- Investor Meet Presentation May 19Document25 pagesInvestor Meet Presentation May 19Tshering Yangzom NamdaNo ratings yet

- Test TB Final Ac Single EntryDocument2 pagesTest TB Final Ac Single EntryMegha BhargavaNo ratings yet

- Remidial Assignment B.tech - Bbs n'22Document9 pagesRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriNo ratings yet

- 132 Saqlain ShaikhDocument10 pages132 Saqlain ShaikhCemon FredNo ratings yet

- Assumptions:: 11. Financial PlanDocument5 pagesAssumptions:: 11. Financial PlanAkib xabedNo ratings yet

- Edex Camb Mock 2025 Sir Rimas-1Document12 pagesEdex Camb Mock 2025 Sir Rimas-1methuli chenara jayasingheNo ratings yet

- University of Central Punjab: Course Title: Pakistan StudiesDocument4 pagesUniversity of Central Punjab: Course Title: Pakistan StudiesSyeda ToobaNo ratings yet

- Presentation Slides: Visual Aids/GraphicsDocument2 pagesPresentation Slides: Visual Aids/GraphicsSyeda ToobaNo ratings yet

- Assignment 4Document5 pagesAssignment 4Syeda ToobaNo ratings yet

- Stratma Matrices SHELLDocument34 pagesStratma Matrices SHELLAngel Pido50% (2)

- Group Presentation TemplateDocument1 pageGroup Presentation TemplateSyeda ToobaNo ratings yet

- Principles of marketing and Bose case studyDocument3 pagesPrinciples of marketing and Bose case studySyeda ToobaNo ratings yet

- Quiz 2Document1 pageQuiz 2Syeda ToobaNo ratings yet

- Quiz 2Document1 pageQuiz 2Syeda ToobaNo ratings yet

- 1981 District Census Report of KhairpurDocument141 pages1981 District Census Report of KhairpurSyeda ToobaNo ratings yet

- Quiz 2Document1 pageQuiz 2Syeda ToobaNo ratings yet

- Ayesha Ashraf Mid TermDocument13 pagesAyesha Ashraf Mid TermSyeda ToobaNo ratings yet

- University of Central Punjab: Course Title: Islamic StudiesDocument4 pagesUniversity of Central Punjab: Course Title: Islamic StudiesSyeda ToobaNo ratings yet

- Quiz No 3Document1 pageQuiz No 3Syeda ToobaNo ratings yet

- Task - Video Analysis (Tooba)Document2 pagesTask - Video Analysis (Tooba)Syeda ToobaNo ratings yet

- MC QsDocument2 pagesMC QsSyeda ToobaNo ratings yet

- Assignment PMDocument3 pagesAssignment PMSyeda ToobaNo ratings yet

- 891 AP 210 598 Cash 110 1000: Sales JournalDocument25 pages891 AP 210 598 Cash 110 1000: Sales JournalSyeda ToobaNo ratings yet

- COST OF CAPITAL Inv App Lecture OnlineDocument11 pagesCOST OF CAPITAL Inv App Lecture OnlineSyeda ToobaNo ratings yet

- Marginal & Absorption Costing Questions AnsweredDocument6 pagesMarginal & Absorption Costing Questions AnsweredSyeda ToobaNo ratings yet

- CH 2 CompleteDocument114 pagesCH 2 CompleteSyeda ToobaNo ratings yet

- Module 9 Demonstration ProblemsDocument15 pagesModule 9 Demonstration ProblemsKatherine JoieNo ratings yet

- Problem 2.4ADocument2 pagesProblem 2.4ASyeda ToobaNo ratings yet

- CH 03Document71 pagesCH 03Syeda ToobaNo ratings yet

- CH 01Document44 pagesCH 01Syeda ToobaNo ratings yet

- Bank Reconciliation Through BS and Cash LedgerDocument4 pagesBank Reconciliation Through BS and Cash LedgerSyeda ToobaNo ratings yet

- Problem 2.3ADocument2 pagesProblem 2.3ASyeda ToobaNo ratings yet

- CH 01Document44 pagesCH 01Syeda ToobaNo ratings yet

- Units Per Unit 1-Dec Purchase 100 10 2-Dec Purchase 200 12 3-Dec Sales 150 50 4-Dec Purchase 200 14 5-Dec Purchase 300 11 6-Dec Sales 550 55Document4 pagesUnits Per Unit 1-Dec Purchase 100 10 2-Dec Purchase 200 12 3-Dec Sales 150 50 4-Dec Purchase 200 14 5-Dec Purchase 300 11 6-Dec Sales 550 55Syeda ToobaNo ratings yet

- International Accounting Standard - IAS 8Document19 pagesInternational Accounting Standard - IAS 8Syeda ToobaNo ratings yet

- J&J FS AnalysisDocument5 pagesJ&J FS AnalysisEarl Justine FerrerNo ratings yet

- (Nov 11, 2016) CMR - Cash Out To Marek PDFDocument2 pages(Nov 11, 2016) CMR - Cash Out To Marek PDFDavid HundeyinNo ratings yet

- Corporate Financial Management 5th Edition Glen Arnold Test Bank DownloadDocument564 pagesCorporate Financial Management 5th Edition Glen Arnold Test Bank DownloadRichard Hunter100% (25)

- Coursebook Answers: Answers To Test Yourself QuestionsDocument2 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii83% (40)

- Valuation of GoodwillDocument34 pagesValuation of GoodwillGamming Evolves100% (1)

- Repo and Reverse Repo RateDocument8 pagesRepo and Reverse Repo RateJinujith MohanNo ratings yet

- Exercises - ManufacturingDocument7 pagesExercises - ManufacturingRiana CellsNo ratings yet

- Training and Developing HDFC BankDocument92 pagesTraining and Developing HDFC BankShwetha RapolNo ratings yet

- Wisma Perkasa SDN BHD V Weatherford (M) SDN BHD & AnorDocument38 pagesWisma Perkasa SDN BHD V Weatherford (M) SDN BHD & AnorSellamal ServaiNo ratings yet

- Gap AnalysisDocument5 pagesGap AnalysisRavi BavariaNo ratings yet

- Business Law and RegulationsDocument5 pagesBusiness Law and RegulationsLoida Joy AvellanaNo ratings yet

- Presentation 4: Credit Rating To Customers in Commercial Banks: Rationality and IssuesDocument10 pagesPresentation 4: Credit Rating To Customers in Commercial Banks: Rationality and IssuesNguyễn Thế LongNo ratings yet

- Income TaxDocument4 pagesIncome TaxsebastianksNo ratings yet

- Families That Rule The WorldDocument5 pagesFamilies That Rule The WorldAries0104No ratings yet

- Companies Act Borrowing PowersDocument11 pagesCompanies Act Borrowing PowersSaptak RoyNo ratings yet

- Revenue Requirements and RAB WebinarDocument26 pagesRevenue Requirements and RAB WebinarDallas Dragon100% (1)

- ACC622 Assignment 2021Document5 pagesACC622 Assignment 2021Nosisa SithebeNo ratings yet

- Negotiable InstrumentDocument6 pagesNegotiable InstrumentMica VillaNo ratings yet

- Diane chptr1 DoneDocument13 pagesDiane chptr1 DoneRosemenjelNo ratings yet

- Full Disclosure in Financial ReportingDocument22 pagesFull Disclosure in Financial ReportingIrwan JanuarNo ratings yet

- Kolehiyo NG Subic: ZambalesDocument3 pagesKolehiyo NG Subic: ZambalesRodeliza DuncanNo ratings yet

- APT Literature Review: Arbitrage Pricing TheoryDocument11 pagesAPT Literature Review: Arbitrage Pricing Theorydiala_khNo ratings yet

- 2010 IRS Notifications To The City of Lauderdake LakesDocument8 pages2010 IRS Notifications To The City of Lauderdake LakesMy-Acts Of-SeditionNo ratings yet

- RFLR v5 n1Document68 pagesRFLR v5 n1navycruise100% (1)

- Tutorial 4 Q and ADocument7 pagesTutorial 4 Q and ASwee Yi LeeNo ratings yet

- Askeladden Capital Investor Letter Scars and How We Got ThemDocument23 pagesAskeladden Capital Investor Letter Scars and How We Got ThemMario Di MarcantonioNo ratings yet

- LKAS 37 - StudentsDocument7 pagesLKAS 37 - StudentskawindraNo ratings yet

- ANSWERS For ExercisesDocument13 pagesANSWERS For ExercisesAlia HazwaniNo ratings yet

- Ghassan George Ojeil: Financial Analysis/ReportingDocument2 pagesGhassan George Ojeil: Financial Analysis/ReportingElie DiabNo ratings yet

- Manufacturing AccountDocument2 pagesManufacturing AccounthassanNo ratings yet