0% found this document useful (0 votes)

558 views6 pagesStock Analysis Checklist

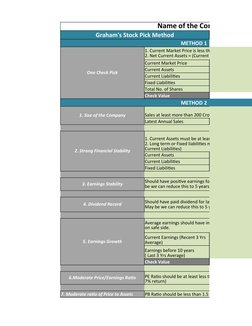

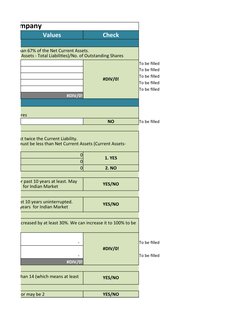

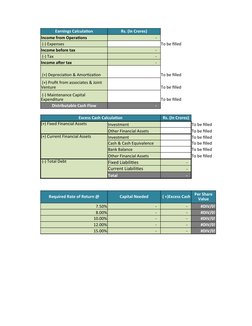

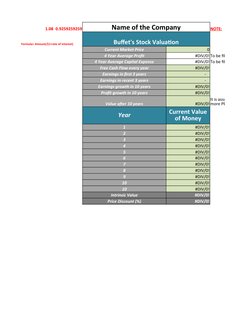

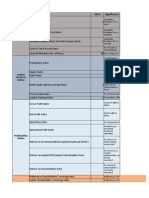

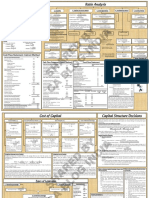

The document outlines Graham's stock pick method and Buffett's stock valuation method. Graham's method has two steps - the first evaluates financial ratios like price to assets, while the second evaluates factors like company size, financial stability, earnings growth and stability, dividend record, and price to earnings ratio. Buffett's method calculates intrinsic value by discounting future free cash flows over 10 years using a discount rate. It compares intrinsic value to current market price to determine price discount.

Uploaded by

senthil ganeshCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

558 views6 pagesStock Analysis Checklist

The document outlines Graham's stock pick method and Buffett's stock valuation method. Graham's method has two steps - the first evaluates financial ratios like price to assets, while the second evaluates factors like company size, financial stability, earnings growth and stability, dividend record, and price to earnings ratio. Buffett's method calculates intrinsic value by discounting future free cash flows over 10 years using a discount rate. It compares intrinsic value to current market price to determine price discount.

Uploaded by

senthil ganeshCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd