Professional Documents

Culture Documents

f7 Examreport s17

Uploaded by

huu nguyenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

f7 Examreport s17

Uploaded by

huu nguyenCopyright:

Available Formats

Examiner’s report

F7 Financial Reporting

September 2017

General Comments

The F7 Financial Reporting paper continues to be offered in both computer-based (CBE) and

paper-based (PBE) formats. The structure of both formats is the same, but the model of delivery

for the CBE exam means that candidates do not all receive the same set of questions. In this

report, the examining team share their observations from the marking process to highlight

strengths and weaknesses in candidates’ performance and offer constructive advice for future

candidates.

The exam consisted of three sections

Section A – 15 objective test questions of 2 marks each (30 marks) – the report focuses on

two questions that caused specific difficulties for candidates

Section B – 3 scenarios each with five 2 mark questions (30 marks) – the report focuses on

the key challenges for this section of the exam

Section C – 2 constructed response questions of 20 marks each (40 marks) – the report

provides commentary around some of the main issues that affected candidates’

performance, including knowledge gaps, common errors and offering guidance on where

exam technique could be improved. The report also offers guidance in the use of the CBE

functionality in answering questions in this format.

Section A

Section A questions test a broad range of the syllabus and candidates need to be prepared for this.

They should avoiding question spotting as there are no “core” learning outcomes and all learning

outcomes carry the same degree of importance. Where answer options are available, candidates

should resist looking at these until they have fully worked the question. As can be seen in the

following two examples, some of the distractors can appear genuine but miss a stage of the

calculation, thereby offering an incomplete answer. The following two questions are reviewed with

the aim of giving future candidates an indication of the types of questions asked, guidance on how

much work is involved in answering 2 mark questions and to provide a technical debrief on the

learning outcomes tested by the specific questions asked.

Sample Questions for Discussion

Here we take a look at two Section A questions that proved to be particularly difficult for

candidates.

Example 1

Jetsam Co entered into a lease for an item of plant on 1 April 20X0 which required payments of

$15,000 to be made annually in arrears. The present value of the lease payments was estimated to

be $100,650 at the inception of the lease and the rate of interest implicit in the lease was 8%. Both

the lease term and the plant’s estimated useful life was ten years.

Examiner’s report – F7 September 2017 1

What is the total amount that should be charged to profit or loss for the right-of-use asset

for the year ended 31 December 20X0?

A $11,250

B $6,039

C $7,549

D $13,588

What does this test?

An understanding that, as the leased asset is capitalised as a non-current asset, the charge to the

Statement of profit or loss in respect of the right-of-use asset will include both depreciation and the

finance cost.

What is the correct answer?

The correct answer is D

Depreciation for the year: 100,650/10 = 10,065

Finance cost for the year: 100,650 x 8% = $8,052

Total charge for the year: 10,650 + 8,052 = $18,702

1 April – 31 December 20X0 = 9 mths so 9/12 x $18,702 = $13,588

Why the correct answer is none of the other options?

Option A is 9/12 x $15,000. This option uses the lease repayment as the basis of the SOPL

charge. It therefore fails to recognise that the asset has, in substance, been purchased and

financed by a loan.

Option B is 9/12 x $8,052 and so recognises the finance cost only, thereby ignoring the

depreciation

Option C is 9/12 x $10,065 and so recognises the depreciation only, thereby ignoring the

finance cost

Example 2

Paprika Co purchased 75% of the equity share capital of Salt Co on 30 April 20X4. Non-controlling

interests are measured at fair value.

The cost of sales of both companies for the year ended 30 April 20X6 are as follows:

Paprika Salt

$ $

Cost of sales 60,000 100,000

The following additional information is provided:

1) Salt Co had machinery included in its net assets at acquisition with a carrying amount of

$120,000 but a fair value of $200,000. The machinery had a remaining useful life of eight

years at the date of acquisition. All depreciation is charged to cost of sales.

2) During the year, Salt Co sold some goods to Paprika Co for $32,000 at a margin of 25%.

Examiner’s report – F7 September 2017 2

Three-quarters of these goods remained in inventory at the year end.

What is the cost of sales in Paprika Co’s consolidated statement of profit or loss for the

year ended 30 April 20X6?

A $144,000

B $132,000

C $176,000

D $140,000

What does this test?

The ability to process routine consolidation adjustments; in this case (i) additional depreciation

when an increased fair value is used to measure non-current assets at acquisition; (ii) the

elimination of intra-group sales and (iii) the adjustment of unrealised profit which may arise as a

result of intra-group sales of inventory.

What is the correct answer?

The correct answer is A

Additional depreciation: (200k-120k)/8 = $10,000

Unrealised profit in inventory: (32k x 25%) = $8,000 x 3/4 = $6,000

Consolidated Cost of sales = $60,000 + $100,000 + $10,000 - $32,000 + $6,000 = $144,000

Why the correct answer is none of the other options?

Option B deducts the unrealised profit instead of adding it on

Option C omits to cancel the intra-group sales

Option D calculates unrealised profit assuming ¾ of goods sold to third parties (instead of

¾ remaining in inventory)

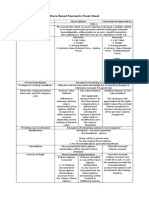

Section B (questions 16 to 30)

This section of the exam presents three scenarios around which 5 (two mark) objective questions

are based. This approach allows the examining team to test a particular learning outcome in some

depth. These scenarios can be based on any of the F7 learning outcomes which means that future

candidates need to have a knowledge of the syllabus which is both wide and deep. They also need

to be able to apply that knowledge in the context of a specific scenario. In September 2017,

candidates demonstrated a superficial knowledge of the following learning outcomes: intangible

assets; leases and revenue recognition. This is surprising given that IFRS 15 Revenue from

Contracts with Customers and IFRS 16 Leases are standards that have been issued by the IASB

relatively recently and so should have been well understood by candidates as they are topical.

There have also been recent technical articles written by the examining team and published on the

ACCA web-site to address these topics. However, it demonstrates that candidates need to use up-

to-date texts and technical articles to ensure that their knowledge is contemporary.

Examiner’s report – F7 September 2017 3

Section C (questions 31 and 32)

Across both PBE and CBE formats, questions covered the following topics:

Analysis of single entity or consolidated financial statements

Preparation of single entity or consolidated financial statements

This report makes comment on one question type from each of the above topics.

Analysis of single entity financial statements

Questions asking for the analysis of financial information will continue to be asked in the F7 exam.

Unfortunately, this is consistently the weakest area for many candidates and this diet was no

exception.

Candidates continue to score well on the calculation of ratios although net asset turnover

(revenue/capital employed) is sometimes overlooked/misunderstood. Candidates should show

their workings for all ratios calculated so that markers can understand the figures used and allow

for any obvious arithmetic errors. CBE candidates were noticeably reluctant to provide workings to

the six ratios asked for.

The level of discussion for the analysis of performance and position required more than merely

saying that a ratio was higher or lower than the previous year or represented a percentage

improvement or deterioration. Many candidates explained how the ratio was calculated or what the

resulting figure represented. None of this is analysis of the financial statements because it doesn’t

use the scenario provided.

When marking interpretation questions, markers look for meaningful use of the scenario provided.

For example, it does not make sense to use an investment in non-current assets during the year to

explain the change in an accounting ratio when the scenario clearly states that no such investment

took place. Had candidates properly read the financial statements, they would have seen that the

increase in non-current assets was almost entirely attributable to a revaluation during the year.

Indeed, the company had a worse set of results in the second year (for five of the six ratios) but it

required a combination of the ratios, the financial statements and the additional information in the

scenario to provide a coherent commentary on the issues facing the company. Possible reasons

for key changes between the two years reported should have been identified and discussed.

In a discussion question of this sort candidates are expected to finish with a brief conclusion.

Separate headings for key sections of the answer (including a conclusion) were used by some

candidates but more use of this technique is encouraged.

Many attempts at the analysis questions (particularly the CBE responses) were very brief which

may be indicative of poor time management. Candidates are encouraged to use the marks clearly

indicated within the questions to plan their time.

Where the interpretation question is based on a set of consolidated financial statements,

candidates must think about the impact of the consolidation on the ratios. Please look at the

suggested solutions provided in the specimen exams

Examiner’s report – F7 September 2017 4

(http://www.accaglobal.com/uk/en/student/exam-support-resources/fundamentals-exams-study-

resources/f7/specimen-exams.html#) and consider similar issues in the context of the question

being asked.

Preparation of consolidated financial statements

The main principles behind the preparation of consolidated financial statements is an area of the

syllabus where candidates generally perform well. The importance of clear workings to support

answers to this type of question cannot be over-emphasised and there has been an improvement

over recent diets. CBE candidates are also encouraged to provide workings because markers still

need to be able to understand where numbers have come from.

The goodwill calculation was generally done well although some candidates were unclear about

dealing with fair value adjustments and the split between the position at the dates of acquisition

and consolidation. Many candidates used a three-column table (at acquisition, at consolidation,

post-acquisition) to analyse the subsidiary’s net assets. Whilst this approach is not required, it is

an example of making it easy for the examiner to understand where the candidates’ numbers are

coming from. Other alternative approaches may also be used provided they can be substantiated

with appropriate workings.

A small number of candidates used proportional consolidation however this is a fundamental error

and entirely inconsistent with the principle of control on which consolidation is based. Candidates

who show share capital other than that of the parent only, quickly reveal a lack of understanding of

the nature of consolidation processes.

The deferred consideration calculation was not well attempted. Candidates were required to

discount this for the goodwill calculation and then “unwind” (in this case) the first year’s interest

which should be deducted from the parent’s retained earnings (or added to finance costs) and

added to the discounted liability. Mark-up and margin continue to confuse many candidates when

calculating the unrealised profit on inventory transferred within the group.

Candidates should know how to treat a revaluation surplus that is reported by the subsidiary.

Many candidates correctly reported the pre-acquisition element in their goodwill calculation and

then included this amount again in the consolidated statement of financial position. The

revaluation surplus of the group is all that of the parent plus the group’s share of the post-

acquisition revaluation surplus of the subsidiary (the remainder of this is part of any non-controlling

interest).

Exam technique for both PBE and CBE formats

As for any exam, good technique is important for success. Strong candidates used good and clear

workings for ratios and in preparing financial statements.

For analysis and discussion, all points made in PBE should be legible (spelling errors, particularly

on CBE answers, are not penalised) and good use of ordered paragraphs should be made. As

suggested above, headings (such as “performance”, “position” and “conclusion”) are indicative of

well organised answers.

Examiner’s report – F7 September 2017 5

It was pleasing to note that most candidates attempted all exam questions. Where time did seem

to be an issue it was the discussion part of the analysis question that saw the greatest impact; this

seemed to be more evident on CBE responses than on the paper-based format.

Word processing and spreadsheet technique for the CBE format

As noted earlier, candidates using the word processing tool were less likely to show workings; this

issue should be addressed so that marks are not lost. Narrative answers were often well

presented although the use of headings would improve them further.

For those preparing financial statements layout was generally good (there are no specific format

marks awarded). For those using the spreadsheet tool, workings were often provided on either the

spreadsheet itself or in the cells using formulae. These different approaches are all acceptable as

markers will check cells for workings and formulae.

There are extensive resources on the ACCA website to support the use of CBE functionality and

candidates are encouraged to engage with this material as part of their preparation for the exam.

Guidance and learning support resources

There are a range of resources available to candidates to help with the F7 exam. Many of the

themes noted in this report regarding exam technique, and ways to improve answers, are

comments commonly made from previous diets. Previous examiner’s reports can be found at

http://www.accaglobal.com/uk/en/student/exam-support-resources/fundamentals-exams-study-

resources/f7/examiners-reports.html and offer good and consistent guidance for what the

examining team are looking from well-prepared candidates.

A key to success in this exam is question practice by attempting questions and reviewing the

answers available to check points of difference. This approach is particularly relevant to the

analysis questions. Although candidates may feel comfortable with their own attempt, a review of

answers available can show the depth of the discussion that is sought. An up-to-date question and

answer bank from one of the Approved Content Providers (and/or the selection of recent past

exams on the ACCA’s website – http://www.accaglobal.com/uk/en/student/exam-support-

resources/fundamentals-exams-study-resources/f7/past-exam-papers.html) is strongly

recommended as a study and revision aid. If using past exam papers, it should be noted these will

not have been updated for changes to the syllabus, format of the paper or accounting standards –

so should be used with caution.

Using the latest syllabus and study guide (http://www.accaglobal.com/uk/en/student/exam-support-

resources/fundamentals-exams-study-resources/f7/syllabus-study-guide.html) is essential from the

start of studying for this paper. Technical articles (http://www.accaglobal.com/uk/en/student/exam-

support-resources/fundamentals-exams-study-resources/f7/technical-articles.html) describe recent

changes and the more challenging areas of the syllabus and the exam technique section provides

guidance for approaching the analysis question and further guidance for resit candidates.

Examiner’s report – F7 September 2017 6

You might also like

- CFAS Lecture Notes - Zeus Millan (2021-2022)Document38 pagesCFAS Lecture Notes - Zeus Millan (2021-2022)Aimee Cute83% (6)

- Test Bank For Financial Reporting and Analysis 8th Edition Lawrence Revsine Daniel Collins Bruce Johnson Fred Mittelstaedt Leonard SofferDocument55 pagesTest Bank For Financial Reporting and Analysis 8th Edition Lawrence Revsine Daniel Collins Bruce Johnson Fred Mittelstaedt Leonard Soffergisellesamvb3100% (20)

- CMA 2013 SampleEntranceExam Revised May 15 2013Document77 pagesCMA 2013 SampleEntranceExam Revised May 15 2013Yeoh MaeNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Sample Midterm QuestionsDocument14 pagesSample Midterm QuestionsdoofwawdNo ratings yet

- 2010 AICPA Newly Released Questions - Financial PDFDocument55 pages2010 AICPA Newly Released Questions - Financial PDFAngelo SantiagoNo ratings yet

- Examiner's Report: Financial Reporting (FR) March 2019Document10 pagesExaminer's Report: Financial Reporting (FR) March 2019Hira AamirNo ratings yet

- Examiner's Report: Financial Reporting (FR) June 2019Document10 pagesExaminer's Report: Financial Reporting (FR) June 2019saad aliNo ratings yet

- f7 Examreport d17Document7 pagesf7 Examreport d17rashad surxayNo ratings yet

- ACCA F7 Examiner's Report 15Document5 pagesACCA F7 Examiner's Report 15kevior2No ratings yet

- F5 Examiner's Report: March 2017Document7 pagesF5 Examiner's Report: March 2017Pink GirlNo ratings yet

- FR SD20 Examiner's ReportDocument21 pagesFR SD20 Examiner's Reportngoba_cuongNo ratings yet

- Examiner's Report: F2/FMA Management Accounting For CBE and Paper Exams Covering July To December 2014Document4 pagesExaminer's Report: F2/FMA Management Accounting For CBE and Paper Exams Covering July To December 2014Kamisiro RizeNo ratings yet

- FM SD20 Examiner's ReportDocument17 pagesFM SD20 Examiner's ReportleylaNo ratings yet

- March June 2022Document24 pagesMarch June 2022nothingNo ratings yet

- F2.fma Examreport Jul Dec14Document4 pagesF2.fma Examreport Jul Dec14Syeda ToobaNo ratings yet

- FFA FA S22-A23 Examiner's ReportDocument11 pagesFFA FA S22-A23 Examiner's ReportM.Huzaifa ShahbazNo ratings yet

- FM SD21 Examiner's ReportDocument19 pagesFM SD21 Examiner's ReportNiharika LuthraNo ratings yet

- FR Examiner's Report M20Document10 pagesFR Examiner's Report M20Saad Khan YTNo ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document25 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- Ma2 Examreport Jul Dec15Document3 pagesMa2 Examreport Jul Dec15Rumaisha Batool100% (1)

- FM Examiner's Report March June 2022Document24 pagesFM Examiner's Report March June 2022leylaNo ratings yet

- BSMAN3009 Accounting For Managers 20 June 2014 Exam PaperDocument8 pagesBSMAN3009 Accounting For Managers 20 June 2014 Exam Paper纪泽勇0% (1)

- FR Examreport June20Document10 pagesFR Examreport June20kokoNo ratings yet

- Examiner's Report: Performance Management (PM) June 2019Document8 pagesExaminer's Report: Performance Management (PM) June 2019Bryan EngNo ratings yet

- F3.ffa Examreport d14Document4 pagesF3.ffa Examreport d14Kian TuckNo ratings yet

- FM MJ21 Examiner's ReportDocument18 pagesFM MJ21 Examiner's ReportZi Qing NgNo ratings yet

- Entrepreneurship Starting and Operating A Small Business 4th Edition Mariotti Test Bank DownloadDocument12 pagesEntrepreneurship Starting and Operating A Small Business 4th Edition Mariotti Test Bank DownloadRhoda Koester100% (22)

- FR SD22 Examiner ReportDocument26 pagesFR SD22 Examiner Reportfeysal shurieNo ratings yet

- ACCA F7 Exam ReoprtDocument5 pagesACCA F7 Exam Reoprtkevior2No ratings yet

- f5 Examreport March 2018Document8 pagesf5 Examreport March 2018Ahmed TallanNo ratings yet

- Text 3345Document22 pagesText 3345kevin digumberNo ratings yet

- FABM2 Wk6Document7 pagesFABM2 Wk6john lester pangilinanNo ratings yet

- Financial 9: Updates For 2011 Edition Last Updated March 8, 2011Document3 pagesFinancial 9: Updates For 2011 Edition Last Updated March 8, 2011livebird78No ratings yet

- Cat/fia (FFM)Document9 pagesCat/fia (FFM)theizzatirosli100% (1)

- EXERCISECHAPTER1Document5 pagesEXERCISECHAPTER1Bạch ThanhNo ratings yet

- f3 Ffa Examreport j15Document4 pagesf3 Ffa Examreport j157777gracieNo ratings yet

- F5 Examiners Report March 18Document8 pagesF5 Examiners Report March 18Izhar MumtazNo ratings yet

- F2 Mock 2Document12 pagesF2 Mock 2Areeba alyNo ratings yet

- Mac Exam Sept 09 ExapleDocument5 pagesMac Exam Sept 09 Exaplethomboelens100% (1)

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document20 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- Microsoft Word - Examiner's Report PM D18 FinalDocument7 pagesMicrosoft Word - Examiner's Report PM D18 FinalMuhammad Hassan Ahmad MadniNo ratings yet

- Alllied Food ProductsDocument4 pagesAlllied Food ProductsHaznetta HowellNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Hirushika BandaraNo ratings yet

- AF301 Final Exam Semester 2, 2014Document8 pagesAF301 Final Exam Semester 2, 2014Anonymous 9dEMgo0No ratings yet

- Fall 2008 Exam 3 BDocument5 pagesFall 2008 Exam 3 BNO NameNo ratings yet

- FM Examiner's Report M20Document10 pagesFM Examiner's Report M20Isavic AlsinaNo ratings yet

- Entrepreneurship Starting and Operating A Small Business 4th Edition Mariotti Test BankDocument13 pagesEntrepreneurship Starting and Operating A Small Business 4th Edition Mariotti Test Bankdeftlyriveting7a69xh100% (27)

- Examiner's Report: F5 Performance Management June 2018Document8 pagesExaminer's Report: F5 Performance Management June 2018Minh PhươngNo ratings yet

- Chapter 2 Practice QuestionsDocument7 pagesChapter 2 Practice QuestionshahaheheNo ratings yet

- FR MJ23 Examiner's Report - FINALDocument24 pagesFR MJ23 Examiner's Report - FINALdeepshikhagupta514No ratings yet

- Pearson LCCI Certificate in Accounting (VRQ) Level 3Document24 pagesPearson LCCI Certificate in Accounting (VRQ) Level 3Aung Zaw HtweNo ratings yet

- 05-Financial Stratement AnalysisDocument8 pages05-Financial Stratement AnalysisPratheep GsNo ratings yet

- Exam For AccountingDocument16 pagesExam For AccountingLong TranNo ratings yet

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniNo ratings yet

- Swarnarik Chatterjee 23405018005 CA2 Management AccountingDocument9 pagesSwarnarik Chatterjee 23405018005 CA2 Management AccountingRik DragneelNo ratings yet

- Underline The Final Answers: ONLY If Any Question Lacks Information, State Your Reasonable Assumption and ProceedDocument4 pagesUnderline The Final Answers: ONLY If Any Question Lacks Information, State Your Reasonable Assumption and ProceedAbhishek GhoshNo ratings yet

- 2010-10-26 233008 SmayerDocument6 pages2010-10-26 233008 Smayernicemann21No ratings yet

- 330 S12 IndSty MT AMongelluzzoDocument8 pages330 S12 IndSty MT AMongelluzzomongo9279No ratings yet

- Financial Statement Analysis 11th Edition Test Bank K R SubramanyamDocument46 pagesFinancial Statement Analysis 11th Edition Test Bank K R SubramanyamMarlys Campbell100% (28)

- F1 Answers May 2013Document15 pagesF1 Answers May 2013Chaturaka GunatilakaNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- CH 11Document74 pagesCH 11huu nguyenNo ratings yet

- CH 10Document40 pagesCH 10huu nguyenNo ratings yet

- CH 09Document32 pagesCH 09huu nguyenNo ratings yet

- Financial AccountingDocument47 pagesFinancial Accountinghuu nguyenNo ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- Jose Maria College College of Business Education: Audit TheoryDocument10 pagesJose Maria College College of Business Education: Audit TheoryMendoza Ron NixonNo ratings yet

- Audit of Investment PropertyDocument5 pagesAudit of Investment PropertyzennongraeNo ratings yet

- Intermediate Accounting Vol 2 Canadian 2nd Edition Lo Test BankDocument51 pagesIntermediate Accounting Vol 2 Canadian 2nd Edition Lo Test BankDarrylWoodsormni100% (16)

- Dissolution and Liquidation Sample ProblemsDocument5 pagesDissolution and Liquidation Sample ProblemsShaz NagaNo ratings yet

- Unit 7. Audit of Biological AssetsDocument4 pagesUnit 7. Audit of Biological AssetsNicNo ratings yet

- PAS8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument8 pagesPAS8 Accounting Policies, Changes in Accounting Estimates and ErrorsFaith BautistaNo ratings yet

- Chapter 14 (Business Combination)Document6 pagesChapter 14 (Business Combination)Kerr John GuilaranNo ratings yet

- Financial InstrumentsDocument40 pagesFinancial InstrumentsHarsh KhandelwalNo ratings yet

- A231 MC 4 IP - QuestionsDocument4 pagesA231 MC 4 IP - QuestionsAmirul HaiqalNo ratings yet

- CH 11Document91 pagesCH 11Putri AsmeliaNo ratings yet

- 0126financial and Corporate ReportingDocument6 pages0126financial and Corporate ReportingSmag SmagNo ratings yet

- Retained Earnings: Appropriation May Be A Result ofDocument5 pagesRetained Earnings: Appropriation May Be A Result ofLane HerreraNo ratings yet

- Latihan Soal Consolidation of SOFP Dan SOPLDocument4 pagesLatihan Soal Consolidation of SOFP Dan SOPLRaihan Nabilah AzaliNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- L2 - Business Combinations II (2023)Document12 pagesL2 - Business Combinations II (2023)waiwaichoi112No ratings yet

- PFRS 7Document22 pagesPFRS 7Princess Jullyn ClaudioNo ratings yet

- Solution Manual For Advanced Accounting 4th Edition Jeter, ChaneyDocument7 pagesSolution Manual For Advanced Accounting 4th Edition Jeter, ChaneyAlif Nurjanah0% (2)

- A. B. C. D.: Do Not Write Anything On The QuestionnaireDocument2 pagesA. B. C. D.: Do Not Write Anything On The QuestionnairedaryllNo ratings yet

- Share Based Compensation Cheat SheetDocument2 pagesShare Based Compensation Cheat SheetJaneNo ratings yet

- Jaguar Racing LimitedDocument24 pagesJaguar Racing LimitedVarun DubeyNo ratings yet

- Chap 004Document132 pagesChap 004affy714No ratings yet

- Advanced-Accounting Fischer 11e - Ch01 TBDocument18 pagesAdvanced-Accounting Fischer 11e - Ch01 TBgilli1tr100% (1)

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- Financial Instruments: Scope and DefinitionsDocument168 pagesFinancial Instruments: Scope and Definitionskiran gNo ratings yet

- IAS 16 Part 2 Revaluation of PPE IAS 16-1Document10 pagesIAS 16 Part 2 Revaluation of PPE IAS 16-1makhanyaNo ratings yet