Professional Documents

Culture Documents

On July 1 2014 Seto Inc Purchased A Fire Extinguisher PDF

On July 1 2014 Seto Inc Purchased A Fire Extinguisher PDF

Uploaded by

hassan taimourOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

On July 1 2014 Seto Inc Purchased A Fire Extinguisher PDF

On July 1 2014 Seto Inc Purchased A Fire Extinguisher PDF

Uploaded by

hassan taimourCopyright:

Available Formats

On July 1 2014 Seto Inc purchased a fire extinguisher #604

On July 1, 2014, Seto, Inc. purchased a fire extinguisher system for $130,000 from MTI

Systems. The fire extinguisher system had an estimated life of 15 years and residual value of

$2,800. Seto paid $4,500 for shipping and insurance, and hired an engineering company to

install and set up the fire extinguisher system for $12,500. MTI asked for $80,000 cash payment

upon purchase, $10,000 is due on July 31, 2014, with a 2% discount if Seto makes the payment

by July 10, and a $40,000 one-year note payable plus 6% interest due on June 30, 2015. Seto

paid the invoice on July 31. Seto uses the straight-line depreciation method.On January 1,

2016, Seto replaced a valve component costing $38,700, and as a result, the useful life of the

fire extinguisher system increased by 3 years.On September 3, 2017, the fire extinguisher

system was destroyed by a factory fire. Seto made a claim to the insurance company.

Subsequently, Seto received $125,000 cash on September 30, 2017.Requirements1. Calculate

the acquisition cost of the fire extinguisher system.2. Prepare all journal entries for 2014, 2015,

2016, and 2017.View Solution:

On July 1 2014 Seto Inc purchased a fire extinguisher

ANSWER

http://paperinstant.com/downloads/on-july-1-2014-seto-inc-purchased-a-fire-extinguisher/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Assignment Adjusting EntriesDocument2 pagesAssignment Adjusting EntriesKim Patrick VictoriaNo ratings yet

- Everything you Ever Wanted to Know About Batteries for Domestic Power, but Were Afraid to askFrom EverandEverything you Ever Wanted to Know About Batteries for Domestic Power, but Were Afraid to askNo ratings yet

- Zumra Company S Annual Accounting Year Ends On December 31 It PDFDocument1 pageZumra Company S Annual Accounting Year Ends On December 31 It PDFhassan taimourNo ratings yet

- New Employment Inc QnsDocument13 pagesNew Employment Inc QnsLoveness JoseehNo ratings yet

- Mark Bennett D D S Opened An Incorporated Dental Practice OnDocument1 pageMark Bennett D D S Opened An Incorporated Dental Practice OnM Bilal SaleemNo ratings yet

- Decision,+ERC+Case+No +2014-118+RCDocument35 pagesDecision,+ERC+Case+No +2014-118+RCDyna EnadNo ratings yet

- Intangible Assets Sample ProblemsDocument5 pagesIntangible Assets Sample ProblemsJanice Ann MacalinaoNo ratings yet

- On July 31 2015 Myron Corporation Purchased Equipment For 750 000Document1 pageOn July 31 2015 Myron Corporation Purchased Equipment For 750 000Miroslav GegoskiNo ratings yet

- 2015 Joint StipulationDocument16 pages2015 Joint Stipulationaswarren77No ratings yet

- Extractor Company Leased A Machine On July 1 2015 UnderDocument1 pageExtractor Company Leased A Machine On July 1 2015 UnderMuhammad ShahidNo ratings yet

- Longterm Motor Products-RDocument10 pagesLongterm Motor Products-Rvikrant sehgalNo ratings yet

- On January 1 2017 Plutonium Corporation Acquired 80 of TheDocument1 pageOn January 1 2017 Plutonium Corporation Acquired 80 of TheMuhammad ShahidNo ratings yet

- On January 1 2010 Green Dog Electronics Leased A FactoryDocument1 pageOn January 1 2010 Green Dog Electronics Leased A FactoryFreelance WorkerNo ratings yet

- Policy SummaryDocument1 pagePolicy Summarythenmoli806No ratings yet

- Policy SummaryDocument1 pagePolicy Summarythenmoli806No ratings yet

- Policy SummaryDocument1 pagePolicy Summarythenmoli806No ratings yet

- Policy SummaryDocument1 pagePolicy Summarythenmoli806No ratings yet

- On January 2 2012 Athol Company Bought A Machine For PDFDocument1 pageOn January 2 2012 Athol Company Bought A Machine For PDFFreelance WorkerNo ratings yet

- On March 1 2015 Zephur Winds LTD Purchased A Machine PDFDocument1 pageOn March 1 2015 Zephur Winds LTD Purchased A Machine PDFhassan taimourNo ratings yet

- Onkar Corporation Bought A Machine On June 1 2010 ForDocument1 pageOnkar Corporation Bought A Machine On June 1 2010 ForLet's Talk With HassanNo ratings yet

- R UK Tidal Stream Industry Update Final 21.03.2018Document33 pagesR UK Tidal Stream Industry Update Final 21.03.2018Juan David Valderrama ArtunduagaNo ratings yet

- On November 1 2007 Columbo Company Adopted A Stock OptionDocument1 pageOn November 1 2007 Columbo Company Adopted A Stock OptionM Bilal SaleemNo ratings yet

- En Econ - Replacement and Retention DecisionDocument11 pagesEn Econ - Replacement and Retention DecisionMoshi JungkasemsukNo ratings yet

- Memorial Medical Centre Bought Equipment On January 2 2014 For PDFDocument1 pageMemorial Medical Centre Bought Equipment On January 2 2014 For PDFTaimour HassanNo ratings yet

- I REC Registry Data October 2023 2Document5,779 pagesI REC Registry Data October 2023 2Andújar Báez CésarNo ratings yet

- On October 1 2014 Lyndon Inc Purchased A Computer System PDFDocument1 pageOn October 1 2014 Lyndon Inc Purchased A Computer System PDFhassan taimourNo ratings yet

- On January 1 2011 Telconnect Acquires 70 Percent of BandmorDocument1 pageOn January 1 2011 Telconnect Acquires 70 Percent of BandmorMiroslav GegoskiNo ratings yet

- On January 1 2015 Picard Inc Purchased A New PieceDocument1 pageOn January 1 2015 Picard Inc Purchased A New PieceMuhammad ShahidNo ratings yet

- Solar Steam Generating SystemDocument5 pagesSolar Steam Generating SystemShailendra ShrivastavaNo ratings yet

- On September 30 2014 Coldwater Corporation Purchased Equipment For 1 1Document1 pageOn September 30 2014 Coldwater Corporation Purchased Equipment For 1 1Miroslav GegoskiNo ratings yet

- Env RP PDFDocument17 pagesEnv RP PDFsakshi.2020.462No ratings yet

- Larsen Improvedbiomasscookstoves 2018Document9 pagesLarsen Improvedbiomasscookstoves 2018Subhashini RamachandranNo ratings yet

- Test Group No.2 - Ias 16 Ifrs 15Document2 pagesTest Group No.2 - Ias 16 Ifrs 15Ngan TrucNo ratings yet

- Central Electricity Regulatory Commission New Delhi: Order in Petition No. 210/MP/2019 Page 1 of 33Document33 pagesCentral Electricity Regulatory Commission New Delhi: Order in Petition No. 210/MP/2019 Page 1 of 33Ajay SharmaNo ratings yet

- The General Ledger of Corso Care Corp A Veterinary CompanyDocument2 pagesThe General Ledger of Corso Care Corp A Veterinary CompanyBube KachevskaNo ratings yet

- Water EC Calculation GuidelinesDocument42 pagesWater EC Calculation Guidelinesplantmanager.pddpcsNo ratings yet

- The Following Information Concerns The Adjusting Entries To Be RecordedDocument1 pageThe Following Information Concerns The Adjusting Entries To Be RecordedHassan JanNo ratings yet

- ELI - University of Idaho - CokeDocument4 pagesELI - University of Idaho - CokeEllen Gonzalvo-CabutihanNo ratings yet

- Go MS 15Document6 pagesGo MS 15Raghu RamNo ratings yet

- Highstreet Inc Is A Distributor of Electronic Equipment in JanuaryDocument1 pageHighstreet Inc Is A Distributor of Electronic Equipment in JanuaryLet's Talk With HassanNo ratings yet

- Rental Contract For Gaming ComputerDocument3 pagesRental Contract For Gaming ComputerJohn Michael VillegasNo ratings yet

- Kim S Nursery Sells A Wide Variety of Plants and Offers PDFDocument1 pageKim S Nursery Sells A Wide Variety of Plants and Offers PDFFreelance Worker0% (1)

- AccountingDocument5 pagesAccountingMaitet CarandangNo ratings yet

- 2020 Assessment 3 Information - RequiredDocument7 pages2020 Assessment 3 Information - RequiredBELLANo ratings yet

- Other DataDocument2 pagesOther Dataaura fitrah auliya SomantriNo ratings yet

- Practice QuestionsDocument5 pagesPractice QuestionsCheuk Ling SoNo ratings yet

- ISREC Newsletter 02a - January 2012Document2 pagesISREC Newsletter 02a - January 2012CFFcarboncalculatorNo ratings yet

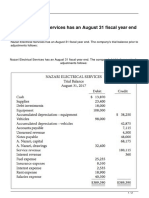

- Nazari Electrical Services Has An August 31 Fiscal Year EndDocument2 pagesNazari Electrical Services Has An August 31 Fiscal Year EndCharlotteNo ratings yet

- 2.profile Information EnglishDocument23 pages2.profile Information EnglishKazi ArefinNo ratings yet

- QUOTATION - Peerless - UPDATED 05.04.2024Document3 pagesQUOTATION - Peerless - UPDATED 05.04.2024subrata sarkarNo ratings yet

- 9 PEMASANGAN AlAt PEMADAM API RINGAN DI Pt. E-t-A INDONESIADocument9 pages9 PEMASANGAN AlAt PEMADAM API RINGAN DI Pt. E-t-A INDONESIAsalsa tikaaNo ratings yet

- Solved A Retailer of Electronic Equipment Received Six Vcrs From The PDFDocument1 pageSolved A Retailer of Electronic Equipment Received Six Vcrs From The PDFAnbu jaromiaNo ratings yet

- 1.3.2 MouDocument206 pages1.3.2 Mousauravgandhi17No ratings yet

- Ulric Solar Power Enterprises Corporation: Cagayan de Oro City, 9000Document1 pageUlric Solar Power Enterprises Corporation: Cagayan de Oro City, 9000Jamali NagamoraNo ratings yet

- Quiz #1 PracticeDocument7 pagesQuiz #1 PracticeSano ManjiroNo ratings yet

- Rainmaker Environmental Consultants Is Just Finishing Its Second Year ofDocument1 pageRainmaker Environmental Consultants Is Just Finishing Its Second Year ofLet's Talk With HassanNo ratings yet

- The Following Transactions Occur Over The Remainder of The Year AugDocument2 pagesThe Following Transactions Occur Over The Remainder of The Year AugBube KachevskaNo ratings yet

- ITC June 2022 Paper 3 Question 2 BiocoreDocument5 pagesITC June 2022 Paper 3 Question 2 Biocoredjbongz777No ratings yet

- PH 3 PEP East Injection ImprovementDocument6 pagesPH 3 PEP East Injection ImprovementElias EliasNo ratings yet

- Agreement Between Agency and Beneficiary 2018-02-19Document3 pagesAgreement Between Agency and Beneficiary 2018-02-19Chhote SinghNo ratings yet

- Objection Deadline: September 14, 2010 Hearing Date: Only If Objections Are Timely FiledDocument31 pagesObjection Deadline: September 14, 2010 Hearing Date: Only If Objections Are Timely FiledChapter 11 DocketsNo ratings yet

- Zippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFDocument1 pageZippy A Regional Convenience Store Chain Maintains Milk Inventory by PDFhassan taimourNo ratings yet

- Your Supervisor Has Asked You To Research The Following Situation PDFDocument1 pageYour Supervisor Has Asked You To Research The Following Situation PDFhassan taimourNo ratings yet

- You Ca Have Been Working For Plener and Partners Chartered PDFDocument4 pagesYou Ca Have Been Working For Plener and Partners Chartered PDFhassan taimourNo ratings yet

- Your Best Friend From Home Writes You A Letter About PDFDocument1 pageYour Best Friend From Home Writes You A Letter About PDFhassan taimourNo ratings yet

- You Manage A 13 5 Million Portfolio Currently All Invested PDFDocument1 pageYou Manage A 13 5 Million Portfolio Currently All Invested PDFhassan taimourNo ratings yet

- Windmere Corporation S Statement of Financial Position at December 31 2016 PDFDocument1 pageWindmere Corporation S Statement of Financial Position at December 31 2016 PDFhassan taimourNo ratings yet

- You Own 10 000 Shares 1 of The Outstanding Shares of PDFDocument1 pageYou Own 10 000 Shares 1 of The Outstanding Shares of PDFhassan taimourNo ratings yet

- Yangzi International Inc Uses The Aging of Accounts Receivable Method PDFDocument1 pageYangzi International Inc Uses The Aging of Accounts Receivable Method PDFhassan taimourNo ratings yet

- You Ca Have Recently Been Assigned As Audit Senior For PDFDocument2 pagesYou Ca Have Recently Been Assigned As Audit Senior For PDFhassan taimourNo ratings yet

- Xanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFDocument1 pageXanadu LTD Has Accounts Receivable Totalling 142 800 and A 3 640 PDFhassan taimourNo ratings yet

- Wright Fishing Charters Has Collected The Following Data For The PDFDocument1 pageWright Fishing Charters Has Collected The Following Data For The PDFhassan taimourNo ratings yet

- Your Friend Is Celebrating Her 30th Birthday Today and Wants PDFDocument1 pageYour Friend Is Celebrating Her 30th Birthday Today and Wants PDFhassan taimourNo ratings yet

- Wood Work LTD Sells Home Furnishings Including A Wide Range PDFDocument1 pageWood Work LTD Sells Home Furnishings Including A Wide Range PDFhassan taimourNo ratings yet

- Wright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFDocument1 pageWright Oil Company S Balance Sheet Includes Three Assets Natural Gas PDFhassan taimourNo ratings yet

- You Are A Senior Manager at Poeing Aircraft and Have PDFDocument1 pageYou Are A Senior Manager at Poeing Aircraft and Have PDFhassan taimourNo ratings yet

- Whistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFDocument1 pageWhistler Blackcomb Holdings Inc Has A 75 Interest in Whistler PDFhassan taimourNo ratings yet

- Whiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFDocument1 pageWhiskey Industries LTD A Nanaimo British Columbia Based Company Has A PDFhassan taimourNo ratings yet

- While Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFDocument1 pageWhile Pursuing His Undergraduate Studies Bruno Clarke Needed To Earn PDFhassan taimourNo ratings yet

- Whitley Company Is Considering Two Capital Investments Both Investments Have PDFDocument1 pageWhitley Company Is Considering Two Capital Investments Both Investments Have PDFhassan taimourNo ratings yet