Professional Documents

Culture Documents

FR Examiner's Report M20 PDF

FR Examiner's Report M20 PDF

Uploaded by

spark1960Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FR Examiner's Report M20 PDF

FR Examiner's Report M20 PDF

Uploaded by

spark1960Copyright:

Available Formats

Examiner’s report

Financial Reporting (FR)

March 2020

The examining team share their observations from the marking process to highlight strengths and

weaknesses in candidates’ performance, and to offer constructive advice for future candidates.

General comments

The Financial Reporting (FR) exam is offered as a computer-based exam (CBE). The model of

delivery for the CBE exam means that candidates do not all receive the same set of questions. In

this report, the examining team share their observations from the marking process to highlight

strengths and weaknesses in candidates’ performance, and to offer constructive advice for future

candidates.

• Section A objective test questions – we focus on two specific questions that caused

difficulty in this sitting of the exam.

• Section B objective test case questions – here we look at the key challenge areas for this

section in the exam.

• Section C constructed response questions - here we provide commentary around some of

the main themes that have affected candidates’ performance in this section of the exam,

identifying common knowledge gaps and offering guidance on where exam technique could

be improved, including in the use of the CBE functionality in answering these questions.

Section A

Here we take a look at TWO Section A questions which proved to be particularly difficult for

candidates.

Example 1:

New Designs Co is considering the following potential assets for inclusion in its statement of

financial position.

Indicate which of the options below should be recognised as intangible assets by dragging

and dropping the appropriate options into the grey target boxes.

OPTIONS Intangible Assets

Brand name developed by New Designs $2m spent on an advertising campaign

Co worth $10m expected to increase revenue by $20m

$2.5m spent on new equipment to $3m paid to acquire the brand name Fast

develop a new successful product Designs

$3m spent on a licence to operate a $1m spent on the construction of a

production facility for six years product prototype before its launch

$1.5m spent on training customer service $2m paid as goodwill when acquiring

staff expected to increase revenue by Unique Co

$5m

Examiner’s report – FR March 2020

What does this test?

This question tests learning outcome B2(c) where candidates should be able to understand the

criteria for the recognition of intangible assets. It is important to note that all four options must be

correct to get 2 marks. Unfortunately, many candidates got three answers correct but not all four. It

is therefore vital that candidates read all of the options carefully and that each option is given equal

consideration before you move to the next question.

What is the correct answer?

The correct answers are identified below for the following reasons:

• $3m to acquire brand name Fast Designs – meets the definition of an intangible asset (note

that this contrasts with the internal development of a brand)

• $3m licence - meets the definition of an intangible asset

• $1m prototype expenditure – meets the definition of development expenditure

• $2m goodwill - meets the definition of an intangible asset

Why the correct answer is none of the other options?

The incorrect answers are identified below for the following reasons:

• $10m brand developed by New Designs Co – internally developed and therefore

capitalisation is prohibited

• $2m advertising campaign – this expenditure cannot be controlled therefore it does not

meet the definition of an asset

• $2.5m spent on equipment – this may be a tangible asset but it is definitely not an

intangible asset

• $1.5m staff training - this expenditure cannot be controlled therefore it does not meet the

definition of an asset

Example 2:

Root Co acquired 30% of the 100,000 equity shares in Branch Co for $7.50 per share on 1 January

20X7, when Branch Co had retained earnings of $460,000 and a balance on the revaluation

surplus of $50,000.

At the year end date of 31 December 20X7, Branch Co had retained earnings of $370,000 and a

balance of $70,000 on the revaluation surplus. Root Co considered that its investment in Branch

Co had suffered an impairment loss of $40,000

Calculate the carrying amount of the investment in Branch Co in the consolidated statement

of financial position of Root Co as at 31 December 20X7

What does this test?

This question tests a candidate’s understanding of how to account for a company’s investment in

an associate company (learning outcome D2). Using equity accounting, the carrying amount is:

COST +/- MOVEMENT IN POST-ACQUISITION RESERVES – DIVIDENDS RECEIVED - IMPAIRMENT

Examiner’s report – FR March 2020 2

What is the correct answer?

$

Cost of investment (30,000 x $7.50) 225,000

Post-acquisition loss in retained earnings (($370,000-$460,000) x 30%) (27,000)

Post-acquisition increase in revaluation surplus (($70,000-$50,000) x 30%) 6,000

Impairment (40,000)

164,000

Why the correct answer is none of the other options?

This was a fill in the blank question (so there were no other options) but many candidates ignored

the post-acquisition increase in the revaluation surplus and some also ignored the post-acquisition

loss in retained earnings. Some treated the post-acquisition loss in retained earnings as a gain and

adjusted for it the wrong way and others only wrote off 30% of the impairment. This suggests that

candidates are either not comfortable with equity accounting or were careless in their workings.

Candidates should take great care with fill in the blank questions and review their answer

thoroughly before moving on the next question.

Section B

Section B tests candidates’ knowledge on a number of topics in more detail than section A, with

three case questions containing five two-mark objective test questions. The range of topics

covered in the March 2020 examination was:

• Accounting policies

• Financial instruments

• Plant, property and equipment; borrowing costs; and government grants

• Leases

• Foreign exchange

• Revenue

Candidates found the following accounting adjustments difficult: the revaluation of a property;

government grants; costs associated with the construction of PPE (in particular borrowing costs);

and the calculation of the carrying amount of a right-of-use leased assets. Admittedly, some of

these topics are technically challenging but this does not mean that the FR examining team will not

examine them. Candidates should be prepared for a balanced FR exam which will contain

challenging questions in addition to questions that are less challenging.

A few key points that came out of section B were:

• Read the case scenario and requirements very carefully. This goes for the whole exam, but

any objective test question is ‘all or nothing’ – if you misread the requirement or miss a vital

piece of information from the scenario and get the answer incorrect you score zero for that

question. Close reading is also important for identifying the instructions in the question on

how to round your answers.

• Cover the whole syllabus. The list above should highlight this – FR has a large syllabus

which can seem daunting, but it is essential to have a broad knowledge. If, for example, a

Examiner’s report – FR March 2020 3

section B OT case testing leases comes up, and you haven’t covered this in your revision,

the 10 marks available are left to chance.

• Be able to apply your knowledge of theories/techniques to the scenario provided, as in the

OT case questions these areas will often be examined in the context of the case. It is

important that you are able to apply the logic of a concept or theory to a problem and so

you need to understand the method and why you are doing the calculations and not just

focus on how to do the calculations.

Section C

Candidates were presented with questions drawn mainly from the areas of:

- Single entity accounts preparation

- Analysis of single entity financial statements

- Preparation of consolidated financial statements

- Analysis of consolidated financial statements

These will be discussed in turn. Although the specifics of individual questions will not be discussed,

common areas candidates either performed well on or struggled with will be highlighted. Advice will

be provided to improve exam performance.

Single entity accounts preparation

Some candidates were required to prepare a statement of profit or loss (SOPL) and other

comprehensive income (OCI), a statement of changes in equity (SOCIE) and extracts from the

statement of cash flow (SCF) using a trial balance (TB)and notes that required adjustments. On

the whole, performances in this area were not as good as in previous diets, however, there were

still many well-prepared candidates that were able to score highly.

A common mistake in the SOPL for some candidates related to the investment in shares. The

question stated that the investment was to be recognised as fair value through other

comprehensive income in accordance with IFRS 9 Financial Instruments. Many candidates

ignored the instruction to record changes in fair value in OCI and instead recognised the gain in

SOPL. There was also a significant number of candidates that viewed this investment as a share

issue in error and recognised it in the SOCIE. It was disappointing that such a large number of

candidates failed to recognise the investment correctly as this is a topic area where the basics

need to be grasped at the FR level to underpin the knowledge required for Strategic Business

Reporting (SBR).

The marking team commented that the SOCIE was often not attempted at all or was largely

incomplete. A surprising number of candidates did not show the opening balances or adjusted

them for a (non-existent) share issue in some questions. In questions where candidates were

presented with a rights issue that had already been recorded, this was often calculated incorrectly

using the opening share capital balances. A common omission throughout the preparation of the

SOCIE was the prior period adjustment that was rarely included. It was pleasing that the majority

of candidates were able to get “own figure” marks for including the profit after tax and OCI (where

relevant) in the SOCIE.

Examiner’s report – FR March 2020 4

Many candidates were able to correctly deal with the adjustment for revaluations and the

subsequent excess depreciation in respect of the annual transfer from the revaluation surplus.

This is an area of the syllabus that is regularly tested, so it was pleasing to see a stronger level of

performance here.

The requirement to prepare extracts from the SCF (investing and financing activities) was omitted

by a significantly large number of candidates. For those that did attempt this part of the question,

the dividend paid was often correctly included as a deduction from financing activities. It is worth

noting that when buying new assets such as investments or a brand, this will result in cash outflow

that should be recognised in investing activities. The requirement to prepare extracts from the

SCF is common in this style of question and is something that candidates need to work on and

improve.

The marking team noted that many candidates produced well-presented financial statements and

for those that provided clear workings, markers were able to apply the ‘own figure rule’. For

example, if a calculation error was made (such as on a rights share issue) candidates still gained

credit for following the incorrect figure through and accounting for it correctly in the SOCIE.

Despite previous guidance in the examiner’s reports, markers have reported that there are still

candidates that continue to type their answer into the spreadsheet rather than showing workings to

explain how they were calculated. In the absence of a working it is impossible for markers to give

credit and the ‘own figure rule’ cannot be applied.

There are multiple past exam questions that demonstrate how single company financial statements

are tested. The examining team recommend that you attempt Vernon Co from the March/June

2019 hybrid paper, Duggan Co from the September/December 2018 hybrid paper and Haverford

Co from the March/June 2018 hybrid paper. These are good examples of this type of question

which students must practice. The FR exam will remain technically challenging and it is essential

that students have a thorough working knowledge of IFRS standards. This knowledge is

necessary to pass this exam and progress to SBR.

Analysis of individual company financial statements

It was pleasing to see that many candidates were able to score maximum marks on the calculation

of basic financial ratios in these questions, with only a minority not attempting the calculations at

all. Some common mistakes included not using profit before interest & tax or using the wrong

capital employed in a return on capital employed calculation. Some candidates also calculated

gearing using debt to debt plus equity, despite the question asking for debt to equity. It is

important to read the question carefully and provide the calculations being asked for. Financial

analysis is something that is tested in every exam diet and therefore candidates must ensure they

are familiar with the various ratio formula. A final point to note for the ratio calculations is perhaps

one of the most important! Candidates must ensure that they show their workings for the ratio

calculations so that credit can be given accordingly.

Responses to the appraisal part of the question were often disappointing. There were many

answers that included very limited analysis, with numerous solutions simply citing the change in

Examiner’s report – FR March 2020 5

the various ratios. Generic comments that are not related to the scenario or performance of the

entity will not score marks. For example, stating that a reduction in gross profit margin could be

due to a fall in sales price or lack of cost control will not score marks when there are clear

indicators for the movement contained within the scenario and these are not addressed.

The marking team also noted that there was an increase in the number of candidates not providing

a conclusion to their analysis. Candidates are advised to provide a conclusion (with a suitable

heading) based on the objective of the question. For example, if you are comparing company

performance year on year, your answer should conclude whether performance has improved or

deteriorated based on your analysis?

It continues to be the case that candidates who score well in these types of questions are those

that attempt to use the scenario to provide a rationale for the differences in ratios (e.g. year on year

or compared to a competitor). These questions are designed to allow candidates to demonstrate

that they can deal with the information provided and prepare a good in-depth analysis of realistic

business scenarios. Candidates must demonstrate that they not only understand what ratios are

and potential reasons for their movement but they must be able to apply this knowledge using the

scenario to provide a robust analysis of company performance.

In recent diets, it has been noted that candidates are now using the CBE software to their

advantage in these question types. High scoring candidates often make use of tables to present

their ratio results and workings and use headings and short paragraphs for their analysis. This

approach makes it easier for the marker to identify the relevant points that the candidate is making.

Poorer performing candidates often do not use headings and provide continuous text where it is

difficult for markers to identify the points that the candidate is trying to make.

By using headings and small paragraphs, candidates will provide better structure to their answer

and enable them to identify how many points have been made. For example, if there are nine

marks for analysis, ideally you would provide nine points using the scenario. These points can be

clearly identified by the marker if you have included them separately in small paragraphs.

The examining team recommend that candidates practice past questions in this area. There are

multiple past exam questions that test the analysis of single entity financial statements, as this has

been a large part of the FR exam for many years. Bun Co from September/December 2019,

Mowair Co from September/December 2017 and Funject Co from March/June 2017 are good

examples of this.

Preparation of consolidated financial statements

General consolidation principles continue to be familiar to candidates with many being able to

score highly. Where workings are clearly shown, markers are able to award marks for relevant

calculations and apply the ‘own figure rule’. The marking team noted that, in line with previous

sittings, a greater proportion of candidates are showing their workings in this type of question,

either within the cell or shown separately elsewhere within the spreadsheet. Both are acceptable

methods and both will be marked by the marking team.

Examiner’s report – FR March 2020 6

This diet required some candidates to prepare a consolidated statement of profit of loss (CSOPL)

and for some to include OCI. The preparation of such statements was done reasonably well with

many candidates able to successfully deal with fair value depreciation, intra-group sales and

unrealised profits.

It was disappointing to note that a surprisingly large number of candidates did not recognise the

mid-year acquisition of a subsidiary which is common place in a CSOPL. In such a situation, the

results of the subsidiary should be time apportioned (for the period of time that the parent has had

control over the subsidiary) when including in the consolidated profit or loss.

Another area of weakness that was highlighted by the marking team was the failure to split the

consolidated profit for the year between the amount attributable to the shareholders of the parent

and the amount attributable to the non-controlling interests. This also extended to the total

comprehensive income (TCI) that also needed to be apportioned by some candidates. The

profit/TCI split is an area that is often overlooked by candidates in the exam and should be

addressed by candidates as part of their revision of this syllabus area.

It continues to be the case that elements of these questions related to ‘non-group’ accounting

adjustments, such as the correct inclusion of a loan per relevant IFRS standards are often not

correctly accounted for. In this diet an adjustment required candidates to reverse out an incorrect

treatment of issue costs and to calculate and correctly account for the correct finance cost. Many

candidates were unable to deal with such an adjustment in the context of consolidated financial

statements, whereas a similar adjustment required to the financial statements of a single entity is

usually well received. Candidates need to be prepared to make adjustments to either the parent or

subsidiary financial statements prior to consolidation.

Some candidates were required to account for an associate in the CSOPL and to calculate the

investment in the associate that would be recognised in the CSFP. On the whole these

requirements were generally well attempted. One of the main errors related to the share of

associate profit. The CSOPL should record the share of associate profit for the current accounting

period only whereas the investment in associate in the CSFP should include the share of all post-

acquisition profit to date. Many candidates calculated the unrealised profit for the associate in the

same way as they would for a subsidiary. Whilst this approach was partially correct, to complete

the calculation candidates needed to adjust only for the share of the associate’s unrealised profit,

for example, 30%.

There are multiple past exam questions that test the preparation of consolidated financial

statements, as this has been a large part of the Financial Reporting exam for many years. Runner

Co from the September/December 2019 hybrid paper, Party Co from the September/December

2017 hybrid paper, Dargent Co from the March/June 2017 hybrid paper and Bycomb Co from the

June 2015 paper are good examples of this type of question which students must practice.

Analysis of consolidated financial statements

This question type may require candidates to complete a small calculation for part (a) before

calculating a number of ratios and analysing the performance or position of a company. In the

March 2020 diet, candidates were either required to calculate goodwill or a group gain following the

Examiner’s report – FR March 2020 7

disposal of a subsidiary. Both the acquisition and the disposal took place mid-way through the

accounting period and the impact of this should have been noted in the analysis part of the

question.

A surprising number of candidates were unable to deal with the calculation of goodwill correctly.

Common errors included not discounting the deferred consideration to present value and using the

incorrect share price when calculating the share exchange and the non-controlling interest.

Group disposals have been part of the syllabus for several years now, so it was very disappointing

to note that many candidates were unable to correctly calculate the gain on the disposal of the

subsidiary. A number of candidates included non-controlling interest at disposal in the calculation,

despite it being a disposal of a 100% owned subsidiary. Candidates were told in the scenario that

the goodwill of the disposed company had been impaired by 50%. Candidates often misread the

information and simply took 50% of the consolidated goodwill from the consolidated statement of

financial position (which included the goodwill of other group companies) in error. Marks were

available for calculating the goodwill on the acquisition of the disposal company and subsequently

reducing this by the impairment amount of 50%. Many candidates did not attempt this and so

missed out on these marks.

It was pleasing to see that a large proportion of candidates were able to score full marks on the

ratio calculations in these questions. For the candidates that did not score full marks on the ratios

there were often errors in the formula used or no workings were provided for the marker. As

already noted in this report, candidates need to record all workings when calculating ratios.

The analysis section of the question produced answers that varied in quality. There was a notable

decline in the performance of candidates in this question type. Some candidates used information

from the scenario and incorporated it into their answer. Candidates that used this information and

recognised the impact that an acquisition or disposal of a subsidiary part-way through the year, or

one-off transactions (such as a gain on disposal or acquisition costs relating to a new subsidiary)

may have, scored very well.

Unfortunately, far too many candidates ignored the scenario provided in the question and the

acquisition/disposal of the subsidiary and produced vague, generic answers. When analysing

consolidated financial statements, it is essential that candidates recognise the impact that the

acquisition/disposal of a subsidiary will have on the financial statements to support their analysis

and use the additional information in the scenario to provide a rationale for the change.

The examining team recommends that previous questions containing group analysis issues are

considered such as Pirlo from the March/June 2019 hybrid paper, Duke Co from the

September/December 2018 hybrid paper, Perkins from the March/June 2018 hybrid paper and the

September 2016 question Gregory Co as examples of how to incorporate knowledge of

consolidations into an answer. To score well on this question type candidates MUST ensure that

they use and apply the information provided in the question scenario.

Examiner’s report – FR March 2020 8

Exam technique

Good exam technique is vital for success in the Financial Reporting exam. Strong candidates

continue to use clearly presented workings for both the preparation of financial statements and

calculation of ratios, enabling them to maximise the marks gained here. As stated earlier,

candidates who failed to provide workings often scored much lower marks on all aspects of

calculation.

The analysis discussion points should be laid out clearly, using headings for each area requested,

such as ‘performance’, ‘position’ or ‘cash flow’. Candidates should make clear statements and

avoid repetition. Numerous candidates continue to repeat the same point two or three times when

explaining the movement in a ratio which will waste time and not provide any further marks. It is

much better to make comments on a wider range of figures than to repeat similar points over one

specific balance.

Candidates should also ensure they include a conclusion on the analysis discussion. A sensible

conclusion summarising the main points of the analysis is important, and marks will be awarded for

a decent attempt to do this.

The completion rate of questions continues to be high, suggesting that many candidates are able

to manage time well. In this diet, it was pleasing to see that the majority of candidates attempted all

sections of the exams. The most commonly omitted questions in section C tended to be areas

where candidates were asked to explain issues. The exam will involve elements of discussion, so

candidates cannot afford to neglect these sections as they practise questions.

Word processing and spreadsheet technique

As stated earlier, candidates using the word processing tool for the analysis question were less

likely to show their workings for calculating ratios than those sitting the paper-based exam, which

needs to be improved so marks are not lost.

Conversely, the narrative answers were often well presented, with headings and spacing used

well.

For the preparation of financial statements question, candidates often laid out the financial

statements and workings well. Some candidates tended to put figures in individual cells and add

the cells across for the answer, whereas others did the entire working in one cell using a formula.

Both approaches are perfectly acceptable as markers can allocate marks to both methods. As

stated earlier, the candidates who do workings on a calculator and simply type in the final answer

often lose marks.

There are resources on ACCA’s website giving more guidance on how to use the spreadsheet

software. A video introducing the main functionality and how to make best use of these in Financial

Reporting can be accessed here.

Examiner’s report – FR March 2020 9

Guidance and Learning Support resources to help you succeed in your exam

There are many resources available to candidates to help with the exam. Many of the common

themes discussed in this report regarding exam technique and ways to improve are comments that

are commonly made across sittings. Previous examiner’s reports can be found here and will give

good, consistent guidance in what the examining team is looking for from well prepared

candidates.

One of the keys to Financial Reporting is question practice, attempting questions and reviewing the

answer to see any areas you may have missed. This is particularly relevant on the analysis

questions. Often on this question candidates feel comfortable, but reviewing the answers can show

the depth of discussion that is being sought here. We strongly recommend that you use an up to

date question and answer bank from one of our Approved Content Providers but if this is not

possible then work through the most recent past exams on our website. However, please note if

you are using the past exams that these are not updated for syllabus changes or changes to the

exam format and so should be used with caution – so check the latest syllabus and study guide for

changes.

Some of the more challenging areas of the syllabus have specific articles describing them in more

depth in the technical articles section and these should provide greater understanding. The exam

technique section also provides guidance for approaching the analysis question, and further

guidance for resit students.

Examiner’s report – FR March 2020 10

You might also like

- Introduction To IFRS 6th Ed PDFDocument563 pagesIntroduction To IFRS 6th Ed PDFSaad Khan YT100% (2)

- Strategic Management A Competitive Advantage Approach Concepts 16th Edition David Solutions ManualDocument22 pagesStrategic Management A Competitive Advantage Approach Concepts 16th Edition David Solutions Manualequally.ungown.q5sgg100% (19)

- 11.1valuation of Intellectual Property Assets PDFDocument31 pages11.1valuation of Intellectual Property Assets PDFShivam Anand100% (1)

- Acca Afm s18 NotesDocument9 pagesAcca Afm s18 NotesUsman MaqsoodNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- ACCA DipIFR Practice & Revision Kit June 2017Document313 pagesACCA DipIFR Practice & Revision Kit June 2017Saad Khan YTNo ratings yet

- ACCA DipIFR Practice & Revision Kit June 2017Document313 pagesACCA DipIFR Practice & Revision Kit June 2017Saad Khan YTNo ratings yet

- PSE Disclosure Form 17-5 Preliminary Information Statement of RRHI For May 28 2018Document204 pagesPSE Disclosure Form 17-5 Preliminary Information Statement of RRHI For May 28 2018John Karlo Caminero100% (1)

- Intermed AC 12e CH 12 Test BankDocument28 pagesIntermed AC 12e CH 12 Test BankSaeym SegoviaNo ratings yet

- Owl Co. and Owlet Co. - NCI in Net AssetsDocument11 pagesOwl Co. and Owlet Co. - NCI in Net AssetsKristine Esplana ToraldeNo ratings yet

- Chapter 14 PartnershipsDocument66 pagesChapter 14 PartnershipsShyam SNo ratings yet

- Advanced Financial Accounting: Solutions ManualDocument18 pagesAdvanced Financial Accounting: Solutions ManualThùy NgânNo ratings yet

- ch08 SM Carlon 5eDocument54 pagesch08 SM Carlon 5eKyleNo ratings yet

- P4Document21 pagesP4reviska100% (1)

- Examiner's Report: Financial Reporting (FR) March 2019Document10 pagesExaminer's Report: Financial Reporting (FR) March 2019Hira AamirNo ratings yet

- Examiner's Report: Financial Reporting (FR) June 2019Document10 pagesExaminer's Report: Financial Reporting (FR) June 2019saad aliNo ratings yet

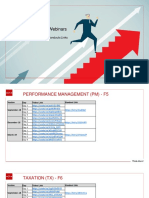

- PM Examreport June20Document8 pagesPM Examreport June20leylaNo ratings yet

- PM Examiner's Report M20Document8 pagesPM Examiner's Report M20tramng12No ratings yet

- The Bcs Professional Examinations BCS Level 5 Diploma in IT October 2007 Examiners' Report Professional Issues in Information Systems PracticeDocument7 pagesThe Bcs Professional Examinations BCS Level 5 Diploma in IT October 2007 Examiners' Report Professional Issues in Information Systems PracticeOzioma IhekwoabaNo ratings yet

- FM Examiner's Report M20Document10 pagesFM Examiner's Report M20Isavic AlsinaNo ratings yet

- FM Examreport m19Document13 pagesFM Examreport m19wanidaphetpugdeeNo ratings yet

- March June 2022Document24 pagesMarch June 2022nothingNo ratings yet

- FR SD20 Examiner's ReportDocument21 pagesFR SD20 Examiner's Reportngoba_cuongNo ratings yet

- FM Examreport d18Document13 pagesFM Examreport d18wanidaphetpugdeeNo ratings yet

- Financial Reporting (FR) Mar / June 2021 Examiner's ReportDocument24 pagesFinancial Reporting (FR) Mar / June 2021 Examiner's ReportKeong ShengNo ratings yet

- FM SD20 Examiner's ReportDocument17 pagesFM SD20 Examiner's ReportleylaNo ratings yet

- f3 Ffa ExamreportDocument4 pagesf3 Ffa ExamreportAinaNo ratings yet

- f5 Examreport March 2018Document8 pagesf5 Examreport March 2018Ahmed TallanNo ratings yet

- FM MJ20 Detailed CommentaryDocument4 pagesFM MJ20 Detailed CommentaryleylaNo ratings yet

- f8 Examreport m17Document7 pagesf8 Examreport m17Omar FarukNo ratings yet

- FR Examreport June20Document10 pagesFR Examreport June20kokoNo ratings yet

- SBR Examiner's Report March June 2022Document14 pagesSBR Examiner's Report March June 2022Jony SaifulNo ratings yet

- Examiners' Report Principal Examiner Feedback January 2020Document5 pagesExaminers' Report Principal Examiner Feedback January 2020DURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- Examiner's Report: F9 Financial Management March 2018Document9 pagesExaminer's Report: F9 Financial Management March 2018Sarah SeeNo ratings yet

- f7 Examreport s17Document6 pagesf7 Examreport s17huu nguyenNo ratings yet

- Examiner's Report: F9 Financial Management June 2018Document10 pagesExaminer's Report: F9 Financial Management June 2018Ngo Vinh AccaNo ratings yet

- Dip IFR Examiner ReportDocument11 pagesDip IFR Examiner Reportluckyjulie567No ratings yet

- FM SD21 Examiner's ReportDocument19 pagesFM SD21 Examiner's ReportNiharika LuthraNo ratings yet

- Examiner's Report: Performance Management (PM) June 2019Document8 pagesExaminer's Report: Performance Management (PM) June 2019Bryan EngNo ratings yet

- Examiners Report F9 June 19Document12 pagesExaminers Report F9 June 19Sakeef SajidNo ratings yet

- Examiner's Report: Strategic Business Reporting (SBR) September 2019Document5 pagesExaminer's Report: Strategic Business Reporting (SBR) September 2019Syn YeeNo ratings yet

- FR MJ20 Detailed CommentaryDocument4 pagesFR MJ20 Detailed Commentarylananhgau1603No ratings yet

- Pearson LCCI Certificate in Management Accounting (VRQ) Level 4Document17 pagesPearson LCCI Certificate in Management Accounting (VRQ) Level 4Aung Zaw HtweNo ratings yet

- Examiner's Report: Audit and Assurance (AA) December 2018Document10 pagesExaminer's Report: Audit and Assurance (AA) December 2018Pink GirlNo ratings yet

- WAC11 01 Pef 20210304Document7 pagesWAC11 01 Pef 20210304new yearNo ratings yet

- Panelists Report Mod B Dec 20 FinalDocument6 pagesPanelists Report Mod B Dec 20 FinalConnieChoiNo ratings yet

- Microsoft Word - Examiner's Report PM D18 FinalDocument7 pagesMicrosoft Word - Examiner's Report PM D18 FinalMuhammad Hassan Ahmad MadniNo ratings yet

- f8 Examreport March 2018Document9 pagesf8 Examreport March 2018lananhgau1603No ratings yet

- F5 Examiners Report March 18Document8 pagesF5 Examiners Report March 18Izhar MumtazNo ratings yet

- FM Examiner's Report March June 2022Document24 pagesFM Examiner's Report March June 2022leylaNo ratings yet

- Principles of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023Document14 pagesPrinciples of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023abrahabrima4No ratings yet

- f7 Examreport d17Document7 pagesf7 Examreport d17rashad surxayNo ratings yet

- AA Examiner's Report M20Document11 pagesAA Examiner's Report M20Ngọc MaiNo ratings yet

- Examiner's Report: F3/FFA Financial Accounting June 2012Document4 pagesExaminer's Report: F3/FFA Financial Accounting June 2012Ahmad Hafid HanifahNo ratings yet

- Peg Sept11 p1Document18 pagesPeg Sept11 p1patriciadouceNo ratings yet

- Apm Examiner's Report s22Document16 pagesApm Examiner's Report s22revisionwithwalazaNo ratings yet

- Senior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3Document26 pagesSenior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3bhaiyarakeshNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- F3.ffa Examreport d14Document4 pagesF3.ffa Examreport d14Kian TuckNo ratings yet

- Examiner's Report: F7 Financial Reporting December 2012Document6 pagesExaminer's Report: F7 Financial Reporting December 2012Selva Bavani SelwaduraiNo ratings yet

- May 2018 Professional Examinations Audit & Assurance (Paper 2.3) Chief Examiner'S Report, Questions and Marking SchemeDocument18 pagesMay 2018 Professional Examinations Audit & Assurance (Paper 2.3) Chief Examiner'S Report, Questions and Marking SchemeMahediNo ratings yet

- Examiner's Report: Performance Management (PM) December 2018Document7 pagesExaminer's Report: Performance Management (PM) December 2018Minh PhươngNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document24 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Afm sd21 Examiners ReportDocument14 pagesAfm sd21 Examiners ReportsulukaNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document20 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- F2.fma Examreport Jul Dec14Document4 pagesF2.fma Examreport Jul Dec14Syeda ToobaNo ratings yet

- ACCA SBR Examination Report March 2019Document4 pagesACCA SBR Examination Report March 2019Gunva TonkNo ratings yet

- Examiner's Report Dec 2019 PDFDocument4 pagesExaminer's Report Dec 2019 PDFAzeem KhanNo ratings yet

- SBR SD22 Examiner ReportDocument15 pagesSBR SD22 Examiner Reportjunk2023No ratings yet

- Examiner's Report: F2/FMA Management Accounting For CBE and Paper Exams Covering July To December 2014Document4 pagesExaminer's Report: F2/FMA Management Accounting For CBE and Paper Exams Covering July To December 2014Kamisiro RizeNo ratings yet

- ACCA Webinars Link - Prepare To Pass - Practice ResourcesDocument13 pagesACCA Webinars Link - Prepare To Pass - Practice ResourcesSaad Khan YT100% (1)

- Cost Accounting - LabourDocument7 pagesCost Accounting - LabourSaad Khan YTNo ratings yet

- Accounting For OverheadsDocument14 pagesAccounting For OverheadsSaad Khan YTNo ratings yet

- Budgeting: Mas Educational CentreDocument9 pagesBudgeting: Mas Educational CentreSaad Khan YTNo ratings yet

- Test PDFDocument1 pageTest PDFSaad Khan YTNo ratings yet

- Cost Accounting - MaterialsDocument18 pagesCost Accounting - MaterialsSaad Khan YTNo ratings yet

- Statistical Techniques: Mas Educational CentreDocument11 pagesStatistical Techniques: Mas Educational CentreSaad Khan YT0% (1)

- Standard Costing and Variance AnalysisDocument14 pagesStandard Costing and Variance AnalysisSaad Khan YTNo ratings yet

- Investment Appraisal: Mas Educational CentreDocument7 pagesInvestment Appraisal: Mas Educational CentreSaad Khan YTNo ratings yet

- Cash FlowDocument3 pagesCash FlowSaad Khan YTNo ratings yet

- Exercises Suspense01 AnsDocument2 pagesExercises Suspense01 AnsSaad Khan YTNo ratings yet

- Financial Accounting Problems: Problem I (Current Assets)Document21 pagesFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNo ratings yet

- MPERS Article - A Comparative Analysis of PERS MPERS and MFRS FrameworksDocument54 pagesMPERS Article - A Comparative Analysis of PERS MPERS and MFRS Frameworkshafis82100% (1)

- SBR Mock C Questions J23Document10 pagesSBR Mock C Questions J23Maria AgathocleousNo ratings yet

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- 3 H077 31-45 Numericals AssignmentDocument31 pages3 H077 31-45 Numericals AssignmentIsha KatiyarNo ratings yet

- PartnershipDocument28 pagesPartnershipAdi Murthy100% (2)

- Today.: Technology For The Next DecadeDocument26 pagesToday.: Technology For The Next DecadeBschool caseNo ratings yet

- Balaji TelefilmsDocument23 pagesBalaji TelefilmsShraddha TiwariNo ratings yet

- PL Financial Accounting and Reporting Sample Paper 1Document11 pagesPL Financial Accounting and Reporting Sample Paper 1karlr9No ratings yet

- MCR MCQDocument28 pagesMCR MCQPritesh Ranjan SahooNo ratings yet

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Document5 pages03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IINo ratings yet

- Deed of PartnershipDocument4 pagesDeed of Partnershipsince1978nsNo ratings yet

- Financial Accounting I Final Practice Exam 1Document14 pagesFinancial Accounting I Final Practice Exam 1misterwaterr100% (1)

- Revised LECPA Syllabi Effective May 2019 and October 2022 ComparisonDocument49 pagesRevised LECPA Syllabi Effective May 2019 and October 2022 ComparisonLloyd ReglosNo ratings yet

- Class 12 Accountancy CH 3 Reconstitution of A Partnership Firm RetirementDocument40 pagesClass 12 Accountancy CH 3 Reconstitution of A Partnership Firm RetirementMayank SharmaNo ratings yet

- TugasCh15 - Heru Kurnia Azra - 1910536018Document9 pagesTugasCh15 - Heru Kurnia Azra - 1910536018Heru Kurnia AzraNo ratings yet

- Famba 8e - SM - Mod 02 - 040220 1Document25 pagesFamba 8e - SM - Mod 02 - 040220 1Shady Mohsen MikhealNo ratings yet

- John Keells Holdings PLC (JKH) - Q3 FY 16 - BUYDocument10 pagesJohn Keells Holdings PLC (JKH) - Q3 FY 16 - BUYSudheera IndrajithNo ratings yet

- Chapter 1 - Introduction To AccountingDocument18 pagesChapter 1 - Introduction To AccountingPaiNo ratings yet

- Seminar 1A - Group Reporting: (A) Power Over The InvesteeDocument44 pagesSeminar 1A - Group Reporting: (A) Power Over The InvesteeJasmine TayNo ratings yet

- Business CombinationDocument4 pagesBusiness CombinationA001AADITYA MALIKNo ratings yet